When you book an airline ticket, you’re typically on the hook for all kinds of taxes and fees. Some are government imposed fees, while others are carrier imposed.

During this week’s Airlines Confidential podcast (which is always worth a listen), Scott McCartney made an interesting observation regarding how some airlines are using increasingly questionable tactics to avoid the federal excise tax on airfare. So I wanted to talk about that in a bit more detail in this post, as he raises a good point.

In this post:

Basics of the 7.5% federal excise tax on airfare

Airline tickets in the United States are subject to a federal excise tax of 7.5%. The important thing to understand is that this excise tax is exclusively charged on the base fare of the ticket, and the same tax doesn’t apply to any optional add-ons.

As you’d expect, airlines use this to their advantage in all kinds of ways. It’s one of the many reasons that airlines like ancillary fees, since those aren’t taxed in the same way. So while airfare is taxed at 7.5%, baggage fees aren’t taxed. Given how low margin the industry is, that difference can add up.

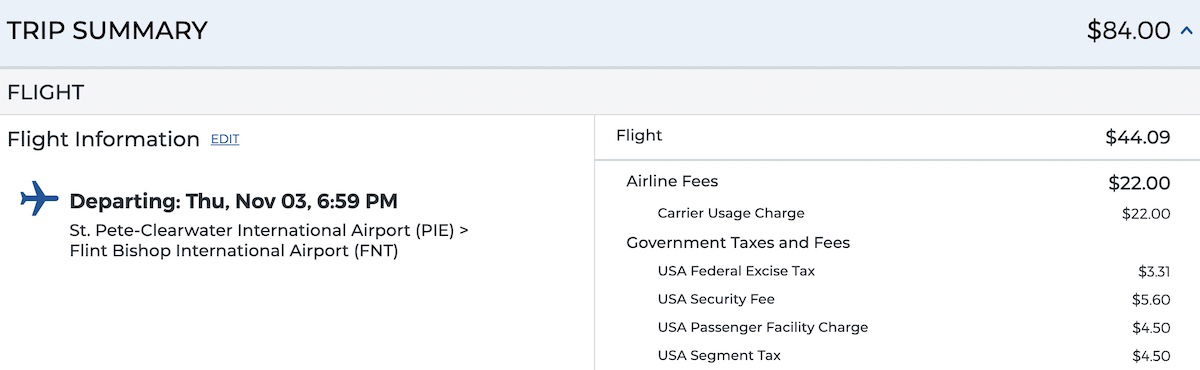

While ultra low cost carriers have historically been heavily focused on ancillaries, they get creative beyond that, in order to skirt these fees. Airlines like Allegiant, Frontier, and Spirit, all have carrier usage charges, which make up a large portion of the airfare. The airlines claim that this is a fee to book tickets through the website, and you can save money by booking at the airport.

The only reason they have these fees is to avoid having to pay federal excise tax on that portion of the airfare. That’s because those fees are technically optional, and they can be avoided by booking your ticket at the airport (go figure these airlines do everything they can to make it hard to book at the airport). For example, a $22 carrier usage surcharge puts an extra $1.65 in the carrier’s pocket, which isn’t nothing.

Now, some will argue that the consumer pays these taxes, so why should the airline care? Well, that’s sort of true. Yes, the consumer pays the federal excise tax, but airlines have to market all-in fares. The demand for airfare is elastic, and consumers don’t care what percent of a fare goes to the airline vs. what percent goes to the government.

How Frontier and Spirit are taking this to the extreme

Both Frontier and Spirit completely overhauled their business models recently, to much more closely reflect what other airlines offer. While both airlines still have a basic economy product, there are now fare bundles that include a lot more things.

