For a limited time, you can earn 50,000 Amex Membership Rewards points for opening a business checking account that potentially doesn’t have any fees (thanks to Doctor Of Credit for flagging this).

Around the same time last year, there was a similar offer allowing you to earn 60,000 Amex points for opening such an account, but this is the best offer we’ve seen since then. Let’s go over all the details, and then I’ll share my experience opening an account last year.

In this post:

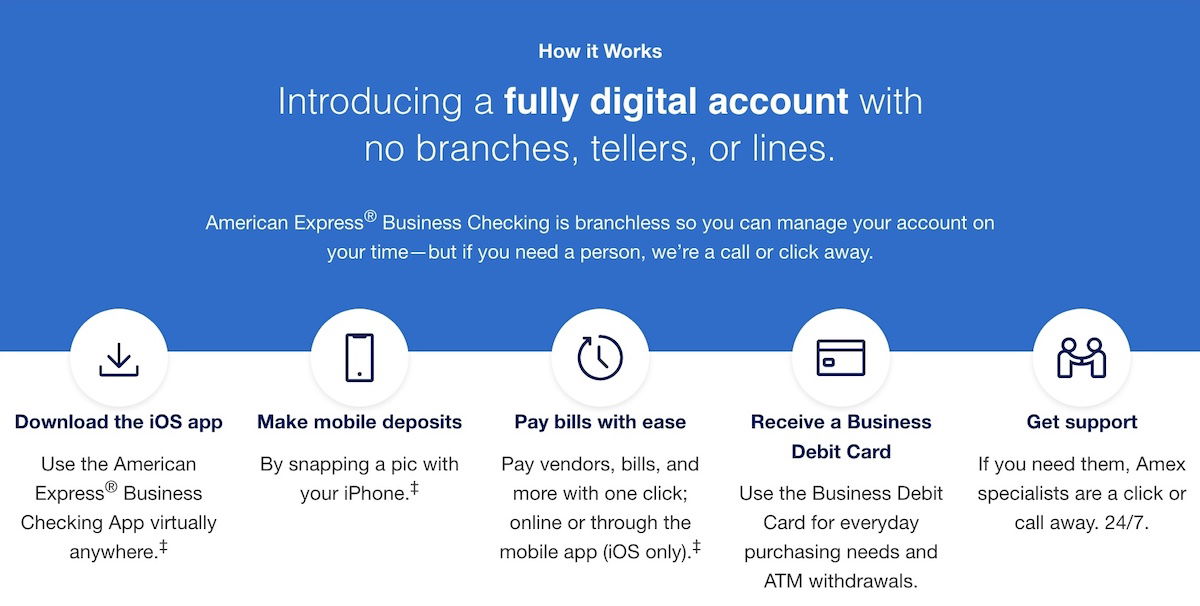

American Express Business Checking basics

American Express Business Checking is Amex’s business checking account concept. Here are some the basics of how this works:

- The checking account offers a 1.3% APY on balances of up to $500K

- The debit feature offers the ability to earn one Membership Rewards point for every $2 of eligible debit purchases

- Membership Rewards points can only be redeemed for deposits into your checking account, unless you have another card earning Membership Rewards points, in which case they could be redeemed the same way as there (meaning you could transfer them to airline & hotel partners)

- This is integrated into the Amex app, so that you can manage this checking account along with all of your other Amex accounts

- There are no monthly maintenance fees for keeping an account, and no domestic ACH fees, domestic incoming wire fees, or international incoming ACH fees

- You can get fee-free ATM withdrawals at 37,000 MoneyPass ATM locations nationwide

Ultimately if you’re already in the American Express ecosystem, then this is a pretty competitive business checking account, especially if you like to self-service your account. Obviously Amex isn’t a traditional bank and doesn’t have branches, but for many of us that’s not an issue.

You do need to have a business to open one of these accounts (as you may have guessed based on the name), though sole proprietorships do qualify.

