Delta Air Lines has long led the US airline industry when it comes to profitability, and in recent years, it seems like there have been no signs of the good times ending. Well, that’s finally starting to change, and some cracks are forming…

In this post:

Delta cuts earnings guidance, stock tanks

Delta has just slashed its earnings and revenue guidance for the first quarter of 2025, ahead of a Tuesday morning presentation at the JP Morgan Industrials Conference. The reason?

“The outlook has been impacted by the recent reduction in consumer and corporate confidence caused by increased macro uncertainty, driving softness in Domestic demand.”

With this updated guidance, Delta has cut its first quarter revenue growth forecast to 3-4%, less than half its earlier forecast of 7-9%. Furthermore, the airline has adjusted its forecast for adjusted earnings to 30-50 cents per share, compared to the earlier forecast of $1 per share.

With this update, the airline expects a first quarter operating margin of 4-5%, compared to the earlier forecast of 6-8%. However, the airline notes that “premium, international and loyalty revenue growth trends are consistent with expectations and reflect the resilience of Delta’s diversified revenue base.”

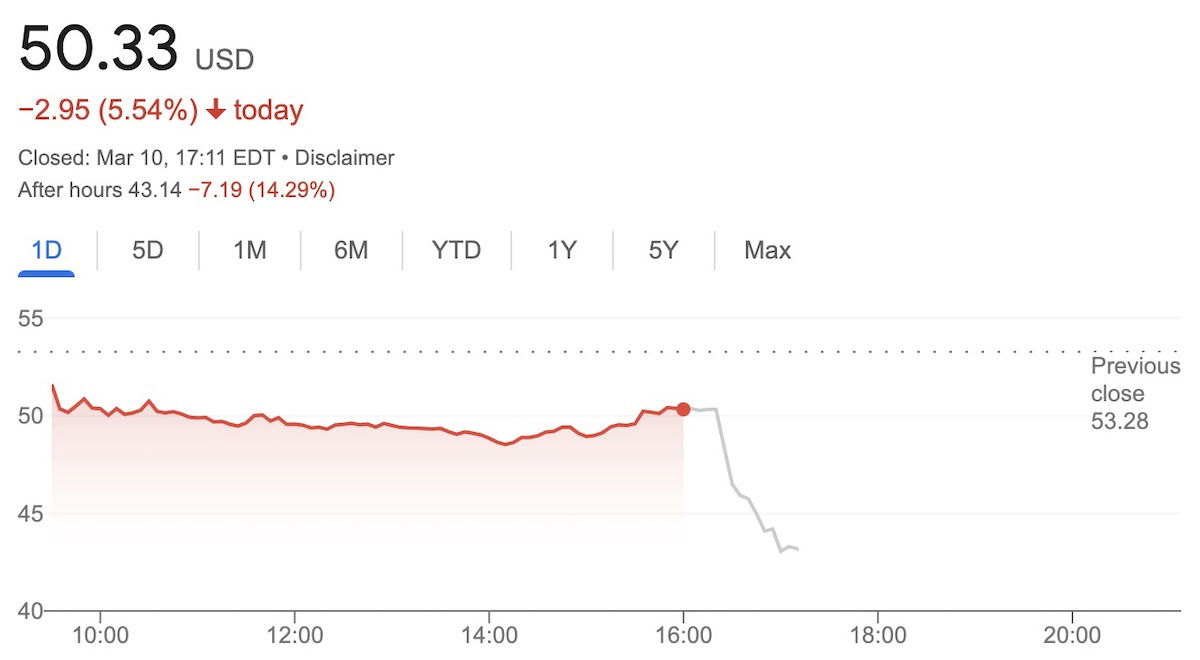

Delta’s stock is tanking in after hours trading, and as of the time of this post, shares are down over 14% (and they’ve already dropped around 25% over the past month).

As you’d expect, other airlines are impacted as well, since this has implications for the entire industry. In particular, United is viewed as Delta’s biggest competitor nowadays, and the carrier’s shares are down 11%.

Is this a bump in the road, or more serious than that?

I’ll let everyone decide for themselves why consumer confidence might be sinking. I mean, I have some theories, but we live in a world where everyone has their own reality, so I don’t want to impose my beliefs on others.

Airlines like Delta and United have been incredibly resilient in recent years. Despite the drop in business travel, the airlines have seen strong demand for premium, international, and leisure travel, plus have had strong revenue for their loyalty programs, and that’s why they’ve been reporting record revenue and profits. There has basically been no sign of that slowing down… until now.

So one wonders, is this just a temporary bump in the road due to [insert what you think is causing this], or is this the start of a bad time for the airline industry?

The airline industry has of course dealt with massively rising costs (especially with labor), so they need a lot more revenue to even cover their costs. In the United States, even the most profitable airlines basically just break even on flying passengers (since the cost per air seat mile and revenue per air seat mile are roughly comparable), and make most of their profits through other means, like their loyalty programs.

There’s only so much upside with loyalty programs, so if consumer confidence continues to decrease, it’ll be even worse news for other airlines, which don’t have loyalty programs that are quite as lucrative.

Bottom line

Delta has updated its guidance for the first quarter of 2025, and it’s bad news. Projected revenue growth and earnings have both been more than slashed in half, which isn’t good. The airline blames this on a reduction in consumer and corporate confidence, caused by increased macro uncertainty.

