We’re used to airline and hotel elite status, but just about all of the major banks also have their own elite tiers of sorts, for those who maintain a minimum balance of assets with the bank. In this post, I’d like to talk briefly about Citi’s elite program of sorts, known as Citigold, especially in light of the renewed interest in the Citi ThankYou program.

Long story short, Citigold can save you money on Citi annual fees, and unlock some additional perks. Let me start with a bit of background, because I think some disclaimers are important.

In this post:

My general philosophy on bank “elite status”

Banks like Chase and Citi have special programs for those who maintain a certain balance of assets with them. Obviously the general goal with these programs is for banks to be able to establish closer relationships with customers, and to get you to invest your money with one of their advisors, as the banks charge fees for this management.

However, generally speaking, all assets you hold with a bank count toward the minimum required for status. This includes if you do your own investing through their tools, or even if you move your retirement account to one of these banks.

I’m of course not a financial planner, or anything, but I’ll share my thoughts and approach:

- You absolutely shouldn’t keep cash in a checking account with a low interest rate simply to qualify for one of these tiers, and you also shouldn’t invest with one of their advisors simply to unlock these perks, unless you otherwise see value in this

- Personally, I’m a pretty conservative investor, and I mostly just like to buy total market index funds, and then sometimes do my own investing for things I feel confident about

- Since my investments aren’t “managed,” I have the flexibility to move them around to whatever bank I’d like to, so I try to see what benefits I can squeeze out of that

- Note that sometimes banks offer cash bonuses if you transfer a certain amount of assets to them, so some people might find that to be worthwhile, but I also like just having an account that offers me long term value, without moving things around

Along those lines, I recently moved some of my retirement investments over to Citi, and unlocked the Citigold tier. Let me explain why others who are into miles & points might want to consider doing the same.

