The premium credit card space sure is heating up. For years American Express Platinum Card® was the go-to premium rewards card, but in the past few years the Citi Prestige® Card and Chase Sapphire Reserve® have given Amex some competition.

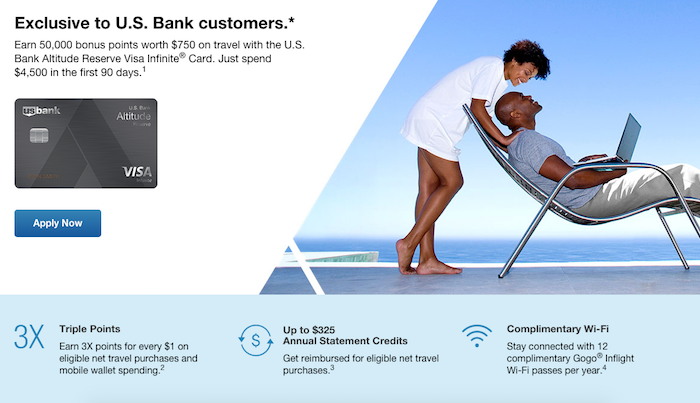

Now US Bank is throwing their hat in the premium card race with the new US Bank Altitude Reserve Card, which started accepting applications today. The first thing to note is that the card is only available to US Bank customers, so you need to have an account with them in order to be eligible for the bonus. Here are the basic details you need to know about the card:

US Bank Altitude Reserve Card welcome bonus

The card is offering a welcome bonus of 50,000 points after spending $4,500 within 90 days. Each point can be redeemed for 1.5 cents towards a travel purchase, meaning that welcome bonus potentially gets you $750 worth of travel.

US Bank Altitude Reserve Card annual fee

The card has a $400 annual fee, which is quite a bit lower than the Amex Platinum, Citi Prestige, and Chase Sapphire Reserve.

US Bank Altitude Reserve Card annual travel credit

The card offers a $325 travel credit per cardmember year. Any purchase coded as travel is eligible for this credit, so I imagine almost everyone will have an easy time maximizing that. Unlike other premium cards, this travel credit is per cardmember year rather than per calendar year, meaning you’ll get exactly one credit per annual fee.

The way I see it, this essentially lowers the out of pocket on the card to $75 per year, when you subtract the $325 from the $400 annual fee.

US Bank Altitude Reserve Card return on spend

This is where the card is awesome. The card offers triple points on travel and mobile wallet purchases, including Android Pay, Apple Pay, Microsoft Wallet, and Samsung Pay. I’m surprisingly low tech, so I can count on one hand the number of times I’ve used Apple Pay. This category is potentially a deal changer, given how mobile payment options are becoming increasingly popular.

At a value of 1.5 cents per point, that’s like getting a return of 4.5 cents on each dollar spent through a mobile wallet. That’s an incredible deal, and a bonus we haven’t seen on any other card.

US Bank Altitude Reserve Card perks

In addition to the $325 travel credit, the card offers all kinds of other perks, including:

- 12 complimentary Gogo Wi-Fi sessions per year

- A $100 statement credit to reimburse you for TSA PreCheck or Global Entry

- A Priority Pass™ Select membership, though you only get four free visits per year, and have to pay $27 per visit thereafter

- Discounts with Silvercar

- Primary collision damage waiver coverage on car rentals

How good is the new US Bank Altitude Reserve Card?

When you remove all the fluff, you’re paying $75 per year in order to earn a ~4.5% return on mobile wallet purchases. The travel credit is nearly worth face value, and I don’t consider the triple points on travel to be especially unique, which is why I break it down that way. Some might also place quite a bit of value on the 12 Gogo passes you get per year, which for many will more than “wipe out” the annual fee.

The points you earn can’t be transferred to airline programs, though getting 1.5 cents of value from them towards airline purchases is pretty compelling. Mobile wallet purchases are becoming increasingly popular, so if it gets to the point where a good portion of my payments are through mobile wallets, then this is a card I’d consider.

