Cardless could revolutionize the credit card industry, making co-brand credit cards accessible both to more businesses and consumers.

For those who are into credit card rewards, there’s an exciting new issuer to keep an eye on, that has the potential to disrupt the space. In this post I wanted to talk about how Cardless could revolutionize the credit card industry, and help all kinds of smaller brands launch co-branded credit cards.

In this post:

The credit card industry hasn’t seen much innovation

The credit card industry fundamentally hasn’t seen much innovation in the past couple of decades. On the surface that might sound counterintuitive, because at least cash back and travel rewards credit cards have become significantly more rewarding in the past decade. Sign-up bonuses, bonus categories for spending, and perks are all vastly improved. However, the same hasn’t been true for co-brand cards in most other industries, like department store cards, gas station cards, etc.

While the credit card industry is extremely competitive, what hasn’t fundamentally changed is how card issuers operate. Just to give a few examples of the areas where we haven’t seen much change:

- While new card products have been introduced, we haven’t seen a major new credit card issuer in the United States in over 25 years (Capital One was the last one back in 1994)

- The credit card issuers that do exist all have high costs, and aren’t exactly lean operations

- For consumers, the requirements to get approved for credit cards haven’t changed all that much; if your credit score isn’t Very Good to Excellent, chances are you’ll struggle to get approved for a credit card with the major issuers

- For companies looking to partner with an issuer to create a co-brand card, this has been limited mostly to agreements that would generate billions of dollars in annual spending; in other words, smaller businesses haven’t been able to partner with a card issuer to develop a co-brand credit card

The reasons for all of these things are quite simple — there hasn’t been much of an incentive to innovate in these areas, as the major card issuers all have similar policies. In the same way that the major airlines don’t want to rock the boat, this is true with major credit card issuers as well.

Why Cardless is unlike anything we’ve seen before

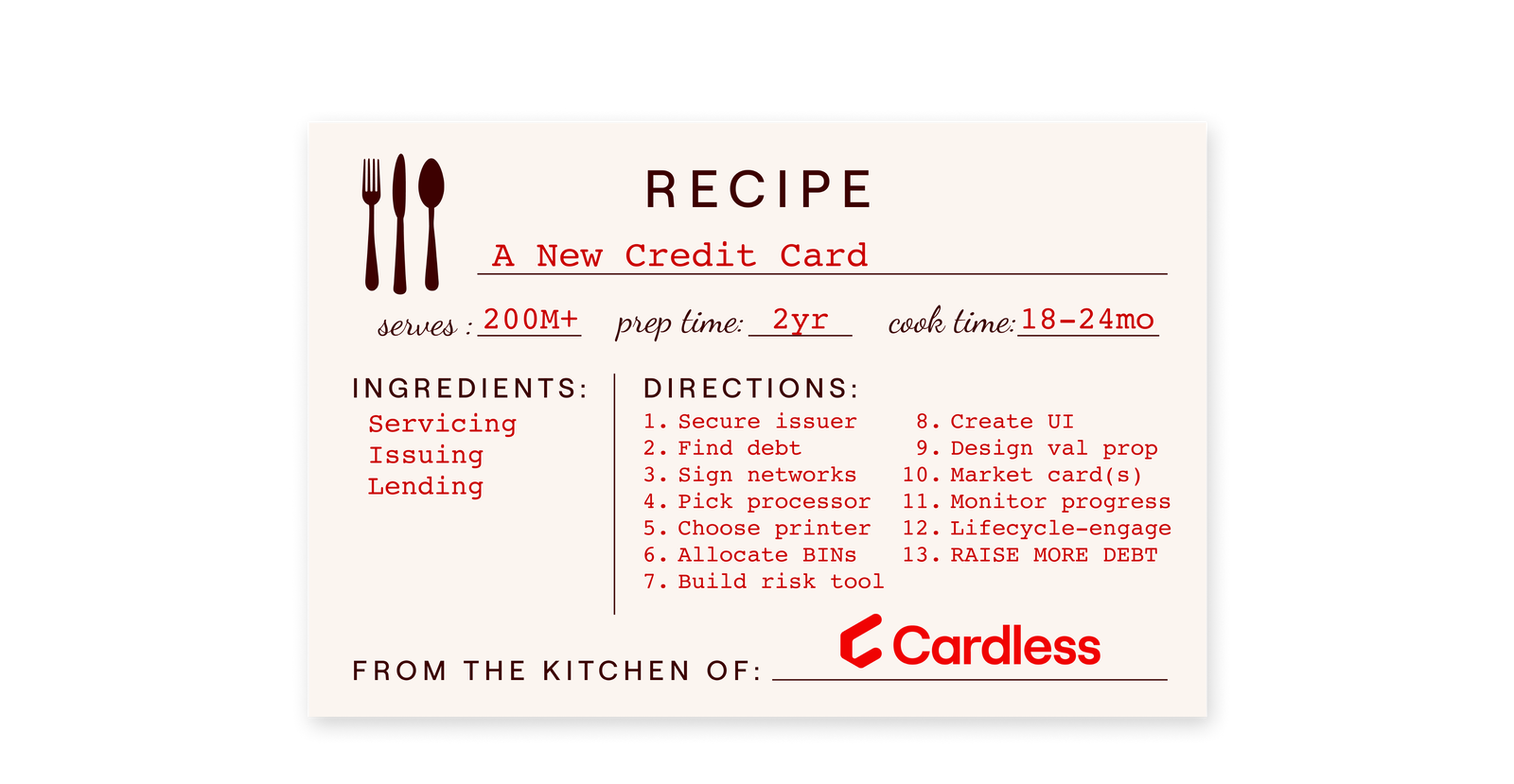

Cardless is a new credit card issuer that’s taking a different approach to issuing credit cards than what we’ve ever seen before. Cardless is essentially trying to help more brands launch credit cards for their most important customers, and they’re doing that by reimagining how the whole process works.

