I’ve written extensively about the Bilt Mastercard® (review), which is an innovative and rewarding credit card. The greatest selling point of the card is that you can earn points for paying your rent with no fee, as long as you make at least five transactions per billing cycle.

Bilt has just introduced a cool new feature, which makes it more rewarding to pay your rent using another credit card. I think this is something that could interest many, as the math checks out.

In this post:

Double dip on your rent payments for a 3% fee

For quite some time, Bilt has allowed people to pay rent through the Bilt platform using a credit card other than the Bilt Mastercard, for a 3% fee. That’s not the most exciting thing on earth, but could still make sense for some people, since you earn whatever credit card rewards that card offers (but not Bilt points, at least historically).

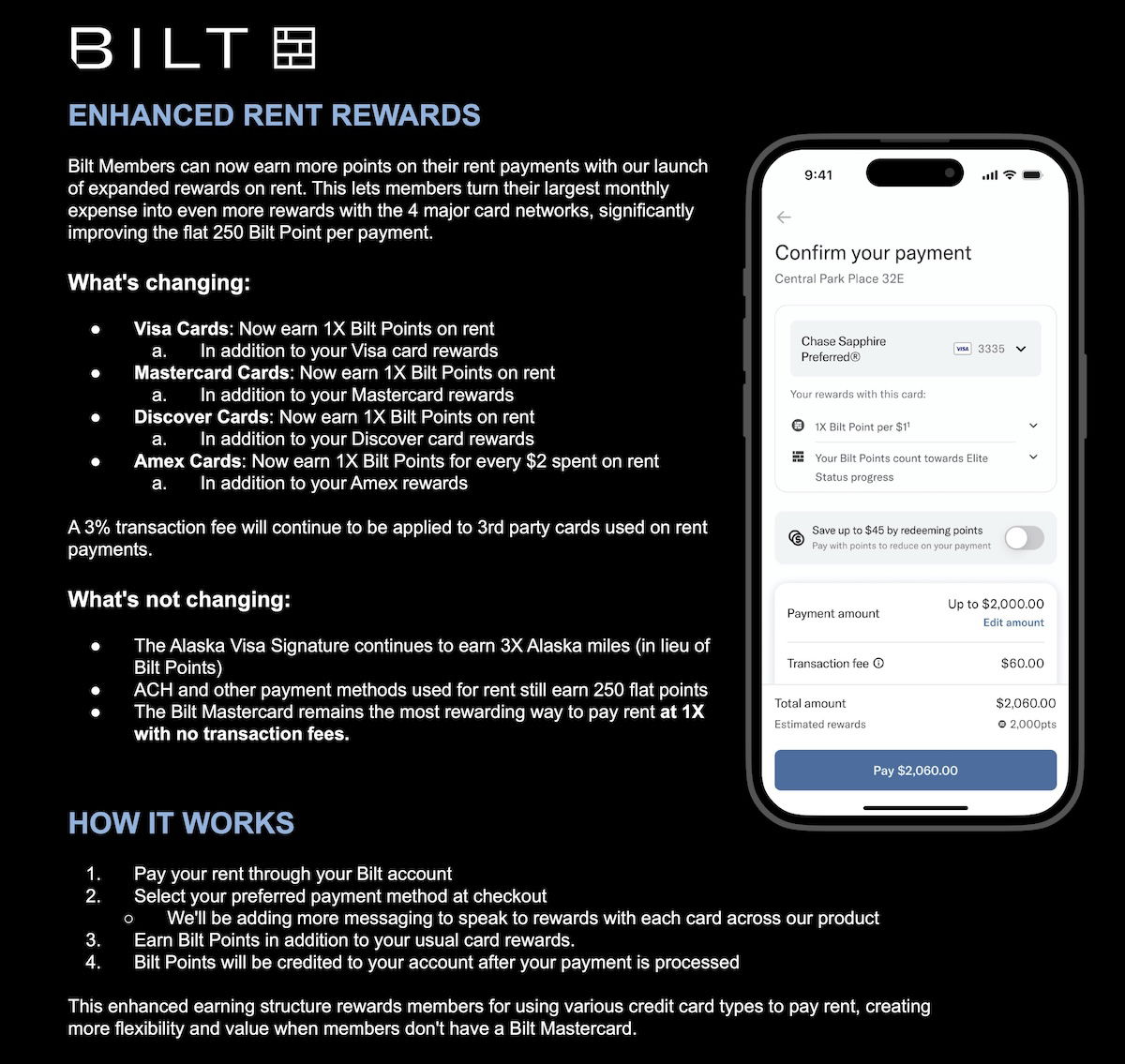

There’s now an exciting update to this, as Bilt has improved the rewards that you earn when paying your rent with any credit card. If you pay the 3% fee for your rent spending through Bilt on another card, you now also earn Bilt points.

