Qatar Airways is currently in the process of strategically investing in a few airlines. The first of those deals has been announced today, as the Doha-based airline is taking a stake in a major South African airline.

In this post:

Qatar Airways finalizes investment in Airlink

Qatar Airways has purchased a 25% stake in Airlink, which is South Africa’s largest regional airline. The stake has been purchased for an undisclosed amount of money.

For Qatar Airways, the goal is for this investment to help the airline boost its regional connectivity, through an enhanced codeshare agreement and a loyalty collaboration.

Here’s how Qatar Airways CEO Badr Mohammed Al Meer describes this development:

“Our investment in Airlink further demonstrates how integral we see Africa being to our business’ future. This partnership not only demonstrates our confidence in Airlink, as a company that is resilient, agile, financially robust and governed on sound principles, but also in Africa as a whole, showing huge potential that I am delighted we are able to help start realising.”

Meanwhile here’s how Airline CEO Rodger Foster describes this news:

“Having Qatar Airways as an equity partner is a powerful endorsement of Airlink and echoes our faith in the markets we currently serve and plan to add to our network. This transaction will unlock growth by providing efficiencies of scale, increasing our capacity and expanding our marketing reach. By bolstering Airlink and its business, this investment will strengthen all of the existing airline partnerships Airlink has nurtured over the years.”

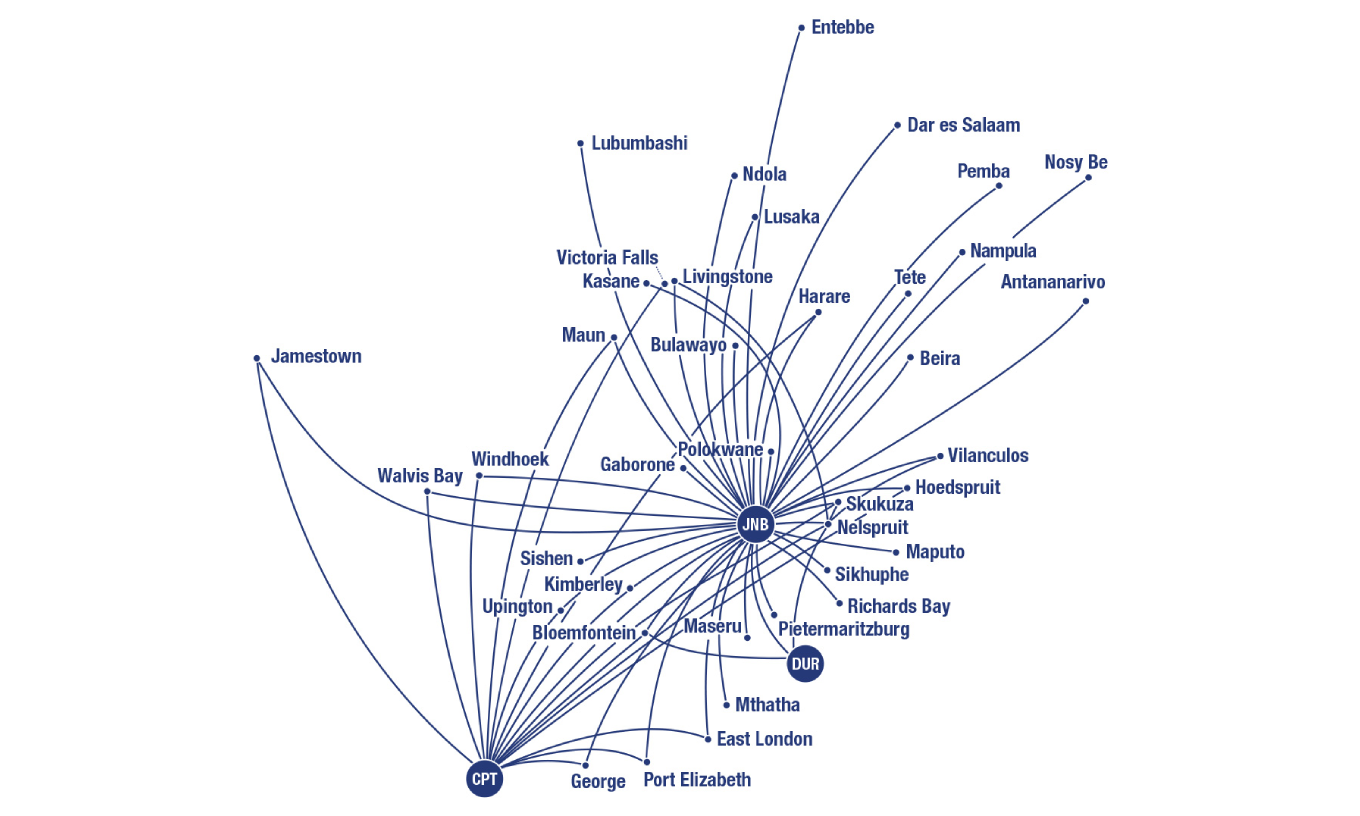

For those not familiar with Airlink, the airline operates a fleet of roughly 65 regional jets, ranging from the Embraer E135 to the Embraer E195. The airline flies to 45 destinations in 15 countries in sub-Saharan Africa. The airline is also profitable, which is quite an accomplishment for the region, given how many airlines there are continuing to sustain losses.

