File this under “things that are interesting but probably not useful, and especially not useful right now, when this is probably the last thing most people are thinking about.”

But I do find it interesting, so will cover it nonetheless.

In this post:

The Amex Centurion Card is invitation only

The Amex Centurion Card (often referred to as the “Black Card”) is invitation only. Generally speaking an invitation seems to be determined based on how much you spend on your American Express cards, as well as your income and net worth.

Amex is tight-lipped about the requirements to get a Black Card, though I’ve heard the following thrown around as key thresholds:

- You need to spend at least $250K per year on Amex cards

- You need to have an income of at least a million dollars per year, and/or a high net worth

The truth is that no one in a position to speak really knows what the requirement is, so that info could be totally off.

You can now request to be considered for the Black Card

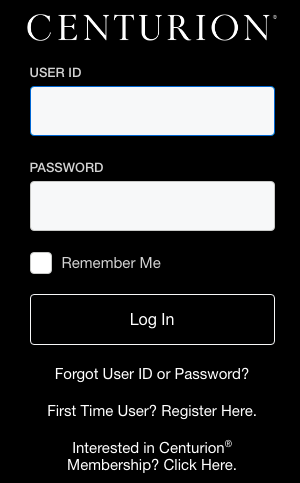

In the past you’d need to hope for an invitation to get the Centurion Card, though Amex has just added a new feature. When you go to centurion.com, you’ll see a link at the bottom that says:

Interested in Centurion Membership? Click Here.

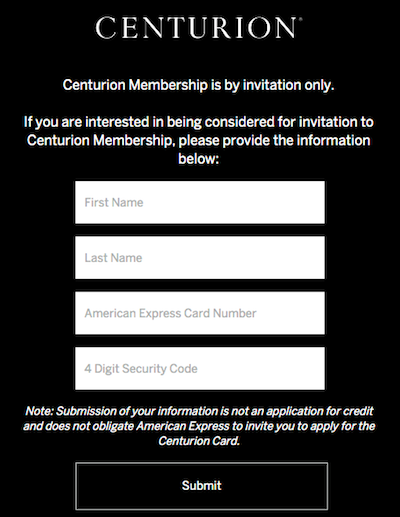

Once you click that button, you’ll be brought to a page asking for your name and details of one of your American Express card numbers, so that you can be considered based on your existing customer profile.

The page also says the following:

Centurion Membership is by invitation only.

If you are interested in being considered for invitation to Centurion Membership, please provide the information below:

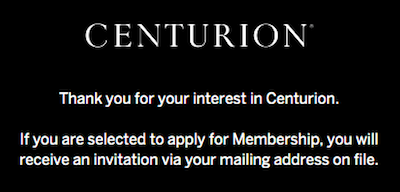

Once you submit that info you’ll get a message saying the following:

Thank you for your interest in Centurion.

If you are selected to apply for Membership, you will receive an invitation via your mailing address on file.

As you can see, it’s not an instant decision. For that matter, they’ll only get in touch with you if you are eligible, so there won’t be a denial if you don’t meet their requirements.

Is the Centurion Card worth it?

The reality is that the Centurion Card is one that you get for the benefits and perhaps the prestige (if that matters to you), but it’s a card that’s not worth spending money on.

The Amex Black Card recently became more expensive — it has a $10,000 initiation fee and $5,000 annual fee, while it used to have a $7,500 initiation fee and $2,500 annual fee.

Some of the perks of the card include the following:

- Delta SkyMiles Platinum Medallion status

- Diamond elite status

- IHG Rewards Club Platinum status

- A CLEAR membership

- A $1,000 Saks credit per calendar year

- An Equinox Destination Access membership; this would ordinarily cost $300 per month

- Expanded access to Centurion Lounges

I guess if you were going to pay for an Equinox membership anyway, and if you could use the Saks credit, then you’re almost breakeven, especially when you consider the value of the potential airline and hotel status. However, without otherwise paying for an Equinox membership I couldn’t make sense of the value.

The bigger problem is that there’s a direct opportunity cost to every dollar spent on this card. There are cards that are so much better for everyday spending. So if you’re getting this card for an ego boost at the register, just know that it comes at an opportunity cost.

