Link: Learn more about American Express Platinum Card®

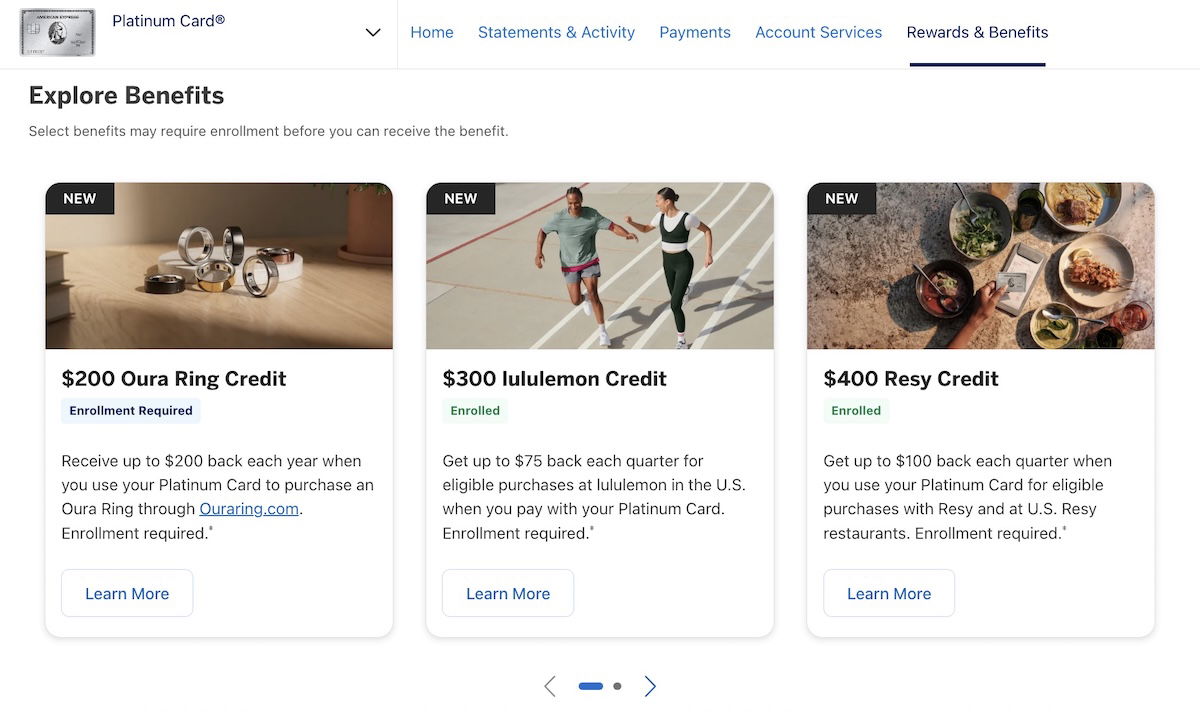

The American Express Platinum Card® (review) has recently undergone a major refresh. With this, we’ve seen the card get an $895 annual fee (Rates & Fees), which is shattering records among premium cards. However, for once, I’d say this card refresh is actually legitimately positive, and I’m having a lot easier of a time justifying the card’s annual fee than in the past, despite the $200 increase.

In particular, I very much appreciate the new credits that have been added. In this post, I’d like to focus specifically on the up to $400 annual Resy credit, since I know there are some questions about the logistics of using this, as it’s (almost) confusingly easy to redeem.

In this post:

Basics of the Amex Platinum Card $400 Resy credit

While the Amex Platinum Card potentially offers thousands of dollars of credits, there are terms and conditions associated with each of them. I’d argue that one of the easiest perks to maximize is the annual $400 Resy credit. For those not familiar, Resy is a restaurant reservation platform, which has well over 10,000 restaurants nationwide in its portfolio. Amex actually acquired the company in 2019, so it belongs to the card issuer.

The Amex Platinum Card offers up to $400 in Resy credits annually, in the form of a $100 credit each calendar quarter. To give the simple summary upfront, all you have to do is register, use your card at an eligible Resy restaurant, and then you’ll be reimbursed.

There’s no need to reserve your restaurant through Resy, you don’t have to let the restaurant know you’re using your benefit, and there’s nothing else special you have to do. So as long as a restaurant is one of the 10,000+ that belongs to Resy, you’re good. You can even use it for takeout, as long as you’re paying directly with the restaurant.

Now, to share some more specific terms:

