Link: Learn more about the Chase Sapphire Reserve® Card or Sapphire Reserve for Business℠

It’s quite a busy time for Chase news, as we’re seeing a refresh of the Chase Sapphire Reserve® Card, and the introduction of the Sapphire Reserve for Business℠ (review). We’ve known that there would be changes to the eligibility requirements for the Chase Sapphire portfolio, and we now have the full details.

In this post, I want to cover a more fundamental change to the Chase Ultimate Rewards points ecosystem, as we’re seeing 1.25-1.5 cent redemptions through Chase Travel℠ dropped, in favor of a new Points Boost feature, with a transition period. Let’s look at that in a bit more detail, starting with the bad news, as this new feature has gone “live” as of today.

In this post:

1.25-1.5 cent Chase Travel redemptions being dropped

There are lots of great ways to redeem Chase Ultimate Rewards points. Personally, I like transferring them to Chase’s airline and hotel partners. However, it’s also possible to redeem Chase points toward the cost of a flight, hotel, rental car, etc., through the Chase Travel portal. Historically, the value you’ve received per point has been based on the card you have:

- The Chase Sapphire Reserve has offered 1.5 cents of value per point through Chase Travel

- The Chase Sapphire Preferred and Chase Ink Business Preferred have offered 1.25 cents of value per point through Chase Travel

- Most other cards have offered 1.0 cents of value per point through Chase Travel

As part of Chase’s card overhaul, this is all changing, as Chase is eliminating the 25-50% bonus for Chase Travel redemptions for those who have premium cards. That means all cards will offer a flat 1.0 cents of value per point through Chase Travel, at least as a standard.

The good news is that these changes only kick in gradually. Assuming you’re an existing cardmember (who picked up the card prior to June 23, 2025), the points you earn through October 25, 2025, will continue to be redeemable at the higher rates (so 1.5 cents for those with the Sapphire Reserve, and 1.25 cents for those with the Sapphire Preferred and Ink Business Preferred).

For points earned by that date, it’ll be possible to redeem at that rate through October 25, 2027, so that’s awesome news, since we’ll still have a couple of years to redeem that way. Let me emphasize that this only applies for points earned through October 25, 2025.

Furthermore, if you combine points into a single account (which can easily be done online), all the points will be able to be redeemed at that higher rate. So it could make sense to consolidate all your Ultimate Rewards points in your Sapphire Reserve account by October 25, so all those points have the flexibility to be redeemed at that higher rate.

For points issued on new accounts as of June 23, 2025 (launch date of the refreshed Sapphire Reserve, and the new Sapphire Reserve for Business), the new rate applies.

Chase rolling out Points Boost, offering more value with points

As of June 23, 2025, Chase has introduced Points Boost, and this is available to new and existing cardmembers. The idea is that this replaces the existing 25-50% bonuses on Chase Travel redemptions (though for some existing cardmembers, it’ll be possible to pick which way you want to redeem for the next couple of years, to really maximize value).

The idea is that Points Boost gives you more than 1.0 cents of value per point for Chase Travel redemptions. With Points Boost, you can instead redeem points for 1.25-2.0 cents each toward the cost of a travel purchase. How can you do that? Well, Points Boost is available on select flight and hotel bookings.

Those with the Chase Sapphire Reserve are able to get up to 2.0 cents of value per point for bookings with The Edit by Chase Travel, which offers extra perks at luxury hotels. Meanwhile they’ll also be able to get 1.25-2.0 cents of value toward select flights, based on the airline, class of service, etc.

Those with the Chase Sapphire Preferred and Ink Business Preferred will be able to get 1.5 cents of value per point for bookings with The Edit by Chase Travel, and 1.25-1.75 cents of value toward select flights, based on the airline, class of service, etc.

So, how useful is this new feature? With it now being live, I’ve played around a bit with the options.