This is a win-win for both smaller brands and for consumers, and that’s something to be excited about.

I recently had the chance to speak with Michael Spelfogel, who is the co-founder of Cardless. He’s a huge miles & points geek, he applied for his first credit card when he was 18, and he has applied for well over 100 credit cards himself. It’s kind of awesome to see someone with that kind of experience and passion applying what they’ve learned to develop new concepts.

I wanted to share some of the things that I learned about Cardless from Michael, and why there’s reason to be excited.

Cardless is taking a different approach to financing

Cardless is taking a different approach to funding transactions. The major credit card issuers in the United States mostly fund their own transactions, and they’ve historically been very conservative in going about that. This has largely meant that only those with ideal credit profiles have access to credit cards, locking out a huge portion of the population.

Of course here at OMAAT we talk about all the ways to keep a great credit score all while taking advantage of great credit card deals, though that’s not necessarily knowledge that the average consumer has.

Cardless is taking a different approach than others — the company plans to assemble a consortium of lenders that are willing to finance different segments of the market. Cardless, working with a bank issuer, wants to facilitate its programs having the highest percentage of card approvals, and ideally wants to facilitate the approval of more people for credit cards, even those who don’t have perfect credit.

Opening up rewards credit cards to a wider consumer base is awesome — not only does it allow more people to build their credit, but it also allows them to be rewarded in ways that wouldn’t be possible if paying for purchases with debit cards or cash.

Cardless can create endless co-brand cards

While the major card issuers have co-brand credit card agreements (for example, Amex working with Delta, Chase working with United, Citi working with American, etc.):

- Typically they’ve only been established if there’s the potential for the portfolio to be worth 10 figures in annual spending

- Actually creating a new card product is a process that takes a very long time, typically over a year; sometimes brands spend years coming up with a co-brand credit card concept, only for it to never actually launch

This is another area where Cardless is taking a very different approach.

Cardless can launch credit cards in about a month, and the economics work for Cardless to launch co-brand agreements for much smaller brands, which creates endless opportunities. Cardless could work with everything from local restaurant groups, to entertainment venues, to nonprofits, to build co-brand credit cards.

We’ve never really seen the concept of launching a credit card be as accessible and easy as with Cardless, so that’s pretty exciting.

