In September 2024, we saw Alaska Airlines’ takeover of Hawaiian Airlines close. It has been an absolutely fascinating several months for Alaska Air Group, as the company has updated its strategy, including turning Seattle into a global gateway.

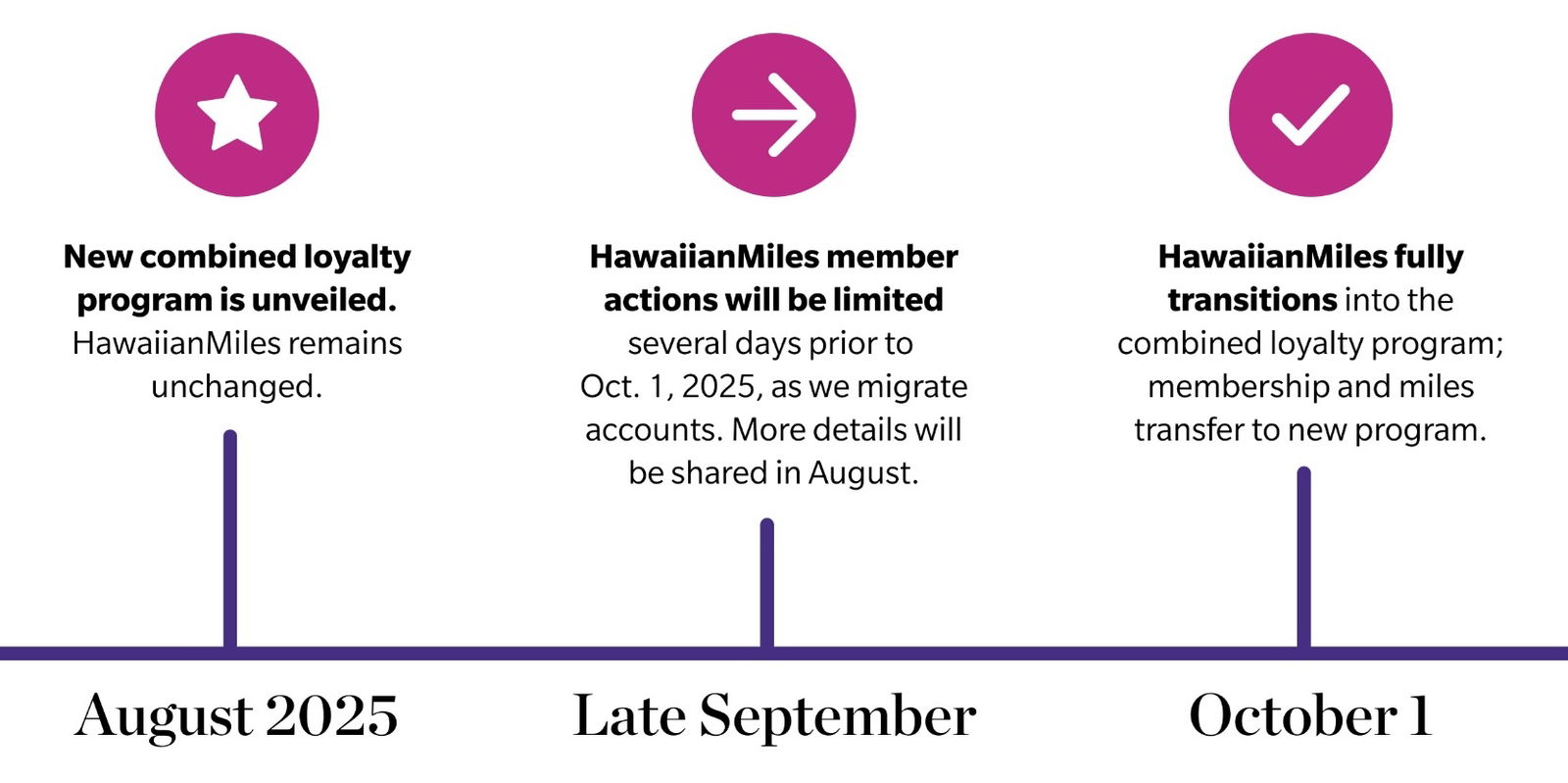

We’ve known that Alaska Airlines and Hawaiian Airlines plan to launch a new loyalty program in the coming months, and we now have more exact details about the timeline for that.

