In February 2017, Cathay Pacific introduced a co-branded credit card in the US. The card is issued by Synchrony Bank, which primarily issues credit cards for retailers. This is the first time they’ve partnered with an airline. On the plus side, I believe it’s pretty easy to be approved for their cards, though they’re also notorious for giving small credit limits.

The card has a $95 annual fee, and doesn’t offer a particularly compelling return on spend:

- 2x points for Cathay Pacific purchases

- 1.5x points on dining

- 1.5x points on purchases outside the U.S.

- 1x point per dollar dollar spent on everything else

Cathay Pacific A350 business class

When the card was first introduced it had a welcome bonus of 25,000 miles after spending $2,500 within 90 days. Since then we’ve seen them offer an increased welcome bonus of 50,000 miles after spending $2,500 within 90 days, which is obviously much better. However, that offer was only around for a limited time, and up until recently the welcome bonus was back to 25,000 points.

The Cathay Pacific Visa Signature Card is now offering an increased welcome bonus of up to 60,000 Asia Miles. This involves a significant amount of spending, though. Here’s how the offer is structured:

- Earn 35,000 bonus miles after spending $2,500 within the first 90 days

- Earn 25,000 additional bonus miles after spending an additional $7,500 within the first 12 months

In other words, in the end you’re earning 60,000 Asia Miles after spending $10,000 within the first year. Incrementally you’re earning a total of ~4.3 Asia Miles per dollar spent between $2,500 and $10,000 of spend (since you earn a total of 32,500 miles for $7,500 worth of incremental spend).

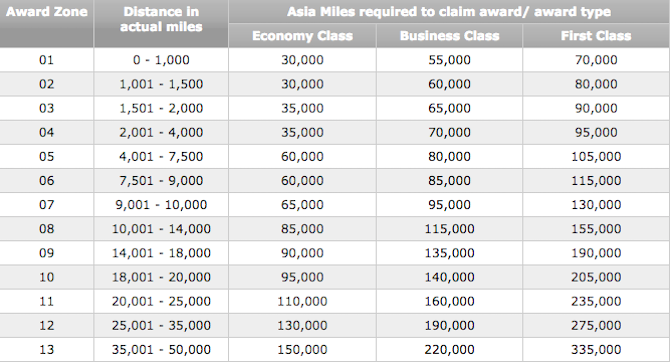

For a sense of how you could spend Asia Miles, here’s their award chart for travel on two or more airlines other than Cathay Pacific (or three or more airlines if including Cathay Pacific), which is based on the cumulative distance of the itinerary:

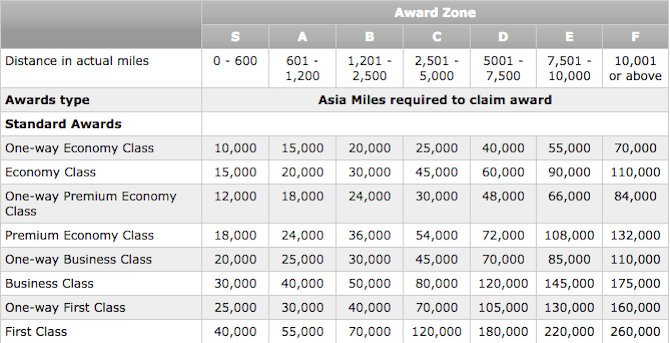

Meanwhile here’s their award chart for travel on a single airline, based on either one-way or roundtrip distance flown:

Personally, I think I’d probably wait for a welcome bonus of 50,000 Asia Miles after spending $2,500 to return.

(Tip of the hat to @IadisGr8)

We fly to the Philippines each year

If I had a Cathy Pacific credit card. Would we have usable credits?

Could I use your credit card on anything and receive credits?

this card I had for three months and had it closed for good as the customer service is bad and security monitoring is way off... Anything they think suspicious they suspend your card...I at least called three 10 times to security team to unlock my card... Don't recommend to get this shithole

They had a 75,000 signup bonus for Marco Polo Members, with $2500 minimum spend within 90 days of account opening. Guess that's a good deal.

What good are avios may I ask? Besides for domestic AA that is. I am currently sitting on 6 digits of avios with no use (and I have 2 companion certificates too) which I find useless due to the surcharges.....?

How is First Class space for two people using Asia Miles? Good availability would make this offer much more worthwhile.

Extra zero in there Lucky.

"after spending $2,5000 within 90 days, "

@T - There is no way to keep Asia miles alive, use them or lose them. Lucky probably should mention this downside in the post as this is unlike most other programs

where is the link for cathay pacific credit card?

just need a article to include BA affiliate link ?

@ king -- Honest mistake on my part, and a bad copy & paste job. Sorry, that's what happens when I blog at 5AM before coffee. Fixed now.

Does having and using this card guarantee that Asia Miles won't expire? (much like Miles and More card where you have to make a few purchases a month to keep your miles alive)