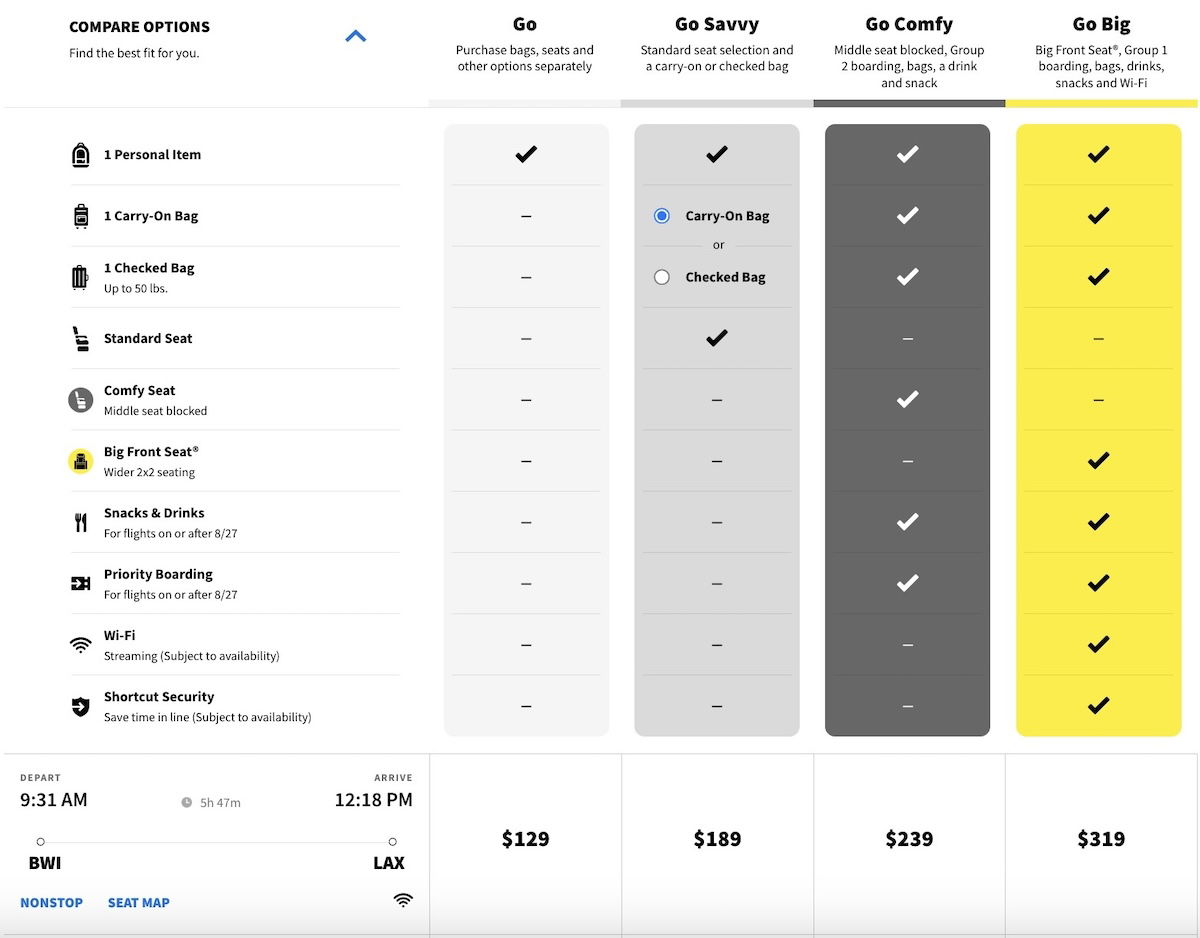

For example, Frontier has a “business bundle,” which is basically the carrier’s version of business class. This includes a seat at the front of the cabin with a blocked middle, and all kinds of priority services. Spirit even has a “Go Big bundle,” which is basically like business class, with a first class style seat, free alcoholic drinks, and more.