Specifically, for Discover, Mastercard, and Visa products, you earn 1x Bilt points per dollar spent on rent, while with Amex products, you earn 1x Bilt points per two dollars spent on rent.

To take advantage of this opportunity, you just need to have a Bilt account (which is free, and is separate from applying for the credit card), and then you need to set up your preferred payment method for your rent payment. Then Bilt points will be credited to your account after your payment is processed.

Note that as before, those with the Alaska Airlines Visa Signature® credit card (review) can earn 3x Mileage Plan miles per dollar spent on rent through Bilt, on up to $50,000 spent annually (after that, you earn 1x miles). That also requires paying the 3% fee, and nothing else about that opportunity has changed, as this is part of a special partnership between Alaska and Bilt.

Is paying rent by card with a 3% fee worth it?

Of course it’s nice to have the no annual fee Bilt Mastercard, and to be able to earn rewards for paying rent, all without paying any extra fee (as long as you have five transactions per billing cycle).

However, I’d argue there’s merit to using another card as well. Yes, you pay a 3% fee, but being able to double dip is awesome. You could use one of the best cards for everyday spending (like one that earn 2x transferable points currencies), and then you could also earn 1x Bilt points per dollar spent. So we’re potentially talking about earning 3x transferable points in exchange for a 3% fee, which I’d consider to be a great deal. If you ask me:

- This could be a good deal for someone who just doesn’t want to get the Bilt Mastercard, for whatever reason; I get that there are limits to how many cards people want to add to their wallets

- This could be a good deal for someone who wants to boost their credit card spending, to earn a welcome bonus, to achieve some sort of other spending threshold bonus, etc.

Bottom line

Bilt has improved the ability to earn rewards for rent payments when not using the Bilt Mastercard. You can now use any other card to pay rent, and earn 1x Bilt points per dollar spent (1x Bilt points per $2 spent on Amex cards), in addition to credit card rewards, in exchange for a 3% fee.

I’d say that this could represent a good deal, in particular if you have a minimum spending requirement you’re trying to reach.

What do you make of the opportunity to double dip points for rent payments through Bilt?

This seems brilliant on Bilt’s part. Before, they were giving you 1x points on rent for free. Now, they are charging you 3%, probably paying 2% to the processor, and keeping 1%. So rather than giving you 1x points on rent for free, they are giving it to you for net 1%, which is likely breakeven or even a bit profitable for them.

Yeah. Makes you wonder if they should just ditch the whole CC model and focus on being a middleman, although there are some people who use the BILT as their primary spend card, as crazy as that sounds.

Does BoFA categorize Bilt transactions in any of the 5.25% cashback categories for the BoFA Customized Cash Rewards credit card? Will Bilt initiate any adverse actions if I do a test rental payment of $100?

My rental portal charges a 3% fee for credit card payments and no fee for ACH payments. I currently get 5.25% cashback because BoFA credit card payments are coded as ONLINE and TRAVEL (REAL ESTATE AGENTS AND MANAGER--RENTALS).

Waiting for Bilt tech support. As others have reported, the app is not cooperative or intuitive.

If only my rent was $33,333k per month, I could get that Cap One Vx Business offer of 350k. /s

Really surprised that business cards can be used for this, since rent is clearly a personal expense. I know most places don't care, but my electric company won't take payments from a business CC.

Business can rent dwelling for employees.

Anyone know if this can still be used to pay maintenance fees and earn points (based on anecdotal evidence)?

Yes I use my AS cc monthly to pay HOA

Very useful for high-spend SUBs.

While the point return wouldn't be as lucrative as a 2x transferable card, using an AA card would present another way to manufacture loyalty points towards status.