Bottom line

I doubt the rollout of this new feature is in any way tied to the current pandemic, but rather it’s probably something they just got around to.

I’m not sure how much we should read into this — the card is still invitation only, I’m guessing they just want to give people a clearer path to being able to initiate this on their end.

I imagine Amex gets quite a few phone calls and messages from people asking how they can get an invitation, and this gives agents an easy way to handle that question.

I imagine Amex is keen to get data on who is interested in the card. I doubt they’re easing requirements right now, but with the annual fee increase, maybe that will change over time.

Interestingly all of this comes at a time when Amex is allegedly considering introducing a new product between the Platinum and Centurion card. Maybe this is a bit farfetched, but it’s also possible that the card could be invitation(ish) only, and maybe those who aren’t eligible for the Centurion Card may still be eligible for the new card.

What do you make of Amex inviting people to inquire about a Centurion Card invitation?

The people who will truly see the value of this card, are not worried about paying $5,000 yearly or a $10,000 initiation fee.

For this type of travel, one stay at a Centurion Hotel could return this investment. I would imagine that Amex ideal Centurion clients would book higher category rooms at the best hotels in the city. Most of these hotels do not even have loyalty programs, and to be frank these type...

The people who will truly see the value of this card, are not worried about paying $5,000 yearly or a $10,000 initiation fee.

For this type of travel, one stay at a Centurion Hotel could return this investment. I would imagine that Amex ideal Centurion clients would book higher category rooms at the best hotels in the city. Most of these hotels do not even have loyalty programs, and to be frank these type of clients are not worried about earning loyalty status for hotels.

An upgrade at the time of booking can easily save $500.00 per night, by booking a suite at the Jr. Suite's rate at most luxury hotels. I think for those of us who cannot see the benefit of it, it is not meant for us. For those who truly love luxury events and travel, I am sure they are getting their money's worth.

With such a big price tag, you would think they would also include the benefits of the Platinum Card and Gold garden points categories (like the 5X airfare).

Years ago this is how you were able to the platinum card. By invitation only.Now they are doing this to get the black card. $15,000 for the first year is a lot of money to feed someone’s ego.

I happen to like the gold card the best.When I was traveling the platinum card is the better of the two.Even if I can afford the black Card.I will not pay that enormous fee

This has been available in some markets for some time already. Not sure if there was a website, but there was/is an email address where you could send your interest in an invitation.

Also, when they are introducing the centurion in new markets it seems like they are very relaxed when it comes to the spending fees etc. I know one guy who got it, but his earnings and spendings are nowhere near the numbers...

This has been available in some markets for some time already. Not sure if there was a website, but there was/is an email address where you could send your interest in an invitation.

Also, when they are introducing the centurion in new markets it seems like they are very relaxed when it comes to the spending fees etc. I know one guy who got it, but his earnings and spendings are nowhere near the numbers mentioned in the article.

At the time I was thinking about asking for an invitation too, just to see whether I would get it, but I then decided not too. I don’t think it’s worth it, and in my market I don’t even think the benefits are as good as in US.

I dont give a fk. I had one it was titanium black card. There were great as a concierge card they setup great times for me and my sons. I hand to make over 25millon a year. I did as a company over all. At the end of the Day I did give a fk to brag or shoe it off. I did see lots of Men wanting to show thete off or being impressed. Yes, Im a women. I dont need No one to know my worth. It had its perks. But definitely Disadvantages. Just saying. Its not for me. #humble

Planning. Sorry. Good job for being an advocate for your readers and not for credit card companies.

Ben. Even in these difficult times, you’ve put your readers’ interest ahead of putting out misleading fluff and not encouraging people to be unwise with their banning.

I used to work with a guy who had a Centurion card. My colleagues and I were convinced that he couldn’t find a guaranteed penis enlargement procedure so he applied for the black card instead. He used to bring it out at restaurants and bars like he was waving a winning lottery ticket. In the end, it did make him a bigger dick.

In other news, the stock market is on sale. Might be a better use of $10k.

@travelinwilly

You nailed it! Great post.

IHG Platinum compared to other hotel groups isn't very rewarding.

With Amex, they want to grab as much cash as soon as they can grab it, and who can blame them? I'd bet that nobody is turned away at this point.

