At the moment, we’re seeing airlines report their financial results for Q2 2024. Delta was the first to report its results, which weren’t great, as the airline saw profitability decline considerably, despite record revenue. United was next to report its results, and actually had pretty solid performance, putting it very much in Delta’s league.

That leaves the third of the “big three” US carriers, which is by far the weakest when it comes to profitability. American has just reported its results, and while Q2 2024 was okay, the carrier’s outlook is really rough…

In this post:

American reports record revenue, lower profits

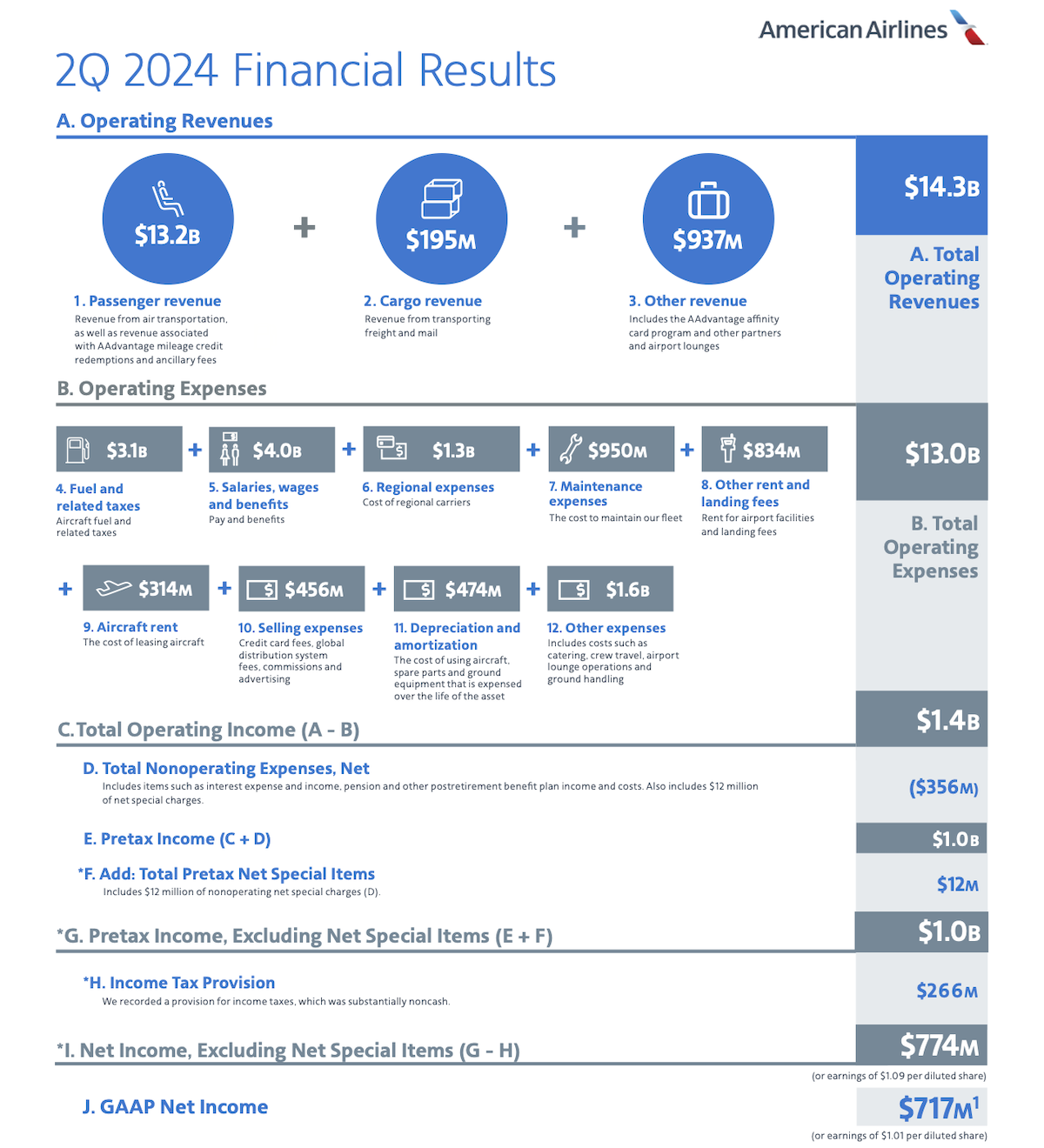

American has reported its Q2 2024 financial results. The good news is that the airline reported highest ever quarterly revenue of $14.3 billion, compared to $14.06 billion in Q2 2023. The bad news is that the airline reported a huge drop in profits, as net income was $717 million, compared to $1.34 billion in Q2 2023.

As you can see, American’s profits fell by around 50% compared to the previous year, which is not great. In fairness, profitability decreasing year over year is a general industry trend. Airlines are dealing with higher costs, and yields are also decreasing compared to the previous year, given how much capacity has increased.

While airlines are largely blaming these poorer financial results on industry overcapacity, that’s not something I see changing for the better any time soon. Airline executives like to tell the narrative that things will change for the better on that front, but when they keep taking delivery of more and more planes, that seems unlikely.

For what it’s worth, both Delta and United reportedly $1.3 billion in net income for Q2 2024, so as you can see, American is at a significant disadvantage.

To look at some other interesting statistics, American’s passenger revenue per air seat mile for the quarter was 17.54 cents, compared to 18.63 cents in the same quarter the previous year, representing a decrease of 5.8%. Meanwhile the cost per air seat mile for the quarter was 17.21 cents, compared to 17.07 cents in the same quarter the previous year, representing an increase of 0.8%.

Here’s how American CEO Robert Isom describes these results:

“American has a fleet, network and product built to deliver results, but during the second quarter, we did not perform to our initial expectations due to our prior sales and distribution strategy and an imbalance of domestic supply and demand. We are taking this challenge head-on, with clear and decisive actions to deliver on a strategy that maximizes our revenue and profitability, and importantly, one that makes it easy for customers to do business with American. When we return to the level of revenue generation we know we can achieve, and we couple that with our operational reliability and best-in-class cost management, we will unlock significant value.”

