Amex has announced an interesting change in strategy that may have some long term effects for both merchants and consumers. Historically Amex has tried to position themselves as the premium card issuer, and as a result they’ve typically had higher merchant fees than other issuers. There are all kinds of merchant contracts that are negotiated based on a variety of factors, so this wasn’t true across the board, though as a general rule of thumb it was.

Amex’s logic has been that their average cardmemember is higher income and spends more, and as a result merchants should be willing to pay a little bit extra to have Amex cards accepted at their business. Some businesses buy into that, and others don’t — Amex lags behind their competitors when it comes to acceptance. This is true in the US to some degree, though it’s especially evident outside the US, where it’s common for Amex cards not to be accepted.

Amex knows they’re losing volume with this strategy, though they’ve historically believed that their superior margins make up for that.

It looks like the card issuer may soon be taking a new strategy, under the leadership of their new CEO. American Express is hoping to close the acceptance gap between their cards and Visa & Mastercard, and they plan to do that by decreasing merchant fees by the greatest amount they’ve done in nearly two decades. The Financial Times reports that Amex plans to lower their average merchant fees by 5-6 basis points, to 2.37% (this is an average, so many small businesses will still pay more, while big businesses will often pay less).

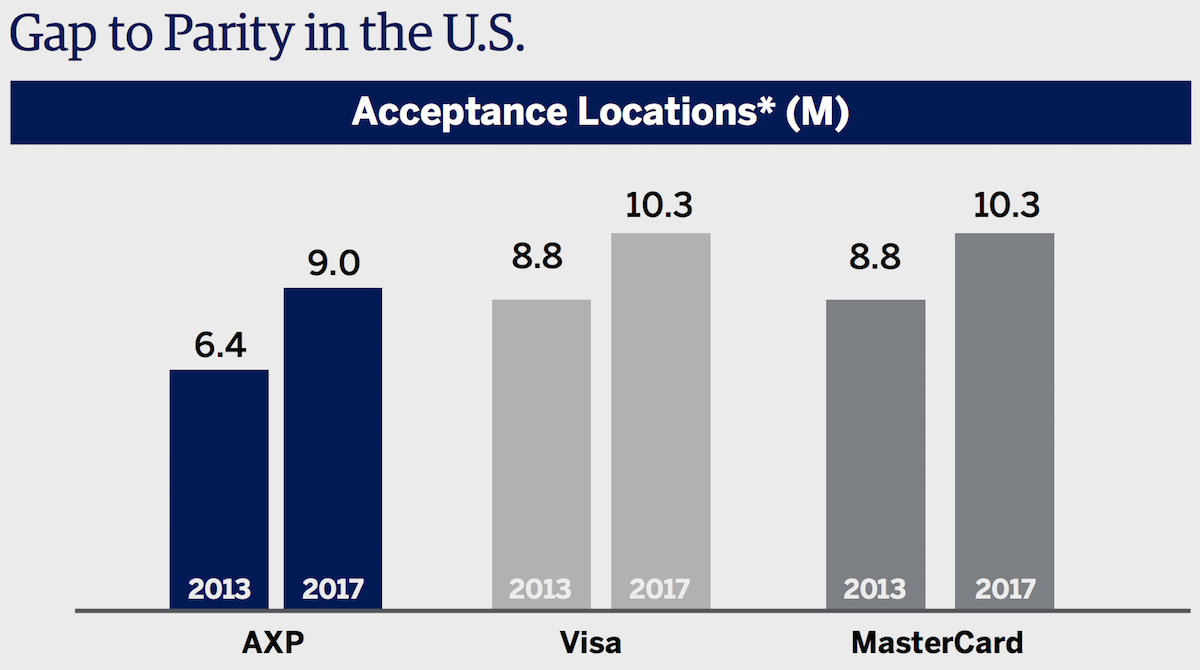

This is all according to an investor day presentation last week, where they outlined their new strategy. Here’s the chart Amex uses to compare their acceptance to that of Visa and Mastercard, as well as how card acceptance has changed between 2013 and 2017:

As you can see, over the past four years they’ve increased acceptance by about 40%, and they’re hoping to close the gap with their competitors.

The natural question is whether Amex reducing merchant fees means that we could see a reduction of benefits on their cards. Their strategy here is to decrease margins but increase transactions, so long term they think this strategy will be more profitable for them. However, it’s a gamble, and we don’t know for sure if it will pay off.