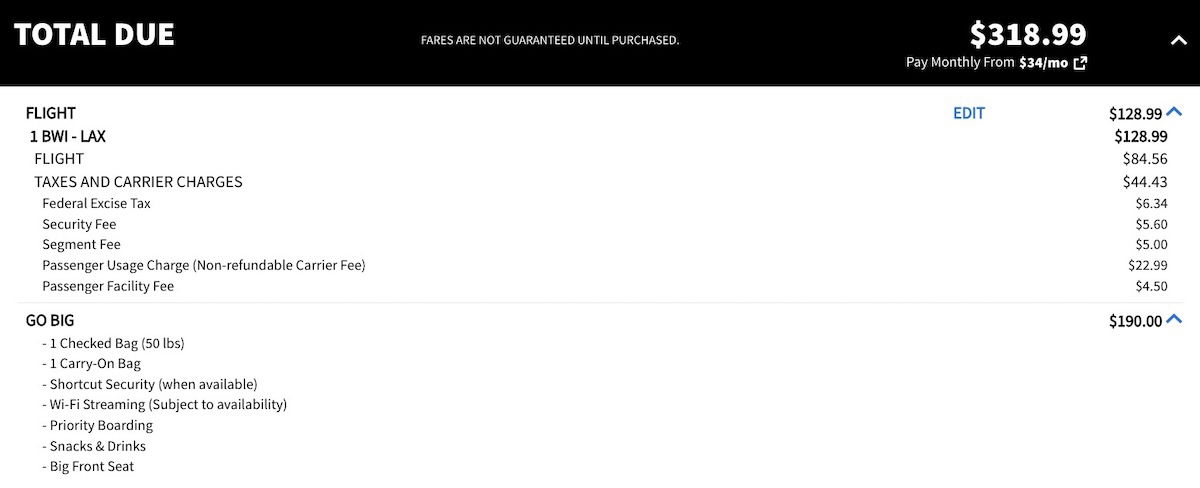

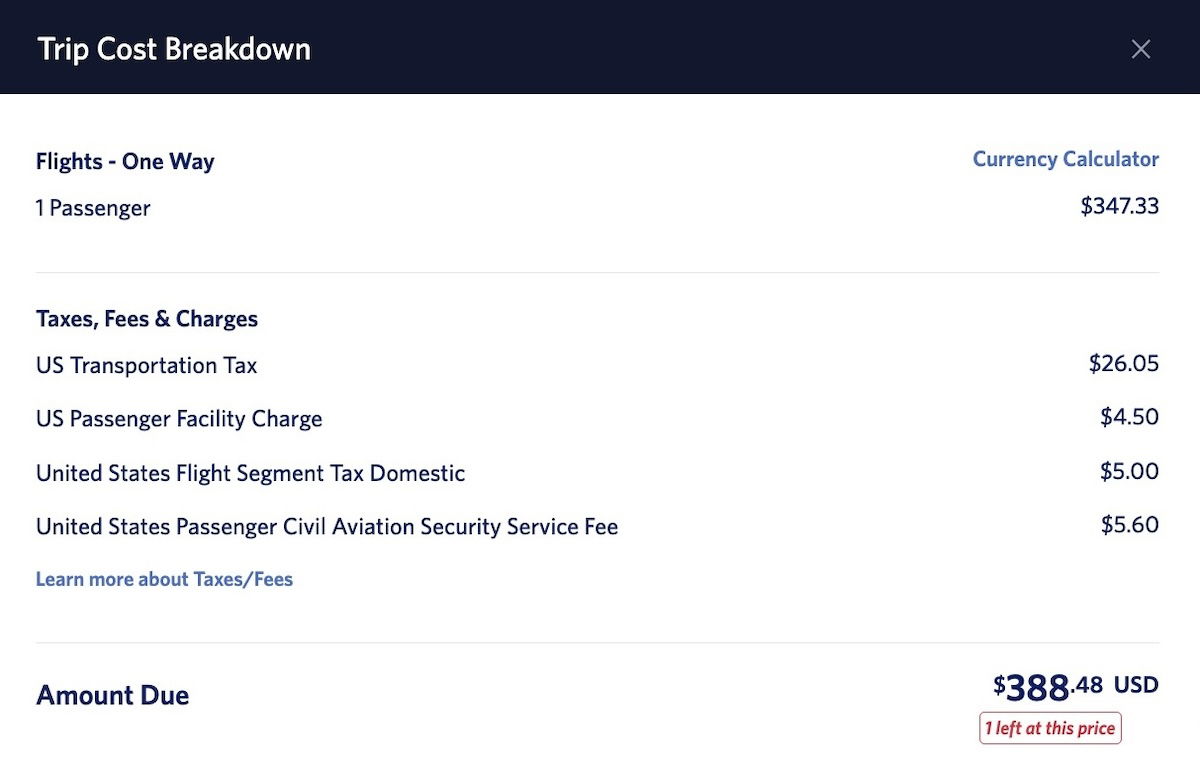

What’s interesting is how the airlines are continuing to avoid most of the federal excise tax on these fares. Want to book a one-way ticket on Spirit from Baltimore to Los Angeles, with the “Go Big” bundle? That costs $319.

It’s interesting to then look at the fare breakdown. The airline considers the flight to cost $84.56, and as a result, the federal excise tax on the entire ticket is just $6.34. Meanwhile everything else, including the $190 “fee” for the product you’re actually buying, is considered an optional purchase.

