Link: Apply for a Bilt credit card, with three options to choose from

We’ve just seen Bilt roll out absolutely massive changes, which impact both the credit card portfolio, as well as the way that rewards are offered on housing payments. With the new cards having recently launched, we’re finally in a new era when it comes to how rewards are earned for housing.

During the transition period, I know a lot of people were confused by the logistics. With my first housing payment under the new system now having been made, I’d like to report back with exactly how this all worked, and my experience with rewards posting.

Let me do my best to share the process of earning rewards on housing payments, which would apply for those with the no annual fee Bilt Blue Card (review), $95 annual fee Bilt Obsidian Card (review), or $495 Bilt Palladium Card (review) — read my Bilt credit card review & comparison.

In this post:

Basics of earning points with Bilt for housing payments

Broadly speaking, the idea is that Bilt lets you earn rewards for your housing payments at no fee. You can make your housing payments as you usually would (by online payment portal or check), but if you set things up correctly and have a Bilt credit card, you can be rewarded nicely:

- Bilt members can earn points for paying their rent, mortgage, and/or HOA fees (typically 1x points, but there’s some variability)

- Bilt members can earn points for one or multiple properties, so if you have multiple eligible housing payments, you can be rewarded for each of them

- Bilt members can earn points on housing payments with no cap, so as long as you earn enough “credits” to be rewarded, the sky is the limit

- Bilt members need to link their payment accounts for eligible housing payments and then the payment is made by ACH, and you’re awarded points (so the housing payment isn’t charged to your Bilt credit card)

For context, the rewards for housing payments come in the form of Bilt points, and that’s a valuable transferable points currency that can be moved to all kinds of partners (and you can get even more value by taking advantage of Rent Day promotions, which are typically most lucrative if you have Bilt elite status).

The big catch is that in order to earn rewards for your housing payments, you need to either complete a certain amount of credit card spending, or you need to rack up sufficient Bilt Cash. In theory, you can change your preference with each billing cycle, but typically I think Bilt Cash is the better of the two options. Let me explain.

Earning rewards on housing payments with Bilt Cash

Bilt Cash is the primary currency by which you can earn rewards for housing payments:

- All three Bilt credit cards offer 4% in Bilt Cash on spending, in addition to the standard rewards structure

- $3 in Bilt Cash is worth 100 Bilt points on your total housing payment, at the rate of 1x points

- Bilt Cash expires on December 31 of the year in which it’s earned, though $100 in Bilt Cash can be rolled over to the next year

- You need to have the Bilt Cash in your account at the time that you try to make your housing payment

- While earning rewards on housing payments is one of the best uses of Bilt Cash, there are other ways to use these rewards as well, like for a spending accelerator, among many other options

To simplify this as much as possible, with this option, you need to spend an average of 75% of your housing payment amount in order to earn 1x points on those payments. In other words, $15,000 in spending on a card would earn you $600 in Bilt Cash, which is enough to earn 20,000 points on $20,000 worth of housing payments.

A vast majority of people should be using Bilt Cash for housing payments, rather than the alternative option, which I’ll cover below.

