Link: Learn more about the Chase Freedom Unlimited®

I’ve been approved for the Chase Freedom Unlimited® (review), which I’m especially excited about, given the great welcome offer. In this post I wanted to share why I applied, what the restrictions are when it comes to getting approved for the card, and then share my experience applying.

In this post:

Why I applied for the Chase Freedom Unlimited

The no annual fee Chase Freedom Unlimited is a key part of a bigger Chase Ultimate Rewards strategy. The Chase Freedom Unlimited is the best personal Chase credit card for everyday spending, as it ordinarily offers the following rewards structure:

- 3x points (or 3% cash back) at drugstores

- 3x points (or 3% cash back) at restaurants, including takeout and eligible delivery services

- 1.5x points (or 1.5% cash back) on all other purchases

What’s great is that in conjunction with the Chase Sapphire Preferred® Card (review), Chase Sapphire Reserve® Card (review), or Ink Business Preferred® Credit Card (review), points earned on the card can be converted into Ultimate Rewards points, and be transferred to the Ultimate Rewards airline and hotel partners, for some amazing redemptions.

Chase Freedom Unlimited application rules & restrictions

Who is eligible for the welcome offer on Chase Freedom Unlimited? Let’s start with the card specific rules, and then we’ll talk about Chase’s general rules.

The Chase Freedom Unlimited isn’t available to those who currently have the card, and to those who have received a new cardmember bonus on this exact card in the past 24 months. Note that:

- Eligibility for this card is unrelated to eligibility for any other Chase card, including the “legacy” Chase Freedom Card, or the Chase Freedom Flex, so you just can’t currently have the Chase Freedom Unlimited, or have received a bonus on the Chase Freedom Unlimited in the past 24 months

- Just to be very clear, past cardmembers are eligible for this card, as long as they don’t currently have the card, and haven’t received a new cardmember bonus on the card in the past 24 months; that 24 month timeline is not based on when you applied for or were approved for the card, but rather is based on when you actually received the bonus

- There are often questions about what it takes for Chase to consider one to be a previous cardmember; it’s all based on what Chase’s system shows, and most reports suggest it takes anywhere from a few days to a few weeks before you’re considered a previous cardmember

- In the event that you’re not eligible for the card, you’ll automatically be declined, but that won’t prevent you from being eligible for the card in the future

In addition to the above, Chase’s general application restrictions apply:

- Chase has the 5/24 rule, whereby you may not be approved for a card if you’ve opened five or more new card accounts in the past 24 months; however, anecdotally this appears to no longer be consistently enforced

- Chase will generally approve you for at most two personal cards in any 30 day period

My experience applying for the Chase Freedom Unlimited

What was my experience like applying for the Chase Freedom Unlimited? For what it’s worth, my credit score is around 820, I’ve had three card applications in the past 24 months (at least that show on my credit report), and I had this card in the past (but am obviously not a current cardmember).