In this post:

New Alaska loyalty program launching August 2025

Alaska Air Group intends to maintain both Alaska and Hawaiian branding, as this is an important commitment that the company has made to the state of Hawaii. However, the company plans to launch a combined loyalty program, to offer more consistency across the two brands. We now know when this will happen:

- In August 2025, the details of the new loyalty program will be unveiled, and Alaska Mileage Plan will transition to the new program at that time

- On October 1, 2025, HawaiianMiles will fully transition to the new program

Now, we don’t know exactly how this will work in practice, in terms of branding. I suspect that the loyalty program may still have elements of both Alaska and Hawaiian branding — maybe there will both be an Alaska Mileage Plan and Hawaiian Mileage Plan program, with the only difference being the branding (much like how Miles & More has both Lufthansa and SWISS branding). Or maybe the “Atmos” branding will somehow play into all of this.

1:1 mileage transfers between the two programs are already possible online at no cost, so at least this gives members the flexibility to transfer miles. Furthermore, the two airlines are already offering status matches and reciprocal perks. Just keep in mind that Hawaiian doesn’t plan to join the oneworld alliance until 2026, so if you want to earn or redeem other oneworld miles, or take advantage of oneworld elite benefits, you’d have to wait until 2026 to do that on Hawaiian operated flights.

When the new loyalty program launches, I’d expect it to basically be along the lines of the current Mileage Plan program, so don’t expect many surprises. There are of course lots of great ways to redeem Mileage Plan miles. On top of that, Mileage Plan has already made major program changes for 2025, including being able to earn elite miles for award flights.

Hopefully we see stronger elite perks for travel on Hawaiian flights, especially with the amount of cross-fleeting happening. For example, hopefully space available first class upgrades on Hawaiian are rolled out on a widespread basis.

The Bank of America credit card portfolio will survive

When it comes to credit cards, Alaska Mileage Plan has co-branded credit cards issued by Bank of America, while HawaiianMiles has co-branded credit cards issued by Barclays.