As you’d expect, though, Qatar Airways’ motivation to invest in Airlink is primarily strategic, and not financial, and is intended to expand Qatar Airways’ reach in the region. The goal is to deliver benefits in terms of increased traffic, broader and deeper market reach, lower distribution costs, and better financing opportunities when ordering aircraft.

As you can see, for now Qatar Airways is taking a minority stake in Airlink. One consideration is that South Africa’s air licensing rules stipulate that international airlines based in South Africa must be “substantially” owned by residents. So obviously Qatar Airways can’t take full ownership of the airline, but rather is just a partner.

What will this investment look like?

Usually I’m really skeptical of airlines investing in other airlines, especially when we’re talking about Gulf carriers. I mean, Etihad’s track record of investing in airlines is comically bad, to the point that it would’ve been more efficient to just throw billions of dollars into a furnace. Meanwhile Qatar Airways’ Air Italy investment several years back ended up in liquidation for the airline.

What do I make of this investment? I guess my first question is what Qatar Airways is gaining by investing in Airlink, rather than just continuing to partner with the airline? The airlines already have a codeshare agreement, so Qatar Airways can get traffic from Airlink.

I suspect part of the motivation may be to better optimize Airlink’s schedule to tie into Qatar Airways’ route network. And perhaps the goal is also to expand Airlink, with Qatar Airways providing financing of newer and larger aircraft.

At the same time, Airlink is currently profitable precisely because the company is so conservative and measured with its growth. The airline is focused on having a sustainable business model, rather than on being flashy.

For example, Airlink’s average fleet age is nearly 18 years old. While newer generation jets would offer better economics in terms of fuel burn, it would be significantly more expensive to operate them.

Is the goal to just have Airlink increase feed to Qatar Airways’ gateways in southern Africa? Or could the goal be for Airlink to get planes that can fly to Doha, and then connect into Qatar Airways’ network? Could we maybe even see Airlink join the oneworld alliance?

I’m very curious to see how this plays out, as it could go several different directions. As I’ve said several times, I’m very impressed by Qatar Airways’ new CEO. Al Meer seems motivated not by prestige or ego for his national carrier, but rather by running a good business. So I certainly have a lot more faith in an investment that he signs off on than some other former Gulf region executives.

Bottom line

Qatar Airways has purchased a 25% stake in Airlink, South Africa’s largest regional airline. Qatar Airways already has a partnership with Airlink, but it seems the goal is to strengthen that even further through an equity investment.

While this deal has been finalized, it remains to be seen what the long term implications will be. Airlink has actually been pretty consistently profitable, precisely because the airline has been so conservative with its fleet, network, etc. I wonder how an investment will change the carrier’s strategy.

What do you make of Qatar Airways investing in Airlink?

Hopefully they sync up the QR flight timing from DOH better with the Airlink southern Africa network. Having a good competitor to KQ and ET for many of the smaller African destinations--without requiring an overnight in JNB--would be FANTASTIC. Unfortunately we do numerous QR tickets with 23-25 hour layovers in JNB simply because the schedules are so close to correct, but just below the MCT.

The Airlink network is heavily focused on Joburg (which makes perfect sense) and Cape Town (which can't be wrong either). But I don't understand the choices they make in (not) serving Durban (no flights to CT while they do find volunteers to fly to Bloem?) a well as serving some other unclear markets (is there such a thing as demand between Nelspruit and Livingstone?).

A lot of tourists use Nelspruit to access the Kruger, and Livingstone is next to Victoria Falls. A niche market, perhaps, but both are on many tourists' bucket list and it may not be that tough to fill an ERJ-140 a few times a week.

Agree with the principle, though -- Airlink not flying CPT-DUR has always struck me odd, though SAA hasn't restored that either.

No surprise here given recent comments by all parties involved. A good match for both sides (for now at least) which will no doubt be challenged at the IASC before eventually being approved.

Let’s not forget QR has a stake in IAG and BA has a significant market share in South Africa so there are benefits there to be had in better coordination too.

How does BA have significant market share in SA?

Comair (which was the carrier BA used for intra-SA and intra southern Africa) has been gone for over two years now.

Internationally they do

In peak times

BA operates double daily A380 to Johannesburg

double daily 777 to Cape Town as well 3 weekly from Gatwick

So they have a huge market share compared to other European carriers

Pre Covid BA even flew to Durban 3 weekly

And had four weekly morning flights to joburg so it is still a big player in the market

BA's 2023 market share in South Africa was in low single digits. Not sure how that is "significant" by any stretch of imagination.

Waiting for Sir Mendis comment.

Excellent move by QR . Makes huge financial sense . Airlink run a good solid operation and this will give them an opportunity to grow . Hopefully flying on airlink will now give us an opportunity to earn avios

WONDERFUL NEWS!

Airlink is a great airline, and as SAA continues to struggle, and with BA / Kalula / Comair gone, Airlink has really stepped up their game service-wise. I hope for nothing but the best with this investment.

Today Qatar sign 25% ownership in Airlink , excellent news