If you follow the US airline industry, you know that among the “big three” carriers, Delta is the most profitable, followed by United, followed by American. American has today released its 2025 full-year results, and the difference in profitability continues to grow, as the company’s leadership is seemingly running out of empty promises it can make.

In this post:

American reports $111 million profit for 2025, an 87% decline

American has today reported its 2025 full-year results, and they’re pretty brutal, at least competitively:

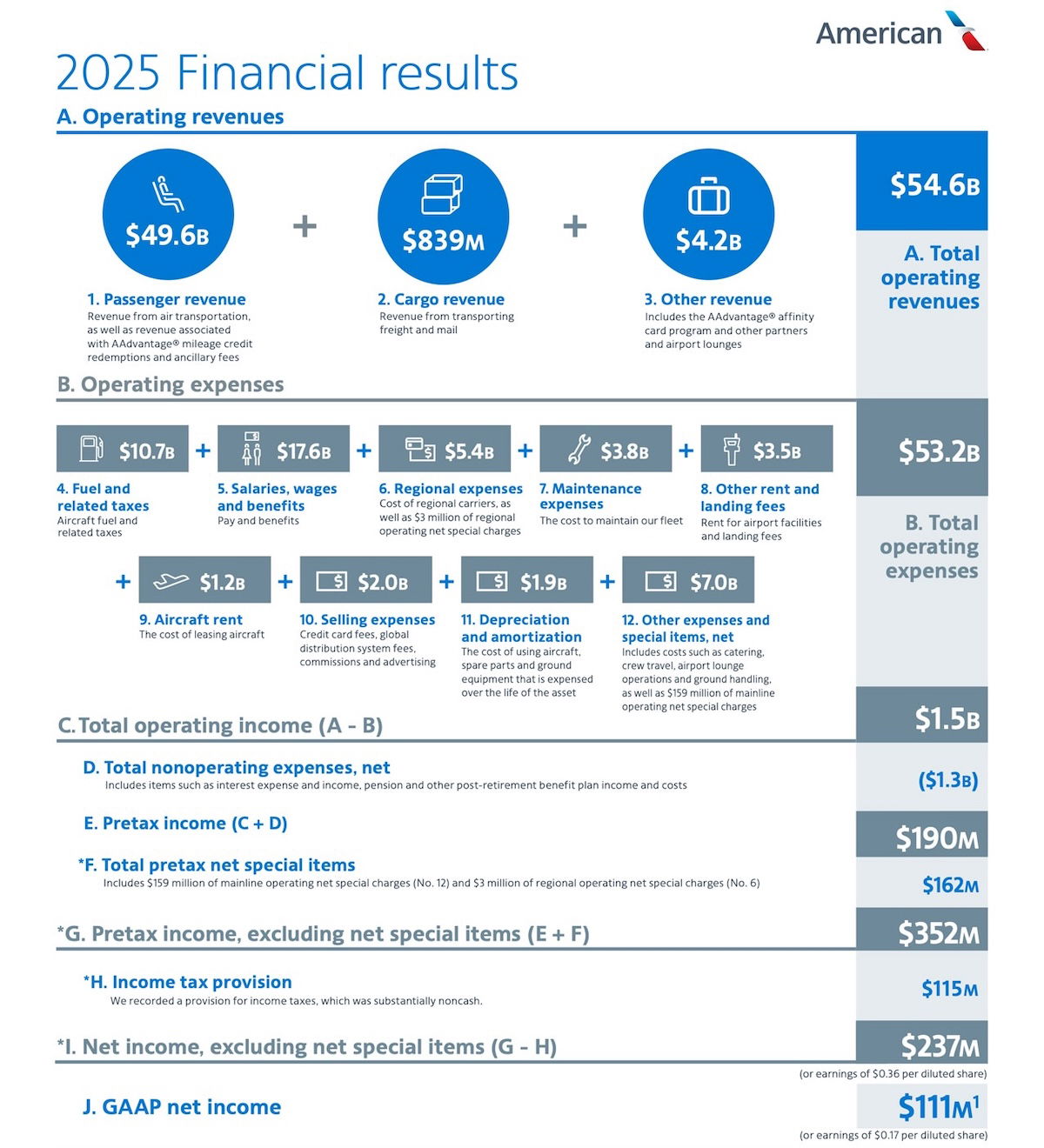

- The company had net income of $111 million, down 87% compared to $846 million the previous year

- The company had total operating revenue of $54.6 billion, up 0.8% compared to $54.2 billion the previous year

- The company had total operating expenses of $53.2 billion, up 3% compared to $51.6 billion the previous year

- The company had passenger load factor of 83.6%, down 1.3% compared to 84.9% the previous year

- The company had total revenue per available seat mile of 18.25 cents, down 1.4% compared to 18.51 cents the previous year

Admittedly 2025 was a tougher year for airlines than 2024, given all the economic uncertainty in the first half of the year. The issue is that American was already so greatly lagging Delta and United, so when things take a turn for the worse, you don’t want to be in American’s position. As a point of comparison, Delta’s net income for 2025 was $5 billion, while United’s was $3.4 billion.

