Link: Apply for a Bilt credit card, whether you’re a new or existing cardmember

Bilt recently announced massive changes. This includes a new portfolio of three credit cards — the no annual fee Bilt Blue Card (review), $95 annual fee Bilt Obsidian Card (review), and $495 Bilt Palladium Card (review) — plus a new system for paying rent and mortgages (read my Bilt credit card review & comparison).

Central to the concept of being able to pay rent and mortgages while earning points is Bilt Cash, which is a Bilt currency separate from points. This makes up a key component of the new Bilt credit card concept. The idea is that Bilt Cash can be redeemed “dollar-for-dollar” for select redemptions, though with major limitations and restrictions.

In this post, I’d like to go over the full details of how Bilt Cash works. How can it be earned, how can it be redeemed, and what are the best options?

In this post:

How can members earn Bilt Cash?

There are two main ways that Bilt Cash can be earned, as it’s based on how many total points you rack up, and it’s also based on how much you spend on a Bilt credit card.

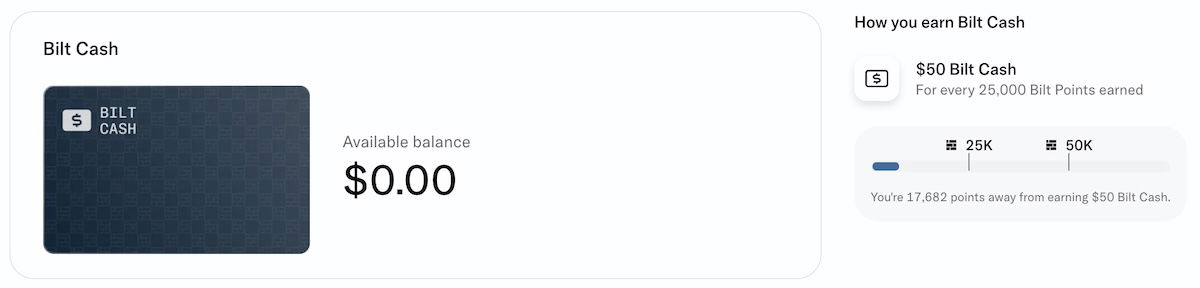

The first is that members can earn $50 in Bilt Cash for every 25,000 Bilt points earned. It doesn’t matter how those points are earned, and of course Bilt Cash is in addition to whatever Bilt points you ordinarily rack up.

The second is that Bilt Cash can be earned with all three Bilt credit cards. So not only do the cards earn points, but they also earn Bilt Cash:

- The no annual fee Bilt Blue Card earns 1x points + 4% back in Bilt Cash on everyday purchases, plus a welcome bonus of $100 in Bilt Cash

- The $95 annual fee Bilt Obsidian Card earns 3x points on your choice of dining or groceries (on up to $25K of spending per year), 1x points on all other purchases, and 4% back in Bilt Cash on all purchases, plus a welcome bonus of $200 in Bilt Cash

- The $495 annual fee Bilt Palladium Card earns 2x points + 4% back in Bilt Cash on everyday purchases, plus a welcome bonus of $300 in Bilt Cash, plus $200 in Bilt Cash every year on an ongoing basis (this is the obvious choice to apply for)

As you can see, all Bilt credit cards earn 4% back in Bilt Cash on all spending. Bilt Cash is valid through December 31 of the year in which it’s earned, though up to $100 in Bilt Cash can be carried over to the next calendar year.

I should mention that earning Bilt Cash for credit card spending assumes you don’t choose to just automatically be rewarded for housing payments as a multiplier of your spending, under a new system that Bilt has come up with. I know, this is all really straightforward, right? 😉 But I’ll just say that a vast majority of people should choose to earn Bilt Cash, as that’s generally going to be the most rewarding.

How can members redeem Bilt Cash?

The ability to redeem Bilt Cash has launched as of February 2026. You can see your Bilt Cash balance by logging into the Bilt website or app, and going to the “Wallet” section, where you can see how much Bilt Cash you have, and your progress toward earning more Bilt Cash.

With that out of the way, let’s talk about the ways that you can redeem Bilt Cash, ranked roughly in the order that I value the options.

