Link: Learn more about the Citi® / AAdvantage® Globe™ Mastercard®

The Citi® / AAdvantage® Globe™ Mastercard® (review) is the brand new Citi American AAdvantage card. Since the product just launched, I figured I’d apply, and in this post, I’d like to report back with my experience. While I ended up getting approved, it wasn’t quite an instant process.

In this post:

Why I applied for the Citi AAdvantage Globe Card

The Citi AAdvantage Globe Card has a $350 annual fee, so it’s the mid-range card in the Citi AAdvantage portfolio. One major incentive to pick up this card is that it’s offering a huge welcome bonus of 90,000 AAdvantage miles after spending $5,000 within four months.

Beyond that, though, the card offers lots of perks that potentially make it worth holding onto. Many people will appreciate the first checked bag free, preferred boarding, and four annual Admirals Club passes.

For those who are more frequent flyers with American, there are some other perks as well, that can help offset the annual fee. For one, the card offers up to 15,000 bonus Loyalty Points per year, in addition to the ones that you earn for spending. This includes 5,000 bonus Loyalty Points for every four American segments flown, up to three times per elite year.

The card also offers lots of credits and other benefits, including up to $100 back annually on American inflight purchases, up to $100 annually in “Splurge Credits,” and a $99 annual domestic companion fare. I’m figuring out how exactly the card will fit into my card portfolio in the long term, but I definitely think it’s a card that’s worth giving a try.

Citi AAdvantage Globe Card application restrictions

Eligibility for the Citi AAdvantage Globe Card is really straightforward. The typical Citi credit card application restrictions apply, including that you can be approved for at most one Citi card every eight days, and at most two Citi cards every 65 days.

On top of that, the bonus isn’t available to those who have received a new account bonus on this exact card in the past 48 months. Fortunately since this card is brand new, virtually everyone should be eligible for it.

Eligibility is unrelated to having any other American Airlines credit cards, though, whether personal or business, and whether issued by Citi or Barclays. So you can pick up this card (and earn the bonus) even if you have the Citi® / AAdvantage® Executive World Elite Mastercard® (review), Citi® / AAdvantage Business™ World Elite Mastercard® (review), etc.