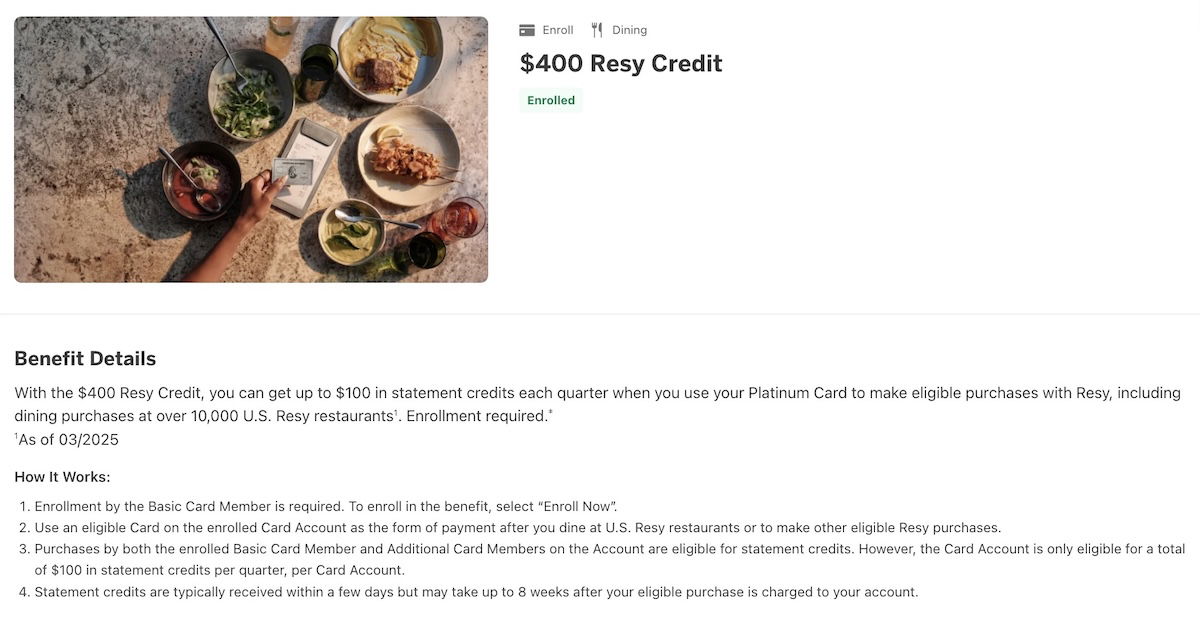

- Registration is required prior to using the benefit

- This is only available on the personal version of the card, and not the business version of the card

- Spending by the primary cardmember or authorized users qualifies toward this credit, but there’s only one credit per primary account

- You can receive up to $100 in statement credits each quarter, and that can be based on spending in one or multiple transactions, and you can only be reimbursed as much as you spend

- Eligible Resy purchases include purchases made directly from U.S. restaurants that offer reservations through the Resy website or app

- It can take up to eight weeks for the credit to post to the eligible account, but typically it’ll post much faster than that

When it comes to registering, just log into your online account for the Amex Platinum Card, click on the “Rewards & Benefits” tab, and find the “$400 Resy Credit” section.

There you’ll find all the terms, and you’ll also see the enrollment button. You’ll also receive an email confirming enrollment.

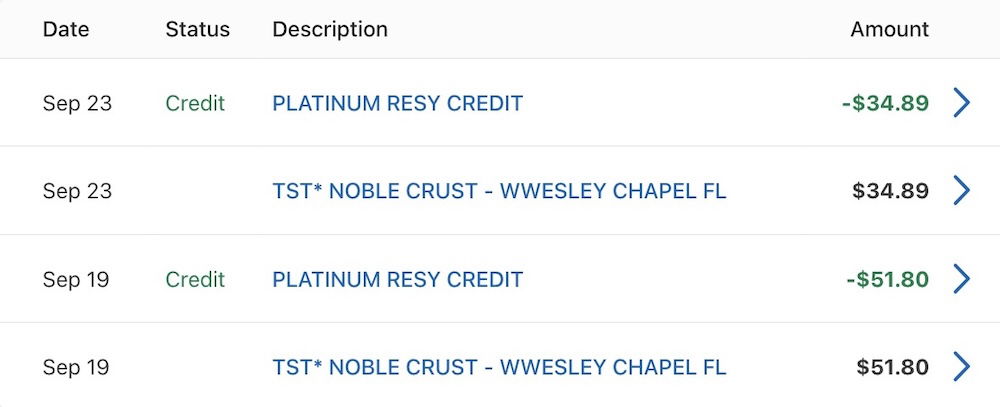

Based on my experiences (and the experience of family members), the credit typically posts in a matter of days.

The Resy credit is worth close to face value, in my opinion

We often refer to some premium cards as “coupon books,” given the number of credits they offer, the hoops you have to jump through to redeem them, and the way they’re broken up. With that in mind, I’ve gotta say, the $400 Resy credit on the Amex Platinum Card is a breath of fresh air, and something I consider to be worth close to face value.

Admittedly all consumers are different, so no credit is going to be valuable for everyone. Like, if you don’t dine out or live in a small town without Resy restaurants, then you might have to go out of your way to maximize it. However, if you dine out with some frequency and live in a major city, I’d say this is worth pretty close to face value.

The way I view it, the major catch with this credit is that the Amex Platinum Card isn’t ordinarily one of the best cards for dining spending, given that that’s not a bonus category for that on the card. So for me, it’s about remembering to use the card once per quarter for a dining purchase.

I get frustrated by this kind of stuff if we’re talking about some super small credit, but for $100, I’m happy to remember to do that. Also keep in mind that if you have a more expensive dining experience, you can typically split your purchase between multiple cards.

Personally, I’d basically view the opportunity cost of this perk as being the rewards I’m forgoing by not earning more than one point per dollar on that dining purchase.

I’m curious about the economics of the $400 Resy credit

Unrelated to the actual value of this perk, I’d be fascinated to know what the economics are of this benefit. A bunch of premium card perks nowadays are merchant funded, which is to say that the merchant covers much of the cost, in exchange for getting access to an affluent consumer base.

In the case of the Amex Platinum Card $400 Resy credit, Resy is owned by Amex, and the credit is being redeemed at any of 10,000+ independent restaurants. My general assumption is that the intent with this perk is twofold:

- To increasingly drive people to using the Resy platform for reservations, since it’s owned by Amex

- To get people to put their dining spending on the Amex Platinum Card more consistently, with the assumption being that if you start using it for dining once per quarter, maybe you’ll start using it more consistently

That being said, $400 per cardmember is a pretty big investment to make on that front. I can’t imagine that individual restaurants are in any way on the hook when these credits are redeemed (or are they?), so I’d be fascinated to know what the accounting on this looks like.

