Link: Apply for the no annual fee Bilt Mastercard®

I recently applied for the Bilt Mastercard® (review). I’m writing some content about the card at the moment, as I’m exploring how various perks of the card work.

In this post I wanted to cover what will for many people be the single most valuable benefit of the Bilt Mastercard, and what sets it apart the most. Specifically, I’m talking about the ability to pay rent with the card, all while earning rewards points without paying a fee.

In this post:

The Bilt Mastercard lets you earn rewards for paying rent

The Bilt Mastercard lets you earn 1x points on your rent payments without a fee, for a total of up to 100,000 points each calendar year (that corresponds to up to ~$8,300 per month in rent). This can be used for up to one rent payment per month, so if you pay rent for multiple places, you’ll only earn rewards for one property.

Bilt points are valuable, and can be transferred to a variety of partners, ranging from American AAdvantage to World of Hyatt.

Being able to pay your rent by credit card with no fee is a game changer for many, given that rent is many peoples’ single biggest expense. This probably sounds too good to be true, so let me further emphasize that:

- While some people are able to pay rent by credit card, there’s almost always a convenience fee for doing so; that doesn’t apply when paying with the Bilt Mastercard

- You can even earn points with Bilt for your rent payment if your landlord doesn’t accept credit cards

The only major restriction to be aware of is that you need to make at least five transactions per billing cycle on the card in order to be able to earn rewards for rent. That shouldn’t be a big deal for most, given that the card earns 3x points on dining and 2x points on travel, so for many, the card can be worth spending money on.

The logistics of paying rent with the Bilt Mastercard

How do the logistics work of paying rent with the Bilt Mastercard, and accruing points at no fee? You have two options for doing so — you can either pay rent online or pay rent via check, so let’s go over how each of those methods work.

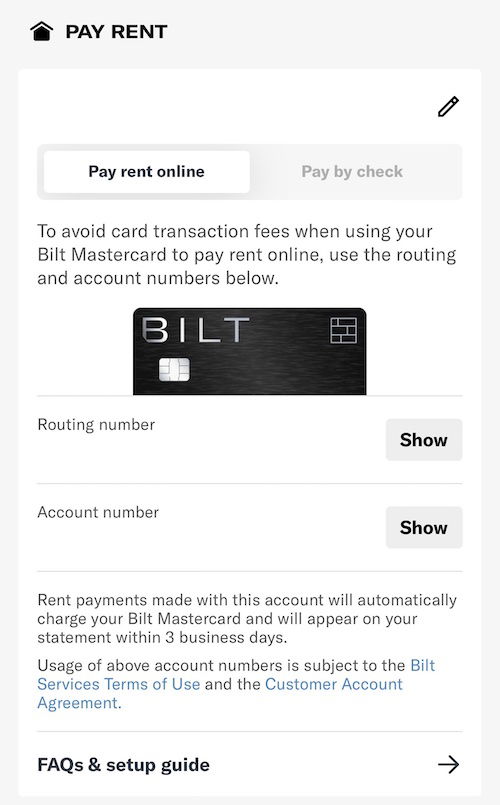

Pay rent online with Bilt

If your landlord lets you pay rent online, then you’ll have access to the easiest way to earn rewards with Bilt for your rent payment. Just log into the Bilt app, and use the account number and routing number provided to pay your rent.

You’ll want to enter that info into the online payment portal your landlord uses, and the rent payment will be processed as an e-check or ACH, which shouldn’t have any fee.

Once Bilt makes that payment, within three business days the purchase will show on your Bilt Mastercard statement as a transaction. You’ll then be able to pay off your credit card bill, and you’ll earn 1x points for that.

