When you look at the trends we’ve seen among legacy carrier loyalty programs the past couple of years, I think it goes without saying that Delta SkyMiles has been a trendsetter. Almost all of the changes have been negative, but there’s no doubt that Delta has been “innovating,” and other carriers have been following their lead.

Early last year, Delta announced that they would be adding a spend requirement for status, whereby you basically have to spend an average of 10 cents per mile (pre-tax) to qualify for status. There were a couple of ways to get around this, like having a SkyMiles account registered at a foreign address, or by putting $25,000 of spend on one of their co-branded Delta American Express credit cards. United quickly followed suit.

Then this year Delta announced something truly radical among legacy carriers. Starting next year Delta will be awarding miles based on how much you spend on a ticket as opposed to how many miles you fly. While United seems to be copying everything Delta does, interestingly this is one area where they haven’t followed suit quite yet.

Meanwhile I’m not surprised that American and US Airways haven’t matched either of these changes yet. That’s because they’ll likely be announcing a combined program next year, so there’s no point in making too many individual changes before the programs merge (which is why I was kind of thrown off by their changes last week).

Anyway, it seems that exploring these options isn’t limited to the “big three.” Admittedly some low cost carriers already have revenue based frequent flier programs, but it looks like Alaska is also at least considering it as well.

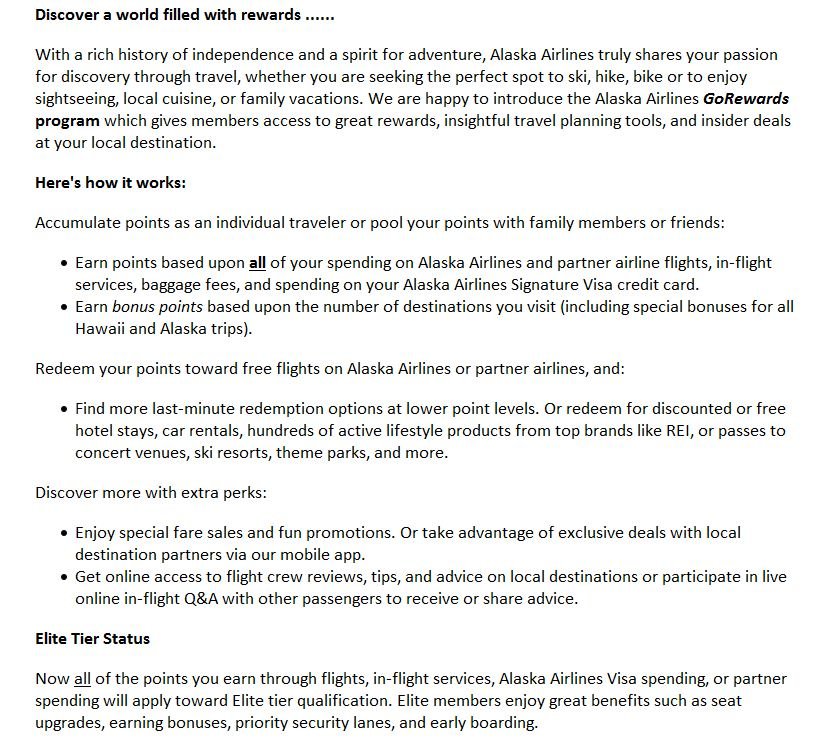

They’ve sent out a survey to select Mileage Plan members, which in part offers the following scenario:

Most interesting is the last section:

Elite Tier Status

Now all of the points you earn through flights, in-flight services, Alaska Airlines Visa spending, or partner spending will apply toward Elite tier qualification. Elite members enjoy great benefits such as seat upgrades, earning bonuses, priority security lanes, and early boarding.