It’s a little different than some sort of a hotel credit, as you see on many cards, where the logic is a little more straightforward — the credit card company gives you a hotel credit, and hopes you’ll book a much more expensive hotel, since they’re acting as an online travel agency, and receive a commission.

Of all of Amex’s credits, the $400 Resy credit is the one that seems most generous and perhaps more costly, in terms of direct funding by Amex and its subsidiaries. I’m curious if others have a different take on that.

Bottom line

The Amex Platinum Card offers thousands of dollars worth of credits, and I’d argue that one of the most valuable is the annual $400 Resy credit. Registration is required, and the credit can be used in increments of $100 quarterly. But beyond that, there really aren’t many hoops to jump through. Just find a participating Resy restaurant, spend money there on your card, and you can receive a statement credit. You don’t even have to book through Resy.

What’s your take on the Amex Platinum Card $400 Resy credit, and what’s your best guess as to the economics?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: American Express Platinum Card® (Rates & Fees).

We spend 99% of our time outside of the US, so sadly, this benefit has no value for us.

Ben, you missed one important step when using that Resy credit - make sure the restaurant takes AmEx. We were surprised (at España in Vancouver - a favorite when we're in town) when our server told us after the meal that we couldn't pay with our Platinum card. Apparently Resy doesn't want to be too imposing when signing up restaurants.

"easy to use"? I guess it depends on where you live at.

There's only 3 restaurants in a 20 mile radius where I live. One is very high-end/priced. That one and another are a min. of a 30 min drive away. The third one is fairly close. But none of them sell GC online. You have to drive and get them in person.

Amex mentioned far in advance of the latest Platinum refresh that it was making its largest "investment" ever in the Platinum card to coincide with an anniversary year. I figured "investment" was just more BS merchant-funded offers, but this is probably what they are talking about. This credit is likely actually costing Amex (and cost is probably split with it's subsidiary, Resy) both to 1) Add additional restaurants to Resy by being able to tout...

Amex mentioned far in advance of the latest Platinum refresh that it was making its largest "investment" ever in the Platinum card to coincide with an anniversary year. I figured "investment" was just more BS merchant-funded offers, but this is probably what they are talking about. This credit is likely actually costing Amex (and cost is probably split with it's subsidiary, Resy) both to 1) Add additional restaurants to Resy by being able to tout the high-income, high-spend Platinum cardmembers who visit Resy restaurants and 2) Sign up additional merchant-funded offers for Platinum by being able to tout all the new high income/high spend Platinum cardholders.

There's nothing suspicious about it. Restaurants pay a monthly fee to be on the Resy platform (it's also why you won't see a restaurant on both Resy and Open Table, due to a non compete agreement).

So the $100 a quarter that Amex gives is essentially free for them, since it's coming from the restaurant's monthly payment. Moreover, these are all at upscale restaurants where you're likely to spend more than $100.

There's...

There's nothing suspicious about it. Restaurants pay a monthly fee to be on the Resy platform (it's also why you won't see a restaurant on both Resy and Open Table, due to a non compete agreement).

So the $100 a quarter that Amex gives is essentially free for them, since it's coming from the restaurant's monthly payment. Moreover, these are all at upscale restaurants where you're likely to spend more than $100.

There's also a lot of "breakage" in that not everyone is going to use the full $400 every year.

Unfortunately not Resy restaurants that I like to frequent near me so not a perk I find easy to use. Also I prefer restaurant spend on my other cards.

It’s the absolute BEST add on! Living in the Bay Area we regularly dine at many of the Resy restaurants. Our regular spots —so a total no brainer bonus! We have a number of Plats and Gold so for a more expensive night out we use several cards and get a free meal!

Amex Platinum Card $400 Resy Dining Credit: Suspiciously Easy for big cities.

"I’m curious about the economics of the $400 Resy credit."

People is smaller cities subsidize with their Suspiciously Expensive annual fees.

Resy restaurant in St. Pete has recently added a 3% credit card fee. I have to imagine it's no coincidence. I'm sure Amex/Resy would tell them to correct this or else lose Resy. But I'm glad to pay it because it's a great place and the credit is so easy to use.

People like you are part of the problem.

Just because you get "credit" doesn't mean you should tolerate this extortion.

By still paying the 3% scam you're enabling them to continue.

It’s useless in my humble opinion if you’re looking for food that doesn’t scream heart attack, stroke, type 2 diabetes or dementia.

I know of one place that has a front facing grab and go/cafe set up. Every time I'm passing through at the train station it's near I grab a coffee, bottle of water and a muffin situation. In that sense it's actually an equal $400 exchange for me.

Next do ann post about how awful the chase selection of 12 restaurants for their credit is and how overpriced the 7 hotels they have in the edit is.

Resy Credit FAQ:

"The Resy Credit is a benefit offered by American Express® to eligible Card Members that rewards them with statement credits when they make qualifying purchases at restaurants that are live on Resy. These purchases may include in-person dining or pre-paid experiences booked through Resy and processed via the restaurant’s point-of-sale system or Resy Pay. This benefit provides value to Card Members while supporting Resy restaurant partners — at no additional cost to...

Resy Credit FAQ:

"The Resy Credit is a benefit offered by American Express® to eligible Card Members that rewards them with statement credits when they make qualifying purchases at restaurants that are live on Resy. These purchases may include in-person dining or pre-paid experiences booked through Resy and processed via the restaurant’s point-of-sale system or Resy Pay. This benefit provides value to Card Members while supporting Resy restaurant partners — at no additional cost to the restaurant."

