Update: Huge changes have been made to the Uber Card.

A couple of months ago we learned that Barclaycard would be introducing a new Uber credit card this fall, and it looks like we now have the details.

The card will be called the Uber Visa Card, and applications will be available starting November 2, 2017. There are quite a few things that surprise me about how the card is structured, though overall it has the potential to be quite lucrative. Let’s look at the details:

Uber Visa Card sign-up bonus

The card offers a sign-up bonus of $100 after spending $500 on purchases in the first 90 days.

Uber Visa Card annual fee

The Uber Visa Card will have no annual fee.

Uber Visa Card return on spend

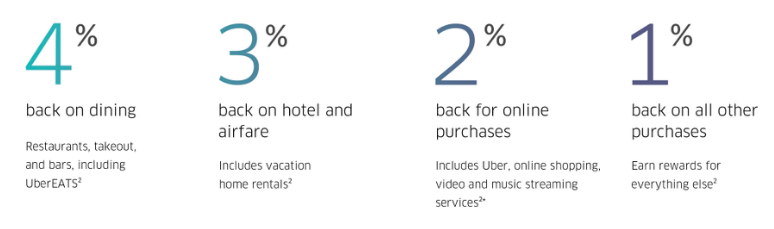

The card has a tiered rewards structure, and offers 4%, 3%, 2%, and 1% back, as follows:

- 4% back on dining, including restaurants, bars, and UberEATS

- 3% back on hotels and airfare, including vacation rentals

- 2% back on online purchases, including Uber, online shopping, video, and music streaming services

- 1% back on everything else

Really your card earns points (with each point being worth a cent), and then you can redeem points for cash, gift cards, or Uber credits. You’ll get the same redemption rate no matter how you choose to redeem.

The only advantage to redeeming for Uber credits is that there’s a lower minimum to redeem. You can redeem for Uber rides when you have 500 points ($5) in your account, while you can only redeem for a statement credit when you have 2,500 points ($25).

Uber Visa Card perks

The card has no foreign transaction fees, which is a nice and fairly rare feature for a card without an annual fee.

While it’s not a reason I’d get the card specifically, you can get a $50 credit for online subscriptions after you spend $5,000 or more on your card per year. Here are the terms associated with that benefit:

You may earn up to a $50 credit for net purchases from eligible digital music, video and shopping subscription services after you spend $5,000 or more in total net purchases on your account during each 12-month period through and including your account anniversary date. When you meet the $5,000 spend threshold, you will receive statement credits for each new eligible digital subscription services transaction when it posts to your account.

The card also offers mobile phone damage or theft protection of up to $600, when you pay your mobile phone bill with your card. Here are the terms associated with that benefit:

Enjoy up to $600 in supplemental insurance coverage against theft of, damage to or involuntary and accidental parting of your cell phone not otherwise covered by another insurance policy when you make your total monthly cell phone bill payment with your Uber Visa Card. See your Guide to Benefits on your online account for complete details about coverage qualifications and replacement or repair reimbursement.

My thoughts on the Uber Visa Card

I’m a bit surprised and overall impressed by the new Uber Visa Card. First let me say that I wouldn’t under any circumstances recommend putting non-bonused spend on the card, when there are cards like the Citi Double Cash® Card, which offer 1% cash back when you make a purchase, and 1% cash back when you pay for that purchase (in the form of ThankYou points). You should never settle for just a 1% return on any spend.

But everything else about this card impresses me. A no annual fee 4% cash back dining card with no foreign transaction fees? Very nice. We recently saw the introduction of the Capital One Savor Cash Rewards Credit Card, which impressed me with 3% cash back on dining, but this is even better.

The cell phone damage and theft benefit is huge as well. It’s similar to the benefit on the Ink Business Preferred® Credit Card, though that card offers 3x points on your cell phone bill. So the only downside with this card is that you’re potentially forgoing a bonus category when using this card. Given how easy it is to damage phones nowadays, this is a perk that many may find valuable.

I guess the part of this card that surprises me is that it isn’t more integrated with Uber. There’s no real bonus category for Uber spend, and in general, your best option is getting cash back rather than Uber credit, since cash is worth more than an equivalent amount in Uber credit for the flexibility.

This is a creative card with compelling benefits, I’m just a bit surprised how loose the connection to Uber is. This almost doesn’t feel like a co-brand card in terms of what they’re offering.

What do you make of the new Uber Visa Card? Is it different than what you were expecting?

Wow, great news for all of us. Yes, Uber Visa Card offers many rewards like gift cards or cash back, include an annual $50 subscription credit that can be used on services like Netflix, Spotify or Amazon Prime. In addition, cardholders also get coverage for mobile phone theft or damage, no foreign transaction fees and will receive invites to exclusive events like secret shows and dining experiences.

Stack Visa Local Offers onto your restaurant spend and the Uber credits you rack up can soar.. in NYC it’s not uncommon to see 10% Visa Local Offers on dining.

Iamhere agreed, and if you transfer points to airlines vs. using the portal to get tickets, 3 miles is a lot more than 3 cents- at least for me they are a bare minimum of 0.02 ea and often 0.04 or more.

Actually, I don't think this card is as good as it sounds. Let's compare it to redeeming points on the JPMorgan Reserve credit card. While you get 3 points per dollar on travel and dining and one point on everything else, you get a 50% bonus when you redeem for travel, so it seems there's a higher value there.

Hmm, I'm curious about the cell phone protection. Since it says it applies when the incident is "not otherwise covered by another insurance policy", does that mean that if my homeowner's insurance theoretically covers it, then the credit card's policy does not apply? I guess we'll see when the full T&C come out.

It's not really "no foreign transaction fee" card as the terms & conditions state that foreign transaction fee is "0% of each transaction in U.S. Dollars". So. transactions in foreign currencies carry some fee, the rate of which is not clear

Is it a true chip and pin card? Would be a great card for that reason alone given it's free and had to foreign transaction fees.

Kind of odd to only offer 2% on Uber rides with 2 other higher earning categories.

Thanks Ben I appreciate your advice! Your blog is always fantastic!

I rather use Lyft than uber, so I wonder if the 2% back on online purchases, including Lyft?

Sounds like a good card. Definitely geared for millineals with the no fee, no foreign transaction fees, "exclusive" events, and travel/dining bonus categories. Agree this should've Come with VIP status similar to the Amex Platinum partnership...which also will be interesting to monitor to see if they continue / change that partnership

The annual $50 credit can also be used to pay for Amazon Prime which many people may find very attractive.

I guess it's a brand people know. But that brand, while it has plenty of strong supporters, also has lots of detractors. So you kind of wonder why the card is branded at all. For a no-fee card though those do seem like decent benefits. I wonder a little bit about the redemption though. Why not just automatically provide a statement credit every month?

My thoughts exactly - why not 10% off on Uber rides, or automatic Uber status (for example the 100 rides level)?