Link: Apply for a Bilt credit card, whether you’re a new or existing cardmember

Bilt recently announced massive changes, including the introduction of three credit cards in partnership with Cardless, plus an all-new system for being rewarded for housing payments (read my Bilt credit card review & comparison).

Just about everything about Bilt is changing, for better or worse, and I covered all those details in a previous post. In this post, I’d like to share my personal strategy after having digested all of this information, including the card I decided on, how my application went, and my overall thoughts.

While I first covered this several days ago, we’ve learned a lot since then (including about how Bilt Cash can be redeemed), so I’d like to incorporate all that information into this post.

In this post:

Why I decided to “upgrade” to the Bilt Palladium Card

In the previous post, I covered the details of the three new Bilt credit cards, so I don’t want to go over all of that again. Long story short, I think the no annual fee Bilt Blue Card and $95 annual fee Bilt Obsidian Card are sort of non-starters, and it’s hard to get excited about them, especially compared to the old Bilt Card, and especially in comparison to the competitive landscape.

Meanwhile I think the $495 Bilt Palladium Card is the product that’s most worth considering. Why? For one, the card has a welcome bonus of 50,000 bonus points and Bilt Gold status after spending $4,000 within three first three months (on non-housing purchases), plus $300 Bilt Cash upon approval.

We’ve never seen a Bilt card have a formal welcome bonus before, and that’s absolutely worth taking advantage of, as the other two cards don’t offer any points with the bonus. At a minimum, the card is worth giving a try for a year.

Beyond that, what intrigues me about the card is simple — it offers 2x Bilt points on everyday spending, which is pretty incredible. Bilt points are valuable, as they can be transfered to Alaska Atmos Rewards, World of Hyatt, and a variety of other programs.

While we’ve seen some transferable points cards offer 2x points, I think being able to earn Bilt points at that rate is incredible, and probably beats the other options.

The icing on the cake is that is that you’re earning 4% back in Bilt Cash on all your spending, and we’ve now learned how Bilt Cash can be redeemed. As I see it, there are two redemption options that are most enticing:

- $3 in Bilt Cash is worth 100 Bilt points on your total rent or mortgage payments, at the rate of 1x points; put another way, you’d get $4,000 worth of housing payments (4,000 points) with $3,000 in spending,

- $200 in Bilt Cash (which you’d unlock after $5,000 in spending) can be redeemed for one extra point per dollar on $5,000 worth of non-housing spending, meaning you’d earn 3x points per dollar spent on everyday spending; you can unlock this perk up to five times per year, for up to $25,000 worth of spending

The numbers here are pretty lucrative. Just to give an example with straightforward math, let’s say you spend $100,000 per year on the card:

- You’d earn 200,000 Bilt points, at the rate of 2x points per dollar spent

- You’d earn at least $4,000 in Bilt Cash, at the rate of 4% back (and that doesn’t factor in the annual Bilt Cash bonus)

- You could redeem $1,000 in Bilt Cash to earn 25,000 bonus points on spending (where you’d earn 3x points), and the other $3,000 in Bilt Cash could unlock earning 1x points on $100K in housing payments annually

- You’d also earn Bilt Platinum status, which gives you extra benefits, like some partner status perks, access to better Rent Day offers, etc.

It’s hard to argue with that return on spending, as that’s pretty spectacular.

My hesitations with the value of the Bilt Palladium Card

While there’s a lot to like about the Bilt Palladium Card, I think we also have to be take off our rose-tinted glasses, and be realistic.

I’m all for us getting outsized value, but I think it’s also important to be balanced, and it sure seems like a disproportionate amount of Bilt coverage out there acts as if the company can do no wrong, and everything is always perfect. So let me just provide some balance. As I see it, there are a few general challenges that stand out.

For one, I’m frustrated by Bilt specifically excluding certain spending categories from being eligible to earn points. For example, Bilt states that it won’t award points for tax payments put on credit cards. Virtually every card from a major issuer doesn’t have such a policy.

That’s a major “spending” category for me, and a way I earn lots of points with other cards. That’s of course Bilt’s prerogative, but it has major implications for how I value the card. So that’s not a category where I can earn rewards with Bilt, and it means I need to keep around another great card for everyday spending. It also makes me wonder how much I really spend in categories that aren’t bonused on other cards.

Second, I need to figure out how much of the $495 annual fee I can actually recoup. The card does offer a Priority Pass membership, plus up to $400 in Bilt portal hotel credits per year (a $200 credit semi-annually, each requiring a minimum two-night stay).

The restrictions on that hotel credit are potentially a little annoying, and I’m not sure I’ll be maximizing the value of that. So how much will I really be paying “out of pocket” to hold onto this card?

Third, there’s just the general question of how sustainable all of this is, and if it will all stick around. The economics here are better for Bilt than they were under the old system, but still, I feel like we’re going to see some more cuts. For example, will Bilt points continue to be as valuable a they are now, as I can’t imagine the current redemption rates are sustainable for Bilt?

I’m putting this card in the category of absolutely being worth trying, but it remains to be seen if it’s the best option in the long run, based on how things play out. I’m also curious to see how much I actually spend on the card in non-bonused categories, since that will determine how much of the annual fee I’m really recouping. I need to be able to spend a lot — and earn a lot of points — for the $495 annual fee to make sense.

I think one of Bilt’s big challenges is that it tends to have a pretty savvy customer base. After all, these are people who care enough to pick up a card specifically to earn housing rewards. Those people are also more likely to take advantage of benefits, maximize their points redemptions, etc.

It’s a much less profitable customer base than with something like Amex, where you have people who don’t really care about the points, but they just want the “status” of spending on an Amex card.

My experience “applying” for the Bilt Palladium Card

As Bilt transitions from Wells Fargo to Cardless, existing cardmembers have the option for a seamless transition. The idea is that you’re supposed to “pre-order” your new card by January 30, 2026, so that you can transition to the product on February 7, 2026, when the card formally launches.