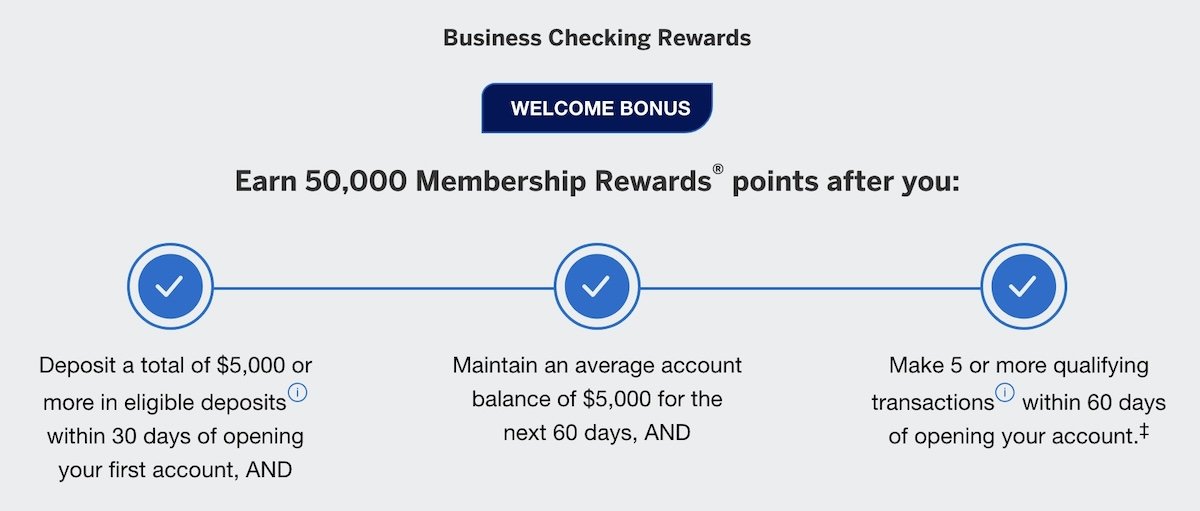

Earn 50K points with American Express Business Checking

There’s a fantastic incentive to apply for an Amex Business Checking account right now. If you apply by Tuesday, December 12, 2023, you can earn 50,000 Amex Membership Rewards points. In order to earn this bonus:

- You need to make eligible deposits of $5,000 or more within 30 days of opening your account

- You need to maintain an average account balance of $5,000 for 60 days

- You need to make five or more qualifying transactions within 60 days of account opening

For those wondering about what would be considered a qualifying transaction:

- Qualifying transactions are mobile deposits, and electronic transactions, including ACH, wire, and bill payments

- Business debit card transactions and deposits using the Redeem for Deposits features are not qualifying transactions

Those requirements seem easy enough to complete. To be clear, debit card transactions don’t count toward the requirement, though electronic transfers from other accounts do count toward this, and should be an easy option.

My experience opening an Amex Business Checking account

Given how lucrative this opportunity is, I opened an Amex Business Checking account for my business about a year ago, and wanted to share my experience, for those who may be considering opening an account now. I was very pleasantly surprised by how easy the whole process was.

If you have an existing Amex account, most of your information will be pre-populated during the application process. Furthermore, you can link any existing bank accounts Amex has on file, so you don’t even have to enter that information manually.