The only positive news here (which is sending American’s stock up) is that the airline has positive projections for 2026. For the full year, the airline is expecting adjusted earnings per diluted share of $1.70-2.70.

In the first quarter of 2026 (compared to the same quarter of 2025), the airline is expecting available seat miles to be up 3-5%, total revenue to be up 7-10%, cost per available seat mile to be up 3-5%, and an adjusted loss of $0.10-0.50 per share.

I can’t help but think that American is very much making “best case scenario” projections here. While it’s important for CEOs of publicly traded companies to be somewhat reliable in terms of the narrative they tell, airline executives have a bit of flexibility nowadays, given how many outside events can impact airline performance.

American doesn’t really have a narrative for fixing things

It’s kind of amazing how American still sort of lacks a narrative for fixing things. Regarding the 2025 results, here’s what American CEO Robert Isom had to say:

“American Airlines is positioned for significant upside in 2026 and beyond. We have built a strong foundation, and we look forward to taking advantage of the investments we have made in our customer experience, network, fleet, partnerships and loyalty program. The strategy we have in place will put American in the right position as we celebrate our centennial and embark on our next 100 years as a premium global airline.”

The airline has been around for 100 years, and it’s still working on “building a strong foundation,” and it “looks forward to taking advantage of the investments that have been made.” This is basically the same type of story we’ve heard year after year. It’s never what has been meaningfully accomplished, but instead, how it positions the carrier better for the future.

When American reported its 2024 earnings results (a year ago), here’s what Isom had to say:

“The American Airlines team achieved a number of important objectives in 2024. We continue to run a reliable operation, and we are reengineering the business to build an even more efficient airline. That, coupled with our commercial actions, resulted in strong financial performance in the fourth quarter. As we look ahead to this year, American remains well-positioned because of the strength of our network, loyalty and co-branded credit card programs, fleet and operational reliability, and the tremendous work of our team.”

What about the year before that? Well, here’s what Isom had to say about 2023 earnings results:

“The American Airlines team produced an exceptionally strong performance in 2023. We are delivering on our commitments and remain well-positioned for the future, supported by the strength of our network and travel rewards program, our young and simplified fleet, our operational reliability, and our outstanding team. As we look forward, we remain focused on delivering a reliable operation for our customers and reengineering the business to build an even more efficient airline.”

American is essentially arguing that it has a lot of upside because of the extent to which it’s investing in a premium customer experience, though it’s not in any way clear how this will set American apart from Delta or United, or allow the airline to win market share.

The airline also argues that it’s maximizing the power of its network and fleet, and how it “operates the strongest network in the U.S.,” “with eight hubs in the 10 largest metropolitan areas.” Essentially, the airline claims that everything that has been done will suddenly improve things, but it hasn’t worked in the past, so it’s not clear how it’s supposed to work in the future.

For that matter, one certainly wonders how American’s profitability will be impacted by the battle it’s having with United in Chicago, where United CEO Scott Kirby is predicting that American will lose $1 billion over the course of the year. We’ll see how that plays out, but that doesn’t exactly suggest that increased profitability is on the horizon.

Of course when looking at the paltry $111 million profit, one can’t help but be reminded of how in 2017, former American CEO Doug Parker said that the airline would never lose money again, and even in a bad year, the airline should earn around $3 billion in profits. That sure didn’t age well, did it?

I continue to think that while Isom is a nice guy, he’s not the person who can turn the airline around. American needs a hard reset, with all employees rallying behind a new vision. Isom has simply lost (or maybe never had?) the support of frontline workers, and he’s not doing much to inspire them, it seems (and the 0.3% profit sharing they’re getting certainly won’t help).

Bottom line

American has reported its 2025 financial results, and the airline had a net profit of $111 million, down 87% compared to the previous year. For that matter, American’s profits were 2% as big as Delta’s, as the airline reported earnings of $5 billion.

Unfortunately American lagging both Delta and United with financial performance is nothing new. While the airline expects that 2026 will be a better year, we saw similar projections in 2025, and that didn’t work out so well.

Unfortunately American just doesn’t have much of a narrative here as to how things will improve, other than emphasizing how it’s premium, its network, and its reliability, even though those are all three areas where American arguably lags Delta and United.

What do you make of American’s 2025 financial results?

i think adding 1000 more flights to DFW, CLT, PHX and PHL will position American for great success in the future.

To beat Delta we will unleash the power of international flights from PIT.

Not surprised to see this. Last time I flew AA was a couple years ago and asked to board early with our 1.5 year old. Was told "board with your group", yet I see people with emotional animals, not service animals, allowed to preboard.