If you’re an existing cardmember, there’s no hard pull when you apply for the new card, and instead, there’s just a soft pull. So unless something absolutely drastic changed since your previous application, you’re supposed to also be approved for the new card (however, there are a concerning number of reports of non-approvals). If you get approved, your credit card number will even stay the same as you transition to the new product.

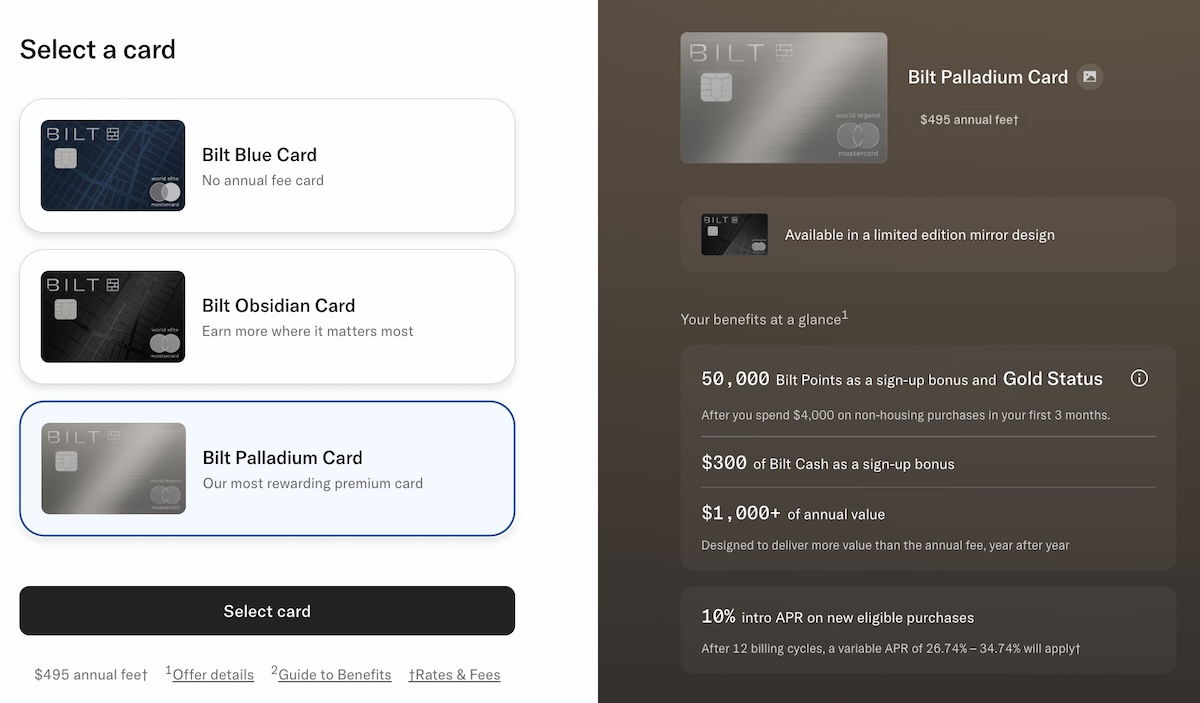

With that in mind, let me share my experience. After going to Bilt’s new credit card page, I logged into my account and clicked the “Apply now” button, and I could choose which card I wanted. I selected the Bilt Palladium Card.