Redeem Bilt Cash for rewards on housing payments

On the most basic level, Bilt Cash is the currency that allows members to earn rewards for their housing payments (rent or mortgage) at no cost. Specifically, every $30 in Bilt Cash can unlock up to 1,000 points on rent or mortgages. As an example:

- If you spent $15,000 on a Bilt card, you’d earn $600 in Bilt Cash (since you earn 4% back in Bilt Cash on all spending on all cards)

- $600 in Bilt Cash would allow you to earn $20,000 in fee free rent or mortgage payments, while earning 1x points

Basically, if you want to be able to pay your rent or mortgage while earning rewards, you’ll need to spend an average of 75% as much as your housing payment to rack up sufficient Bilt Cash to cover the cost (this doesn’t include things like Bilt Cash as part of welcome bonuses, or the $50 in Bilt Cash you earn for every 25,000 points earned, so the math is actually more favorable than that).

Redeem Bilt Cash for points accelerator on spending

Exclusively for those with a Bilt credit card, Bilt Cash can be redeemed for a points accelerator on everyday spending, which I’d consider to be pretty lucrative.

Specifically, cardmembers can enable an extra 1x points on everyday spending for the next $5,000 spent following activation. This is exclusively available to Obsidian and Palladium cardmembers, at the cost of $200 in Bilt Cash, and up to five activations are allowed each calendar year.

This means that the Palladium would earn an incredible 3x points on everyday spending, while the Obsidian would earn 4x points on dining or grocery, 3x points on travel, and 2x points on everyday spending.

Redeem Bilt Cash for bigger Rent Day transfer bonuses

Bilt offers a monthly Rent Day promotion, which often includes transfer bonuses to airline & hotel partners. The size of the transfer bonus that you’re eligible for is often based on your Bilt elite status.

Fortunately you can use Bilt Cash to upgrade your Rent Day transfer bonus to the next status tier, and top tier Platinum members can even receive an additional boost. While pricing and availability are subject to change, you can expect that it’ll typically cost $75 in Bilt Cash to unlock a bigger transfer bonus, and then there’s usually no limit on how many points you can transfer.

So there’s a lot of potential upside here, especially if you want to make a big transfer.

Redeem Bilt Cash for BLADE helicopter flights

Starting March 1, 2026, it’ll be possible to redeem Bilt Cash for BLADE airport flights. Specifically, it’ll be possible to use up to $700 per year in Bilt Cash on BLADE, at the rate of up to $350 per seat. While this is somewhat niche, this is an example of a way to redeem Bilt Cash for what’s a “big ticket” purchase.

Redeem Bilt Cash for other travel & lifestyle rewards

Personally I’d consider the above to be the most exciting ways to redeem Bilt Cash, though those are far from the only options. To cover some of the other redemption options, all of which are either in small increments or come with a lot of terms or catches:

- Redeem up to $1,200 per year in Bilt Cash toward Bilt Travel Portal hotel bookings, with a two-night minimum stay; the limit is up to $50 per month for Blue and Silver members, and up to $100 per month for Gold and Platinum members

- Starting March 1, 2026, redeem up to $600 per year in Bilt Cash toward dining experience bookings via Bilt dining experiences, with a credit of up to $50 per month

- Redeem up to $300 per year in Bilt Cash toward restaurant credits at select Bilt Dining partners; use Bilt Cash toward meals at select Bilt partner restaurants via Mobile Dining Checkout, with one visit per month of up to $25, and rollout expanding to thousands of restaurants nationwide

- Redeem up to $150 per year in Bilt Cash toward Blacklane rides; the limit is up to $50 per year for Blue and Silver members, up to $100 per year for Gold members, and up to $150 per year for Platinum members

- Redeem up to $120 per year in Bilt Cash toward Lyft credits, with a $10 credit per month

- Redeem up to $120 per year in Bilt Cash toward Walgreens credits, with up to a $10 credit per month

- Starting March 1, 2026, redeem $120 per year in Bilt Cash toward grocery or restaurant delivery fulfilled via GrubHub, with a $10 credit each month

- Starting March 1, 2026, redeem up to $100 per year in Bilt Cash to cover a Gopuff Fam membership for up to twelve months, for either a monthly or annual membership

My take on the value and best uses of Bilt Cash

You really have to view Bilt Cash as an incremental perk that’s in addition to the standard rewards for credit card spending, so I’d almost view this as “monopoly money,” so to speak. For example, the Bilt Palladium Card offers 2x points on everyday spending, which is already incredibly competitive, so earning an extra 4% Bilt Cash is the icing on the cake.