Okay, that all sounds great, but what exactly is the strategy that’s going to maximize revenue and profitability, and provide best-in-class cost management? That of course all sounds great, but is easier said than done.

Below is a fact sheet with some of American’s Q2 2024 financial results.

American expects to breakeven this quarter?!?

Here’s where it gets really ugly. American has updated its guidance for Q3 2024, and the airline only anticipates breaking even during the quarter, as it expects unit revenue to drop by as much as 4.5%. The airline claims that this is based on the company’s previous failed sales and distribution strategy, as well as based on current demand trends, and the current fuel price forecast.

Furthermore, the breakeven number excludes any net special items, and the airline may very well be paying out a lot of cash to flight attendants in retroactive pay, as part of a new flight attendant contract.

Honestly, what an absolute disaster American is. The airline lost $312 million in the first quarter, made $717 million in the second quarter, and expects to breakeven in the third quarter. In the fourth quarter of 2023, American made only $19 million, and 2023 was a much better year for airlines than 2024. So will American even breakeven in 2024, or will the airline report a loss?

I don’t understand how American’s current management team is still in power. This seems like borderline negligence on the part of the company’s board. How can you watch an airline underperform quarter after quarter, and just not do anything?

As I’ve often said, airline executives have tough jobs, and they always have to sell Wall Street on what a good investment airlines are, even though they aren’t. I’m reminded of how in 2017, former American CEO Doug Parker said that the airline would never lose money again, and even in a bad year, the airline should earn around $3 billion in profits. That sure didn’t age well, did it?

While all airlines are tough businesses, you can’t help but notice the contrast in direction between American and United, with Scott Kirby now at the helm at United. He has brought United into Delta’s league, and has left American in the dust. So while virtually all airlines are having a tougher time than in 2023, that doesn’t mean they’re performing equally poorly.