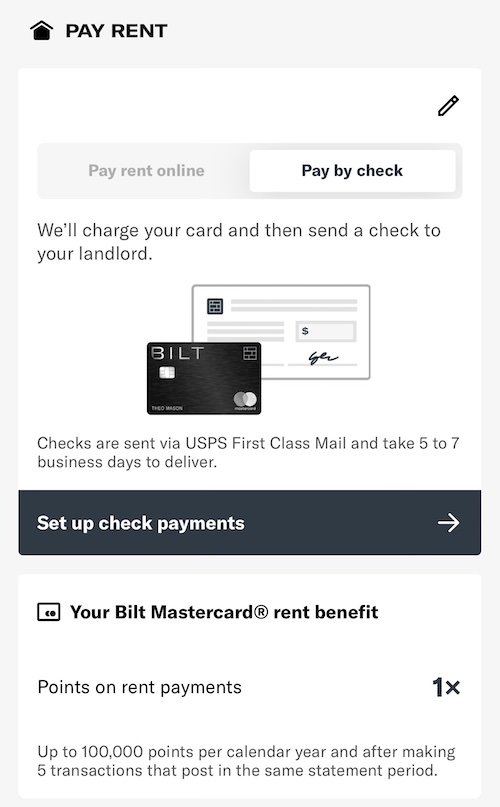

Pay rent by check with Bilt

If your landlord doesn’t let you pay rent online, or for whatever reason there’s a fee for paying by e-check or ACH, you can also have Bilt send a check to your landlord on your behalf. You’ll simply want to set up check payments through the Bilt app, and then your landlord will be sent a check within five to seven business days.

Just like with the online payment method, your Bilt Mastercard will then be charged for that entire amount, and you can pay off your credit card bill, earning 1x points per dollar spent.

What about mortgage payments & HOAs?

Unfortunately the Bilt Mastercard doesn’t allow mortgage payments with no fee. However, there is potentially a way to pay HOAs without fees, which I’ll be covering in a separate post. That feature is also the main reason that I finally applied for this card, as I don’t rent.

How is this sustainable for Bilt?

Many people are probably thinking “well that sounds too good to be true, how is that sustainable?” It’s a fair question. I don’t have any knowledge into the inside workings of Bilt’s business model, beyond what’s publicly available. And I also don’t claim to really understand much of the economy anymore, which is so much about gaining market share with venture capital money, rather than profitability.

That being said, there’s not really a catch here, and my best guess is as follows:

- Bilt presumably has a two-sided business model; the company’s customers aren’t just cardmembers, but also rental properties that Bilt is trying to get onto its network

- Other cards offer huge welcome bonuses to incentivize people to apply, while you can think of the Bilt Mastercard as instead doling out rewards on an ongoing basis (though the card also has a “secret” sign-up bonus, at least for some)

- Rewarding rent payments is a way that Bilt can ensure that the card remains front of wallet for consumers, since you need to make at least five transactions per billing cycle to earn rewards

So while I’m not sure if Bilt will ultimately be successful, it’s not too hard to figure out what the company’s play is, and rewarding free points for rent is a major part of that. This isn’t some promotional gimmick that’s likely to be pulled, but rather that’s the core value proposition of what Bilt is offering.

Bottom line

The Bilt Mastercard‘s unique selling point is the ability to pay rent by credit card without a fee, with the opportunity to earn up to 100,00 points per year this way. Given that rent is the single biggest expense for many Americans, this is an incredible way to maximize your points earning potential.

Earning points with Bilt for rent is possible regardless of whether or not your landlord accepts credit cards, so this really is as good as it sounds. Just keep in mind that you’re limited to one rent payment per month, and you also have to make five transactions per billing cycle on the card.

If you’ve paid rent with the Bilt Mastercard, what was your experience like?

Interesting.. I've been holding off on getting a Bilt card since it would be another points ecosystem to keep track of, but my apartment just raised credit card transaction fees from a modest flat rate to a percentage and on my rent the fee pretty much doubled overnight to use my Freedom Unlimited, but waives the fee if I use Bilt.

Considering I have to put 5 transactions on the Bilt card at significantly...

Interesting.. I've been holding off on getting a Bilt card since it would be another points ecosystem to keep track of, but my apartment just raised credit card transaction fees from a modest flat rate to a percentage and on my rent the fee pretty much doubled overnight to use my Freedom Unlimited, but waives the fee if I use Bilt.

Considering I have to put 5 transactions on the Bilt card at significantly lower point rates to get the full amount, I have to ask myself is it better to just pay the increased fee for the 1.5x on the CFU or actually apply for a Bilt card.

I'm also planning on leaving the property after my lease expires next year so it's just turning into a big mess for me now lol.

Ben - Are you still planning to do the separate post for HOA dues? I've been in eager anticipation of it for most of this week. Thx.

I've got no need for a new credit card, but Bilt let me take advantage of their truncated World of Hyatt promo without applying for their card, so they're alright in my book...at least until I see "Globalist until Feb 2025" on my WoH account.

How is this sustainable for Bilt?

They're letting renters potentially finance rent payments at credit card rates.

Shouldn't that be potentially very profitable?

So you're saying, due to high interests, Bilt should also be expecting people to default on card payments which these payments are supposed to be rental income for the landlords. Which these landlords themselves, who have good credit ratings, finance the real estate and have their property as a collateral.

