Southwest Rapid Rewards and Chase have a suite of co-branded credit cards. Well, these cards are getting a complete overhaul — we’re seeing annual fees increase, though we’re also seeing new benefits added.

The timing of this announcement isn’t surprising, given that changes that Southwest is undergoing. With the airline having introduced bag fees, and soon planning on introducing assigned and premium seating, and new boarding groups, there obviously needs to be an update to the core benefits of the card.

In this post:

Southwest credit card annual fees increasing

Let’s start with what’s unarguably bad news. The annual fees on all Southwest credit cards are increasing, ranging anywhere from 43-54%:

- The Southwest Rapid Rewards Plus Card annual fee is increasing from $69 to $99

- The Southwest Rapid Rewards Premier Card annual fee is increasing from $99 to $149

- The Southwest Rapid Rewards Priority Card annual fee is increasing from $149 to $229

- The Southwest Rapid Rewards Premier Business Card annual fee is increasing from $99 to $149

- The Southwest Rapid Rewards Performance Business Card annual fee is increasing from $199 to $299

These new annual fees apply effective immediately for new cardmembers, and as of the 2026 renewal date for existing cardmembers.

Southwest credit card bag, boarding, and seating perks

We’ve already known most of this, but all Southwest credit cards are getting perks that align with Southwest’s new business model. Regardless of which of the cards you have:

- Cardmembers and up to eight companions on the same reservation receive a first checked bag free

- Cardmembers and up to eight companions on the same reservation receive Group 5 boarding (there are a total of eight groups)

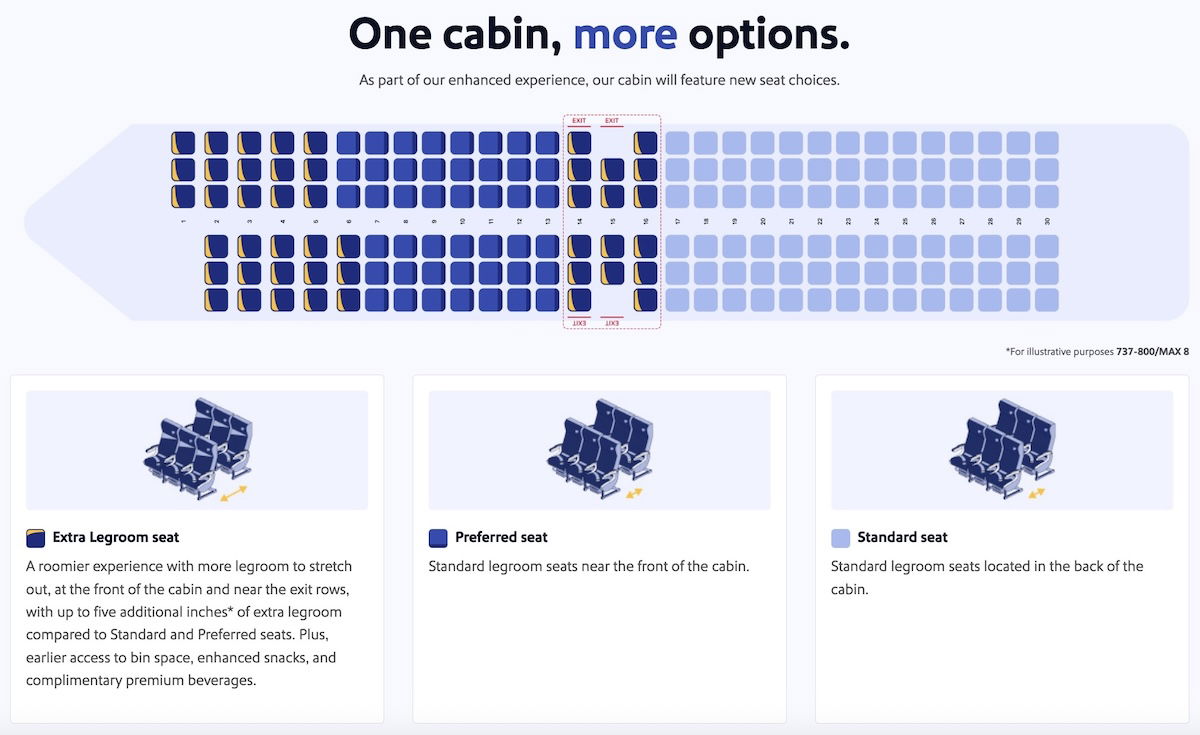

Cardmembers can also receive complimentary seat selection, for themselves and up to eight companions on the same reservation. The seating you have access to depends on which card you have:

- The Southwest Plus Card offers standard seat selection 48 hours before departure

- The Southwest Premier Card and Southwest Premier Business Card offer standard or preferred seat selection 48 hours before departure

- The Southwest Priority Card and Southwest Performance Business Card offer standard or preferred seat selection at booking, and extra legroom seat selection 48 hours before departure

Southwest credit cards receive other new perks

Beyond the above, Southwest credit cards are getting a slew of new perks and bonus categories:

- The Southwest Plus Card no longer has foreign transaction fees, earns 2x points on gas station and grocery purchases (up to $5,000 in combined purchases per year), and offers a 10% promo code for a flight discount each anniversary year, excluding basic fares

- The Southwest Premier Card earns 2x points on grocery and restaurant purchases (up to $8,000 in combined purchases per year), and offer a 15% promo code for a flight discount each anniversary year, excluding basic fares

- The Southwest Premier Business Card earns 2x points on grocery and restaurant purchases (up to $8,000 in combined purchases per year)

- The Southwest Priority Card and Southwest Performance Business Card earn 2x points on gas station and restaurant purchases with no caps, and 2,500 tier qualifying points toward A-List status for every $5,000 spent annually

The cards are keeping existing perks like anniversary bonus points, and 25% savings on inflight purchases.

My take on these Southwest credit card changes

The changes to Southwest’s credit card portfolio are more or less what you’d expect, given how the airline is evolving. The way I view it:

- These cards probably aren’t worth having just for the perks, assuming you’re not a frequent Southwest flyer

- If you do fly Southwest multiple times per year, it probably makes sense to have a co-branded Southwest credit card

- The more frequently you fly Southwest, the more premium of a card you should consider picking up, as the value will add up

- At the same time, if you fly Southwest very frequently and automatically earn A-List or A-List Preferred, odds are that the additional perks like extra legroom seating won’t actually be worth all that much

- The Southwest Priority Card has really lost a lot of value, as it doesn’t get an anniversary discount credit, and also loses its $75 annual Southwest credit

Perhaps the bigger question that many consumers will have is whether it’s still worth being loyal to Southwest, with everything that has changed. Ultimately Southwest has a huge network, so I imagine that’s a primary motivator for why people will continue flying with the airline.

Bottom line

Southwest Airlines has overhauled its credit card portfolio, coinciding with the carrier changing its policies around bags, seating, and boarding. The changes are a mixed bag, with card annual fees increasingly considerably, but the cards do also receive new benefits.

I don’t have terribly strong opinions on these changes. I think on balance they’re probably negative compared to the previous value proposition, but with Southwest has changed its business model, obviously the cards needed to evolve as well.

What do you make of these Southwest credit card changes?

Not sure why everyone is upset. You will get a discount coupon yearly, Anniversary points, 1 free bag both ways, free seats. Go to another airline and see what happens. That means less folks on my SWA flight

Slurp slurp

It's all too bad. Have flown SWA nearly exclusively the past 7 years, since the changes this year on 4 different airlines with several Alaska Air flights. All but 1 would have been on SWA in the past. Bank mainly with chase and use SWA card. Raise fees, well a new card isn't that hard to handle.

It will be interesting to see if the card changes banks in the future if many people give up on the card. It will also be interesting to seeif the benefits evolve with time too. Now with the changes the only reason to choose this airline is if they fly to a more convenient airport or they are the only non stop provider between the two points.

called two days ago and got the 149 annual fee reversed in 2 min

no questions asked guess not many people want the card anymore

my Priority card renews in August of this year. Will I have to pay the old/current $149 renewal fee? Thank you.

My understanding is that it takes effect on your renewal in 2026. So you could keep the card at current annual fee especially if you’ll use the 75 credit and upgraded boardings before they dies early on Dec 31. That’s my plan at least. Wait until 2026 and then do a product credit card change with chase. My fee is also in August.

Thank you! Since I only have one o/w trip on SWA this year, I think I will just cancel the card (I have the Plus card as well) before August.

I wonder how (or if) this will affect me. I have an old version of the Southwest card (not offered anymore), with a $39 annual fee and essentially no perks.

Priority cards just not worth it anymore. Southwest is just begging us to swith to another airline. Raise the annual and lose the $75 annual cretit......No thanks Southwest.

No more 4 free upgraded boardings on the Priority

Overall negative, like most of the WN changes recently.

I will be downgrading my Priority card to the Premier next year, before the new annual fee is charged. The only reason that I won't drop the card altogether is because I have had some version of it for ~25 years, so it would detrimental to my credit score. The value proposition for the Priority card is completely upended with these changes, particularly since I...