Then while queuing with out boarding group, the gate agent had the nerve to say "move your stroller out of the way" as if it was blocking anyone. I told...

Not surprised to see this. Last time I flew AA was a couple years ago and asked to board early with our 1.5 year old. Was told "board with your group", yet I see people with emotional animals, not service animals, allowed to preboard.

Then while queuing with out boarding group, the gate agent had the nerve to say "move your stroller out of the way" as if it was blocking anyone. I told my wife "this is why we wanted to board early" and then the gate agent said "stop or you wont be getting on this flight!". Not too long after a best friend told me about a travel issue they had with them, and they are legacy members with multiple family members who have worked at AA. It was so bad they actively choose other airlines despite being at an AA hub.

Have avoided them since aside from this flight I saw recently that is about $4k cheaper than the alternative option, so I'll hold my nose this time. But this news doesnt surprise me. Just about any other US airline aside from Spirit/Frontier are much better.

Dave Tepper bought the stock at $11.89, his largest holding, it is going up if it is at $13.44 with no winter storm this weekend. I agree, get medical help.

Let’s try to get Elon back in the picture

Alaska will buy american by 2030

Premium ticket prices for a Frontier / Spirit experience.

To me, AA looks a lot like the old Eastern Airlines: a giant, rambling domestic carrier with an international focus in the Caribbean, Central, and South America. Those of use who flew EA back then will remember it for terrible union relations, poor reliability and customer service, often dirty planes, and constantly shifting strategies. Things only got worse when the Texas Air people (the Don Parker crew of the day) took over in the early...

To me, AA looks a lot like the old Eastern Airlines: a giant, rambling domestic carrier with an international focus in the Caribbean, Central, and South America. Those of use who flew EA back then will remember it for terrible union relations, poor reliability and customer service, often dirty planes, and constantly shifting strategies. Things only got worse when the Texas Air people (the Don Parker crew of the day) took over in the early 80s. I worked for DL back then, and all we had to do to compete with EA in ATL was be on time and be relatively nice to people.

All this talk about them investing in premium is garbage. They’ve done nothing do the average passenger. All American has really done is brought a few XLRs into the fleet this year—an aircraft that will fly only international and transcon routes. They’ve done absolutely zilch for 100% of domestic coach passengers who can look forward to dingy grey cabins with no seatback entertainment and no mood lighting. How could they be more out of touch?...

All this talk about them investing in premium is garbage. They’ve done nothing do the average passenger. All American has really done is brought a few XLRs into the fleet this year—an aircraft that will fly only international and transcon routes. They’ve done absolutely zilch for 100% of domestic coach passengers who can look forward to dingy grey cabins with no seatback entertainment and no mood lighting. How could they be more out of touch? But hey, they made $111 million. That’s enough to pay the CEO his $35 million a year compensation and that’s all they care about!

@Ben

This is out of topic but Delta has just ordered more aircraft from Airbus. The order includes 16 A330-900neos and 15 A350-900s.

https://news.delta.com/delta-grows-airbus-widebody-fleet-new-order

we ask that you please bear with us

AA cxld 42% of its flights today which is worse than a number of the past 5 days.

And it isn't just avgeeks that are watching this. The Wall Street Journal just ran an article noting how badly AA's recovery trails the rest of the industry.

AA has already cxld 8% of its mainline flights tomorrow while PSA has cxld 12% of its flights.

AA said on its earnings call that their slow recovery is...

AA cxld 42% of its flights today which is worse than a number of the past 5 days.

And it isn't just avgeeks that are watching this. The Wall Street Journal just ran an article noting how badly AA's recovery trails the rest of the industry.

AA has already cxld 8% of its mainline flights tomorrow while PSA has cxld 12% of its flights.

AA said on its earnings call that their slow recovery is going to cost them significantly in their earnings for this quarter - but that was before they cxld as many flights as they cxld today.

On flights of 2+ hours, I want my IFE monitor. But AA keeps pulling them out while UA keeps adding them and DL, well DL, they're on nearly all their planes. It's important to me so when I have choices, AA is the last choice.

I've got to fly them MCO-DFW-HNL later this year. I sure hope the latter flight (Boeing 788) has monitors!

"On flights of 2+ hours, I want my IFE monitor."

OK boomer.

AA doesn't have a strong NE hub (PHL doesn't cut it) nor a strong West Coast hub. DFW is the strongest hub. Plus AA is weakest on international flights. Too many 788's with only 20 J seats and too many misconnects into PHL.

If we can’t compare AA’s performance to rivals or past years, what benchmark would some here prefer to use? The point outlined are valid.

Ten years ago after 4 flights in paid first class where my partner and I experienced not just sub par meals, but a service level that on the LGA-MIA leg was almost hostile, crews that just decided not to perform even basic service like a beverage re-fill on a 2 hour leg.... I swore off AA forever. There is simply no reason for me to spend money traveling with them. Thank God I do not live in an AA hub.