@305, I hadn’t thought of that but that’s a great suggestion. Thanks

My slum….i mean landlord is check only, and this still seems to be unchanged for us check folks. Am I wrong? I cannot see how it’s updated there.

you could always use a credit card to pay rent by check on bilt

My mistake, yes I meant can I now use say my Alaska card to pat rent via check? I’ve been using my Bilt card but would prefer to use, at times, other cards.

I use Bilt to mail my landlord a check, and b/c I have the Bilt MC, I get 1x points on that.

Oh. Whoops I mean Other than the Bilt card

Countdown for the Credit card networks to classify Bilt payments as cash advance..

Why would the credit card networks care? The current credit card "processing" fees are added by your property management service because *they* do not want to pay the "hefty" credit card fees. In fact, some management services like my own lovely one add small fees to any card transaction, even debit.

Plus Amex won't care regardless -- people are still getting free cash advances via Amex Send/Venmo with no repercussions.

They are preparing everyone for the termination of their agreement with WSF.

Precisely this. They are testing the waters.

WSF? Does that stand for Wells Fargo?

Interesting. I'm tempted to start doing this just because I hate the BILT card so much (I have a credit limit that's literally $150 more than my monthly credit limit, so If I don't time payments right by credit score can get a nasty utilization ding).

Like Ben says, though, the ideal strategy here is to go after SUB for a new card and double-dip.

Gosh I wish they had something like this for mortgages and auto loan payments.

I'm sure at 3% Bilt would be happy to sell you points for anything.

This is just testing the system.

They’ve teased mortgage payments.

But no actual dates.

I don't know what Bilt is as I have never read up on it, but if it is a credit card, it would not be/will never be able to be used to pay mortgage or auto loan.

That would be amazing

@Justin Dev, thank you for that insightful contribution.

@Redacted:

Your comment can be taken one of two ways. I will take it that you mean to be sarcastic. In response to my assuming it is sarcasm, I will state that I think it is blatantly obvious why it will not be able to be used to pay mortgages etc. But for those who do not understand the obviousness of this...

Ben stated :"I’ve written extensively about the Bilt Mastercard® (review), which is an...

@Redacted:

Your comment can be taken one of two ways. I will take it that you mean to be sarcastic. In response to my assuming it is sarcasm, I will state that I think it is blatantly obvious why it will not be able to be used to pay mortgages etc. But for those who do not understand the obviousness of this...

Ben stated :"I’ve written extensively about the Bilt Mastercard® (review), which is an innovative and rewarding credit card."

The obviousness: A credit card is a debt instrument. Mortgages and car loans are also debt instruments. The credit card networks will not allow a debt to be paid with a debt.

@Justin, relax. My comment was indeed sarcastic but perhaps not for the reason you think. My point is that four years ago, someone might have said something similar about earning points and not having a fee for credit card rent payments… then BILT came along. It’s okay for people to hope/dream that some day the same will be offered to mortgages. That’s all.

@Justin Dev

"not allow a debt to be paid with a debt"

The obviousness: Balance transfer, debt consolidation, refinance, etc.

Does anyone know if this can be done when paying by check with the Bilt Card (via "BiltProtect Debit"? I am not seeing a way to actually change the payment method from the Bilt card when selecting pay by check.

I don’t use BILT protect, but doesn’t that just pull directly from your bank account?

Don’t you only use that if your BILT credit line is too low?

If your other credit card has enough of a credit line, you can just use it directly, no BILT protect needed.

So, paying with the Alaska Visa only earns 3x AS, but 0x Bilt?

You get the Bilt points, too! Can confirm that this happened with my April payment (1x Bilt points plus 3x Alaska points). Thought it was a glitch, but this article makes me realize it was intentional.

wait if this is true, then Alaska visa is lowkey hella hype!

I didnt get the Bilt 1x for April, only AS 3x

I just conirmed with Bilt:

“We can confirm, for your Alaska Airlines Visa card, you will only earn 3 miles for every dollar spent on rent, you will not receive Bilt points when paying with this card.”

Hi Eric, which date was ur Apr payment?

I'm trying to figure out how much in fees I'll end up paying with this promotion...

My property isn't Bilt affiliated, so I currently pay no fees by paying rent with my Bilt ACH account.

Using a credit card (visa/MC/Amex) at my rental property charges a 4%ish fee, so will Bilt charge another 3% on top of that?

