Link: Apply for a Bilt credit card, with three options to choose from

We’ve just seen Bilt roll out absolutely massive changes, which impact both the credit card portfolio, as well as the way that rewards are offered on housing payments. With the new cards having now launched, we’re finally in a new era when it comes to how rewards are earned for housing.

However, I know a lot of people are still confused by the logistics. If you were used to the old system, odds are that your last payment was made on February 1. So what happens as of March 1? How does everything change, and how do you set things up so that you’re rewarded correctly?

Bilt has published surprisingly little information about the actual logistics of earning rewards on housing payments under the new system, so let me do my best to share the process, as I understand it. This would apply for those with the no annual fee Bilt Blue Card, $95 annual fee Bilt Obsidian Card, or $495 Bilt Palladium Card (read my Bilt credit card review & comparison).

In this post:

Basics of earning points with Bilt for housing payments

Broadly speaking, the idea is that Bilt lets you earn rewards for your housing payments at no fee. You can make your housing payments as you usually would (by online payment portal or check), but if you set things up correctly and have a co-branded credit card, you can be rewarded nicely:

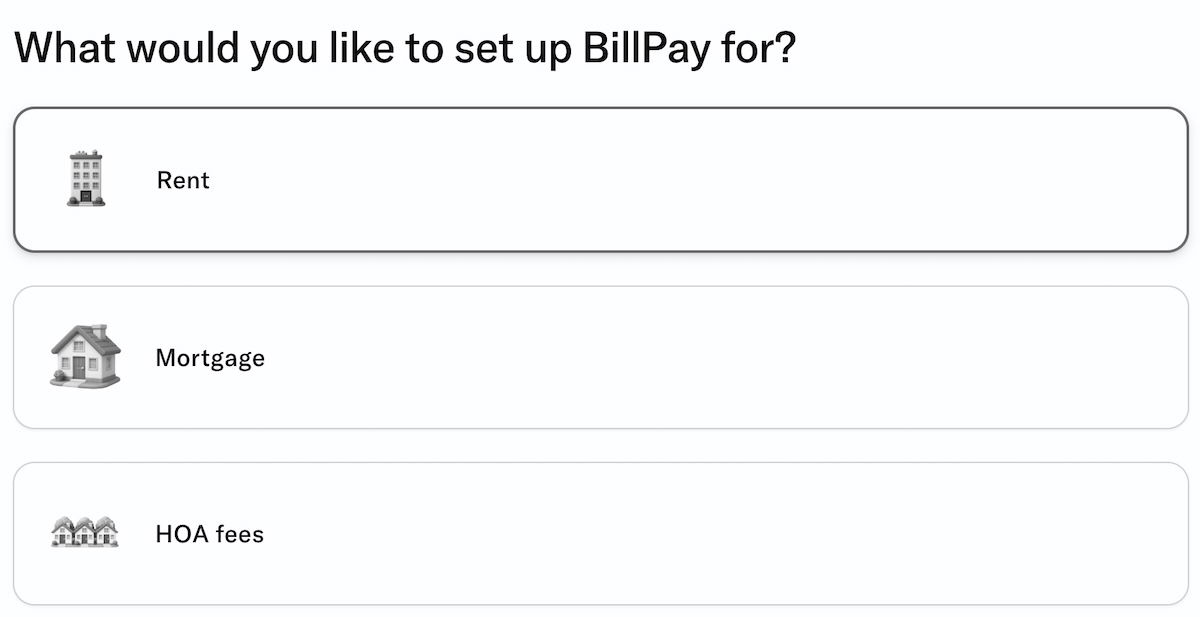

- Bilt members can earn points for paying their rent, mortgage, and/or HOA fees (typically 1x points, but there’s some variability)

- Bilt members can earn points for one or multiple properties, so if you have multiple eligible housing payments, you can be rewarded for each of them

- Bilt members can earn points on housing payments with no cap, so as long as you earn enough “credits” to be rewarded, the sky is the limit

- Bilt members need to link their payment accounts for eligible housing payments and then the payment is made by ACH, and you’re awarded points (so the housing payment isn’t charged to your Bilt credit card)

For context, the rewards for housing payments come in the form of Bilt points, and that’s a valuable transferable points currency that can be moved to all kinds of partners (and you can get even more value by taking advantage of Rent Day promotions).

The big catch is that in order to earn rewards for your housing payments, you need to either complete a certain amount of credit card spending, or you need to rack up sufficient Bilt Cash. In theory, you can change your preference with each billing cycle, but typically I think Bilt Cash is the better of the two options. Let me explain.

Earning rewards on housing payments with Bilt Cash

Bilt Cash is the primary currency by which you can earn rewards for housing payments:

- All three Bilt credit cards offer 4% in Bilt Cash on spending, in addition to the standard rewards structure

- $3 in Bilt Cash is worth 100 Bilt points on your total housing payment, at the rate of 1x points

- Bilt Cash expires on December 31 of the year in which it’s earned, though $100 in Bilt Cash can be rolled over to the next year

- You need to have the Bilt Cash in your account at the time that you try to make your housing payment

- While earning rewards on housing payments is one of the best uses of Bilt Cash, there are other ways to use these rewards as well, like for a spending accelerator, among many other options

To simplify this as much as possible, with this option, you need to spend an average of 75% of your housing payment amount in order to earn 1x points on those payments. In other words, $15,000 in spending on a card would earn you $800 in Bilt Cash, which is enough to earn 20,000 points on $20,000 worth of housing payments.

A vast majority of people should be using Bilt Cash for housing payments, rather than the alternative option, which I’ll cover below.