In other news, DL just announced additional A330-900 and A350 orders, converting their previous options and adding 20 more.

Deliveries will start in 2029, right after the 35K order

Please stay on topic and get medical help.

Tim is going to have a mental breakdown when the industry follows its usual pattern of cyclical profitability among various airlines. How soon Tim forgets how recently Delta was bankrupt and closing hubs when they couldn't compete against AA

Pretty sure Tim was a part of Delta when they could do nothing but lose but great work by Delta to get rid of Tim and do well. But now Tim finds his inner joy watching...

Tim is going to have a mental breakdown when the industry follows its usual pattern of cyclical profitability among various airlines. How soon Tim forgets how recently Delta was bankrupt and closing hubs when they couldn't compete against AA

Pretty sure Tim was a part of Delta when they could do nothing but lose but great work by Delta to get rid of Tim and do well. But now Tim finds his inner joy watching others succeed at Delta when they couldn't with him there.

what a legacy

Thanks Max. Totally agree. The Dunce is a real sick puppy!

you are so hypocritical it is stunning.

You and others tout the massive order book that UA has but DL has ordered/converted options for 61 widebodies and there is now a risk of a massive downturn?

You can't even get the basic facts of the order right so you attack the person that does grasp it all.

and the implication for AA - and this thread - is obvious. UA is beating the crap out...

you are so hypocritical it is stunning.

You and others tout the massive order book that UA has but DL has ordered/converted options for 61 widebodies and there is now a risk of a massive downturn?

You can't even get the basic facts of the order right so you attack the person that does grasp it all.

and the implication for AA - and this thread - is obvious. UA is beating the crap out of AA domestically, UA makes 2/3 of what DL makes despite flying 10% more capacity, and DL decides to go full throttle on international growth using the most capable and efficient aircraft in the US fleet - even while setting up to earn billions in engine overhaul revenue that no other US airline can match.

@Tim

who even knows what your random order book reply to me was about.

I tout the massive United order book? I bring it up because you love to talk about Delta's massive international growth that will overtake United in the Pacific but you conveniently ignore that Delta's order book pales vs United.

I don't bring it up, I just remind you to use facts and data vs your dreams.

I really...

@Tim

who even knows what your random order book reply to me was about.

I tout the massive United order book? I bring it up because you love to talk about Delta's massive international growth that will overtake United in the Pacific but you conveniently ignore that Delta's order book pales vs United.

I don't bring it up, I just remind you to use facts and data vs your dreams.

I really don't care that DL ordered more A330NEOs. There's a reason why no other US airlines wants those but it's not as though I care one way or the other whether Delta buys them.

You really do just need to take a step back, breathe, and think about your life sometimes. Your rants are quite funny to many but it does make many wonder what state of reality you live in, if any, that you spend your days posting on aviation articles under a fake username exalting an airline that fired you while constantly hurling insults to anyone that dares use data to remind you of a reality you don't seem to live in.

Night night

“Tim is going to have a mental breakdown when the industry follows its usual pattern of cyclical profitability among various airlines.”

Considering that he had a complete psychotic meltdown and went on a drinking spree just because it was announced that AA has better wifi than DL, I’d say that he’s already having a breakdown.

you mean you melted down in being fed the truth that AA can't possibly have more aircraft equipped with WiFi than DL if AA doesn't have widebodies with it even if DL doesn't have it on the 717s.

The truth is powerful no matter how much you want to shut it down.

But, of course, this site is just another opportunity for your personal vendetta - because you can't stand that AA and UA really are no threat to DL - because they are each other's biggest threats.

"AA can't possibly have more aircraft equipped with WiFi than DL if AA doesn't have widebodies with it even if DL doesn't have it on the 717s."

Oh right... you mean the entire AA widebody fleet that has had global wifi for years now? That works over the ocean and was upgraded about 2-3 years ago so the Panasonic birds could offer streaming (I personally don't find it that it streams too great... but it...

"AA can't possibly have more aircraft equipped with WiFi than DL if AA doesn't have widebodies with it even if DL doesn't have it on the 717s."

Oh right... you mean the entire AA widebody fleet that has had global wifi for years now? That works over the ocean and was upgraded about 2-3 years ago so the Panasonic birds could offer streaming (I personally don't find it that it streams too great... but it theoretically can)? Those AA widebodies with no wifi? ;) Oh you must mean free wifi though you didn't write it but if you'd read for once your life, you'd realize some of the widebodies will have free wifi and AA is working toward getting free wifi on the panasonic birds too -- also widely reported but... it doesn't fit your narrative so you just choose to ignore the real world.

Max,

Neither AA or UA offer FREE high speed WiFi on longhaul international flights.

and you know exactly what I have written a million times but you have nothing else to do but to look for the least opportunity to prove how big of a hypocrite you are.

