Chase is known for its portfolio of business credit cards, which are among the best business cards out there.

These include the Ink Business Preferred® Credit Card (review), Ink Business Premier® Credit Card (review), Ink Business Cash® Credit Card (review), and Ink Business Unlimited® Credit Card (review). There’s also the Sapphire Reserve for BusinessSM (review), which for all practical purposes is part of the same card lineup, despite the different branding. However, I won’t address that much in this post, since I think there’s less confusion about the rewards there.

In this post, I’d like to address the single question that I get the most often Chase Ink business cards, which relates to what kind of rewards these cards earn. Do they earn cash back, travel rewards, or both?

I can totally understand the confusion, given that the cards have different marketing (with some promoting travel rewards and others promoting cash rewards), one card has “Cash” in the name, etc. There’s quite a bit of nuance to this, so let’s take a closer look.

In this post:

Chase Ink business card rewards simplified

There are four Chase Ink business cards, and they have three different kinds of rewards structures. To be clear, I’m not talking about the bonus categories or return on spending offered by the cards, but rather, this post is specifically about the types of rewards that these cards offer.

Do they offer points that can be redeemed toward travel, do they offer cash back, or do they offer the flexibility for either? Across these four cards, you’ll find three different policies:

- The Ink Business Preferred® Credit Card earns travel rewards, so you can redeem points as cash toward travel, or can transfer them to travel partners

- The Ink Business Premier® Credit Card earns cash back, with no option to convert the rewards to travel partners

- The Ink Business Cash® Credit Card and Ink Business Unlimited® Credit Card earn cash back, but also offer the ability to convert rewards into travel rewards at a favorable rate, so that you can redeem points as cash toward travel, or can transfer them to travel partners

Let me discuss each of these cards in a bit more detail below, to better explain that…

The Chase Ink Preferred earns travel rewards

The $95 annual fee Ink Business Preferred® Credit Card is arguably the most lucrative card in the portfolio. This is a travel rewards card, plain and simple, and it accrues Ultimate Rewards points. What this means is that:

- Points can be redeemed for one cent each toward a travel purchase through the Chase Travel℠ Portal; if you also have the Chase Sapphire Reserve® Card (review), then you can pool points, and they can potentially be redeemed at a rate of up to two cents for select travel purchases using the Points Boost feature

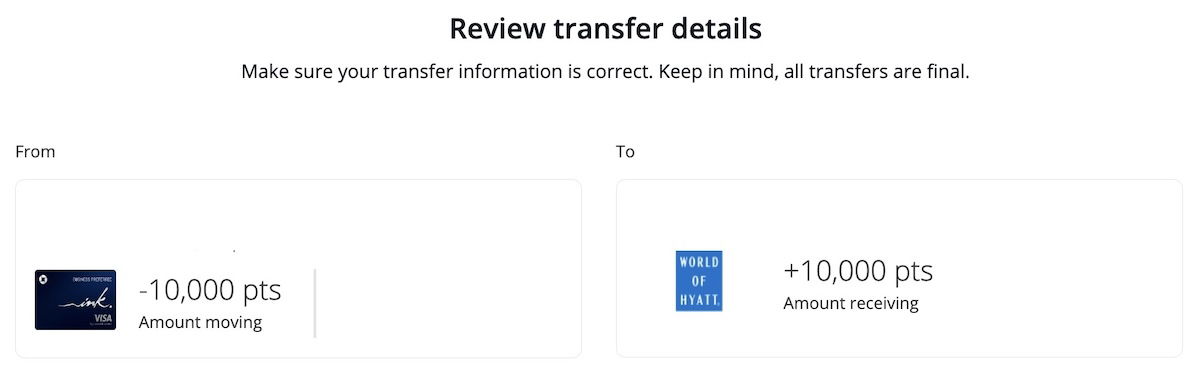

- Points can be transferred to Chase Ultimate Rewards airline & hotel partners, ranging from Air Canada Aeroplan to World of Hyatt, and this can offer outsized value

- Points can be converted into cash back, though each point gets you only one cent, so this isn’t how I’d recommend redeeming

So as you can see, the Ink Business Preferred is a travel rewards card in the true sense, with the option to redeem for cash at a suboptimal value.

The Chase Ink Premier earns cash back

The $195 annual fee Ink Business Premier® Credit Card is one of the best cash back cards on the market, as it offers a flat 2.5% cash back on purchases of over $5,000 (otherwise you earn at least 2% cash back). This is a true cash back card:

- You’ll see that rewards post to your account as points (2.5x points per dollar on purchases of $5,000 or more, and a minimum of 2x points per dollar on other purchases)

- Each point can then be redeemed for one cent, whether you prefer cash back, a gift card, or whatever else; you might as well redeem your rewards for cash, since there’s no other way to get outsized value

- There’s no option to pool your points with those of other Chase cards to increase their value; so you can’t transfer the point to Chase Ultimate Rewards airline or hotel partners, or redeem at an elevated rate through the Chase Travel℠ Portal

While the Ink Business Premier is an amazing cash back card, it’s the most restrictive Chase Ink business card when it comes to being able to combine rewards. So you’ll only want to get this card if you’re truly looking to earn cash back.

The Chase Ink Cash & Unlimited earn cash back or travel rewards

The no annual fee Ink Business Cash® Credit Card and Ink Business Unlimited® Credit Card are both great products, as they offer a rewarding return on spending. The cards also tend to cause the most confusion when it comes to their rewards structures.