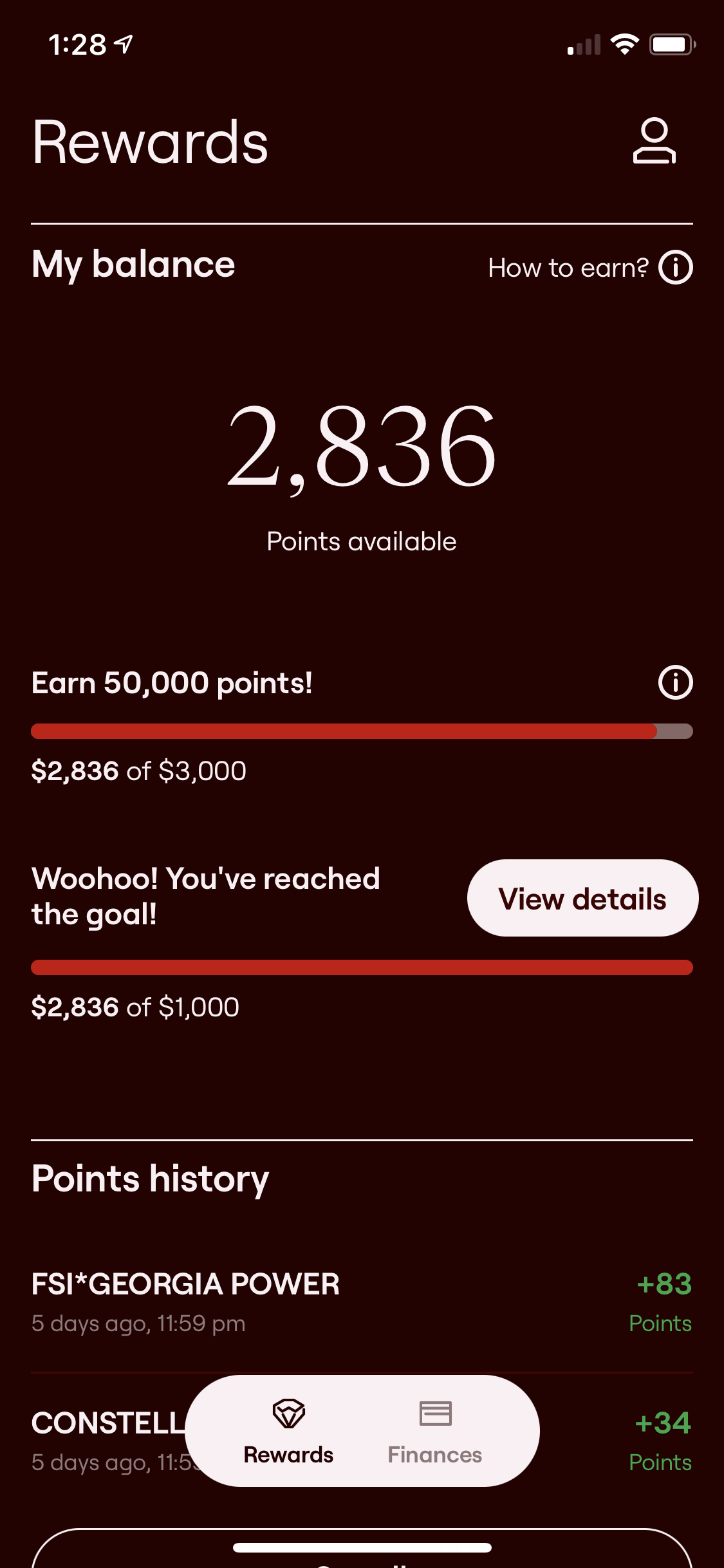

For what it’s worth, up until now Cardless has launched cards in the professional sports team space — specifically, Cardless has cards for the Cleveland Cavaliers and Manchester United. This makes perfect sense, as these teams have loyal followings, though historically probably haven’t had a big enough fan base for a co-brand agreement to be worthwhile to one of the other major issuers.

Cardless plans to expand its portfolio to all kinds of other industries, including the travel space (which is probably what interests the OMAAT community most)..

Cardless can offer unique, valuable rewards

Ultimately there are limits to how rewarding credit cards can be in terms of the rewards for spending, and in many ways this is an area where existing card issuers are already doing a good job. However, it’s also an area where Cardless has a lot of potential:

- Cardless should have a lower cost structure than most traditional issuers, and therefore can invest more in rewards

- Nowadays credit card value propositions go way beyond return on spending, and include things like perks for being a cardmember and other one-of-a-kind experiences; by potentially having all kinds of partnerships, the possibilities here are endless

- Down the road, Cardless is even hoping to make it so that once you’re approved for a Cardless product you can swap it for virtually any other Cardless card, and perhaps even do so multiple times (this would be significantly more generous than the current product change policies we see with other issuers)

Just to give a further example of this, I’m sure I’m not alone in having several cards with a Global Entry or TSA PreCheck fee credit, and I could never use as many of these credits as I have. This is a great perk with wide appeal, and I get why card issuers currently do this, because they often have to take a “one size fits all” approach for benefits on a particular card. Cardless has the potential to offer much more customized rewards.

Similarly, say Cardless got a co-brand agreement with an airline. Most cards offer the same perks regardless of whether you have elite status or not. Imagine if we saw Cardless offer customized perks based on your status or relationship with that airline. This is all stuff that Cardless could do much more easily than other issuers, thanks to the nimble approach that Cardless takes.