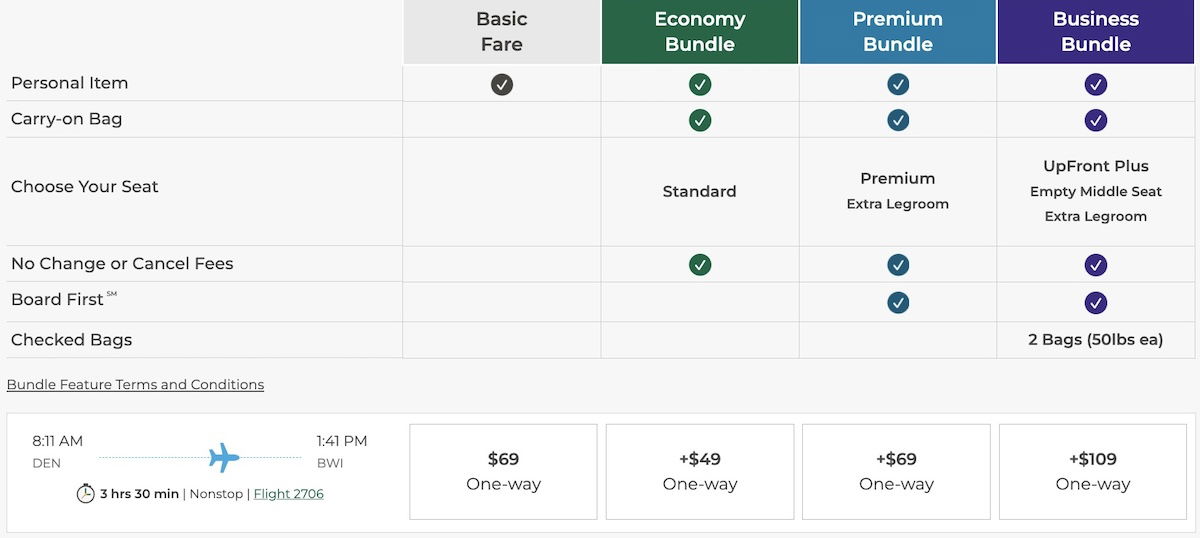

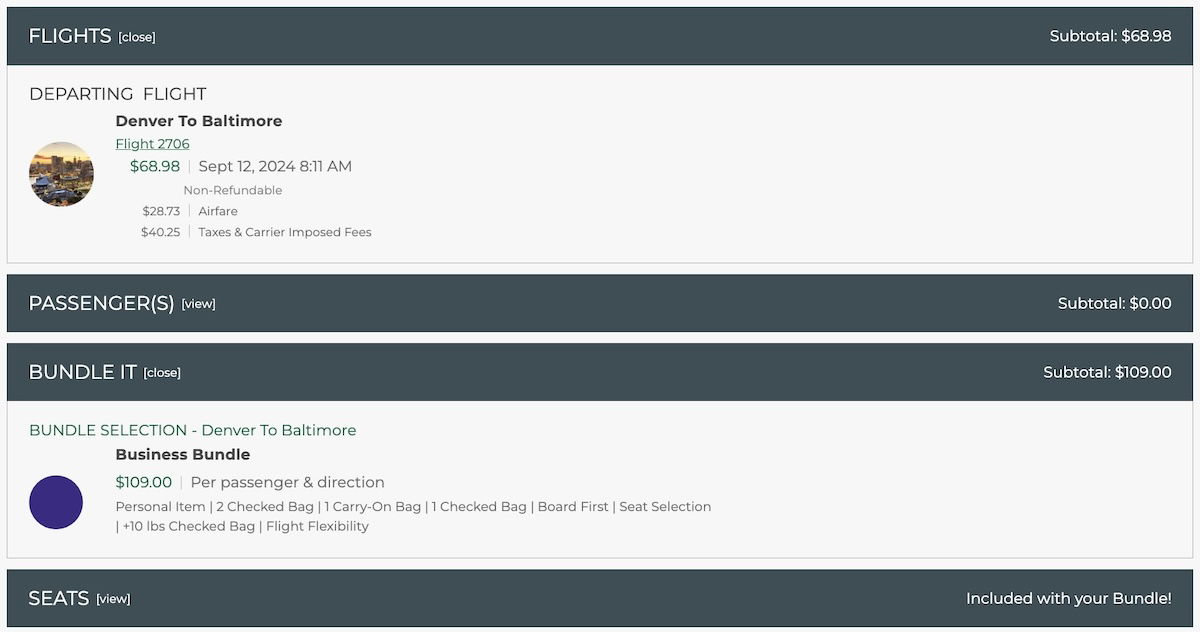

The same is true at Frontier. Take a one-way ticket from Denver to Baltimore, with the “Business Bundle.” That costs $178 one-way.