Bottom line

American has reported its Q2 2024 financial results. The airline has reported record revenue… and that’s where the good news stops. Profits fell around 50% compared to the same quarter last year, and even worse, American only expects to breakeven in the third quarter. At this point, American will be lucky if it even breaks even for the entire year.

While all airlines are dealing with lower revenue (which they blame on “overcapacity”), American’s results are especially awful.

What do you make of American’s financial results, and performance compared to Delta and United?

The glaring problem with AA is the lack of commercial leadership. There is great operational and cost control leadership BUT you need forward thinking commercial strategy. Reinstating agency relationships is a band aid solution. You need dynamic, forward looking commercial leaders who are missing today.

It was very sad to hear Isom & the CFO provide hollow answers to qstns. Listen to the detailed region by region analysis and commentary from United or Delta. Compare...

The glaring problem with AA is the lack of commercial leadership. There is great operational and cost control leadership BUT you need forward thinking commercial strategy. Reinstating agency relationships is a band aid solution. You need dynamic, forward looking commercial leaders who are missing today.

It was very sad to hear Isom & the CFO provide hollow answers to qstns. Listen to the detailed region by region analysis and commentary from United or Delta. Compare that to the bravado coming out on the AA calls.

The sad reality is that letting Kirby leave was the worst decision every made by AA. He took all the worthwhile people from AA with him. Look at UA innovating on all fronts now and delivering improving financial performance.

Lucky can you also call out the fact that retired pilots received a fat check after their contracts was ratified ?

I'm a AA Employee, and my Colleagues and I are seriously worried about the future of our Airline! We can all see Isom and the Rest of them are leading us to certain Doom!! But yet Noone is doing anything! We are selling seats in the fare class called "Basic Economy"!!! Essentially selling seats even cheaper than bottom of the barrel Frontier and Spirit!! Yet if there is Irregular Operations, they are compensated like full...

I'm a AA Employee, and my Colleagues and I are seriously worried about the future of our Airline! We can all see Isom and the Rest of them are leading us to certain Doom!! But yet Noone is doing anything! We are selling seats in the fare class called "Basic Economy"!!! Essentially selling seats even cheaper than bottom of the barrel Frontier and Spirit!! Yet if there is Irregular Operations, they are compensated like full fare passengers???? This is not only Ludacris but laughable!! We all agree, we need a Vote of "No Confidence" and get Isom's 30 million dollar ass right out the front door!!!

American Airlines needs to get their shit together. I am a loyal AA Frequent flyer and always will be I hope, with over 2 million miles flown with current executive platinum status and love flying AA, but their product has suffered for the last 10 years if not more. Their staff is disjointed and do not seem happy, their flight crews are stressed and is easily observed while flying.

I supply AA with much...

American Airlines needs to get their shit together. I am a loyal AA Frequent flyer and always will be I hope, with over 2 million miles flown with current executive platinum status and love flying AA, but their product has suffered for the last 10 years if not more. Their staff is disjointed and do not seem happy, their flight crews are stressed and is easily observed while flying.

I supply AA with much of their lighting both inside and outside of the actual aircraft and have always been well taken care of, but I am embarrassed by the way they have handled business and the travel experience over the past few years.

I hope AA can do better asap, I will always fly AA but AA needs to do it right, get their sit together, forget the BS from the past, and rewrite the script the sooner, the better for all AA flyers!

AA NEEDS NEW UPPER MANAGEMENT.

POOR PLANNING!

YOUR RIGHT ON TARGET!

I'm sure the boatload of flights American just added to Florida from LaGuardia just to squat on the slots JetBlue handed back to them will help. Adding to the 1,856 flights already going to Orlando is a good thing.

The world's greatest premium airline would never do this. Delta delivers the best product in the world. Delta One is equivalent to international first class! They do all this whilst being the most profitable, probably because they never give refunds when there are any minor delays! But people are still privileged to be allowed to fly them!

p.s. If it was up to me only the best people would be allowed the privilege of flying Delta!

YOUR SO FULL OF CRAP!

PAID DELTOID INFLUENCER!

