For years, we haven’t seen any major US airlines introduce co-branded debit cards, due to lack of ability to make money there. Fortunately that’s a trend that’s now changing. Recently we saw Southwest Airlines introduce a debit card, and now United Airlines has introduced a debit card as well.

In this post:

Details of the new United MileagePlus Debit Rewards Card

The new United MileagePlus Debit Rewards Card has just launched, powered by Galileo. The card is issued by Sunrise Banks N.A., member FDIC, with Visa as the payment network. Customers can now sign up for this product at uniteddebitrewards.com, and there’s no credit check when applying.

To cover the basics of United’s new debit card:

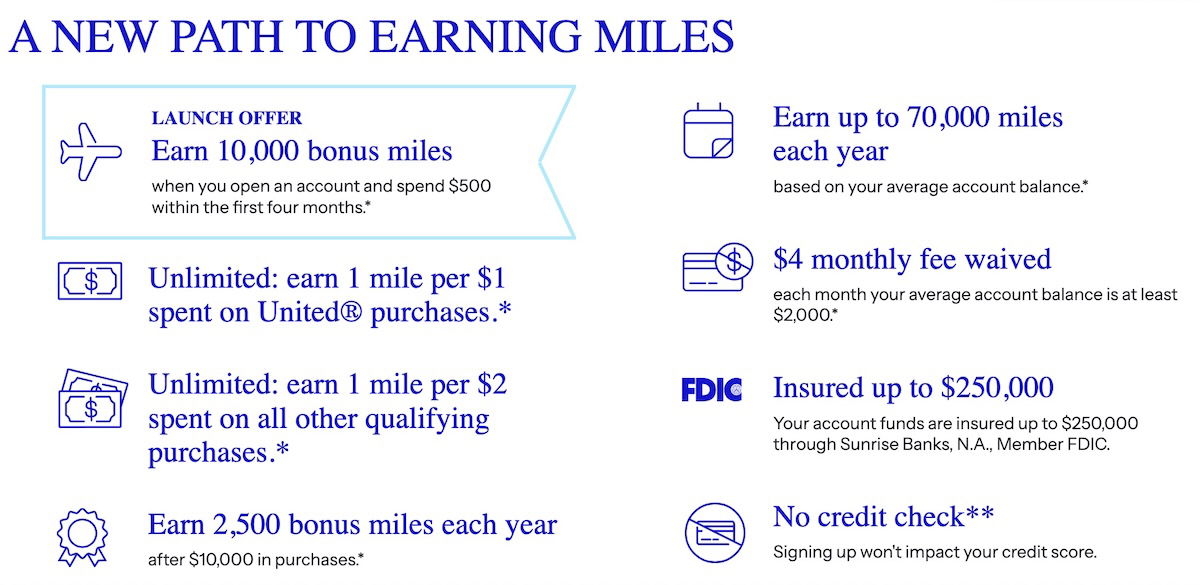

- The card has a welcome bonus of 10,000 bonus miles after spending $500 within the first four months

- The card offers one mile per two dollars spent on everyday purchases, plus one mile per dollar spent on United purchases

- The card offers 2,500 bonus miles each calendar year after spending $10,000

- The card has waived monthly fees as long as you keep an average daily account balance of $2,000; otherwise, a $4 monthly fee applies

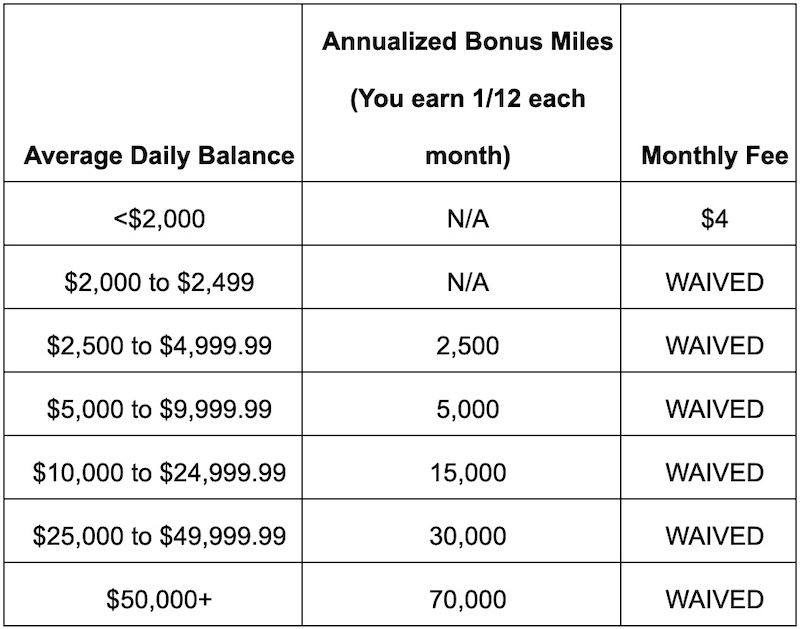

Another unique aspect of the card is that it offers bonus miles for saving. You can receive annualized bonus miles (you earn 1/12 each month) based on your balance. For example, if you keep a balance of $50,000+, you can earn 70,000 bonus MileagePlus miles per year. Now, is that the best rate of return, compared to a high interest savings account? No… but it’s better than nothing.