My general inclination is that this won’t lead to a reduction in benefits on Amex cards. That’s because ultimately Amex’s decision to provide benefits isn’t driven by their merchant fees (at least not directly), but rather by their need to compete with Chase, Citi, etc. We’ve seen Amex make their cards more competitive lately in response to what their competitors are doing, and they didn’t raise merchant fees as a result.

Perhaps short term there may be some impact, as groups are encouraged to cost cut to improve Amex’s short term performance, but long term that’s not a way to compete.

So we’ll have to see how this plays out, though personally I’m not too worried. I welcome anything they can do to improve card acceptance.

What’s your take on Amex reducing merchant fees?

Mastercard and Visa in Europe are now at interchange rates of 0.3% (albeit small shops will be charged more once payment processor fees are taken into account) so Amex are going to have to go a long way to remain competitive!

@Daniel - You are right, if you are holding an Amex you most likely do also have a VISA or Mastercard as well. I do also carry my LH Mastercard but the earning rate is such crap that I try not to use it unless I really need to do so. I can of course say that I have walked into a place who doesn't take Amex and have used my Mastercard instead but to...

@Daniel - You are right, if you are holding an Amex you most likely do also have a VISA or Mastercard as well. I do also carry my LH Mastercard but the earning rate is such crap that I try not to use it unless I really need to do so. I can of course say that I have walked into a place who doesn't take Amex and have used my Mastercard instead but to @Callum's point, I have also avoided certain restaurants or shops becuase they don't accept it and instead either purchased online or went to the shop that did. Sure they may not be loosing tons of business but they are loosing some.

Daniel - You don't need to imagine, you've just been told that they do it...

Personally, if I like 2 places equally and 1 doesn't take Amex I will go to the one that accepts Amex. Sometimes the only card I have on me is an Amex as well.

If no-one else did that, logically no shop in the world would accept Amex - what would be the point?

As a small business owner of Four Retail units I would like to point out a few things:

1. While technologies like Square (and others) have made it easy and cost effective for smaller businesses to use AMEX (and discover) there is one BIG thing noted in the fine print. They can charge up to four percent (in California) for rewards cards; for example most rewards cards with Visa Signature, MasterCard world Elite, and...

As a small business owner of Four Retail units I would like to point out a few things:

1. While technologies like Square (and others) have made it easy and cost effective for smaller businesses to use AMEX (and discover) there is one BIG thing noted in the fine print. They can charge up to four percent (in California) for rewards cards; for example most rewards cards with Visa Signature, MasterCard world Elite, and AMEX Gold will generally be charged at a higher rate. So the new move in return may reduce fees for smaller businesses.

2. Card acceptance does MATTER. A lot of customers want points or cashback, and on many occasions I used to hear "why dont you accept AMEX." To know I hear "sweet you accept AMEX, ill come in more often. (as a Moot point when i went from sole prop to incorporated I found a Merchant services provider that would charge me 1.35% on ALL debit and credit cards (Including VISA, MC, AMEX,Discover) on inserted chip cards.

3. People have to pay for points. In the day and age of points and rewards schemes, its usually the merchant who pays for all of this. I am not a Safeway, Kroger, or Whole Foods who can pay that much for people to use credit cards. Especially for Low margin items like Tobacco, (on most cases we make 75 cents on ten dollars of tobacco sold. So the 15 cent Merchant fees comes out of my profit, and realistically taking away from my small profits. So we have now introduced cash and non cash prices to make up for it. People bitch and complain, and want to report us to the city for enacting a charge, however it is hard to sustain without surcharging.

4. However, as a merchant, AMEX is the best to deal with, it just really is. With AMEX, Fraud department being so tight, I never see disputed transactions or chargebacks. My biggest quarrel with VISA and MasterCard has been that chargebacks are so easy to do so; VISA and MasterCard have rules that restrict us from matching signatures or IDing people. We get around that now by stating that the State Board of Equalization and Alcohol Beverage Control require us to match ID for credit cards, to make sure the person stated on the card is in fact above age. So from my perspective AMEX wins in the customer service and fraud prevention department.

5. While AMEX charges might still be higher than VISA/MC, the reduction in fees for some businesses may help acquire more customers. It is not always a fair assumption to assume that people with more lucrative cards will be your best customers, because I have seen people with some really nice cards and vehicles complain about paying for bags in California

As a consumer, the seduction and awe of having AMEX aside. I still prefer it to my Chase and Citi cards portfolio. Yes I think its cheap that when I travel internationally I dont get bonus points for eating out etc but the service and reliability is MUCH MUCH better.