Citi AAdvantage Globe Card application process & approval

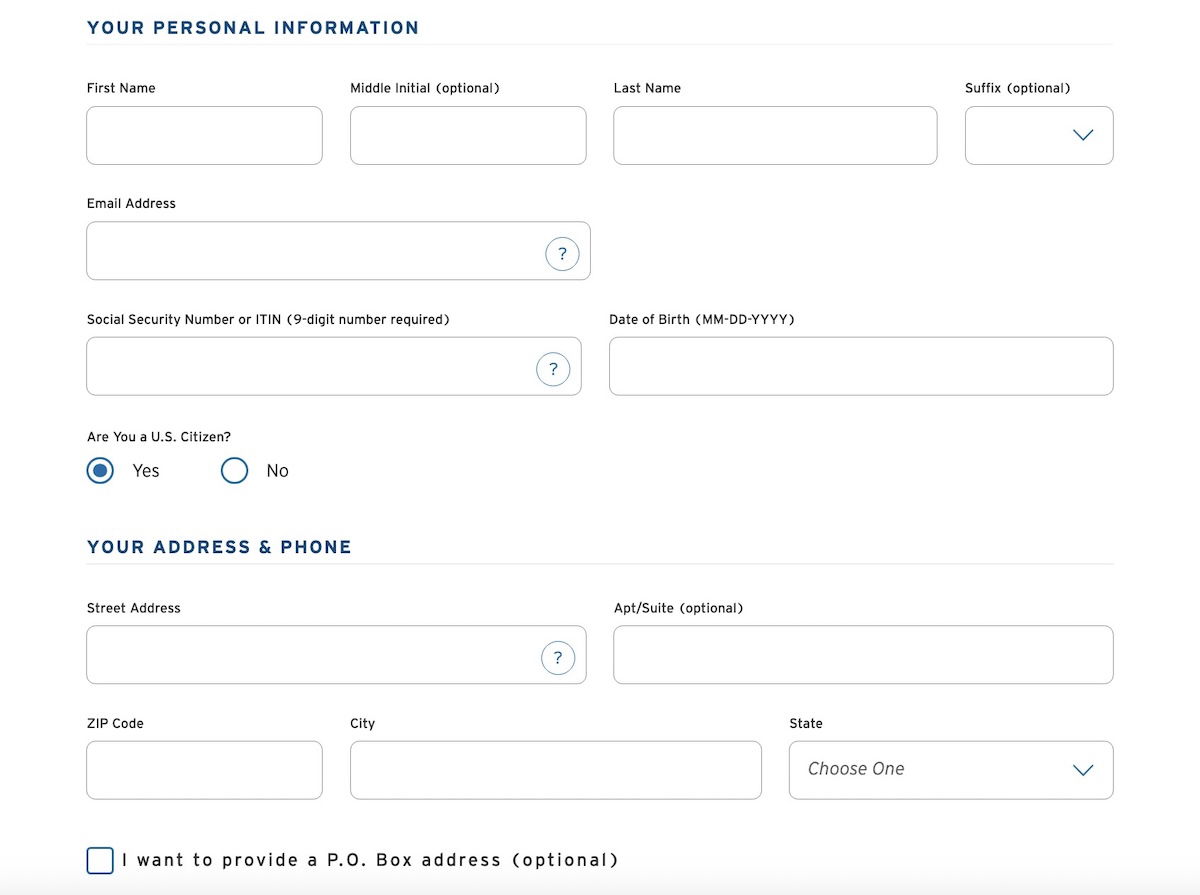

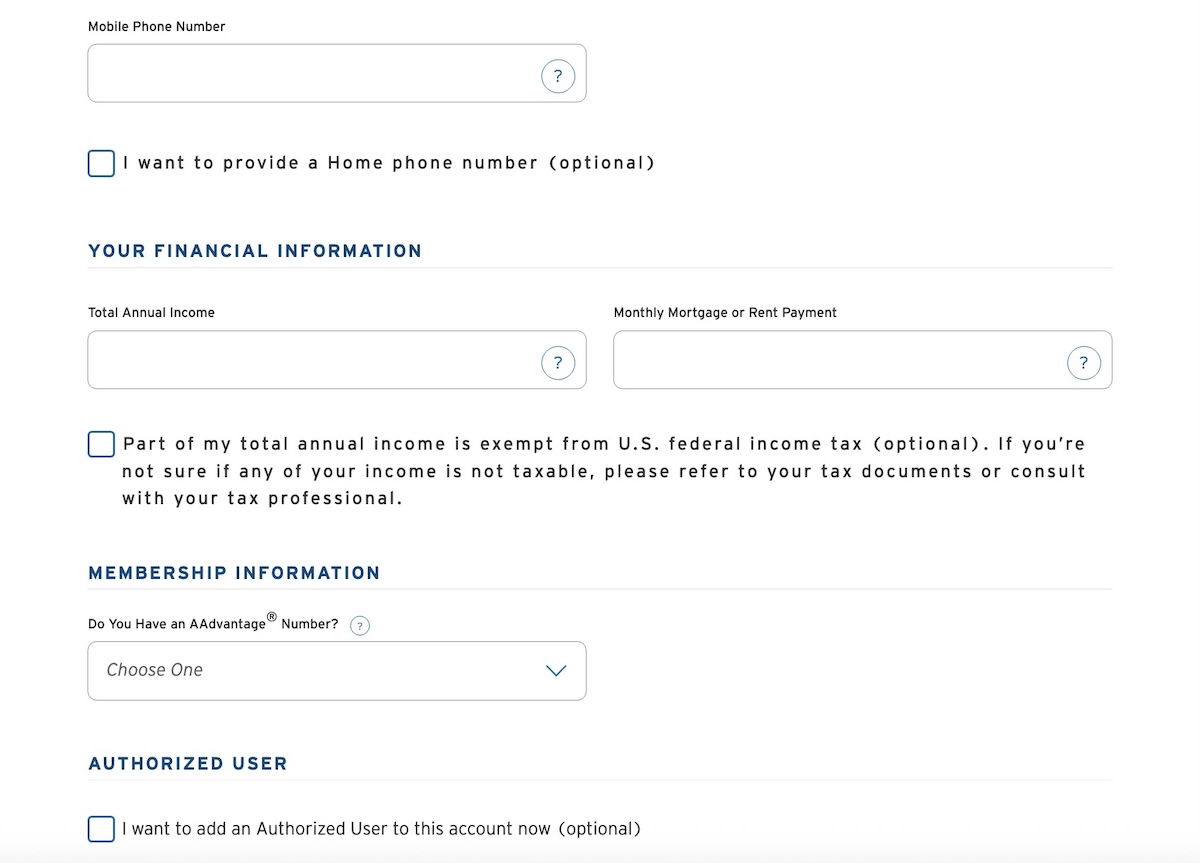

The Citi AAdvantage Globe Card online application process is straightforward, and consists of just one page. It’s shorter than applications with most other card issuers. It asks for personal details — name, date of birth, social security number, address, phone number, income, etc. If you have an existing Citi account, you even have the option to log-in, and that will then pre-fill many details.