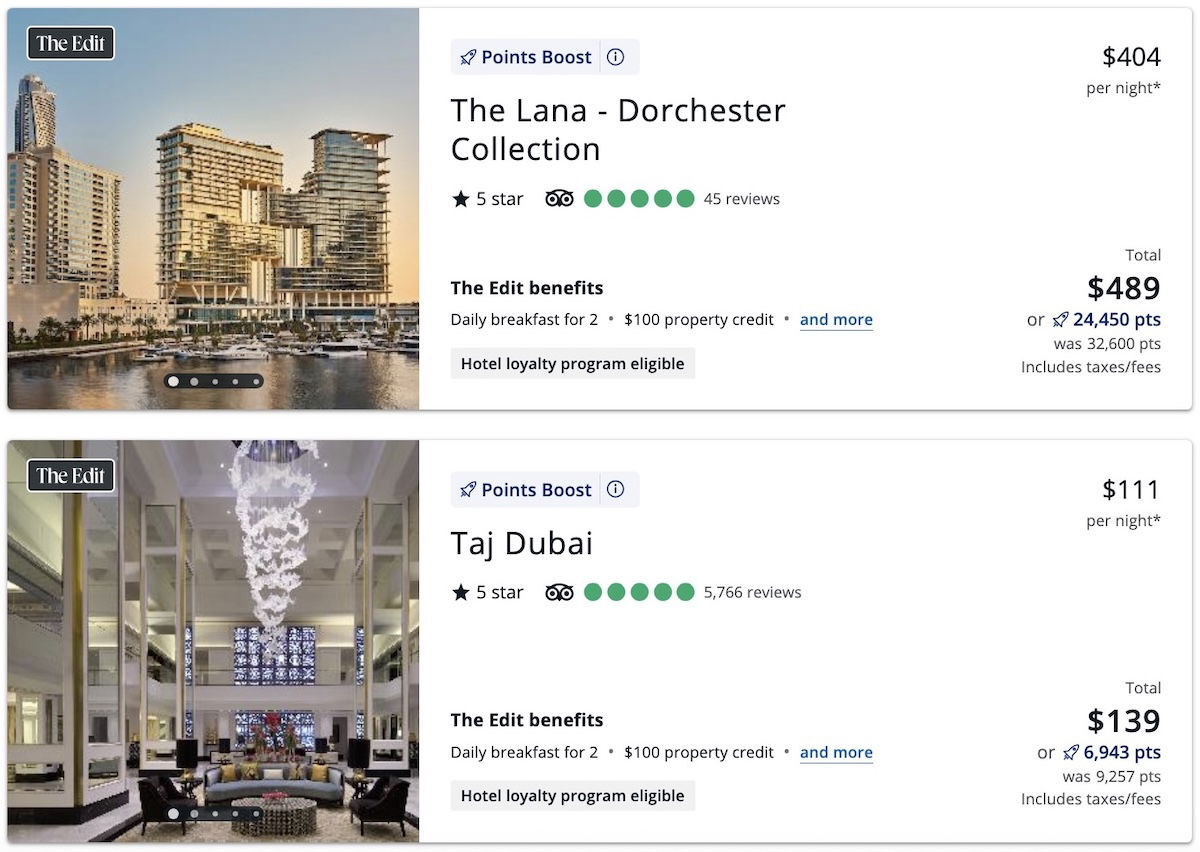

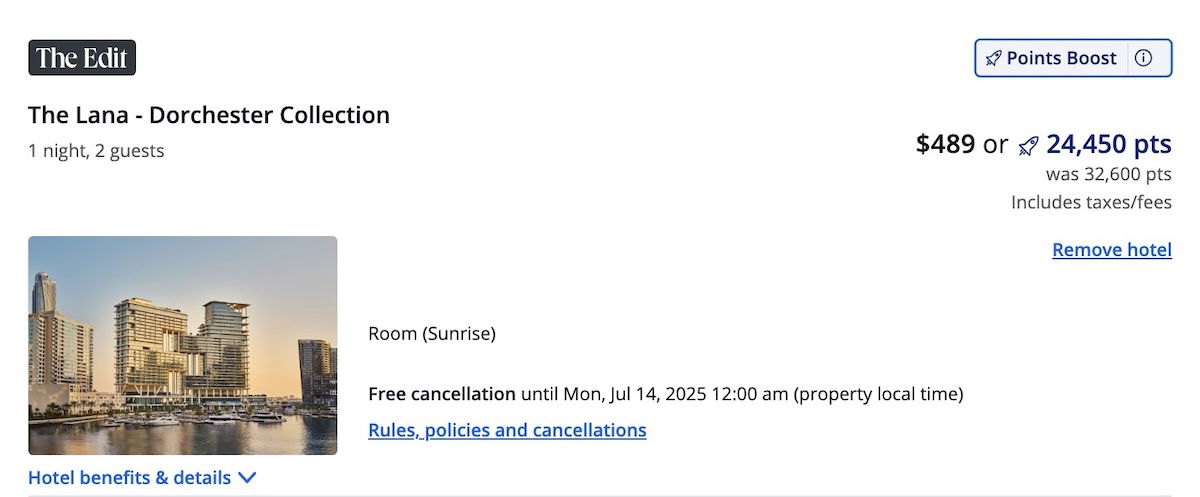

It’s nice how The Edit by Chase Travel bookings all qualify for the higher redemptions, meaning that if you have the Sapphire Reserve, you can redeem your points for 2.0 cents each toward a luxury hotel stay. For example, a hotel costing $489 all-in would require 24,250 points.

You can tell if a hotel is eligible for Points Boost based on the little rocket symbol next to the price in points.

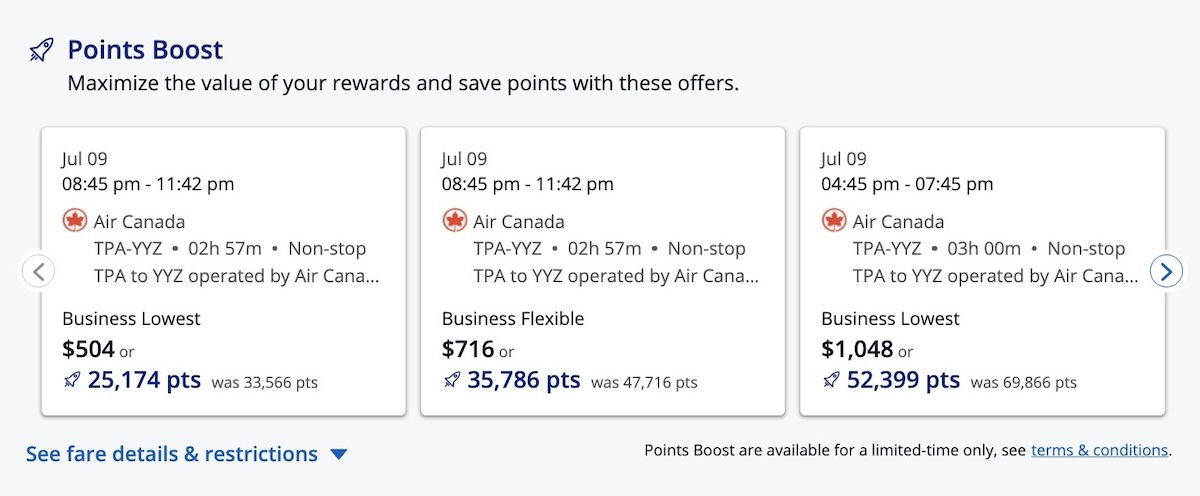

When it comes to flights, the Points Boost feature is only available on select airlines, for select classes of service. These options can also change over time. For example, as of now, I see the ability to redeem for 2.0 cents each for premium cabin travel on airlines like Air Canada, Emirates, and United.

There’s no list anywhere (as far as I can tell) of what airlines or classes are eligible. Instead, when you do a search, you’ll see the Points Boost options listed at the top, if there are any eligible options. Just like with hotels, you’ll see the little rocket symbol next to any option that’s available with that deal.

Bottom line

Chase has made major changes to how Ultimate Rewards points can be redeemed. Chase has dropped the previous standard 25-50% bonus on Chase Travel redemptions for premium cardmembers, allowing you to redeem points for 1.25-1.5 cents each toward a travel purchase. However, this will be a gradual process, and existing cardmembers will have through October 2027 to redeem that way.