However, personally I’m not sure with how many purchases I’d come out ahead at the moment. In other words, I’m already earning 3-5x points per dollar spent at gas stations, restaurants, supermarkets, etc., so how many categories does that leave? I put my taxes on credit cards, so is there a way to make those purchases using a mobile wallet? 😉

Bottom line

There’s no denying that US Bank is introducing a unique product into the premium card market. While it’s somewhat similar to what other issuers have introduced, it has a unique bonus category that I think a lot of consumers will like. Given the $400 annual fee and $325 annual travel credit, it’s not an especially expensive card to hold onto either.

Do you plan on picking up the US Bank Altitude Reserve Card? Just how much do you value the 3x points on mobile wallet purchases?

2025 Update: mailed to me Friday, US Bank sent out a notice hatcheting the best benefits of this card. No more 1.5x multiplier on redemptions, mobile payments capped at 5k / month for the 3x earnings. Dining credit now has to be used in their travel portal. Yay for change fees.

Along with: "Transfer your Altitude Reserve points to other airline and hotel loyalty programs providing valuable flexibility to maximize your travel."

Which... well, okay....

2025 Update: mailed to me Friday, US Bank sent out a notice hatcheting the best benefits of this card. No more 1.5x multiplier on redemptions, mobile payments capped at 5k / month for the 3x earnings. Dining credit now has to be used in their travel portal. Yay for change fees.

Along with: "Transfer your Altitude Reserve points to other airline and hotel loyalty programs providing valuable flexibility to maximize your travel."

Which... well, okay. It's still 3x to a point (I only exceeded 5k once) with no FTF. If they announce Priority Pass Restaurants are gone, I'll be out for sure.

How do you make mobile payments to pay for taxes?

@freqflyer Samsung pay can be used nearly anywhere. Look it up. Online, I agree with you, but even that could be navigated if cleaver. Just think outside the box!

Someone please tell me, what's the redemption minimum, how many points? With CSR, it starts at 1 point which is $0.01. Also, can I pay a portion of a ticket with points and the rest with money like CSR.

@THEsocalledfan - how do you get to 100% at 3x? A good portion of my charges are online (so ineligible) and a fairly decent percentage of the physical locations I go to do not support mobile payments. I will know more once I start using the card, but I would expect to get far less than 50% at 3x.

Interesting... I max at my Amex everyday for grocery pretty early on in the year and this would make a great second card for my groceries purchases, given that every one of the places I shop at takes Apple Pay... plus it gives me a new place to buy gift cards...

Does it also work for Apple Pay on the web?

@Jason Brandt

Except that you can get a 4.5% travel return on literally every purchase. But, other than that, no, it is horrible.

I don't see ANY reason to acquire this card . . .

Hey Ben, or anyone, what are those altitude points worth in terms of airlines. For example you can transfer Ultimate rewards points to SQ, or Amex points to Emirates, or Citi points of Garuda. Does US bank have their own list of transfer partners?

@James - the issue is if you try to book a coach ticket and then apply points to the purchase, you are all too often forced into a Basic Economy fare with no simple workaround. One of my colleagues at Travel Codex covered the process of trying to call customer service and force a fare class change with all three (Amex, Citi, Chase). It's not easy, and in some cases seemed impossible. If you're booking...

@James - the issue is if you try to book a coach ticket and then apply points to the purchase, you are all too often forced into a Basic Economy fare with no simple workaround. One of my colleagues at Travel Codex covered the process of trying to call customer service and force a fare class change with all three (Amex, Citi, Chase). It's not easy, and in some cases seemed impossible. If you're booking J or F, then you're right, it doesn't matter. Hotels are also an issue because most of the chains block elite benefits and points earning for any rooms booked through a third-party website. So yes, the room is still "free", though at an opportunity cost.

@MeanMeosh - why wouldn't their travel portal work like Amex's? If you use their points through their portal to buy tickets, and possibly even business or first class, it would be like using cash as far as the airline is concerned and you'd earn miles on those flights. Plus, avoid blackout dates, too, that miles have to deal with.