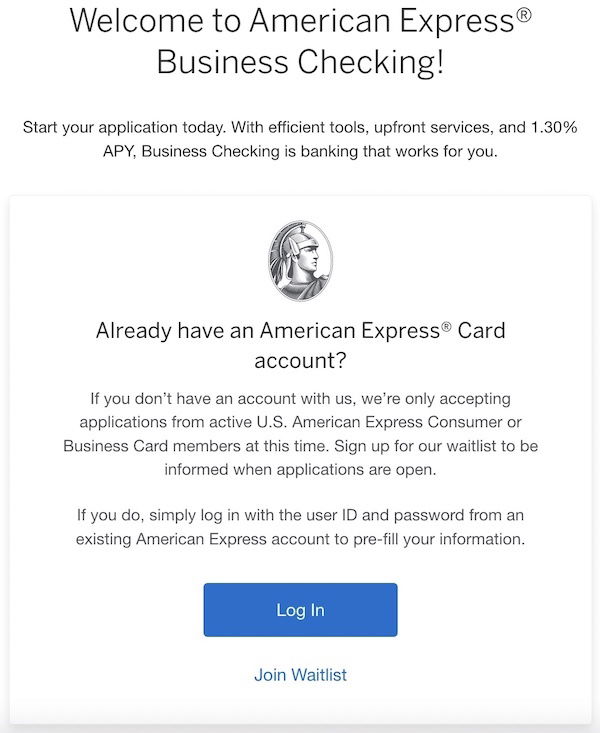

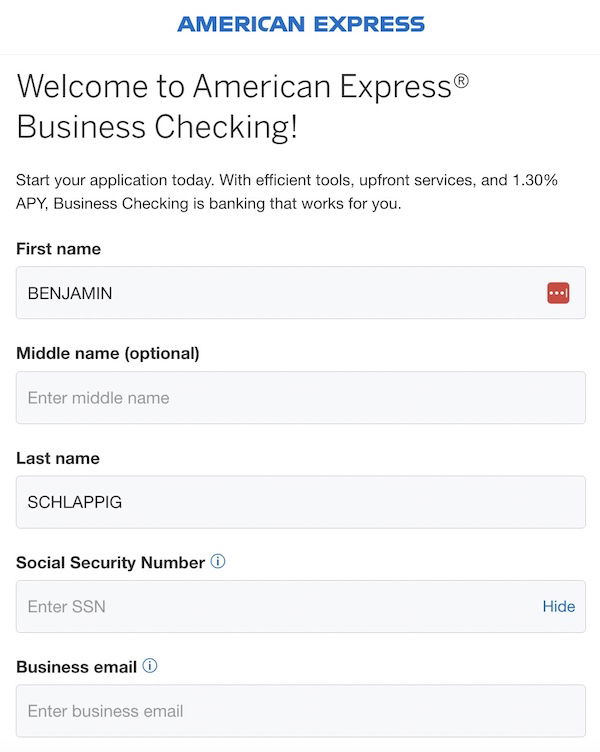

To briefly go through the application process, first you’ll want to log-in with your existing Amex credentials.

You’ll then be able to start your application by selecting which Amex account you want to “pull” information from for your application. I chose one of my business cards.

A lot of the information is already pre-populated, but you do have to enter things like your social security number, etc.

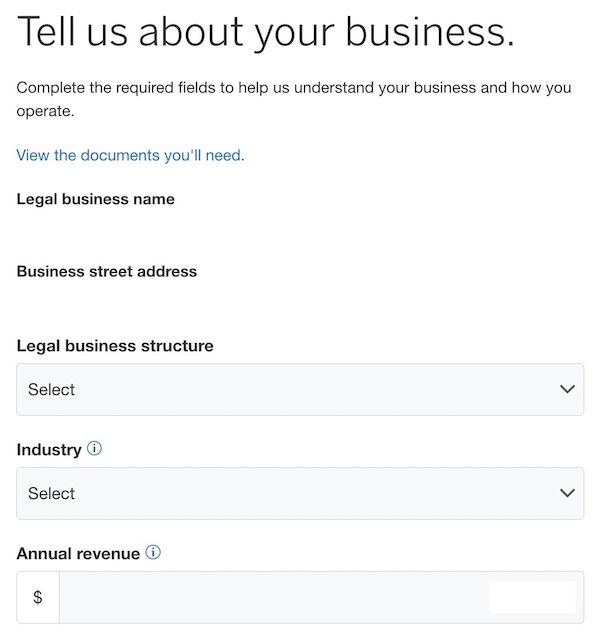

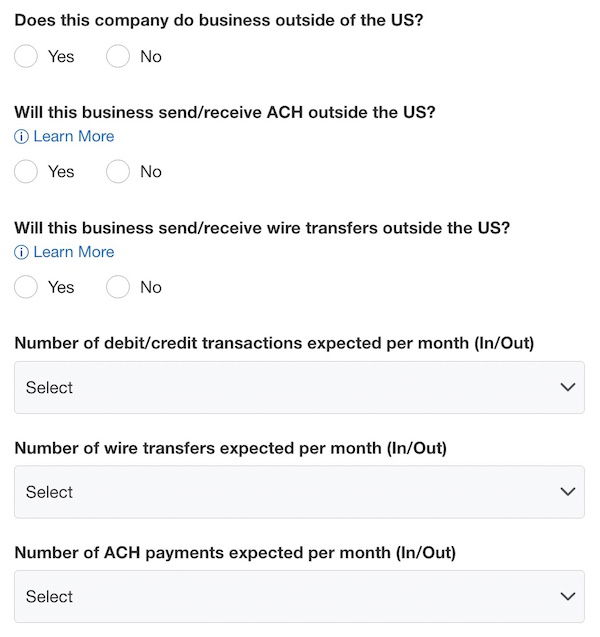

Then you have to answer a series of pretty straightforward questions about your business.