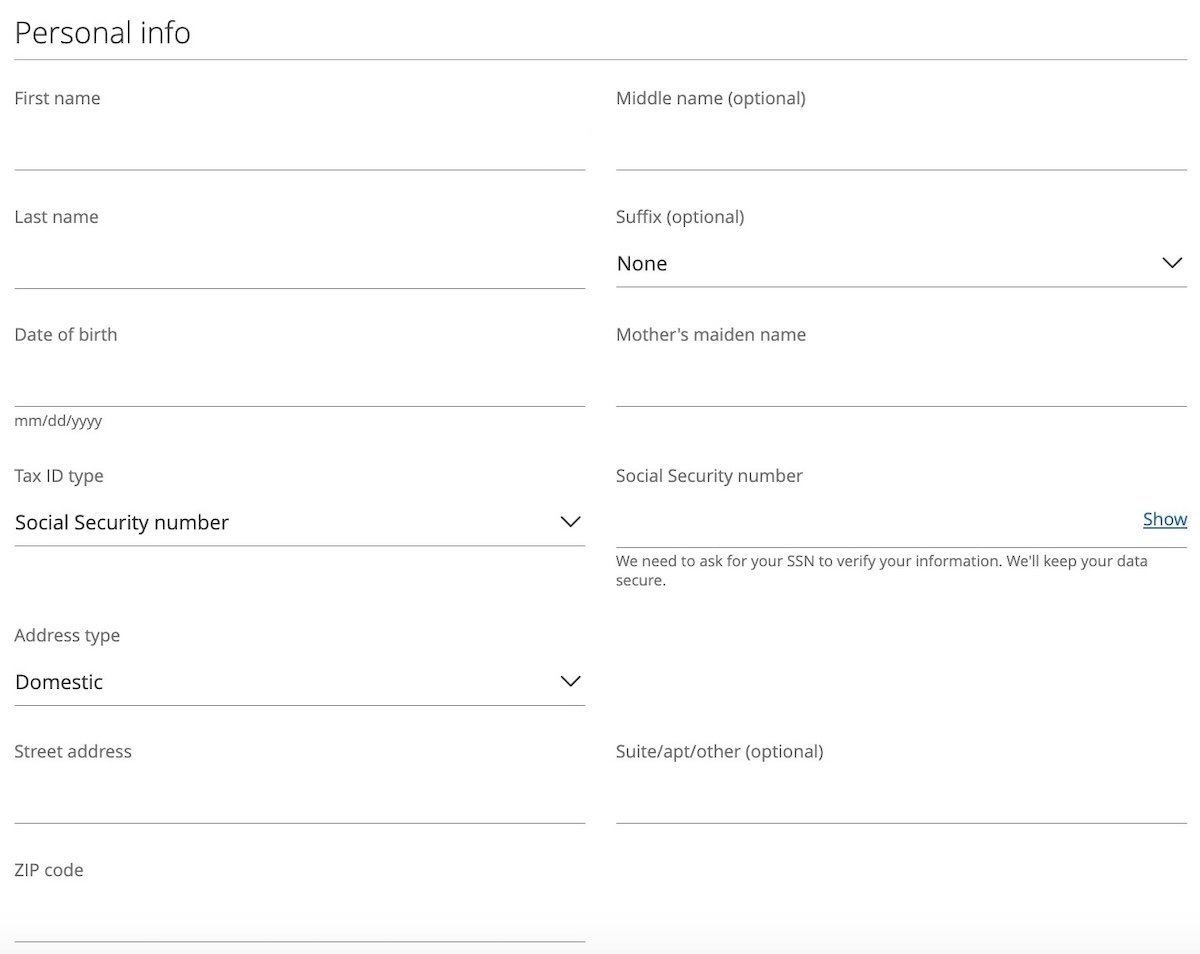

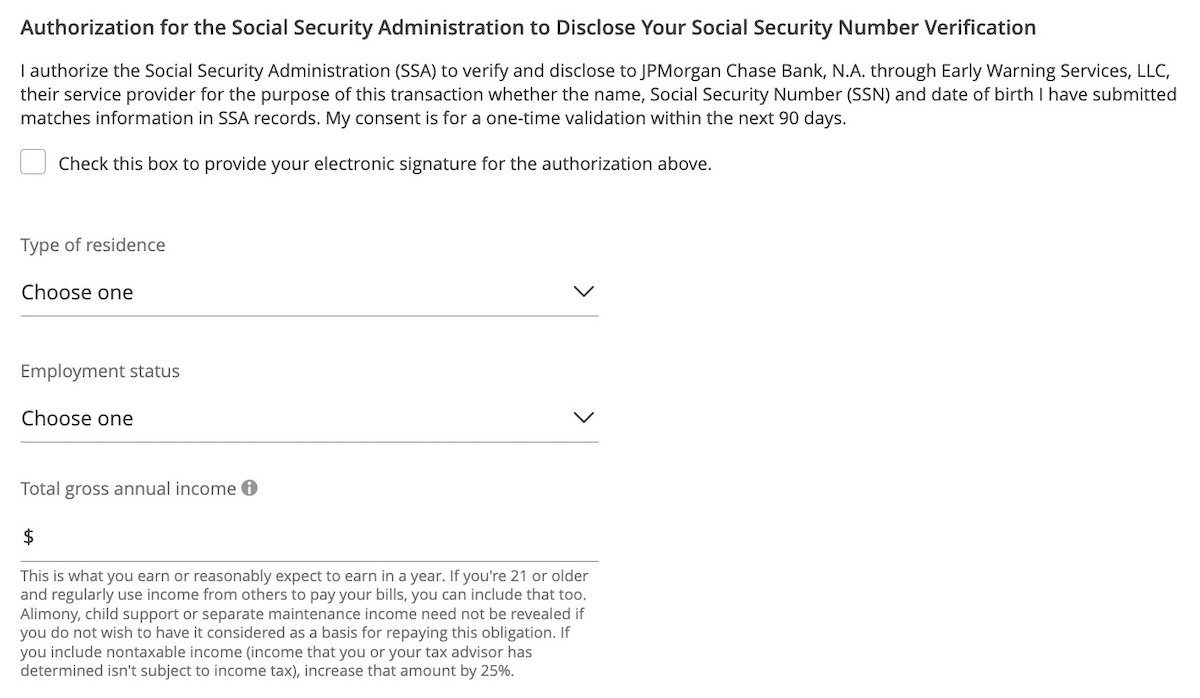

I find Chase card applications to be super straightforward. The application was a single page, and asked for basic personal details, like my name, date of birth, address, SSN, type of residence, employment status, and income.