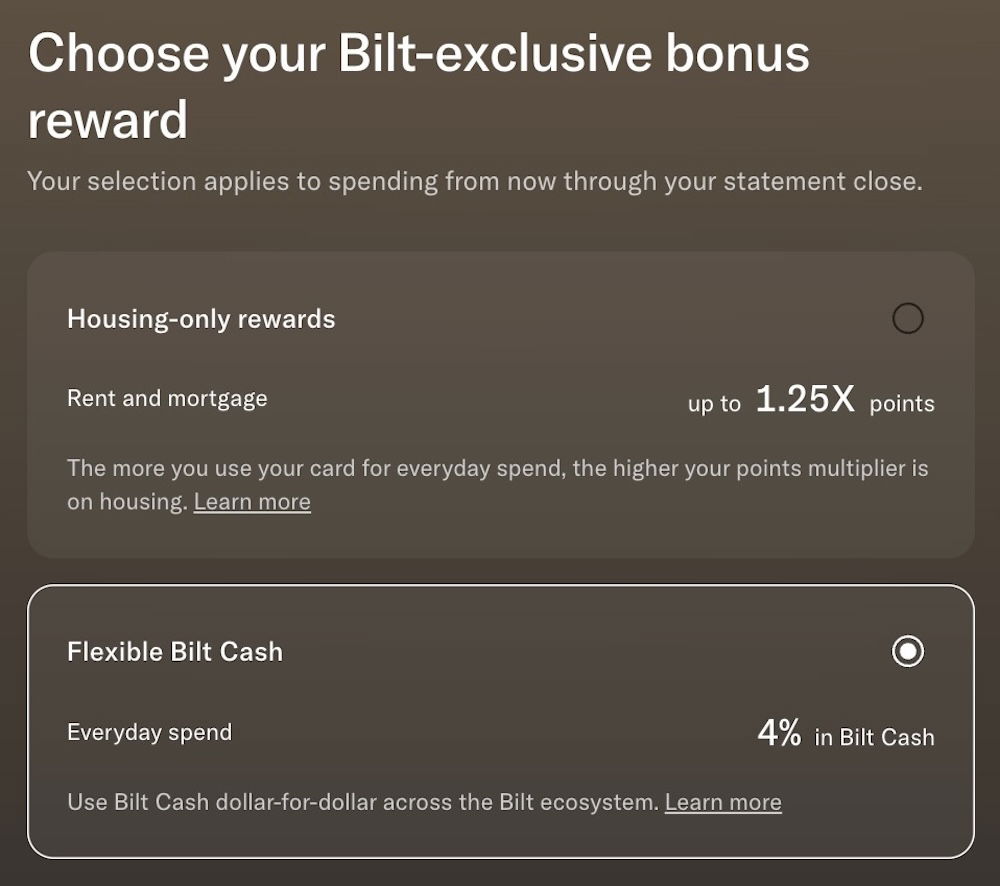

Earning rewards on housing with housing-only rewards

Bilt does have one alternative to the Bilt Cash concept (this was designed at the last minute, for people who thought the Bilt Cash system was too complicated). Rather than earning Bilt Cash, cardmembers can instead be rewarded for their housing payment using a housing-only rewards system.

The idea is that the more you spend, the bigger your multiplier on housing, up to 1.25x points. You can find the chart below.

Points on Housing | Minimum everyday spend as a % of monthly rent / mortgage (Example of $2,000 rent) |

|---|---|

0.5x points | Spend at least 25% of monthly rent ($500) |

0.75x points | Spend at least 50% of monthly rent ($1,000) |

1x points | Spend at least 75% of monthly rent ($1,500) |

1.25x points | Spend the same or more as your monthly rent ($2,000) |

That might sound good, but I consider Bilt Cash to be more lucrative, given that excess Bilt Cash can be redeemed in all kinds of other way, to earn you even more points.

Step-by-step to rewards on housing payments with Bilt

While the above covers how much you can be rewarded for housing payments, what’s the actual process for setting things up so you’re being rewarded correctly? This is something that can be confusing at first, especially when you transition from one system to another.