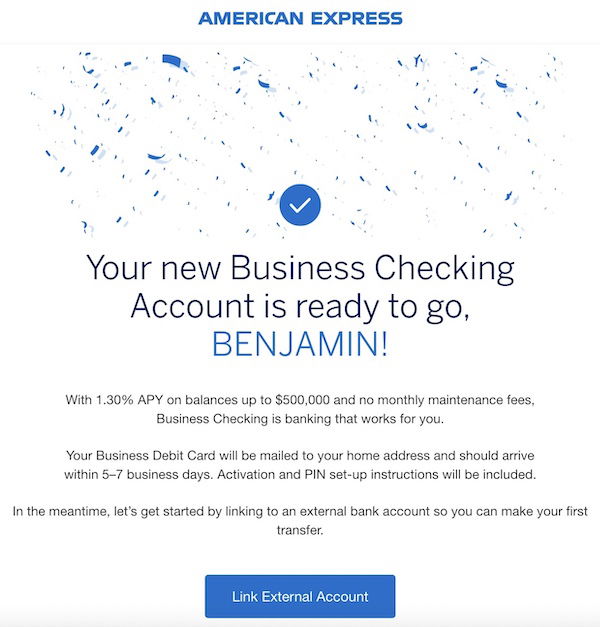

At that point I could submit my application, and I was instantly approved — woot! Note that some people are reporting having to upload business documents, but that wasn’t something I was asked for during my application process.

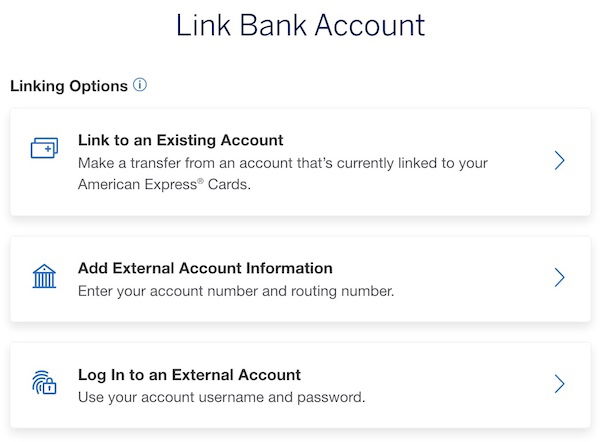

I could then link my bank account. This was easy, since I could just link the business checking account already associated with my Amex business cards.