Chase is also introducing the Points Boost concept as of June 23, 2025, whereby cardmembers are able to redeem points for anywhere from 1.25-2.0 cents per point, toward select hotel and flight redemptions. The higher redemption rates seem to mostly be available for luxury hotels and premium cabin flights on select airlines.

If you can cash out your points at 2.0 cents each toward a flight or hotel, that could potentially represent a good deal.

What do you make of the Chase Points Boost program?

The problem with most of the credit card travel centers is that I can find a cheaper flight option on the same flights direct or elsewhere. Limiting the bonus is yet another reason to downgrade to the Preferred card.

"Points Boost" is for suckers.

i just ran this against 2 seperate LAX > HKG roundtrips i have to take this summer/fall, ideally direct on Cathay or secondarily via Japan on AA/JAL.

points boost only shows United and Air Canada flights with stopovers, which, when correlated to their respective websites, are showing full fare prices only.

as someone else stated, this is akin to 'dynamic pricing'... but also selective, as it doesn't even cover all airlines at any...

i just ran this against 2 seperate LAX > HKG roundtrips i have to take this summer/fall, ideally direct on Cathay or secondarily via Japan on AA/JAL.

points boost only shows United and Air Canada flights with stopovers, which, when correlated to their respective websites, are showing full fare prices only.

as someone else stated, this is akin to 'dynamic pricing'... but also selective, as it doesn't even cover all airlines at any given date or time.

CSR to be cancelled mid october 2025.

Dynamic "pricing" was already baked in. This is "Dynamic Devaluation".

Dynamic pricing: "It costs whatever we say it costs, whenever we say it."

Dynamic Devaluation: "Your points are only worth whatever we say they're worth, whenever we say it."

Bend over, you're getting screwed on both ends now - the value of your currency, and the prices they will charge,

ha, yes, true.

i'd go even further and say "Dynamic Destruction"

the beauty of Chase points, or AA points for that matter, is that even with dynamic pricing, if there was a seat open, you could take it, no matter at what cost.

now, you're beholden to the terrible Chase portal that already showed you limited options, but this all blows it up.

Fears confirmed...Another game to play. This is awful. 3 of the 4 flights I searched have higher prices through Chase than directly through United, so the "points boost" is BULLSH*T

Lucky, I hope you will call them out on this stuff. I'm sure it doesn't fit well with your job of "selling" points travel. But let's be intellectually honest about this.

@ Barry -- I'm curious, can you provide some examples, like dates and routes? I'd like to look into that. I wouldn't be surprised if it happens sometimes, but it shouldn't be happening with any frequency...

Sure...

IAH to SJO Jan 31 935am; business

LIR to IAH Feb 10 214pm; business

MIA TO IAH Nov 30 1155am; first

If you "toggle" points boost, only premium cabin fares (Premium Plus, business, first on United) will appear. It's possible that you may be comparing Premium Plus (extra legroom) fares to basic or main cabin fares on United web site.

What a joke... Amex had 8 nights at the hotel I'm looking at in Rome for $1973 and I get a $100 credit. Chase had the same hotel and room for $4016 with no credit... but at least you are able to use points boost to get amazing value for your points. Even with the points boost it was 267k points, so it's 1.5x only. I honestly think they are just raising the price for any "points boost" hotel.

@ Andrew -- Curious here. Do you have dates/hotels you can provide as an example? Would like to look into this...

Lucky,

As you continue to boost these cards, I would like you to tell us - honestly - how often you use the pigs’ breakfast that is Chase Travel

@ ErikOJ -- Historically I've used Chase Travel very little. These changes will make me use it (or at least attempt to use it) a lot more, and of course I'll report back with my experience.

The unpublished aspect of this reminds me of dynamic pricing. Sure, it could provide value, but it's resulted in my steering away from every program that uses this, because aspirational awards have aspirational pricing.

I think this just continues to knock value away from the Chase ecosystem, unfortunately.