I think with the new management team, they will segment the market. Before, AMEX was not easily attainable, but with the shifting market make-up they are going to have to target each segment of the market differently. So while banks and card processors tap into the market with products like sapphire reserve, the luxury black card, US banks Visa Infinte card, AMEX needs to chase a mass market. I forecast that AMEX is now in customer acquisition mode; acquiring more merchants that will accept AMEX, and Offering more Unique AMEX products for a broader market.

They must be doing ok in the US but in Asia and Australia Amex is just about dead in the water. I used to use it for everything but in the past 10 years we've seen imposts of 3% on many transactions as merchants try to recoup costs.

Just about the only place it works ok is in the supermarkets ( no surcharge).

With a significant annual fee, crazy transaction fees and limited acceptance, Amex simply isn't worth it in this region.

I think the real issue is that Amex lost the premium card game. Sure, they still have Plat & Centurion, but they're no longer the only player in the market. Citi, Chase, even US Bank are offering cards with generally better benefits. While Amex Plat might have a higher-than-average customer income, the rest of Amex's portfolio ain't what it used to be.

Before the credit crunch, I remember plenty of friends' mailboxes being peppered...

I think the real issue is that Amex lost the premium card game. Sure, they still have Plat & Centurion, but they're no longer the only player in the market. Citi, Chase, even US Bank are offering cards with generally better benefits. While Amex Plat might have a higher-than-average customer income, the rest of Amex's portfolio ain't what it used to be.

Before the credit crunch, I remember plenty of friends' mailboxes being peppered with all sorts of Amex product promotions. Most of them were college students, living off of student loans. Some of them have never had an actual job. Sure, some day they might be pulling a six-figure salary, but those days were easily 10+ years off at that point.

We spend 3-5 months on the road (Europe/South Africa etc) and it is a real pain that AMEX is only rarely accepted. I DO choose carefully for establishments who take AMEX so the reduction in fees is probably going to be a positive move provided it attracts more vendors.

I think you need to divide the numbers in detail a bit more. You say that their acceptance rate has increased 40%, but I disagree with this number. The reason is because many people classified in the 40% are people that are not truly holding an AmEx card, but rather an AmEx partnered card, or one of the lower end AmEx cards. You see, AmEx used to only have high quality cards such as the...

I think you need to divide the numbers in detail a bit more. You say that their acceptance rate has increased 40%, but I disagree with this number. The reason is because many people classified in the 40% are people that are not truly holding an AmEx card, but rather an AmEx partnered card, or one of the lower end AmEx cards. You see, AmEx used to only have high quality cards such as the AmEx Gold or Platinum card, but in recent years we have seen many more 'other' cards through them, some of these earn cash back or points with non-AmEx firms.

The real reason behind this is competition. They have lost a lot of business to the Chase Reserve card, among others. What they hope is more merchants will accept them. I wonder as many people mentioned other providers such as Square and Intuit, how many people accept AmEx through these payment processors, and their statistics of customers.

@Taylor - I just can't imagine many people will walk into an establishment that doesn't take AMEX and walk back out the door to another establishment that does accept AMEX. Everyone who has an AMEX has a Visa or MC; they'll just pay with that. I'm a "point freak," too, and that's what I do.

@Daniel - I have to disagree, at least for my situation. As I am living in Germany and try to use my Amex whenever possible, it will affect my decision to eat at a certain restaurant or stop at a certain liquor store if they don't accept my Amex. I rarely carry cash even though cash is king here. Being a "point freak" paying in cash is not giving me anything in return. Sure this...

@Daniel - I have to disagree, at least for my situation. As I am living in Germany and try to use my Amex whenever possible, it will affect my decision to eat at a certain restaurant or stop at a certain liquor store if they don't accept my Amex. I rarely carry cash even though cash is king here. Being a "point freak" paying in cash is not giving me anything in return. Sure this isn't always the case but if I want the usual or something quick, I will always go to the spot that will accept my card instead of hunting down an ATM, getting cash out, etc. VISA/Master are more accepted but Germany hasn't caught on with the whole credit card game like in the states. We have barely any options to begin with.

Why should I accept Amex if they are charging me more as compared to Visa and MC. I get my credit card processing through Elevon (through Costco.) They charge me 1.22% plus 12 cents for each swiped transaction. They do charge me more if there is an online transaction (1.99% per 25 cents per transaction.) I will never accept Amex unless their transaction fee is the same. I have a relative who used to work...

Why should I accept Amex if they are charging me more as compared to Visa and MC. I get my credit card processing through Elevon (through Costco.) They charge me 1.22% plus 12 cents for each swiped transaction. They do charge me more if there is an online transaction (1.99% per 25 cents per transaction.) I will never accept Amex unless their transaction fee is the same. I have a relative who used to work for Amex. He told me several years ago that Amex as a company is going down because of bad corporate decisions. One of those decisions led to loss of Costco business not very long ago.