Cardless has a technology focus

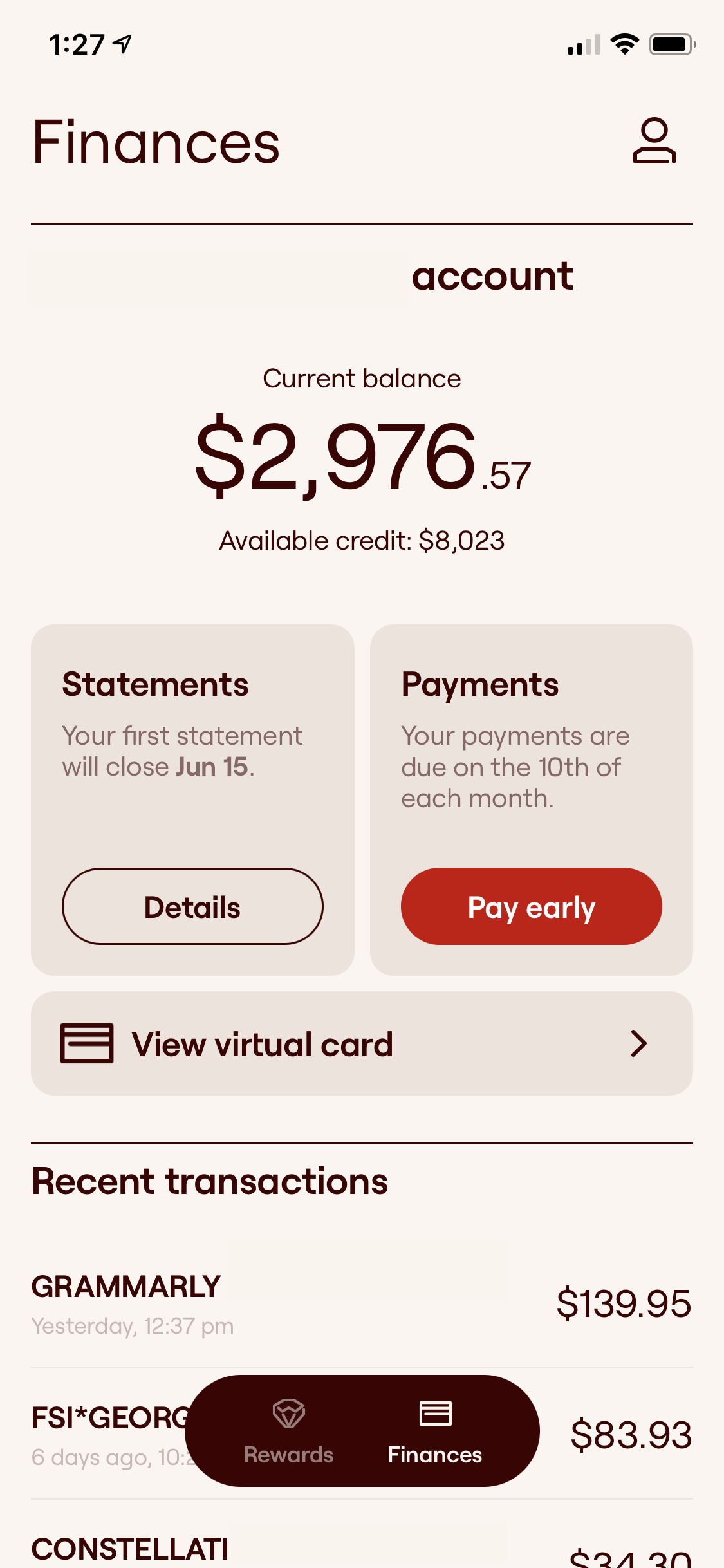

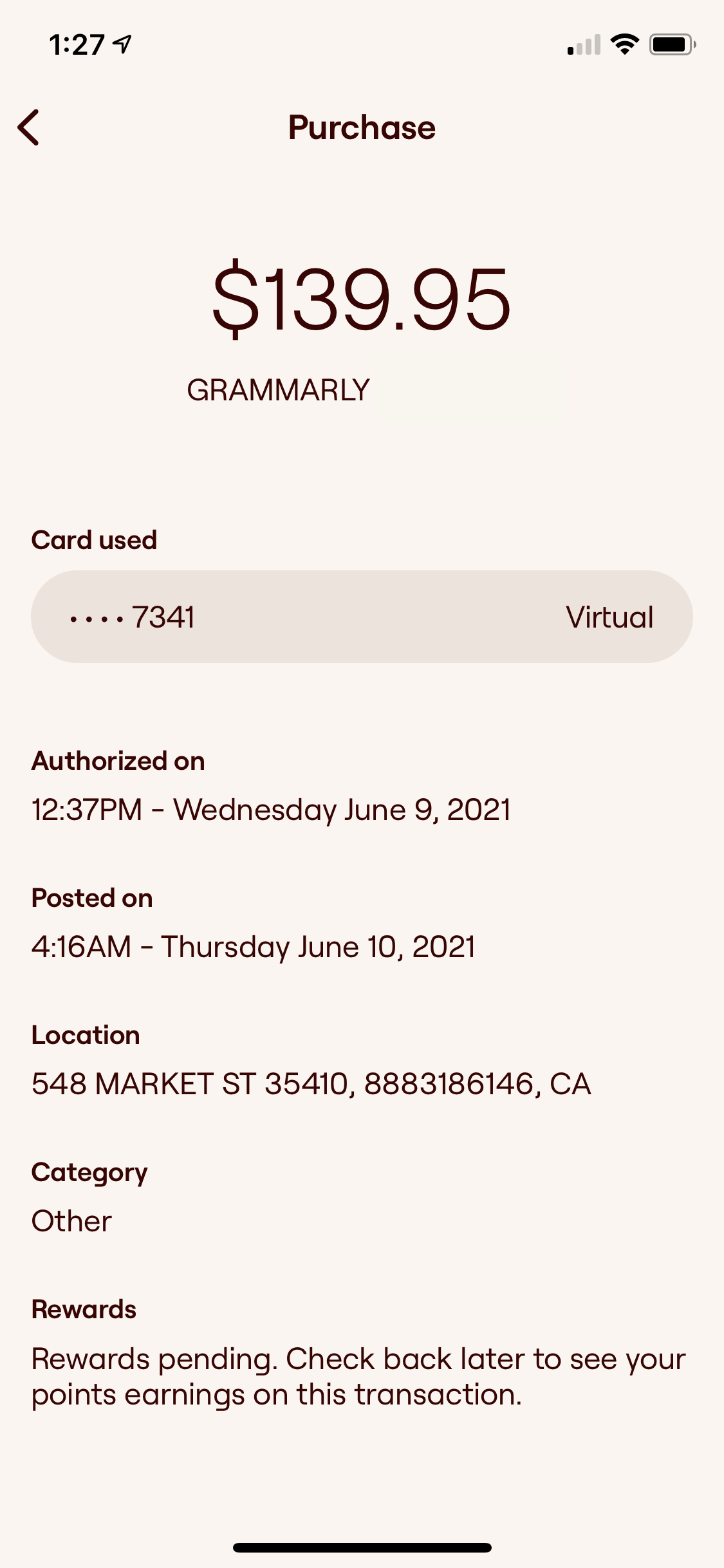

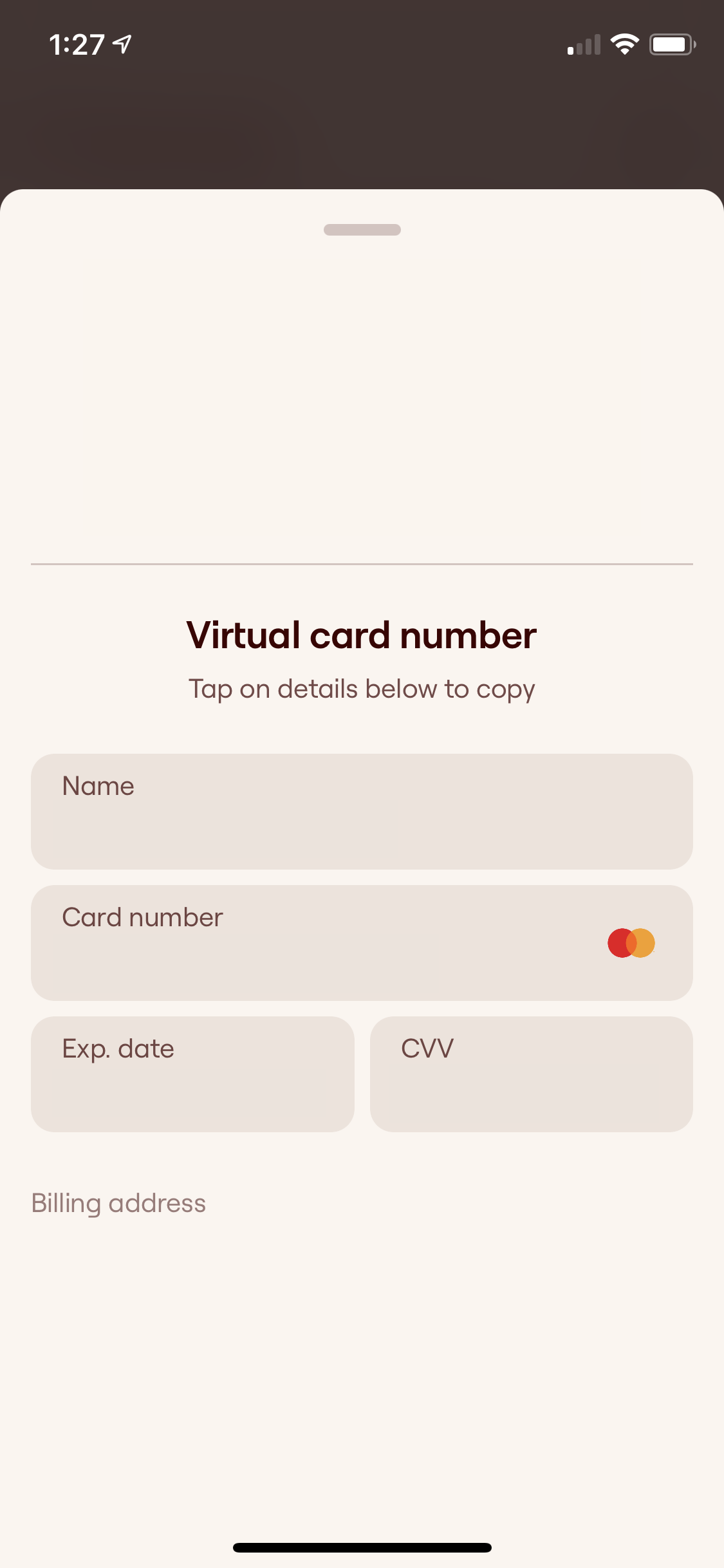

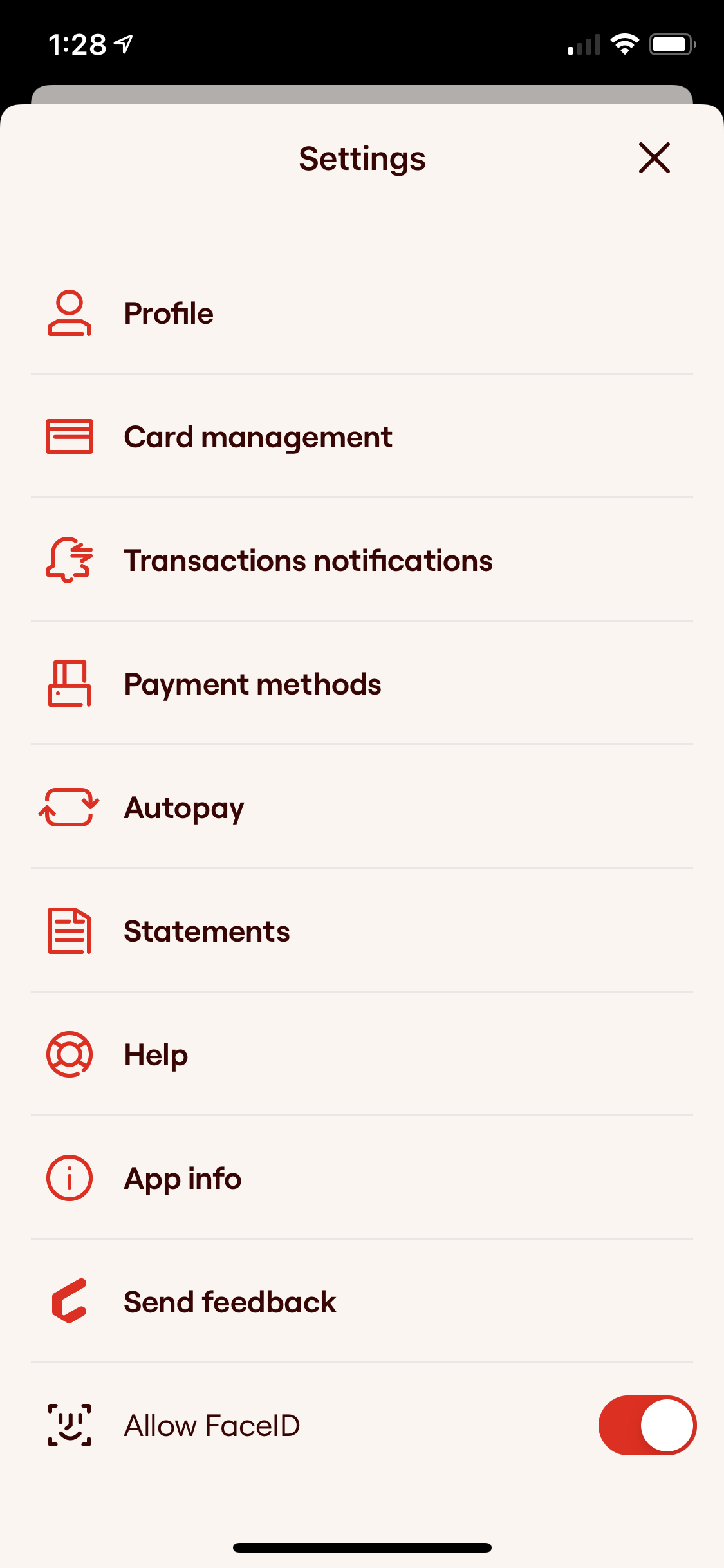

While a lot of companies claim that technology is a focus, Cardless actually backs it up. Cardless has an iOS app (an Android app is coming soon), and through the app you can apply for cards and manage your account.

As soon as you’re approved you’ll be issued an instant virtual card number, so you can start making purchases right away. To me, the Cardless user experience and technology focus seems most comparable to the Apple Card.

Why companies should want a co-branded credit card

We know how much loyalty programs have changed the course of the airline industry, and this could happen similarly for smaller companies as well with co-brand credit card agreements. The potential is endless:

- Co-brand partners could make money through the partnership as such, based on how many people get the card and how much money they spend on it

- Beyond that, those who have a co-brand credit card are better customers for that brand — on average they spend more money and are more engaged

- It’s easier for smaller brands to offer special perks and experiences that can make cards worth getting and worth keeping