-With the economic downturn, Amex can see that a whole bunch of people are going to go past due on their bills, go into collections (and many states are curbing the ability to collect at all on certain accounts/products at the moment), and ultimately...

With Amex, they want to grab as much cash as soon as they can grab it, and who can blame them? I'd bet that nobody is turned away at this point.

-With the economic downturn, Amex can see that a whole bunch of people are going to go past due on their bills, go into collections (and many states are curbing the ability to collect at all on certain accounts/products at the moment), and ultimately have their accounts charged off; the assets (balances due) will go poof.

-They see that with the practical cessation of travel (think planes, trains, rental cars, hotels, etc., both personal and corporate) and travel-related services (restaurants, etc.) their income from merchant-paid fees for use of their cards will be dropping to practically zero in the near future.

-They see that with the number of job losses hitting knowledge workers/white collar workers, they're going to take a bath on the number of new accounts people apply for.

That said, there's really no compelling value to having this card unless/until they add on a TON of new, valuable benefits. But these will be benefits nobody can really use while travel is so restricted and wallets have snapped shut, so Amex should spend this time making this a compelling card and then come see us when the economy starts to recover.

And why do they call it an "initiation fee?" This isn't a club...just call it a fee, that's what it is.

such a waste of money

I called Amex about 10 years ago, when the initiation fee was considerably less, and inquired about the card. (I had a platinum card at the time).They approved me immediately over the telephone. I'm not sure when they abandoned their "By Invitation Only" policy, but it has not been strictly applied for quite some time.

I get most use out of the relationship manager service, which can get the cardholders reservations at tough to get...

I called Amex about 10 years ago, when the initiation fee was considerably less, and inquired about the card. (I had a platinum card at the time).They approved me immediately over the telephone. I'm not sure when they abandoned their "By Invitation Only" policy, but it has not been strictly applied for quite some time.

I get most use out of the relationship manager service, which can get the cardholders reservations at tough to get establishments. The centurion card hotel benefits and sometimes the rates as well, are considerably better than the Platinum card.

This has been around for a while, there were links on Flyertalk.

"I doubt the rollout of this new feature is in any way tied to the current pandemic"

Of course it is. Who is going to spend that kind of annual fee on a card whose benefits are worthless to so many people right now (airline or hotel status? CLEAR membership? a gym you can't access?).

It's AMEX basically saying, hey, if you'll give us $10k plus $5k/year, we'll gladly take your money right now, thanks!

On my recent trip to Asia and Europe I found that I could not use an AMEX card for anything other than major brand hotels (Hilton) and some airlines (for instance not Air Asia, AirSwift). So hardly worth having a gold card let alone anything more expensive/exotic.

I was unable to use the card in most restaurants, car rentals and supermarkets either.

Luckily had a new Scotia Visa that had no Forex so reaped a...

On my recent trip to Asia and Europe I found that I could not use an AMEX card for anything other than major brand hotels (Hilton) and some airlines (for instance not Air Asia, AirSwift). So hardly worth having a gold card let alone anything more expensive/exotic.

I was unable to use the card in most restaurants, car rentals and supermarkets either.

Luckily had a new Scotia Visa that had no Forex so reaped a lot of useless(?) points and saved some money.

So I guess I will have to pass. Thanks for all the fish.

the centurion card issued is an exceptional card for me because it is a payment card with no predefined payment limit

Unlike other Centurions cards issued in other countries where it is issued as a credit card with rates close to the absurd if you do not pay the amount co, from the start.

My last highest purchase last month is €. 22,000 I had fun on ebay

I remind you that...

the centurion card issued is an exceptional card for me because it is a payment card with no predefined payment limit

Unlike other Centurions cards issued in other countries where it is issued as a credit card with rates close to the absurd if you do not pay the amount co, from the start.

My last highest purchase last month is €. 22,000 I had fun on ebay

I remind you that I am taken from my bank account of this amount every 8th of the month so before making the request and putting your debts and bulls on your back think about children

This card has no payment limit the only defect will be the anti fraud limit issued by the merchant or store or pass it.