Citigold & Citigold Private Client perks & benefits

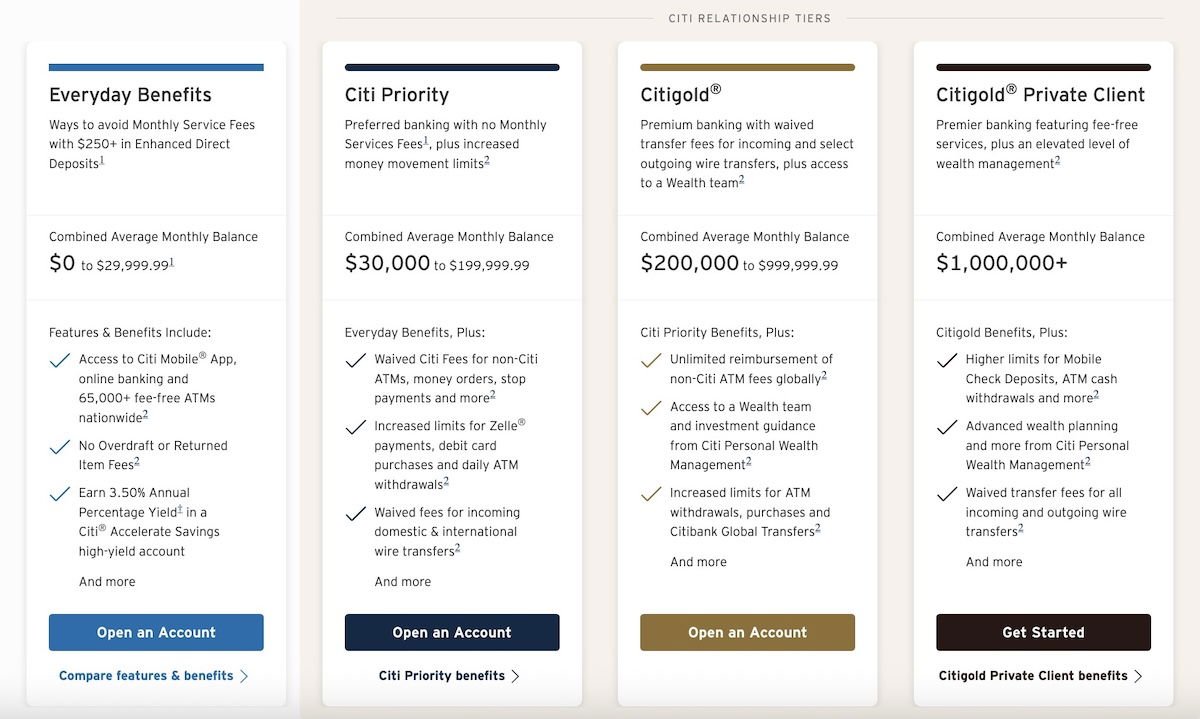

Citigold has a few different tiers of membership, but I want to focus specifically on two tiers:

- Citigold is the most common elite tier, which requires having $200,000 in assets with the bank

- Citigold Private Client is the more exclusive elite tier, which requires having $1,000,000 in assets with the bank

Those amounts are based on eligible linked deposit, retirement, and investment accounts, regardless of whether they’re independent or managed by Citi. Citi often has significant cash bonuses for those who move assets to the bank, so keep an eye out for those, and they can make it even more lucrative to get a Citigold account.

