Sometimes credit card companies will offer targeted bonuses to existing card members to encourage them to put spending on their card. This goes beyond the initial welcome bonuses offered by the cards, and even goes bonus categories.

These bonuses are targeted and are usually either emailed or mailed to members. Personally I rarely find them worthwhile. For example, sometimes I’ll get a targeted promotion on an airline credit card offering double points on dining for some period of time, but that’s not worth it to me when other cards offer up to 5x points on dining.

Yesterday Bank of America sent out some targeted spending bonuses that I wanted to talk about in this post. I’m writing about this because:

- The offer is actually lucrative

- It seems to be pretty widely targeted, because I received the offer, Ford received the offer, and I’ve gotten no fewer than a dozen messages from people who received the offer

If you want to see if you’re eligible, check your email inbox for the following subject line:

Account update – bonus cash offer now available

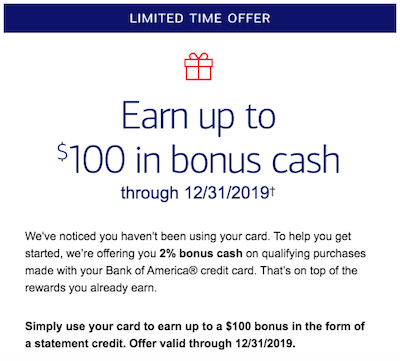

With this offer you can earn up to $100 in bonus cash through December 31, 2019. This seems to be a bonus for those who haven’t been using their card a lot, because that’s noted in the email.

Basically you’ll earn 2% bonus cash back, up to a total of $100 cash back, for spending through December 31, 2019. Best of all, that’s in addition to your normal rewards. In other words, you could maximize this by spending $5,000.

Personally, I see the offer on my Alaska Airlines Card, meaning that for the first $5,000 spent I’d be earning 2% cash back plus one Alaska mile per dollar spent. I value Alaska miles at close to two cents each, so that’s just about a 4% return on non-bonused credit card spending, which is better than anything else you’ll find for everyday spending.

The terms state that it could take up to 12 weeks for the statement credit to post. I’d also note that the terms suggest “you may be issued an Internal Revenue Service Form 1099 (or other appropriate form) that reflects the value of such reward.” However, as far as I know that really shouldn’t happen, since rewards earned through credit card spending shouldn’t be taxable.

Bottom Line

Usually I don’t write about these kinds of targeted credit card spending offers, but in this case it seems to be pretty widely targeted, and also is an excellent deal. If you have any Bank of America cards on which you haven’t spent money in a while, check your email to see if you were targeted for this offer.

I’ll gladly spend $5,000 on my Alaska Card to earn 5,000 Alaska miles plus $100 cash back.

Were you targeted for this offer, and if so, do you plan on taking advantage of it?

Nothing for me.

Interesting, it seems that the offer you receive will depend on your prior usage of the card. I have been using my BoA Cash Rewards card frequently on 'Online Shopping' since I opened it in Jun '19. I received the following version:

"Earn up to $150 cash back on online shopping

purchases through December 31, 2019. That’s a 6%

bonus on up to $2,500 in purchases—and it's on top of

the rewards...

Interesting, it seems that the offer you receive will depend on your prior usage of the card. I have been using my BoA Cash Rewards card frequently on 'Online Shopping' since I opened it in Jun '19. I received the following version:

"Earn up to $150 cash back on online shopping

purchases through December 31, 2019. That’s a 6%

bonus on up to $2,500 in purchases—and it's on top of

the rewards you already earn with your credit card.

Maximize your rewards

Change your 3% category to Online Shopping for the

holiday season—or choose Gas, Dining, Travel, Drug

Stores or Home Improvement and Furnishings. You can

change your 3% category once each calendar month at

bankofamerica.com/maximizemyrewards."

Now the fact that it mentions that the bonus applies 'on top of the regular rewards' seems to indicate that the final cash back rate you will get if you set your BoA Cash Rewards category to 'Online Shopping", will be 3% (regular reward) + 6% (targeted offer bonus) = 9%.

And if you are a Platinum Honors customer, it nets to 3% x 1.75 + 6% = 11.25%.

This is just mind-blowing especially given their 'Online Shopping' definition is extremely broad (any non-store purchase, with the exception of Utilities, Home Cleaning or Insurance).

I got 6% cash back up to $150

I had $150 last quarter and I didn't use it.. got an email doubling it to $300 ...

$150 for me, but in form of selecting from a list of categories of spend that will earn 3% cash back (travel, gas, etc.). If it was on an Alaska card, I’d probably do it. But it’s only on my cash rewards. Unless they add property taxes as a bonus category . . .

Got the same, but $150