Link: Learn more about the Marriott Bonvoy Brilliant® American Express® Card

The Marriott Bonvoy Brilliant® American Express® Card (review) is Marriott’s most premium co-branded credit card, and there are all kinds of reasons to consider picking it up, including a great welcome offer.

While the card has a steep $650 annual fee (Rates & Fees), I find that to be easy to justify, thanks to benefits like Platinum Elite status, 25 elite nights toward status annually, an annual free night award, a $300 annual restaurant credit, and more.

In this post, I want to take a closer look at how the card’s $300 annual restaurant credit works. While this benefit (annoyingly) has to be used monthly, I find it quite easy to maximize, so let’s go over the details.

In this post:

Details of the Marriott Bonvoy Brilliant Card $300 restaurant credit

The Marriott Bonvoy Brilliant Card offers up to $300 in restaurant credits every calendar year, in the form of a $25 monthly credit. As you’d expect, there are some terms to be aware of:

- The $300 credit is broken down into a $25 monthly credit, so you can receive a statement credit for up to $25 each calendar month

- The credit applies toward restaurant purchases worldwide, so it’s not limited to purchases in the United States

- The month toward which the credit is applied is based on the date where the purchase is processed

- The credit isn’t valid for the purchase of gift cards or merchandise, or for purchases at non-restaurant merchants, including nightclubs, convenience stores, grocery stores, and supermarkets

- Whether a purchase qualifies for the credit depends on how the merchant categorizes themselves

- It can take 8-12 weeks after an eligible purchase for the statement credit to post, though in practice they’ll typically post faster than that

- Eligible purchases can be made by either the basic card member or an authorized user, though you still only get a total of up to $300 in credits per year

- There’s no registration required to take advantage of this, as long as you make the correct eligible purchases with the card

Anecdotally, any purchase that’s coded as restaurant or dining spending would qualify. I know many people have had luck using this credit on food delivery services as well, assuming the merchant codes those purchases as such.

How I use the Marriott Bonvoy Brilliant Card $300 restaurant credit

Amex cards are known for having credits that are broken up monthly, quarterly, or semi-annually. Presumably this is partly intended to increase wallet share, by consistently reminding consumers to use a particular card. Of course breakage is also a major factor.

Now, personally I don’t prefer to use the Marriott Bonvoy Brilliant Card for most of my restaurant spending, since there are much more rewarding cards for dining, in terms of the bonus points offered. So I don’t want to put $1,000 per month in restaurant spending on a card, only to receive a $25 statement credit, but then miss out on lots of rewards.

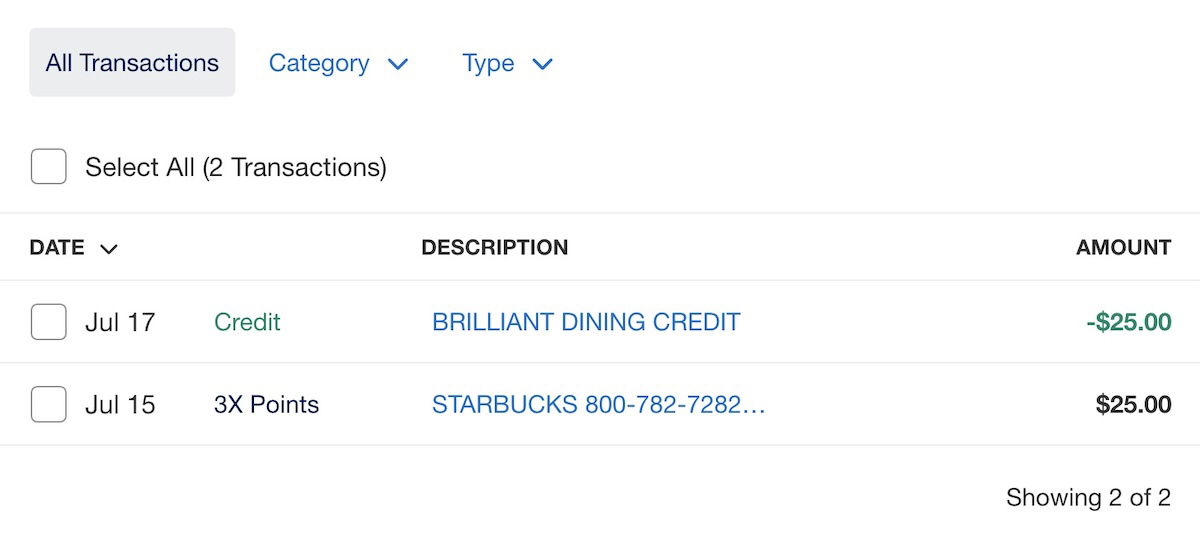

Instead, my approach is that I load $25 onto my Starbucks account every month via the Starbucks app, and then I consistently receive a statement credit for that amount a couple of days later. I imagine this would work similarly with other retailers in the restaurant category (in terms of how they’re categorized with their merchant agreement).

The way I view it, this card gets me $300 in spending with Starbucks annually. While I’m by no means a huge Starbucks fan (there’s much better coffee), stopping at a Starbucks is always useful on a road trip, and my Starbucks balance never gets too high, so I guess it works out.

To me, this is one of the perks that helps justify the $650 annual fee on the card. I’d consider the restaurant credit to more or less be worth face value, so to me, the card really “costs” me around $350 per year. Personally I’d pay $350 for the annual free night certificate alone (since it’s valid at a property costing up to 85,000 points), and then the rest of the perks are the icing on the cake.

Bottom line

The Marriott Bonvoy Brilliant Card offers many valuable benefits, and among those is a $300 annual restaurant credit. This is a monthly credit, so you get up to a $25 statement credit every month that can be applied toward an eligible restaurant purchase worldwide.

Using the credit is easy, but to me the key is doing so without much opportunity cost. If you ask me, the easiest way to do this is to reload your Starbucks balance $25 each month, so that you’re spending exactly as much as the credit. To me, this offsets the annual fee on the card by nearly 50%.

What has your experience been with using the Marriott Bonvoy Brilliant Card $300 restaurant credit?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: Marriott Bonvoy Brilliant® American Express® Card (Rates & Fees).

The sad part is you cannot use it in the last Days of the month. It is when your charges are posted & settled, Not everyone posts the charges the same Day and Amex does not settle everything the same day. that is what I was told. so your benefit end's up in the next month's account.

It's been 24 hours now without any clickbait - thanks Ben!

Amex is surveying cardholders about a business version.

Annoying that the Starbucks app/accounts do not appear to allow you to set a monthly auto-reload for $25 a month, and instead the only option is "when you balance drops below $X." Anyone know if I'm missing something? Or other restaurants/dining options that make this an easy option? Manually reloading every month is still kind of annoying.