Source: https://helpdesk.resy.com/en_us/resy-credit-faq-HJSEckqixl

Not only did my first $100 credit post within days but I also chose a restaurant with Rakuten dining so also got 5x MR points on the meal from Rakuten. Just a ridiculously easy benefit to use for many of us.

How did you get 5x from Rakuten?

If more restaurants outside of urban centers where on Resy it would make up more value to me. For now most of us are learning what "Toast" is to gift cards until we dump this overpriced coupon book card.

Sorry farmer John but “most of us” who have an AMEX Platinum live in those urban centers.

The credit benefits AMEX by encouraging restaurants to join the Resy platform over places like Open Table.

Also, many people may have a second card that gets better than the AMEX 1x dining points, which they are more likely to use in restaurants. So this credit tries to get more diners in the habit of using their AMEX over their “other” card.

Really really dumb that it isn't available for world-wide restaurants, since there ARE restaurants on Resy in other countries AND the Bonvoy Brilliant credit works overseas! And it's supposed to be a travel card for the affluent? Lol.

Plenty of restaurants use Resy. Linked my Resy account and enrolled. Used it Sunday and had the credit Monday. Easy.

You don't need to link your Resy account or even have one to begin with. All you need to do is click the register button in your Amex account.

But the problem is how many of them consider as good restaurant

A simple Internet search would have revealed that restaurants pay anywhere from $299 to nearly $900 a month to be on the Resy platform so Amex is not really out an money on the rebate they are giving. Also I am sure the assumption is that people will spend more than $100 per visit.

What is the conversion rate to earn the $100 per quarter?

Well, check the fine print. I was happy to find one of our favorite high-end pizza places on the list and so ordered a big takeout order to get our $100 worth in September. I made sure to order on the restaurant website and not a third-party site and did pick-up, not delivery. Turns out the restaurant uses a credit card processor for their website and so I don't think I will get a credit....

Well, check the fine print. I was happy to find one of our favorite high-end pizza places on the list and so ordered a big takeout order to get our $100 worth in September. I made sure to order on the restaurant website and not a third-party site and did pick-up, not delivery. Turns out the restaurant uses a credit card processor for their website and so I don't think I will get a credit. I contacted amex and got conflicting info from them, but ultimately told me to wait another few weeks to see. They said if I ordered on the website it should be fine, but then in the next sentence quoted the fine print: "The transaction may not be eligible if: it is not made directly with the merchant, it is made at a merchant located within another establishment (e.g. a restaurant inside a hotel or department store), it is for a non-dining purchase (e.g. Resy-branded American Express® gift cards or merchandise that features Resy branding or is sold at Resy restaurants), the merchant uses a third-party to process or submit the transaction to American Express (e.g. using mobile or wireless card readers), or you make a purchase using a third-party (e.g. a third-party payment platform or food delivery service)." So, buyer beware

Speaking of purchases inside department stores, this is a problem of epidemic proportions in Japan. It's ridiculously common that any store/restaurant located anywhere inside a shopping mall or shopping center will use the mall's merchant category code and the purchase won't be coded correctly, so you don't get the extra points or restaurant credit. In a city like Tokyo, I'd say the majority of restaurants are inside shopping malls, so it's a big problem for...

Speaking of purchases inside department stores, this is a problem of epidemic proportions in Japan. It's ridiculously common that any store/restaurant located anywhere inside a shopping mall or shopping center will use the mall's merchant category code and the purchase won't be coded correctly, so you don't get the extra points or restaurant credit. In a city like Tokyo, I'd say the majority of restaurants are inside shopping malls, so it's a big problem for non-Japanese. I think Japanese credit cards don't have bonus categories and there are still many restaurants that don't even accept credit cards, even in 2025. Even outside of malls, it's common to find restaurants or coffee shops that use the wrong MCC. One restaurant I recently went to was coded as "personal services."

I live in an area that has very few Resy restaurants, and I am not really interested in them. I do travel a lot to NYC and MIA, so I can use my quarterly credit pretty easy. In order to beat the September 30 deadline, I bought a gift card from one of my usually Resy restaurants. I requested a card, not an ecard. I knew that it was chancy but I was fighting the...

I live in an area that has very few Resy restaurants, and I am not really interested in them. I do travel a lot to NYC and MIA, so I can use my quarterly credit pretty easy. In order to beat the September 30 deadline, I bought a gift card from one of my usually Resy restaurants. I requested a card, not an ecard. I knew that it was chancy but I was fighting the clock. I had to pay kist under $20 ( ripoff ) for shipping, and when it got billed, it was billed by the restaurant groups ownership that also sells bakery products, not the restaurant itself. I did not get the credit. In October, I used the $100 gift card plus my Amex Platinum for a dinner, and got the $100 credit pretty quick. If you want to buy a gift card, it is best to do it in the restaurant where they charge your card on the same machine as a meal.

@Allison

It seemed to be hit or miss if the credit would be applied when the restaurant used a 3rd party site when placing an online order. I had one credit and not not.. Totasttab seems to trigger it, but Tock did not. I'm going to try a Toasttab site again later this month to see..

@Pete

Tell me about it.. I learned the hard way regarding this too when I had...

@Allison

It seemed to be hit or miss if the credit would be applied when the restaurant used a 3rd party site when placing an online order. I had one credit and not not.. Totasttab seems to trigger it, but Tock did not. I'm going to try a Toasttab site again later this month to see..

@Pete

Tell me about it.. I learned the hard way regarding this too when I had a $50ish meal at a restaurant in the Yodobashi Akihabara and it charged as Yodobashi and only gave me 1x points.

Buying food at the food court at Haneda airport charges as Haneda Airport so the travel category will actually apply and not the restaurant category.