The most obvious way to redeem Bilt Cash is of course toward rewards on housing payments, given that this is one of the key selling points of the Bilt ecosystem. Still, if you’re a big credit card spender, you’ll likely have a lot of Bilt Cash left over.

I think the next most exciting thing is the ability to earn an extra point per dollar spent on the Bilt Palladium Card, as you can redeem $200 in Bilt Cash for that, to earn 3x points on up to $5,000 in spending. Just to crunch the numbers on that, $5,000 in spending would unlock $200 in Bilt Cash, and would in turn earn you an extra point per dollar spent, and then you can do that up to five times per year. That’s pretty awesome.

Beyond that, I’d argue that being able to unlock the bigger Rent Day bonuses could also be a good way to redeem Bilt Cash.

Personally, I think the new Bilt concept is incredibly complicated, to the point that it will be hard for many people to follow. That being said, I absolutely do think there’s value to be had, and my strategy will be to spend on the Bilt Palladium Card, and then primarily redeem my Bilt Cash toward rewards on housing payments, plus the points accelerator option. That’s a pretty unbeatable combination for non-bonused spending.

Bottom line

Bilt Cash is a currency that’s separate from Bilt points, and it’s increasingly important in the overall context of how Bilt is evolving with rent and mortgage payments. All new Bilt credit cards earn 4% Bilt Cash on spending (in addition to standard rewards), plus members can earn $50 in Bilt Cash for every 25,000 points earned.

Bilt Cash redemptions are now live, and if you have a Bilt credit card, every $30 in Bilt Cash can unlock up to 1,000 points on rent or mortgages. But Bilt Cash can also be redeemed “dollar-for-dollar” toward all kinds of other purchases, ranging from hotels, to Lyft credits.

As you’d expect, there are major catches. We’re talking about being able to redeem for (mostly) small amounts toward purchases, with credits being doled out on a monthly basis. Maybe it’s just me, but I don’t get that excited about a $5 monthly delivery credit, or a $10 monthly Lyft or Walgreens credit.

What I am more excited about is being able to redeem $200 in Bilt Cash in order to earn an extra point per dollar spent, on up to $5,000 of spending, up to five times per year. That’s a potentially great value.

What do you make of the Bilt Cash concept, and the value of redemptions?

The problem with Bilt cash is that it can only be used for retailers and deals within their ecosystem. It is not like you can redeem for actual cash or gift cards at popular retailers, etc. If you do not use those providers then it is of little to no value to you.

Anyone searching for restaurants where they can redeem Bilt Cash be aware that the Mobile checkout filter doesn't appear to be working other than in NYC. So all restaurants are being displayed, not just those where you can use your Bilt Cash.

Has anyone received the new card yet? Applied well before the deadline and mine still hasn’t been shipped yet. What happens if it doesn’t arrive before the old one is deactivated?

Mhm. Selected mine early. Got new BILT end of last week (same number as 1.0 MC); new Autograph over weekend (new card number). No updates from the credit bureaus on 'new accounts' or 'hard pulls' yet. Anyone find something different?

I have a lot of everything spent (100k) plus a $4500 mortgage payment,

This palladium card will be my main driving card now. It’s gonna simplify everything I do now. No more 25 different cards. Just put all my spend on this card and watch the points roll in

Happy for you (and BILT), Dave. They're hoping for folks just like you to keep them afloat. 2x everything is decent (though there are better cash-back cards, like BofA 2.62 until they nerf that, just none with their high-quality transfer partners (like Hyatt, Alaska, even United). With that kinda spend, you'll probably earn BILT Platinum status, if that means anything.

This has been a terrible roll out and the marketing is all wrong. But the revision to how to earn Bilt Cash so that every point earned now counts vastly improves the economics from launch. Requires dramatically less spend to unlock housing pours. Worth running the math.

So… leaning towards Bilt Cash or the other rent option (250 points-0.5x-1x-1.25x)? Don’t we need to select by activation?

If you're going to go through the trouble of running housing spend through bilt, hard to imagine you're going to do that just to get the best cpp by choosing the other rent option and spending 25% of housing cost to get 50% of housing cost points. Plus you have to be consistent with that spend on a month to month basis. Bilt Cash is more complicated, but I think it's the way to go here. I think you can toggle back and forth every month though.