On the surface, these are cash back cards. You’ll see the cards marketed as offering cash back, both in terms of the welcome bonuses (often somewhere around $750, but it varies), and in terms of the return on spending (which could be anywhere from 1-5%).

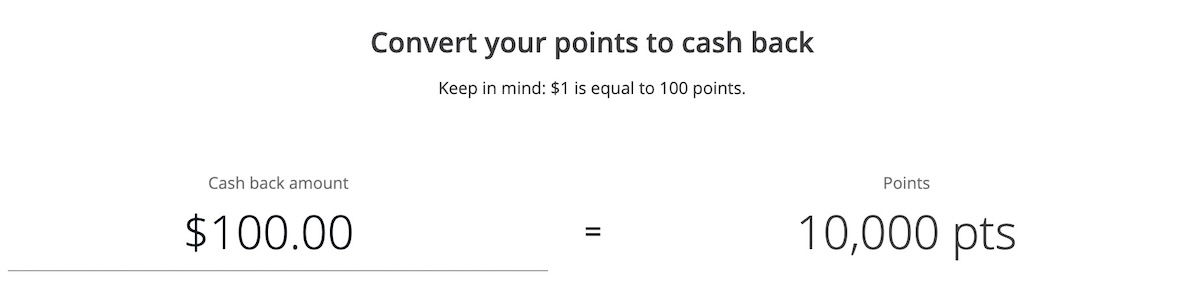

In reality, each cent cash back posts to your account as one point, and then you can redeem those points for statement credits or other cash equivalents. In other words, $100 in accrued cash back would show in your account as 10,000 points, and could then be redeemed at any point for $100.

But this is also where these cards get interesting. Unlike on the Ink Business Premier® Credit Card, rewards on the Ink Business Cash® Credit Card and Ink Business Unlimited® Credit Card can be converted into “premium” Ultimate Rewards points, which can be redeemed at a higher value.

Any of the following four cards would allow you to redeem all your points earned on these cards at a higher value:

- Chase Sapphire Reserve® Card (review)

- Chase Sapphire Preferred® Card (review)

- Sapphire Reserve for BusinessSM (review)

- Ink Business Preferred Card (review)

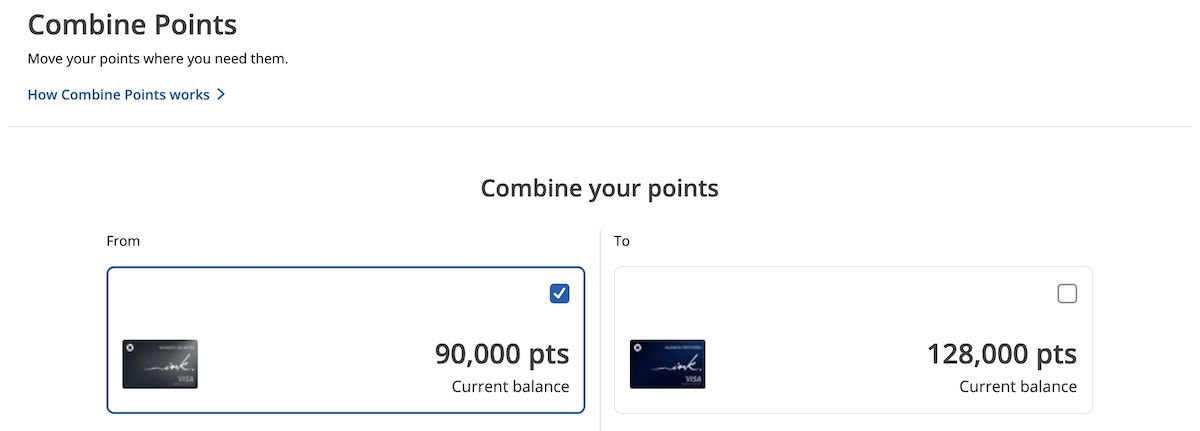

If you have the Ink Business Cash® Credit Card or Ink Business Unlimited® Credit Card in conjunction with one of those cards, suddenly your points are much more valuable. Specifically, you can then transfer them to one of the Ultimate Rewards airline or hotel partners, which can often get you way more than one cent of value per point.

By moving the points to another card, you can also potentially redeem them for 1.25-2.0 cents each using the Points Boost feature, for select redemptions. For more details on how to move your Ultimate Rewards points between cards, see this post.

Bottom line

Chase Ink business cards are excellent, though it can be hard to make sense of which cards earn which rewards, given how the cards are structured. Hopefully the above is a useful rundown for anyone who was confused, though to summarize:

- The Ink Business Preferred® Credit Card earns travel rewards, and points can be transferred to airline or hotel partners, or can be redeemed at a higher rate toward select travel purchases with Points Boost (or at an even higher rate in conjunction with the Chase Sapphire Reserve® Card)

- The Ink Business Premier® Credit Card exclusively offers cash back, regardless of which other cards you have

- The Ink Business Cash® Credit Card and Ink Business Unlimited® Credit Card earn cash back, but in conjunction with a “premium” Ultimate Rewards card, you can redeem these points for more value, including being able to transfer them to airline and hotel partners

Any questions about the value of Chase Ink business card points that I missed?

Not a new concept. Many credit cards are cash back cards but technically earn points and have a decent value for converting to cash.