What do you make of Delta’s updated earnings guidance, and how do you see this playing out for the industry?

Not at all

Its simply folks started saying no to one way 500 dollar coach tickets short haul plus bag fees plus non refundable seat fees

Did I say easily the most overpriced award redemption in aviation history on average.

Others are bad but not that bad!Ripping off customers with greed has come back to roost/bite them in the backside

Well gee confidence has nothing to do with landing a plane upside down....nope all economy based, because we "hate the guy".....yup!

I love how all it took was the 3 months between election promises and inauguration actions to sink the booming economy Biden built post-COVID. Even though people moaned about the price of eggs, consumers were spending like it was a strong economy. Eating out more, going on more vacations, buying more luxury items. Now Trump is actually at the precipice to hike the prices of literally everything with his tariff fixation, and surprise surprise people...

I love how all it took was the 3 months between election promises and inauguration actions to sink the booming economy Biden built post-COVID. Even though people moaned about the price of eggs, consumers were spending like it was a strong economy. Eating out more, going on more vacations, buying more luxury items. Now Trump is actually at the precipice to hike the prices of literally everything with his tariff fixation, and surprise surprise people are realizing their utility bills, gasoline bills, and even basics like COFFEE are going to get much more expensive.

What the heck did you Trump voters think "tariffs" meant? Vibes? Essays? You got what you voted for.

Genius HOW MUCH IS CANADA's Tariffs on US milk? Bet you have NO CLUE right? Try 270% BEFORE "the guy you hate and lives in your head daily" was even elected....is that Fair Dusty? Is it?

Guess who negotiated the deal that resulted in that potential tariff (which only comes into play if certain conditions happen... which they haven't ever yet).

Tell me Bill, who pays a tariff? The exporting country, or the importing business? And why is it so important to you that American milk farmers gain access to the 40 million person Canadian market when they have a 340 million person domestic market to sell to?

Trump did this.

Trump take earnings.

Uncompassionate take: With DOGE taking an axe to government travel, could we see more open seats and thus J availability to/from IAD?

Consumers have never had such levels of credit card debt, not mention student loan and car loan debt. The post COVID gimmies and days of free flowing credit card spending is coming to an end. It hit the ULCCs first because that's the group of consumers that first taps out.

While I support most of what Trump is doing this is going to haunt him. There isn't much that can be done unless the government starts more rounds of helicopter cash to the masses.

A change in consumer spend would seem to hurt Delta the most.

While Delta has a premium reputation, the reality is they lose, BY FAR, the most money flying passengers. And Delta spends THE MOST money to fly those passenger per ASM despite AA having the shorter stage lengths between AA and DL which should naturally give AA the higher casm between the two.

Delta's profits come from other revenue like card spend....

A change in consumer spend would seem to hurt Delta the most.

While Delta has a premium reputation, the reality is they lose, BY FAR, the most money flying passengers. And Delta spends THE MOST money to fly those passenger per ASM despite AA having the shorter stage lengths between AA and DL which should naturally give AA the higher casm between the two.

Delta's profits come from other revenue like card spend. There are other things that come into CASM but they're largely things that simply support the flying of passengers like the refinery. United does, by far, the best flying passengers at a profit.

2024 PRASM vs CASM

DL:

PRASM: 17.65

CASM: 19.30

Flying profit/(Loss) per ASM: ($0.0165)

AA:

PRASM: 16.93

CASM: 17.61

Flying profit/(Loss) per ASM: ($0.0068)

UA:

PRASM: 16.66

CASM: 16.70

Flying profit/(Loss) per ASM: ($0.0004)

Delta and Amex fit like a glove but DL is very exposed to their credit card for profitability. As consumers spend less with credit cards and as their mileage devaluation continues, Delta could see the biggest impact. . It works in the short term, but it's uncharted territory whether it works in the long term.

and yet DL said their loyalty program is not seeing weakness. Neither is their international or premium passenger revenue -domestic or international.

It is the low end domestic market that is most exposed and DL transformed itself years ago to take less and less of that market.

It is the ultra low cost carriers and WN and B6 that are most exposed to these changes.

And UA's plans to grow domestic revenue by taking basic...

and yet DL said their loyalty program is not seeing weakness. Neither is their international or premium passenger revenue -domestic or international.

It is the low end domestic market that is most exposed and DL transformed itself years ago to take less and less of that market.

It is the ultra low cost carriers and WN and B6 that are most exposed to these changes.

And UA's plans to grow domestic revenue by taking basic economy share from other airlines will be much harder.

It is AA and UA that STILL have yet to bring ALL their employees up to industry-leading pay levels. AA and UA have benefitted from not having to pay higher salaries while DL and WN are paying at that level.

At some point, AA and UA employees will say enough is enough and those two companies will have to absorb even higher costs on lower revenues.

and AA has a new credit card contract that closes the gap with DL. UA does not have a new credit card contract. It will be much harder for them to get what DL and now AA has if the bottom falls out as you think it is doing.

DL is in the best shape in the industry to weather the next economic cycle no matter how long it lasts or how deep it goes.

"It is AA and UA that STILL have yet to bring ALL their employees up to industry-leading pay levels. "

Which AA groups, Tim? Try again. And think before you type. But perhaps you actually are this ignorant. That is not true as it pertains to AA.

