The major credit card issuers have various policies in place to crack down on those who apply for credit cards exclusively for welcome offers. While credit card issuers sometimes have big bonuses to get customers to apply, they do so with the hope of people holding onto a credit card long term. While it’s understandable that sometimes a card might not work out for someone, those who constantly open and close cards may find themselves facing some restrictions.

In the case of American Express, the issuer has a policy of only letting you earn the welcome offer on a card “once in a lifetime.” Anecdotally a “lifetime” in this context typically refers to a period of around seven years, though that policy isn’t published. So if you’ve had a card before, you won’t generally be eligible for the welcome offer on the card again.

In the case of American Express, there’s a pop-up that has been showing up during the application process for some people for the past several years, so I want to cover that in more detail.

In this post:

What is the Amex application pop-up warning?

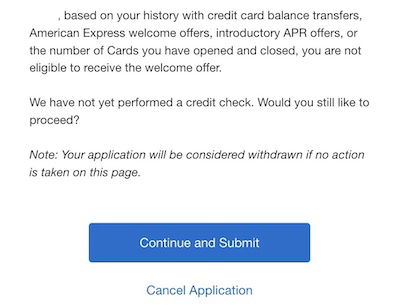

During the American Express application process, you might see that you’re faced with the following pop-up:

Based on your history with credit card balance transfers, American Express welcome offers, introductory APR offers, or the number of Cards you have opened and closed, you are not eligible to receive the welcome offer.

We have not yet performed a credit check. Would you still like to proceed?

Note: Your application will be considered withdrawn if no action is taken on this page.

This will typically appear after you enter your personal information and submit your application. As the message states, there’s the potential that you won’t be eligible for the welcome offer on the card that you applied for.

This means you could still apply for the card and simply not receive the bonus. But this also gives you the option to cancel your application, so that there’s no credit pull (separately, Amex also has an awesome “Apply with Confidence” feature on some cards).

What causes the Amex application pop-up warning?

There are several reasons you could potentially be faced with this pop-up warning during the application process.

You could get this message because you’ve applied for this card in the past, and just didn’t remember. In this case I’d consider the message to be genuinely helpful and a great feature, since you’re able to avoid a hard pull for a card where you won’t get the bonus.

Under other circumstances this can be a bit more confusing, though. The warning officially states that you could be ineligible due to one of four reasons:

- Your history with credit card balance transfers

- Your history with Amex welcome offers

- Your history with introductory APR offers

- Your history with the number of Amex cards that you’ve opened and closed

Suffice it to say that this is vague. What does all of this mean in practice? I’d say the most likely reasons you’d be faced with this message is the following:

- Even though you may technically be eligible for a welcome offer based on not having had that exact card before, Amex may decide that you’ve had too many cards in that same card “family,” and maybe canceled too many of them too quickly, didn’t spend enough on them, etc.

- Maybe Amex feels you have opened and closed too many cards with the issuer, and/or haven’t spent enough on the cards for it to make sense to approve you for another bonus

- If you’ve engaged in any sort of other behavior that Amex frowns down upon, Amex may decide not to offer you a welcome bonus on a particular card

One other interesting twist is that sometimes these pop-ups are specific to certain “families” of cards. In other words, you may get this message when applying for a Hilton Honors Amex you’ve never applied for before, while you may not get this message when applying for an Amex Platinum Card.

Is the Amex pop-up warning becoming more common?

While I don’t have any data, anecdotally it sure seems to me like there are more and more reports of these pop-up warnings, even for situations where you wouldn’t expect them.

I think most of us can understand why Amex would want to restrict people who repeatedly open and close cards, without keeping them for a long time and spending money on them. However, I’m increasingly seeing data points of people getting this warning even though they only have a few Amex cards, have had them open for years, have never even had a card in the same family, etc.

So while I don’t have an explanation as to what is causing this, know that you’re not alone if you’re finding yourself getting the pop-up warning even if you’re a good Amex customer.

Is there any way to get around the Amex application pop-up warning?

If you’re faced with this pop-up during the application process, is there anything you can do? Yes and no.

No, there’s no one you can (realistically) contact to appeal this warning, and there’s no way that you’ll get this removed from one minute to the next. For whatever reason Amex has decided you shouldn’t be eligible for a welcome offer on a particular card, and that’s that.

The good news is that just because you get this message once, doesn’t mean you’re locked out of earning welcome offers forever. While there’s no magic formula, here are some things to consider doing:

- Avoid applying for Amex cards for some significant amount of time (maybe a few months, at least); I’d assume Amex is tracking how often people apply for cards, so don’t submit an application every few days to see if the pop-up still shows up

- If you have a lot of open Amex cards you’re not spending money on, put some spending on those cards to show some activity

- Since these restrictions are often specific to “families” of cards, after a few months maybe try applying for a card in a different “family,” to see if you have the same message (it’s also possible you might not get a message like this if you applied immediately for a different card, but I’m trying to recommend a conservative approach here)

Like I said, there’s no consistent way to get this resolved. Assuming you’ve never had a particular card before, Amex has probably decided that something about your current relationship with the company isn’t ideal, and try to adjust things accordingly.

Bottom line

Amex has a pop-up warning during the application process, which will tell you if you’re not eligible for the welcome offer on a card, prior to even pulling your credit. This is helpful if you’re not sure if you’ve had a card before, given Amex’s “once in a lifetime” application rule.

But Amex isn’t just using this pop-up in situations where you’ve had a particular card before, but also sometimes in situations where the issuer has simply decided that you shouldn’t get the bonus on a card. This can happen for a variety of reasons, and the best way you can deal with it is by continuing to spend responsibly on your Amex cards, and not applying for other Amex cards for a while.