I, also, am leaning towards BILT Cash for Palladium, then using Atmos for rent, eating the fees, earning the 3x points, spending towards the $50,000 maximum, earning the 100K cert., probably getting status with AS, even though I only really fly their partners, unless they end that 3x promotion, and/or you/others have found a better way?

It sure is complicated but if you have nothing better to do than sift through the options there are a couple of ways to extract value.

If you are Platinum with Bilt can make use of and value Blacklane the $150 Bilt Cash acts is real money at full value and stacks with the $100 biannual Citi Strata Elite credit. $250 should completely pay for most rides.

The hotel credit stacks with the one you...

It sure is complicated but if you have nothing better to do than sift through the options there are a couple of ways to extract value.

If you are Platinum with Bilt can make use of and value Blacklane the $150 Bilt Cash acts is real money at full value and stacks with the $100 biannual Citi Strata Elite credit. $250 should completely pay for most rides.

The hotel credit stacks with the one you get for having the credit card so that's $300 towards a two night stay.

It looks like one can get a decent lunch for the $25 dining credit and assuming all the restaurants shown on the website as participating really do.

Rent would be for Bilt Cash that is left over except for people looking to earn status on Alaska who'd use their Atmos card.

Ben, I'm a fairly intelligent guy, but I struggle to understand this post and the explanation of Bilt Cash. With my old Bilt card, they paid my mortgage monthly and gave me points that I could apply to a large range of airlines - some of which are not available with other cards. Why can't I keep doing that? When my mortgage payment is due on March 1, what do I need to do with...

Ben, I'm a fairly intelligent guy, but I struggle to understand this post and the explanation of Bilt Cash. With my old Bilt card, they paid my mortgage monthly and gave me points that I could apply to a large range of airlines - some of which are not available with other cards. Why can't I keep doing that? When my mortgage payment is due on March 1, what do I need to do with the new card, since I opted to cancel the old card and transition to the new one? I just need this whole thing explained in basic language.

Of course, I could just paste your post into AI and ask it to "translate" for me, but I'm guessing other readers are just as confused.

Why?

Bilt was losing a ton of money, and the old system is no longer financially viable

What?

Just pay attention to this line from the article: "Basically, if you want to be able to pay your rent or mortgage while earning rewards, you’ll need to spend an average of 75% as much as your housing payment to rack up sufficient Bilt Cash to cover the cost"

"Bilt Cash" is used to cover the "cost"...

Why?

Bilt was losing a ton of money, and the old system is no longer financially viable

What?

Just pay attention to this line from the article: "Basically, if you want to be able to pay your rent or mortgage while earning rewards, you’ll need to spend an average of 75% as much as your housing payment to rack up sufficient Bilt Cash to cover the cost"

"Bilt Cash" is used to cover the "cost" of paying your rent with the Bilt card. If you don't have enough, you come up with it on your end. If you have extra, you'll be able to burn it on coupons

"When my mortgage payment is due on March 1, what do I need to do with the new card, since I opted to cancel the old card and transition to the new one?" -> what do you mean by "new one"? Did you request a new Bilt card or did you transition to the Wells Fargo Autograph?

Slight correction: Wells Fargo was losing $10 million per month; BILT was doing fine; I wish WF was still all our’s gravy train. Oh well. RIP 1.0

Seems like way more trouble than it's worth -- just in terms of occupying one's mental energy, having to keep yet another credit card around, and worrying about spending enough on it to justify the benefit.

TL;DR for Bilt Cash: it’s a big coupon book, but a coupon book of your choosing.

Value points? Use the cash to earn on your rent/mortgage or activate a points accelerator.

Value saving on travel/dining? Use the cash for hotel/Lyft/dining discounts.

Want to feel like a baller for 15 minutes? Use the cash for BLADE and Blacklane.

Just distill the options to what matters to you and forget about the rest. Personally, I’ll...

TL;DR for Bilt Cash: it’s a big coupon book, but a coupon book of your choosing.

Value points? Use the cash to earn on your rent/mortgage or activate a points accelerator.

Value saving on travel/dining? Use the cash for hotel/Lyft/dining discounts.

Want to feel like a baller for 15 minutes? Use the cash for BLADE and Blacklane.