There are *six* Resy restaurants where I live. Not really so useful.

Similar here - I'm in the Baltimore area, and unless I want to eat somewhere particularly expensive in downtown Baltimore or DC, the options are slim to none. I get much more value out of the "coupon book" plus either the 3% restaurant cash back on Chase, or my flat 2.25% cash back on everything through my BofA card. I often end up with 6-10% cash back on those cards for restaurants.

With two Platinum and two Gold cards between me and my co-P1 these Resy credits are a huge win. We have several excellent options nearby where we can easily spend $150+ on dinner, but not something we would normally do. Along with the Lululemon and Uber credits getting value from this card's AF is not hard.

Ha early in the month I'm often at a restaurant dining with my wife pulling out to bonvoy cards at Delta reserve and a Delta Platinum to pay a quarter of the bill on each and collect all my resi and other dining credits

I am a business traveler and mostly eat alone. I tried to use Resy to make a reservation for 1 and deliberately chose quiet days and off times and yet Resy stated that there were no tables available. Pretty useless. Have any other business travelers had the same problem?

youre using it wrong

Just show up and eat. Pay with a qualifying card when you're done.

That's it.

Resy benefit stacked with an Amex dining offer.

Lululemon benefit stacked with a 20% Capital One Shopping rewards offer.

NYC MTA tap to pay offer.

It’s date night with a fresh pair of drawers. Wish me luck.

AMEX'S CEO EXPLAINED IT ON A QUARTERLY EARNINGS CALL. It no longer looks at each credit on its own . . . or what an individual cardholder uses . . . it knows the AVERAGE person will use only a percentage of the sum total. Instead, it looks at the total revenue it receives from all statement credit sponsors relative to the total use of statement credit usage. That's what matters to Amex. But, it...

AMEX'S CEO EXPLAINED IT ON A QUARTERLY EARNINGS CALL. It no longer looks at each credit on its own . . . or what an individual cardholder uses . . . it knows the AVERAGE person will use only a percentage of the sum total. Instead, it looks at the total revenue it receives from all statement credit sponsors relative to the total use of statement credit usage. That's what matters to Amex. But, it should be emphasized that restaurants pay a (software) subscription to be on Resy . . . or Open Table . . . or Seven Rooms.

What is "suspicious" about this? It may be surprisingly easy to use, but suspicious suggests that there is something nefarious that will happen to you because you are baited into using it by its ease of use.

"Suspicious" is a convenient word to entice the unsuspecting click.

It's a marketing scheme -- with $400 credit more people will step in Resy restaurants, which would attract restaurants to join Resy Platform.

Yes. And, I refuse to use my $400 in statement credits in protest. They are not pulling a fast one on me.

The 'coupon' is only worth close to face value if you live in a big city. There is only one Resy restaurant in the smaller metro area where I live, so it's value is limited. I struggled to use the $50 Resy coupon on the Gold card, having to plan when I travel to eat at one of their restos. Now I will have to scheme much harder to use such a credit 4X per year. Also factor in that there are many cards that offer a higher return than the Plat on restos.

I do not live in a big city and there are a few restaurants on the platform. Including one of our favorites, BUT, if a cardholder is the "target" customer . . . that is , someone who travels . . . then one will likely have a greater opportunity to use the credit. If a cardholder is not the "target" customer . . . that is, someone who doesn't travel . . . then the card is not a fit. And, thus, why complain?

Oh the naivete here. Being in thrall with premium credit cards that charge big money and offer various “benefits” to offset the annual cost is being a lamb to the slaughter. I’m an AMEX “member” since 1974. So I guess I should feel special. At least that’s what AMEX wants. But really I’m a sucker. Less so than most, but still. These cards are marketed to high end consumers. These are not consumers who cut...

Oh the naivete here. Being in thrall with premium credit cards that charge big money and offer various “benefits” to offset the annual cost is being a lamb to the slaughter. I’m an AMEX “member” since 1974. So I guess I should feel special. At least that’s what AMEX wants. But really I’m a sucker. Less so than most, but still. These cards are marketed to high end consumers. These are not consumers who cut coupons out of the newspaper to save money at the grocery store. They can’t be bothered. So while many who renew may justify the cost based on all these money-back “deals,” I’d guess 10% actually get their money back. As a member of the 10%, I’ve spent all sorts of time figuring out how to do so and ended up buying stuff I don’t even want at, for example, Saks. Then, when I walk miles to the Centurion lounge I find that there’s a line AND I have to pay for my partner to enter. We’re really special to AMEX. No we are not. This is all a big game in which we are the losers. It’s why I am bailing on AMEX after more than 50 years and moving to the Venture X. I’ll still get access to some lounges, free mobile phone insurance, and can negate most of the cost with one airline ticket. One Mile at a Time should be excoriating AMEX. Not implying it’s some great deal. That’s just playing into the AMEX profit machine. I will no longer fall for this.

To be fair, each person must assess the value of the card for oneself. It's not anyone's responsibility to ensure it is of value to any other person. Some might not capture a single statement credit but find incredible subjective value in lounge access . . . and that's the only reason they hold the card. Are they a chump? If the card is not a fit for YOU, fine. I capture huge value on existing spending. Let's not impose our outcomes on others.

Agree, but let's expose this to what it is for MOST people: Selling the sizzle, not the steak; a veneer of exclusivity. Let's say a cardholder is someone who regularly flies through airports by themselves with Centurion lounges that are mostly available at the times they go through. Then maybe that alone is worth it to them. What I'm suggesting is that for 90% of AMEX customers, the vast majority of the "deals" are going...