When you look at the breakdown, you’ll see that the fare is just $28.73, and as a result, the federal excise tax on the entire ticket is just $2.15.

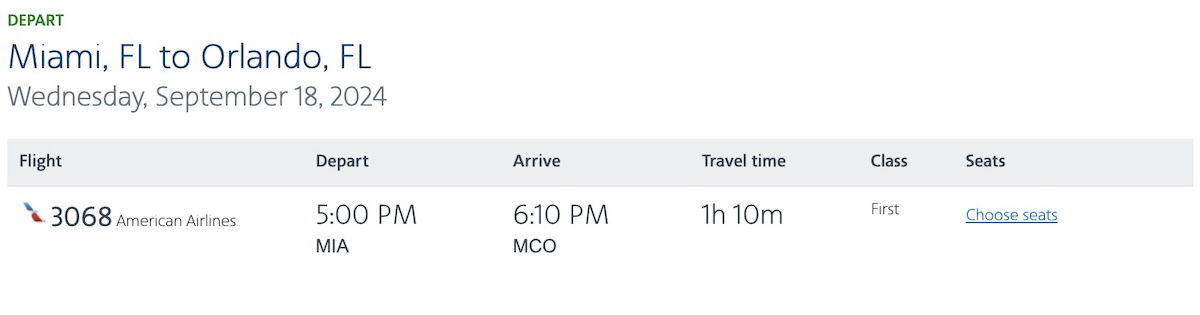

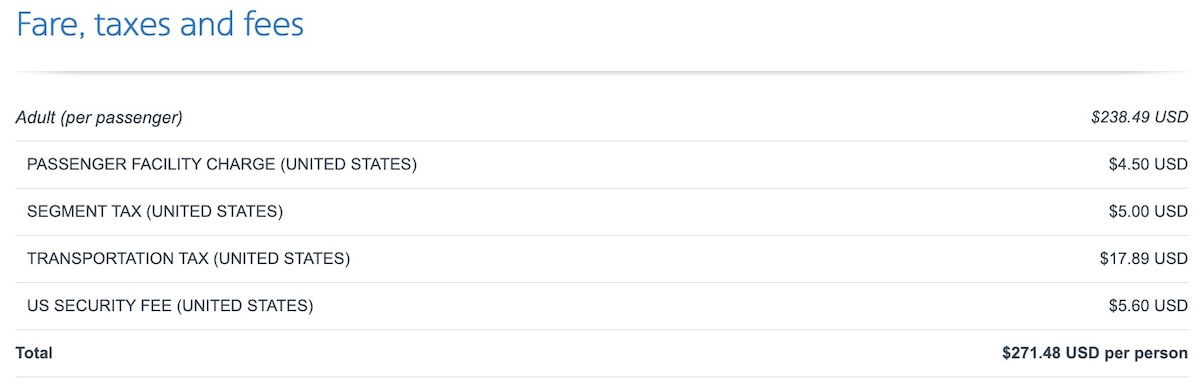

Just to compare this to how legacy carriers would approach this, if you booked a first class ticket on American from Miami to Orlando for $271.48, that would include $17.89 in federal excise taxes, reflecting the $238.49 base fare.

Should the government crack down on this?

In the Airlines Confidential podcast, McCartney argues that what airlines like Spirit are doing is crossing the line, and will no doubt draw attention from regulators, and cause some changes. After all, the government is missing out on billions of dollars in tax revenue. I don’t disagree with McCartney, but I’m also not sure I totally agree.

Based on how the rules are written, I don’t necessarily think Frontier or Spirit are being unreasonable by arguing that people are buying fare bundles, because in fairness, they are fare bundles.

Let me take it a step further — I think this is less unreasonable than carriers like Frontier and Spirit having passenger usage charges, which can only be avoided by booking your ticket at the airport, with the sole intent being to avoid that 7.5% federal excise tax.