In other words, Bilt is trying to repackage subprime loans into mortgage backed securities.

Sounds exactly like what happened in 2008.

Very sustainable, very...

So you're saying, due to high interests, Bilt should also be expecting people to default on card payments which these payments are supposed to be rental income for the landlords. Which these landlords themselves, who have good credit ratings, finance the real estate and have their property as a collateral.

In other words, Bilt is trying to repackage subprime loans into mortgage backed securities.

Sounds exactly like what happened in 2008.

Very sustainable, very profitable. Wallstreet never learns.

Here's a scenario I'm thinking of:

- The house is under my name only although I live with my wife and kids in it.

- I draft a simple residential lease agreement between my wife and me - a free, simple contract was easy to find. The monthly rent would be =< monthly mortgage.

- My wife uses her Bilt Mastercard to pay me a rent and gets points.

- I pay my mortgage as usual.

Would this work? Any potential tax implications for my "rent income?"

Thanks!

In the words of our President, "C'mon, man."

Bilt is trying to run an honest business and you are devising a way to rip 'em off. This is also the kind of stuff that gets lucrative award travel opportunities shut down and makes the whole miles-and-points game less appealing to all of us. Please do not do this.

Thank you for sharing your thoughts.

If it's against Bilt's terms of service and not allowed, I would understand. But, why is it "ripping them off" if the system allows it? I'm asking if it's within the terms, albeit it in the narrowest technical sense perhaps.

One big aspect of travel/credit cards/rewards hobby, I've learned, is to find little known loopholes that may or may not be consistent with original intent but can be used...

Thank you for sharing your thoughts.

If it's against Bilt's terms of service and not allowed, I would understand. But, why is it "ripping them off" if the system allows it? I'm asking if it's within the terms, albeit it in the narrowest technical sense perhaps.

One big aspect of travel/credit cards/rewards hobby, I've learned, is to find little known loopholes that may or may not be consistent with original intent but can be used to your benefit. I believe this is one of those, no?

BILT has folks who participate in the online travel hacking fora and I expect they read this blog as well, so perhaps they'll chime in with a statement about whether this is allowed and, if not, what their chances are of detecting it, and what exactly their T & C allow them to do to you if they are able to detect it.

Besides the T&S issues, in practice the money you receive will be rent income and you'll have to pay taxes on it, so wiping out all benefits from Bilt and then some. You'd also have to pay for a payment processor to process the credit card payment for you, or at least a ACH debit from the rent payment account Bilt provides. That costs money too and the processor will snitch you to the IRS by issuing tax forms.

@JKL

Just like cabin crews, they write and enforce their own rules judge, jury, executioner style.

And just like cabin crews, they can kick you out for any reason.

I can’t figure out how to make Bilt work for me: our property owner only wants a direct deposit ACH into his company’s bank account, not a check, and there’s no online payment portal for paying with a card number or Bilt’s routing/account number. Does Bilt have a service similar to Zelle or other Send-Money services direct to another routing/account number?

You should be able to pay your rent with ACH. Your Bilt card has routing and account numbers

Yes, it does, but what system do I use to make a transfer/ payment to the owner's routing and account number? He doesn't have an online system to pay through, and I've been using Zelle through my bank account. I cannot figure out exactly HOW to use Bilt's routing and account number, and I can't find instructions for my situation anywhere.

I’m in the same position which is why I haven’t applied for the card. This is only for actual landlords who can deduct money from someone else’s account via ACH. If you’re renting from an individual or small owner where you need to send them money via ACH, this card doesn’t work. That makes sense, since Bilt would have no way to determine that those weren’t personal payments.

Contact [email protected]

Bilt c/s is admittedly a little slow but will eventually get back with how to work it for you.

I have paid my own HOA 4x now on the online portal & points have posted as they advertise.

You go Bilt option - pay rent online , then you tick on Bilt Protect debit , link a bank account (if you haven’t yet) and that should be it .

No , Bilt's ACH numbers is only for ACH debit transaction from your Bilt account, similar to autopay for utility bills, credit card bills etc.

What the OP is asking for is to be able to send money to the landlord's bank account routing numbers which Bilt does not support

You go Bilt option - pay rent online , then you tick on Bilt Protect debit , link a bank account (if you haven’t yet) and that should be it .

Bilt only allows ACH “pull” transactions. You cannot ACH “push” funds out of the account.