Despite the fact that I have dozens of credit cards, I deal with very little credit card fraud, all things considered. It’s also not something that I’m too paranoid about, given the great protection offered by most credit cards in the event of fraud.

It had been quite some time since I’ve dealt with credit card fraud, though I guess it was time for that clock to reset. I always find it interesting to see the methods used for credit card fraud, and this one is particularly strange, so I’m curious if any OMAAT readers have theories.

In this post:

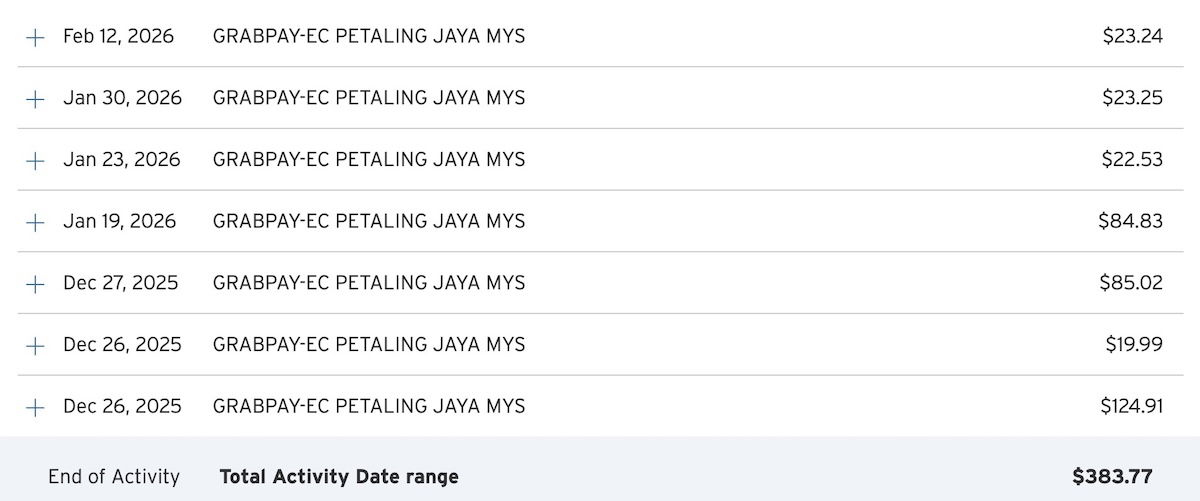

Seven fraudulent Grab transactions on my credit card

While going through all of my credit card transactions this morning, I noticed something strange on my Citi Double Cash Card. It’s not a card that I’m currently using for spending (it’s “sock drawered,” for the time being), though I just noticed that I’ve had seven transactions on the card in recent weeks, all from Grab in Malaysia (or at least that’s what it appears to be, based on the currency).

For those not familiar, think of Grab as being the equivalent of Uber in Asia. The transactions ranged from $19.99 to $124.91, and it’s interesting how they’re spaced out so much.

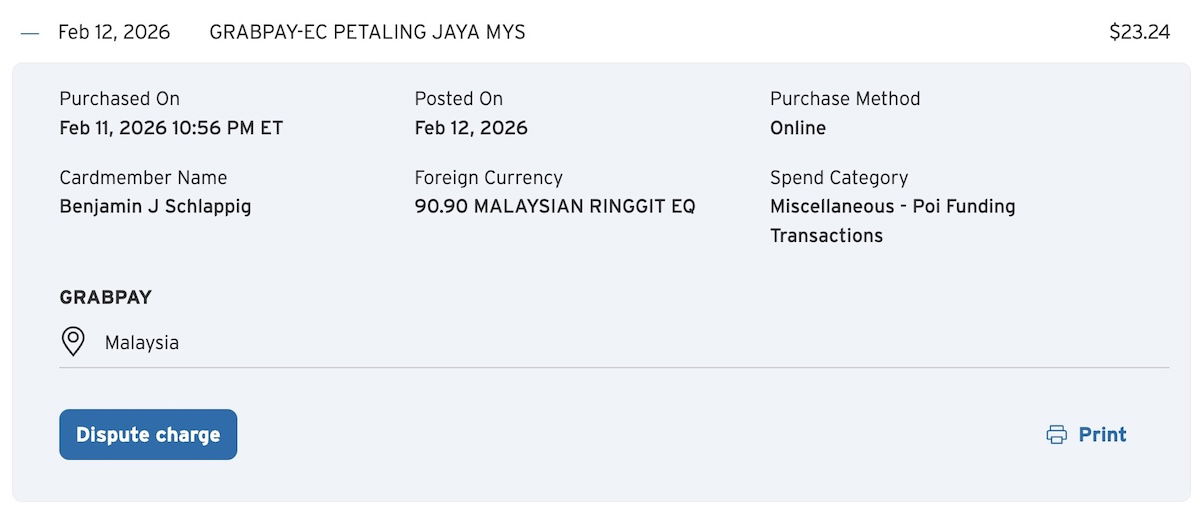

When I look at the breakdown, the “Spend Category” shows as “Miscellaneous – Poi Funding Transactions” for all the purchases. I’m not sure if that’s just usually how Grab purchases post, or if that’s a hint of something? Because nearly $125 for a Grab ride in Malaysia is mighty expensive!