The real world knows that DL, not AA and UA, have the largest fleet of free high speed WiFI and there isn't a single airline in the world that is anywhere close to challenging that.

suck it up buttercup.

"Neither AA or UA offer FREE high speed WiFi on longhaul international flights."

And neither does Delta but there's a difference... Delta has never had wifi across the Pacific (per their website), much less free wifi.

And yes, tim. If you'd read, you'd realize AA does have free wifi on some of their widebodies already and is looking to do it on their panasonic birds as well.

United is working on their starlink...

"Neither AA or UA offer FREE high speed WiFi on longhaul international flights."

And neither does Delta but there's a difference... Delta has never had wifi across the Pacific (per their website), much less free wifi.

And yes, tim. If you'd read, you'd realize AA does have free wifi on some of their widebodies already and is looking to do it on their panasonic birds as well.

United is working on their starlink rollout which will be free wifi. AA and UA are both ahead of Delta on global wifi coverage already and always have been

but please do get some mental help. In case you've never realized it, you live in a different mental reality than everyone else. Everyone around you see it. Your past employer, Delta, saw it.

Perhaps it's time to get some mental help.

Dear Timmy: I’m brazilian, I have no business in the aviation industry, and I couldn’t care less about who trails who in the US aviation industry. Please seek medical help so you can live a happier life. Your condition makes you think that everyone has the same sick obsession that you have. I’ve seen people with deeper psychological issues who turned it around. You can do it Timmy.

You have quoted Isom incorrectly, if you have reproduced accurately and that's poor form. Isom's quote says: "We have built a strong foundation...". You have written in quotes "building a strong foundation...". Two different lines and misrepresentation.

The fact that they keep gutting lower level management with 2 surprise days where they axed MANY who just showed up to work and were told it was their last day shows what they think the answer is. In December there was a round of massive cuts and again even more massive 2 weeks ago.

Con Key DFW. Last three flights in 1st class - broken tray table, dead power port, back seat pocket bottom stripped so anything placed in it falls to the floor. Shifting as many flights to UAL, Delta, Alaska as possible. Takes more time, but half the cost, the planes are well maintained, and the crew are pleasant. I would love to stick with American, but the product isn't worth it. Sad.

Yes, it's like being the underachieving child in a family. If you're already doing the worst, doing mildly better will result in significantly more celebration than your star sibs continuing to excel

I meant "incel", not "excel"

I suspect Isom's plan is for AA to price its way to profitability and to be considered a premium airline. Why else are they charging $10,000+ for their tired F product USA to Europe. If consumers are purchasing at such price points, then that's a winning strategy and kudos to AA's management.

It begins with customer loyalty. Having experienced consistent worse than bad treatment as a loyal, premium status customer on multiple occasions I won't fly AA except as a last resort. Same for at least a dozen of my small circle of frequent traveler friends.

It won't turn around until Customer service is something other than dis-service and employees stop acting as the paying passenger is a nuisance.

Exactly. Have shifted my business largely to UA, and other AA loyal flyers have done the same, tired of AA's awful operation and even worse customer service response to it.

“Isom” and “nice guy” being used in the same sentence is comical.

"You think you just fell out of a coconut tree?"

We have been flying American for years, almost exclusively where there's been no alternative. We consistently encounter late flights, flights that are rescheduled for hours well after (or before) the times we've booked; poor service, etc. Why can Alaska provide good services and products, while AA consistently fails at the basics?

Where are the "customers only care about price, not things like tvs and service" clowns that used to run rampant. Show yourselves.

I still firmly believe this is true, and I'm with you. The arguably more important, often unsaid flip side of this is that profitable customers, do in fact care about those things.

Wasn't the architect of that philosophy fired 20 months ago?

@Ben, thanks for providing the historical perspective of 2023 and 2024...this adds a lot of context.

What AA is dealing with is a failure of its executive leadership AND its Board. The Board is sitting back year over year and watching their executive team put the car in the ditch and then spend years spinning their wheels in the mud. The Board needs to own their fiduciary responsibility and take control of the situation. The...

@Ben, thanks for providing the historical perspective of 2023 and 2024...this adds a lot of context.

What AA is dealing with is a failure of its executive leadership AND its Board. The Board is sitting back year over year and watching their executive team put the car in the ditch and then spend years spinning their wheels in the mud. The Board needs to own their fiduciary responsibility and take control of the situation. The alternative will either be further limping along, reorganization or, worst case scenario, activist investors will start mobilizing and AA will become the next WN.

Well hey, with both being DFW HQed companies, it wouldn't be surprising.

The problem is that management has made strategic decisions based around the belief that people only care about the price and the schedule. And the blunder to retire too many widebody aircrafts.

Digging out of this hole will take years and probably new management with a vision.