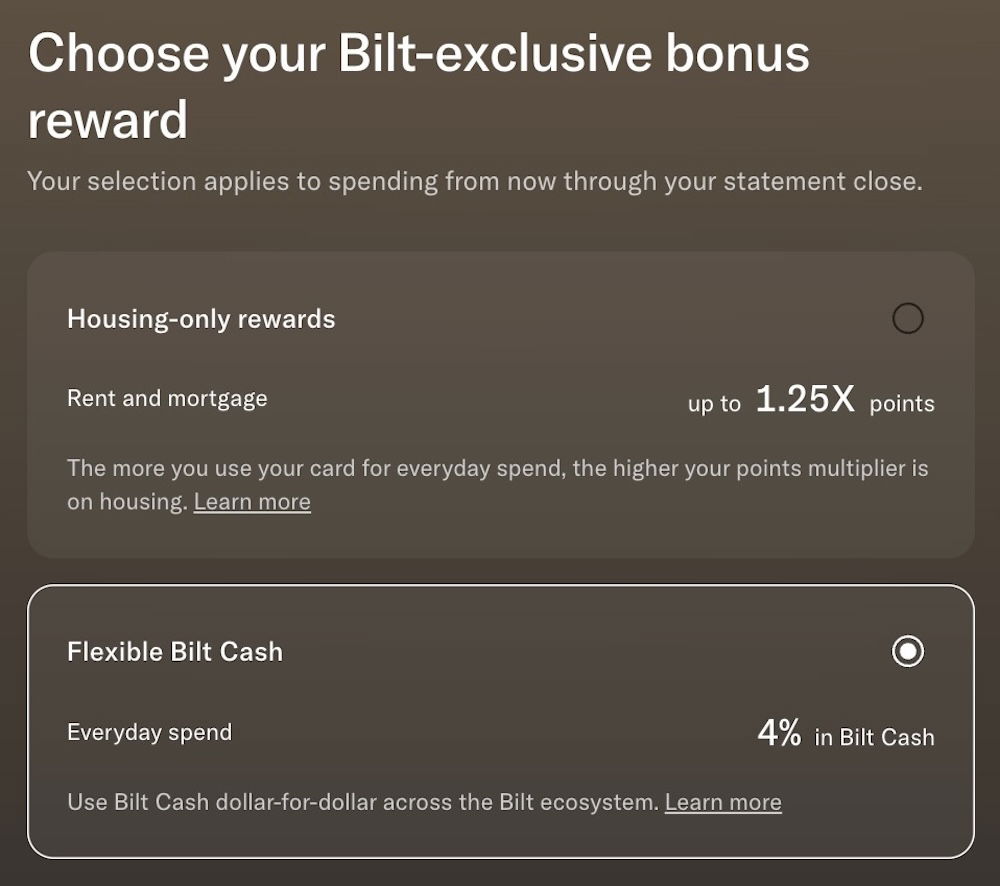

Earning rewards on housing with housing-only rewards

Bilt does have one alternative to the Bilt Cash concept (this was designed at the last minute, for people who thought the Bilt Cash system was too complicated). Rather than earning Bilt Cash, cardmembers can instead be rewarded for their housing payment using a housing-only rewards system.

The idea is that the more you spend, the bigger your multiplier on housing, up to 1.25x points. You can find the chart below.

Points on Housing | Minimum everyday spend as a % of monthly rent / mortgage (Example of $2,000 rent) |

|---|---|

0.5x points | Spend at least 25% of monthly rent ($500) |

0.75x points | Spend at least 50% of monthly rent ($1,000) |

1x points | Spend at least 75% of monthly rent ($1,500) |

1.25x points | Spend the same or more as your monthly rent ($2,000) |

That might sound good, but I consider Bilt Cash to be more lucrative, given that excess Bilt Cash can be redeemed in all kinds of other way, to earn you even more points.

Step-by-step to rewards on housing payments with Bilt

While the above covers how much you can be rewarded for housing payments, what’s the actual process for setting things up so you’re being rewarded correctly? This is certainly something I was confused about, since I was used to the old system, and am now wondering what I need to do for March 1, when my next housing payment is due.