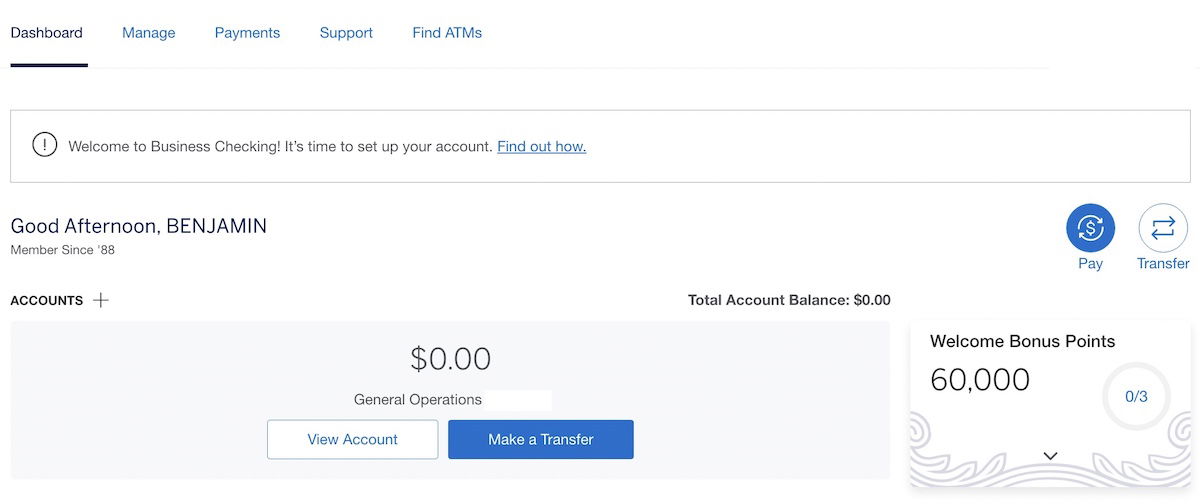

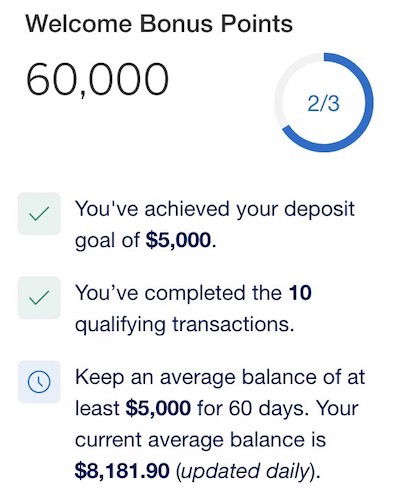

I have to say, I really like the dashboard for the Amex Business Checking account. It’s nice how it’s integrated into your Amex account with all of your cards, and it’s easy to use. There’s even a tracker on your dashboard showing how you’re doing with your activities toward earning the welcome bonus.

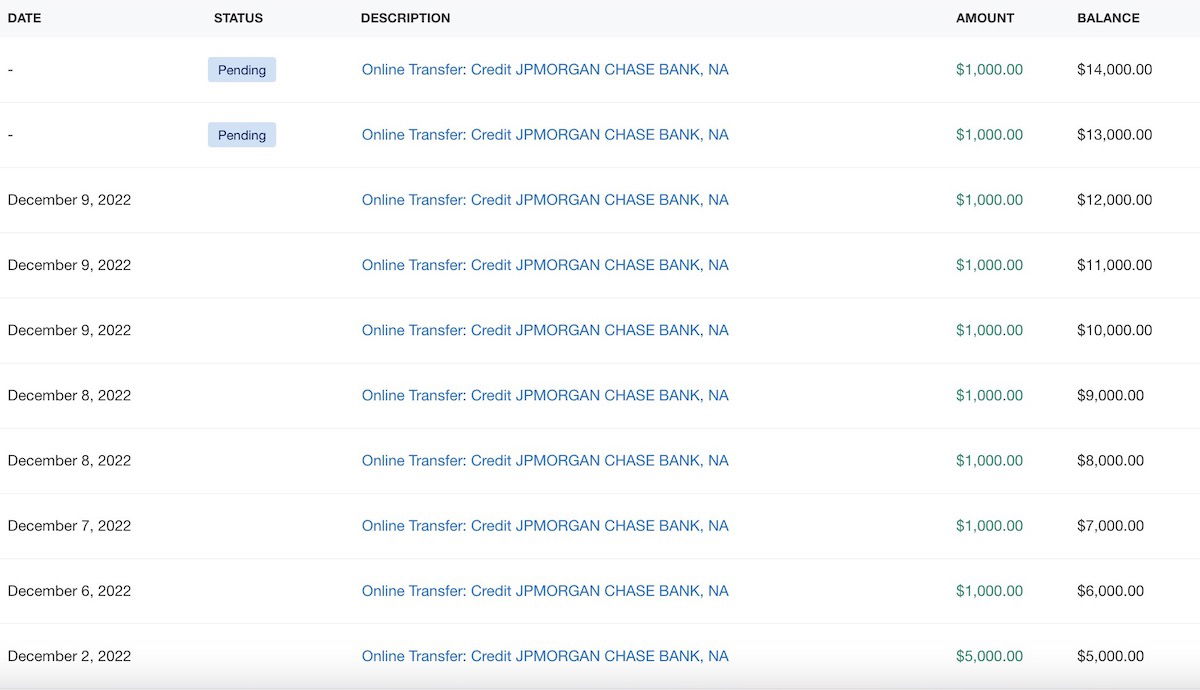

I also completed the transactions required to unlock the bonus. How did I do that? Well, I had initially funded my account with $5,000, which is the average balance amount you have to keep in your account for 60 days. However, I then decided to simply make nine more transfers to my account, for $1,000 each.

I could even make multiple transfers per day (they just have to be at least five minutes apart if they’re duplicate amounts). I figured this was a good idea anyway, since the interest rate here is higher than for my standard Chase business checking account.

As soon as the 10 transactions showed in my Amex account, the dashboard updated to reflect that I’ve completed two of the three tasks required to earn the bonus. Then I just had to keep an average balance of at least $5,000 in the account for 60 days.

Now that I’ve opened this account, I actually think I might really like this Amex Business Checking concept, and could see myself keeping around this account in the long run. We’ll see.

Bottom line

American Express Business Checking offers a solid and affordable business checking account option. At the moment you can earn 50,000 Membership Rewards points if you open an account and complete qualifying activity.