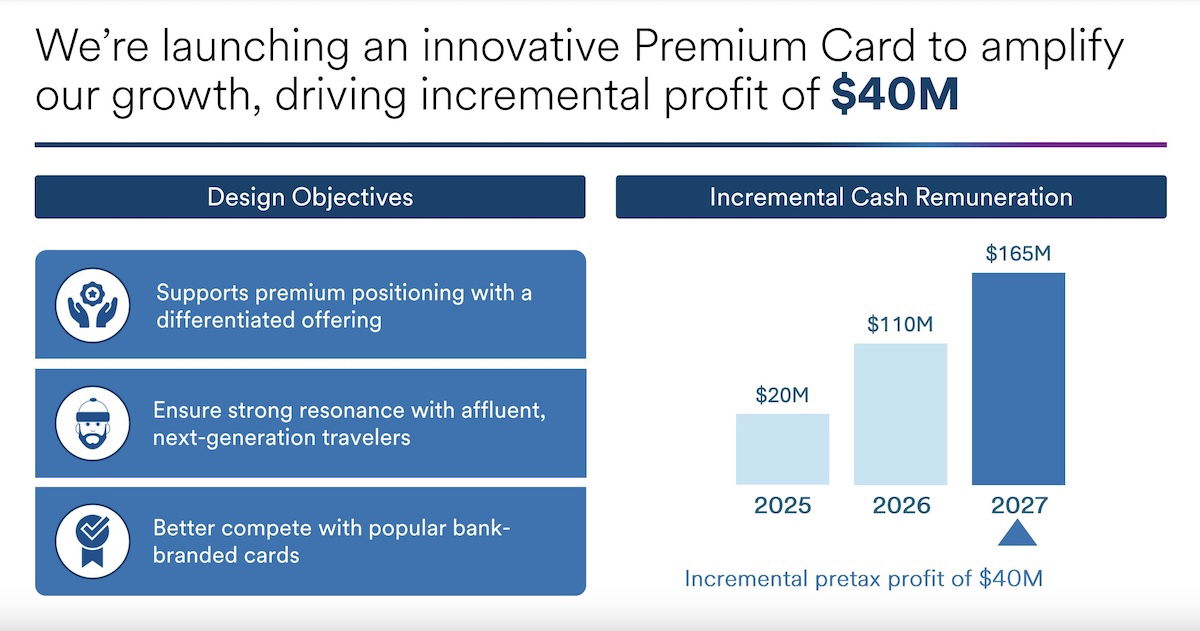

Once a single loyalty program is formed, the expectation is that the Alaska Mileage Plan partnership with Bank of America will continue. Not only that, but it will actually be expanded. In addition to the existing Alaska co-branded credit cards, in August we’ll also see the launch of a new premium credit card.

The expectation is that Hawaiian’s co-branded credit cards with Barclays will be discontinued, though we don’t have the timeline for that yet. Once that happens, members will be given the option to switch to a Bank of America card. Of course not having access to as many sign-up bonuses isn’t great, but I think that’s ultimately a logical development.

Loyalty was a major motivation for the Hawaiian takeover

Nowadays US carriers — even the most successful ones — make a large percentage of their profits from their loyalty programs, and in particular, from their lucrative co-branded credit card agreements. For an airline of its size, Alaska is really good at making money off its loyalty program.