- Thanks to Cardless’ flexible approach, perks could be even more customizable than what we’ve otherwise seen in the industry up until now

I’ve written in the past about how loyalty programs make consumers often act irrationally, so what business wouldn’t want that? 😉

Bottom line

Cardless is a new credit card issuer that has the potential to disrupt the consumer credit card space. The company wants to help smaller brands launch credit cards, all while approving more people than traditional card issuers have in the past. Cardless is essentially reverse-engineering the process of building a credit card company.

For consumers this is something to be excited about, as we could see dozens of new credit cards launched for all kinds of smaller brands, with awesome rewards structures. Arguably this is even more exciting for smaller businesses where the concept of co-brand cards was previously unattainable. Launching a credit card opens a world of possibilities, both to generate revenue and to increase brand loyalty.

Stay away from cardless credit cards, they do not monitor fraud and they do not have a fraud call center off hours. A friend of mine had there number stolen. Couldn’t get a hold of anyone and left him liable for fraudulent charges. All around bad business!!!

Ben. Why would you link to this in today’s (6/21/22) post? I missed it until now, and…just wow. Ben. Blink twice if you need us to call for help.

While I understand and support you in making a living from the blog via the credit card pitches (I got my CSR from one of your links!) and via the advertisements, I don't like that this post has been the top post on the traditional "blog" part of your site for nearly a week. Maybe these types of posts could be up for 1-2 days or so in the future and then come down to feature the latest content as you did on the old site?

Is this a sponsored post? It should be labeled as such.

Do you have a source for your claim, "The credit card issuers that do exist all have high costs, and aren’t exactly lean operations".

It sounds like a line from Cardless's VC pitchdeck. Would be nice for some footnotes showing you validated their claims.

OK, a few things:

1. An iOS app doesn't make a company "technology focus." Seriously. It's not even on all mobile platforms.

2. I am not sure how valuable the knowledge of Cardless is... It's like knowing that Netflix runs on top of AWS (now, these *are* serious tech companies). Does it even matter? If tomorrow Netflix decides to move to Microsoft cloud, do we viewers care?