I went through the process of opening an Amex Business Checking account, and completing the required transactions. I found the whole experience to be easy, and quite like the account interface as well. I could see myself keeping this account long term.

Anyone else plan on opening an Amex Business Checking account?

Interested in doing this, even if my "business" is VERY small (think selling things on FB marketplace occasionally). Does this seem like a good fit? Also, is it easy to transfer money back out to a personal account after the requirements have been met, and/or close the account?

"We are currently accepting applications from eligible U.S. businesses. Current and prior American Express Rewards Checking customers are not eligible to apply at this time."

Does Amex send out 1099 form for the points?

No need to do 10 transfers. The current offer for 50K MR points (Nov 2023) only requires 5 transfers, not 10 (which seems to have been the case for the 60K MR points in 2022). You might want to amend the post. I can report that after I did five transfers (from my other bank account to here) that I got the green check box.

Does it say how large the ten transactions have to be? Could I do ten $5 transactions?

After one year , I still haven’t received an MR points for every 2$ of qualifying purchases . Has anyone been able to figure out which are “ the qualifying purchases “ ?

@ Ben , please ?

Just to note that a ‘qualifying transaction’ can also simply be doing a mobile deposit of a check. So ten deposits of $1 checks also works

@ben I did this last year with AMEX for 60K checking. Can I apply again for this 50K?

Anyone know how long it takes for points to post after completing the requirements?

I was checking back to figure out the same thing. I hit all three requirements last week and the points have NOT posted. Per the T&Cs it says it can take 8-12 weeks to post:

After you have completed all the above qualifying criteria, American Express will credit the Membership Rewards points to the Membership Rewards Program Account linked to your American Express® Business Checking account within 8-12 weeks. We may not credit the Membership...

I was checking back to figure out the same thing. I hit all three requirements last week and the points have NOT posted. Per the T&Cs it says it can take 8-12 weeks to post:

After you have completed all the above qualifying criteria, American Express will credit the Membership Rewards points to the Membership Rewards Program Account linked to your American Express® Business Checking account within 8-12 weeks. We may not credit the Membership Rewards points, or we may take away the Membership Rewards points if we determine, in our sole discretion, that you have engaged in abuse, misuse, or gaming in connection with the offer in any way or that you intend to do so. We may also cancel this account and other accounts you may have with us if we determine abuse, misuse or gaming behavior has been shown. Your American Express® Business Checking account must be open at the time of fulfillment; we may not credit the Membership Rewards points if you or we close your American Express® Business Checking account.

Opened the account on December 29 last year and received the 60,000 points (that was the prior offer) welcome bonus on March 19. So it took just over 2-1/2 months.

I am a 20+ year American Express loyalist and I just cancelled my business checking account with them. If you sign up for any kind of banking product with them, you will be forced to do two step verification EVERY TIME you log in to any product of theirs - personal credit cards, business credit cards, etc. There is no way around this. With multiple credit cards and multiple users this is maddening. Every time...

I am a 20+ year American Express loyalist and I just cancelled my business checking account with them. If you sign up for any kind of banking product with them, you will be forced to do two step verification EVERY TIME you log in to any product of theirs - personal credit cards, business credit cards, etc. There is no way around this. With multiple credit cards and multiple users this is maddening. Every time I need to do anything on the mobile app or website, two step verification is required, which adds a ton of time. I've spoke to multiple people at Amex about this and appealed it and there is no way around it. The rep told me they have had many business owners cancel accounts due to this.

I am a 30+ year American Express loyalist and this is not the case. I have multiple accounts open and almost never need to do 2FA on the website. Maybe that's because I have credit cards and personal as well as business bank accounts, but this hasn't been an issue.

Possibly only useful if you have a new company. Otherwise probably not so useful. Most people won't take the time and effort to open the account just for the points if they don't plan to routinely use the account.

Thanks for flagging this Ben. Sole proprietor here with 2 AmEx business cards and a SS number rather than EIN. Used the "other" category and explained the business in the comments as others have suggested. Instant approval with no additional documentation required.

If you've had one of these accounts before can you open up a new one and receive the bonus? I closed a few months ago.

Question for the group - My only Membership Rewards card is a personal one (Gold personal). Any issue transferring from AmEx business account to personal? I have a Delta Gold biz card, but AmEx required me to have a separate log-in for that account.

