The American Express® Gold Card (review) is one of the best cards for earning Membership Rewards points, and it also has an excellent welcome offer. The card is ideal for anyone who spends a lot on dining, whether at restaurants or supermarkets, and in my experience, getting approved for the card is quite easy.

The Amex Gold Card has a $325 annual fee (Rates & Fees), though the card also offers up to $424 in annual credits, which could more than offset the annual fee, not even accounting for all the other perks.

Now, a vast majority of cardmembers aren’t going to maximize all the credits the card offers, since it is a bit of a “coupon book” vibe, in terms of how the credits are issued. In this post, I want to take a closer look at how these credits work, exactly.

In this post:

How to use the $424 in Amex Gold Card credits

The Amex Gold Card potentially offers statement credits or credits with Uber, select dining establishments, Resy, and Dunkin’. The terms associated with using each of these credits varies, so it’s worth covering all the details. Let’s go over the details and terms of each of these credits in-depth, in no particular order.

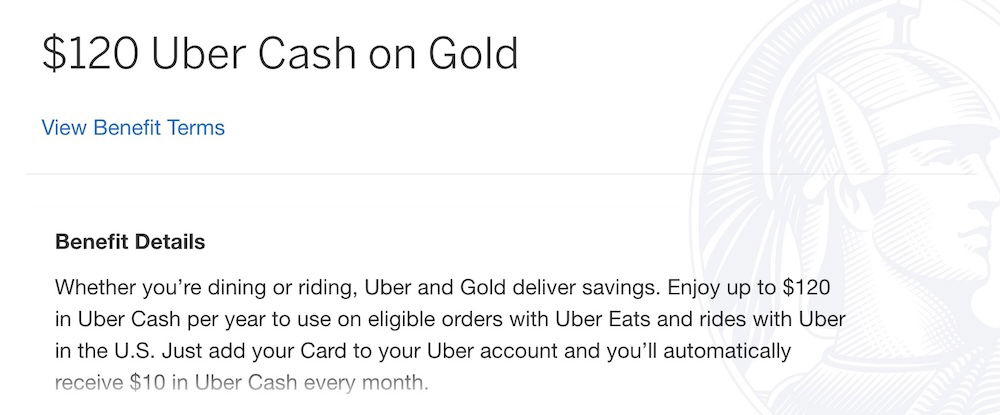

Amex Gold Card up to $120 Uber Cash credit

The Amex Gold Card offers up to $120 in Uber Cash annually:

- Enrollment is required, by logging into your Amex account, and going to the “Benefits” tab of your card

- You must have downloaded the latest version of the Uber app, and your eligible Amex Gold Card must be a method of payment in your Uber account

- This comes in the form of a monthly $10 Uber Cash credit, which posts to your Uber account; so this isn’t a statement credit, but rather is Uber Cash

- The Uber Cash can be used for Uber rides or Uber Eats purchases in the U.S.

- When you request a ride in the Uber app or place an Uber Eats order, your Uber Cash benefit will automatically be applied to your transaction, and there’s no need to pay with the card to trigger it

- If you have the same card added to multiple Uber accounts, only the first Uber account to which the card is added will receive the benefit

What’s my take on this credit? As someone who uses both Uber and Uber Eats more than once per month, this benefit is basically as good as cash to me.