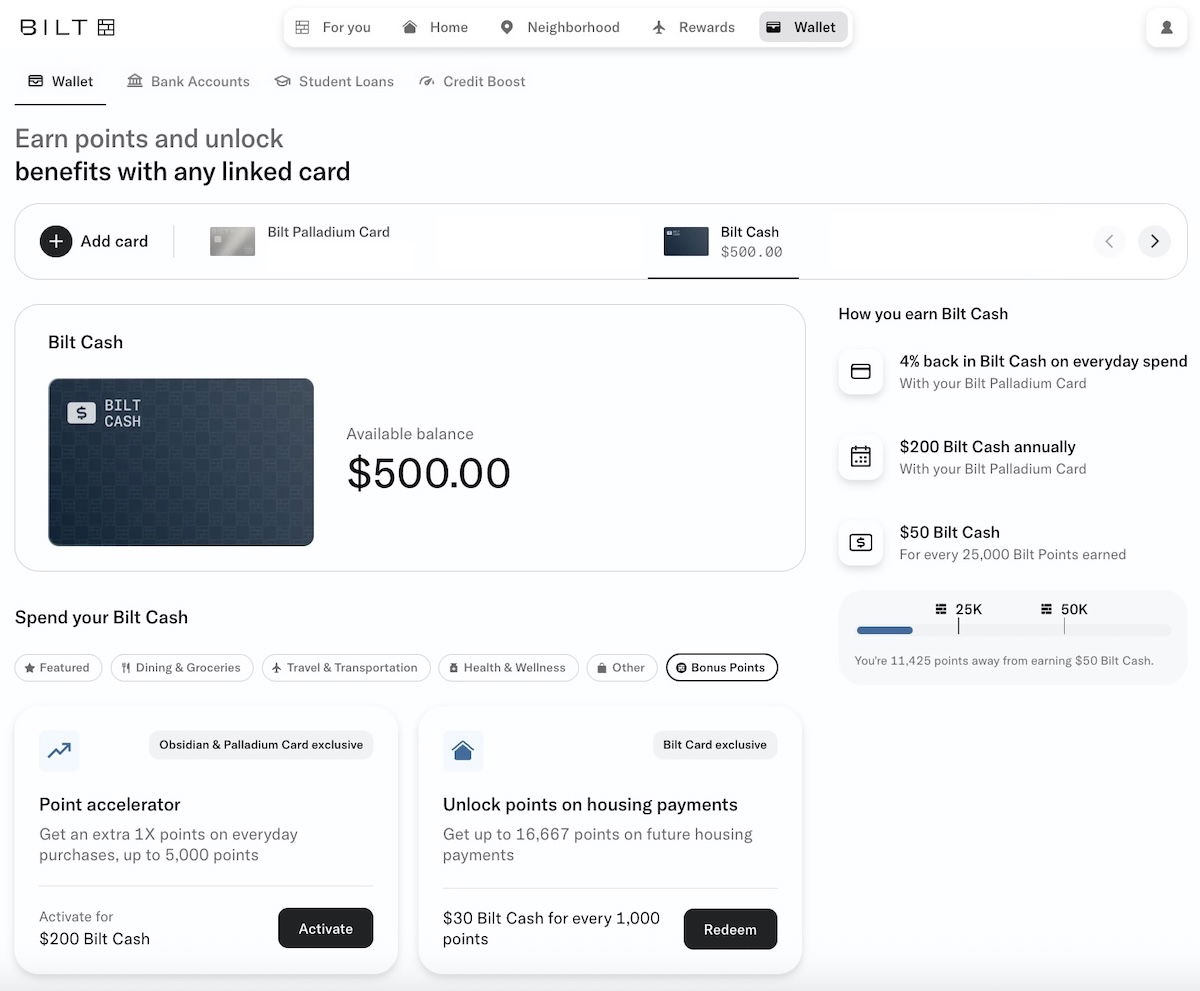

For what it’s worth, I picked up the Bilt Palladium Card, and as part of the welcome bonus on that card, I earned $500 in Bilt Cash (all Bilt credit cards offer some Bilt Cash as part of the sign-up bonuses, to get people started on earning rewards on housing payments).

What’s the process for setting things up correctly? Before I get into this, let me explain the below instructions assume that you choose to earn Bilt Cash, which is what I would recommend. That’s because you first need to select if you want Bilt Cash or the housing-only rewards option, so the process is slightly different for the latter.

With that out of the way, you’ll want to log into your Bilt account, and go to the “Wallet” section of your account. Then go to the “Bilt Cash” section, which will show how much Bilt Cash you have available. Note that Bilt Cash that’s part of the sign-up bonus generally posts as soon as you activate your card.