At the end of the application, you’ll be asked for your American AAdvantage number, so you’ll of course want to enter that. Not only is that where all your miles will be deposited, but it’s also where your Admirals Club passes will be deposited, as that’s an ongoing card perk.

I have to be honest, I was curious if I would be approved or not. I only recently applied for the Citi Strata Elite℠ Card (review), and when I was approved for that, I got only a $5,000 credit limit, which is the minimum credit limit one can get on the card while being approved.

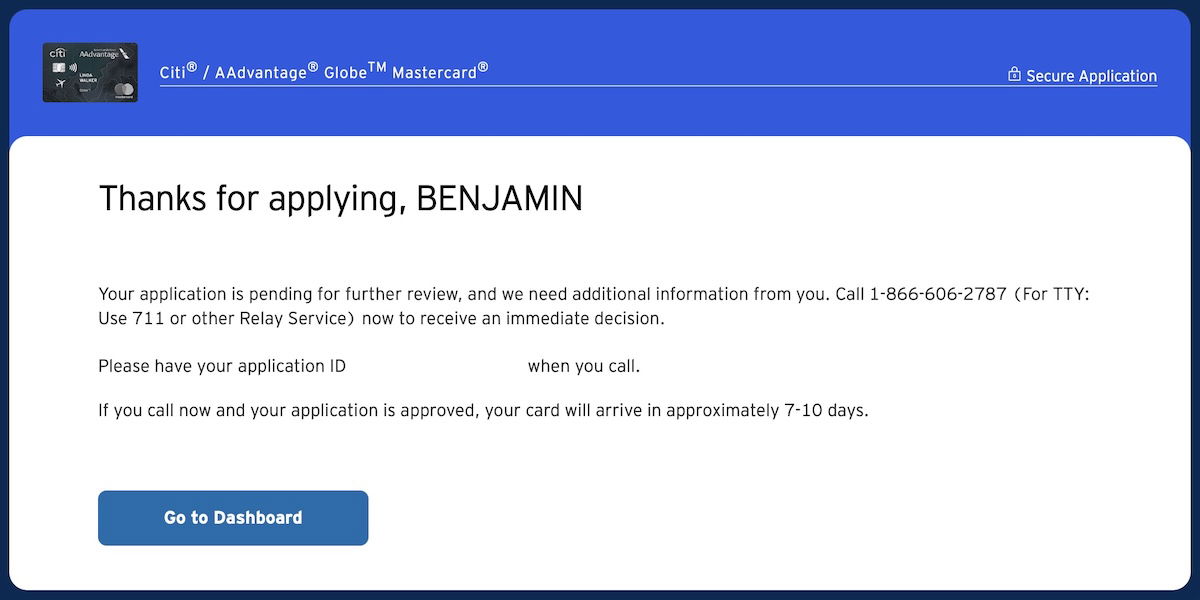

That’s because I have a couple of other Citi cards that have massive credit lines, including the Citi® / AAdvantage® Executive World Elite Mastercard® (review). So upon submitting my application, I was thanked for applying, and was given a number to call, along with an application ID.