Overall negative, like most of the WN changes recently.

I will be downgrading my Priority card to the Premier next year, before the new annual fee is charged. The only reason that I won't drop the card altogether is because I have had some version of it for ~25 years, so it would detrimental to my credit score. The value proposition for the Priority card is completely upended with these changes, particularly since I never check bags on WN flights anyway, and the Premier seems like the best value now, with the 6000 pts annually adding most of the value.

Curious why not product change to the Plus?

Because I have to fly WN a few times a year, and the 6000 RR points are worth much more than the $50 difference in annual fee for me.

I currently have the Priority Card. I see the 7500 anniversary points remained, and that's worth around $90 (assuming 1.2 cent/point worth). So there's still $139 gap with the increased annual fee. Given the perks of a free checked bag and seat selection on all cards (with some slight differences on the type of seat one can select), I will definitely downgrade or cancel the Priority Card and then apply for the Plus Card and...

I currently have the Priority Card. I see the 7500 anniversary points remained, and that's worth around $90 (assuming 1.2 cent/point worth). So there's still $139 gap with the increased annual fee. Given the perks of a free checked bag and seat selection on all cards (with some slight differences on the type of seat one can select), I will definitely downgrade or cancel the Priority Card and then apply for the Plus Card and get the 100,000 bonus points (need to check if that's possible. Anyone knows?).

The removal of the annual $75 flight credit completely changes the value equation of this card. With the annual 7500 points plus the $75 flight credit the card, which had a $149 annual fee, was a no brainer. Now, however, it is hard to justify the $229 cost. I have had this card for many year but will be cancelling in December because the value is no longer there.

You don’t need to cancel and reapply. Chase allows product changes. Just give them a call and this way you keep your credit history with the same account and also no rechecking your credit

Sorry. I see now you already said downgrade so already knew my previous comment. I just saw reapply and thought immediately you might not know about product change.

@Kyle I am just considering which way I should go: downgrade, or cancel and apply to take advantage of the current 100,000 bonus offering (and I can do that because I received the last bonus more than 2 years ago, so I will be eligible after cancelling the Priority Card). That's something I'll decide when my Priority Card renew in early 2026 - it really depends on the bonus offering then.

As far as...

@Kyle I am just considering which way I should go: downgrade, or cancel and apply to take advantage of the current 100,000 bonus offering (and I can do that because I received the last bonus more than 2 years ago, so I will be eligible after cancelling the Priority Card). That's something I'll decide when my Priority Card renew in early 2026 - it really depends on the bonus offering then.

As far as which card is better (Plus vs Premier), I think the value is better with the Premier than Plus Cards. There is a $50 annual fee difference and 3000 anniversary points difference (value at $36 using 1.2 cent/pt). Also, there's a 10% discount vs 15% discount (assuming it's a one time use for a roundtrip, and let's say a roundtrip of $300, the 5% point gap is worth about $15). So the anniversary point difference and the 5% discount difference would make up the $50 annual fee difference. The Premier also get 3X point on SW purchases vs 2X on Plus card, but since you don't need to charge the SW Tix purchase on the SW Card in order to receive the free seat selection 48 hours before flights and free check bag benefit (all you have to do is being a cardmember), I don't see the 3X vs 2X is valuable, especially I have other credit card that gives me 3X transferable points on air tix.

My mother flies one or two round trips per year on Southwest and has the priority card which kinda paid for itself. I will encourage her to cancel it as it's a horrible value now.

It will be interesting to see how WNs strategy plays out. For me it won't make much difference as I rarely fly them. They tend to be much more expensive than the competition in the SF bay area unless...

My mother flies one or two round trips per year on Southwest and has the priority card which kinda paid for itself. I will encourage her to cancel it as it's a horrible value now.

It will be interesting to see how WNs strategy plays out. For me it won't make much difference as I rarely fly them. They tend to be much more expensive than the competition in the SF bay area unless you book months in advance. This month I flew Spirit premium economy from OAK to SAN for less than a third of the price of Southwest. Boarding was much more pleasant than WN and my gate was next to the escape lounge. It felt more 'premium' than any WN flight I've been on lol.

The thing I appreciated most about WN is the cabin crew was usually pleasant, I wonder if that is going to change under the new leadership. While I wish them the best it seems like most of the changes have been negative for the consumer and probably the employees as well.

What's the word on the companion pass?

The Southwest Priority Card has really lost a lot of value, as it doesn’t get an anniversary discount credit, and also loses its $75 annual Southwest credit.

So I'm paying $75 more and losing more than $100 in benefits. Bye bye bye. Might as downgrade to the lowest card for the free bag perk until that goes away next.