AA's credit card deal hasn't started yet and isn't in the numbers. nice try.

Delta loses, by far, the most money flying passengers. Facts hurt. You just don't...

"It is AA and UA that STILL have yet to bring ALL their employees up to industry-leading pay levels. "

Which AA groups, Tim? Try again. And think before you type. But perhaps you actually are this ignorant. That is not true as it pertains to AA.

AA's credit card deal hasn't started yet and isn't in the numbers. nice try.

Delta loses, by far, the most money flying passengers. Facts hurt. You just don't like them.

Delta is VERY exposed to their credit card deal. And we'll see what Delta says about 2Q and 3Q today and the coming weeks.

Like I said before, this would be the first downturn ever to see higher international exposure vs domestic as a positive thing. No one is taking a trip to RAK if they can't buy eggs and milk.

Are you really going to spend your entire day arguing facts and data again?

You really don't know which AA employee groups don't post covid contracts? It isn't just about FAs.

And it doesn't change that UA has the most employee groups that need to be brought up to post covid salary levels which are much higher than before covid.

AA has provided guidance about what its Citi deal w/ generate. The market is counting on it.

DL generates the most ancillary revenue and it is the bottom...

You really don't know which AA employee groups don't post covid contracts? It isn't just about FAs.

And it doesn't change that UA has the most employee groups that need to be brought up to post covid salary levels which are much higher than before covid.

AA has provided guidance about what its Citi deal w/ generate. The market is counting on it.

DL generates the most ancillary revenue and it is the bottom line that matters no matter how much you or anyone else wants to think that DL's revenue is at greater risk.

and it is DC revenue that is being hurt the most for any region. For once, being weaker than AA and DL and WN in the BWI/DC area is an advantage for DL

You desperately want to see DL fall - we get it. You simply do not understand or want to believe what is actually being said and who is most vulnerable.

It isn't DL, max

correction

and it is DC revenue that is being hurt the most for any region of the country. For once, being weaker than AA and UA and WN in the BWI/DC area is an advantage for DL

"You really don't know which AA employee groups don't post covid contracts? It isn't just about FAs."

Again, Tim. Name the AA group that doesn't have a post covid contract. There isn't one. Your ignorance and double down on that really never ceases to amaze.

"and it is DC revenue that is being hurt the most for any region. For once, being weaker than AA and DL and WN in the BWI/DC area is an...

"You really don't know which AA employee groups don't post covid contracts? It isn't just about FAs."

Again, Tim. Name the AA group that doesn't have a post covid contract. There isn't one. Your ignorance and double down on that really never ceases to amaze.

"and it is DC revenue that is being hurt the most for any region. For once, being weaker than AA and DL and WN in the BWI/DC area is an advantage for DL"

And yet DL is lowering their revenue guidance more than AA. Nice try. Try again.

"You desperately want to see DL fall - we get it. You simply do not understand or want to believe what is actually being said and who is most vulnerable."

And here we go... Tim defaults to the only response he has when confronted with facts. Delta was impacted the most, so far (i haven't looked to see if UA posted new guidance yet), I noted that vs AA. Despite the fact that AA is FAR more exposed to the worst revenue environment in the US, DC. You said yesterday Delta change in guidance would be better than others. it is not. You were wrong, as usual.

I also showed with SEC filings that Delta loses the most money flying passengers. That is just a fact. Their credit card deal is the most profitable in the US. But it also means they're the most exposed to reduced consumer spend. Delta loses the most money flying passengers. There's just no debate there when you look at the numbers.

Yep. We get it. You don't know how to respond to data but move along. You're wrong and just trying your usual obfuscation trying to say people want to see Delta fail.

Tim, I enjoy watching you fall in your face with your usual idiocy day after day. I have no desire to watch any company fail. I do desire to note facts that Delta is, so far, the most impacted of the US3 by their change in revenue guidance and that they already lose the most money per ASM flying passengers, by far.

AA and its wholly owned subsidiaries have over 10,000 employees whose contracts are beyond the date of being amendable or will be this year.

If you don't realize that AA was expecting to post a loss before and is now guiding to a deeper loss, you truly aren't interested in facts. DL will make money. UA probably will. It is up for debate about the rest of the industry but AA certainly will not. DL...

AA and its wholly owned subsidiaries have over 10,000 employees whose contracts are beyond the date of being amendable or will be this year.

If you don't realize that AA was expecting to post a loss before and is now guiding to a deeper loss, you truly aren't interested in facts. DL will make money. UA probably will. It is up for debate about the rest of the industry but AA certainly will not. DL will be the most profitable US airline not just for the first quarter but for the whole year.

The only that works overtime posting multiple times per day to try to convince the world you are right is you - and you are wrong. You cherrypick and manipulate data more than anyone else because you desperately can't stand to admit that DL still sits at the top of the industry.

oh now we're expanding the reference. Ok. why don't you talk about Endeavor unions?

Every AA mainline union group has a post covid contract.

You can go ahead and stop your usual attempts to broaden the topic when you realize you're wrong.

"If you don't realize that AA was expecting to post a loss before and is now guiding to a deeper loss, you truly aren't interested in facts. "

Not you bringing...

oh now we're expanding the reference. Ok. why don't you talk about Endeavor unions?

Every AA mainline union group has a post covid contract.

You can go ahead and stop your usual attempts to broaden the topic when you realize you're wrong.