To me this raises an interesting question — why haven’t legacy carriers taken a similar approach to Frontier and Spirit? For example, if you take a look at a Delta Comfort+ fare (the carrier’s extra legroom economy), the airline doesn’t claim that you’re purchasing an upgraded bundle, but rather the entire fare is subjected to the federal excise tax.

One thing I absolutely do agree with McCartney on is that we’re overdue for some reform when it comes to the federal excise tax that airlines pay. Now, I’m not saying I want higher taxes on airfare, though I would rather see airlines not be incentivized to sell things as add-ons.

Personally, I’d much rather see the federal excise tax percentage lowered, but charged to all airline ticket related purchases, regardless of whether it’s technically base fare or add-ons. The rules were written at a time when airlines didn’t nickel-and-dime for everything, and I think they should be updated to reflect the new reality.

Bottom line

The United States has a 7.5% federal excise tax on airfare, which doesn’t apply to any optional add-ons. This has given airlines a huge incentive to lean into ancillaries, rather than having a higher base fare. Ultra low cost carriers have been the most aggressive about this, historically.

What’s interesting is that even with carriers like Frontier and Spirit essentially reversing their business models, they’re keeping the same tactics for avoiding federal excise taxes. Want to book a ticket in what’s essentially Spirit first class? Well, the airline claims that the basic economy fare is a base fare, and everything else is an ancillary, and therefore not taxed.

What do you think — should the federal excise tax on airfare be reformed? Are Frontier and Spirit acting unethically?

Oh yes, the lobbyists do the same in Strasbourg France (parliament) and Brussels Beligium (congress), and that includes American lobbyist coming to Europe as well.

What is a lobbyist really? Its a bribe.

Sad.

Ben, the airlines DC lobbyists pay alot more to govt officials than we do as voters.

The kind of changes you describe are completly good and fair, but for them to come, it would need to come from Above.

Its proven time and time again, lobbyist money goes so much further influencing politicians than we could ever do even when voting.

Sad.

I usually buy my tickets at the airport counter for Spirit and Frontier, but I will admit they make it as hard as possible. Usually you need to wait for most people to check in before the agent will attend to you. At one point would create further hurdles by setting up "ticketing hours" of 12PM - 8PM despite the counter being open 3AM - 11PM while Frontier only sells tickets if there's a flight...

I usually buy my tickets at the airport counter for Spirit and Frontier, but I will admit they make it as hard as possible. Usually you need to wait for most people to check in before the agent will attend to you. At one point would create further hurdles by setting up "ticketing hours" of 12PM - 8PM despite the counter being open 3AM - 11PM while Frontier only sells tickets if there's a flight for that time. The third party ground staff they both hire are usually unprofessional as well.

Let me make sure I understand this: in the USA, airlines must display a fare inclusive of all taxes but retailers can get away with not including sales taxes in their displayed prices??

Not only that, but now you are also expected to tip 20-30% after buying the t-shirt also!

The difference is that sales tax is a fixed amount based on the state/county where the item is purchased and the tax rate for the item. While the excise tax on a domestic flight is a fixed amount, the other taxes vary based on the routing, there are flight segment fees, security fees and airport fees which vary and are subject to change. International tickets can have a dozen or more taxes. International flights also...

The difference is that sales tax is a fixed amount based on the state/county where the item is purchased and the tax rate for the item. While the excise tax on a domestic flight is a fixed amount, the other taxes vary based on the routing, there are flight segment fees, security fees and airport fees which vary and are subject to change. International tickets can have a dozen or more taxes. International flights also include a "fuel surcharge" which was originally added to provide flexibility when the price of jet fuel was increasing at a rapid rate. The carriers then realized that because the fuel surcharge was separate from the base fare, they didn't have to factor it into corporate discounts and travel agent commissions. Additionally, before airlines had to include taxes and fees in advertised pricing, they could advertise the base fare only, which is deceptive. Currently, most airlines lowest base fare for a round trip from New York to London is $1, even though with fees and taxes you'll pay $632.

In the US, sales tax varies, sometimes dramatically, between jurisdictions. This is unlike most VAT tax in European countries, which is uniform across often an entire country.

US Cities, counties, and states all impose different rates. It can vary from 0%, all the way up to 10%, and many local governments love to include or exclude various classes of goods (usually food). From a retailer perspective, it would be a nightmare to try putting...