You read the comments on this blog and you'd think AA was sharply down in the stock market today.

Well, exactly the opposite happened. Every CEO talking about serious problems in the domestic market and the domestic-focused carriers like JB, SW, and AA up 6%+, 5%+, and 4%+. The more international-focused and much more profitable UA and DA up just 1.5% and 1.3%.

The midpoint of AA's outlook for the whole year is...

You read the comments on this blog and you'd think AA was sharply down in the stock market today.

Well, exactly the opposite happened. Every CEO talking about serious problems in the domestic market and the domestic-focused carriers like JB, SW, and AA up 6%+, 5%+, and 4%+. The more international-focused and much more profitable UA and DA up just 1.5% and 1.3%.

The midpoint of AA's outlook for the whole year is 1 dollar per share, so AA is trading at more than 10 times earnings, while UA and DA at 4.7 and 6.7 with a lot less debt and risk. It doesn't make any sense. Go figure.

Sometimes the stock market behaves in irrational ways, but today's action is really difficult to understand. It was like tell me who's having problems and is overvalued and I'll buy them.

Sounds like American are at a disAAdvantage versus everyone else

AA does bad because there inflight attendants are so nasty

But I thought ripping out all the IFE screens was supposed to save on fuel costs? How weird.

I'm an Alaska loyalist and I tolerate the lack of IFE because of the service I get, but after a SEA-MIA-CTG flight on AA I find myself flying UNITED (!!!!!!!!!!!!!) over AA on any route that doesn't have an Alaska option or AA lie flat business at a reasonable price. I feel like I'm living in the Twilight Zone having not flown United since 2001!!

Unless and until the front line employees understand their financial future is in the hands of the customers they mistreat each and every day. Customers choose where to buy a service. Although I’m supremely disappointed in Delta’s apparent under investment in the IT I believe that will be fixed and the front line people who treat me like they’re glad their flight is full will keep me coming back. No fare can be low enough...

Unless and until the front line employees understand their financial future is in the hands of the customers they mistreat each and every day. Customers choose where to buy a service. Although I’m supremely disappointed in Delta’s apparent under investment in the IT I believe that will be fixed and the front line people who treat me like they’re glad their flight is full will keep me coming back. No fare can be low enough to be treated as AA and UA flight attendants can mistreat and misrepresent the actions of their customers Negotiating huge profit sharing doesn’t matter when you aren’t contributing to the company’s bottom line.

AA need to concentrate on what works, reverse the strategies it implemented, cut the underperforming routes and absorb the subsidy and associated revenue losses. Bite the bullet and bring an end to the employee contract and pay issues, yes the financials for the rest of the FY and possibly next years will take a hit but with a clear turnaround plan it’s a credible proposition.

America West management needs to go! They're the reason why AA has gone from a full service, legacy airline to a low cost product but with legacy airline prices.

It's interesting to see that so many people seem to derive pleasure from others' struggles - and how so many of those same people appear to be hoping that American Airlines gets liquidated.

speaking the truth is NOT wishing ill on anybody.

AA has been poorly run as a business for 20 years.

Now, labor costs are soaring and AA's revenue generation is in the toilet.

Ironic coming from you.

Desert, every airline has fans who are so passionate that they become irrational and blind to faults- despite reality. And you’re one of them for American. I’ve seen you comment in American’s favor on several sites, as well as tear their competitors down. Well, reality is here, and even you have to wake up to it.

No one is “happy” to see an iconic brand like American face a bleak future, but the majority...

Desert, every airline has fans who are so passionate that they become irrational and blind to faults- despite reality. And you’re one of them for American. I’ve seen you comment in American’s favor on several sites, as well as tear their competitors down. Well, reality is here, and even you have to wake up to it.

No one is “happy” to see an iconic brand like American face a bleak future, but the majority of us have seen this coming for a long time, since the merger with US Airways a decade ago. They’ve made poor choice after poor choice, cheapening themselves, cutting their international network, losing NYC, losing LA, losing Boston, losing Chicago, losing the trust of their employees, alienating customers. This is just the natural end to a business run like that. It’s sad, but I’ve accepted it for how it is- and it’s time for you to as well. American has to pay the piper, just too bad they can’t afford it anymore.