"If you don't realize that AA was expecting to post a loss before and is now guiding to a deeper loss, you truly aren't interested in facts. "

Not you bringing up a new topic that I never said.

Get a life, loser. Your attempts to misdirect the actual topic are laughable, as usual. I never talked about whether AA was going to be profitable in the first quarter.

Bring up new topics? Like redefine profits by tailoring only what you want to discuss?

Delta will still be the most profitable US airline just a little less than before.

Stop coming up with your own cherry picked metrics and we can each post once and be done

You live in your own world.

My post was about Delta's profits being derived from credit card revenue. They are.

Go back to your hole. You're a useless troll that can't respond on topic or intelligently.

Prasm vs CASM is not cherry picked data lol. This is truly just tragic from you.

Revenue Guidance so far:

Delta: 8% to 3.5% = down 450 basis points

AA: 4% to Flat = down 400 basis points

UA: No update yet on their IR page at 8am eastern

EPS:

Delta: down $0.45/share

AA: down $0.40/share

At 8am eastern time. Delta is the worst in "delta" vs prior guidance but certainly by no means by a lot.

one day and esp. pre-market movements have very little to no significance over a quarter or let alone a year.

DL often peaks and falls the most because it is the US and global airline that identifies trends first.

They are still the highest market cap airline and based even on the guidance they have provided will still be the most profitable US airline

your celebration of DL doom is more than premature

AA should've had the worst change in guidance since government travel has been slashed out of DCA. They did not. It was Delta

And Tim, "one day and esp. pre-market movements have very little to no significance over a quarter or let alone a year."

It's literally a guide to the quarter. Yes, it does have significance to the quarter. What an idiotic response lol

"your celebration of DL doom is more than premature"

...

AA should've had the worst change in guidance since government travel has been slashed out of DCA. They did not. It was Delta

And Tim, "one day and esp. pre-market movements have very little to no significance over a quarter or let alone a year."

It's literally a guide to the quarter. Yes, it does have significance to the quarter. What an idiotic response lol

"your celebration of DL doom is more than premature"

you stated yesterday every guide would be worse than DL. It was not despite that it should've been AA given the government funding slash. No one is celebrating DL Doom or saying it is doom. I reported change in guidance. Nothing more.

Delta is hurting the most

except the stock movements that you are fixated on for one day don't tell the whole story.

DL guided to a much higher profit than any other US airline for the first quarter. The amount that DL is pulling back to will still be a larger profit than other airlines including AA.

you desperately want to see DL fail. We get it.

as with everything else, you manipulate reality to match what you want -...

except the stock movements that you are fixated on for one day don't tell the whole story.

DL guided to a much higher profit than any other US airline for the first quarter. The amount that DL is pulling back to will still be a larger profit than other airlines including AA.

you desperately want to see DL fail. We get it.

as with everything else, you manipulate reality to match what you want - not the reality that actually exists.

it is you that has jumped on here multiple times.... keep it at. You will still be wrong.

when did I ever mention stock performance? Are you high? Did you forget your meds?

Focus on facts. Focus on Data. You've never liked what Delta says about their own hubs. You seem to hate Delta's own 10-K. Now you hate their own revenue guidance despite little exposure to DC revenue, like AA.

Go back to bed little man.

You cherrypick and manipulate data more than anyone else because you desperately can't stand to admit that DL still sits at the top of the industry.

You can just apologize and admit you're wrong. I never talked about stock performance. Trying to respond with an insult is just your usual attempt to say something while saying nothing.

I talked about PRASM vs CASM. I brought up new revenue guidance from AA and UA. Manipulation? Hardly. Delta loses the most money flying passengers per ASM. If you hate that, talk to the Delta folks that write the 10-k. Your idiocy is omnipresent and not worth responding to.

Fired from Delta.

Banned from multiple websites.

Resorts to the same weird insults when proven wrong.

Ladies and Gentlemen, Tim Dunn.

In other words you can’t compete on content and facts so you attack the messenger

Meet Max. Tiny little max in every sense but with a big keyboard

I have never been fired from anything

yes you have, Tim. Fired for your drinking from Delta. It's well documented from your a.net days.

And your drinking has not stopped. You still get on here and talk about things you know nothing about and that no part of the industry has ever fired you for, most of all delta, that fired you.

Your attempts to change the topic to something new like stock performance are so strange but also your easy...

yes you have, Tim. Fired for your drinking from Delta. It's well documented from your a.net days.

And your drinking has not stopped. You still get on here and talk about things you know nothing about and that no part of the industry has ever fired you for, most of all delta, that fired you.

Your attempts to change the topic to something new like stock performance are so strange but also your easy tell when you know you have nothing to respond with. You attack others then change the topic and act like it was the topic all along.

Again. A troll. Get a life.

the bigger airline story for today is that WN is ending bags fly free for most passengers.

Combined w/ domestic weakness which appears to be the source of DL's problems, and thus the industry's, the road to financial recovery for WN will be much tougher.

From the outside looking into the goldfish bowl, your ‘president’ Rocket-man, does not appear to be having a good start to 2025.

DL are not the only US enterprise who could fall foul of the marriage of such strange bedfellows.

One awaits the anticipated humorous rhetoric, to be caused by the arrival of the new British Ambassador in DC.

Slime ball meets hard balls could be very entertaining.