Some might wonder how I didn’t catch this sooner. It’s a fair question. I have the card set up on autopay, and since I’m not currently using the card much, I wasn’t paying much attention. However, I tend to review all of my transactions every several weeks, since that’s still within the time period where things can be disputed. It was while doing one of these “sweeps” today that I caught this.

What confuses me about this Grab credit card fraud

It’s always fascinating to see the methods used for credit card fraud, and I’m really struggling to make sense of this. Here are some details that make this interesting, as I see it:

- I actually did use Grab for the first time in early November 2025 (I can’t believe it had taken so long!), in Malaysia; however, I used a completely different card for my Grab purchases, and not the Citi Double Cash Card on which the fraud occurred

- None of the above transactions show in my Grab account, and let me emphasize that my Citi Double Cash Card isn’t saved to my Grab profile

- I have the Citi Double Cash Card in my possession, so it’s not that the card was stolen; however, I did have the Citi Double Cash Card in the backpack I was traveling with (along with around a dozen other cards — I didn’t have fraud on any of those other cards)

So does anyone have any theory as to what’s going on here? Is it just a complete coincidence that this fraud happened weeks after I used Grab for the first time, also in Malaysia? Did someone remove the card from my backpack while I was in Malaysia, and has been using it for transactions ever since (but only for Grab, and not any other cards that were in my backpack)? Is this even being used for Grab rides, or is this “Poi Funding Transactions” thing indicative of something else?

I’ll tell you one thing — credit card fraud is never boring, and the circumstances of how it happens always fascinate me. So if anyone has any thoughts, I’d be fascinated to hear them.

Bottom line

For the first time in quite a long time, I’ve dealt with credit card fraud. Specifically, my Citi Double Cash Card (which I don’t otherwise put spending on nowadays) has had seven transactions with rideshare app Grab in the past several weeks.

The odd thing is that this came just shortly after I used Grab for the first time, also in Malaysia. However, this isn’t the card that I used with Grab, and I also have the card in my possession, which makes this all very strange to me.

Does anyone have any theories as to what’s going on with this fraud?

I've had a couple of bizarre fraud scenarios recently on amex cards. One involved a string of fraudulent amazon purchases (both with cash and redeeming MR) which was able to continue even after I reported the fraud and received a new card number twice. Only stopped when I had amex put merchant blocks on amazon charges (interestingly, freezing the card blocked cash purchases, but MR purchases still kept going through).

Another was a single $500...

I've had a couple of bizarre fraud scenarios recently on amex cards. One involved a string of fraudulent amazon purchases (both with cash and redeeming MR) which was able to continue even after I reported the fraud and received a new card number twice. Only stopped when I had amex put merchant blocks on amazon charges (interestingly, freezing the card blocked cash purchases, but MR purchases still kept going through).

Another was a single $500 charge on a different amex card in what looked to be a donation (!!) to a legit NYC charity.

Did you leave your backpack unattended anywhere- like your hotel room? It's possible a housekeeper snapped a photo of the card details. While there was no fraud on any of these other cards, this one makes the most sense to me. I had a similar situation happen years ago and that is the only logical conclusion I could come up with.

I do this whenever I go to countries where I don't feel familiar with, normally I order a sub card or use a card that I normally use, but then the moment I get back home, I report it lost and get a replacement with new number altogether. It's a pain to update wallets etc. But at least I get home with a clean slate.

Curious about why you would even have a card that charges an intl transaction fee in your bag when you travel overseas. I always leave my city doublecash card at home when I leave the country, since I won't be using it.

@ Craig -- To be honest, I probably shouldn't have had the card in my bag, even. However, lately I've had about a dozen cards just sitting in there (separate from my wallet), and I forgot they were even in there.

You can buy groceries, get food delivered, rent a driver and a car for a full day, etc on Grab - it's very likely the more substantial purchase was something like that as opposed to a single ride from point A to point B.

I don’t have the Grab app or a Grab account but I returned from a trip to SE Asia (that included Malaysia) and later found incremental charges on my Chase card from Grab. I was able to stop them and cancel the card, etc. before anything more happened. I assumed my Chase card info was intercepted somewhere on my trip and the Grab charges were just the start of a larger series of fraudulent activity.

