Links:

While a lot of airline and hotel loyalty programs seem to be running on “autopilot” the past several years, one of the most innovative programs of the past couple of years has to be Club Carlson. A few years ago they had a virtually unheard of loyalty program, at least for those of us in the US, while they’ve run several huge promotions since then to make their loyalty program arguably one of the most rewarding out there. Another way in which they’ve innovated is with their credit card, which has some really unique benefits, and is quite possibly one of the most rewarding credit cards to keep long term.

Sign-up bonus

The card offers 50,000 points after the first purchase, and an additional 35,000 points after spending $2,500 on the card within 90 days.

Earnings structure

The card offers 10x points per dollar spent at Club Carlson properties and 5x points per dollar spent on everything else.

Annual fee & foreign transaction fees

The card comes with a very reasonable $75 annual fee, which isn’t waived for the first year (and I’ll get into why it’s totally worth it shortly). The card also has a 3% foreign transaction fee, so you can put the card away when you travel internationally, and are better off using one of Chase’s no foreign transaction fee credit cards.

Annual benefits

This is the point at which the card starts to get awesome. First of all, you get 40,000 bonus points upon account anniversary every year. There’s no catch, no minimum spend, you just get those points for paying the $75 annual fee. We’ll get into what those points get you shortly, but that’s a lot of points.

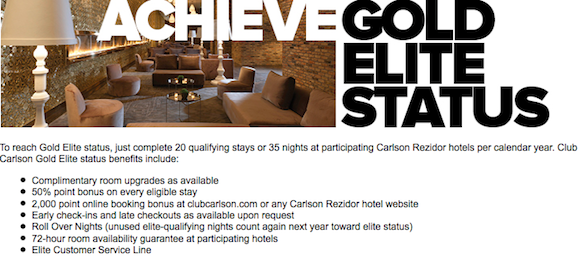

Furthermore, you get Club Carlson Gold status for as long as you have the card, which comes with the following benefits:

So most importantly you get complimentary internet (which all Club Carlson members get), a room upgrades, early check-in and late check-out subject to availability, a 50% points bonus, and a welcome gift. So while this isn’t as good as top tier status with Starwood or Hyatt, for example, it gets you some of the most important benefits out there, in my opinion, like free internet (which can be outrageously expensive in Europe) and possibly a room upgrade.

It’s worth noting that points rack up really quickly for Club Carlson spend as well. You get 20 base points per dollar spent at Club Carlson properties, a 50% bonus as a Gold member, and an additional 10 points per dollar if paying with the Club Carlson Visa, so you’re potentially looking at 40 points per dollar.

THE PERK THAT MAKES THIS CARD AMAZING

The single greatest thing about the card — what actually makes the card almost too good to be true, in my opinion — is that if you have this card you get one free award night for every two or more consecutive award nights you redeem for. Yes, it’s literally a buy one get one free. If you book two award nights at a hotel you pay for just one. Now you can’t do two back-to-back stays at a property and take advantage of that benefit both times, but you can hotel hop and do two nights at a time, then you’re essentially always getting 50% off redemptions.

Redeeming Gold Passport points

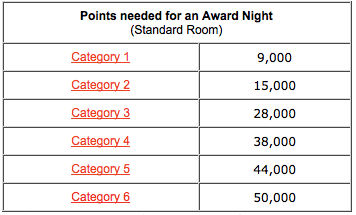

Club Carlson’s award chart has six categories (though there are a few hotels that are more expensive), pricing out between 9,000 and 50,000 points per night, as follows:

Let’s use London as an example. I happen to think London is one of the single most frustrating hotel markets for those looking to redeem points (or looking to pay, for that matter, but I can’t imagine every paying for a hotel in London). Hotels in London are extremely expensive to begin with, and points redemption rates reflect that. Club Carlson has over two dozen properties in the greater London area, many of which are category six properties.

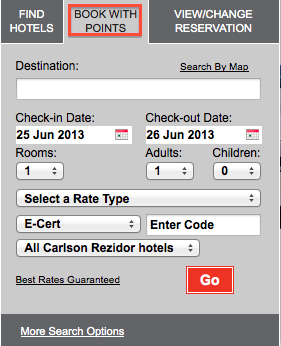

Their award search tool is really easy to use. Simply go to their home page and select “Book With Points,” and it’ll show you what’s available without even being logged into your account.