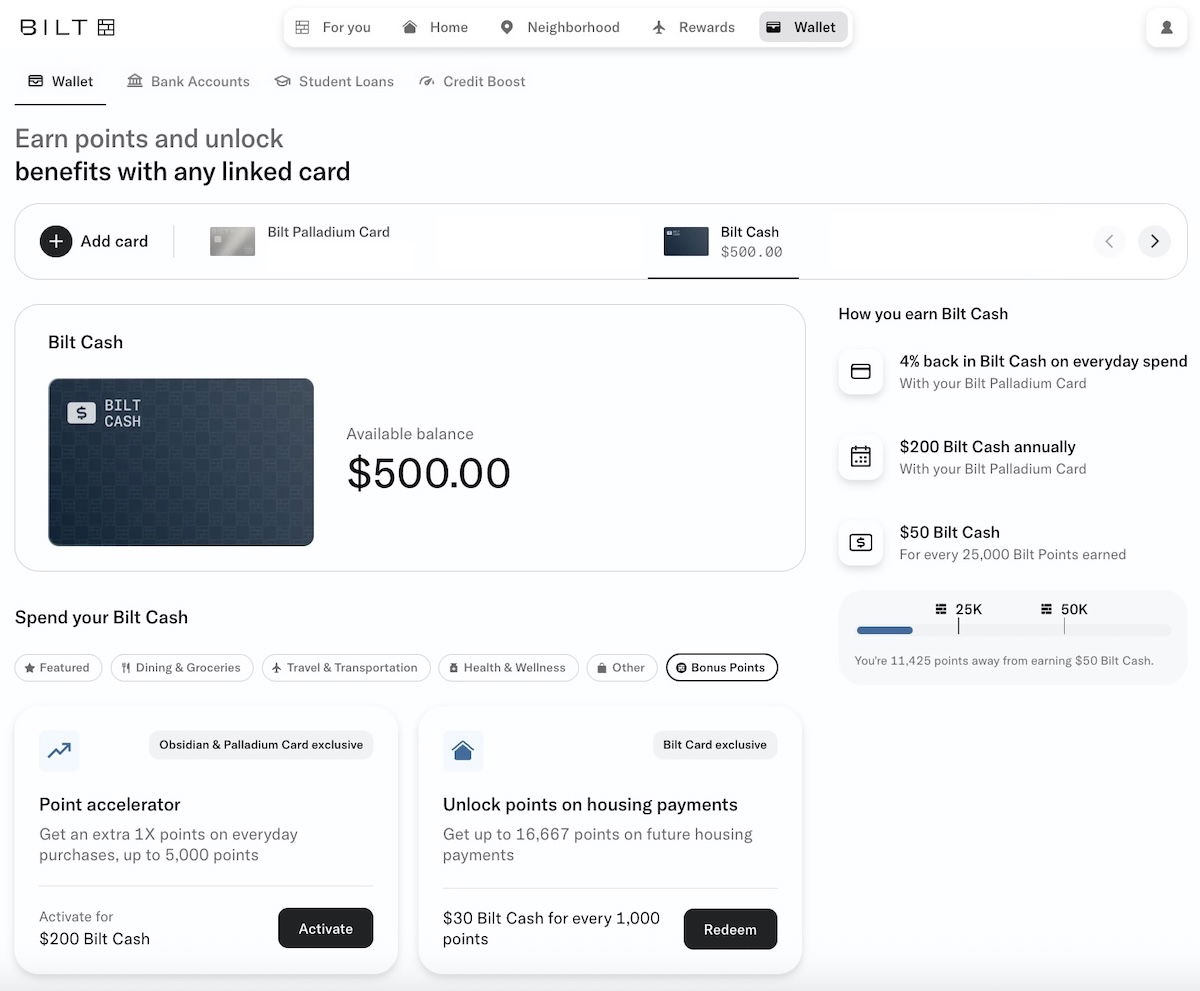

For what it’s worth, I picked up the Bilt Palladium Card, and as part of the welcome bonus on that card, I earned $500 in Bilt Cash (all Bilt credit cards offer some Bilt Cash as part of the sign-up bonuses, to get people started on earning rewards on housing payments).

Before I get into this, let me explain the below instructions assume that you choose to earn Bilt Cash, which is what I would recommend. That’s because you first need to select if you want Bilt Cash or the housing-only rewards option, so the process is slightly different for the latter.

With that out of the way, you’ll want to log into your Bilt account, and go to the “Wallet” section of your account. Then go to the “Bilt Cash” section, which will show how much Bilt Cash you have available. Note that Bilt Cash that’s part of the sign-up bonus generally posts as soon as you activate your card, while Bilt Cash from spending posts shortly after the purchase is made (rather than only after the statement closes).