No one, not even Tim, and not Gary @ VFTW, is calling for AA’s liquidation. Posting facts is not calling for liquidation. AA has a massive debt load, earns less revenue and less profit…. These are facts.

As The old saying goes, invest a billion dollars in an airline and end up with a million dollars.

I wonder what Richard Anderson is doing these days. Perhaps he can be lured out of retirement. He of all people could turn AA around.

Hey guys the stock market is not making much sense today, right?

AAL, LUV, and JBLU up strongly today? After all that is being said about the domestic market?

There must be some kind of rumors flying around. Does anybody know anything?

Ben Schlappig, your armchair ceo article on B6 and first class was quite good.

Care to try and do another armchair ceo blog post on how you would turn around AAL/American? Plenty of us in the comments section would love to suggest and discuss our own ideas too

If you think Delta financial performance is good now, wait till they have to dump money on their technology and infrastructure!

(Applying Tim Dunn aka ClipperSkipper logic abt AA/UA and their contracts)

Why are you so two-faced that you post over on Gary's site that AA's failed distribution strategy will cost it $1.5 billion JUST THIS YEAR.

You are so Teflon coated you can't stand to admit that Delta and United have picked up billions of dollars in revenue from passengers that fled American over the past decade.

The Delta IT issue and even the meltdown - which UA has a bill for as well -...

Why are you so two-faced that you post over on Gary's site that AA's failed distribution strategy will cost it $1.5 billion JUST THIS YEAR.

You are so Teflon coated you can't stand to admit that Delta and United have picked up billions of dollars in revenue from passengers that fled American over the past decade.

The Delta IT issue and even the meltdown - which UA has a bill for as well - will cost FAR, FAR less than the revenue that AA has lost due to AA's OWN STRATEGIES.

and AA and UA BOTH will spend far more than DL will need to spend in order to settle with their flight attendants.

Nobody is gloating but rather dealing with reality that you seem incapable of handling so you lash out at others.

AA has been a failing business for 20 years.

Take the log out of your own eye before trying to take the speck out of someone else's

Okay ClipperSkipper. One day you say that I'm a UA shill, the next you say I'm an AA shill.

Pick a side bro.

If I loved AA so much, I wouldn't have said that.

Southwest is spending nearly $2 billion on technology this year alone. You're dreaming if this will cost pennies for the world's only perfect airline

I don’t understand how American’s current management team is still in power. This seems like borderline negligence on the part of the company’s board. How can you watch an airline underperform quarter after quarter, and just not do anything?

This paragraph says it all. Vast Raja’s head rolling should’ve been just the beginning.

Delta is a better airline than American!

AA EP here.

Raja left AA nothing but a subprime network strategy and worsened corp relationships.

Distribution fiasco aside, AA’s presence at LA city area and NYC area, namely LAX, LGA, and JFK, decreased under his leadership. Before the pandemic, though marginally, AA was the biggest carrier at LAX while being #2 now, with only less than 0.2% advantage comparing to #3 UA, and around 5% behind DL. We can surely conclude this...

AA EP here.

Raja left AA nothing but a subprime network strategy and worsened corp relationships.

Distribution fiasco aside, AA’s presence at LA city area and NYC area, namely LAX, LGA, and JFK, decreased under his leadership. Before the pandemic, though marginally, AA was the biggest carrier at LAX while being #2 now, with only less than 0.2% advantage comparing to #3 UA, and around 5% behind DL. We can surely conclude this partially to development plans at T4, but mostly because of Raja’s poor, if not non-existent, network plans. This is because AA never stepped up towards competitions at LAX or NYC. Instead, it resorted itself into partnerships (aka let someone else fly) and fortress hubs, like PHL, CLT, and DFW. Short-term, looks like it kept its network at profit, but long-term, I don’t see any difference between this and gifting corp contracts to the On-Timmy Machine.