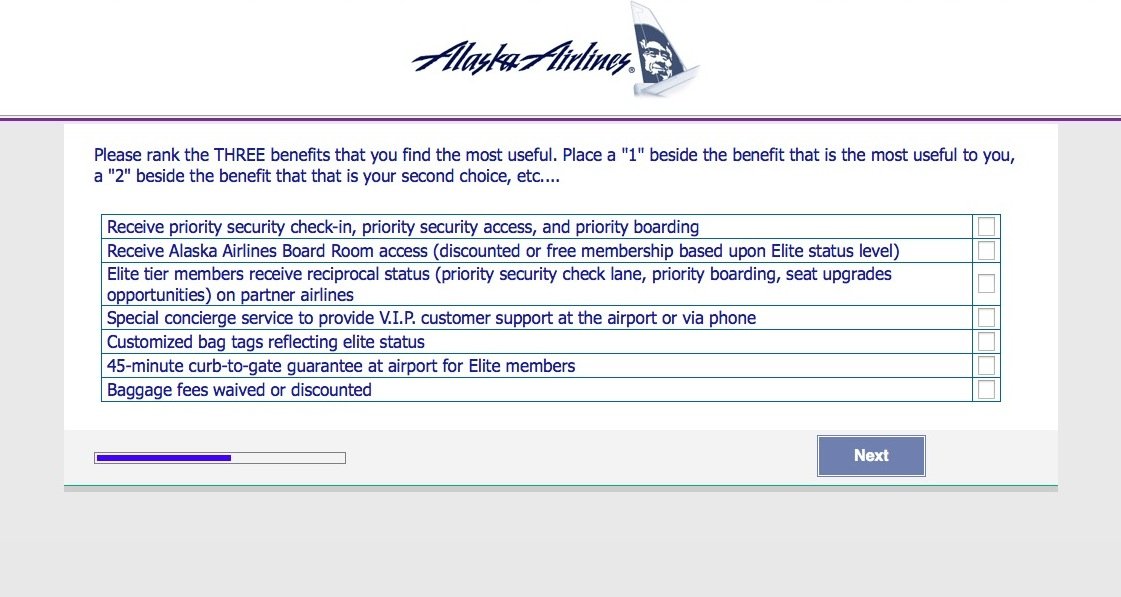

And then they also seem to be exploring which benefits members value the most:

Anyway, nothing even remotely conclusive here, but it’s pretty clear that Alaska is at least exploring the possibility of a revenue based program…

With Delta taking on AS in SEA, it doesn't seem wise to disrupt AS's frequent flyer base... unless AS thinks they won't notice. The elites will notice and understand.

Given AS's fairly weak F product, and how hard it is to get upgrades on transcons, for SEA-based frequent flyers the two things that would really damage the AS value proposition for me are if they make it harder to earn MVP Gold status or if...

With Delta taking on AS in SEA, it doesn't seem wise to disrupt AS's frequent flyer base... unless AS thinks they won't notice. The elites will notice and understand.

Given AS's fairly weak F product, and how hard it is to get upgrades on transcons, for SEA-based frequent flyers the two things that would really damage the AS value proposition for me are if they make it harder to earn MVP Gold status or if they do anything to the no-change-fee for changes/cancellation and the same day change policies.

AS isn't always cheapest, but no change fee has real value when a trip is tentative. AS's frequency on the west coast is getting a strong run for the money from DL.

Anyway, I hope AS doesn't gut the program.

What will happen to those excellent redemptions on their partners Cathay and Emirates if there is a change to revenue based system?

Nightmare?!

@ Manik -- Even for airlines with revenue based programs, they often still have fixed value charts for partners. Every hint we've seen at a revenue based program with Alaska suggests that earnings is revenue based, not necessarily redemptions.

@ Lucky - Don't think they'd be so generous either but it's still interesting. There aren't any CC that give airline elite status based on spend, are there?

@ Ivan Y -- There are some credit cards that offer some elite qualifying miles for meeting spend thresholds, but not a flat one elite qualifying mile per dollar spent.

Hmm... So what does everyone think about Alaska Visa spending counting toward Elite Tier? Are they really going to give out MVP Gold 75K for $75K or $90K in credit card spend??? That would be really interesting -- I'm sure MS gurus will be all over that.

@ Ivan Y -- If they had a system like this, I can't imagine they'd actually award one elite qualifying mile per dollar spent on the card.

I agree with Carl. It sounds like GoRewards program will replace Mileageplan.

1. Why is Gary showing off his post here implying that he predicted it well ahead? Seems odd and a bit unprofessional... He should respect Ben's blog

2. I think those who are not based in Alaskan hubs will leave their program if they implement this rule. No advantages left if Alaskan follows what the others do...

It is sounding like Alaska has already decided to make the change to this model and is just trying to decide the tweaks and how to spin it

I got the survey as well, but the two options presented were two different variations of a revenue-based model. I didn't make a screen capture, but it would be neat to compare the versions Alaska is shopping around.

(From my memory, one offering perks like Elite status during the month of your birthday, and the other allowed you to customize your elite benefits based on a menu of services.)