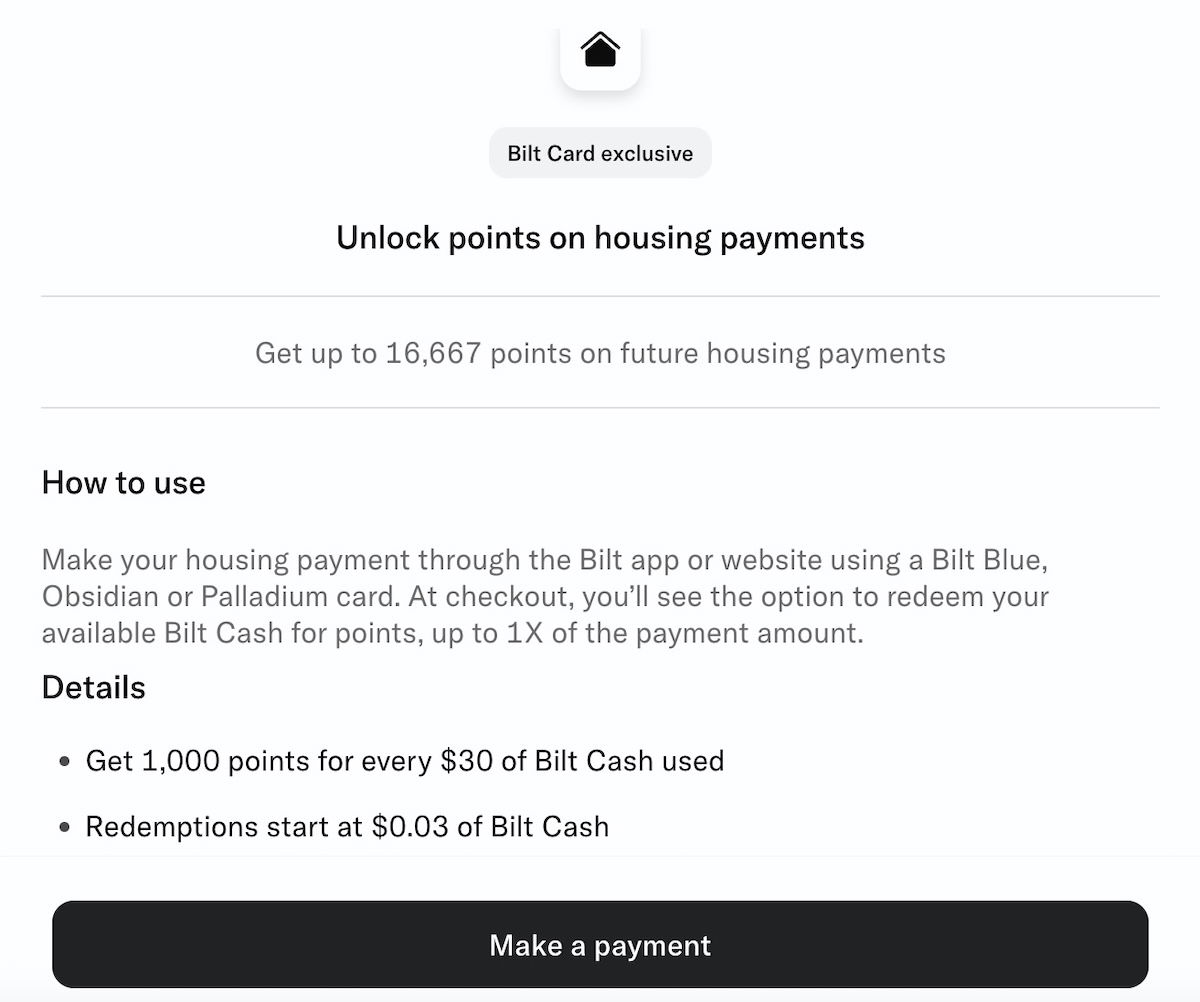

Underneath the Bilt Cash area, you should see a heading that says “Spend your Bilt Cash.” Choose “Bonus Points,” and then the “Unlock points on housing payments” section, and then click “Redeem.”

You’ll see the maximum number of points you can earn on future housing payments based on your Bilt Cash balance. For example, my $500 in Bilt Cash is enough to earn me 16,667 points. So you should then click the “Make a Payment” button.