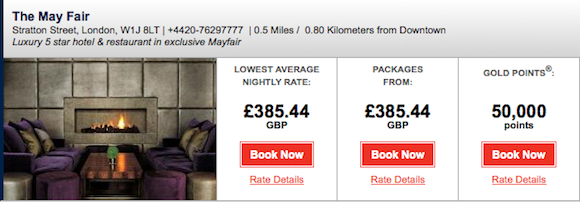

Let’s look at London this summer, for example. In pulling up avilability for July 9-11, let’s look at a couple of the better options that are available:

While paid rates are £385.44 (~$592USD) per night, a redemption would only cost 50,000 points per night. And keep in mind if you stay for two nights you’d just pay for one, so you’d literally be paying 50,000 points for a stay that would otherwise cost you ~$1,184USD.

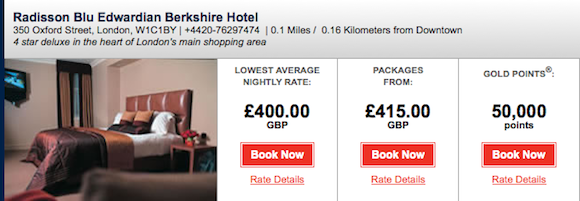

And just to be clear, the above rate isn’t an isolated event or anything, and it’s not like there’s just one hotel in that league. The Radisson Blue Edwardian Berkshire is even more expensive, at an average of £400 (~$615USD) per night. Again, the second night would be free, so you’d pay a total of 50,000 points for two nights that would retail for ~$1,230USD.

Club Carlson is also pretty strong in Paris. For example, take a look at the rates at the Radisson Blue Champs Elysees — it goes for €410 (~$537USD) per night, or 50,000 points. With the second night free you’re getting ~$1,074 worth of hotel at retail for just 50,000 points.

The fact is that Club Carlson is especially strong in Europe, so no matter where in Europe you go, you’re probably going to get amazing value using Club Carlson points.

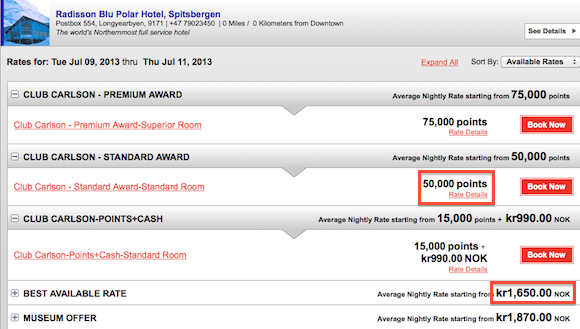

Or hell, maybe you’re as nutty as me and want to go to the world’s Northernmost full service hotel — yep, it’s the Radisson Blu Polar Hotel in Longyearbyen.

You can pay either $270USD per night or 50,000 points. Again, the second night would be free so you’d be paying 50,000 points for two nights, which I think is about all you need here. 😉

What are Club Carlson points worth?

Back in March I valued hotel points, and I said Club Carlson points are worth 0.4 cents each. My reasoning is that my internal “valuation” of a stay at a category six property is ~$200USD. That’s definitely on the conservative side given the above rates, though I don’t think it was too far off. What a lot of people correctly pointed out is that the value of those points potentially doubles if you’re taking advantage of the second night free offer. Of course I didn’t hard code that into the valuation back when I wrote the post because I can’t assume everyone has the credit card, and that would start to create a really skewed sense of valuation. But if you don’t mind staying in two night increments that would indeed double the value of points to 0.8 cents each (and many thought even that was low). Given that the card earns five points per dollar spent on everything, that’s potentially the equivalent of 4% “return” on everyday spend, which is about as good as it gets.

The bottom line

Assume you spend $3,000 on the card (the minimum spend is $2,500 to get the full sign-up bonus). That would get you 100,000 points (the 85,000 point sign-up bonus plus five points per dollar for the $3,000 you spend). That’s enough for two sets of two night stays at any Club Carlson category six property, including any of the above. So that’s literally four free nights at their top properties just for signing up for the card and spending $3,000.

Similarly, just for having the card each year you’re getting 40,000 points, almost enough for two more nights at their top properties. Given how easy Club Carlson points are to rack up otherwise — either through their generous promotions or 5x points for every day spend — this card is a total no brainer.

And even not factoring in the sign-up bonus or anniversary bonus, at five points per dollar spent you have to spend $10,000 on the card to earn 50,000 points, which is enough for two nights at their top hotels. That basically means if you’re doing things right you’re getting a free night at one of their top hotels for every $5,000 spent on everyday purchases. In non bonus categories, what other cards gives that kind of a return?

Links:

I was denied the card when i applied online. I called the reconsideration line and they granted me the card after seeing my DL and proof of income. I had to have this card the value of the bonus is incredible. I was denied due to too many inquiries. All you gotta do is talk to the people and they pretty much give you the card if you provide what they need.

@ ryan prillman -- Happy to hear you got approved in the end!

in your opinion please... my carlson personal account annual fee is coming due in 1 month. i just opened the carlson business also. worth keeping the personal anyway? thanks

Thanks, UAPhil.

