Premium rewards cards are all the rage nowadays. Cards like the Chase Sapphire Reserve® Card and American Express Platinum Card® offer perks and bonus categories that more than justify their hefty annual fees, in my opinion.

I’m always excited when a new premium credit card is introduced, since I hope it will have unique benefits that make the card worthwhile… and then there’s the new Korean Air SkyPass Select Visa Signature Card, issued by US Bank.

Details of Korean Air’s new $450 annual fee card

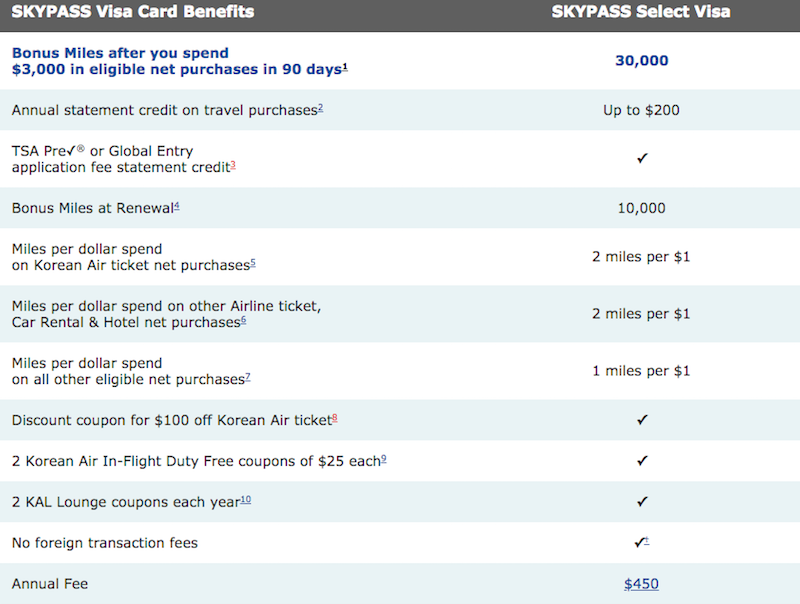

The new SkyPass Select Visa Signature Card has a $450 annual fee and offers:

- A welcome bonus of 30,000 miles after spending $3,000 within the first three months of account opening

- A $200 annual statement credit on travel purchases (applied automatically towards airline, car rental, or hotel purchases)

- A TSA PreCheck or Global Entry fee credit every four years

- 2 Korean Air Lounge passes every year (valid in North America and Seoul only)

- 2 Korean Air in-flight duty free vouchers of $25 each (each only redeemable on a purchase of $50 or more)

- $100 discount on a Korean Air ticket, valid for 90 days from when it’s issued, and some fares may not qualify

Those are the perks, and then here are the rewards the card offers on spend:

- 2x miles on Korean Air purchases

- 2x miles on airline ticket, car rental, and hotel purchases

- 1x miles on all other purchases

- 10,000 bonus miles every cardmember year where you spend $35,000

Just how bad is this card?

Usually if I’m not a fan of a card I’ll simply say that I think it could make sense for a certain type of consumer, even if it doesn’t make sense for most. However, in this case I think the card makes sense for… just about no one? This card is so spectacularly bad that I’m almost amused.

Let’s really call this a $250 annual fee card, after you subtract the $200 annual statement credit from the $450 annual fee, given that it’s easy enough to use. For that you’re getting a Global Entry fee credit once every four year (many of us have more of those than we can use), two restrictive Korean Air Lounge passes, two restrictive Korean Air duty free vouchers, and a restrictive $100 Korean Air flight discount.

Then the card doesn’t even have a compelling rewards structure, as you earn at most 2x miles per dollar spent in select categories, and 10,000 bonus miles when you spend $35,000 per year.

You can also redeem Ultimate Rewards points for travel in Korean Air first class

This $450 annual fee card offers:

- A welcome bonus of 50,000 points upon completing minimum spend (which can be converted into 50,000 Korean Air miles)

- A $300 annual travel credit (that will automatically be applied towards virtually any travel purchase)

- Triple points on dining and travel

- A Priority Pass™ Select membership that will get you access to Korean Air Lounges in North America and Seoul, just like the lounge passes offered by Korean Air, except you can bring two guests

- A TSA PreCheck or Global Entry fee credit every four years

I understand some card issuers create niche products that won’t appeal to everyone, but I truly think US Bank and Korean Air have created a card that makes sense for no one. That takes effort.