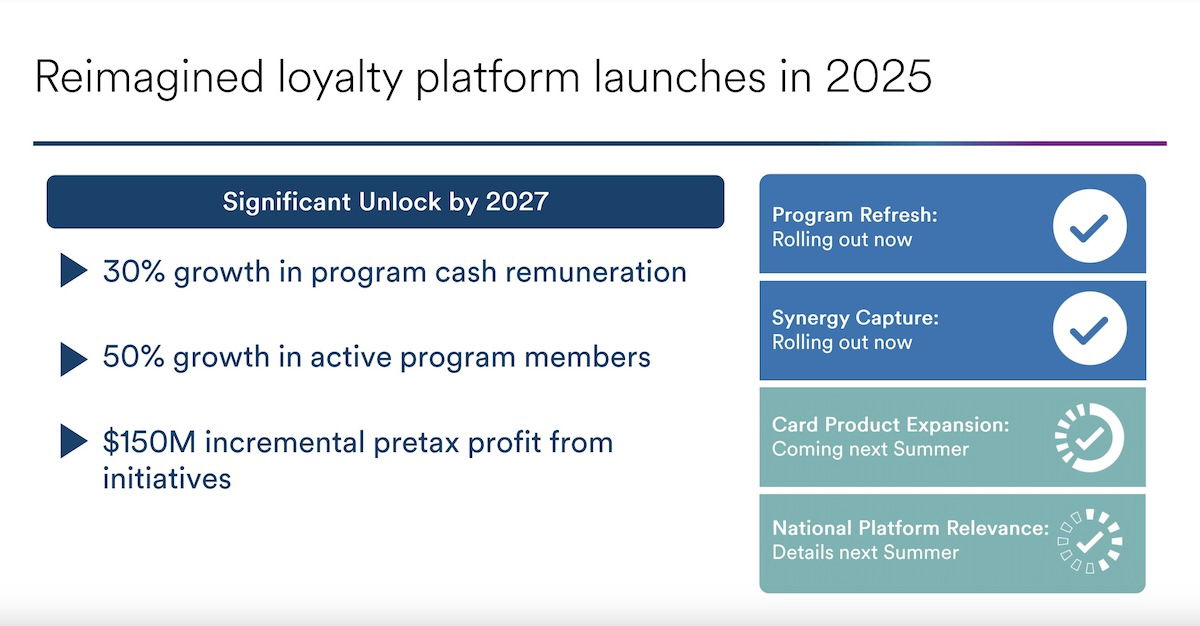

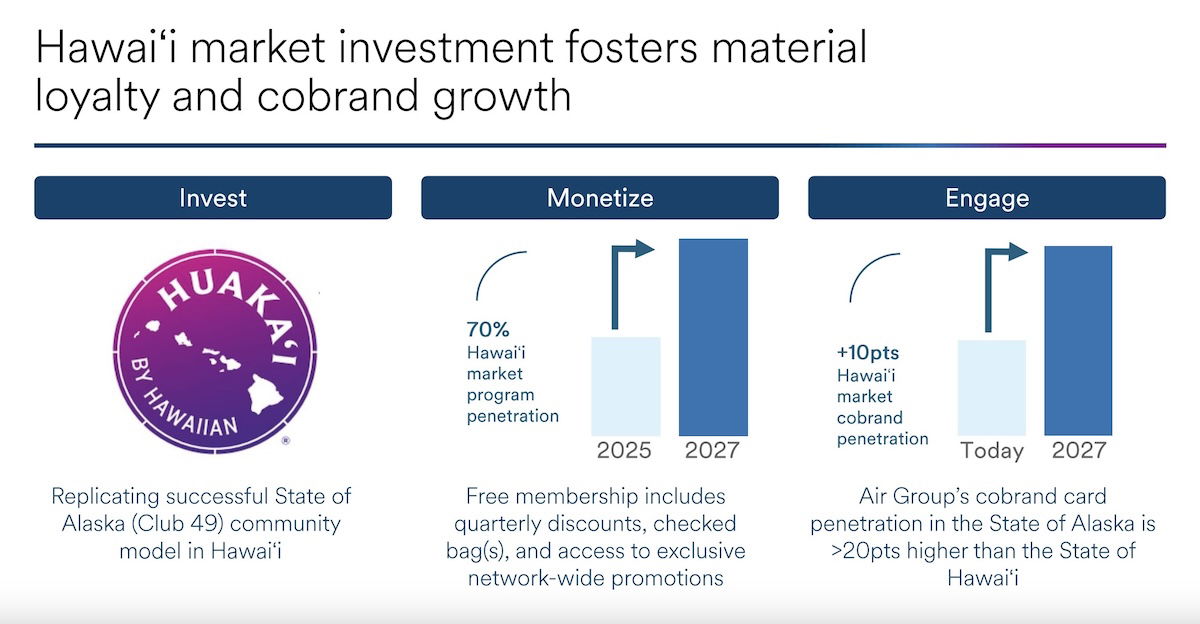

It’s interesting to note that for Alaska Air Group, the upside with the loyalty program was a major motivator for acquiring Hawaiian. As a percentage of total revenue, Alaska does much better with its loyalty program than Hawaiian. That seems like a major opportunity, since Hawaiian is based in a place that many people love to vacation, and that’s a major incentive for consumers to pick up a credit card.

So from being able to better monetize Hawaiian’s customer base in Hawaii, to being able to offer reward flights to Alaska loyalists, there’s so much upside here, and untapped potential. To drive home this point, below are some slides from Alaska’s Investor Day 2024 presentation, showing how the company sees this playing out.

Bottom line

Alaska Air Group is expected to announce details of its new loyalty program in August 2025. Alaska Mileage Plan will immediately adopt the new program, while HawaiianMiles will be discontinued as of October 1, 2025.

While I could be wrong, I suspect that the new program will be very similar to the existing Mileage Plan program, with the benefit of strong benefits on Hawaiian flights. Of course there might be some unpleasant surprises as well, but overall, I’m pretty optimistic.

What are you expecting from a combined Alaska & Hawaiian loyalty program?