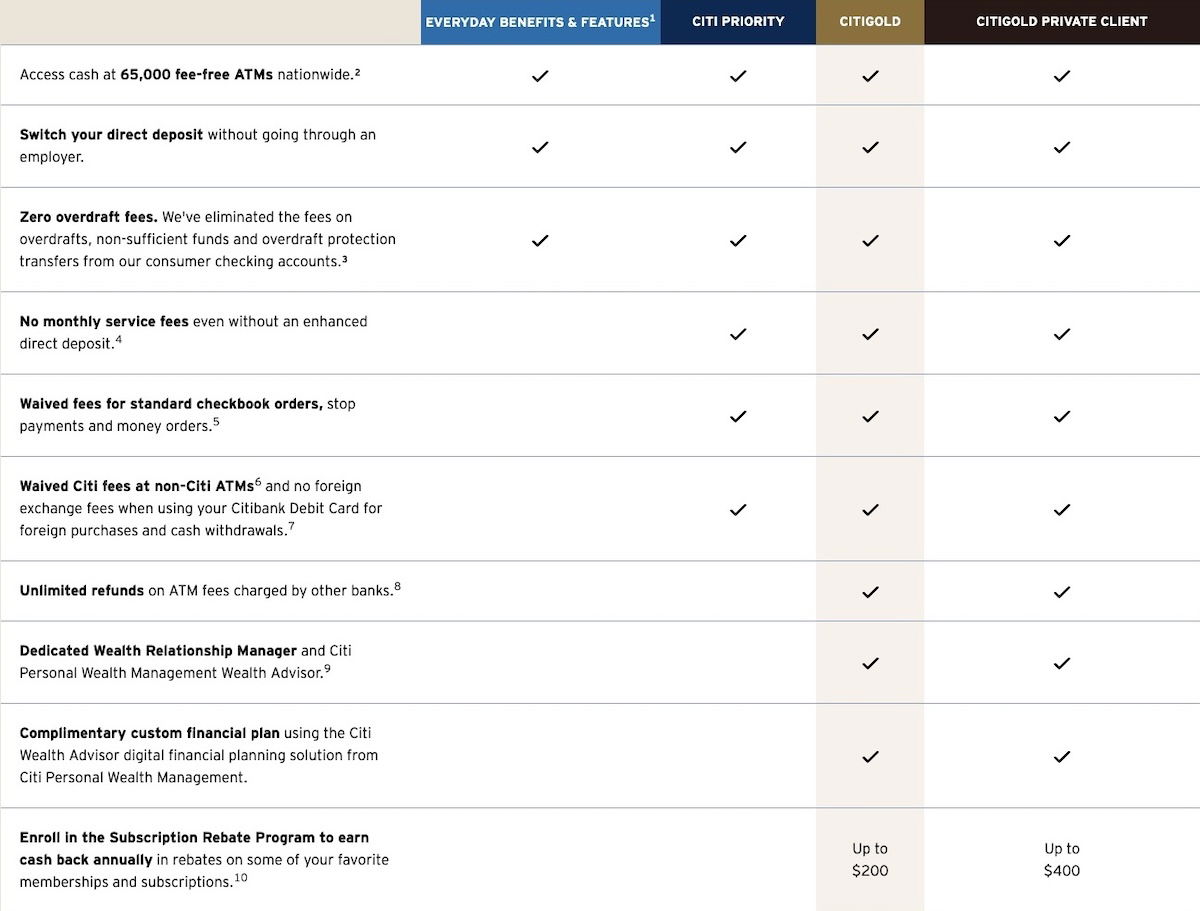

What Citi most widely tries to promote about this is all the fee waivers you receive with Citigold, ranging from fee-free ATMs, to no monthly service fees, to zero overdraft fees, to waived fees for checkbook orders, etc.

However, for those of us into credit cards, there are two particular perks that I want to call out…

Citigold $145 credit card annual fee rebate

Citigold clients receive a $145 banking relationship annual credit. This applies specifically to Citi’s most premium, high annual fee cards, including the Citi Strata Elite℠ Card (review), Citi® / AAdvantage® Executive World Elite Mastercard® (review), and (discontinued) Citi Prestige Card.

The way this works, if you’re a Citigold client and the primary cardmember on one of these cards, you receive a $145 annual credit toward your annual fee. The key things to know are that you must have Citigold status on the date your annual fee is charged. Furthermore, it can take up to three billing cycles after the annual fee is charged for the credit to post.

So if you have one or more cards, that offers some consistent savings, and can potentially make the math on some credit cards work much better. Let me emphasize that this only works on the above three cards, so you couldn’t use these credits for lower annual fee cards.

Citigold $200 subscription rebate credit

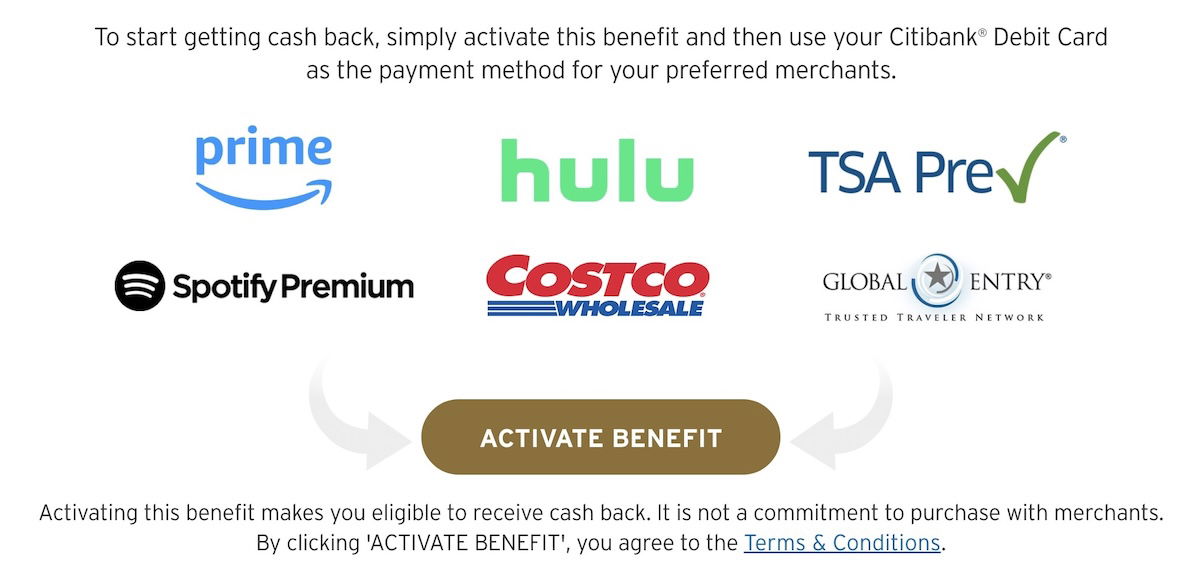

Citigold clients receive an additional “good as cash” rebate, which is also worth caling out. Specifically, this is a subscription rebate credit, and it’s $200 annually for Citigold members, and $400 annually for Citigold Private Client members.