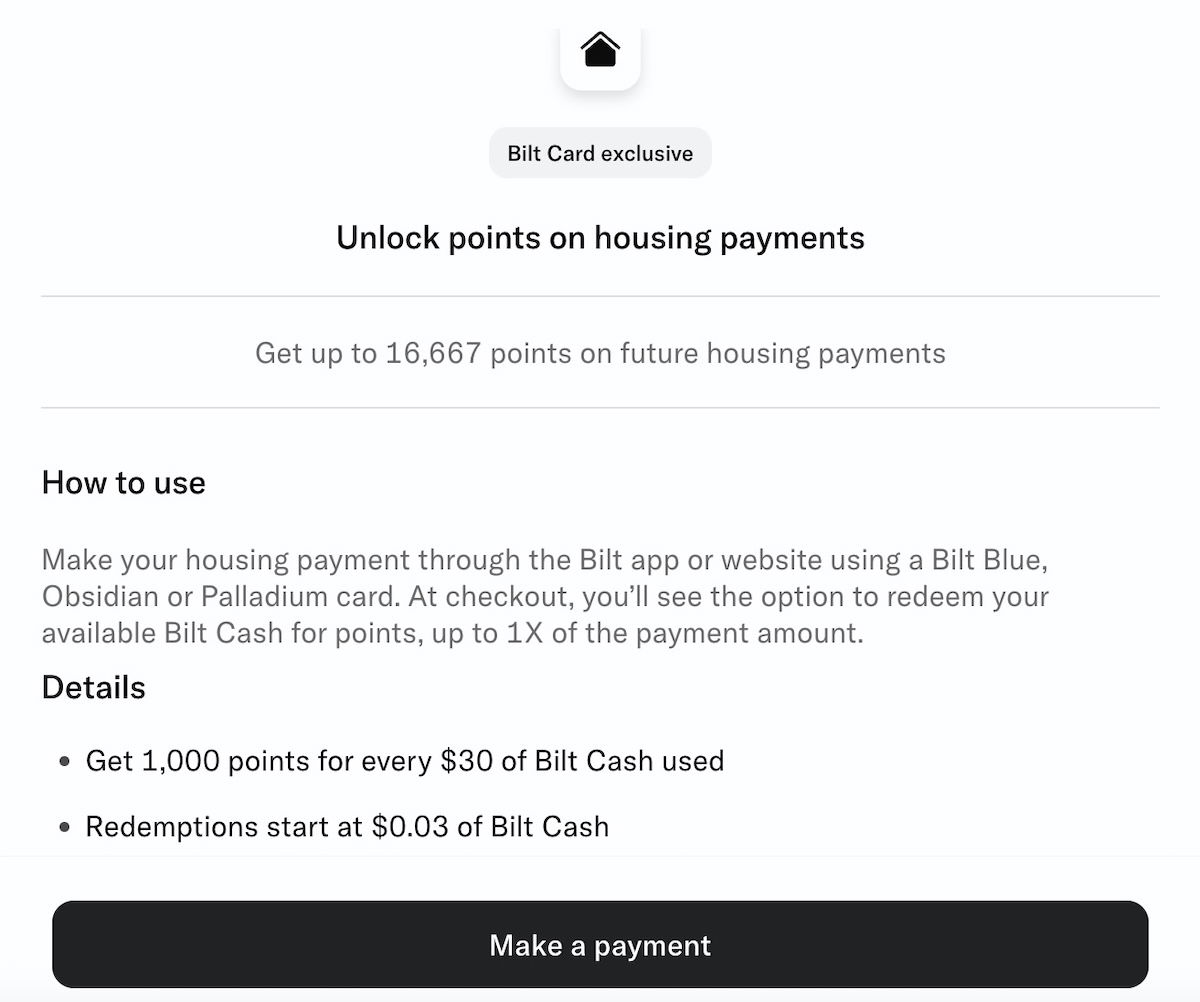

Underneath the Bilt Cash area, you should see a heading that says “Spend your Bilt Cash.” Choose “Bonus Points,” and then the “Unlock points on housing payments” section, and then click “Redeem.”