I believe that IAG and AFKL both beat analyst expectations, so this doesn't look like an industry-wide global phenomenon.

It's country-wide, not industry-wide. And there's a reason for that.

Why is DL updating their Q1 guidance so significantly with less than three weeks left in the quarter?

To cut the guidance by more than half with so much of the quarter completed, they either saw this coming since early February, or revenue has dropped off a cliff, accounting for the last few weeks having such an outsized impact.

most companies provide updates in the last half to third of the quarter. They don't report their financials the day after the quarter ends so the update in this case is in the final third of the reporting cycle.

there is an airline industry investor conference today which provided the platform for DL to update its guidance. Other airlines will be asked the same thing at the conference or outside.

The stock market is unwinding...

most companies provide updates in the last half to third of the quarter. They don't report their financials the day after the quarter ends so the update in this case is in the final third of the reporting cycle.

there is an airline industry investor conference today which provided the platform for DL to update its guidance. Other airlines will be asked the same thing at the conference or outside.

The stock market is unwinding most of the gains the strongest players in the airline industry had over the past year.

I wonder though if Delta does actually lose its coveted spot as the most profitable airline in the entire world will Tim finally stop using that as a reason to defend Delta. Regardless, I am concerned about the overall economy of the U.S. Not sure how much worse it is going to get before it can get better.

Delta has not been the most profitable on a worldwide consistent basis. It has been the most profitable among US carriers - and in the Americas.

It does generate the most revenue and also has the highest market cap - although that is likely to shrink by about 25%.

The rest of the US industry is moving down as well.

Let's see where the rest of the industry heads but DAL is not likely to give up those two titles.

and if the highest market cap

In short, people are hesitant to plan trips if they're not going to be able to afford electricity and eggs.

It all started last week when he decided to announce fake tariffs on Mexico and Canada.

So glad Bastian’s alignment with the victor is beginning to pay off for him.

"I’ll let everyone decide for themselves why consumer confidence might be sinking. I mean, I have some theories, but we live in a world where everyone has their own reality, so I don’t want to impose my beliefs on others."

This is to become a Classic! Very impressed by the way you are able to express yourself, Ben.

In times past, like two months ago, the federal government would have salivated, rightfully so, to get their hands on somebody as gifted.

I commend Ben for his restraint.

Regardless of where things go, there is no doubt that there will be pain getting there. Not sure most Americans vote to be worse off as part of the process of remaking the American economy and government - although they may or may not be happy in 3 years and 8 months.

With travel ban/restriction on many fed employees, meetings are being cancelled in the last minute and my colleagues are busy cancelling flights to DC. Like exactly 5 years ago, we're rapidly switching meetings to virtual. No surprise airlines feel pressure.

Sure, earnings are falling and the stock market has given up all gains since October, but at least things are getting more expensive now that we have tariffs. Plus we have more measles than we've had in long time and RFK is going to help people pick food that will prevent measles, and we are finally slashing employment at the FAA, National Parks, Social Security, VA, and all these other agencies that people have been...

Sure, earnings are falling and the stock market has given up all gains since October, but at least things are getting more expensive now that we have tariffs. Plus we have more measles than we've had in long time and RFK is going to help people pick food that will prevent measles, and we are finally slashing employment at the FAA, National Parks, Social Security, VA, and all these other agencies that people have been trying to eliminate for decades. Keep the stupid factory running. Do not stop. The last thing I want to see is a pause to this idiocy. Keep it up for 4 years. This guy has been a joke since the 1980's. No rationale, words or facts will ever reach the acorn brained people who watched the Apprentice and thought it was real. Only personal suffering will. More. Keep it coming.

Why are you complaining now.

Every voter had a 4 year preview and they still voted for him.

Well, in all fairness, people who didn’t vote for DJT are free to complain.

Well, in all fairness, people who didn’t vote for DJT are free to complain.

Well in fairness, that's democracy. You had your chance of voting against him and YOU failed.

The only thing you're really complaining is about democracy.

Not a complaint, keep going. More of this.

Yep, that's what I told my family members that voted for Trump. I hope they get everything they voted for.

Hey, quick question for those who voted for Trump: Are you better off now than you were a year ago?

Cmon comparing to Joe Biden is doing Trump a favor.

The only significant accomplishment for Biden was he prevented Trump from being reelected. A task he failed 4 years later.

Nah, Trump had a pretty strong chance of getting re-elected no matter who the Democrats ran. You said it yourself, the voters did this. And for better or worse, thanks to Elon and the right-wing media machine, voters are swimming in a sea of misinformation. Remember, the cost of lies is not that we'll mistake them for the truth. It's that if we hear enough lies, we no longer recognize the truth at all.

Unless FA's stop saying "this flight is completely full, take your bags off of the seats and do not put your personal item in the overhead bin", I ain't believing this. People are about to be flush with tax return money and will be spending it.

Lounges are bursting at the seams and premium cabins are full.

I’ve been on quite a few not so full flights lately.

Front cabin could all be upgrades.

I have a may reservation on united and the flight was canceled, so I was moved to another departure. The planes will go out full but they will consolidate departures

The economy has been stagnant for a while….better part of 18 months.

The quality of jobs was an issue for that long. Most job growth was shown to be part time at a full expense to full time work.

Layoffs have been happening for a while. It takes a while to people to run through thier cushion until they have to make hard decisions. Which travel is the first to go.