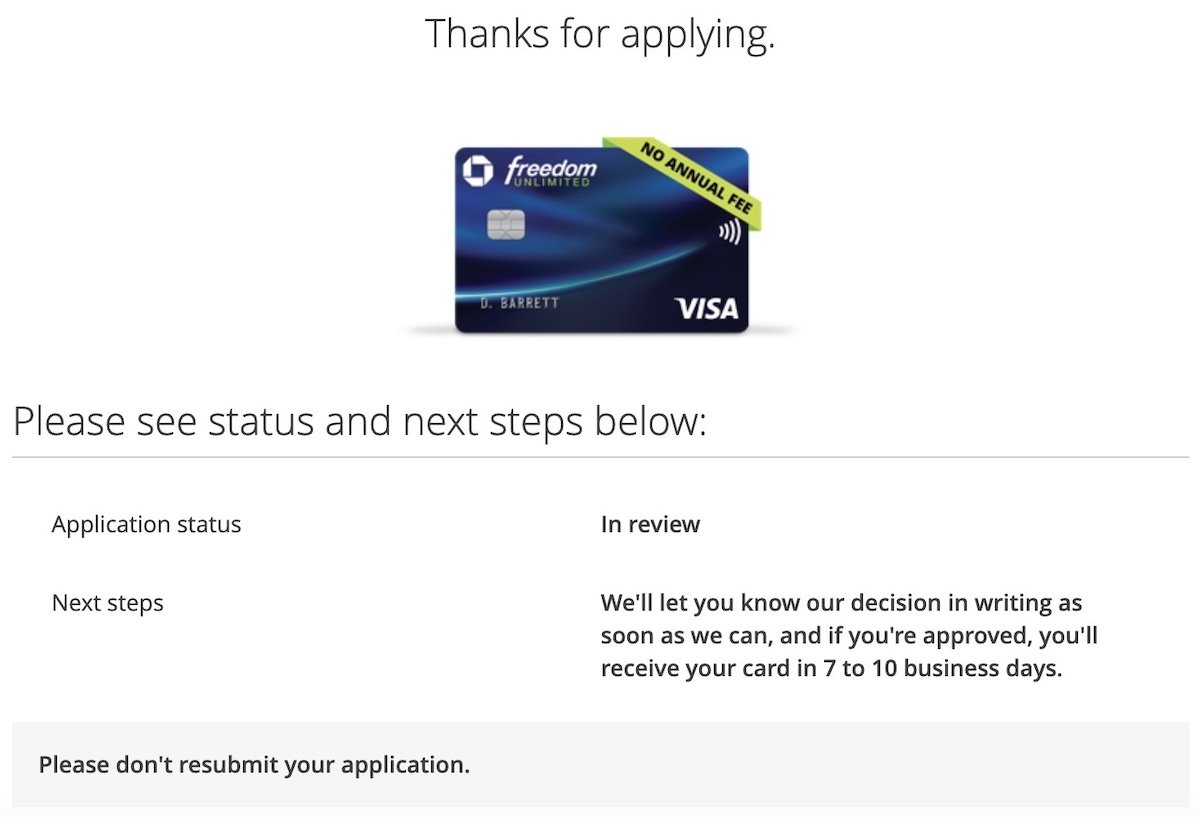

Upon confirming all those details I submitted my application. It’s always a bit nerve-racking as you wait to see if you’re approved or not. Upon submitting my application, I got a “Thanks for applying” message, and was told I’d receive a response in 7-10 business days.

That wasn’t necessarily bad news, but of course it’s always nice to get an instant approval. Fortunately within a minute, I received an email from Chase confirming that I had been approved, and the card immediately showed up in my existing Chase profile. Yay!

The application couldn’t have gone better, and I can’t wait to start spending on the card!

Bottom line

I just got approved for the Chase Freedom Unlimited, which I’m really excited about. This no annual fee card is an important part of a Chase Ultimate Rewards strategy.

Anyone else planning on picking up the Chase Freedom Unlimited?

Applied via your link, Ben -- which DID show the double points promotion when the application landing page opened and I signed in to my existing Chase account. Was instantly approved, with a useful $23K limit. It also instantly appeared among my other Chase cards on the Chase website, albeit with no specific confirmation of the 2x points SUB. That the 2X promotion was clearly displayed on the application landing page is an encouraging sign, at least.

Chase = bait and switch.

Just received the card and decided it was time to call.

My card does NOT show their double points offer, instead a 0% introductory APR plus a few other perks, blah blah blah...

The customer service rep basically squirmed his way through the whole call, reciting the offer that I have been given, and not directly replying to ANY of my VERY direct questions.

I am...

Chase = bait and switch.

Just received the card and decided it was time to call.

My card does NOT show their double points offer, instead a 0% introductory APR plus a few other perks, blah blah blah...

The customer service rep basically squirmed his way through the whole call, reciting the offer that I have been given, and not directly replying to ANY of my VERY direct questions.

I am extremely disillusioned by this but was given no recourse.

The Chase rep was polite, but COLD.

@ Doug -- If you applied through the link that showed the bonus then it absolutely should be honored. Have you tried sending a secure message to Chase, so you can get the details of the offer in writing?

For what it's worth, I think some phone reps are just confused. When my card first arrived, I also called Chase, and the rep wasn't aware of the bonus. However, I then sent a secure message,...

@ Doug -- If you applied through the link that showed the bonus then it absolutely should be honored. Have you tried sending a secure message to Chase, so you can get the details of the offer in writing?

For what it's worth, I think some phone reps are just confused. When my card first arrived, I also called Chase, and the rep wasn't aware of the bonus. However, I then sent a secure message, and it was confirmed in writing that the offer was as expected. I'm sure you'll have the same experience. :-)

You were right, Ben.

It took almost a week, but my secure message was received and reviewed. A Cust Serv supervisor has now confirmed to me that the card carries the 12 mos 2X points benefit.

It's gonna be my new "daily driver," especially for its own bonused categories, but in lieu of Citi Double Cash and Cap One V-X for now.