I just tried a 2 night test booking in London in May, still got the bonus night.

@ John -- Haven't heard that yet, believe it still applies.

I thought I read that the second night free is not available in Europe any longer. Is that true?

I value the 40,000 point anniversary bonus most

@ mary -- Yes, your free nights would still be available. However, if you don't have the card you don't get the second night free, so you wouldn't get as much benefit out of those points.

@ lucky - If I cancel the card say after I get 100K points, would my free nights still be available since they are based on point redemption, or like the Hilton/Hyatt cards, I need to use them within a year and have to keep the card?

@ jim -- Aside from US Bank other bueareu don't seem to pull from there, so it doesn't seem like it would impact any other applications.

If I freeze IDA/ARS to get the CC card, will this effect my other credit card apps?

I wanted to throw an app party.

One more data point: I applied for the card 36 hours ago, got the "we'll let you know in 7-10 days" message. This morning I received an approval. I had not frozen my credit reports at IDA/ARS (but I'm not a compulsive card opener; I've "only" opened about 3 other cards in the last year and 8 total in the last 3 years)..

Lucky, thank you for a comprehensive summary of a fantastic card. You missed one more great benefit. CC frequently offers to Gold members "pay one get one free" sales. Finding deals takes some patience since they do not list the discounted destinations but the list seems to be quite long. For this summer, I booked 3x2 nights in Berlin and 2 nights in Warsaw at their already very low one-night prices. With "second night free"...

Lucky, thank you for a comprehensive summary of a fantastic card. You missed one more great benefit. CC frequently offers to Gold members "pay one get one free" sales. Finding deals takes some patience since they do not list the discounted destinations but the list seems to be quite long. For this summer, I booked 3x2 nights in Berlin and 2 nights in Warsaw at their already very low one-night prices. With "second night free" redemption, I would have received less than 0.2 cent/point. Cheers! http://www.clubcarlson.com/2for1

@ Jamie -- You certainly could, though I don't think Club Carlson is as generous/strict when it comes to upgrades as other programs. So it's almost entirely at the discretion of the person checking you in, meaning you may get a suite if you book a standard room, or may get nothing if you book a premium room.

I'm wondering about getting a business class room as well. Here's my thinking and please correct me if I'm wrong. If you're gold, which you get with the card, you may get your room upgraded. So, if you use points to get a business class room, then are you more likely to get bumped up to a proper suite, because that's now the next category up?

And quality of the stays. We just spent three nights at the Radisson Blu Bosphorus in Istanbul and truly enjoyed the location, room, and service...all were excellent. Upgraded to deluxe room with view of the bridge. The breakfasts overlooking the Bosphorus were a great way to start the day and the neighborhood was lively and fun. I didn't hesitate to collect more points through their flash sale this week!

I have both personal and business cards and am very happy with the benefits a

@ UAPhil -- Not any advantage or disadvantage as far as I know.

Thanks also for the heads up about the comment notification. Have put in a request to have that fixed!

Lucky, I'm not currently a Club Carlson member. Is there any advantage to joining (or not) before I submit my Visa card application?

(BTW, the "notify me" options disappeared from your blog posts since the server migration.)

That Radisson Blue Polar Hotel is among the coolest (no pun intended) things I've ever seen! It's on my bucket list now!

Thanks so much for showing Carlson some love. With so much negative progress in hotel loyalty, isn't it wonderful seeing a program actively court our business?

--Sent from the Radisson Blu Champs Elysees, paid for by their sweet points promotions last year

I forgot to mention the forex fee sucks. They even get you on purchases in USD but from a foreign company. I received a fee on about $1000 in fees on a BA award which was a little under $20. Not a huge deal and I put that charge because I was trying to meet min spend but I only did it because the charge was in USD. So no chance I use it on...

I forgot to mention the forex fee sucks. They even get you on purchases in USD but from a foreign company. I received a fee on about $1000 in fees on a BA award which was a little under $20. Not a huge deal and I put that charge because I was trying to meet min spend but I only did it because the charge was in USD. So no chance I use it on my Carlson hotels abroad because 2X UR > 10X CC points - 3% fee. I wish all of these cards at least waived the forex fees on purchases of the branded company.

good and accurate review as always.. my only complaint is the 3% forex fee considering the only worthwhile properties to stay at are in Europe. Overall one of the best cards and many people can make this program work for them very well

@ David -- That's a great question. I believe in most cases it's not worthwhile since it's just an "executive" or "deluxe" room, though I'll do some investigating.

@Chris -- no checkout, no moving around, the hotel doesn't care where the points come from, and it's easier for them to keep me in the same room. It's Club Carlson and US Bank that cough up the points, so as long as they let you book it, you're good.