The...

The economy has been stagnant for a while….better part of 18 months.

The quality of jobs was an issue for that long. Most job growth was shown to be part time at a full expense to full time work.

Layoffs have been happening for a while. It takes a while to people to run through thier cushion until they have to make hard decisions. Which travel is the first to go.

The economy hit the iceberg early last year. It takes a while for the ship to take on enough water to have the violins stop playing.

Trump also stopped the public money bailouts which forced public agencies to finally make the deep cuts they needed to be financially solvent (like transportation systems).

So it’s not all Trump. We have been living beyond our means for 5 years now. The music has to stop.

Finally here we are. I always get nervous when a company like delta proclaims they will always be profitable and are arrogant.

“We have been living beyond our means for 5 years now.”

Is that really what you think? Five years?

Welcome to the President Musk recession.

The RWNJs own this one.

Thanks to Eliot, WN hasn't been competitive on price in many months. DL & UA responded in kind and now consumers are saying no, no, no. Def a left field take.

You voted for this economy, Trumptards

The left wing elites are having a tantrum and trying to punish ordinary Americans because they lost against democracy.

Keep drinking the Kool Aid Elon

Delta is the bellwether for the industry. Others will guide as bad or worse.

AA and UA have already cited weaker government travel but this much weakness in consumer demand was not expected this soon.

The implications for the rest of the industry and those LCCs and ULCCs that are trying to turn themselves around are very significant

"Delta is the bellwether for the industry. Others will guide as bad or worse."

Always nice to get your delta dogma on the record. But let's be clear, it isn't a bad guide in any normal year, it's rather a significant change in previous guidance for Delta. We already know some other guides are worse in absolute terms. That's a pretty useless thing to say and a simplistic way to look at this change...

"Delta is the bellwether for the industry. Others will guide as bad or worse."

Always nice to get your delta dogma on the record. But let's be clear, it isn't a bad guide in any normal year, it's rather a significant change in previous guidance for Delta. We already know some other guides are worse in absolute terms. That's a pretty useless thing to say and a simplistic way to look at this change in guidance.

The "delta for Delta" in guidance... vs AA and UA. That's where the news is.

And i'm not suggesting I have a crystal ball either. But let's set the correct comparisons. Other carriers may or may not have been as optimistic with future earnings as Delta.

This is where network strength matters the most. A robust network will be more rigid and immune to fluctuations in demand and retain stronger pricing. ULCCs and LCCs will certainly suffer because of that. Among the big 3 carriers, we shall see what happens.

They were. See what UA said vs will say.

Very bad news for AA and WN

Others could be even worse

Yes the delta is eye opening for Delta

Will be much worse for other carriers

"Very bad news for AA and WN"

Perhaps. But it would be the first economic downturn where having more international exposure vs domestic was a better thing. Delta is seeing more domestic pressure because it's the first quarter and international is at the normal winter lows already.

But, sure, in terms of ability to absorb lower margins, sure, AA is exposed, but I doubt Delta and, in particular, United's international exposure will be a good...

"Very bad news for AA and WN"

Perhaps. But it would be the first economic downturn where having more international exposure vs domestic was a better thing. Delta is seeing more domestic pressure because it's the first quarter and international is at the normal winter lows already.

But, sure, in terms of ability to absorb lower margins, sure, AA is exposed, but I doubt Delta and, in particular, United's international exposure will be a good thing if this turns out to be a full year trend.

They'll likely be asked about 2Q and 3Q tomorrow.

not perhaps.

AA and WN's margins have been well below DL and UA's with the latter in front.

DL just said that international and premium demand is holding up. Domestic is the problem. Let's see what everyone else says but the market is reacting because the evidence is overwhelmingly about far more than DL.

again. It's the first quarter. And it would be the first downturn where international leisure was the better thing to have in a slow down.

And read what I write before repeating what you already said.

In international vs domestic.

United is the most exposed to international

Delta the second most

AA the third

Of course I read what Delta said but that means little when it's only the 1st quarter being spoken to

The difference this time is that a lot of the international travel today is aspirational travel done on points from travel credit cards, whereas most of the domestic travel is paid for in fiat currency. In a recession this distinction will matter now because airline points are NOT easily fungible for cash. Even transferrable points currencies are worth less when converted to cash. This means that even cash-strapped consumers who are recently unemployed might still...

The difference this time is that a lot of the international travel today is aspirational travel done on points from travel credit cards, whereas most of the domestic travel is paid for in fiat currency. In a recession this distinction will matter now because airline points are NOT easily fungible for cash. Even transferrable points currencies are worth less when converted to cash. This means that even cash-strapped consumers who are recently unemployed might still take an aspirational international trip because their already accrued points are "use it or lose it". They will cut back, however, on paying cash rates for domestic trips.

I usually disagree with you, but you’re right about Delta being the bellweather here. This is not gonna be a good quarter for the entire travel industry.

you don't have to like what I say but that doesn't change that I am right.

DL sees and addresses the trends as good as or better than the industry and speaks to Wall Street faster - which is why they have established a reputation for being the best-run company.

Airlines are often at the front end of macroeconomic trends.

as much as some want to see this as just being a first quarter...

you don't have to like what I say but that doesn't change that I am right.

DL sees and addresses the trends as good as or better than the industry and speaks to Wall Street faster - which is why they have established a reputation for being the best-run company.