You’ll see the maximum number of points you can earn on future housing payments based on your Bilt Cash balance. For example, my $500 in Bilt Cash is enough to earn me 16,667 points. So you should then click the “Make a Payment” button.

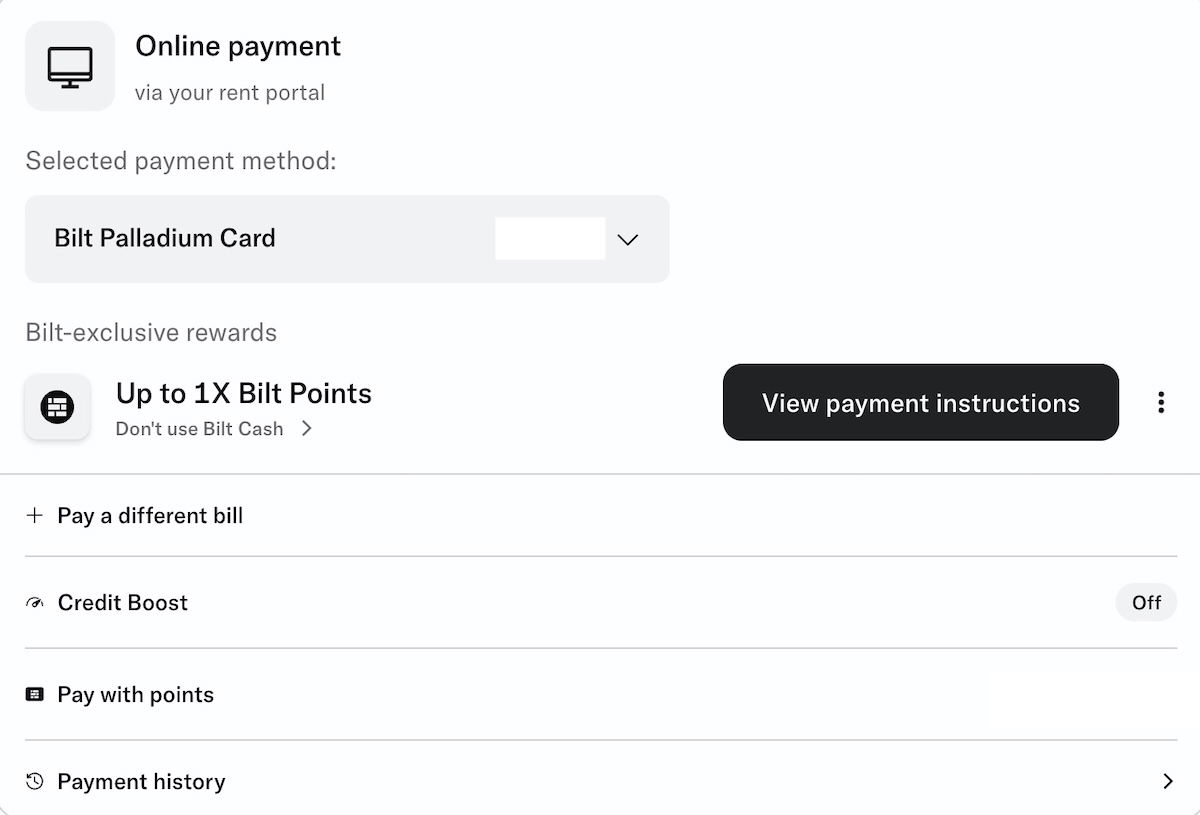

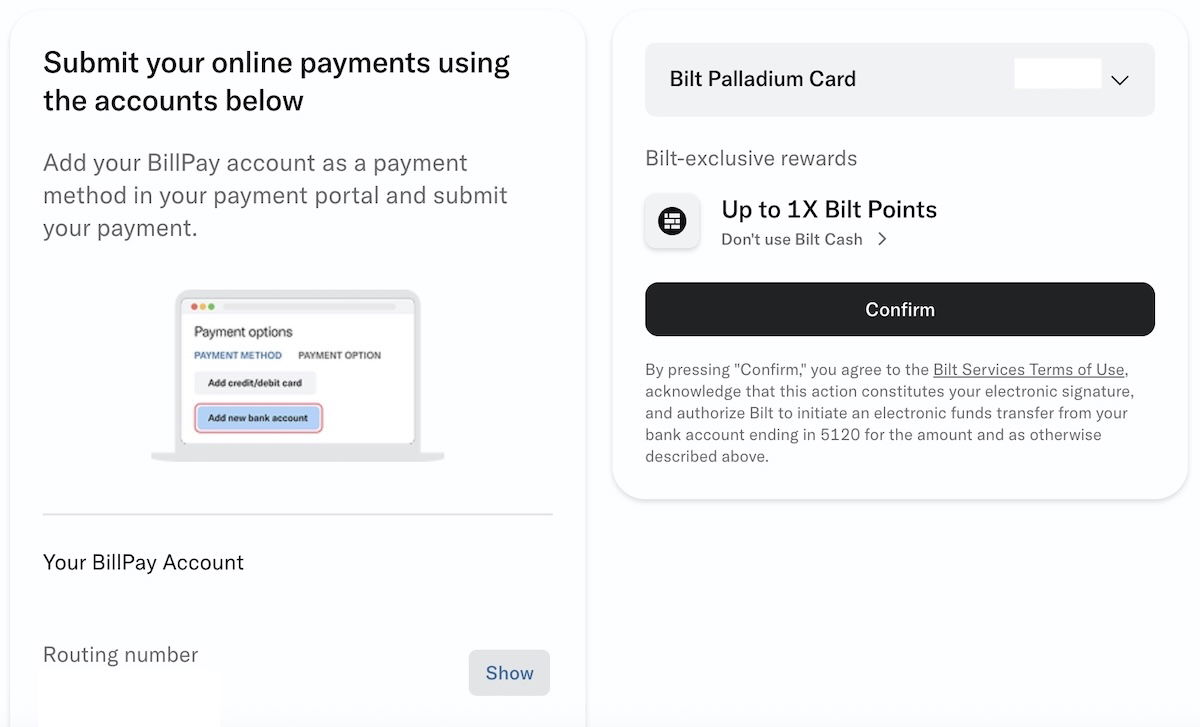

On the next page, under “Bilt-exclusive rewards,” you’ll want to make sure that the “Using available Bilt Cash” option is selected, which should appear in green. The alternative is that it says “Don’t use Bilt Cash.” If you see that, toggle the switch, and make sure it’s selected so that you do use Bilt Cash to earn points.

Then everything should be all set for the next housing payment posting, and at that time points will also credit to the account (up to the limit of how much Bilt Cash you have).