I may have answered my own question. I went ahead and opened the account through my AmEx Delta Gold biz card log-in. Was approved... Now on that dashboard is shows my Membership Rewards balance from my personal Gold card.

Hopefully this info is useful to others.

“The debit feature offers the ability to earn one Membership Rewards point for every $2 of eligible debit purchases“

Which debit purchases are eligible ?

Ben thanks for this post, we opened the account and all is going just as you outlined.

Do take note, small business owners / self-employed: transfers do not clear quickly. Amex holds the money in order to make money. Expect to wait days for a normal transfer to clear. Meaning if you have low cash flow this isn't the account for you!

My experience is the opposite. Business accounts with Chase, Bank of America and opened my Amex last year. By far Amex is the quicker, two days or less usually one. Chase is the slowest. Chase is sometimes 5 business days so earning off the float much more than Amex.

Jesus. Any reason you, Boarding Area or Facebook just decided to spam the crap out of Facebook with every article you have written over the last year? 30+ posts all in a row on my feed. Annoying.

@ Ryan -- Yes, I apologize, that was a mistake. I updated some of the review guides to reflect that it's a new year (many reflected 2022 perks, etc.). The intent was to update them in the background without having them go to the front page of the blog, as that's what I usually do. For whatever reason the posts seemed to automatically be sent to BoardingArea social media, though (which I don't have access...

@ Ryan -- Yes, I apologize, that was a mistake. I updated some of the review guides to reflect that it's a new year (many reflected 2022 perks, etc.). The intent was to update them in the background without having them go to the front page of the blog, as that's what I usually do. For whatever reason the posts seemed to automatically be sent to BoardingArea social media, though (which I don't have access to, in order to delete). My apologies, as that wasn't the intent.

Any dps on getting denied for the following message: We are not currently offering accounts to companies within your industry.

I applied as a sole proprietor, put my SSN instead of EIN and choose other for business type. I resell items on eBay and other platforms.

I’ve seen others get approved for similar business types, so not sure what I did wrong.

It looks like there's a limit on how many points you can redeem in one transaction of $100k worth.

I was able to skip the need for uploading docs by selecting "Other" as my business type, then fully explaining it in the field below. Instant approval for a sole prop eBay business.

To meet the requirements, I'm doing 10 transactions of $501, $502 etc. spaced an hour apart from a previously linked checking account.

The 'Other' business type seems no longer available.

I still see it there.

Thank you. Although I generally visit other travel blogs, they have never mentioned this? Will be back to visit your blog. Again thank you for the info!

WOuld the debit feauture work to pay taxes with no fee since its a debit card?

Thanks for writing about this deal. I received the 30k offer a while back but now that it increased to 60k, i just applied and got approved.

I opened one for my real estate business LLC, but I also have an LLC for my rental property and property management business... wondering if you know how I could open a second one? Every time I go to apply it just takes me to the account for my real estate LLC checking I created. Wondering if anyone knows a way to get two checking's for two totally different businesses?

Amex told me in a chat that you can “unlink” a credit card from your account and then use the unlinked card to apply for the 60k again.

Looks like iPhone-only for mobile deposits. What a shame. Not for me now. Pure lazy hubris for Amex to not code an Android app to do deposits since they do have an Android app for consumers. Maybe Tim Cook has a new lover who works at Amex business banking. Or maybe Amex supports iPhone factory Foxconn slavery while hypocritically opposing the history of slavery in the USA. Either way, I will pass.

What an obnoxious and stupid thing to say about Tim Cook.

Maybe Happy Hour early is in order for you...geez!!

I also got as far as them asking for business documents. Am a sole proprietor with only 1 rental house. Anyone have a suggestion on how to get past this point?

Maybe a redacted schedule C or E (if you are counting the rental income...catch 22)? If you have not registered your business in your city/county, I can't think of some paper trail showing you are a business? Assume no FID, but using SSN? Did you state anything for DBA? Otherwise put yourself in their position, how do they know you are business, but rather an individual chasing 60K points?

Oh, regardless, Good Luck!

so what's the deal with some not getting asked to upload documents? anyone figured out? I picked sole proprietor and it wouldn't let me submit the app without uploading the doc.

In the next drop-down after business type (where you selected sole prop), select "other" at the very end of the list instead of choosing a specific category. That seems to remove the requirement to upload documentation.

Do you have a business federal ID number or use your SSN? If you use your SSN, again as I wrote above, what does Amex have to go by that you are really a business other than some kind of doc(s)? Some registration or something otherwise again as above, can you blame them (Amex) for wanting proof?