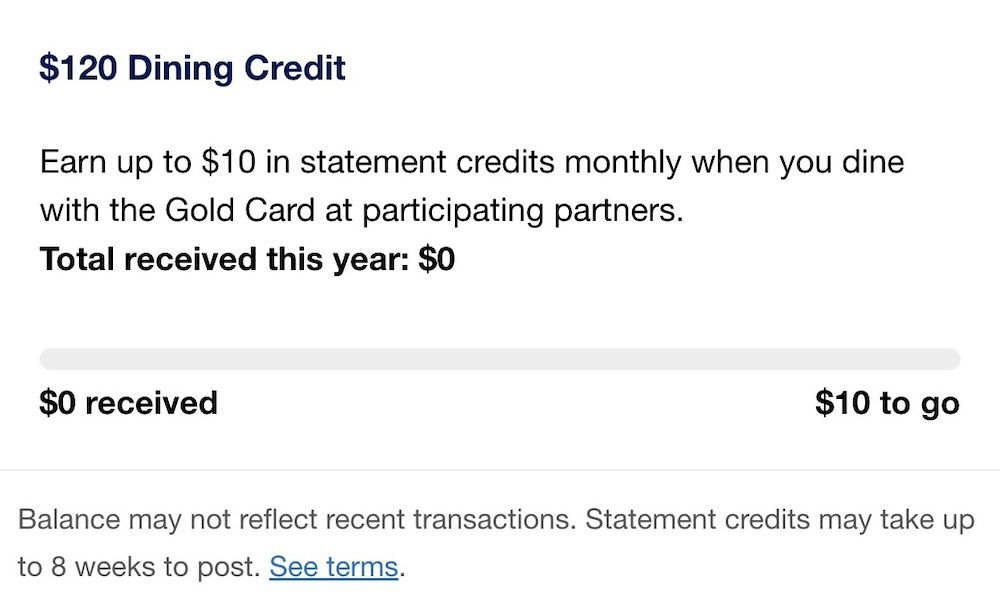

Amex Gold Card up to $120 dining credit

The Amex Gold Card offers up to $120 in dining credits annually:

- Enrollment is required, by logging into your Amex account, and going to the “Benefits” tab of your card

- This comes in the form of a monthly statement credit, so you can receive up to a $10 credit each calendar month

- The credit can be used by the primary cardmember or authorized users, though you only get one credit per account

- The credit can be used for purchases with Grubhub (including Seamless), The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys

- According to the terms, the benefit doesn’t offer statement credits for purchases of gift cards or merchandise

- It can take up to eight weeks after an eligible dining purchase for the statement credit to post to your account, though in practice, it typically posts much faster than that

What’s my take on this credit? Everyone has different spending patterns. Personally, I don’t frequently dine at any of the establishments included with this credit, though I do use Grubhub. So, this saves me $10 per month with those purchases.

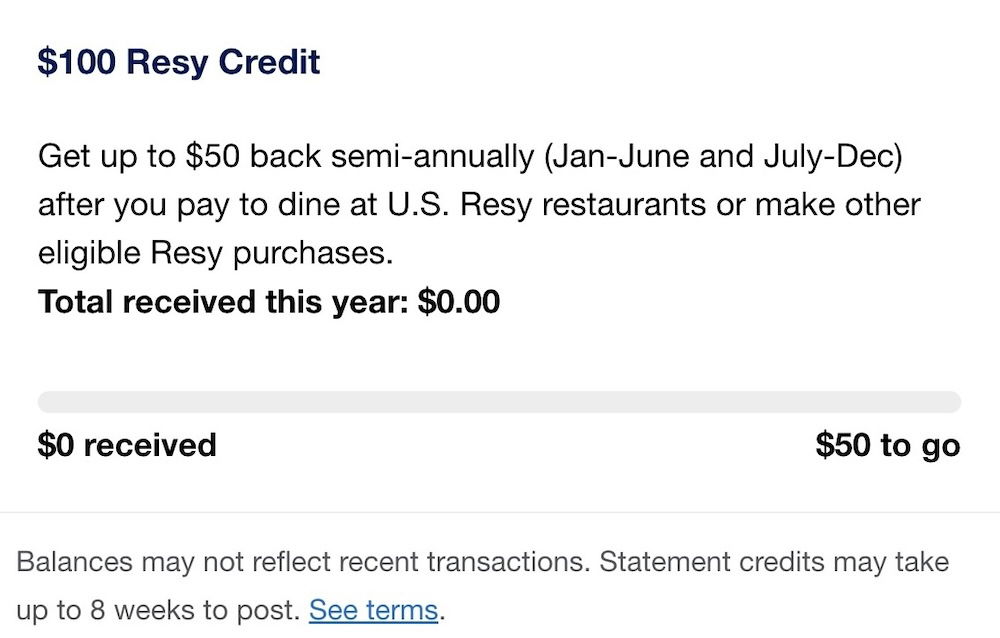

Amex Gold Card up to $100 Resy credit

The Amex Gold Card offers up to $100 in Resy credits annually:

- Enrollment is required, by logging into your Amex account, and going to the “Benefits” tab of your card

- This comes in the form of a semi-annual statement credit, so you receive up to a $50 credit in January through June, and up to a $50 credit in July through December

- The primary cardmember or authorized users can use the credit, though you only get one credit per account

- Eligible Resy purchases include purchases made directly from U.S. restaurants that offer reservations through Resy’s website or app, and purchases made directly through the Resy website or app also qualify

- According to the terms, purchases via Resy Pay, purchases of Resy OS restaurant management software, Resy-branded Amex gift cards, and gift cards purchased at restaurants, may not be eligible to receive the statement credit

- It can take up to eight weeks after an eligible Resy purchase for the statement credit to post to your account, though in practice, it typically posts much faster than that

Let me emphasize that you don’t have to jump through hoops at a restaurant to take advantage of this statement credit. You don’t even have to make your reservation through Resy, as long as it’s a Resy partner restaurant.

What’s my take on this credit? If you dine out frequently and live in a decently sized city, visiting a Resy restaurant should be super easy. Personally I’d be able to maximize this without even trying, since I go to restaurants associated with Resy all the time. Admittedly, this is of limited use to those in small towns, where not many restaurants may use the Resy platform.

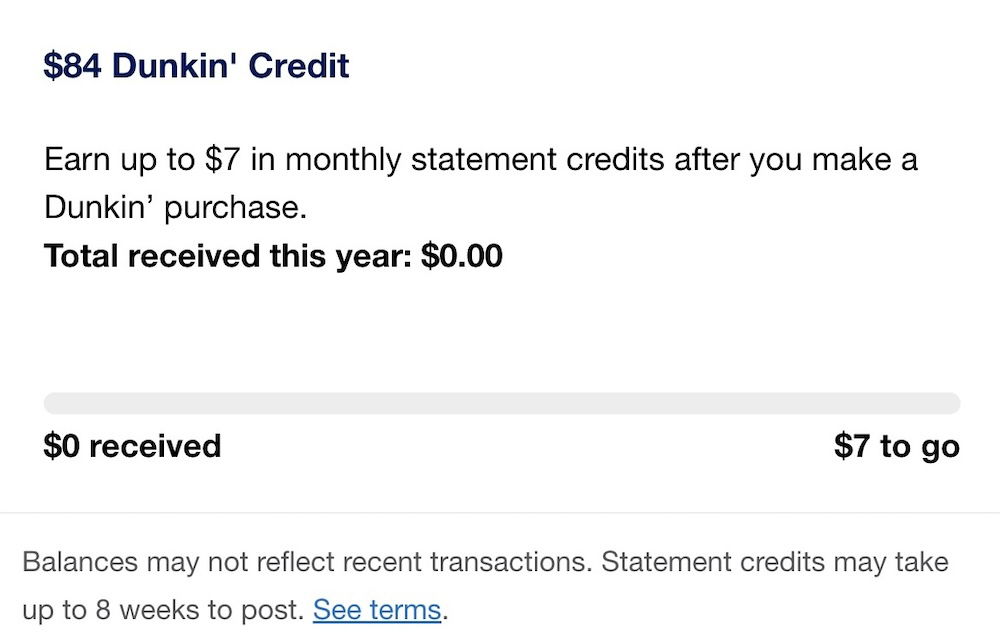

Amex Gold Card up to $84 Dunkin’ credit

The Amex Gold Card offers up to $84 in Dunkin’ credits annually:

- Enrollment is required, by logging into your Amex account, and going to the “Benefits” tab of your card

- This comes in the form of a monthly statement credit, so you can receive up to a $7 credit each calendar month

- The primary cardmember or authorized users can use the credit, though you only get one credit per account

- Eligible Dunkin’ purchases include those at Dunkin’ locations in the U.S. that accept American Express cards

- According to the terms, gift cards purchased online or any Dunkin’ branded products purchased at other retailers don’t count toward this statement credit

- It can take up to eight weeks after an eligible Dunkin’ purchase for the statement credit to post to your account, though in practice, it typically posts much faster than that

You can maximize this by spending at least $7 per month at a Dunkin’ location with your Amex Gold Card.