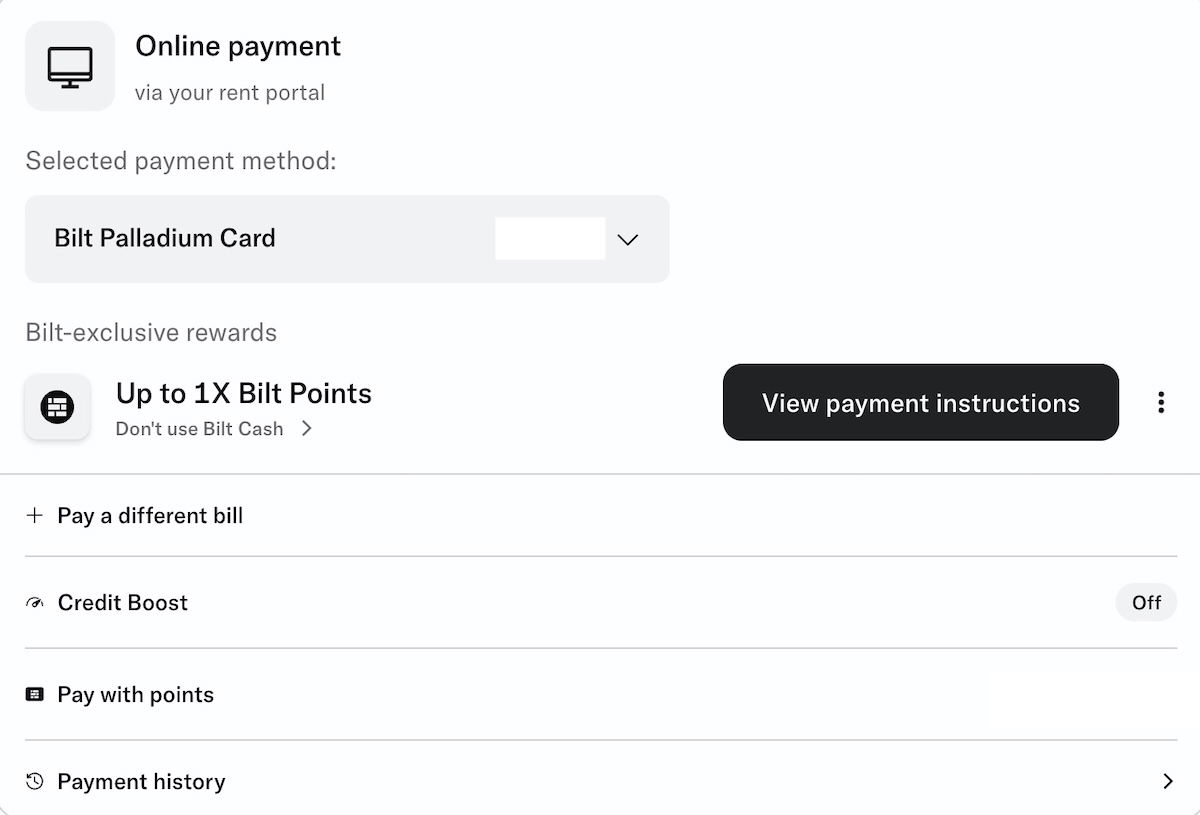

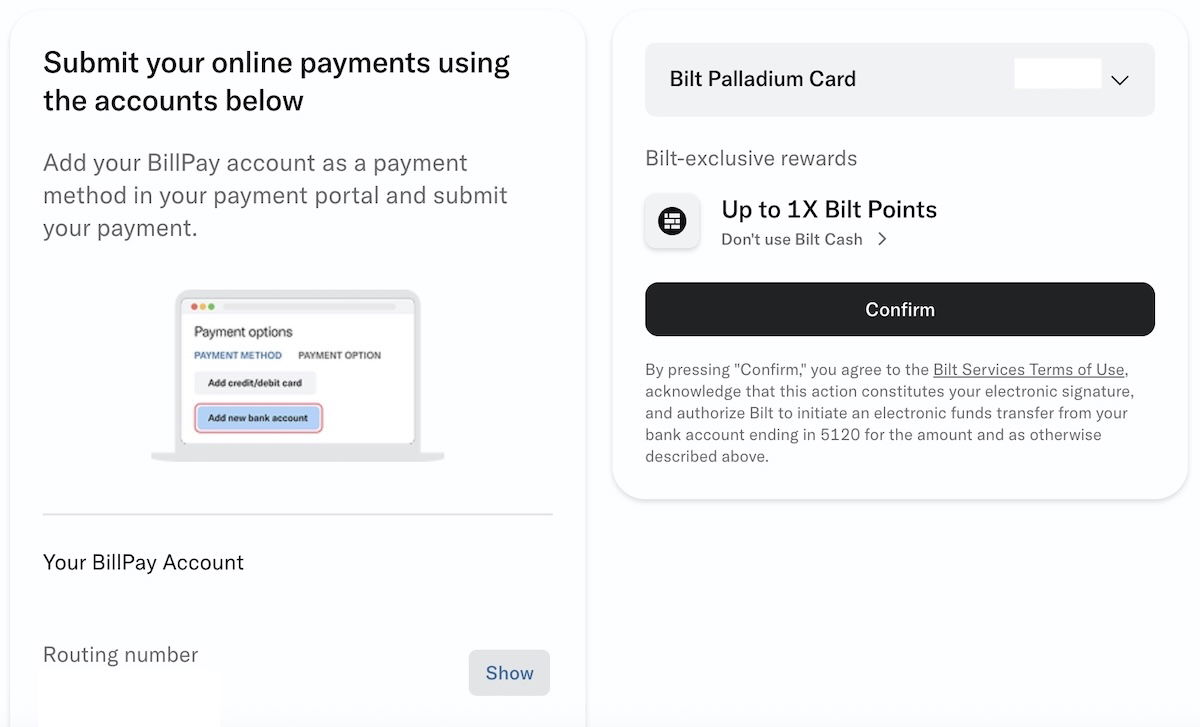

If you already have your housing payment linked to Bilt, then you should see it already listed. The only action you have to take is that under “Bilt-exclusive rewards,” make sure you click the “Don’t use Bilt Cash” button, and then on the next page, toggle the switch, so that you do use Bilt Cash to earn points.

Then everything should be all set for the next housing payment posting, and at that time points will also credit to the account (up to the limit of how much Bilt Cash you have).

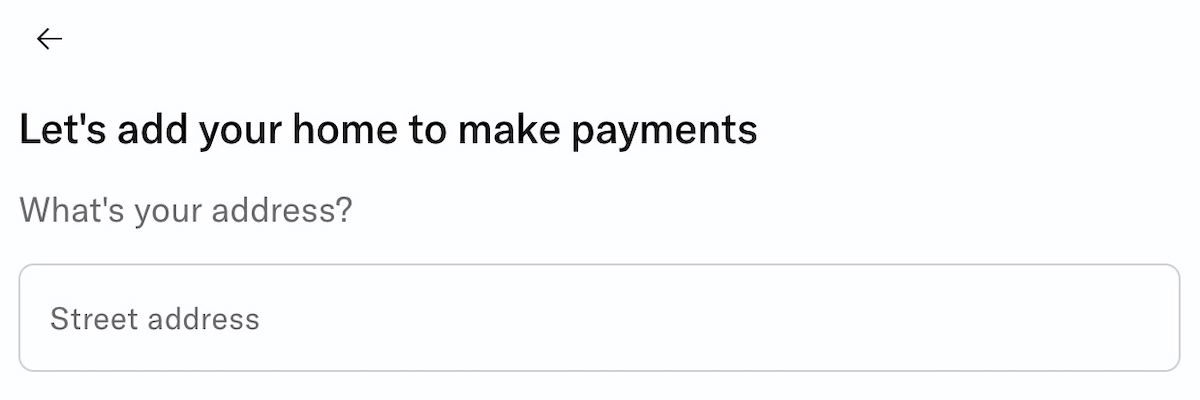

But what if you’re setting up a new housing payment, or a payment for a second home? Well, on the above page, click the “Pay a different bill” button, and then you’ll be brought to a page where you’re asked to enter the property’s address.

On the next page, you’ll want to click the “Get Started” button.

Then you’ll be asked if you’re trying to pay rent, a mortgage, or HOA fees.

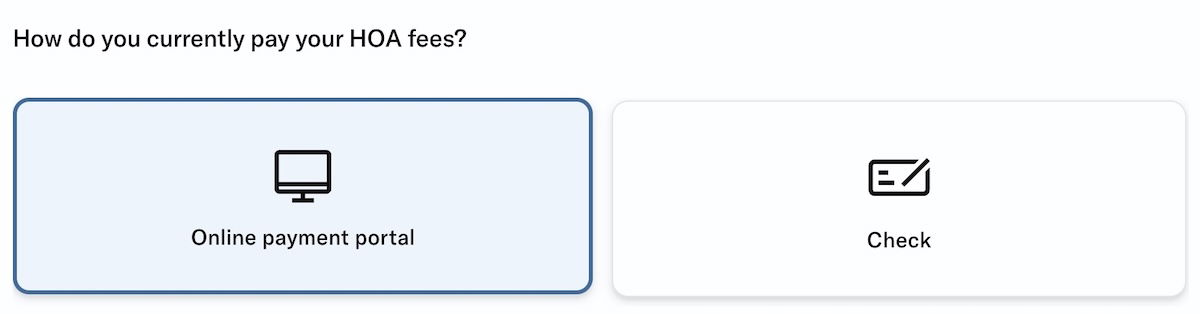

On the page you’ll be asked if you want to make your payment through an online payment portal or by check.

Assuming you select the online payment portal option, on the next page you’ll be given the routing and account number you need to use for the payment. So you’d then want to enter that information on the payment portal website, as if you’re paying out of a bank account.

That’s it, you’re then all set. You’ll then earn rewards once your payment processes, assuming you have sufficient Bilt Cash in your account to earn those rewards.

Bottom line

Bilt lets members earn rewards for making their housing payments, whether it’s rent, a mortgage, or HOA fees. The catch is that you need to complete certain activity in order to be rewarded on those payments.

Most people will want to use Bilt Cash in order to earn rewards on housing payments, and it’s a pretty straightforward process. You just need to link your account, and then once your housing payment is charged, you should earn the corresponding points, assuming you have sufficient Bilt Cash to cover those rewards.