Are you aware of hotels where the extra "Business Class" room redemptions are worthwhile? This is 75K instead of 50K...normally bigger room, breakfast.

I saw once that the difference in rates between a std and bus room was 20€, so not worth the extra 12.5K CC pts/nt, but it might be worthwhile in other hotels...

Frequent Burner: I also have the personal and business card. Great cards if you can get them! Did they let you keep the same room? Did you have to check out of the room and remove your stuff before you started the second 2-day stay?

I actually stayed 2 nights at the Radisson Blu Champs Elysees in March using points. Beautiful place! At the time I didn't realize the main benefit of the CC card and never applied for one. It made me sick when I realized I just threw 50k points out the window.

I was in Europe for 10 days and pretty much stayed in 5 star hotels for pretty much free using CC points and SPG...

I actually stayed 2 nights at the Radisson Blu Champs Elysees in March using points. Beautiful place! At the time I didn't realize the main benefit of the CC card and never applied for one. It made me sick when I realized I just threw 50k points out the window.

I was in Europe for 10 days and pretty much stayed in 5 star hotels for pretty much free using CC points and SPG Cash and points. I can say without a doubt the CC points are extremely valuable in expensive cities like London and Paris.

My husband got the gold card and I got the personal gold and business cards. We've booked 2 free nights in Salzburg and 4 in Vienna. For Vienna, we booked 2 nights in his name and 2 in my name. After meeting the spend we still have enough points for 4 more free nights (2 each). We might use them in Germany or save them for Chicago. We had no problem getting the personal cards but I did have to call in about the business card.

Lucky, you forget to mention how difficult it is to get this card, your friend over Hack my trip shows a tip to get approve but require some work.

@ Lucky,

Oddly enough, I got instantly approved for a business card (used my SSN for a business I actually want to start) and got wait listed for the Personal. I'll know in a few days if I get the Personal but they were the first two cards I applied for in my applications over the weekend. Also went for the 50k United business offer and should know soon on that too. I valued the...

@ Lucky,

Oddly enough, I got instantly approved for a business card (used my SSN for a business I actually want to start) and got wait listed for the Personal. I'll know in a few days if I get the Personal but they were the first two cards I applied for in my applications over the weekend. Also went for the 50k United business offer and should know soon on that too. I valued the 50k United more then the 60k Ink since the increase over standard (50k vs 30k on United as opposed to the 60k vs. 50k on the Ink) was better with less spend, assuming I get it. Also bagged the Lufthansa, so a one way first class trip from Europe is in my future too.

Even though I pretty much know that already, it still makes my heart beat a little faster reading those examples. Can't wait to use some CC points in London and Paris!!

My only complaint with the CC card is US Bank does the bait and switch like Bank of America does. I apped for the gold card, got an email that I was approved for the gold card, but actually received the silver card, which ticked me off. I still get the 2nd night free, though, so I'm keeping it for now.

Love the CC card. I've earned quite a few points from it and that second night stay feature is great. I'll be hotel hopping this summer in London, two nights at a Radisson Blu and then one night at a IHG property which was under $200/night. I valued the extra 50K points at more than $200 so paid cash.

Those rates are insane for London, guess if its cutting it close, but when I booked...

Love the CC card. I've earned quite a few points from it and that second night stay feature is great. I'll be hotel hopping this summer in London, two nights at a Radisson Blu and then one night at a IHG property which was under $200/night. I valued the extra 50K points at more than $200 so paid cash.

Those rates are insane for London, guess if its cutting it close, but when I booked in Feb rates were in the upper 200s (GBP) or so for most London properties.

I unfortunately do expect some sort of devaluation in the next year or so but hopefully it won't be as severe as Hilton's. I reckon they will and should add one more tier and move up many of the London/Paris properties along with the new properties in the Maldives and some other Blu's such as the one in St Martin, Aruba, and Chicago. Say its 60K a night or so which would be fair.

@jason - Lucky is correct, you'd have enough because the discount is applied when the reservation is made. I've done this several times.

Is it really enough for two sets of 2 night stays? I thought you had to have the points in your account in order to book. Meaning that after your first stay of 2 nights, you would only have 50k points, so you would not be able to book another 2 night stay until you earned another 50k. Am I wrong about this?

@george

yes

Lucky

The problem is that CC requires card holder / acct holder to be present at the time for the free night

I have had problems getting a free day for my family (and friends) in EU when they checkin on a 2 adult reservation that I have made for them.

Can I sign up for both and get double the points?

With a business card, US Bank will create a second Club Carlson account for you, which allows you to book alternating 2-night stays....so no need for hotel hopping. I used this in europe recently.