Does anyone have a different take on Korean Air’s new premium credit card?

(Tip of the hat to Doctor Of Credit)

with chase UR ending 1:1 transfer of UR to korean air miles, would this be worth it for occasional korean air users? i also heard that they're conducting targeted mail ads. i've received an offer for this card with 50k mile sign up bonus. i prefer to fly korean air when going to korea but i'd say i go once in 2-3 years. i also have CSR so i won't benefit from $100 TSA pre credit. what do you guys think?

well i guess now this card makes sense??

decent for MS?

$450 and you only get two lounge passes? This is card shouldn't even be allowed to be offered at that price point. Might as well light your money on fire every year if you get this card.

Have never been granted access to their lounges in JFK AND LAX with my Priority Pass. Rude personnel

US Bank value prop, customer service is the absolute worst bar none, so be sure to add that in.

@Henrik @Frederic

I'm completely with you. From a European perspective this an attractive card ...

@Lars K

While this may be true for the EU, it is definitely not true for non-EU European countries ... and still the credit cards are much less attractive than in the US. So this can't be the reason.

I'd rather explain it by monopolies/oligopolies: In most European countries there are only 2 or 3 issuers of...

@Henrik @Frederic

I'm completely with you. From a European perspective this an attractive card ...

@Lars K

While this may be true for the EU, it is definitely not true for non-EU European countries ... and still the credit cards are much less attractive than in the US. So this can't be the reason.

I'd rather explain it by monopolies/oligopolies: In most European countries there are only 2 or 3 issuers of Visa/MasterCard and only 1 issuer of Amex/Diners. With little to no competition, there's simply no need to make attractive proposals.

@Henrik @Frederic

Well, there is actually a reason, at least for Europe, why credit cards cannot be as lucrative for consumers. The reason is: They are also not as lucrative for credit card companies because of the EU payment services directive (PSD), which limits the maximum credit card fees to less than 0.7%.

This is meant to „protect“ or benefit consumers but effectively, it benefits merchants and it means that there are no...

@Henrik @Frederic

Well, there is actually a reason, at least for Europe, why credit cards cannot be as lucrative for consumers. The reason is: They are also not as lucrative for credit card companies because of the EU payment services directive (PSD), which limits the maximum credit card fees to less than 0.7%.

This is meant to „protect“ or benefit consumers but effectively, it benefits merchants and it means that there are no rewarding credit cards out there for consumers because it is economically not possible for credit card companies.

With $450 annual fee, I expected nothing less than 100,000 Skypass bonus miles, and I don't care about that $200 statement credit as the statement credit focus on certain categories.

The new KAL Prestige lounges at ICN Terminal 2 are much nicer than the old ICN T1 and Concourse lounges and the KAL lounges in the US. That won't make the card worth it.

Can you get this card without credit history in the US?

Lucky how many starpoints did you buy?

Wow, this is a non-event product and there is so much better in the market, especially if you are willing to be patient and apply only for the best to preserve your credit score. It takes a minimum of 60,000 miles or points convertible 1:1 to airline miles, and usually 80-100,000 miles to get my attention...more for hotel bonuses which are usually worth a bit less. These high value sign-up bonuses are fewer but they...

Wow, this is a non-event product and there is so much better in the market, especially if you are willing to be patient and apply only for the best to preserve your credit score. It takes a minimum of 60,000 miles or points convertible 1:1 to airline miles, and usually 80-100,000 miles to get my attention...more for hotel bonuses which are usually worth a bit less. These high value sign-up bonuses are fewer but they do show up regularly.

Also important to get my attention: Wow me with benefits not usually available. The latest card I acquired this year was the new Hilton/Amex: 100,000 intro bonus, $250.00 travel credit et:al and best of all: Hilton Diamond status. I already have Lifetime Platinum with Marriott/SPG but a top tier back up never hurts.