Nah, those a330s and 767s were gettin' old anyway.

Delta has a ton of ancient A330s and 767s and they still make $$$ on routes using those planes.

@1990, although the A330-300s dated from 2000-2001, all the 332s were from 2009 of newer. Plenty of life left in all of them, but especially the -200s. The 767s on the other hand…

Old means cheap and fully depreciated. Low ownership cost = $$$

Isom has to go bring a new CEO.

He certainly didn't deserve the $34 million compensation back in 2023...

They need much better marketing. Can't just throw around some pictures of a couple new planes that most people will never fly on and expect that is going to turn things around. And they of course need to execute better operationally.

Being premium also means competing in premium markets. Engaging in a turf war in Chicago may be costly but at least shows they have a little bit of fight in them. But they...

They need much better marketing. Can't just throw around some pictures of a couple new planes that most people will never fly on and expect that is going to turn things around. And they of course need to execute better operationally.

Being premium also means competing in premium markets. Engaging in a turf war in Chicago may be costly but at least shows they have a little bit of fight in them. But they have to do better in places like NYC if they want to drive CC spend.

More MCE?

You said it! I suspect their math showed that they give it away for free to loyalty members more than people buy it, which led them to the conclusion that they don't need it on their premium configured planes because what they really want to do is push their loyalty members to buy PE, because their loyalty members are their best source of revenue.

The problem is that's a two way street, and it's pretty...

You said it! I suspect their math showed that they give it away for free to loyalty members more than people buy it, which led them to the conclusion that they don't need it on their premium configured planes because what they really want to do is push their loyalty members to buy PE, because their loyalty members are their best source of revenue.

The problem is that's a two way street, and it's pretty easy to walk across the street to DL or UA and find plenty of extra legroom seating and a status match. It's not like they're flying their new premium planes only in AA fortress hubs, so far it's the XLR between JFK and LAX and the 787Ps from ORD and JFK (in addition to DFW and PHL).

People have choices! You have to incentivize loyalty members to remain with the program. MCE seating matters in that analysis! The value of AA miles, especially with AA partners, is the biggest benefit of the program by far (those oneworld first class lounges are pretty nice also). The value of AA's product itself? Middling at best.

Why does AA keep talking about their network like it's some huge advantage? It's not like I'm struggling for other options domestically, and they have huge gaps in their international network

What concrete steps can they take? When I fly the US3, I can’t really tell them apart.

Install domestic economy IFE + fight for market share in New York + get Alaska and Cathay in the TPAC JV

I like MDR's ideas! IFE FTW.

The fact that AA is not fighting for market share in NY is just baffling. Who knows what will happen with B6/UA but right now UA is stuck on the other side of the river in Newark and there's a lane to chip away at DL - will be inch by inch for sure, but provide more competition! Can't still be smarting about the death of the NEA and licking wounds - have to move on and execute your own business plan.

AA has to devote all of its effort to fighting in NYC; everything else can wait.

DL is not engaged in market share battles in NYC but they are incrementally adding capacity where it makes sense.

Chicago is do or die for AA and it leaves them vulnerable in other hubs and regions as DL and WN who aren't involved in the Chicago shootout can grow at AA's expense.

I have some ideas.

1. More MCE. (They have a very small number compared to competition, and it's often fully booked weeks out. As a business traveler who sometimes has to book close-in, I'm going to book UA, which still has the seats.)

2. IFE. The two other major competitors have it (or increasingly so), and AA doesn't.

3. ORD used to have several 'exception' markets for first class meals, such as LGA, DCA, PHL,...

I have some ideas.

1. More MCE. (They have a very small number compared to competition, and it's often fully booked weeks out. As a business traveler who sometimes has to book close-in, I'm going to book UA, which still has the seats.)

2. IFE. The two other major competitors have it (or increasingly so), and AA doesn't.

3. ORD used to have several 'exception' markets for first class meals, such as LGA, DCA, PHL, BOS; AA was serving meals upfront on those legs as a way of differentiating themselves from the competition. Note that this aligns with the time when they won the competition for local share for ORD travelers. Bring those back.

4. Fix how delays are communicated. We all get it, sometimes flights get delayed. But you can stop the ridiculous wait-until-after-departure-time-to-announce-the-delay-and-then-delay-in-10-minute-increments shenanigans. Be honest about it. We all know a late inbound A321 cannot deplane, clean, and reboard in 10 minutes.

5. Get better food in the clubs. The offering (even the 'enhanced' one) pales in comparison to UA and DL.

6. Make systemwide upgrades actually useable again.

7. Give Admirals Club agents back the customer service flexibility they used to have. Stop tying the hands of your premium agents so they actually can provide some premium service.

8. Get the app to be functional. As functional as UA's.

I could go on...

You should feel free to go on. Unlike so many of the “little” commenters that post, post, post with absolutely nothing on the bone, you offer valid suggestions. Thank you.