What’s your take on the process of earning rewards on housing payments with Bilt?

If my rent payment was already set up on "autopay" through BILT 1.0 (and displays as still set up that way in BILT 2.0), will I automatically earn points through Bilt Cash? Or do I need to affirmatively, manually "unlock" points on housing payments / re-set up monthly auto-pay? Thanks!

I have a question regarding the first mortgage payment. If I pay my first mortgage on March 1st, when will the needed spend have to be? During the month of March or during month of February?

That is does the spend requirement to get points precede or follow the mortgage payment? If it is AFTER, then if we choose “housing only” instead of Bilt cash, what happens to spend in February? Will it be automatically deposited as Bilt cash or I just gain nothing?

I have a question regarding the first mortgage payment. If I pay my first mortgage on March 1st, when will the needed spend have to be? During the month of March or during month of February?

That is does the spend requirement to get points precede or follow the mortgage payment? If it is AFTER, then if we choose “housing only” instead of Bilt cash, what happens to spend in February? Will it be automatically deposited as Bilt cash or I just gain nothing?

I must have read a dozen articles on this and watched an equal# of videos and I walk away each time with 2 things.

1. I get more confused especially the nuances. 2. I come to the conclusion why am I wasting time on this eco system with miniscule roi. There are plenty of other cards to work on and investments to manage.

Ben - I'm deep in this points world, but I simply can't make 2.0 work/make sense. I have $10k mo in vacation rental mortgage payments, $4k in HOA dues, and $4k/mo in rent. I would love to earn points on all of that (216k points!), but there's simply no way I can spend $13.5k/month (75% of $18k above) on top of my housing-related payments. Like zero chance.

I currently use my Alaska Summit card...

Ben - I'm deep in this points world, but I simply can't make 2.0 work/make sense. I have $10k mo in vacation rental mortgage payments, $4k in HOA dues, and $4k/mo in rent. I would love to earn points on all of that (216k points!), but there's simply no way I can spend $13.5k/month (75% of $18k above) on top of my housing-related payments. Like zero chance.

I currently use my Alaska Summit card to pay the HOA dues and get 3x. 12k Alaska points/month is worth the 3% fee since I earn status AND points. I'm currently Platinum.

My question - does getting even the cheapest Bilt card unlock my ability to use Venmo for rent payments?

Rent is the low hanging fruit for me, but I apparently can't do it without a true Bilt account. I would still choose to use my Alaska card most of the time since my rent + HOA dues alone would net me 288k AS points (!!!) and be Gold (ow Sapphire) and pretty close to Plat (emerald).

I forgot to mention $60k of AS Summit spend also gets the 100k companion cert, so effectively 388k points!

You're making the right choice with AS Summit. Now, we wait for when BILT/BofA/AS nerfs it.

Are you able to earn points for Home Equity loans? I don't see this answered anywhere.

You also earn $50 in Bilt Cash for every 25k points you unlock or earn. So while 75% spend is a good benchmark to think about to unlock the points, depending on the level of spend and housing spend, it’s less than 75% required. Factor in the $200 of annual Bilt Cash on the $495 card and it’s even less.

Oh no, Peter... they got to you... *sigh* Was it the TPG link? The Palladium SUB? Are you being held hostage?? We'll send an extraction team to Bond St., right away! /s

I just think that portion is significantly underreported. I mean, they changed how you earn the $50 per 25k points during the launch, so of course it is.

Take $50k of housing spend - you need $1500 of Bilt Cash to unlock it. If you spend $27500 you'll earn $1100 of B$ (4%). But you also get B$200 annually plus you're going to earn $200 in Bilt Cash from unlocking 50k housing points ($100) and...

I just think that portion is significantly underreported. I mean, they changed how you earn the $50 per 25k points during the launch, so of course it is.

Take $50k of housing spend - you need $1500 of Bilt Cash to unlock it. If you spend $27500 you'll earn $1100 of B$ (4%). But you also get B$200 annually plus you're going to earn $200 in Bilt Cash from unlocking 50k housing points ($100) and 2x points on spend (55k points - $100). So you are getting 105k points on $27.5k spend or 3.81x. You're not spending 75% to unlock the 50k housing points either ($37.5k) you're spending $10k less- or 55%.

That's a huge difference! Did they "get to me"? I don't even have the card yet. I have my reservations about Bilt, it's management team, it's 4 way deal, its awful launch. But if there's math that's getting those kinds of returns... I just don't understand why the bloggers aren't emphasizing it. Sure it's complicated - but lots of things are complicated.

Pardon the duplicates on here.

Yeah, I expect more changes, which, if so, is not a sign of great consistency or reliability. Let's say you were relying on those $50 per 25K... and, rug-pull, bait-n-switch, poof, gone.

I hope you get the card, soon. Take it out for a test drive. It's fine, for now.

Fair enough! I'll probably get it in a few weeks, just wanted to see if they actually survived February without making more dramatic changes, etc (to your point). If so, could see driving some spend on it for sure, and preserving 1:1 Rakuten transfers.

Rakuten 1:1 through May is still a really good thing for all of us who partake in it. Even with my concerns, I think and hope they'll survive at least a year. Where it gets interesting is next Feb, if folks do not renew their AF cards...

I've got another ~28k points heading my way in a few days... it's a really great benefit. That said, would it be the end of the world if I switched back to Amex MR? Of course not.

I’m gonna enjoy it while it lasts, then, yes, back to MR after.

Oh no, Peter... they got to you... *sigh* Was it the TPG link? The Palladium SUB? Are you being held hostage?? We'll send an extraction team to Bond St., right away! /s

Just don't see what the frustration is about here. This seems like a major win for simple points earners, such as myself. Coming from a CSR and CFU, this is a major win.