Does Ford have any sketchy friends that came into the house???

In Miami? No way.

Really good example of why you shouldn't store credit card information into any app. Not sure if this is how they got your information. If they did it's pretty clear someone has unfettered access to Grabs secure area internally most likely.

Also I travel immensely internationally for work. Dozens of credit cards I only use one internationally or two. Limits yourself from damage should any occur. I 100% do not use a ATM.

@ BA -- Fair points, but I hadn't saved this card in the Grab app (or any other app that I can think of).

I recently used my ETrade ATM card in Germany. When I got home and checked my statement I had 3 debits from MILLARSSHOE 51 market street Market GB for $162 each. Then it stopped weeks before I notified Etrade. It's a shoe store website in the UK. Weird.

Also of note, the regular Etrade checking account no longer waives foreign transaction fees. They have a new "Max Rate" checking account that still does this. I...

I recently used my ETrade ATM card in Germany. When I got home and checked my statement I had 3 debits from MILLARSSHOE 51 market street Market GB for $162 each. Then it stopped weeks before I notified Etrade. It's a shoe store website in the UK. Weird.

Also of note, the regular Etrade checking account no longer waives foreign transaction fees. They have a new "Max Rate" checking account that still does this. I was not notified. Thanks Morgan Stanley for not letting me know of the change.

Actually, it's not as big a deal as it used to be since in many countries I don't even bother to get any local currency these days. I only took out cash in Germany last trip because somebody told me they only take Bargeld at the Christmas market stalls which was incorrect information.

I always set alerts on all my (20+) credit cards for the lowest amount possible and lock my sock drawer ones. Scammers tend to start with small transactions to see if you notice before making a large purchase. Granted, you're still not liable but it is a headache to deal with this.

Yup. Every single transaction on a CC gets an alert, either text or email (for whichever is more manageable for you.) Then, in real time, you get a sense of what is going on. While your method works to batch the review every few weeks, just seems alot more satisfying to catch the first fraudulent transaction and reissue the card.

POI is Point of Interaction as opposed to POS Point of Sale. Typically POI designation is used for quasi-cash transactions, for example, when you top up a digital wallet or purchase a gift card, etc.

So somebody appears to have used it for topping up a Grab Wallet and using numbers that don't look suspicious in terms of round numbers.

Check where your card was and then last 10 or 20 transactions before these fraud...

POI is Point of Interaction as opposed to POS Point of Sale. Typically POI designation is used for quasi-cash transactions, for example, when you top up a digital wallet or purchase a gift card, etc.

So somebody appears to have used it for topping up a Grab Wallet and using numbers that don't look suspicious in terms of round numbers.

Check where your card was and then last 10 or 20 transactions before these fraud transactions started. But even that isnt reliable because the theft of card details may have happened somewhere else at a different time or hack into an entity where the card was registered even perhaps unrelated to Malaysia. And then that info sold to someone in Malaysia in the digital underground.

Asian countries depend on OTP or Card Pin code to validate or just go through the transaction with no verification fir US cards that don't have a pin unless flagged by the processor.

So where it was compromised may be separated from the usage by location and time.

@ GV -- Good insights, thanks. There hadn't been any transactions in many months, for what it's worth (in reference to the question about the "last 10 or 20 transactions before these fraud transactions started").

I don't think it's related to Grab. These were online transactions according to your screen capture. I also doubt someone used your card by copying it out of your backpack. I assume someone bought it off the darkweb, where it was stolen in some profile you might have saved online. Thieves like to use small transactions like these to prove the card still works and stay off your radar (which worked in your case). Could...

I don't think it's related to Grab. These were online transactions according to your screen capture. I also doubt someone used your card by copying it out of your backpack. I assume someone bought it off the darkweb, where it was stolen in some profile you might have saved online. Thieves like to use small transactions like these to prove the card still works and stay off your radar (which worked in your case). Could have also been sniffed off any public wifi you might have used (although I'm sure you're smarter than doing that). The fact is you'll never know. This data is all out there in the darkweb

Right, doesn’t look like it’s related to Ben’s Grab account. Someone just got his card number and added it to a different Grab account, and is now using the Grabpay feature to spend.

Wonder if it could be someone who NFC/RFID’d the card then used it afterwards?

@ George Henan -- For what it's worth, I hadn't used this card for any sort of a transaction in many months.

This was my thought as well. If the card was in a pocket of the backpack and not in an rfid-safe place, anyone could have skimmed the CC info. That happened to me in India last year. Now I only keep credit cards in rfid-protected wallet or leave them home.

"Ghost tapping" might be it.

There are some videos on youtube showing people with remote charge terminals walking up to people's backpacks and wallets.