You have to enroll for this, and then you just need to use your Citibank debit card as the payment method with your preferred merchant. Eligible merchants include Amazon Prime, Costco, Global Entry, Hulu, Spotify Premium, and TSA PreCheck.

Technically, the subscription rebate credit can only be used toward full priced memberships or subscriptions purchased online, except for Costco (where purchases can also be made by phone or in store), and TSA PreCheck (where purchases at enrollment centers qualify). Anecdotally, I’ve also heard of some non-subscriptions crediting, but that’s not something you can count on.

Bottom line

Citigold is Citi’s special banking tier for those who have at least $200,000 in assets with the bank. The good thing is that this can include retirement accounts, self invest accounts, etc. While Citi often highlights how this offers waived banking fees and access to a dedicated advisor, there are other perks worth keeping in mind.

Citigold customers can receive a $145 rebate on select premium Citi cards, and also receive a $200 annual subscription rebate credit, valid for things like Amazon Prime and Costco memberships.

This isn’t some incredible program that’s going to change your life, but it’s at least nice to get some value from parking your investments with one bank over another. At least that’s my opinion.

Are there any other Citigold customers, and if so, what has your experience been like? Are there any other awesome hidden perks I’m missing with other banks?

Is the 145 per card or per person/account?

I am also wondering this. Would it be possible to get $145 off the Strata Elite and AA Executive both? And to layer more on, if you and your spouse are both on the account, can you both get $145 off each card?

CITI sucks!

Ben can you do similar posts for BOA, Charles Schwab and Chase? Or a comparison even?

I'm unhappy with my investment account so I'm looking to move to one with perks

I don't know about Citi, but in Chase's similar program you can also get a discount on your mortgage rate by transferring in assets, including transferring an IRA (or rolling over a 401k to an IRA). But you have to do it at the time you're taking out the mortgage, so if that's on the horizon, it could be worth waiting for that to maximize the bonus. (I was able to stack the mortgage rate discount with a cash rebate promo for moving assets, as well.)

The simple fact is, it’s better than almost any other bank does, even if it is nominal. It’s a rebate and a tax-free benefit. I do take advantage of their credit card rebate for the AA Exec card. And having “free” Prime and Costco membership is always a nice benefit as well.

Their investment trading platform really sucks, but if you’re doing things right, it’s not really that big of a problem. (“Always be buying”, to quote the Money Guys)

Hi Ben, something you did not mention is that Citigold Private Client clients can get a first-year waiver of the annual fee for the AA Executive card as well as the Strata elite card. They would then receive the $145 off the annual fee in subsequent years.

Is this in the Ts and Cs somewhere? I would be even more likely to do a one year Strata Elite if I could guarantee this.

From the T&C on the Citi Homepage: "Banking Relationship First Year and Annual Credits for qualifying Citigold® Private Clients To qualify for the $595 First Year Banking Relationship and $145 Annual Credits, the primary cardmember must have an open and current Citi Strata Elite Card account with an assessed Annual Membership Fee of $595. Cardmembers paying an Annual Fee of $595 will earn a $595 statement credit in the first year of cardmembership and a...

From the T&C on the Citi Homepage: "Banking Relationship First Year and Annual Credits for qualifying Citigold® Private Clients To qualify for the $595 First Year Banking Relationship and $145 Annual Credits, the primary cardmember must have an open and current Citi Strata Elite Card account with an assessed Annual Membership Fee of $595. Cardmembers paying an Annual Fee of $595 will earn a $595 statement credit in the first year of cardmembership and a $145 statement credit each year thereafter. "

the rebate is quite easy for Amazon Prime and Costco. Wish the strata elite is more competitive, which basically charges the same as CSR and Amex Plat, more than C1 VX, but without the lounges.