Hope AA can get a way out of this sooner.

Agreed. I still prefer AA out of LAX for flagship LHR/JFK/BOS, but everything else about the airline (especially as a customer based in LA and formerly NY) leaves little to be desired. Why would I connect in DFW or CLT when DL or UA can get me there non-stop?

Well you wouldn't, particularly if you were a high-yield customer who was willing to pay more for non-stop service at peak times.

I’m in the same boat as you; used to be based in NY, now LA, fly AA J a lot between LAX and JFK/BOS but have started shifting some of that to DL. The LAX D1 check in is really nice, and once their D1 Lounge at LAX is open, the ground experience will be a lot better than AA.

Only in the United States of Amurica is a $717 million quarterly profit viewed as meager.

@ Mike -- Well, I didn't use the word meager. But I think we can agree it's not great when your profit falls by roughly 50% compared to the previous year, and is roughly half of what your competitors are reporting for the same quarter, with similar revenue.

Furthermore, it's one thing if the airline could sustain a 5% margin throughout the year, but the airline lost money in the first quarter, and doesn't...

@ Mike -- Well, I didn't use the word meager. But I think we can agree it's not great when your profit falls by roughly 50% compared to the previous year, and is roughly half of what your competitors are reporting for the same quarter, with similar revenue.

Furthermore, it's one thing if the airline could sustain a 5% margin throughout the year, but the airline lost money in the first quarter, and doesn't expect to make money in the third quarter.

It's not a good situation.

Its not comparable to AA's competitors even if you add back in the $750m lost revenue from the failed sales strategy for the first 6months. To lower the hoop further, it still falls short of DL's revenue when you remove the revenue from the refinery. To AA's benefit, their CASM is lower than DL even with DL being 4% more efficient with their fuel use offsetting the slightly higher fuel unit cost DL is paying

@Mike - in any country, not just the US, businesses are judged not only by standalone performance but also by comparison to a relevant peer set. If you're making a 30% gross margin in Software, compared to some industries that seems phenomenal but in tech it's terrible and you'd be wondering where all that money is going.

Have flown 4m miles on American. This is an example of why they are in the shape they are in. Customers don't mean anything to them. Their customer service, inflight offerings, lounges and loyalty program all are shameful. Whatever was said about their poor performance is a distraction from the truth.

I wish that AA's board paid attention to heavy customer feedback, like reading the comments on this blog for example. But of they aren't even paying attention to the quarterly results of AA itself, I guess they aren't doing ANY research? Isom needs to go. Period. And so do several other management members. I am a longtime AA loyalist, worked my way up to EXP duting the pandemic, and fly 60+ paid FC segments a...

I wish that AA's board paid attention to heavy customer feedback, like reading the comments on this blog for example. But of they aren't even paying attention to the quarterly results of AA itself, I guess they aren't doing ANY research? Isom needs to go. Period. And so do several other management members. I am a longtime AA loyalist, worked my way up to EXP duting the pandemic, and fly 60+ paid FC segments a year on AA itself, based out of DFW. I haven't flown on them since early June when they left me in Vegas for 2 days due to IRROPS. Something has to change here.

That’s because AA has red neck bases

and, remember, this is before settling the FA contract which AS has already said will take a bite of their 3rd quarter and AA and UA haven't even announced the cost of the settlement with their FAs but it will be north of $500 million just in the first year.

I feel like they could crack down on the excessive carry on from economy passengers. I often see people stuffing like 2 bags and a carry-on luggage in the overhead bins, even though technically the backpack should fit under the seat if you have a suitcase. I can't imagine "basic" economy fares are very profitable or useful either.

Yes that should quickly reverse their profit forecast woes.

Maybe they can take away seatbacks entirely to save on fuel!

@Ben

You are basically reporting AA is making a 5% margin. That is what a business in a mature, competitive market should make over the long run. These results, and other airlines moving towards similar numbers, suggest the American aviation market is functioning better and getting healthier after a long period of over consolidation.