I need more Ult Rewards points, and this will do a lot to remedy that.

“We'll match your cash back after your first 12 months of spending with your Freedom Unlimited card”.

Ben also mentioned in his post that there’s no instant gratification on double points/ cash back. It’s at the end of 12 months.

Just picked it up yesterday BUT with the other bonus via Chase.com: 5x on groceries and gas for the first year, plus $200 (=20,000 points) for spending $500 in the first three months. We all crunch numbers differently, but this seemed like a better offer for us given the other cards we currently use for spending.

I also applied for this offer soon after it started and received no confirmation of the SUB. The points were not doubled after the first billing cycle and, when I called, I was told that there is no offer attached to the account. They are sending the terms and conditions by mail, but it looks like nothing can be done to make sure that the offer is applied. Very disappointing. It may be that the link is wrong, or some other glitch, but it's not a sure thing.

And when you thought Lucky no longer MS :)

Ben - what sort of confirmation do you have/maintain that you got the sign up bonus? I’ve read some reports of people being told there is a cap. My wife applied through your link a couple weeks ago and was approved. Called yesterday to confirm the SUB. They said there was some error in their system and it was showing no SUB. Transferred to supervisor and same thing. So now they are looking into it...

Ben - what sort of confirmation do you have/maintain that you got the sign up bonus? I’ve read some reports of people being told there is a cap. My wife applied through your link a couple weeks ago and was approved. Called yesterday to confirm the SUB. They said there was some error in their system and it was showing no SUB. Transferred to supervisor and same thing. So now they are looking into it and supposed to send an email with the findings. Obviously a huge deal, as if unmatched we’d put almost everything on the card in the next 12 months (including taxes) and earn 7 figures worth of points.

Got this a couple of weeks ago, and for those of us who love Ultimate Rewards points and dine out often, this is an unbelievably great deal for a no-fee card. I'm envisioning more Hyatt resprt stays!

I've had my Unlimited for several years now, so haven't received the bonus in a while. If I cancel today and try re-opening next week for example, can I get the bonus?

Wondering this too. I thought it was 2 years from when you had the account open, but based on this it's 2 years from when you had the sign up bonus. So can we cancel it today and get the new bonus (I had the sign up bonus easily 5+ years ago)? I understand I'd lose that account longevity, but would be worth it for this bonus.

Yes - I product changed my CFU to a Slate to keep the account history (got in 2018 when they first/last offered double points for a yr BUT CFU didn’t yet offer 3x on dining so this promo a lot better than that). Chase won’t change to a Freedom Flex (my preferrence) as it is a MasterCard and they can’t change from Visa to MC. I waited 5 business days then applied.

When I...

Yes - I product changed my CFU to a Slate to keep the account history (got in 2018 when they first/last offered double points for a yr BUT CFU didn’t yet offer 3x on dining so this promo a lot better than that). Chase won’t change to a Freedom Flex (my preferrence) as it is a MasterCard and they can’t change from Visa to MC. I waited 5 business days then applied.

When I changed, Chase said it could take up to 45 days to reflect on my credit report, but I took the chance after 5 days knowing this promo won’t last long (last time only about 5 days).

I earned so many URs 5 yrs ago, gonna be even sweeter with dining 6x for an entire yr! Best SUBs ever for my spending.

@ TravelMD -- Unfortunately not. It's apparently available until a certain cap is reached, so there's no published end date. I'd apply sooner rather than later if possible, since it has already been around for several weeks.

Unfortunately I am sitting right at 5/24. Not sure what the odds are of approval.

Thanks for the update Ben. Any idea how long this welcome offer will last?

Anecdotally, it appears to be dead already.

It seems that Chase is attaching different benefit sets to approved applications -- at least in my case, plus a few other posters in this thread.

@OMAAT, are you still getting affiliate commissions for clicks through your link? Is there anything YOU can do to make Chase "deliver what was promised?"

(Or at least seemed to be.)