3. By the by, Cardless' supposedly...

OK, a few things:

1. An iOS app doesn't make a company "technology focus." Seriously. It's not even on all mobile platforms.

2. I am not sure how valuable the knowledge of Cardless is... It's like knowing that Netflix runs on top of AWS (now, these *are* serious tech companies). Does it even matter? If tomorrow Netflix decides to move to Microsoft cloud, do we viewers care?

3. By the by, Cardless' supposedly lower transaction cost (I am not exactly sure how this works out...) doesn't automatically or even necessarily translates into better rewards. If anything, it's the other way around. If each transaction "costs" less, that means the company (Cardless) makes less revenue for each transaction, which means less money for reward.

4. I am not 100% sure if trying to get *everyone* on reward credit cards is a good idea. Reward for spending is a tricky thing. It's good if you can control your spending. It's not as good if either you can't or you are still learning. Given the level of personal saving rate and consumer debt in USA, do we really want more reward for spending?

I mean, I am as exciting about anyone else if there is a good credit card product. But until that happens, well, let's keep cool and try not to make this looking like an advertisement.

Like many others, I will share a 'thank you' for disclosing that this was sponsored content. And with that said, like many others, I will share a 'please stop'.

I give a pass on the credit card pitches because 1) you need to make a living, 2) I get value from the other content you post, and 3) I even sometimes learn something or get a redemption idea from the credit card posts.

But this? No. Just no.

I read that whole thing, I still don't really understand what Cardless is, but I have excellent credit (like probably 95% of OMAAT readers) so my only takeaway is Cardless isn't for me. Congrats Ben, on the big payday though.

This is literally just a press release. What is the point of this? There's no product for us to apply for? We can't help this company forge new partnerships even if we wanted to.

"Cardless has a teChnOloGY focus" yet doesn't have an Android app thereby disregarding 80% of the world's smartphone and close to half in US.

Also Ben, you know very well how 'compelling' their cards currently are...cashout points for 0.5x. Its worse than Amex or even using points for Amazon purchases, that you actively seem to discourage elsewhere :)

Ben, I've read every single post you've written in the past decade. The reason for this is that every single post has been written by you (or Tiffany etc.) based on your personal experience. Very disheartening to read this sponsored post. Your readers are here to read your posts not sponsored marketing nonsense. I hope you don't turn into the next TPG.

Agreed. This post is awful.

V disappointed to see this post. No substance whatsoever. Complete informercial. Hate to say it, but others are right, this feels like a step towards TPG.

If there's a number more like these, you're gonna lose the genuine readers who want unvarnished. honest views. I understand that may happen - as TPG has shown, it can be very lucrative. It's your blog/site, so completely your choice of course.

So the idea is that they provide credit to people who would better not get credit, lure them into spending more than they should with creative “rewards“, and then make their investors rich with the interest payments from the half-broke consumers who ideally are never able to pay back their debt and just keep paying interest for ever. Genius.

No amount can be worth this. This cardless model sounds like dog crap wrapped in a chocolate wrapper. Don't make anyone eat that.

The only factual differentiation you point out is how they fund their cards and thus can open an individual card up to a broader audience (although each individual card looks like it will cater to a large proportion of a small sub-audience).

You don't explain what they do that makes them more nimble, why they have a lower cost structure, or how their tech is any better than the tech of any other issuer.

The only factual differentiation you point out is how they fund their cards and thus can open an individual card up to a broader audience (although each individual card looks like it will cater to a large proportion of a small sub-audience).

You don't explain what they do that makes them more nimble, why they have a lower cost structure, or how their tech is any better than the tech of any other issuer.

Looking at the benefits of the Cavs card, .5 cents back per dollar? Or 1 cent if you'll take it in the form of a Cavs gift card?

Am I missing something? I fail to see what is compelling about them.

Love the blog Lucky, but this feels more like a sponsored post than anything else. Really disappointing to see though I hope I'm wrong. Maybe I am...

He says at the top that this is a sponsored post.

This was really, really bad.

This model has existed before with MBNA. No one cares about the app. And as far as simple cards go, a double cash is a far superior card on any level. No innovation needed

This is a shill job and a really bad one.

I feel less informed than when I started reading this

Ben, I’m not gagging.

I thought that TPG was the sell out to the card companies….but this ‘review’ feels like it’s straight off a careless pitch deck. So sorry you sold out.

I hope they're paying you a lot to jerk them off like this

Grateful for the full disclosure that this piece was in part put together by the company in the post. I don’t think this will gain any meaningful momentum in its current configuration, more out of the box thinking is required by credit card providers on how they can become novel in an ever increasing crowded market.

Awful, and not innovative.

TL;DR- it won't

Thanks for always disclosing when it's an ad :)

If you're going the way of sponsored adver-posts, I'm going the way of finding another blog to read and trust.

Ben,

I think your disclosure was appropriate. My two cents is that I'm on board with you introducing sponsored posts for financial products and things like travel insurance, but I would be very uncomfortable with sponsored content (even properly disclosed) from travel organizations. I stopped trusting TPG after he took Marriott's invite to the Oscar's a few years back. Please don't mess with your independence around the companies you're in a position to review.