In the US, sales tax varies, sometimes dramatically, between jurisdictions. This is unlike most VAT tax in European countries, which is uniform across often an entire country.

US Cities, counties, and states all impose different rates. It can vary from 0%, all the way up to 10%, and many local governments love to include or exclude various classes of goods (usually food). From a retailer perspective, it would be a nightmare to try putting price tags or menu prices on things *with sales tax included*, since it could would mean a $5 sandwich at one location may need to be visibly priced at $5.35, and at another location just down the road might be $5.50.

This is easier these days with digital price tags and payment by card that doesn’t require as much “round number” pricing.

But it’s why we historically haven’t included the tax in the price tag for many things.

Airfares are usually taxed on a nationwide level - one of the few things Americans buy that actually has a federal level sales tax - so it’s much easier to require “up front” pricing in these cases.

Here's an idea, if you lower the tax percentage but you control the extra fees that the carrier can charge it would be a win-win. You would get more in tax money as a dollar figure but equally avoid the ways around.

If airlines want lower taxes we need to implement EU style passenger protections rights.

Didn't the EU style of hands on approach in the name of protection that enable CrowdStrike to do so much damage?

The purpose of an excise (or sin) tax is to discourage consumption. It's why alcohol and tobacco are priced far above what they would be in an actual free market. To discourage air travel is to effectively limit GDP growth when businesses and individuals are already penalized for productivity with things like the payroll tax or personal income tax. So it makes perfect sense that massive companies would use their massive legal teams to avoid...

The purpose of an excise (or sin) tax is to discourage consumption. It's why alcohol and tobacco are priced far above what they would be in an actual free market. To discourage air travel is to effectively limit GDP growth when businesses and individuals are already penalized for productivity with things like the payroll tax or personal income tax. So it makes perfect sense that massive companies would use their massive legal teams to avoid what is fundamentally an unjust tax. You listed three others that don't need to exist because airlines already pay to access services for their passengers at these same airports. It's odd that the federal government is focused on eliminating "junk fees" while also imposing unnecessary security protocol and taxes like these on travelers, wasting untold hours and dollars every year.

You know that sin tax wouldn't discourage consumption if the stuff you consume is addictive.

It's only to make the companies who get people addicted richer.

Who cares if it's addictive or not. My point was that the price shouldn't be artificially inflated for what is ultimately a personal purchase choice.

You're missing the point.

Perhaps I missed this, if so forgive me; but you did not discuss " The Buffer Zone" which is 200 miles surrounding the continental USA. Which includes most Canadian cities and some in Mexico... the 7.5 percent applies to flights WITHIN this zone. Flights to and from Alaska & Hawaii are taxed at a different percentage rate and flights out of the buffer zone are taxed at a flat rate which was $6.00. MAy have changed, but that is the buffer zone.

I think your whole premise is wrong. "The only reason they have these fees is to avoid having to pay federal excise tax on that portion of the airfare." The reason they have these fees is a marketing advantage over legacy carriers, perception of differentiation, and to drive the cost to the consumer to its lowest value. ULCCs pay the taxes regardless of whether line A or line A - E is included in the...

I think your whole premise is wrong. "The only reason they have these fees is to avoid having to pay federal excise tax on that portion of the airfare." The reason they have these fees is a marketing advantage over legacy carriers, perception of differentiation, and to drive the cost to the consumer to its lowest value. ULCCs pay the taxes regardless of whether line A or line A - E is included in the spreadsheet.

A ULCC doesn't have an advantage on any of those fees because all carriers effectively have the same ability to price and display the same way. Any airline arguing on behalf of consumers around the feds 'increasing taxes' is a fear technique about losing a percentage of customers who are ultra-price sensitive (ULCC's target market) and causing a drop in overall revenue.

But because of all in pricing, the consumer only sees the final price. The consumer doesn’t care if it is a $50 fare with a $20 booking fee or a $70 fare all-in. All the same.

As much as we all like low fares, the flying public should pay their fair share. Taxes should increase because the flying public is able to pay, unlike the poor. This is why VP Harris should get a promotion as she is aware of the need for the rich to pay their fare share. The excise tax should be increased to 25% (EU VAT is 25% and the EU is very progressive) and have it apply to all fees.

EU is very progressive?

Obvious troll is obvious.

VladG doesn't have to admit being a troll. I agree it is obvious!