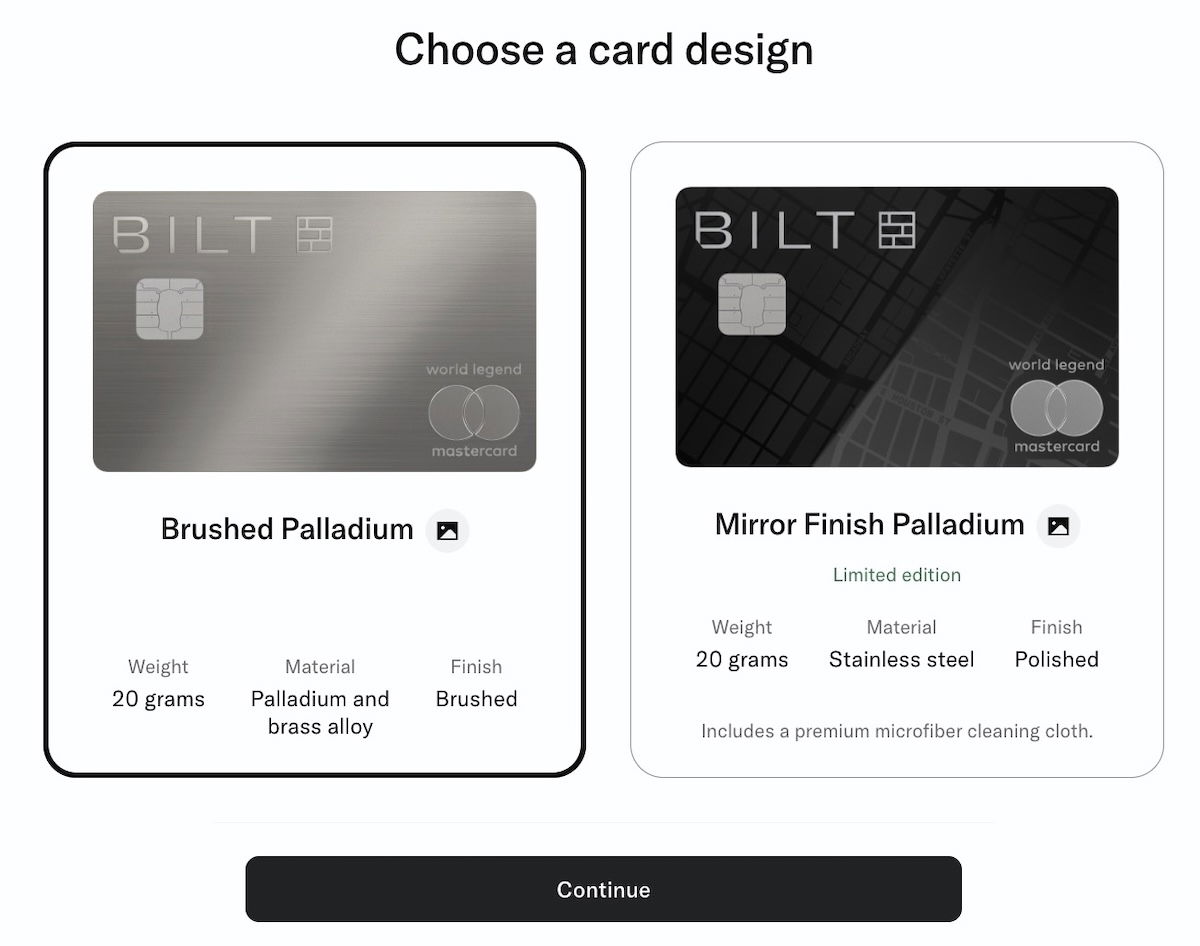

I could then choose my card design, between brushed palladium or mirror finish palladium.

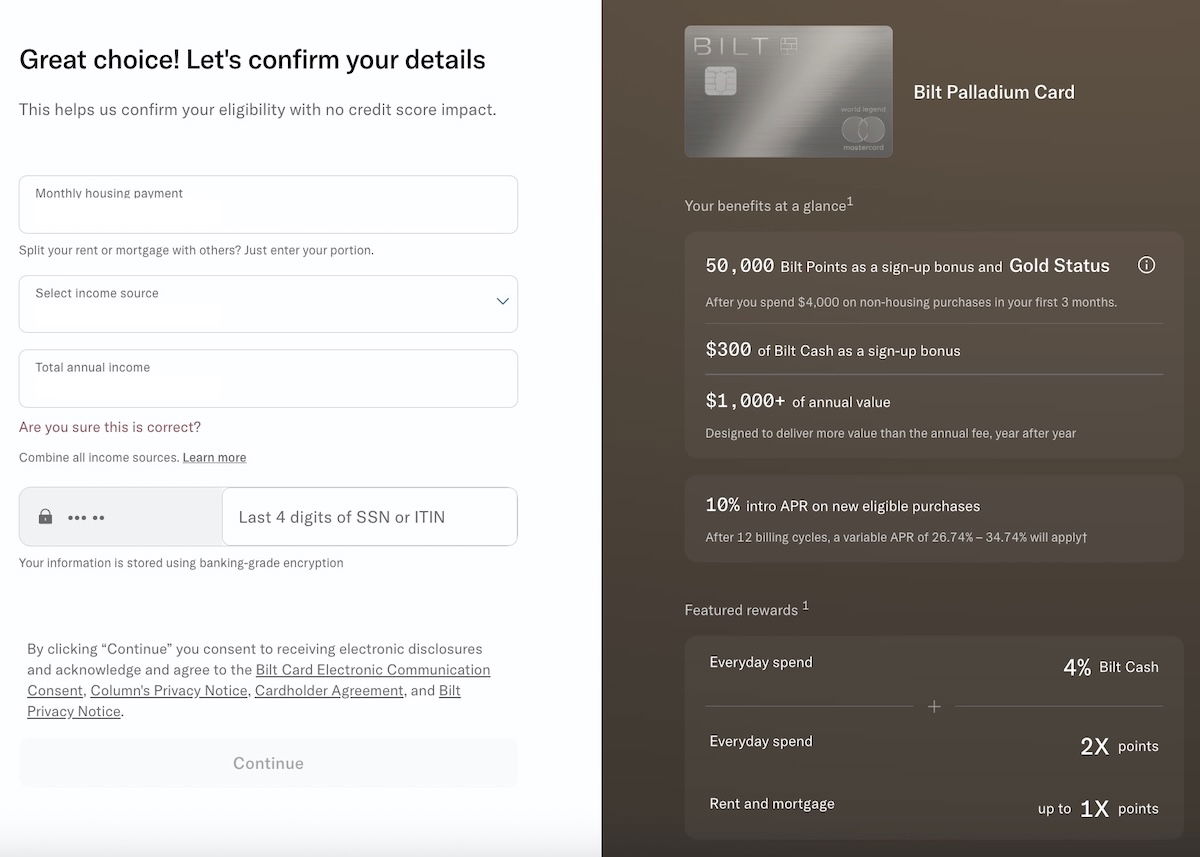

I was then asked to confirm the information I had provided to Wells Fargo in the past, including my monthly housing payment, income, etc.