Agree, but let's expose this to what it is for MOST people: Selling the sizzle, not the steak; a veneer of exclusivity. Let's say a cardholder is someone who regularly flies through airports by themselves with Centurion lounges that are mostly available at the times they go through. Then maybe that alone is worth it to them. What I'm suggesting is that for 90% of AMEX customers, the vast majority of the "deals" are going to go unredeemed, so this is mostly just a way to extract more money from customers.

This is exactly the truth. Just the way some people are justifying these so called perks is laughable. If you want to feel special then by so means get it. I get a free one via Morgan Stanley otherwise I wouldn't get it. The capital one venture x is the one I feel that actually provides good value.

The goal is to attract more restaurants to use Resy. Restaurant pay for the service. If they think they can some of that $400 pie, they may use that platform over, say, OpenTable.

Ben - there has been a lot of discussion on the Lululemon credit as well. $75 a quarter credit at a store that sells many useful items at or below that price also seems pretty generous.

In terms of the economics - Amex must be funding a lot of the Resy discount given most Resy restaurants are independent. For some of the other credits, they seem generous to the point Amex seems to be funding a lot of it

The Lulu credit is almost certainly funded by Lulu. They took a look at the average Amex Platinum cart size at Lulu and extrapolated from there. I think the Lulu execs are delulu about this. Thanks to adverse selection, the new Lulu cart size will decrease towards $75 :P

I entered a Lululemon store for the first time in my life on Sunday to use the Amex credit before it expired. The cheerful staff seemed to sense my unfamiliarity with the store. "First time at Lulu?" the sales lady politely asked me. Long story short: I ended up buying way more than $75 in merchandise. I was impressed with the selection and quality of the clothes as well as the excellent service. I am a fan of Lulu now.

I have to assume that Resy restaurants are paying a fee to be listed in Resy. It is a form of advertising. You can make a reservation on Resy (like Open Table), so maybe the restaurant pays a fee for reservations. AmEx is offering a quarterly incentive to get people to eat there. AmEx also gets is fee for the CC charge.

Yes. Like Open Table and other reservation platforms, there is a software subscription that each restaurant pays. One can find these fees by going to these platforms' websites and looking for "For Restaurant Owners" or a similar link. As opposed to the consumer side of its website.

I have to assume that Resy restaurants are paying a fee to be listed in Resy. It is a form of advertising. You can make a reservation on Resy (like Open Table), so maybe the restaurant pays a fee for reservations. AmEx is offering a quarterly incentive to get people to eat there. AmEx also gets is fee for the CC charge.

Resy is a reservation management system. Like any other system a company might use you pay a monthly/yearly subscription to use it.

“Easy to use”. Lolz. First dinning, 10 days later and no credit has posted still. 2nd dinning, on 9/28, I bought a gift card but it did not process (got an error), so I left without buying. Later I see charge as pending and credit for same amount pending as well….i didn’t even get the gift card!

I will be canceling this overpriced coupon book. Can’t even bring a guest into centurion for free on a $900 year/ $75 a month membership card!

My wife and I just used the Resy credit on my American Express Platinum. I am the primary cardholder. We did make a reservation in Resy (I don't believe that is required), we ate at the restaurant and paid our bill on 09/27, the charge posted for $148.50 on 09/28 and the "Platinum Resy Credit" posted for $100.00 on the same date. All went well and it was easy.

This is a dining credit, not a “dinning” credit. This is most likely why it didn’t credit for you.

It's nice that it is easy but looking at the listing of restaurants near me in the SF Bay Area it's still pretty sparse. I would have to very specifically go out of my way to check the box to eat at any of them and many are would push you well over $100/meal for 2.

I travel a lot and most of my reservations (purely at random) are on open table. I too would have to be intentional about visiting a resy restaurant (and passing up my first choices). When I am eating out, I look for the experience, service and food so price isn’t a limiting factor.

I looked back through my emails and it looks like I end up at a resy restaurant about once a year.

I get the sense that individual restaurants are not on the hook for anything, or that anything they lose is trivial. One of our local restaurants blasted their email lists saying they've been slammed with everyone using the credits, so they are instead offering $110 value gift cards for $100. I doubt they would do that if they weren't getting close to $100 from it.

It is a credit if you live in/near Washington DC. Tons of ny favorite restaurants are on Resy. Easy to use

Have had good success in NoVA. In general, I see mostly open table.

I imagine the play must be to get more restaurants to switch from OpenTable to Resy and to get more dinners to make reservations on Resy. They increased the cost of the card by $200/year so it’s only an incremental cost of $200/year (before breakage). Many smaller cities don’t have any Resy restaurants so I suspect there will be more breakage than one may suspect living in a big city.

I definately overspent recently because of it!

I live in a small city, South Bend, that has one resturant on Resy that I've only been to once and it was terrible.

I travel once a month-ish and was out of town when the credit was announced in Providence, RI - already had a reservation with friends at a resturant that night on Resy (they insisted on paying), next night I was alone in Providence,...

I definately overspent recently because of it!

I live in a small city, South Bend, that has one resturant on Resy that I've only been to once and it was terrible.

I travel once a month-ish and was out of town when the credit was announced in Providence, RI - already had a reservation with friends at a resturant that night on Resy (they insisted on paying), next night I was alone in Providence, and ate dinner at a tapas bar on Resy, something I wouldn't have done other than the Resy Credit (credit posted for that $60 meal), next stop was visiting family in Rural Vermont, and much to my suprise the only real resturant in a small nearby town was on Resy and I took one of them out there for dinner, the over $100 bill way blew over my remaining Resy credit but it was a fun thing to do.