Spot on! Agree with all of this, you should replace Isom

You must not take many flights

American doesn't need to make money. Most of their employees are getting paid well, have nice benefits and AA has great airport hubs and lounges. The need to make money for an airline their size is a useless talking point.

that signs good in socialism but the money has to come from somewhere to actually pay the people that provide the capital that AA uses to generate revenue and pay its people.

For years, AA has had negative stockholder equity (meaning it has a stockholders deficit) which means the company has no value; at the end of 2025, it was in the hole to the tune of $3.7 billion.

The only people that benefit from...

that signs good in socialism but the money has to come from somewhere to actually pay the people that provide the capital that AA uses to generate revenue and pay its people.

For years, AA has had negative stockholder equity (meaning it has a stockholders deficit) which means the company has no value; at the end of 2025, it was in the hole to the tune of $3.7 billion.

The only people that benefit from AA's continued operation is the 125k employees and the banks that make money on the $30 billion in debt that AA carries.

Tim, Tim, Tim... keep lickin' those tasty boots!!

So 125,000 people benefit from it. Whereas only 1 person benefits when you post, my psychiatrist.

Is this post a joke or can anyone be that clueless? AA is a public listed company controlled shareholders whose only interest in holding AA shares is to make money either by dividends or stock appreciation both of which directly result from profits.

And you think shareholders would be ok with that philosophy for a publicly traded company?

Why though?The CC income are weakening?

Probably. These are 'credit cards with wings' after all.

It is also noteworthy that AA's load factor in the 4th quarter fell by 2 points; they haven't said why but operational issues have got to be a factor.

AA is now in the 5th day of double digit percentages of cancellations with AA having already cancelled 25% of its mainline flights including 15% of DFW and 10% of CLT. They simply cannot get their network restarted. There are people that are buying tickets on...

It is also noteworthy that AA's load factor in the 4th quarter fell by 2 points; they haven't said why but operational issues have got to be a factor.

AA is now in the 5th day of double digit percentages of cancellations with AA having already cancelled 25% of its mainline flights including 15% of DFW and 10% of CLT. They simply cannot get their network restarted. There are people that are buying tickets on other airlines to get home and will not fly AA again if AA doesn't give those passengers' tickets to other carriers.

The competitive attack between AA and UA will take a toll on both airlines; the real issue is that AA cannot make progress in fixing the company as long as it is tied up in competitive battles.

Let's also not forget that AA has post covid contracts w/ all of its labor groups while AA does not.

Trying to argue about AA's vulnerability when UA will take a labor cost hit is an apples to oranges comparison, at best.

B6 also reported it is losing money. The US airline industry is still very vulnerable.

The only airline that is making good money and is not facing major strategic challenges is DL while WN is likely to take the "most improved for 2026 award"

You almost made it without referencing Delta once, but you had to fumble it in the last paragraph.

He can’t. It’s a mental illness. Hope he gets treatment.

you do realize that Ben, accurately referenced DL in the article. You can't talk about how well any airline does financially without talking about their position in the industry as a whole.

We know full well that you don't like comparisons but the fact that AA made a tiny fraction of what DL made while DL flew less ASMs speaks volumes about the fact that AA's business plan is not working.

"We know full well that you don't like comparisons"

who is we? Are you with a group of fellow Delta enthusiasts?

WN is, right now, making the same mistakes that got AA into this position. Their long term prospects are bleak.

let's see what WN reports but I doubt their prospects are as grim as AA's. WN is well into its turnaround plan, something AA can't even seem to articulate, as Ben notes

LOAD FACTOR... knew I'd see that on here.

@Tim,

"The only airline that is making good money and is not facing major strategic challenges is DL"

cough "AS in Seattle" cough

@dtw

Now now

AA (maybe) losing money now in chicago for a historically quite profitable hub and essential Midwest hub…? Well, that’s just bad strategy by AA and the prospects are grim. But just to be clear, delta will triumph in all this regardless.

But delta in Seattle? Well being half the size there of AS and unprofitable with no room to grow, at all, vs Alaska? Well, that’s just good and necessary strategy...

@dtw

Now now

AA (maybe) losing money now in chicago for a historically quite profitable hub and essential Midwest hub…? Well, that’s just bad strategy by AA and the prospects are grim. But just to be clear, delta will triumph in all this regardless.

But delta in Seattle? Well being half the size there of AS and unprofitable with no room to grow, at all, vs Alaska? Well, that’s just good and necessary strategy and investors should be expected to foot the losses since it’s for delta

;)

feel free to post the net income margins for 2025 for the airlines that have reported so far....

newsflash... AS' margins are not anywhere near UA, let alone DL. AS is NOT making good money whether they face major strategic challenges or not.

@Tim,

Moving the goal posts again.