Previously:

I was earning 0 points on my mortgage payment, so this is another 72k+ points/year for me.

I was earning 3x points on dining, which I will continue to earn on the CSP

Travel was all put on...

Just don't see what the frustration is about here. This seems like a major win for simple points earners, such as myself. Coming from a CSR and CFU, this is a major win.

Previously:

I was earning 0 points on my mortgage payment, so this is another 72k+ points/year for me.

I was earning 3x points on dining, which I will continue to earn on the CSP

Travel was all put on my United Club Card, which will continue.

All else was previously earning 1.5 points, and now I will earn 2-3 (by simply using Bilt Cash, which is much easier than getting value from the coupon book cards)

So ultimately, the fee ends up roughly the same (after travel credits on CSR) and I get an additional ~200k points/year without any major effort at all. Seems like a no brainer.

I'm not one to transfer points to Air Canada or anywhere but United, since that makes the process too difficult and have never been able to find any value in doing so. Hyatt points will continue as well. Win, Win, Win.

Major caveat: Those 72,000 points 'earned' via your mortgage will come at a cost, 3% fee, which can be offset, but that is the complicated part. That 3x earning is also a technicality, because the Accelerator isn't 'free' and also isn't 'unlimited.' Thankfully Chase has Hyatt transfers, too, and, we'll see how long BILT keeps them, because at any moment Chase can pull a Citi and get them off the table (like they did with...

Major caveat: Those 72,000 points 'earned' via your mortgage will come at a cost, 3% fee, which can be offset, but that is the complicated part. That 3x earning is also a technicality, because the Accelerator isn't 'free' and also isn't 'unlimited.' Thankfully Chase has Hyatt transfers, too, and, we'll see how long BILT keeps them, because at any moment Chase can pull a Citi and get them off the table (like they did with AA transfers). By the way, how much does BILT pay to shill for them? Maybe I can be bought... Wait, are you doing this for free? Yikes...

Doesn't seem complicated to me at all. The 3% fee is offset by the Bilt Cash, and as long as I'm spending 75% of my mortgage each month then I break even. I spend more than that so it won't ever be a problem. I don't need to do the math each month. Any bonus cash can easily be used to increase points earning with the click of a button. Of course, they can yank...

Doesn't seem complicated to me at all. The 3% fee is offset by the Bilt Cash, and as long as I'm spending 75% of my mortgage each month then I break even. I spend more than that so it won't ever be a problem. I don't need to do the math each month. Any bonus cash can easily be used to increase points earning with the click of a button. Of course, they can yank transfer partners and in that case it would be time to reevaluate.

You know what's complicated? Keeping track of mostly useless coupons on each CC. Changing autopay cards when an issuer decides to offer another coupon/credit/bonus. Transferring to varying airlines in order to find optimal awards (and constantly changing valuations). Checking multiple Travel portals to find a hotel or restaurant that offers you a discount or perk.

"as long as I'm spending 75% of my mortgage each month"...ok, $6,000/mo for mortgage, so, $4,500/mo in non-mortgage spend. Maybe that's do-able for you, but, let's not kid ourselves, that's a lot of extra spend for most. $10.5K/mo in minimum spend, $126K/year. Let's say you live in state without income tax, so, just paying federal, standard deduction, etc., ball-park, you need to make at least $160K/year to break-even (top $10% of earners). If you live...

"as long as I'm spending 75% of my mortgage each month"...ok, $6,000/mo for mortgage, so, $4,500/mo in non-mortgage spend. Maybe that's do-able for you, but, let's not kid ourselves, that's a lot of extra spend for most. $10.5K/mo in minimum spend, $126K/year. Let's say you live in state without income tax, so, just paying federal, standard deduction, etc., ball-park, you need to make at least $160K/year to break-even (top $10% of earners). If you live in NYC, let's call it +$200K, because we got city/state income taxes, too.

If you're already in the top 10% of earners, yes, you "don't need to do the math each month" or at all, so long as you keep earning, never get laid off, only good things happen to you, forever and ever. Also, you'll want BILT to last forever and never change, too. What I'm saying is... things are looking 'great again' for you, in-particular, Lost...And...Jetlagged...

Every time I read about the logistics of earning points with Bilt, I think of the boys' school scene in Monty Python's "The Meaning of Life," when the teacher provides some simple instructions:

"I do wish you'd listen, Wymer. It's perfectly simple. If you're not getting your hair cut, you don't have to move your brother's clothes down to the lower peg. You simply collect his note before lunch, after you've done your scripture...

Every time I read about the logistics of earning points with Bilt, I think of the boys' school scene in Monty Python's "The Meaning of Life," when the teacher provides some simple instructions:

"I do wish you'd listen, Wymer. It's perfectly simple. If you're not getting your hair cut, you don't have to move your brother's clothes down to the lower peg. You simply collect his note before lunch, after you've done your scripture prep, when you've written your letter home, before rest, move your own clothes onto the lower peg, greet the visitors, and report to Mr. Viney that you've had your chit signed."

"Now... sex!"

(great analogy, by the way.)

Slightly off topic but, has anyone successfully Bilt Cash at a restaurant? That seems like a pretty straightforward use for it. The only unknown is the Mobile Checkout requirement.

... successfully used Bilt Cash ...

Not yet. It's all too new, honestly. Besides, it's not for use at literally at any restaurant. Instead, it's "$25 credit at select Bilt Dining partners" meaning, far more limited and tedious. Unless you live in an area with a lot of those partners pre-existing (like NYC), expect to be disappointed by that offering/use of Bilt Cash.

"How to use...Dine at any restaurant that uses Bilt mobile checkout. At checkout, you’ll see the option to apply your available Bilt Cash, up to $25 every month." And, yet, no list of applicable restaurants, so, one assumes, it's either so widespread to work nearly everywhere (unlikely), or it works at very, very few places, so as to be practically un-usable (a 'win' for them, a 'loss' for you!)