What’s my take on this credit? Admittedly, this is niche, and seems like an odd fit for a premium card. Dunkin’ isn’t exactly a high-end brand, and the $7 credit seems quite random. However, I think this is easy enough to manage. It’s also worth emphasizing that as of now, simply loading your Dunkin’ account through the Dunkin’ app with $7 per month seems to trigger the credit.

Based on how I read the terms, that’s not even a fluke. The terms say the credit can’t be used for gift cards, though loading a Dunkin’ account isn’t a gift card. So as things currently stand, basically view this as an $84 annual Dunkin’ gift card (which you must load monthly).

Best strategy for maximizing Amex Gold Card credits

Just about any credit card with perks that are distributed throughout the year and where enrollment is required will have a significant amount of breakage. That’s only natural, and as I see it, it’s a double-edged sword. On the plus side, I view it as an opportunity for savvy consumers to get outsized value from a card.

With that in mind, how much do I value the up to $424 in credits offered on the Amex Gold Card? Here’s my general thought:

- I’d consider the $100 Resy credit to be worth close to face value, since I dine at Resy restaurants way more than twice per year, and no effort is required to use this

- I also value the $120 Uber Cash benefit at close to face value, since I naturally use Uber or Uber Eats more than once per month, so those are direct savings

- I view the Dunkin’ credit as being maybe worth half of the $84 face value; it’s easy to enough to load $7 onto a Dunkin’ account every month, and when I take road trips, I do end up at Dunkin’ once in a while (Dunkin’ coffee is better than Starbucks coffee, in my opinion)

- I struggle the most with the $120 dining credit; yes, I rarely use Grubhub, as I prefer Uber Eats and DoorDash, so I really have to go out of my way to use that, and I don’t put too much value in this perk

When all is said and done, I’d say that I value the credits on the Amex Gold Card at maybe under $100 under the card’s annual fee, give or take. To me, that essentially puts this Membership Rewards points-earning powerhouse in line with other mid-range cards, in terms of the cost of holding onto it. Everyone’s math will differ, so crunch the numbers to decide how much value the card offers to you.

Bottom line

The Amex Gold Card is a product you primarily get for the excellent return it offers on everyday spending. The card has a steep annual fee, though the good news is that this can largely be offset thanks to the up to $424 in annual credits it offers. Hopefully, the above is a useful rundown of how each of these credits can be used.

These credits won’t be equally valuable for everyone, but if you dine at Resy restaurants and use Uber (for rides or food delivery) with any frequency, you should be able to recoup much of the annual fee.

What do you make of the Amex Gold Card credits, and how much value are you able to get out of them?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: American Express® Gold Card (Rates & Fees).

Ben, what is the beach restaurant in the lead photo? Looks enticing!

There isn’t a GrubHub restaurant in my town, but there is one in a city I visit 2-3 times a week. I make a point to order a GrubHub pick-up, and then grab my lunch and take it to a park.

Wish it was open table ! Then it would be worth something. Amx owns most of Resy, that’s why

Yeah the Resy credit actually snuck up on me in 1H'25. I wasn't expecting to use it at the restaurant, didn't know it was part of the program etc. and then a few days after the meal, I saw the credit. It is nice and so unusual to have an unexpected experience be positive these days. My "little town" does have one solitary restaurant that participates so at least I can go there twice a year if I'm not travelling.

For the $10 dining credit you can just buy a Wine.com gift card each month for 40% off (lowest increment they offer is $25). Save up and get a nice bottle of champagne on the cheap or something.

For me, I value $100 for Uber, $60 for Dining (I would normally go to these restaurants 6 times a year w/o this credit), $100 for Resy (there's a restaurant we go at least 4 times a year nearby), and $40 for Dunkin (plenty nearby but I only go there because of this credit). Total=$300. Keep the card? Yes - good earning and redemption choices.

Now that I moved away from Dunkintown (Boston) closer to the Canadian border, I wish the credit covered Tim Hortons purchases as well. They definitely have better coffee.