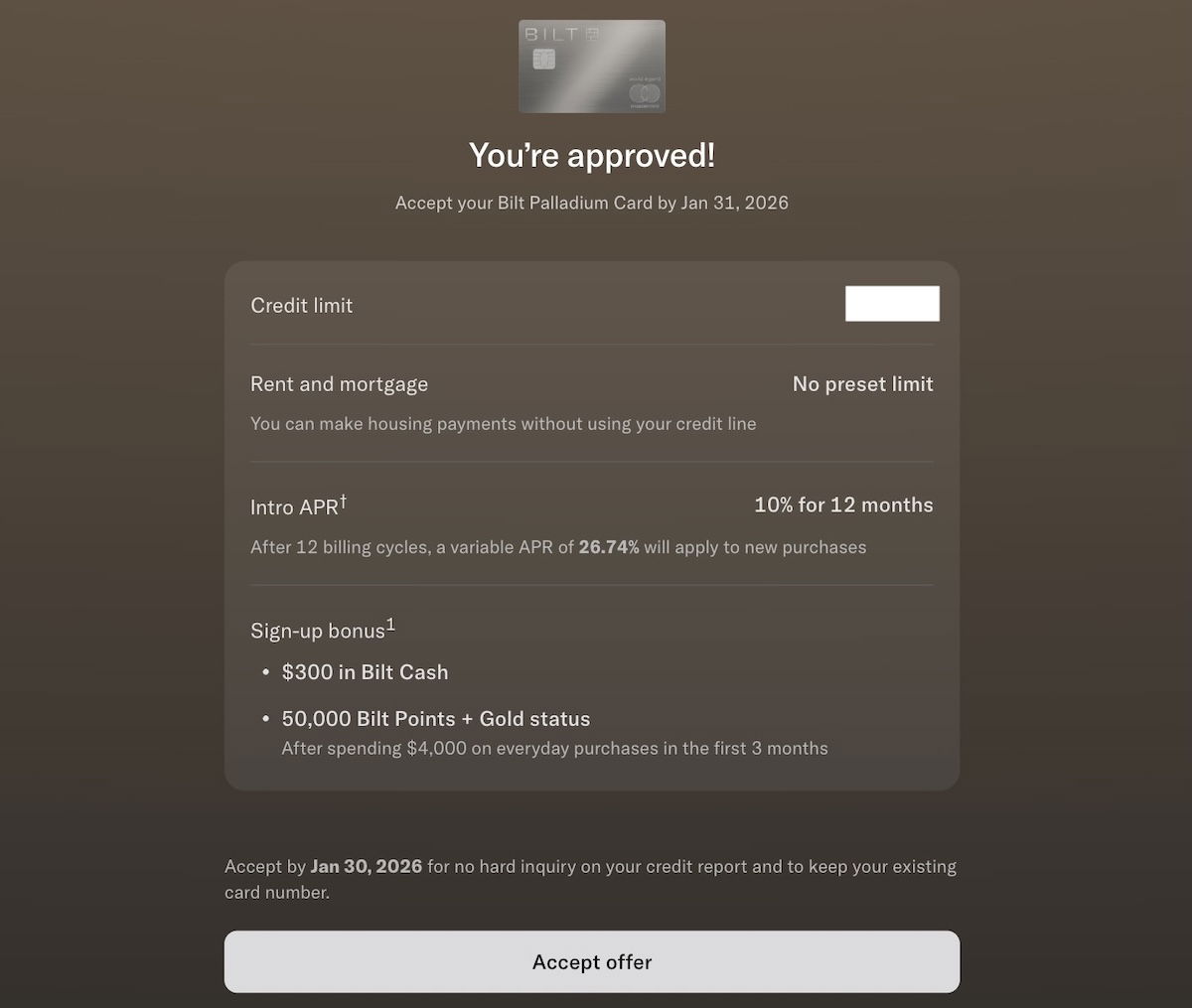

I then submitted that information and found that I was approved, with a big credit line (though it was still about 30% smaller than my Wells Fargo credit line, which was oddly large). Keep in mind that with the transition to Cardless, your rent or mortgage payment no longer counts toward your credit line (since it’s paid by ACH rather than being charged to your card), so that gives a little more flexibility. I was asked if I wanted to accept the offer.

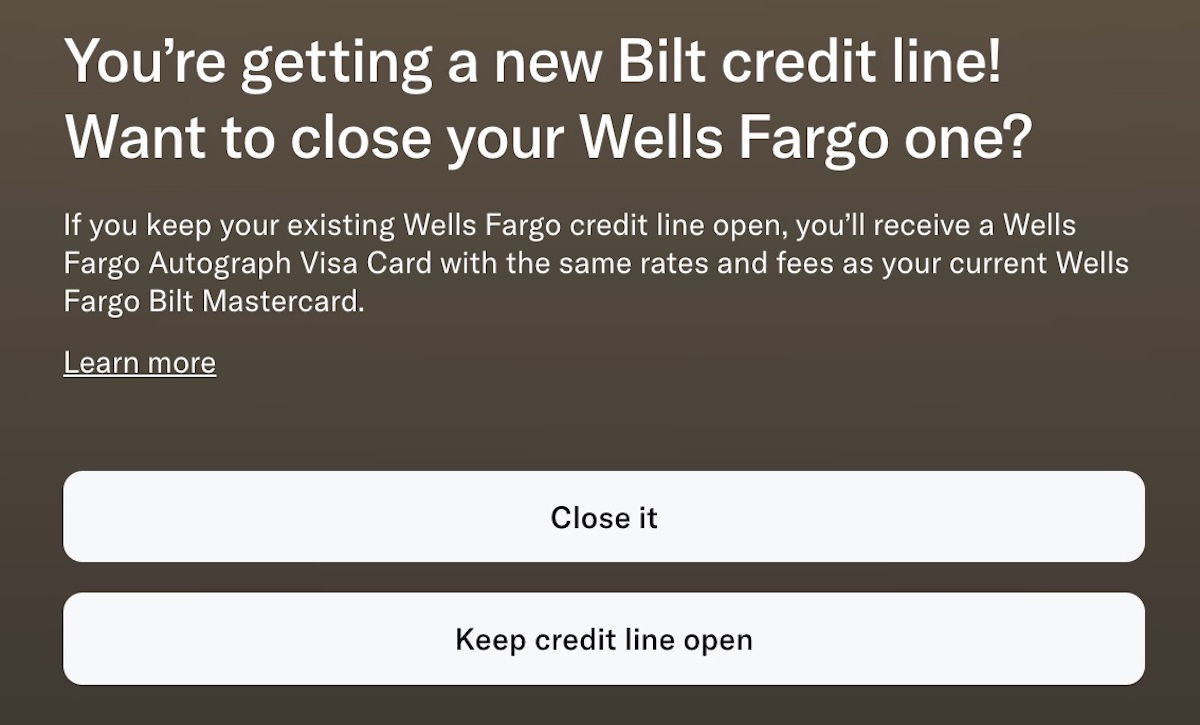

After accepting the offer, I was asked if I wanted to keep my Wells Fargo credit line open, which I didn’t want, so I clicked “Close it.” In theory there’s value to keeping cards open in order to maximize your available credit, which can be good for your credit score. However, I have so many credit cards and so much available credit that I’m no longer trying to keep them open unnecessarily.