@ kay_elemeno -- We agree with you. Our advertising and ethics policies are linked at the top and bottom of every page, and the latter addresses specifically that.

First off, thank you for disclosing this as an advertorial. This is very important.

I do have some points to bring up.

1. If the last new major issuer was Capital One 25 years ago, it still is.

2. "The company plans to assemble a consortium of lenders" - Adding itself as another middle man doesn't save cost, it adds cost. Not quite the idea of lean.

3. "We’ve never really seen...

First off, thank you for disclosing this as an advertorial. This is very important.

I do have some points to bring up.

1. If the last new major issuer was Capital One 25 years ago, it still is.

2. "The company plans to assemble a consortium of lenders" - Adding itself as another middle man doesn't save cost, it adds cost. Not quite the idea of lean.

3. "We’ve never really seen the concept of launching a credit card be as accessible and easy" - I don't know the details but Synchrony or Comenity having around +100 cards each doesn't make it look difficult either. Nothing new here.

4. "offer unique, valuable rewards" - They really need to make it unique (and still earn profit). Can they really beat Citi x5 or Amex x4 on restaurants or travel. Too unique would hardly attract everyday user.

4.1 The “one size fits all” stuff like TSA precheck means the bank knows if you have more than one card, they can save this cost without losing the benefit list.

5. "has a technology focus" - This and this alone is really the decider if it will succeed or not. So far, they rush to launch a bit too quick. But if they can cut cost enough using technology, they can still make it.

I don't see how this is disrupting anything for now. The main drivers are still interest and fees to make money. It still needs a large scale to be sustainable. And if its grows big it loses it's flexibility.

Do you think the no branch, online only banks disrupt banking? I don't think so.

Promoting this product here where readers are card savvy would mean the product will only be used when that one single usage is better than Chase Amex or Citi. That is a very high cost to them. If it's going to succeed, they need to strike a balance of lending to the subprime and debt recovery, which is Capital One's territory (and maybe why they are the last major issuer in the last 25 years, they found this segment). If they are after sub subprime, they should be handing out cards at thrift stores and foreclose homes to pay credit card bills. (which I can consider they disrupt the bankruptcy and foreclose numbers)

As far as I see, their exit would be to sell off the technology to larger banks if they operate long enough. I'm sure they are very good at pitching it to investors (who probably have only 2 credit cards).

Give us a $1000 bonus, we'll use it until we get the bonus then we put it away and go back to Chase.

Wait is that why readers here missed out on the Manchester United bonus?

By the way, how is Brex doing?

Any readers who have a Brex account still using it?

Looking at their Cleveland Cavs card there's nothing revolutionary - in fact pretty uncompetitive. 1 cent per dollar gift card rewards. No ability to use poits to get premium seating at a discount / much better than 1 cent per dollar spent value. Wasting time.

To take the perishable inventory thing further...

Would be great to get high value premium concert seat at a material discount via a rewards program - or a day of baseball game seat upgrade for points that's at a superior value - not some quasi cash level. Like the first class intl award - 5 to 10 cents per dollar spent to get the reward in value.

Not sure you need this program to...

To take the perishable inventory thing further...

Would be great to get high value premium concert seat at a material discount via a rewards program - or a day of baseball game seat upgrade for points that's at a superior value - not some quasi cash level. Like the first class intl award - 5 to 10 cents per dollar spent to get the reward in value.

Not sure you need this program to deliver it and not sure it solves why that isn't offered. But they should focus on those kinds of things if they want readers here interested.

Sorry but I see a lot of marketing bafflegab without anything hard and fast that makes this compelling. It's great that smaller brands can get into the game but what's in it for Cardless. Sure Uber was a great deal for us but they have yet to make money and won't until transit becomes a monopoly.

This is the MBNA 'affinity cards' biz model that cluttered the landscape pre 2008 - hundreds of alumni associatoin, sports team, etc had a 'rewards' program that offered little useful beyond cash.

The best rewards are perishable inventory that would otherwise go unused - which is why airline and hotel miles are so valuable. Just about everything else is a modest rebate that's hard to compete with straight cash rewards.

It's an interesting concept but I think they're going to have brutal competition from Google Pay and Apple Wallet, since they offer perks (especially cashback) that are stackable on top of the general card perks (such as 3x travel on CSR).

Also - "applied for over 100 cards himself". Are there even 100 cards in existence? Genuine question...

Like saying "I am a people person because I am also a person"

The customer service is absolute shit. Apparently that's what the revolution means - worse than Amex, Chase, and Citi.

Standard fintech startup disruption playbook is to provide no customer support.

I want to know if I can move my Manchester United “points” into something else or if I should just cash them out now.

Um brex??? Careful what you push pre-product, don’t want to end up like GSTP pushing that garbage upgrade scam

I was hoping the redesigned site was just a UX growing pain, and not a sign of the commercialization of OMAAT, but I fear this post puts it beyond all doubt: OMAAT has jumped the shark into TPG land.

So sad, as I've enjoyed your posts, Ben, since back when you were signing them lucky9876coins...

You’d think since Cardless was paying you to write this they wouldn’t have made the message so blandly uninteresting.

Now we know who has paid that “enhancement” of this Blog… Bye bye Brex, hello Cardless