@ OliverBoliver -- A roughly 5% margin in the best quarter of the year, while the airline lost money in the first quarter, and expects to breakeven in the third quarter.

Ben,

what are your suggestions then? Easy to identify problems. It would be more interesting to identify the ways forward. Based on your narrative there is absolutely no hope in hell for them?

If I was AA right now I would get out my corporate account rolladex and start making calls. Businesses are pissed at DL and could hit while the iron is hot. Also time to drop the A320s and align the fleet. Focus on DFW and CLT hasn't worked and with B6 dropping JFK routes, start to rebuild there. AA management has to start thinking Premium up front and back. Make a difference and start making $$. Wouldn't hurt to call up Kirby and ask for the play book too.

Don’t disagree about the Rolodex except that aa fired the department that makes those calls and their Rolodexes with them

Exactly. No one left to make those calls. Isom is too busy mismanaging.

My company has already blocked most AA flights when there is a viable alternative (and unless you’re hub captive, there almost always is).

Costs have risen but those costs can't be passed on in the way of higher fares and even fees. At the same time planes are packed to the gills. The industry again has too much unprofitable capacity. You will soon see layoffs, reduction in flying, deferring delivery of aircraft and cutting of routes. You will also see more monetization of premium cabins.

Yes what @George said.

Agree, but what has driven the costs? Revenue is higher than ever, so why can’t they manage the costs appropriately?

"In fairness, profitably decreasing year over year..." I presume you mean profitability.

@ Lukas -- Indeed, thank you!

Have we reached a plateau???

- labor cost went thru the roof, now is the time to pay up

- pilots and FAs are asked to sit out a month or two with furloughs to balance the books

- there is only so much revenue to be squeezed from PAX

- loyalty programs have turned into hollow promises

- lots of luck redeeming point/miles within a alliance

- Sky...

Have we reached a plateau???

- labor cost went thru the roof, now is the time to pay up

- pilots and FAs are asked to sit out a month or two with furloughs to balance the books

- there is only so much revenue to be squeezed from PAX

- loyalty programs have turned into hollow promises

- lots of luck redeeming point/miles within a alliance

- Sky miles have turned into sky pesos

- AA alienated it core business PAX

- lounges look like Greyhound buses stations

- Southwest finally got religion with assigned seating

- Even premium Delta has hit a max

The airline business is feast or famine... nothing new!!

We are heading for the ebb part of the cycle.

However, there is light at the end of the tunnel.

Just give it time.

Isom drives a 737 right over Vasu Raja's "prior sales and distribution strategy"...

For all the talk about the efficiency of capitalism's markets, it clearly doesn't apply to the top of labor. Aviation executives especially are allowed to fly their companies into the ground figuratively, when not literally. Only in this world does it make sense that the exec of Boeing's defect-prone supplier, which it must purchase to fix, is a leading contender to run the entire s-show. (By the way, does Delta pay Bastian to podcast or run an airline?)

Paid Business class tickets bring most of the revenue most legacy airlines make nowdays, and American business class is so shit that it makes delta one and Polaris look like Singapore airlines. Once they introduce their new product profitability will probably go up but the soft product desperately needs to improve too if they want any chance to compete.

" . . . due to our prior sales strategy . . . ". Thank you Vasu Raja. Next is to stabilize network planning. Under Znotins, there's huge uncertainty about booking certain routes . . . there's risk of cancellation. No thanks. I've moved much business from AA for this reason.

In the same way that it’s still called Boeing but we’re actually dealing with incompetent McDonnell-Douglas execs, American is actually US Airways and that explains so much. A fleet of shitty Airbuses to take you via CLT but a correspondingly minor international route network and a management team that always seems one step ahead of bankruptcy? Sounds like US Air!

When you decimate the frequent flyer program and treat your paying customers terribly, this is par for the course.

Insert comment about rude AA FAs here:

It’s too early. I’ll be back lol

Comment of the day lol

This is what happens when you take away IFE. Provide a Greyhound level product and don't be shocked when customers are only willing to pay Greyhound level prices