Just distill the options to what matters to you and forget about the rest. Personally, I’ll earn extra points as much as possible and then use any overage for hotels or to ball for 15 minutes. :)

So, do you work for BILT or Blade? *burp*

Nah...though it'd be nice to have some stock options with Bilt at it's current valuation (assuming I could sell them).

No IPO yet, but, if it did, sheesh, waaay over-valued. Then again, everything is memes these days, so, who cares about fundamentals. Just don't be a bag-holder, right? No, no... FOMO!

Ben and VFTW have been very positive on the points booster redemption option -- but I will note that it doesn't seem like an extraordinarily good deal: You are essentially paying $0.04 in Bilt cash per Bilt point.

While this is in a sense great because $1 in Bilt cash is definitely not worth $1 in actual USD cash, *some* of the redemption options are more competitive: E.g., I've done a couple of the...

Ben and VFTW have been very positive on the points booster redemption option -- but I will note that it doesn't seem like an extraordinarily good deal: You are essentially paying $0.04 in Bilt cash per Bilt point.

While this is in a sense great because $1 in Bilt cash is definitely not worth $1 in actual USD cash, *some* of the redemption options are more competitive: E.g., I've done a couple of the dining experiences and they're solid got the price they charge; if you get $50 off one by redeeming $50 in Bilt cash, that's a good deal. The $10 in Lyft savings is worth like 90 cents on the dollar to most of us -- assuming it's easily used (I don't think we've heard anything about how it will work). Spending $350 in Bilt cash on a Blade ride could be appealing -- think of it like spending $175 (or less) to get to JFK, which isn't crazy.

Huh, that’s not very cynical. You should rename yourself, DiogenesTheOptimist.

Chuck at DoC set forth a super easy way of using Bilt Cash. As one reader commented, it's so easy that a GEICO caveman can do it. Who cares about all of the other stuff? Just follow what he advises and earn 3X +/- on everyday spending. Or, don't. In five years, there will be those who will have been earning 3X and those who will still be complaining that Bilt is a scam that is on the verge of bankruptcy. Get over it.

Tom, those of us earning 1 point per dollar on rent with zero fees for years never thought it was a scam; most of us wish Bilt 1.0 would’ve lasted forever, with Wells Fargo covering our fun, but, that’s soon dead. 2.0 is a totally different card/program, far more complicated, many potential fail points, and so far, very disorganized and confusing for most. Feel free to keep putting lipstick on that pig! *oink*

Every time I get a new email from Ankur Jain, I just roll my eyes. The audacity… and that email that they are so excited that 83% of existing members signed up for new cards. You lost 17% of your existing customer base overnight because of your change? Yikes!

David, you weren't impressed by "A quick thank you" yesterday?

You're the (guy) who's been hammering Bilt as a scam. Then, you say you've had the 1.0 card for how ever long and you have upgraded to the new card. "Oh, just for the SUB." What a dysfunctional knucklehead (with diarrhea of the keyboard).

Correction, Tom, I've been hammering them on how they've lost their sugar-daddy, Wells Fargo, and that VC money isn't gonna replace that gravy train. I wanted BILT 1.0 to last, but, it's now over, and I'll milk Palladium for its SUB, for a year, then re-evaluate. May not even pay rent with it; probably going with Alaska for 3x, ideally, earning 100K certificate.

(And, by all means, say whatever you wanna say on here or elsewhere. Who are you or I to censor anyone else. More is more, dawg.)

The 83% is a lie. He said “83% active users requested.” The first step of the process was you request, and then you could apply if you were approved. So it excludes those who were denied and those who didn’t proceed with the application. And who knows how they are defining what “active users” mean. They could be defining “active users” as those who spent more than a specific amount per month which could exclude all the 5-banana users.

Jake, it’s almost as if Ankur’s word is meaningless… naw… he’s ole buddy pals with Mr. Beast and A$AP Rocky… how could he not be truthy. Psh.

I'm realizing how I describe my credit card strategy to people not in the hobby sounds a lot like how Bilt is trying to explain Bilt Cash to me

Hahaha so true. You earn 1.5 cents per dollar spent on the freedom unlimited but then if you also have the sapphire reserve you can transfer your cents to ultimate rewards points and redeem them for 2 cents per dollar but then wait you can also transfer ultimate rewards points to Aeroplan points and redeem them for 3.8 cents per dollar. Easy peasy