No. You will only be charged the Bilt fee of 3%. You first charge the rent amount to your credit card using the Bilt app. Bilt will then provide you with a bank routing and account number, which you will use to actually pay your rent on your landlord's online portal. You landlord will treat the transaction as a bank account transfer, not a credit card payment. That is the beauty of the system!

Yeah, like Regis says it's just the 3% since you're making the payment directly to BILT. Obviously if you had to pay the typical credit card fee this would negate the points benefit for anything other than a sign up bonus.

Ahh.. that makes more sense.

So in essence, Bilt is acting like the middleman to take the CC payment and 'relay' to the rental property via ACH, hence the 3% fee by them.

So if my rent was $2000 and used the Amex BBP which gets 2 points per dollar, I get 4000 Amex points, 1000 Bilt points, and get charged a 3% fee by Bilt which would be $60?

Or if I linked a 1.5 points per dollar CFU, it would be 3000 Chase points and 2000 Bilt points?

@Jinxed_K, yeah that math looks correct to me -- not a bad deal. I just wish I had a 2x general spend card right now :(

Thanks for the heads up Ben! I just signed up for the Citibank AA Mastercard. In order to achieve the minimum spending for the 75K sign up bonus, I was going to use the card to pay my rent this month using my landlord's online portal. Now I will use the card to pay the rent through the Bilt app and collect those Bilt points too. Every point counts!

Well said! Ben gets so much hate for his BILT posts, but the amount of money he has saved me and countless others by timely updates on this stuff is brilliant.

4% Smartly getting plugged into the BILT payment process for as long as it lasts!

Let’s go!

And does paying with a card other the Bilt one still count earning elite status the same way as Bilt card?

@ zz -- All Bilt points earned count as qualifying points, but they wouldn't count toward the "fast track" that's based on spending on the Bilt Mastercard.

BILT MC spending for rent specifically never counted for “fast track”

So that means, if I pay using the AS visa card, it won't earn anything toward Bilt status?

BILT status has two “tracks”.

The regular track counts rent payments and everything else.

The “fast track” doesn’t count rent payments.

IMO (not IMHO; I'm a $6MM/year equity partner and not afraid to flaunt it)

If you already have a lot of points, and I suspect many people reading this have more points than they know what to do with, it doesn't make sense to pay to hoard even more points. Signup bonuses and whatnot on other cards should be met with organic spending that incurs no additional fee.

Points lose value over time. Providers make...

IMO (not IMHO; I'm a $6MM/year equity partner and not afraid to flaunt it)

If you already have a lot of points, and I suspect many people reading this have more points than they know what to do with, it doesn't make sense to pay to hoard even more points. Signup bonuses and whatnot on other cards should be met with organic spending that incurs no additional fee.

Points lose value over time. Providers make redemptions more expensive and points don't make interest. Cash, invested or even in a HYSA, grows in value.

I'd almost never pay to earn more points. This is no exception.

Paying for points can be speculative, yes, but IMO there can be value to this practice. I disagree with your assertion that most people here are sitting on mountains of points. In fact, any experienced points/miles enthusiast knows that the first rule in this space is to earn & burn. That means that you are always trying to increase your points pile with the aim to redeem within the short/medium term --> do not horde...

Paying for points can be speculative, yes, but IMO there can be value to this practice. I disagree with your assertion that most people here are sitting on mountains of points. In fact, any experienced points/miles enthusiast knows that the first rule in this space is to earn & burn. That means that you are always trying to increase your points pile with the aim to redeem within the short/medium term --> do not horde your points for more than 6-12 months for the very reasons you stated. So if your goal is to earn & burn, then this is a good way to do it.

Nah this fake Skadden partner is just a wannabe. Don't take his word for anything.

Real 6MM partner rolls with Centurion card and several million points. The looks when a social climing gold digger like @Arps see how many points we have is priceless.

The game is never about maximizing earning or burning.

If you were a partner at Davis Polk ($7.8MM PPP), you wouldn’t even need to come to OMAAT every day desperately looking for miles and points deals.

I respect you for making a good point, and for no reason other than to attract attention that you evidently feed on, adding in a line that makes anyone reading your comment immediately think you're a douche, and welcoming that. Non $6MM/year equity partners getting peeved at you must get you off or something. Gangster stuff. Touche.