I see the airlines simply colluding implicitly by copying each other moves. If all significant mileage programs are equally bad, then you can't really do anything. It seems in the long term that all these mileage programs will converge towards being revenue-based. Hence, there's no point in collecting miles based on butt-in-seats, but rather which CC's offers the highest number of bonus miles.

Last night I got a similar survey from AA. Asked about different types of earning structures (ticket price only, combo of price and miles flown, different types of bonus, etc).

Doesn't make sense for AS to change their program to match Delta's revenue-based inferior program. They should use their current program to entice DL flyers to switch over in their current fight.

Likewise, I don't interpret this as a totally revenue based program consideration. Further, while the airlines might back it more difficult to earn miles (e.g., make revenue linked to earning ratios), I think they will be HARD PRESSED to make it a model like Southwest/Jetblue, etc. Two totally different animals. I think it's the status quo for now - you will find a MASS EXODUS from any program which converts from a standard mileage redemption...

Likewise, I don't interpret this as a totally revenue based program consideration. Further, while the airlines might back it more difficult to earn miles (e.g., make revenue linked to earning ratios), I think they will be HARD PRESSED to make it a model like Southwest/Jetblue, etc. Two totally different animals. I think it's the status quo for now - you will find a MASS EXODUS from any program which converts from a standard mileage redemption scheme to a revenue based (sliding scale) redemption scheme.

I think there are too many factors in play to convert totally this, including the fact that banks still make mega bucks from credit card transactions, hence they give you "free" miles for getting a new card with the hopes you will use their cards a lot. Severe dilution will occur if a full revenue based program was put in place and this will pretty much piss off the banks (as well as the customers).

Alaska will destroy their Mileage program for long-term members if they do this. Also hurt their position relative to Delta.

I didn't interpret that as moving to a revenue based program but rather awarding miles for purchases you don't have to make on Alaska besides buying your ticket such as baggage fees, in flight food, etc. I would love to see mileage accrual stay as it is but perhaps add 5 miles per dollar spent on in flight food and duty free.

As long as the redemption value doesn't change much I think it's ok. I wish Alaska could add a round the world award considering they have lots of great partners and AA just took that away.

That last point is what AA allowed up until about a year and a half ago.

I wrote about the Alaska conjecture in October 2012

https://viewfromthewing.boardingarea.com/2012/10/19/are-delta-us-airways-and-alaska-airlines-the-most-likely-to-switch-to-a-revenue-based-program-and-what-about-our-current-mileage-balances/

"Are Delta, US Airways, and Alaska Airlines the Most Likely to Switch to a Revenue-Based Program?"

Lucky,

Revenue based ACCRUAL is ok with me, as long as they do not go to fixed value redemption like Southwest.

The day they do that I dust off my Fidelity Amex and go for 2% cash back.

For this, 1 mile is costing me 1.6c at most for my airline CC spend

I do not care about the "free" mile rebate from cash tickets, as I value that at 1c each +...

Lucky,

Revenue based ACCRUAL is ok with me, as long as they do not go to fixed value redemption like Southwest.

The day they do that I dust off my Fidelity Amex and go for 2% cash back.

For this, 1 mile is costing me 1.6c at most for my airline CC spend

I do not care about the "free" mile rebate from cash tickets, as I value that at 1c each + 50% bonus for my elite status = 1.5% cash back.

I just analyzed our whole family spend for 2013 on Amex on an old Blue Cash card with 5% cash back with no fees.

What I found was that I keep this card for the 5% cash back, but it only gave me 5% back on 20% of charges

So Let us say I spend 10k = > 2k gets 5% back = 100$ back

8k gets 1.5% back = 120$

Total cash back 220/10k = 2.2% ONLY!

AND

the first 6500 is at 1.5% and 0.5% rebate levels.

So real cash back was around 2% for the past 2 years.

I realized that there is a reason for the all round cash back cards and the spg amex = 2% cash back overall vs spg @2c each = 1.6c for any airline mile is my real cost.

If an airline will only give me 1.4c value for the mile, it is hurting me a lot more just to get the miles than to buy the ticket outright.

So no southwest card for me

I would still encourage all bloggers to shill for cards as the bonuses alter the equation a bit. If I spend 3k and get 30k bonus, I am getting 11m /$ instead of 2c = cost of 0.2 cpm, (better than the Pudding Guy btw)

So what's wrong with that? You get rewards based on how much you paid for! Seems fair to me!