I found a way to get the "list" of restaurants that allow mobile check out through Bilt App - Neighborhood/Dining/Brows all Restaurants and filter by "mobile checkout".

Assuming that the app is accurate, there are 40 of them in New York city. Interestingly, it also shows both the neighborhood restaurants in our little township! However, I don't recall seeing the mobile checkout there. I am going to check it out soon.

Good find! 40 isn't nothing, but, also, isn't a lot for NYC. Congrats for your 'little township.' If it works for you, then that's a good thing! *fingers crossed*

The filter doesn't work. It still displays all restaurants, at least in cities other than NY.

the filters on the app are pretty broken. not sure if i can send reddit links here, but there's a deep dive into what's currently available (only 127 restaurants): https://www.reddit.com/r/biltrewards/comments/1qxz02f/warning_for_redeeming_bilt_cash_at_restaurants/

Im pretty sure on the page where it has your online rent payment portal informaiton you need to click where it says 'Don't use bilt cash' and change it to enable using bilt cash to earn points.

@ JustinB -- Whoops, indeed! That could be clearer. Fixed... thanks!

Agreed! If they don’t make that more intuitive there are gonna be a lot of unhappy people come March 5th

There are already a lot of unhappy people on February 9...

“How does it work?” Welp. Not as easy as it used to be, that’s for damn sure.

Please, someone do tell me how grateful I should be paying $495 for 2x because it has Hyatt, Alaska as transfer partners, when I can get 2x cash back with ole DoubleCash $0 AF.

‘But, but… BILT Cash! $10 coupon to Walgreens…’ (ok, fine, take my $495! /s)

Forget about earning on housing for a minute. Let's say that you use Bilt Cash for nothing else but the 1X earning accelerator and are able to earn 25,000 extra points. What are those points worth? If we said 2cpp, then you have your $500. Now, a smart guy like you will find it in himself to devise means to extract more value out of the card than just that. And, like Amex's coupons, not...

Forget about earning on housing for a minute. Let's say that you use Bilt Cash for nothing else but the 1X earning accelerator and are able to earn 25,000 extra points. What are those points worth? If we said 2cpp, then you have your $500. Now, a smart guy like you will find it in himself to devise means to extract more value out of the card than just that. And, like Amex's coupons, not all will attract everyone . . . such as the Gold Card's monthly $8 Dunkin credit.

'Forget about' the main thing BILT has been about? Yikes. Lee, that's some top-tier shilling you got there. By the way, Amex Gold is $7/mo Dunkin. You should know that. And, BILT copying that 'coupon book' model is not something most would praise. *facepalm*

@Lee the Gold Card Dunkin credit is $7 per month, not $8! ;)

Voian, I feel like Lee did that on purpose... he was testing us! LOL.

I hope people don't write articles like this proclaiming Bilt 2.0 cardholders somehow "earn" rewards for paying their rents or mortgages. They do NOT earn any rewards for rent or mortgage payments. They earn rewards only for spend in categories other than rent or mortgage (or taxes). Rent or mortgage payments are used only as a mechanism to redeem Bilt Cash, so that Bilt can tout, very misleadingly, that cardholders are still being rewarded for...

I hope people don't write articles like this proclaiming Bilt 2.0 cardholders somehow "earn" rewards for paying their rents or mortgages. They do NOT earn any rewards for rent or mortgage payments. They earn rewards only for spend in categories other than rent or mortgage (or taxes). Rent or mortgage payments are used only as a mechanism to redeem Bilt Cash, so that Bilt can tout, very misleadingly, that cardholders are still being rewarded for making housing payments as they did in Bilt 1.0

Thank you, Tony. We really did ‘earn’ in 1.0, whereas, 2.0 is nothing like it. Maximizers will enjoy the games in 2.0, but, for most renters, 2.0 is a nightmare, and a net loss. I like Ben, Gary, and the others, but they’re all gonna sound more like the shills at TPG for a while, until Ankur’s VC money finally dries up.

I hope people don't write comments like this proclaiming Bilt 2.0 cardholders somehow won't *earn* rewards on other spending (without any housing payment at all) that can be accelerated to an effective 3X . . . which can then potentially achieve a 100 percent transfer bonus.

Lee, 'potentially' is doing all the work there. For most, none of that will happen. And, as far as transfer bonuses, since when are the 'good ones' ever getting that treatment? Call us back when Hyatt gets a 100% bonus... psh.

The 3X is not potential. Who would complain about 3X going to Hyatt without a transfer bonus. And, certainly, transfer bonuses to other programs are probabilistic. But, I captured 100/150 bonuses to Air France and Virgin multiple times. Earlier was Emirates. Your argument seems dogmatic.

You need to use $200 BILT Cash for the 1x Accelerator up to 5000, limited to 5x/year. Yes, 25,000 bonus maximum, after using $1,000 BILT Cash. If you have to pay the 3% fee for rent/mortgage to get points, then, BILT Cash probably better for that first. You'd need to be earning a lot of BILT Cash to do the Accelerators. That doesn't seem in consumers favor; that seems like in the business' (BILT) favor.

...You need to use $200 BILT Cash for the 1x Accelerator up to 5000, limited to 5x/year. Yes, 25,000 bonus maximum, after using $1,000 BILT Cash. If you have to pay the 3% fee for rent/mortgage to get points, then, BILT Cash probably better for that first. You'd need to be earning a lot of BILT Cash to do the Accelerators. That doesn't seem in consumers favor; that seems like in the business' (BILT) favor.

As far as 'dogmatic,' that's cute. Buddy, 'welcoming to the internet... have a look around...'

@ Tony

Thank you for the clarification as that's just what I have been thinking these many posts about the Bilt product were stating.