Taxes should be increased so people will pay their fair share!

If only billionaires paid their fair share.

How much did Warren Buffett or Jeff Bezos paid again?

I think it's less than 1%.

While the average American paid what 10-15%?

EU billionaire don't even get taxed globally, or in Caymans.

LOL, EU is very progressive.

All airlines should pay their fair share

lol the airlines just ADD more to the price of a ticket to PAY taxes. So remember you PAY more when you want an airline to pay more taxes.

Yes, but then free economics work their magic and bring airfares back down to what a customer is willing to pay (equilibrium), eroding back the profits of the airline.

Or collectively cut down on fleet purchase to restrict supply and artificially inflate price.

Free economics work both ways.

I think all of the airline government and mandatory taxes should be lowered...ALos we need lowering of Federal taxes but Comma La and the dnc want more of our $$$$ so ........

I think it's interesting how this article doesn't bother to question the tax period. Why not repeal it and let the public enjoy airfares that are 7.5% lower?

The big carriers probably have a handshake deal they won't enforce similar pricing structures in favor of other concessions to the federal goverment

Legally they are in the clear but I think that ethicaly not. The federal excise tax is used to both pay for air traffic control and projects like runway improvement. So, if both a legacy carrier and a "low cost" carrier charge the same total amount (including all charges) from here to there, the latter has paid less than their fair share for the same services. I believe that all charges shoud be subject to...

Legally they are in the clear but I think that ethicaly not. The federal excise tax is used to both pay for air traffic control and projects like runway improvement. So, if both a legacy carrier and a "low cost" carrier charge the same total amount (including all charges) from here to there, the latter has paid less than their fair share for the same services. I believe that all charges shoud be subject to this tax. Maybe that would help improve funding for the FAA and salaries for their employees.

both of these can be paid without levying an arbitrary 7.5% tax. The runway portion should already come from fees charged to the airline for using their services. If the FAA isn't receiving all of that money, then where is it going?

This is where the govt needs to step in. "Airport ticket purchases are available only on Tuesdays from 11:00 am to 1:00 pm ET at Breeze cities currently operating flights." Meanwhile Breeze staffs the ticket counter 2.5 hrs ahead of each departing flight. This is a deliberate attempt to deter people booking in person.

If you are going to say I have an option to book a flight unperson to avoid the online booking...

This is where the govt needs to step in. "Airport ticket purchases are available only on Tuesdays from 11:00 am to 1:00 pm ET at Breeze cities currently operating flights." Meanwhile Breeze staffs the ticket counter 2.5 hrs ahead of each departing flight. This is a deliberate attempt to deter people booking in person.

If you are going to say I have an option to book a flight unperson to avoid the online booking fee then it should have to be a reasonable time available to book.

Government agencies should have reasonable time available too.

Hello DMV.

They can't even fix election day. Doesn't make it easy for employed person to vote.

A reason we get clowns for the last 8 years, and at least another 4.

So I'm not complaining if I have 2 hours to book at the airport.

Elections are largely a state and county enterprise. As an employed person I have never had a problem voting and have voted in every election since I became eligible to vote at age 18 (I'm now in my 60s).

If you're having trouble voting then you should discuss this with your state and local officials.

@henare

A lot of people did.

It's still on Tuesday.

And don't forget your so called 'state and local officials' are subject to gerrymandering?

Just because you can exercise doesn't mean the system isn't broken.

They should raise the tax and apply it across the board.

Why revise tax and go after ULCC flyers.

System can't get billionaires to pay their taxes.

Which explains why the Administration wants to eliminate “Junk Fees”…. They want their cut

No different than getting robbed on Friday after you cash your paycheck. They contribute nothing and feel entitled to their share, at the threat of violence or imprisonment.

Same issue with hotels and destination fees. Make those fees subject to the tax and it’s a simpler world.

Otherwise , we’ll see more and more junk fees. It will never stop.

Lowering the % but increasing the base and keep it tax neutral.

anything to end JUNK fees by hotels.

Realize that Spirit and Frontier will play the "we make air travel affordable for millions that would not be able to fly" card and politicians will go right along. This excuse was used to stop the JetBlue/Spirit merger (albeit a crappy business decision)-that a combined JetBlue/Spirit merger would jack up fares although it's doubtful they would/could have.

Ethically they are in the clear. This is more akin to tax avoidance than tax evasion.