Citi would undoubtedly like more HNWI folks in its card ecosystem. The problem is they didn't announce or develop their own lounge network and have nothing to offer other than an Elite card that gets you 4 admirals club passes (and some portal points that anyone who actually wanted to book through a portal could already get through Rakuten). When you are offering a $145 credit to high end banking customers, it's very telling as...

Citi would undoubtedly like more HNWI folks in its card ecosystem. The problem is they didn't announce or develop their own lounge network and have nothing to offer other than an Elite card that gets you 4 admirals club passes (and some portal points that anyone who actually wanted to book through a portal could already get through Rakuten). When you are offering a $145 credit to high end banking customers, it's very telling as to the weakness of your offering. And so Citi's HNWIs will take a quick look to see what all the fuss is about, see it's about 4 admirals club passes and some extra dining points, and continue along on their merry way as existing Amex Plat and CSR customers that grumble about their higher fees but enjoy the lounges and the aura (dare I say Prestige) around those cards. If anything, they'll take a quick look at C1 because... they have some fancy new lounges.

With or without the $145 credit can you earn a couple of bucks on the Elite card? Sure. But if you have Citigold level of investments your net worth rises and falls by thousands of dollars every day based on what happened in the market. $145 is not moving the needle. And they're literally giving it away to their Private clients.

I agree - the $145 credit + $200 credit don't seem worth the effort to move a $200k+ retirement account to Citi.

@ LP -- I hear you, it's not a huge reward, but if there's no opportunity cost, the value can add up over years.

Some marketing materials also mention a complimentary Citibike bikeshare membership in the New York area, which is an additional ~200$ credit a year. I am not sure if this benefit is still current however.

Hi Ben - how does the cover picture of Admiral Club relate to Citigold?

@ Morley -- Because Citi's two premium credit cards that are open to new applicants and qualify for the $145 credit both offer Admirals Club access in some form as a perk. I had to include a picture of something, and I don't have a stack of $200,000 in bills, so this seemed like the next best option. :-)

That makes sense, @Ben! I thought there was a promo for Citigold account holders about AA Admiral Clubs or something, and got excited for a sec :D

Big fan of Schwab for the ATM reimbursements and zero fees/account minimums

And on the subject of banking, SoFi is offering 30k MR points via Rakuten for creating an account and making a $500+ direct deposit within 45 days

Pretty solid deal to get half/third of a credit card sign-up bonus for zero fee and no minimum spend requirement. Also doesn't cause a hard pull on your credit

Note that the ATM fee refund also applies internationally - very valuable.

i literally get that for free with my schwab checking account. ($0 investments with them)

Yeah, I also get that with Fidelity CMA checking, which is high interest checking -- highly recommend it if you allready have accounts with Fidelity, it was very convenient to move money there for the high yield and it had the single other attribute I'd want in a checking account (the ATM rebate thing).

Good to know! Is that for all ATMs, or just in their network? (Which network?)

"Note that the ATM fee refund also applies internationally - very valuable."

Completely agree. SoFi used to offer this on all SoFi checking accounts, but has since withdrawn this benefit.

Note also that some financial institutions have global relationships that can help with fees. For example I have my primary account at one of the US military credit unions, which has a large global footprint (mainly to help enlisted military members). So it's easy for...

"Note that the ATM fee refund also applies internationally - very valuable."

Completely agree. SoFi used to offer this on all SoFi checking accounts, but has since withdrawn this benefit.

Note also that some financial institutions have global relationships that can help with fees. For example I have my primary account at one of the US military credit unions, which has a large global footprint (mainly to help enlisted military members). So it's easy for me to find ATMs that don't charge any fees in pretty much any country I visit. Just something to look for when one is choosing a financial institution.