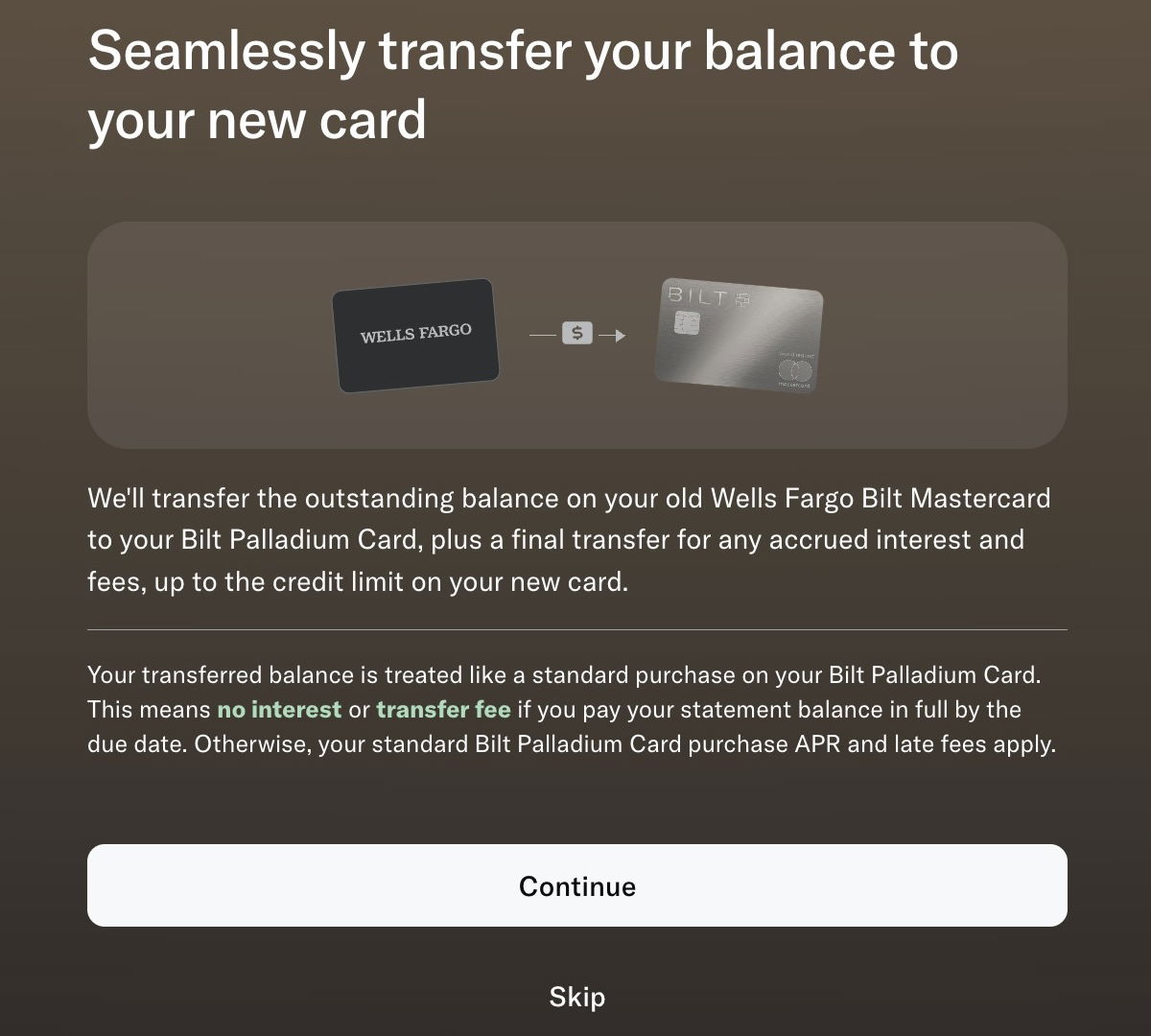

Lastly, I was asked if I wanted to transfer my balance to my new card, and I said that I did.

All-in-all, I found it to be a straightforward process.

Bottom line

We’re seeing the Bilt credit card portfolio change completely, along with a new system for being rewarded for rent and mortgages. If you are going to continue to be involved in the Bilt ecosystem, then I think the $495 annual fee Bilt Palladium Card is the obvious choice, assuming you spend a decent amount on your credit card, and on rent or mortgages.

It’s the only card with a substantial welcome bonus, and as I view it, that bonus more than covers the card’s annual fee for the first year. The biggest selling point of the card is that it earns 2x points on all spending, which I’d argue makes it one of the best cards out there for everyday spending, given the value of Bilt points.

Then your spending earns you Bilt Cash, which you can redeem for a combination of housing payments and to earn even more bonus points, so that you can earn 3x points on up to $25,000 of spending annually.

However, I also have concerns. I don’t like how tax payments aren’t eligible for earning points, and I’m not sure how easily I’ll be able to recoup the annual fee, given the lack of meaningful benefits outside of Bilt Cash and the Bilt hotel credit. For now I’m simply viewing this as a card that I’m giving a try for a year, and then I’ll decide on my long term strategy based on how things play out.

How are you thinking about which Bilt card makes the most sense, and which did you decide on, if any?

Ben - I too was disappointed that I couldn't put my taxes on the BILT 2.0. What is your (non-SUB) strategy for paying taxes?