I just got off an Alaska air flight. I am disappointed in the new website. They use to notify me and made everything easy. It is not that way anymore. I will think twice before booking with Alaska again

Only difference I see SO FAR is that they are taking away the 2 free bags for card holders and reducing it to just one for the person flying. Nice though that my 6 additional passengers (that I seldom ever have) on my same booking still get a free bag. Alaska program and their app and web site as well as the "humans" have always been top notch and I hope that doesn't change.

@ Jan — Sorry, which card offered two free checked bags per person?

It is uncommon for airlines or hotels to be with two credit card providers in one market. The case of Marriott is rare.

The real question is what happens to those short-haul AA awards for 4.5K?

As an Elite Gold 100K, I have not flown to Hawaii for the past 7 months because AS operated flights were severely curtailed and there is no upgrade policy on HA operated flights.

Let's see how the upgrade policies are applied and what incentives are there for upgrades (mileage included) for international flights.....

It's interesting that every other merger in the US (e.g. NW/DL, US/AA, UA/CO) eliminated an airline fully in the process. But the HA/AS merger is using AF/KL as its template. Continue both airline's branding, but have one unified loyalty program.

@James K., your AF/KL comparison is valid, but there are some important differences to consider.

National Identity: AF/KL represent actual countries within Europe, which carries serious national brand equity. This is in ways that don't really apply to Alaska-Hawaiian.

Cost Reality: When the next industry downturn hits, some MBA in Seattle will inevitably target the obvious savings from running two brands; duplicate uniforms, different cabin service, separate catering, branded items, and maintaining two livery schemes....

@James K., your AF/KL comparison is valid, but there are some important differences to consider.

National Identity: AF/KL represent actual countries within Europe, which carries serious national brand equity. This is in ways that don't really apply to Alaska-Hawaiian.

Cost Reality: When the next industry downturn hits, some MBA in Seattle will inevitably target the obvious savings from running two brands; duplicate uniforms, different cabin service, separate catering, branded items, and maintaining two livery schemes. These redundancies become irresistible cost-cutting targets when revenue gets tight.

Route Overlap: Unlike AF/KL's complementary international networks, Alaska-Hawaiian will face pressure to clean up overlapping West Coast-Hawaii routes under one brand.

Fleet Benefits: Aircraft commonality (training, maintenance, parts) heavily favors unified operations and identity.

Corporate DNA: Alaska's acquisition-heavy growth approach is different from European airline partnerships—they're more willing to fully integrate

History shows that without regulatory or political roadblocks, airline mergers/acquisitions here in the USA usually end up with unified brands within 5-7 years. The operational savings are just too tempting to ignore long-term, despite stated intentions now.

"Of course there might be some unpleasant surprises as well, but overall, I’m pretty optimistic."

Likewise, Ben. Lots of oddly negative comments on the chat so far.

As a MP member who has hoarded a buncha miles, I'm a little nervous to see what the "reimagined" program will be.

I'm cashing out all of mine and my family's miles for an Asia trip this fall and a South America trip in the spring...

Burn the miles now, folks, a devaluation is inevitable with Alaska.

I don't have a lot of AS miles, but I do have some. I'm a little nervous to see how those miles are reimagined to the new program, too.

Kicking myself for not getting the Hawaiian Barclays card when SUB was 75,000. Anyways, is this a good time to get 60k SUB for $99 AF? I already have Alaska card I'm planning to cancel.

With Alaska MP being such a strong program and Hawaiian being a transfer partner of some cc’s (at least I think they are off the top of my head?) are there good opportunities to transfer miles from cc->hawaiian->MP right now?

Well, AmEx transfers to Hawaiian went away on June 30 - so unfortunately you missed the boat on that one...

@JustinB, sadly we're all done with that now. I'm kicking myself for not offloading Amex points when I had the chance.

So devaluations hit Oct.2?

Expect massive amounts of Alaska IT issues

"Hello, I am (Someone) in Boise" will be very busy, no doubt.