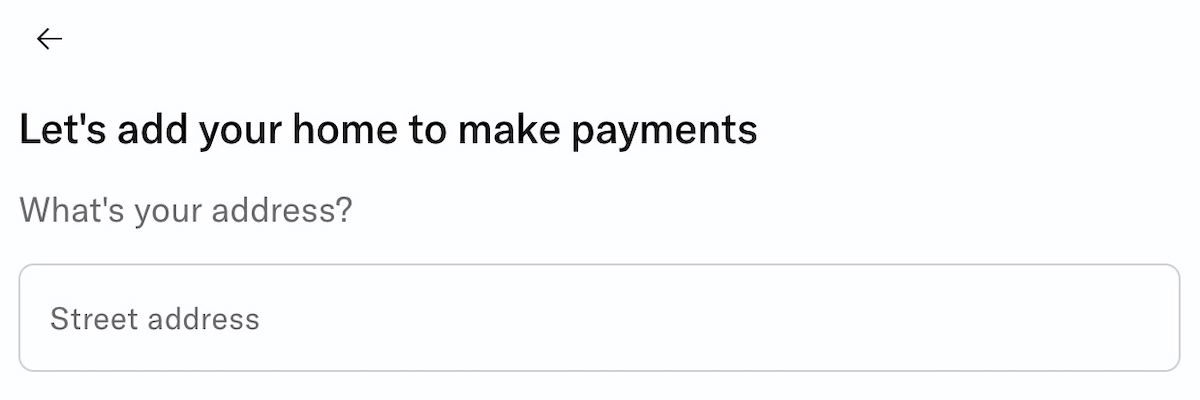

But what if you’re setting up a new housing payment, or a payment for a second home? Well, on the above page, click the “Pay a different bill” button, and then you’ll be brought to a page where you’re asked to enter the property’s address.

On the next page, you’ll want to click the “Get Started” button.

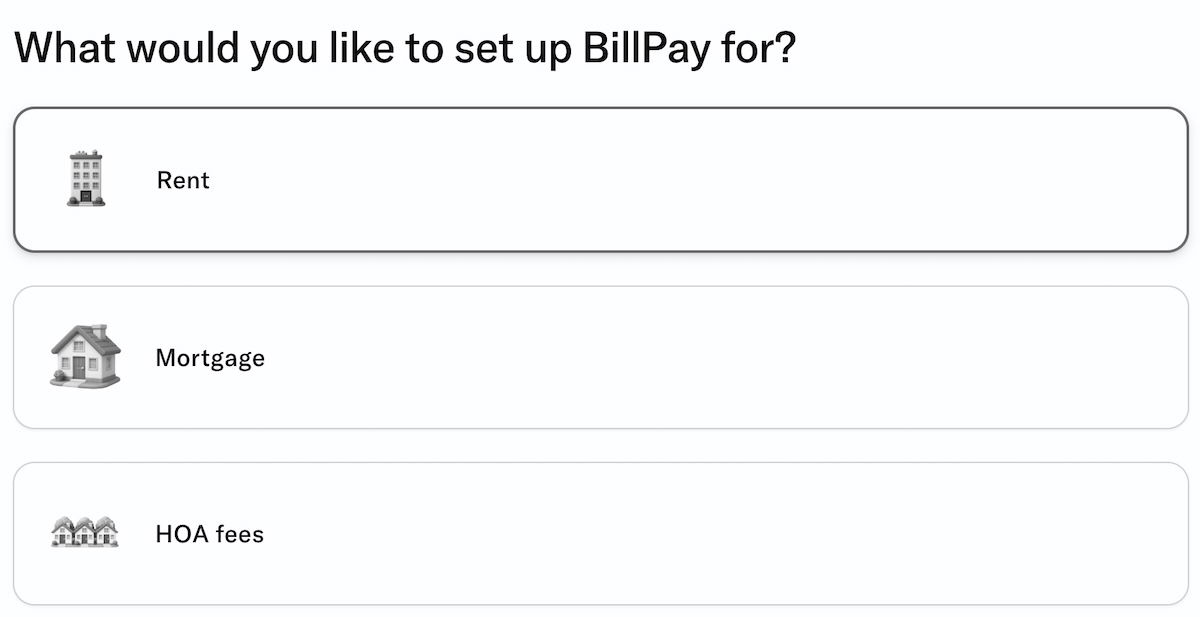

Then you’ll be asked if you’re trying to pay rent, a mortgage, or HOA fees.