I just received my new Palladium card yesterday (Jan 31) and tried to activate it as instructed and kept receiving error messages. Maybe I cannot activate my card until official switch to the new card on Feb 7th? Does anyone have same experiences as mine? Thanks

I found it interesting that although I haven't had the Bilt card in the past, it said I could see my offer without any impact to my credit. I didn't even need to enter my full SSN, just last 4 digits. After submitting, I got a message that I would need to unfreeze my Experian account, I did, resubmitted and refroze my account. Got approved and accepted (while Experian was re-frozen). Not sure when or if they actually do a hard pull.

What going to happen with the Bilt dining program after the transition?

The summit card by Alaska is promoted in the Bilt app to be used for rent. It even allowed the preauth for PayPal payments. Then when you do it. Bilt rejects it saying only Bilt MC. But they allow the workflow authorization. This cost me over 200 in fees and zero rewards earning as a result.

Bilt needs to go bankrupt. They don’t make it right by fixing their mistake.

Just signed up for the Palladium card. Looks like you can only link your bank account by signing into your bank, which I will not do. There is a manual option but selecting it routes to the portal to use your bank's login credentials. Guess I will give them a call but otherwise will be canceling.

Ben as you and i have discussed privately there is NO value here for most people. The exception is high spending hyatt globalists who can get 3x points on $25k of spend and 2x on the remainder. They also can get benefit from housing expenses being covered. The hotel credits are worse than useless ... no loyalty participation, a two night minimum, and overpriced rates. Most kf us have lounge access multiple times over. Most...

Ben as you and i have discussed privately there is NO value here for most people. The exception is high spending hyatt globalists who can get 3x points on $25k of spend and 2x on the remainder. They also can get benefit from housing expenses being covered. The hotel credits are worse than useless ... no loyalty participation, a two night minimum, and overpriced rates. Most kf us have lounge access multiple times over. Most will get NO value from Blade or priority pass "guest passes" so you are paying 1 cent per point for bilt points. Ok but nothing special.

I've never had trouble understanding @Ben's description of anything, but the description of Bilt earnings was incomprehensible. This isn't a knock on Ben. The card is just stunningly complicated. I would have had to read Ben's detailed post on the card to begin to understand and that shouldn't be necessary.

Does your new sign-up bonus spending offer begin immediately after you are approved? Or do you have to wait for the new 2.0 card to arrive?

From Bilt: You'll be able to activate and start using your Bilt Card 2.0-including your digital card, mobile wallet, & online transactions beg February 7, 2026.

I don't have the exact time of day when activation will open, but you'll see the option to activate and access your card details in your Bilt account as soon as it's available.

Can’t use the new cards until February 7; however, knowing BILT, they probably ‘start the clock’ on your approval date, because yet another bait-and-switch feels very on-brand.

Ben has done an admirable job of distilling down the complexity.

In short the Palladium card only makes sense if you have enough ordinary spend that the 3x you get with Bilt is enough to offset the card's high annual fee.

At $100k, it's worth it. Less than that compare to the Citi, no fee, or the Capital One Venture X, modest net fee, both of which earn 2x.

I love how you run your calculations based on $100k spend… Given it’s just everyday spend (not travel, dining, supermarkets, for which there are far better cards) and the fact you cannot put taxes on this card, I think I’ll use this card for a small fraction of my spending… and close after a year.

All your recent posts on Bilt suggest that you value their points more than others. However, your published point value is still the same as Amex and the rest. Please address this sometime soon.

Bilt is the only 2x un-bonused spend that transfers to Hyatt.

If that makes it worth more than 1.7 cents per point, Ben should say so. I have more use for AAdvantage points than Hyatt, and Bilt lost AAdvantage to Citi.

Atmos for AA transatlantic business class is my best redemption with Bilt, but I'm really put off by the complexity and short decision period with Bilt 2.0.

Wasn’t this article posted a few days ago? Will be nice once BILT goes away, it will be for good next time. What they’re doing is terrible for rewards space.

@ Jerry -- A different version was posted several days ago, yes. As I explained in the intro, I wanted to do an updated analysis, since we've learned about exclusions on what payments don't earn points with Bilt, and also how Bilt Cash can be redeemed, both of which are important details.

Here's a question - from the T&Cs: Card Purchase Rewards: Bilt Points and Bilt Cash earned from Bilt Card purchases typically post within 2-5 business days after the transaction posts to your Account.

So it's not on a statement basis, it's on a per transaction basis and sort of in real time? That's fascinating. And I wonder how that will work in December... last week of December purchases may not post until January for instance?...

Here's a question - from the T&Cs: Card Purchase Rewards: Bilt Points and Bilt Cash earned from Bilt Card purchases typically post within 2-5 business days after the transaction posts to your Account.

So it's not on a statement basis, it's on a per transaction basis and sort of in real time? That's fascinating. And I wonder how that will work in December... last week of December purchases may not post until January for instance? So does that Bilt Cash expire? Is it based on the transaction date or the posting date?

@ Peter -- Unfortunately I think this is one of those things where we're going to have to wait and see, since this very much feels like a launch where the details are being figured out as we go along.

Here's what the Bilt AI help desk says- pretty funny, actually. Maybe Bilt AI should speak with Bilt management.

"Bilt Cash is credited to your account after your eligible transaction posts and is confirmed, not based on the purchase date itself.

If you make a purchase on December 31, 2026, the Bilt Cash you earn will be counted as of the date it is actually credited to your account, which may be after the transaction...

Here's what the Bilt AI help desk says- pretty funny, actually. Maybe Bilt AI should speak with Bilt management.

"Bilt Cash is credited to your account after your eligible transaction posts and is confirmed, not based on the purchase date itself.

If you make a purchase on December 31, 2026, the Bilt Cash you earn will be counted as of the date it is actually credited to your account, which may be after the transaction date.