It is delivered on two supports one with chip and nip and the other without chip.

concerning the insurance issued by this card it is almost equal to my Visa from my bank only advantage the concierge service which gives a return and a quality of service clearly more advantageous and more professional if you have to find a ticket for Asia. Single number for personal agent cash advance of € .50,000 in any bank machine accepting AMEX London bank transfers

What I don't like is refused for amounts below € .3500 just use the platinum.

For us in Europe it remains an appreciable card which will not make you ashamed with a breathtaking anti fraud system so advice to amateurs to try and not it is not reserved for the wealthy you just need to have income and return suitable from € .600K annual

10k for initiation? I thought April fools day was yesterday

I have had The Centurion Card for many years and can say with confidence it is not worth the yearly fee. I have better awards with British Airways Amex and my former Platinum Card. However it is one of those clubs that once accepted into is hard to want to cancel.

A great way to use my Stimulus check! Can you add Additional Cardmembers for under $1,500.00 a piece?

This form has been up for at least 6 months. I remember running across it last year (it wasn't yet linked to on the homepage) and filled it out. I'm coming close to the requirements but I'm still short - still no invite.

Some time ago I twice received invitations to get the card but ignored them as 1. I Didn't think it was worth it 2. I Don't know why I received them.

If you can leverage the Equinox membership (so basically if you live in NYC or LA, that have the fancier clubs), then it's kinda worth it - but of course there is the initiation fee that completely ruins the value. The only way it could make sense if is you're going to heavily use the concierge service, which I've heard is unparalleled. Other than that, people signing up for this probably have some serious self...

If you can leverage the Equinox membership (so basically if you live in NYC or LA, that have the fancier clubs), then it's kinda worth it - but of course there is the initiation fee that completely ruins the value. The only way it could make sense if is you're going to heavily use the concierge service, which I've heard is unparalleled. Other than that, people signing up for this probably have some serious self esteem issues and are trying to compensate somehow...? Idk.

You could do a great review of the process and the card, although it might be a touch pricey. It comes with such great perks though. IHG Platinum? AND Hilton Diamond?? Le gasp! Simply amazing! You'd best contact them immediately, before they change their minds.

@Lucky

Someone seems to be poking around. But I remember this request was out for sometime now. Before that I think you can call in and request to be considered.

"I guess if you were going to pay for an Equinox membership anyway, and if you could use the Saks credit, then you’re almost breakeven."

You can't even breakeven with AF and you forgot to allocate in the $10,000 initiation fee.

You don't get this card to maximize benefits.

This option has been there for at least 6 months. I remember using it. I first saw it on flyertalk

The free AMEX Everyday card has a better day to day spend bonus then Centurion. Makes no sense.

I had one from 2003-2007. Was an additional cardholder on a family account. But more so at this time it was more rumored to be in existence. It was the greatest fake ID on earth. But, the annual fee and initiation fee are insane. Plus no bonus MR points. I loved having it, but it is not worth the price tag.....just to say you have it. I think somewhat of ego trip... but again, anyone...

I had one from 2003-2007. Was an additional cardholder on a family account. But more so at this time it was more rumored to be in existence. It was the greatest fake ID on earth. But, the annual fee and initiation fee are insane. Plus no bonus MR points. I loved having it, but it is not worth the price tag.....just to say you have it. I think somewhat of ego trip... but again, anyone who gets this card may not miss the money and you shouldn’t spend that amount on fees if you would miss the money. .Platinum is very good for me today and wife today.

Right at the time when Im ready to cancel my bloated yearly fee Amex cards. The last thing in my mind to get another amex card with even more absurd yearly fee.

I would be totally happy with a card that had an amalgamation of benefits vs. having multiple cards each to do different things with.

I got invited by AMEX last year for this card (in Netherlands) and to me the price is certainly not worth the extra benefits over the platinum card. I can only remember Hilton Diamon instead of Hilton gold, apart from some other minor added benefits. I guess it's meant for people who care a lot about 'status' and not so much about value of money.

centurion title

You are not eligible to enter this site.

You can visit your account home at americanexpress.com

It's been there a while actually. Not related to the virus. I remember seeing this back when they increased the initiation and annual fees

You gotta have some major inadequacy issues in order to need a card like this to feel better about yourself.

Initiation fee is now $10k