Have you ever dealt with Amex’s pop-up warning? If so, what was your experience?

I got pre-approved for a 250k SUB on Sep 18th (which I withdrew)

on Sep 25th I tried reapplying with a 300k offer and got the popup, tried again with a 250k offer and got the pop up again .....

I guess family of cards would also mean the Marriott Chase and Marriott Amex which they generally consider together. This said within Amex, could you discuss what is meant by a family of cards? Amex usually does not have cards that relate to each other as other providers do.

I got this message applying for the Bonvoy Brilliant 2 weeks ago. I have over 5 cards open with them, including two business cards. I haven't cancelled a single card with them. Only thing I can think is it may be the amount of spend I put on them? My velocity has also been relatively fast I suppose since I opened the Aspire 3 months prior to applying.

There are sometimes links with no-lifetime language. But referral links always have lifetime language, so sometimes the choice is to forgo the P2 referral and apply with the no-lifetime link

I tried to apply for the Amex Bonvoy card with the 185,000 point offer and got pop-up jail. In the last 1-2 years I've opened an Amex Business Blue Plus (or whatever they call it!) and an Amex Delta Reserve. Prior to that, nothing since an Amex Platinum back in 1989.

Only other card opened in the last 1-2 years was a Venture X.

Oh, also opened an Amex business checking account and got 50K...

I tried to apply for the Amex Bonvoy card with the 185,000 point offer and got pop-up jail. In the last 1-2 years I've opened an Amex Business Blue Plus (or whatever they call it!) and an Amex Delta Reserve. Prior to that, nothing since an Amex Platinum back in 1989.

Only other card opened in the last 1-2 years was a Venture X.

Oh, also opened an Amex business checking account and got 50K points through that.

Cest la vie. Credit score is 790-820 depending on where/when I check.

May try again later, but what can you do.

A bit bummed, but meh.

My husband closed his Business Platinum because I already have one, and I wanted one of us to have a Personal Platinum instead. He has been getting this pop up for 6 months now. He spends a lot on an AmEx Blue Business Plus, but has no other AmEx. Credit score is 850. Has barely opened or closed any cards at all in over 5 years.

The funny thing is when he logs in...

My husband closed his Business Platinum because I already have one, and I wanted one of us to have a Personal Platinum instead. He has been getting this pop up for 6 months now. He spends a lot on an AmEx Blue Business Plus, but has no other AmEx. Credit score is 850. Has barely opened or closed any cards at all in over 5 years.

The funny thing is when he logs in they're always begging him to get a Bussiness Gold for 200,000 points, which is more than the welcome offer for the Platinum that they keep declining.

This is required for those that go after every bonus offer in sight, Credit Card and Airlines are wise to this (just like the monkey business with loyalty programs) and their computers are smarter than you... be warned

Hi, reading with interest. What is a PUJ please?

Pop Up Jail

I applied and was approved for a business platinum in December. There was NO pop up warning about the bonus points. I made the minimum spend in the first cycle and no bonus. I called and the rep made a note on the account for management. Second cycle, still no bonus. Then I spoke to a higher level rep. They wouldn't budge. So I canceled the card. Probably no more Amex for me, especially if they jack up the annual fee on the personal platinum as rumored.

Have put $40K spend on my 2 Amex's since I got my first two years ago. Have been in PUJ for over 18 months. It's super annoying and has soured my relationship with Amex. Applied for Hilton Aspire multiple times over past 18 months and every time I got PUJ.

I keep getting the popup for amex biz hold and never had it before. I got targeted for it for a sub par welcome offer and not the 0% APR. when I tried to apply with P2 referral link, I got the popup - even though I am targeted inside the amex offers.

I will not apply if not getting the 200k with 0%

If you are on any of P2's cards as an authorized user, Amex might characterize the referral as a "self-referral." It happened to me several years ago.

Aside the common reasons of too many AmEx credit cards (5 the limit not including hybrids), "7 year" rule, obvious opening and closing say @ year renewal, it's spend. It could be narrowed some to spend in a family of cards. Just applied for the Marriott Bevy after closely following all of Marriott's AmEx/Chase rules and got the pop-up. Otherwise perfectly clear with a great FICO, you name it. I have the AmEx Marriott business...

Aside the common reasons of too many AmEx credit cards (5 the limit not including hybrids), "7 year" rule, obvious opening and closing say @ year renewal, it's spend. It could be narrowed some to spend in a family of cards. Just applied for the Marriott Bevy after closely following all of Marriott's AmEx/Chase rules and got the pop-up. Otherwise perfectly clear with a great FICO, you name it. I have the AmEx Marriott business card and basically no spend except at a Marriott property a few times a year (retired). So for me, no worries I won't get the card and go to plan B or C. Not the first time in this game.

@Lucky, I currently have 7 AMEX cards and have never been the recipient of the dreaded pop up alert. However, P2 has 1 AMEX card that is 5 years old, she has many other cards that she uses and she has an 835+ credit score. Yet, she receives the pop up alert when applying for the Hilton Aspire card. We will be trying again this fall, as I would like her to have the card...

@Lucky, I currently have 7 AMEX cards and have never been the recipient of the dreaded pop up alert. However, P2 has 1 AMEX card that is 5 years old, she has many other cards that she uses and she has an 835+ credit score. Yet, she receives the pop up alert when applying for the Hilton Aspire card. We will be trying again this fall, as I would like her to have the card with approximately the same renewal date as my Aspire card. Any advice or recommendations would be appreciated.

@ Robert R -- I wish I had any additional tips. For example, Ford is in pop-up jail as well, despite having fewer Amex cards (and applying for fewer cards in general) than I do. It's a mystery sometimes...