Yeah, that's my view too. Anything that adds friction to the process is generally not good for consumers, and this is the very definition of friction.

My comment on original article.

2 cpp from points boost is actually pretty good for a lot of people. Since points redeemed for flights are considered revenue tickets, you earn FF miles and status back.

This means on a program like AA, you could earn something like 9x to 11x miles if you're a Plat Pro/EP.'

So if I spent 50k points for a $1000 ticket, I'd get back around 10k AA miles, meaning I...

My comment on original article.

2 cpp from points boost is actually pretty good for a lot of people. Since points redeemed for flights are considered revenue tickets, you earn FF miles and status back.

This means on a program like AA, you could earn something like 9x to 11x miles if you're a Plat Pro/EP.'

So if I spent 50k points for a $1000 ticket, I'd get back around 10k AA miles, meaning I spent a net 40k points for $1000 of value, a solid 2.5 cpp, which is above average, and lower effort than hunting for award space. And arguably AA miles are worth more than 1 cent as well.

I prefer this to the existing 1.25-1.5 cpp flat redemption, which I assume most people did not use (at least at 1.25). My CSP & Ink Preferred were offered 2 cpp last month during the trial run so I'm already used to this feature. The map search for hotels is a bit quirky and the filtering does not work well. As a data point: I'm seeing redemptions rates of 1.5-1.75 cpp using my CSP & Ink Preferred now.

Good luck having to change travel plans and dealing with “Michael” at the unbelievably awful Chase Travel call center

Not true. I changed my flight directly with the airline

"I prefer this to the existing 1.25-1.5 cpp flat redemption, which I assume most people did not use (at least at 1.25)."

You're kidding right? Av/points geeks aside, and churning aside, the majority of Sapphire redemptions occur via the portal. Most people cannot be bothered to transfer points... or it makes them feel uncomfortable... or whatever. Heck, I wouldn't be shocked if the portal redemption percentage is as high as 75%.

From what I read: “With new Points Boost offers, your points will be worth up to 2x on thousands of both top booked hotels and flights with select airlines through Chase Travel.” Nothing about Activities, Cars, or Cruises & I can’t off-hand find any noted with a Rocket Ship, either. Not happy if those cats will only be 1x moving forward

@ Pam -- Correct, it's limited to select flights and hotels, and not other types of purchases. You should see the rocket logo if searching for "The Edit" hotels, or premium cabin tickets on carriers like Air Canada, Emirates, and United.

I am excited about the point boost and the edit credit for the eligible hyatt and marriott properties where on a two night stay you get elite night credit and points f and benefit from hyatt or marriott, $250 credit toward the 2 night stay from Reserve, the Edit $100 credit and free breakfast credit, can apply points at 2 cents per point toward the reservation and pay cash on the reserve prepaid and earn...

I am excited about the point boost and the edit credit for the eligible hyatt and marriott properties where on a two night stay you get elite night credit and points f and benefit from hyatt or marriott, $250 credit toward the 2 night stay from Reserve, the Edit $100 credit and free breakfast credit, can apply points at 2 cents per point toward the reservation and pay cash on the reserve prepaid and earn 8 ultimate reward points per dollar spent. I compared directly booking with hyatt using points or cash and you can much better on the edit properties I checked using this approach.

Also finallly we can use points at good value toward Edit four seasons properties that were not available to us before using transferable points at a good value so another win.

Are we certain these booking count towards elite night credits and redemption points?

I do see this now on CSP but no indication when I looked at a couple of test bookings that CSP cardholders have access to the Edit and Hyatt/Marriott/IHG loyalty benefits when they book- possibly that is going to remain CSR exclusive?

To note. It seems some Edit hotels have a minimum 2 nights for benefits

@ Ni -- The only two night minimum I know if is for using the $250 semi-annual credit. Otherwise I believe perks should apply for one night stays, unless I'm missing something?

Thanks Ben!

Nobu Warsaw I believe has 2 night minimum

Aside from rocket symbol, is there a way to know which edit hotels are eligible?

@ Ni -- All hotels belonging to The Edit should be redeemable via Points Boost, as I understand it.