Airlines are often at the front end of macroeconomic trends.

as much as some want to see this as just being a first quarter thing or confined to a particular part/segment of the airline industry, the impact will be felt across the entire industry.

Some airlines will fare worse than others. DL is still in the best position to navigate the changes with other airlines that were trying to turn things around being even more vulnerable.

Maybe if their prices weren't so exorbitant they could get a bit more business.

This. I'm PM on the way to DM this year already and their delusions of grandeur as a "premium" airline are so laughable. Are they marginally better than AA and UA? Subjectively, sure. But I have a flight JFK-BCN in two weeks and the upgrade to D1 for a >7-hour flight is $3500. That's $500/hour for the A339 "suite" and access to the D1 lounge. I'm forced to fly DL for work but even that's...

This. I'm PM on the way to DM this year already and their delusions of grandeur as a "premium" airline are so laughable. Are they marginally better than AA and UA? Subjectively, sure. But I have a flight JFK-BCN in two weeks and the upgrade to D1 for a >7-hour flight is $3500. That's $500/hour for the A339 "suite" and access to the D1 lounge. I'm forced to fly DL for work but even that's tanking soon even though it's our preferred airline. I work at a FAANG with lots of US FedGov contracts and DOGE has put a stop on a lot of travel for our customers. Which means we don't travel. Colleague had to go to Germany a couple of weeks ago. Gov't sponsor wasn't able (DOGE mandate) so we picked up the slack on their behalf. Required a Sr. VP to approve two people for three days. Delta needs to get their act together. But part of me can't wait for the Schadenfreude when they realize they're still a garbage carrier *and* nobody is paying their stupid high fares...even contracted ones with industry.

DL is a company high on their own supply. Best case, this is a wake up call to get back to basics. Worst case, they rationalize it and keep singing & dancing right off the cliff.

orange_i_did_that_sticker.jpeg

From a purely economic and apolitical standpoints, Trump administrations policies are largely inflationary. The economy was doing well at a macro-level before, these changes have taken it off this course.

Ed is not wrong about these factors.

I don’t know what part of the economy your in. But out west. There are commercial real estate vacancies of 40 percent. Plus the space they want to sublease.

This economy has not been ok for a while.

Trump stopped the public bailouts of agencies living beyond what’s responsible. Hence the sudden stop.

Not here. Economy has been booming and my portfolio was up 43% over the last two years. Thankfully I sold everything when Trump took office otherwise my portfolio would be down 31% (so far) from where I sold.

If this is just the first quarter that they are warning about, which was largely booked long before the economic turmoil, it does not appear to bode well for future quarters that are being booked right now

I know we are winning because I have been told we are, but this winning sure doesn't look like I thought it would

This isn't just a Delta problem. A downturn in travel (and overall economy) is right around the corner.

Maybe don't spend money going to the Olympics and on Tom Brady ads then? Maybe Tim owns enough stock to impact the company's decisions at this point with a BOD vote.

Hi Ben, how about sharing your first impressions of the Park Hyatt Niseko?

This must be the business-friendly environment Ed Bastian was talking about last November when he was expressing his satisfaction with the election results

He would, and should, say that regardless of who wins. No business leader would insult the incumbent president unless they were asking for trouble.

He didn't have to say anything - "silence is golden".

There's a difference between insulting the (I believe you meant to write "incoming" not "incumbent") President, vs constantly pining for the change that we now have, before was electorally had it.

Yes, incoming. Thank you.

prayers up for you know who's net worth right now. what do we think his net worth allocation is towards Delta? 85%? 90%?

There’s a lot of economic uncertainty right now and I think people are going to try to hold onto their cash rather than book trips. The recent spate of accidents and near misses (I am quite aware it is not a trend, but a blip) also has even non-fearful fliers thinking twice. It looks like travel demand will be softer this year at least through the beginning of summer and this is reflected in their...

There’s a lot of economic uncertainty right now and I think people are going to try to hold onto their cash rather than book trips. The recent spate of accidents and near misses (I am quite aware it is not a trend, but a blip) also has even non-fearful fliers thinking twice. It looks like travel demand will be softer this year at least through the beginning of summer and this is reflected in their updated earnings forecast. Other airlines will probably have similar remarks in the coming days.

My best bet is we will see people book trips closer to come and closer to departure.

Unfortunately I think the business community is at the beginning of the sowing portion of the reaping/sowing cycle. Lots of people — big business included — say "take [redacted] seriously, but not literally!" as a way to make themselves feel better about this person's volatile beliefs, but the guardrails are off now and the seriously/literally are the same thing and we're now doing a speedrun towards stagflation. Good luck everyone!

will be interesting to see what AA and UA push out to investors vs previous guidance.

Delta hubris would be nothing new nor would blaming that hubris on something other than themselves.

Personally, I think there will be a significant slowdown or even a recession within the next 3-4 quarters, but Delta's late February and March results must be pretty disastrous vs previous guidance to influence the first quarter so late in the...

will be interesting to see what AA and UA push out to investors vs previous guidance.

Delta hubris would be nothing new nor would blaming that hubris on something other than themselves.

Personally, I think there will be a significant slowdown or even a recession within the next 3-4 quarters, but Delta's late February and March results must be pretty disastrous vs previous guidance to influence the first quarter so late in the game when you consider the math to change in the last 59 days without any update since January 10th with this material change in guidance.