I remember the same with the Brex deals a year or so ago? Brex required some proof for sole proprietors. Ask Lucky as he was the link to those deals.

I have multiple AMEX cards including business cards but during the application it is asking me for business documents and will not let me proceed without uploading them. Which is odd because my business is a Sole Proprietorship.

Not odd at all. What differentiates you personally from your business using your SSN? With a business tax ID is just that and not you personally. Now some posters I've read have had no issues with sole proprietorship. Go figure.

Do you need to have a business to open an account? Or can anyone open one?

I just confirmed through Amex Chat with the Business Checking rep that you can apply for the Business Checking account as a Sole Proprietor and you can use your social

I started the app several weeks back and baled. So I go back and Amex stated do I want to finish? Sure. Applied and no issues at all including no docs. Now my business is a corporation, been around for 30+ years and has a DUNNS number. I would think that makes an approval a lot easier.

" could potentially transfer them to airline & hotel partners" -- this will be the deciding factor for many, how certain are we on this?

@Ben - I jumped at 30k offer a couple of weeks ago, and like others have mentioned here, AMEX wouldn't match my offer to this offer.

Re: transactions - I have already met the 10 transaction requirements and it's pretty simple. Any non-purchase transaction should work here. In my case, I had 5 incoming ACH (3 from Paypal to fund the account for 5k, 1 from another checking account, and one international money transfer), and...

@Ben - I jumped at 30k offer a couple of weeks ago, and like others have mentioned here, AMEX wouldn't match my offer to this offer.

Re: transactions - I have already met the 10 transaction requirements and it's pretty simple. Any non-purchase transaction should work here. In my case, I had 5 incoming ACH (3 from Paypal to fund the account for 5k, 1 from another checking account, and one international money transfer), and 5 CC bill payments (3 of them for the same card since I was running a couple of test payments after adding this checking account to my CC profile). All of them have counted towards the 10 transaction requirement. AMEX has a nice little tracker on the Business Checking dashboard that shows what criteria have been met, and what are pending, as well as average daily balance (updated daily).

One more tip for Sole Proprietors who may not have a registered business. On the application page, AMEX requires you to upload Business license document. I didn't have one, but I uploaded a copy of my international passport, and that seems to have worked. No questions asked and my application for business checking was approved within minutes. FWIW, I have had 3 business credit cards with AMEX this year, so perhaps that had some role to play here.

I just uploaded a scan of my driver's license, and got approved immediately.

Amex will NEVER match a newer deal. Even if you just took advantage of a previous offer last week. Even if you threaten to close the card or account.

This is particularly galling for me, as a platinum card holder since 1988, I have never received a personal platinum card bonus of any type.

I applied for my Biz Plat when 125k bonus was available, only to find in less than 10 days a 250k...

Amex will NEVER match a newer deal. Even if you just took advantage of a previous offer last week. Even if you threaten to close the card or account.

This is particularly galling for me, as a platinum card holder since 1988, I have never received a personal platinum card bonus of any type.

I applied for my Biz Plat when 125k bonus was available, only to find in less than 10 days a 250k bonus became available.

Called, escalated, a supervisor said to me (paraphrased): we spent the point to get you, we got you, why should we give you more?

From a business rule perspective, makes absolutely sense

However, it PMRTFO.

Received an offer in the mail for 30k. This is def much better and the push I needed to open it. Thanks!

Just opened one for the 30k offer two weeks ago. Asked about being matched to current offer. No luck.

Same here. Very frustrating - would have waited a few weeks if I had known this was coming.

This appears to be an easy 60K MR. I am certainly going to open an account.

Something worth mentioning in case it applies to anyone, you cannot open a business checking account with AMEX if you are a current or former personal checking account customer. Same T&C's apply when opening a personal checking account. It seems like AMEX wants to ensure there is no double dipping for sign up bonuses. I recently opened a personal checking account, which offered a $250 sign up bonus with at least one direct deposit of...

Something worth mentioning in case it applies to anyone, you cannot open a business checking account with AMEX if you are a current or former personal checking account customer. Same T&C's apply when opening a personal checking account. It seems like AMEX wants to ensure there is no double dipping for sign up bonuses. I recently opened a personal checking account, which offered a $250 sign up bonus with at least one direct deposit of $500 or more. Seemed like a good deal at the time, but I would rather have opted for the new elevated offer on business accounts.