Nobody is talking about net income margins, YOU said, "The only airline that is making good money and is not facing major strategic challenges is DL" demonstrably false statement. DL is facing the exact same thing at SEA with AS announcing a huge order for 737-10s in order to increase ASMs since they are gate and airfield constrained. It's literally the same strategy.

What benefit do you get coming on here and talking about Delta's net income margins? I don't know about you guys, but as a passenger, my choice for an airline comes down to 3 things: Price, schedule, and net income margins.

AS had margins higher than UA & DL prior to the HA merger. See VA merger.

“Let's also not forget that AA has post covid contracts w/ all of its labor groups while AA does not.”

Yes, I can see how difficult it would be to run a company and make money entirely within Schrodinger’s box. Actually a lot of parallels to your posts, Tim - something both us and isn’t at the same time.

please, rebel,

AS underperformed DL for most of the period from the Virgin America merger until the Hawaiian merger; they are just starting over w/ the same process that sucked financial strength for years.

And we are in 2026. It doesn't matter what any company did 3, 5, or 10 years ago.

DTWNYC,

I posted about financial performance because, wait, wait, that IS the topic that Ben discussed in this article and...

please, rebel,

AS underperformed DL for most of the period from the Virgin America merger until the Hawaiian merger; they are just starting over w/ the same process that sucked financial strength for years.

And we are in 2026. It doesn't matter what any company did 3, 5, or 10 years ago.

DTWNYC,

I posted about financial performance because, wait, wait, that IS the topic that Ben discussed in this article and HE made appropriate comparisons.

You and your ilk want desperately to shut down any discussion of financial comparisons esp. if involves DL because nobody else in the US is coming close to matching DL's profitability.

Tim

Rebel & DTW are simply mentioning how you say something stupid

"DL is the only one without strategic challenges like ORD for AA/UA", get called out on it, then you try to change the topic since it's obvious to everyone that you, as usual, said something idiotic and a lie.

It's pretty simple to see that's not true since Delta has decided to fight in Seattle a battle they simply can't win...

Tim

Rebel & DTW are simply mentioning how you say something stupid

"DL is the only one without strategic challenges like ORD for AA/UA", get called out on it, then you try to change the topic since it's obvious to everyone that you, as usual, said something idiotic and a lie.

It's pretty simple to see that's not true since Delta has decided to fight in Seattle a battle they simply can't win profitably and are asking their investors to lose millions in the name of "strategy". Delta is also growing at LAX despite being in the smallest alliance in southern California and the West Coast not to mention the inevitability of AA getting the gates back again to be bigger in metal alone at LAX. Oh and then there's Austin fighting Southwest with no easily identifiable advantage against WN except that DL has nowhere else to go in Texas after walking away from DFW with its tail between its legs 20 years ago.

So yes. Profitability is interesting, but not when you state something stupid that is objectively WRONG then try to change the topic so you don't have to admit how stupid your initial statement was.

Just admit when you're wrong and say stupid things then move on.

No. Delta's profits don't belong to Delta They belong to Delta's owners. In terms of how that money should be used on "Strategy", there's little difference in making $100M in profit or $3B -- that money belongs to the owners and it's the same thing to lose money in ORD for a hub that has always been profitable and is just the latest battle started by UA this time -- or the same thing for Delta to lose money for their owners fighting a losing battle in Seattle that they truly have no hope of winning short of buying Alaska.

I think they are in trouble, especially since the massive fare war with Chicago is going to hurt margins dramatically. They need to focus on improving their product/adding more premium seats/expand internationally, rather than put in so much extra capacity in a market that doesn’t need it.

Chicago is one of their smaller stations, the massive "fare war" doesn't affect their bottom line much at all.

It's similar to how DL can subsidize BOS and SEA vs competitors because those are very small operations compared to their core hubs.

Isom said it is AA's 3rd largest hub.

Smaller is relative. Yes, it’ll be smaller than DFW/CLT, but they are scheduled to run 500+ flights out of ORD this summer. To put into perspective, that is more departures than all of Delta’s hubs except for Atlanta.

Delta’s Seattle and Boston hubs are much smaller in the 200ish range. Boston might even be smaller than 200.

Third largest out of 8 hubs is not small. Think again. Haha In fact, this summer they’re expecting 550 flights per day at ORD witj the addition of another three gates this fall.

"The only positive news here (which is sending American’s stock up) is that the airline has positive projections for 2026."

I'll never understand the stock market. Loons.

The $846M profit figure from 2024 was largely funded by the Citi deal renewal. This was a one time payment and is misleading to characterize profits being down 87% by lack of this payment.

There was nothing in 2024 of an increase from citi. That extra revenue doesn’t kick in till this year. Also the citi deal was announced I think in early 2025… regardless 2024 and 2025 did not get increased revenue from Citibank deal. Only 2026

Credit card company cosplaying as an airline?

Every aircraft ready to fly every morning.