This is similar to the fact I like trying to book my now bi-yearly FHR reservation in a place where I need a hotel and am visiting friends, and then using the dinner credit and free breakfast for 2 to have a meal with others. Did this in Denver at the Thompson in August, treated one friend to a basically free dinner, and a different friend for free breakfast.

It’s not quite so easy. I’ve eaten at 3 Resy restaurants, on Resy site, and no credit. The issue at restaurants in hotels is they often charge it to an account with the hotel so doesn’t post as restaurant and Resy. This is fraud I think, the restaurant getting Amex Resy exposure but not paying so much for it. I’ve many times spoken to Amex about this and even with supervisors and just get a...

It’s not quite so easy. I’ve eaten at 3 Resy restaurants, on Resy site, and no credit. The issue at restaurants in hotels is they often charge it to an account with the hotel so doesn’t post as restaurant and Resy. This is fraud I think, the restaurant getting Amex Resy exposure but not paying so much for it. I’ve many times spoken to Amex about this and even with supervisors and just get a shrug basically. That’s BS and Amex should reimburse me per the credit rules and should go after the restaurants. They do neither. Amex is accelerated the demise of Resy, I give them 2 years max.

Went to one Sunday night, and it was slammed by Amex credit users. Server said they were doing 5x their number of usual covers for several days and got to the point of running out of menu items. Said Amex didn't warn them.

This was an upscale resturant.

Most of the patrons weren't ordering any alcohol - in a place that's pretty well known for its wine list - so they were basically trying to...

Went to one Sunday night, and it was slammed by Amex credit users. Server said they were doing 5x their number of usual covers for several days and got to the point of running out of menu items. Said Amex didn't warn them.

This was an upscale resturant.

Most of the patrons weren't ordering any alcohol - in a place that's pretty well known for its wine list - so they were basically trying to hit as close to $100 as they could.

We ordered up, and the server appreciated that. Ended up with a great pour of a special wine.

Your restaurant order is controlled by what pleases the server? Is that why you eat out? To please the wait staff? Yeah, this was the last weekend of the quarter to get a $100 free meal so of course a lot of card members will be out. Most of the Resy restaurants are upscale so no surprise there either.

Ordering well like we normally do and getting a comp pour has zero to do with wanting to please the server.

The fact that so many people were not ordering drinks (alcoholic or not), which is out of norm for that restaurant, while we ordered drinks like we normally would stood out to him and we benefited.

Live in a decent sized California city, was somewhat surprised there were around a dozen restaurants in my local area in the list - -a few more in the 'burbs.

of the dozen or so, we actually go 1-2x per year to maybe a handful -- thus for us, a rather nice perk to make a point to going to those places 1x per quarter.

Charge posted and credit issued really quickly -- happy to have capitalized on this before the quarter closed.

Yes, I enrolled the day the new Plat card benefits were announced September 18, realized the quarter was quickly ending, so took a couple friends out for dinner last Thursday the 25th.

Tab came to just over $100, and the credit was already in my account Monday the 29th. Wow!

I used to have an AX Delta platinum card that has a smaller Resy benefit, so I knew one didn’t have to use the...

Yes, I enrolled the day the new Plat card benefits were announced September 18, realized the quarter was quickly ending, so took a couple friends out for dinner last Thursday the 25th.

Tab came to just over $100, and the credit was already in my account Monday the 29th. Wow!

I used to have an AX Delta platinum card that has a smaller Resy benefit, so I knew one didn’t have to use the reservation feature to get the credit. However, taking those two out to dinner last week on my Plat card, I actually did use the reservation feature, which asked about any food allergies. One of my guests has a shrimp allergy.

I was quite impressed when the waiter greeted us after giving us his name, the very next question was “OK, who has the allergy I’m told about?”. Impressed.

And like your discussion in this review, one of our topics at dinner last week was: “what is the economics of this benefit for American Express Co. and the restaurant?” We didn’t fully resolve it either!

Overall, I really, really like this new benefit on my card, plan to use it quarterly, but like you, probably not shifting all my restaurant purchases to the Plat card.

Picking up $90 in tacos right now to burn through that credit. Thanks for the reminder, would have forgotten to use this quarter

I was excited initially. However, there are not too many restaurants on Resy in Northern California. Yes, there are some, but none of my regulars or the ones I have been keen on trying.

Maybe it is a move by Amex to get more restaurants on the Resy platform by promoting demand from all their Platinum card members?

It’s real value especially when compared to the $300 CSR credit which has literally tens of restaurants that it is good at. 10,000+ restaurants, $100 a quarter, easy as pie.

Chase increased the fee by more than Amex did and made the CSR credits illusory and impossible, and also changed the fundamentals of the card by taking away 3x travel. Three months later Amex comes in with a clear message to disillusioned Chase customers...

It’s real value especially when compared to the $300 CSR credit which has literally tens of restaurants that it is good at. 10,000+ restaurants, $100 a quarter, easy as pie.

Chase increased the fee by more than Amex did and made the CSR credits illusory and impossible, and also changed the fundamentals of the card by taking away 3x travel. Three months later Amex comes in with a clear message to disillusioned Chase customers - we’ve been here all along, we’re taking nothing away, in fact we’re adding tons of value, and nothing else is like the Platinum card.

Hard to argue given the value being offered! Heads should be rolling at Chase.

Chase had the first mover disadvantage here. Amex saw it and seized the competitive opportunity. I bet Amex didn't have $400 Resy on the roadmap initially, but after the Chase launch, Amex execs regrouped with the product team and agreed to take a riskier bet on funding this lucrative credit.

Maybe in 1-2 years we will see Amex increase the fee to $1,495 with no additional credits.