They've been at other investor conferences since January 10th where they could've updated guidance.

But again, will be interesting to see how AA and UA change guidance and who had better conservatism in their January guide.

I think the corporate confidence piece is the bigger issue. Can’t do business when the administration changes its mind every half hour and feels like it needs to dominate the news flow with noise and nonsense. Business travelers will just stay home

And businesses stop CapEx spending (meaning no growth) because of too much uncertainty.

Mentioned this above but we are 100% experiencing that. DOGE restrictions for USG customers means a lot of DIB companies are following suit. If the customer can't travel, there's usually not a lot of need for us to travel, either. Conferences, planning sessions, working groups, etc. Teams held up through Covid, it will during this uncertainty as well. My company's travel policy was just updated to near-Covid stipulations: VP or CxO approval for any foreign...

Mentioned this above but we are 100% experiencing that. DOGE restrictions for USG customers means a lot of DIB companies are following suit. If the customer can't travel, there's usually not a lot of need for us to travel, either. Conferences, planning sessions, working groups, etc. Teams held up through Covid, it will during this uncertainty as well. My company's travel policy was just updated to near-Covid stipulations: VP or CxO approval for any foreign travel, and all domestic travel is for internal meetings only that can't be done online. DL is our preferred carrier. Waiting for the Dildo of Justice to work its magic on DL for their egregious pricing.

This is temporary. Cutting government spending is reducing short term growth but increasing long term growth potential.

Therefore Doge should do its job and from next year or the year after that we can expect sustainable economic growth.

LOL. Pass me some of that kool-aid bro

Exactly how the Chinese people thought about the CCP...

Need some new knee pads for your time with Elon and Trump, Max?

Just a short introduction to economics:

If you cut government spending (funded by debt) you reduce growth as you are decreasing money supply.

And if you decrease government spending you can in turn reduce taxes and thereby decrease the dead weight loss and increase a sustainable non dept funded growth in the not too distant future.

You do not have to study economics to understand that.

At my university these connections are...

Just a short introduction to economics:

If you cut government spending (funded by debt) you reduce growth as you are decreasing money supply.

And if you decrease government spending you can in turn reduce taxes and thereby decrease the dead weight loss and increase a sustainable non dept funded growth in the not too distant future.

You do not have to study economics to understand that.

At my university these connections are taught in the first bachelor semesters.

And I teach them usually within the first weeks of people beginning their studies.

“If you cut government spending (funded by debt) you reduce growth as you are decreasing money supply.”

You literally just said “I don’t understand economics.”

Well if that growth is artificially created by government debt and you are decreasing your spending by returning to a balanced budget you are in fact reducing short term growth for a specific period.

@Max

Ignore that Willy.

You are correct in theory. But as Willy has proven, Macro is confusing. You shouldn't be teaching this stuff among the first they learn.

@Max -- Question.... Is there a point where too many cuts lead to a reduction in services needed by businesses and result in the stagnation of the economy?

One example - Regulatory approvals. Every agency that is not law enforcement has had or will have cuts to positions that are deemed "non-essential". Based on current cuts, this may include those who are part of the process of reviewing regulatory approvals in banking, health care, transportation,...

@Max -- Question.... Is there a point where too many cuts lead to a reduction in services needed by businesses and result in the stagnation of the economy?

One example - Regulatory approvals. Every agency that is not law enforcement has had or will have cuts to positions that are deemed "non-essential". Based on current cuts, this may include those who are part of the process of reviewing regulatory approvals in banking, health care, transportation, foreign commerce/exports, infrastructure, technology, energy, along with many other areas. These areas make up large portions of our economy and delays could cost billions of dollars in economic growth.

My concern is that the cuts are being made without any thought to the impact they will have and are only being viewed as dollars on a ledger. And regulatory approvals is just one example.

@Max

Maybe you should stick to theory, because reality disagrees with you. The US is currently and has been undertaxed for decades. There is no possible way for Trump to balance the budget, even if he didn't keep his richman tax cuts, without cutting defense, Medicare/Medicaid, and Social Security. Balancing the budget is a red herring, he's just after more tax cuts for himself and his rich cronies, while also destroying the government's ability...

@Max

Maybe you should stick to theory, because reality disagrees with you. The US is currently and has been undertaxed for decades. There is no possible way for Trump to balance the budget, even if he didn't keep his richman tax cuts, without cutting defense, Medicare/Medicaid, and Social Security. Balancing the budget is a red herring, he's just after more tax cuts for himself and his rich cronies, while also destroying the government's ability to function for anybody who isn't a multi-millionaire. For example, if you have elderly parents/grandparents, I sure hope you have plenty of money to hire full-time home caretakers, because if Medicaid and Social Security get cut it would quite literally be a death knell to the retirement home industry and put a lot of grandparents out on the street. That's the reality of what will happen if Trump balances the budget by cuts alone.

I agree with you @Ben, of course it's [insert what you think is causing this]'s fault.

Business travel has never recovered. Delta's planes are full because they're flying fewer flights. Sales, business development and meetings/events workers aren't traveling like they did in 2018 and 2019. Just look at Hyatt. Hyatt is all-in on resorts and all-inclusives because the big, downtown city center hotels are dead and never coming back.

Vasu? Is that you? :)