If you have good to great credit and travel enough to use these benefits, be picky. You are the prize!

@Doug:

And that's a loooot of people. My parents, for instance, are wowed by my and my partner's "luxury" travel as a result of points/miles. Yet every time I try to provide insight and guidance on how they can do it, too, they refuse to give up their Marriott card and their UA Mileage Plus card because "[they] only fly United and only stay at Marriotts. Why would [they] need any other cards?" ::facepalm::

If the travel credit is for calendar year, at least you could get $400 total in year one. I would get this if the bonus went up to 60,000 or so.

I get it. This is a promo for the American Express Platinum Card. If I buy my KL tickets from KL I can get 5X Membership Rewards points (although cannot transfer to KL this way). Still would rather have 5X Membership Rewards points in most cases. If want KL points would use CSR for 3X.

This card is almost as bad as the grocery store cards that offer a free 12 pack of Pepsi after approval.

Lame. No one is going to sign up for this.

I find it funny that this is the only card branded by a travel company where you can earn a bonus amount of miles on its competitors, since you earn 2x miles on any airline. It's still a terrible card, and the fact that they're willing to reward you for flying other airlines is perhaps the worst way it's terrible.

I do hope that Korean partnering with US Bank doesn't mean the days of UR transfers are numbered though.

The card will appeal to the clueless people who never heard of CSR. Let's say someone flies Korean often, they have a Korean Sky Pass account, they live under a rock with no internet access or never bother to look online for credit card offers. Since they fly Korean, one day they get a piece of mail with this offer. Since they don't know about other premium cards they get excited about this offer and apply for the card.

Lucky, you should look and Canadian and European cards.... even the Amex Platinum and SPG cards have much less perks than their US counterparts. Totally agree with @Henrik!

The funny thing is that this would be a pretty attractive card for us in Europe.

@Lucky

Those Korean Air passes are actually more restrictive than you might think.

If it’s anything like the ones issued by the lower fee co-branded card from US Bank, they’re only good if paired with a same day Korean Air boarding pass.

@Jerry D

Priority Pass entry at LAX into the KE lounge is restricted to afternoon hours at least. There are a lot of SkyTeam departures in the morning. That’s the one situation where a specific lounge pass might come in handy.

@Anthony "Not necessarily a bad card for those that fly paid Korean Air tickets on a regular basis (which isn’t the audience of this blog). The fee, credits, and bonus categories could line up a bit differently."

The point that Lucky is trying to make is that even if you spend 100% of the card's spend on paid Korean tickets and want to redeem 100% of the rewards on Korean Air's FF Program, you would...

@Anthony "Not necessarily a bad card for those that fly paid Korean Air tickets on a regular basis (which isn’t the audience of this blog). The fee, credits, and bonus categories could line up a bit differently."

The point that Lucky is trying to make is that even if you spend 100% of the card's spend on paid Korean tickets and want to redeem 100% of the rewards on Korean Air's FF Program, you would be better off getting the Sapphire Reserve, which would give you 3 miles/travel over 2 miles.

Not necessarily a bad card for those that fly paid Korean Air tickets on a regular basis (which isn't the audience of this blog). The fee, credits, and bonus categories could line up a bit differently.

Delta AMEX cards only give you 1 mile per dollar in general and 2 miles per dollar on Delta flights, but the cards are incredibly popular for daily use, so such cards can be designed.

@ Anthony -- The Delta Cards are popular for other reasons -- they give you perks when flying the airline, and you can earn elite miles towards status by spending on the card. There's simply no advantage to this card over the Sapphire Reserve even if you exclusively fly Korean Air, as aarowa points out.

US bank is risk averse. They grow slowly.

I thought the KAL lounges are included in the priority pass access so wouldn't it be totally stupid to only get 2 passes a year?

Seems more like a $95 yearly fee card if you remove the 200 dollar credit and lower it to 95. Everything else would line up perfectly.

Also those Korean Air lounges are dank as hell

Korean Air lounges suck anyway.

What if you're over 5/24 and need a quick 30,000 Korean Air miles?

At first I thought this was an Air Koryo Visa Signature card.