On the consumer side, I have seen Amex's customer service decline which was the primary reason I cancelled my Amex Platinum since I was not using their lounges very frequently.

On a different CC issue, does anyone know what is going on with the Diners Club CC?

Quite a while ago I had one for a number of years, mainly due to them being one of the few (at that time) CCs that provided primary car insurance on rentals.

Their web site doesn't seem to allow for any applications, at least from the US, although I haven't tried using a VPN.

Just curious if anyone knows anything about their situation. (I think someone purchased them a while ago?)

American Express has lost all or most trust with me as a cardholder.

Many of the agents are in overseas call centers and have trouble with English and don't have a clue in what they are saying and can not assist except in the most simple of requests

Have a trouble with a promotion you registered for and didn't receive credit for?

You are typically out of luck

They no longer...

American Express has lost all or most trust with me as a cardholder.

Many of the agents are in overseas call centers and have trouble with English and don't have a clue in what they are saying and can not assist except in the most simple of requests

Have a trouble with a promotion you registered for and didn't receive credit for?

You are typically out of luck

They no longer handle a dispute well if at all and then there are the irritating beeps as they record every last thing you say.I hate/despise the company now

I do what I can to spend on Citibank and Chase due to their awful non empowered customer service

While they were once a world class premium card with exceptional customer service today they are a company that has been sued with class action lawsuits countless times for ripping off customers fraudulently

They are a far cry from what they once were.I've canceled the vast majority of my cards with them.Keeping SPG Amex

The executive team while once caring with and supportive with any cardholder issue or problem are now an embarrassment to the company and worse arrogant.For decades they were a large part of my go to cards in my portfolio . They blew it bad in recent years and they deserve everything they got from the blown Costco deal to losing card holders to their competitors who offer richer rewards and superior customer service

I expect the worst for them as clueless leadership and eroding CRM starting at the top will ultimately do them in long term

Very sad

Signed a former decades AMEX evangelist

Amex all over the globe is accepted so much less than Visa/MC. Its crazy how bad it is.

It is a big deal especially for the bigger players. We take Amex on our company web site (not huge amounts by any means) and there is a larger difference between Amex and competition. But you get also charged more for reward cards.

Also there is usually a difference between swiped rate and keyed rate (keyed being higher).

We run intuit payments and the fee is 2.5% for all cards. It’s been that way for years so I don’t see why that’s a big deal.

I think Amex sees the writing on the wall:

https://www.bloomberg.com/news/articles/2018-02-26/amex-rules-weighed-by-high-court-in-antitrust-enforcement-test

Are more businesses signing up with them, or are more businesses using Square, which in turn accepts Amex?

I know every very small business around here that went from cash-only to accepting cards did so via a tablet system, and that means they accept Amex and Discover too.

I'm not sure I agree as stated, "...ultimately Amex's decision to provide benefits isn't driven by their merchant fees (at least not directly), but rather by their need to compete with Chase, Citi, etc.

In other words I think profit is at least the long term goal, and not merely market share.

This action at this time is likely the tipping point where the former strategy is no longer working. (No longer maximizing...

I'm not sure I agree as stated, "...ultimately Amex's decision to provide benefits isn't driven by their merchant fees (at least not directly), but rather by their need to compete with Chase, Citi, etc.

In other words I think profit is at least the long term goal, and not merely market share.

This action at this time is likely the tipping point where the former strategy is no longer working. (No longer maximizing profit from the free market by taking an elite / charging more for their brand attitude.) If they truly intend to win this battle, they may need to pull in financial resources to cut fees to merchants AND increase rewards to consumers over that of V/MC and their issuing banks! The question is can they afford to play that strategy to a winning position. Perhaps the expanding centurion lounge locations and other actions is a foundation to do just that. We shall see. I hope to see some good innovation ... Perhaps the legacy mindset of V/MC will be unable to change fast enough to keep their position.

If you're a merchant, and you accept Visa and Mastercard, not accepting AMEX isn't going to hurt your business. I see why AMEX wants to get broader acceptance, but they really can't be charging more than Visa and Mastercard to do so.

Any idea how their new fee structure will compare with V/MC?

The reason they aren’t accepted by small businesses isn’t just that they have higher fees. They also have tons of paperwork the others don’t and make every process more complex. I won’t start accepting them because of this. My customers are fine paying by Visa or Mastercard.