Of course, we don't anything about how this would work, but when I read about redeeming...

@MeanMeosh - why wouldn't their travel portal work like Amex's? If you use their points through their portal to buy tickets, and possibly even business or first class, it would be like using cash as far as the airline is concerned and you'd earn miles on those flights. Plus, avoid blackout dates, too, that miles have to deal with.

Of course, we don't anything about how this would work, but when I read about redeeming for travel thru a portal, I assumed that's how it was. Could be wrong. I'm being hopeful, but cautiously watching how the card and program ends up.

The major limitation with this card is that in order to redeem at the 1.5x rate for travel, you have to do so through the US Bank travel portal. That means potentially getting stuck with Basic Economy fares, no elite benefits at hotels, etc. I guess you could just book what you want and redeem at 1 cent/point, but then why not just get a no-fee cash back card? Not a winner in my book...

The major limitation with this card is that in order to redeem at the 1.5x rate for travel, you have to do so through the US Bank travel portal. That means potentially getting stuck with Basic Economy fares, no elite benefits at hotels, etc. I guess you could just book what you want and redeem at 1 cent/point, but then why not just get a no-fee cash back card? Not a winner in my book - unless Kroger and Sam's start taking Apple Pay, in which case I'll probably bite the bullet and get it.

@Jason - no dice on 6x points. The T&Cs say all mobile wallet purchases will count under the "mobile wallet" category, even if it's a travel purchase.

So these points are not Flexperks, but some other points. Please clarify

Watching this card with interest. I currently have an SPG for transfers to AA, but the possibility of getting 4.5 cents toward airfare (3x bonus and 1.5x redeem) would be a great addition. Eventually, I would imagine SPG will go away and if AA doesn't become a transfer partner with Thank you points, this would be a good companion for us. Need to get a newer Samsung phone though, LOL.

You don't need a checking or savings account. I applied and got approved. I do have 2 credit cards with them, both about 1 year and 7 months old.

Ben, you need to get a Samsung phone.

This is interesting, paying rent with Radpad codes as travel with many cards (CSP, CSR), you can also pay using apple pay or android pay, thus becoming mobile wallet. Could you potentially get 6x points using this service? That would make me go get a us bank account today!

Hey Lucky--you actually can pay your taxes with mobile wallet. See the IRS's payment page, the third column: https://www.irs.gov/uac/pay-taxes-by-credit-or-debit-card

Sam, ok great I have a long standing Cash+ card. thanks will try.

@JL100- Correct. They are only seeing checking accounts etc but not realizing Credit Card accounts and therefore if you don't have checking/savings before 30 days or so, then they automatically deny the app. You have to call and then they will see whether you have a credit card and accept that and give it to a manager for manual review.

Do you mean you do have accounts, but US Bank online is not recognizing that?

only 50k points? not exactly on my to do list. while there may be some good perks to offest some of the high annual fee, i can get Numerous 50k cards with no to lil annual fee.

my first bank account was with US Bank over 20 years and i have $5 in it still accruing about a penny each year.

I think a lot of online applications are getting denied due to not having a relationship with US Bank. There seems to be a screening issue right now. I would call them and ask them and they will do a manual review by a manager and get back in a day or 2.

That is what happened with me.

You can refill Starbucks cards using Apple Pay. How much do you spend on Starbucks in a year, Ben?

;)

Denied - credit score 825 but I'm sure too many inquiries for them. Never a problem for Chase non 5/24 cards, Amex, Barclays, and B of A.

Denied. Screw US Bank! I never liked them in the first place

@Ben: Just a quick heads up about the small typo in the first sentence ;-)

"The premium credit card space sure is heating us" should be "heating up".

Would other personal and business CC count toward "being a customer"?

I recently froze ARS and Sagestream credit reports, because of all the stuff I read that USBank checks those and it's an issue. but now I'm seeing DPs of people being rejected specifically because they froze those reports.

Any news on this? Should I unfreeze before applying for anything?