The Gold card has had a $100 ($50/half) Resy credit for a while now, so the Platinum getting a larger version isn't that surprising. Certainly not something they added as a whim in response to the CSR change

Agree completely. Amex owns Resy. Was always going to be a credit because it's something that they can comprehensively deliver well.

Chase instead intentionally handpicked obscure select restaurants that no one will go to. People will be getting this credit randomly if they ever happen to go to one of the tens of restaurants on Chase's list.

Chase knows it screwed up. The last minute one time only $250 IHG credit (2 night stay...

Agree completely. Amex owns Resy. Was always going to be a credit because it's something that they can comprehensively deliver well.

Chase instead intentionally handpicked obscure select restaurants that no one will go to. People will be getting this credit randomly if they ever happen to go to one of the tens of restaurants on Chase's list.

Chase knows it screwed up. The last minute one time only $250 IHG credit (2 night stay still required!) reeked of desperation. Giving you the ability to use The Edit credits all at once - no one wants to use the Edit anyway, it's simply not as good as FHR. Giving away ice in winter.

When you are the largest bank by market cap in the world, you do not have a "first mover disadvantage". Give me a break. They knew exactly what they were doing - they always hated that this card provided outsized value from day one and it was never limited to the HNWIs it was really targeting. What they failed to take into account is that the CSR became a loss leader promotion for their other banking services. Made people feel good about Chase because there was a perception of value. "Hey, maybe that largest bank in the world isn't such a bad company after all!" marketing is really really really hard to get. Why on earth they would decide to shoot themselves in the public perception foot is beyond me, but kudos to Amex for rubbing salt in their self inflicted wound.

I applied to the CSR when they revamped the card and got rejected because of the 5/24 rule. Was very upset then. Then the new Amex Plat came out and I was approved. I am actually very happy now for Chase to have rejected my application as I couldn’t justify having both cards.

Of course Resy (and consequently the restaurants, since they fund Resy) is partially funding this. Why would Amex have chosen Resy if this weren't the case - they'd have just offered a $400 general dining credit.

I agree the restaurants may not be out of pocket when you specifically use it but they are derail finding Resy's share as part of their fees for the overall proposition.

@ Chris D -- To be clear, Amex owns Resy. So if Resy is funding it, Amex is funding it.

Resy is only in some major metros, so if you arent in a major city, it's very hard to use.

I dined at a local Resy restaurant but was annoyed at the end when they added an undisclosed 3% credit card surcharge.

Not true. I just searched my backwater hometown in middle America. There is one Resy restaurant. Incredibly, the entrees go up to $78. So you can definitely make full use of the credit if you just eat there once a quarter.

I actually wonder if that's where you ate. The PDF menu online says that a 3% surcharge is added, avoidable by paying cash or debit.

In some areas, they are few, but do exist. Here in Venice, Florida, there is only one, which we usually avoid because it is known for high prices. But with $100 credit last week for our party of three, ended up being pretty nice. And good food too.

In fairness to American Express, there are several participating restaurants in the town about 20 miles north of us.

San Antonio - one restaurant.

Bought a gift card - no reimbursement. Will try the actual restaurant next time I am up there.

It varies widely. I'm in a city of 45,000 people and there are at least two dozen restaurants on Resy, including several of my favorites. There's also a very popular winery so if all else fails, I can grab a couple of bottles at the end of a quarter.

NYC tourism department probably chips in because an overwhelming number of restaurants here are on Resy, and an overwhelming number of Resy restaurants are here, so having this credit draws people to NYC to spend money and pay taxes either as a visitor or even as a resident

Just went out to dinner last night to use my Platinum Resy credit. Meal cost $148. Was disappointed in myself that I didn't bring my Gold card with me (still need to use the Jul-Dec $50 credit), but I decided I might as well get some extra points, so I had the waitress charge $100 to the Platinum and the rest to my Alaska Summit card. Small extra hoop but worth it to spend on a card that provides more value.

That's how Amex gotcha - you're not organically spending that much money on dinner

I agree you have to watch out for inflated spending (vs. replacing spending), but I suspect going out last night was in part because it was the end of the quarter and the credit is use it or lose it. I also went out last night to use it (arguably that replaced eating out somewhere else).

Since they introduced this so close to the end of Q3, I suspect it created a small rush of...

I agree you have to watch out for inflated spending (vs. replacing spending), but I suspect going out last night was in part because it was the end of the quarter and the credit is use it or lose it. I also went out last night to use it (arguably that replaced eating out somewhere else).

Since they introduced this so close to the end of Q3, I suspect it created a small rush of people trying to use it immediately. I'm a little surprised they didn't say that it starts in September.

This time around yes. In the future there are places I’d normally go to where I’ll be able to use the credit organically, though to be fair I’d have to remember to carry my Platinum with me, so maybe not so organic.

I though my you had to add your Amex to your Resy app profile. No?

You do not have to

Aww, PENILE lookin’ out for others…

Out of interest if I go to a resy resturant tonight (30 Sep) but the charge is in pending for the next few days, does anyone know if I can use the credit due to expire at the end of this quarter?

Yes just make sure the date of the transaction is today

In other words don't get wasted and drink past midnight

think it kinda depends on the date it actually posts. i've had purchases on the last day of something but they end up posting on the following day instead.

Thank you so much, I had no idea it was so easy to use the Resy credit! I mistakenly assumed one would have to make the reservation on Resident in order to get the credit so this is extraordinarily helpful.

By the way, “fresh of breath air"... as that a mistake or did you do that on purpose? :-)

*Sorry Resy, not resident.

@ Dan Nainan -- Bleh, fixed, thank you!