Not only that, the AF is increasing to $229, so you are paying more for less.

A downgrade for the performance business card. I lose free internet but only get 25% off of in flight purchases. All this for $299. If you have A-List, this card is redundant.

Guess I can add this one to the chopping block when it renews in October. Need to check if I've used that $75 credit and maybe book a flight somewhere (and possibly cancel), although I do have at least one more trip I could legitimately use it on. It's almost like WN has been encouraging me to fly other airlines lately. And honestly, most of my flights I have been just booking the business select...

Guess I can add this one to the chopping block when it renews in October. Need to check if I've used that $75 credit and maybe book a flight somewhere (and possibly cancel), although I do have at least one more trip I could legitimately use it on. It's almost like WN has been encouraging me to fly other airlines lately. And honestly, most of my flights I have been just booking the business select fairs with points so I don't have to deal with any of the BS. I still have 350k points, so I'll be flying them for a while longer, but not really sure how this "priority" card benefits me at all now.

I canceled my Southwest Priority Card late last year and am increasingly satisfied with that decision, especially given the announced fee increases and benefit reductions here. My Chase Sapphire Reserve will provide Southwest benefits through spending in 2026. Based at DFW/DAL, I now accept connections with United and Delta for destinations beyond a six-hour drive, only considering nonstop flights on American or Southwest when driving or taking Vonlane isn't feasible.

I canceled my Southwest Priority Card late last year and am increasingly satisfied with that decision, especially given the announced fee increases and benefit reductions here. My Chase Sapphire Reserve will provide Southwest benefits through spending in 2026. Based at DFW/DAL, I now accept connections with United and Delta for destinations beyond a six-hour drive, only considering nonstop flights on American or Southwest when driving or taking Vonlane isn't feasible.

I've been finding that UA is often cheaper than WN on many flights out of DEN, so I'm no longer loyal. And since I have Silver, thanks to Marriott Lifetime Unobtanium, I've been flying with them a lot more. Even got a great deal to EYW for 34,000 points in Dec.

I used to be a champion for WN, but this new airline is no different than the rest now.

@John. You don’t have to book and cancel a ticket to get the $75 benefit. Just buy a SWA gift card on SWA. It will trigger the $75 refund into your cc.

I have done it in the past two years.

Thanks ... Didn't realize. When I went back and looked I think I missed the credit last year. Oh well. I need to go to PHX in October anyway, so I booked a leg on the card and the return with points.

You can use the $75 credit for a SW gift card that doesn't expire. No need to book a flight then cancel.

With these credit card benefits, the value of earning just basic A-List status seems completely neutralized if you carry the Priority card. It looks like the seating benefits are duplicated between basic A-List and the card, both in terms of preferred seating at booking and extra legroom seating with the same window. I will grant that I'm at least unaware of any card that grants these type of seating benefits on any other airline, so...

With these credit card benefits, the value of earning just basic A-List status seems completely neutralized if you carry the Priority card. It looks like the seating benefits are duplicated between basic A-List and the card, both in terms of preferred seating at booking and extra legroom seating with the same window. I will grant that I'm at least unaware of any card that grants these type of seating benefits on any other airline, so at least you have a potentially-unique benefit. The baggage allowance is the same. The only perk of A-List that does not seem to be offered is the 25% earning bonus, which is a pittance. Maybe there is some marginal boarding position priority (Group 4 for A-Listers vs Group 5 for card members?). But overall, I fail to see the incentive to spend on the card or fly enough to earn status when you can effectively purchase A-List benefits by carrying the card.

Conversely, if you are going to get A-List anyway because you fly WN enough to get A-List, what value does that premium card offer you? 7500 points for $229? Terrible deal. You're better off with a cheaper card that gives you a 15% off discount in addition.

I guess WN and Chase want to kick off all the sock drawer people who get a Priority card and pocket the points and $75 annual credit?

Interesting analysis and so true. My original thought was people that fly not very often won’t get the benefit of the card now so should cancel. But you point out people that fly a lot and have a list also don’t need the card. Which begs the question. Who the +%^% is their intended customer for this card now!?

Priority card loses the $75 credit annual credit and also does not get the flight discount that the lower tier cards do--very interesting strategy here. Counting on folks banking on "saving" seat fees I guess. No longer a no-brainer card unfortunately

Losing that $75 annual credit means neither my wife nor I will be keeping that card. Southwest is losing business with all of the negative changes, and so will Chase.

Only thing we are interested in today is the Allegris LH review ;)

Frankly I fly a lot more WN than LH (though not so much after the May changes) and I carry the Priority card (though not after THESE changes).