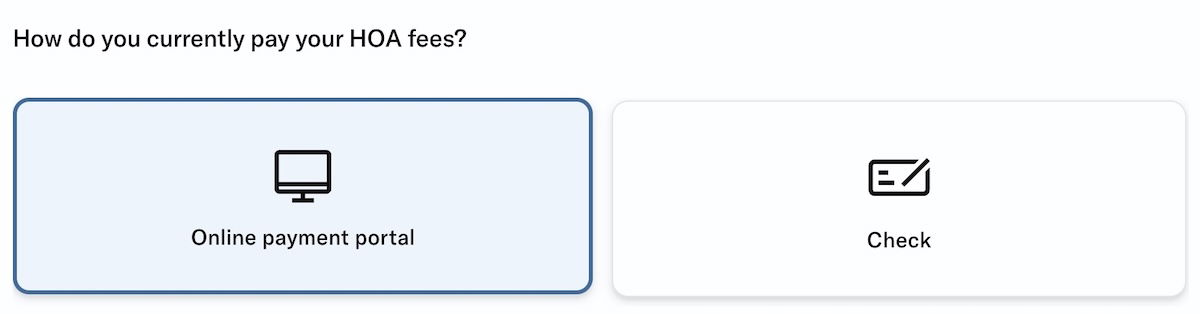

On the page you’ll be asked if you want to make your payment through an online payment portal or by check.

Assuming you select the online payment portal option, on the next page you’ll be given the routing and account number you need to use for the payment. So you’d then want to enter that information on the payment portal website, as if you’re paying out of a bank account.

That’s it, you’re then all set. You’ll then earn rewards once your payment processes, assuming you have sufficient Bilt Cash in your account to earn those rewards. Once the payment processes, you should get an email from Bilt confirming the payment being processed, plus the amount of Bilt Cash that’s being redeemed in order to earn points.

If you look in the “Recent activity” tab of your Bilt account, you should see the points post within a couple of days.

Bottom line

Bilt lets members earn rewards for making their housing payments, whether it’s rent, a mortgage, or HOA fees. The catch is that you need to complete certain activity in order to be rewarded on those payments.

Most people will want to use Bilt Cash in order to earn rewards on housing payments, and it’s a pretty straightforward process. You just need to link your account, and then once your housing payment is charged, you should earn the corresponding points, assuming you have sufficient Bilt Cash to cover those rewards.

What’s your take on the process of earning rewards on housing payments with Bilt?

It's worth highlighting that you need to link your checking/payment account via Plaid (not manually entering routing/account #) for eligible housing payments to successfully process. Initially I had manually entered this information but my automated housing payment failed on the 1st of the month. Received a Bilt email asking me to use Plaid to reconnect my payment account before manually processing the housing payment.

There’s a way to get 4x in spending using a HELOC that you repay right away through Bilt (drawing 4x your spend from the Helic).. Could you outline that,

The title of this article is highly misleading. You don't earn any rewards for housing payments. Housing payments only offer you one of ways to "cash out" those rewards you earned on non-housing related spend.

Yup. Tony gets it. BILT tries so hard with 2.0 to convince us there are 'no fees' on earning points on rent, etc. ...but there's a real cost, so, yeah, basically, FEES. Kind of like refusing to call a 'war' a war, when it's clearly a war. (No, no... 'special' military operation... a 'conflict'... right. Psh.)

The real question is if it is working. The usual corners of the internet seem to have growing pains stories right now.

@ Peter -- I can only share my experience, and at least in my case, the points did post correctly, which is why I'm providing an update on this.

Totally fair and appreciated! Personally just waiting a month or two before considering paying a mortgage with them.

I had to manually re-select payment method before 'rent day'; otherwise, it worked.

So tired of all the blogs writing daily about Bilt. I guess the commish must be pretty juicy.

Given your negative comments on seemingly every topic, it is curious why you are dedicated enough to this blog that you are a Diamond member.

@Jack

Why are you so negative about seemingly all my comments? Curious why you are so dedicated to read all my comments despite just being a guest. Creepy stalker vibes.

Jack, please note that (Dr.) Mantis (Toboggan) is an American, who now lives overseas (somewhere in Asia), and yes, he constantly whines (on here and elsewhere, like VFTW), often blaming 'the left' for his woes.