This timing is important for expiration purposes, since Bilt Cash earned during a calendar year expires at year-end, with up to $100 rolling over."

Ben - is it clear how earning Bilt Platinum status will work for those getting Gold via the Palladium sign-up bonus? Eg would we only need to earn / spend the incremental amount of points / spending, or would we need to earn / spend the full amount to hit Platinum? Eg 75k points / 25k spend or the full 200k points / 50k spend?

full amount

@ VirginClubhouseKween -- Harold is correct, you'd still have to spend the full amount, unfortunately.

WHAT ABOUT THE CLAWBACK LANGUAGE? I generally love your content, but I find it find it disingenuous that you and others won’t acknowledge it, address it, or clarify with their contacts at Bilt. Cardless’ annual fee billing practices and the clawback language are an huge elephant in the room. We are potentially being set up to pay a second annual fee by accepting the sign-up bonus—look at the T&Cs.

@ Jason -- There's no intention on my part to ignore those questions. I've not gotten answers to my most recent questions passed on to Bilt, so I'm afraid there's not a whole lot else I can do to clarify things.

I think the clawback language isn't that different from other card issuers. Personally, if you keep the card for a year and then decide it's not for you (and close it before paying...

@ Jason -- There's no intention on my part to ignore those questions. I've not gotten answers to my most recent questions passed on to Bilt, so I'm afraid there's not a whole lot else I can do to clarify things.

I think the clawback language isn't that different from other card issuers. Personally, if you keep the card for a year and then decide it's not for you (and close it before paying the second annual fee), it would be entirely unreasonable for Bilt to try to claw back any points.

So it's not something I'd be worried about, personally. If they do that, I'll scream from the rooftops on behalf of everyone until they come to their senses. I just don't see it happening.

I'm wondering - assuming you held the card for 12 months and had transferred all points out some time before, what would there be /to/ claw back? Presuming that the language isn't /that/ different from other cards, this seems like shenanigans would run into "boilerplate contract" issues with enforcement (basically, the courts tend to be less-than-thrilled with companies doing weird stuff with sneaky contract language), so wouldn't the question be whether you were willing to...

I'm wondering - assuming you held the card for 12 months and had transferred all points out some time before, what would there be /to/ claw back? Presuming that the language isn't /that/ different from other cards, this seems like shenanigans would run into "boilerplate contract" issues with enforcement (basically, the courts tend to be less-than-thrilled with companies doing weird stuff with sneaky contract language), so wouldn't the question be whether you were willing to burn your bridges with Cardless at that point?

I think the concern is that you might want to keep some/all of your Bilt points after closing/downgrading the card, and you'd be open to clawback at that point. And all the vibes (IE no points for tax payments, ebay, etc - plus the sudden nerf of Rent Day, etc.) from Bilt point to them looking unkindly on ANYTHING they might consider 'abuse'. IE downgrading/canceling after a year to avoid a second AF. And I...

I think the concern is that you might want to keep some/all of your Bilt points after closing/downgrading the card, and you'd be open to clawback at that point. And all the vibes (IE no points for tax payments, ebay, etc - plus the sudden nerf of Rent Day, etc.) from Bilt point to them looking unkindly on ANYTHING they might consider 'abuse'. IE downgrading/canceling after a year to avoid a second AF. And I have no Cardless experience, but everything I hear is bad and similar anti-maximizer vibes.

Why don't you paste the clawback language and your analysis here?

I am not offering legal advice but assuming your sole concern is a clawback as a result of not agreeing to pay for second year's annual fee here's what you can do. The Card Offer Terms only permit Bilt to reclaim the Welcome Bonus if you cancel, downgrade or close your account within 12 months after your Account Open Date. Call Bilt during the 30 day period that starts with your Account Open Date and...

I am not offering legal advice but assuming your sole concern is a clawback as a result of not agreeing to pay for second year's annual fee here's what you can do. The Card Offer Terms only permit Bilt to reclaim the Welcome Bonus if you cancel, downgrade or close your account within 12 months after your Account Open Date. Call Bilt during the 30 day period that starts with your Account Open Date and ask them how long you have from when your second year annual fee bills to cancel the card and not have to pay the second year annual fee.

I'm sure you will find that there is a significant window, typically 30 to 45 days however you should make sure you understand if the window runs from the day the annual fee posts to your account or from the date the bill closes which contains the annual fee.

Also make sure you know exactly what date is your Account Open Date. So long as you cancel before the window shuts to not have to pay the second year fee but at least 12 months from your Account Open Date and that you didn't violate any of the other provisions that would allow Bilt to clawback your welcome bonus then it seems unlikely they would attempt to do so.

SO now Bilt does automatic balance transfers in transitions - that's actually a learning. When they were transitioning from "Beta" Bilt card with Evolve to Wells Fargo, they didn't do it. So I applied for my Wells card, got approved and took the 10K SUB then, and left a significant balance on the old Evolve card, caused by some unexpected big medical expenses in the family. And was slowly making minimum payments on it due...

SO now Bilt does automatic balance transfers in transitions - that's actually a learning. When they were transitioning from "Beta" Bilt card with Evolve to Wells Fargo, they didn't do it. So I applied for my Wells card, got approved and took the 10K SUB then, and left a significant balance on the old Evolve card, caused by some unexpected big medical expenses in the family. And was slowly making minimum payments on it due to interest being lower than most other cards or unsecured credit lines.

Over the course of the next few months, I received a few offers of $500 if I pay off or transfer the balance elsewhere. And in the fall - a little wonder happened: I received an email from Bilt that payments on my old card are no longer required, and the balance is being written off. And there was about $ 10K left, slightly less. So for me this is clearly a win.