Here’s how Bob Daly, United’s Managing Director of Global Co-Brand Cards, describes this:

“We’re constantly looking for new ways to add value and optionality for our members, and a debit card is a natural next step. The United MileagePlus Debit Rewards Card offers customers an additional way to earn miles whether they’re spending on United flights and everyday purchases or saving and making plans for the future.”

Wait, how do the economics of debit cards suddenly work?

Back in the day, there were plenty of debit cards offering half decent rewards. However, in 2011, debit card fees in the United States were capped by the Federal Reserve, following the passage of the Durbin Amendment to the Dodd-Frank Act. With that, the maximum interchange fee for debit card transactions was set at $0.21 plus 0.05%.

It goes without saying that this doesn’t leave much upside for debit card issuers, or for any co-brand partners. That’s why we saw lucrative debit cards largely eliminated.

Credit cards have become increasingly big businesses year after year, and for airlines, we’ve also seen a large percentage of profits generated from these co-brand agreements. But in recent years, there hasn’t been upside with debit cards.

So, why are airlines suddenly once again looking at debit cards? It seems they’re getting more creative, and there are a few main considerations:

- There’s a small issuer exemption, whereby banks with less than $10 billion in assets can still earn higher interchange fees, so that’s a loophole that’s presumably being used

- There’s potentially money to be made by a bank having someone in their “ecosystem,” in terms of holding a balance with the bank, being able to sell them more banking products, collecting fees, etc.

- Airlines are of course obsessed with getting people to apply for their credit cards, so the goal might be to first get someone to apply for a debit card, and use that to eventually get them to apply for a credit card, if/when their credit improves

To state the obvious, if you qualify for credit cards (based on having a decent credit score) and can use credit cards responsibly, you absolutely should use them. They offer much better rewards (in terms of the welcome bonuses, return on spending, and benefits), and they also offer better consumer protection.

But if you don’t qualify for credit cards, you’re still better off earning some rewards with a decent debit card, rather than no rewards.

Bottom line

United Airlines is getting back into the debit card business, with the introduction of a new debit card. This comes just days after Southwest Airlines launched a similar product.

We otherwise haven’t seen much action on this front in the past 15 years, given the lack of upside. However, thanks to creative partnerships between airlines, issuers, and banks, I suspect that’s a trend that will now reverse, and this will become the norm rather than the exception.

What do you make of United launching a debit card product?

As Brent mentioned, the Bask Bank savings account that earns AA miles is similar and much more lucrative (that is, until their recent "interest rate" cut/devaluation)

I did a quick read of terms. I was curious if it paid interest (no). You can do a one time deposit to the card with another debit card ($500 max) and you can have direct deposits made with no limits to the card. However, your ability to transfer money from another account into this one is limited to $500 per rolling 30 days. So, for many here, it is impractical. It seems designed for...

I did a quick read of terms. I was curious if it paid interest (no). You can do a one time deposit to the card with another debit card ($500 max) and you can have direct deposits made with no limits to the card. However, your ability to transfer money from another account into this one is limited to $500 per rolling 30 days. So, for many here, it is impractical. It seems designed for an audience not found here. They suggest you might be able to get the limit raised. And, it sounds like they do this because they fear this would be used for fraudulent transfer from others accounts.

Wait, so after the first funding, the only way I can put more than $500/mo onto this card is via direct deposit from my employer?

Yep, If I read it correctly. The Southwest equivalent has the same. But, again, it sounds like a security concern is to prevent it being used as a clearing house for fraud. The suggest that limit could be raised if there concerns can be assuaged.

Is any here going to claim he is Debit but using a different name?

Stay away from debit cards... and protect your bank accounts while you're at it. Debit cards offer much weaker protection against fraud and when money's taken out of your account, it's on you pretty much to get it back. And watch out for POS card skimmers stealing your info/money.

My internet and utilities providers charge 3% on credit card billing but $0 on debit card use.

Wouldn't this be a no brainer for me to earn a bit.

$4800/yr in spend = 2400 miles + 10k sign up bonus = $124

Considering loss of $48 in annual fees or 80 in lost interest on $2000/yr = $60-80 positive benefit.

What a joke. Only 2.5k miles after $10k spending and the miles earned (the cash value) is about half of that for just holding a balance at a normal bank's HYSA

How feasible would it be to make estimated tax payments using this? Are there more stringent limits on amounts that can be charged in a single transaction for debit cards, vs credit cards?

I think it's a max of $7500/day.

Each bank will have different transaction limits in addition to any operational limits like lower limits for the initial x days after opening an account.

Will it give access to more award inventory?

I would like to know this as well. I would consider getting the debit card if it provides access to expanded award inventory without having to use a 5/24 slot.

If you consider 1 UA point is worth 1.8 cents, letting this bank hold $50k would get you about $1.26k in "interest" per 12 months, which equals to about 2.5% in interest. Right now a mmkt is producing about 3.7%. Unless you're redeeming for 80k tatl or 100k tpac route, def not worth the deposit.

I mean...it is functionally a competitor to the Bask Bank AA miles program. Not quite as lucrative, but there are a lot of people with savings rates of 0.25% or worse out there. I would take one United mile for that.

The Debit card market is big, and some people don't want credit products. There's probably a decent market for stuff like this.