Because you want us to also apply for the card and click your link? :)

I don't blame you as you deserve to be paid for this although I am the rare breed that would rather just pay you for good content as even you are having trouble defending this one. Happy Friday!

@ Andrew -- Hey, fair enough! I'm not trying to defend anything here, and I think I've been one of the more balanced voices with Bilt. My intent is to share my strategy, because I'm not going to leave points on the table. And because of the really sloppy rollout, unfortunately that requires multiple updates, given that we learn something new every day.

The question of how much of the $495 you can recoup in year 2 (year 1 you get the SUB and the Gold status so it's a wash) depends on how much spend you will put on the card and the value of Bilt Cash. Assume $0 for PP and $0 for the $400 in hotel credits (2x $200 with 2 night stays - that's not something I would ever prepay for and I value...

The question of how much of the $495 you can recoup in year 2 (year 1 you get the SUB and the Gold status so it's a wash) depends on how much spend you will put on the card and the value of Bilt Cash. Assume $0 for PP and $0 for the $400 in hotel credits (2x $200 with 2 night stays - that's not something I would ever prepay for and I value it at $0).

You get $200 of Bilt Cash with the card every year. Between the $10 Lyft, $10 Walgreens and $25 restaurant credits every month, it is plausible that over the course of a year you can get $200 of cash value with those credits. Yes you can discount the pre-paid nature of that, but that could make the $495 feel more like $295.

Or you can go with the $200 = an extra 1x up to 5k points. If you value Bilt Points at 2cpp that's... $100. So what's the right way to think about it - is your $495 card really $395 or $295?

The thing is that after the $540 in annual "Lyft/Walgreens/Restaurant" credits, the rest of the Bilt Cash laundry list is pretty hard to get real value from (unless you value Blacklane... like Citi Strata Elite users claim to). So if you're going to run a bunch of spend through the card on account of a large housing payment(s) for instance, and you end up with a bunch of surplus Bilt Cash to use on the extra up to 25k points, and you get a couple hundred bucks of cash value through Lyft etc... now suddenly you might feel like you are getting $700+ of value ($500 for the 25k points and ~$200 on the Lyft stuff) on a $495 card before even considering the 1x points on housing cost.

Of course, given that Bilt Cash expires on 12/31 other than $100, it makes earning really messy. If you are going to put any spend on the card in December (a typical high spend month!) you have to spend down all of your Bilt Cash by November. Obviously depends a bit depending on your exact payment cycle, but they need to fix that. You need to have at least until 1/31 to redeem the prior years Bilt Cash (or at least the prior December's Bilt Cash).

So straightforward... right? Your post the other day nailed it - the elevator pitch on this one is really hard. I wonder if they are hoping that the elevator pitch in year 1 for many is "you have to use Bilt to pay your rent anyway and here's a 10% intro APR for a year - who cares about the rest of it."

Don't count on the restaurant credits with Bilt Cash. That's only possible with Mobile Checkout. Very few restaurants in our area have Bilt Mobile Checkout. The amount of fine print on this card is mindboggling.

Oh I'm sure it's hard to use. This is all still in beta test mode. My only point is that there may be a couple hundred bucks of actual cash value from Bilt Cash before the value drops to $0.10-$0.25 or whatever and getting more points is the only attractive option (which, admittedly, is what I would care most about anyway).

In my viewfinder, I see Chase re-releasing the double points 1st yr CFU offer to compete

All the travel bloggers who are being paid for ads from Bilt are all pushing this. They screwed the pooch. Way too complicated and no longer good for most people.

If the bloggers aren't to be trusted, what are you doing here?

I'll presume that's a real question. Until you read what a person has to say you don't know what that is. I have yet to read a single blogger who has affiliate links talking about how the new system has a lot more negatives than positives - even disregarding the devaluation needed to make the program palatable to a bank. The one exception is FM. I'd personally hoped that more bloggers would likewise take some...

I'll presume that's a real question. Until you read what a person has to say you don't know what that is. I have yet to read a single blogger who has affiliate links talking about how the new system has a lot more negatives than positives - even disregarding the devaluation needed to make the program palatable to a bank. The one exception is FM. I'd personally hoped that more bloggers would likewise take some ownership of the issues and publicly call on Bilt to simplify and de-couponize the cards a bit. That hasn't happened, which implies a lot, and none of it good. I bit on the headline to see if there was anything new or relevant to me. No but I'll still read a blog even if I feel the source is tainted as long as I bear in mind where the blog's true interest lies. It doesn't make Ben evil that he values his relationship with Bilt absolutely over his relationship with readers.

The challenge with the card is the complexity of Bilt Cash. But, there might be a better way of looking at it. If a person can cover the annual fee with just the hotel credits plus the annual grant of Bilt Cash, convert earned Bilt Cash for 3X on up to 25k extra Bilt Points, and FORGET ABOUT EVERYTHING ELSE, then there's an attractiveness to the card. But, get bogged down trying to game it and you're sunk.

@ Tom -- For sure, if you can make the math work that way, that's great. But I also struggle with getting excited over recouping my annual fee with $5-10 per month coupon clipping, and I already have so many credit card hotel credits that I struggle to use them. Everyone will of course be different regarding that.

Hey Ben,

With the hotel credits, can you get EQN's and loyalty recognition from Hyatt and Marriott when booking through BILT? Don't have the card yet, but am strongly considering it and being able to use the credit and get EQN's through Hyatt would be good.

Don't count on it.

Personally I agree w/ other posters on counting the hotels as zero value. If they earned elite credit and points maybe I'd feel differently.

Which option 1 or 2 do we have to use in order to do this: convert earned Bilt Cash for 3X on up to 25k extra Bilt Points, and FORGET ABOUT EVERYTHING ELSE,?

The options are so mixed up in my head after reading all the blogs, that Im looking to do exacly what you suggest but cant rattle my brain enough to determine if its done via choosing Option 1 or Option 2.