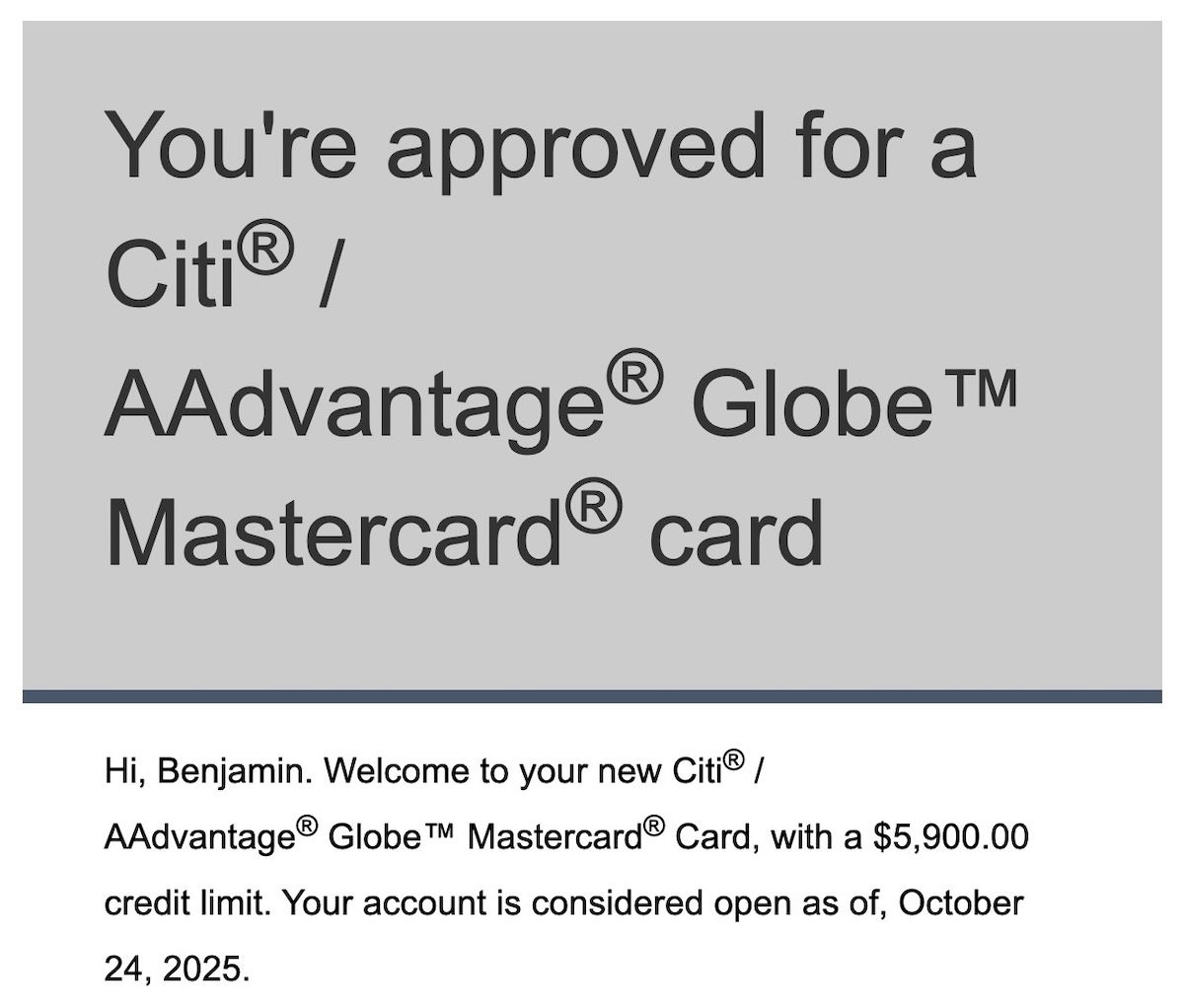

I phoned up, and was connected to a friendly agent. She had no questions for me, but asked to have a couple of minutes to review my application. After a brief hold, she congratulated me for being approved, with a credit line of $5,900. I thanked her, and also immediately received an email confirming my account approval.

I figured I’d have to move around some of my credit line, so I was actually surprised that wasn’t the case. Interestingly, she called me back a couple of minutes later, mentioning that she saw I had a lot of credit on my other Citi cards, and asked if I wanted to move some of it over to this card. So I did that, and moved over an extra $10,000 in credit from another card.

By the way, I also instantly received an email confirming that the Admirals Club passes had already been deposited in my AAdvantage account. So if you are applying shortly before a trip and get instant approval, that’s great news.

Bottom line

The Citi AAdvantage Globe Card recently launched, and I figured I should apply for the card to report back. I got approved, though it wasn’t instant, presumably because I already have a lot of outstanding credit with Citi. Fortunately after a quick phone call, everything was taken care of.

The Citi AAdvantage Globe Card has a limited time welcome bonus that makes it worth applying for, and between the up to 15,000 bonus Loyalty Points, up to $100 in annual American inflight credits, up to $100 annual Splurge Credit, etc., I think I can make the math on this card work.

If you’ve applied for the Citi AAdvantage Globe Card, what was your experience like?

Applied this past weekend and received instant approval - but unlike you, I did not get the email about Admiral's Club passes nor does the card show an Aadvantage logo when I pull up the card in my Citi account. I called Citi this morning and got a useless response about how the card is new so they have no information. I have travel in two days so hoping I get credit toward the streak LP bonus since that's one of the draws for me.

I am grateful for your account, no pun intended, of the application process. Using your referral link, I applied and received instant acceptance despite being rejected for the Strata Elite when it first hit the market. As I also carry the Executive card, the club passes would serve little purpose to me but the sign-up bonus is a definite winner. By the by, the club passes arrived in my email a moment or two before the acceptance message.

Do you mind sharing your stats on new inquiries and me credit accounts (x/6, x/12, x24) as I an on the fence on whether I'd be approved or not. Like you, I recently got the Citi Strata Elite and Alaska Summit cards but would like to apply for this card, as well. Thanks as always for a fantastic blog!

Thank you so much for your post. I've just applied and got approved (very surprisingly). By learning from your post, I realized I might have a chance to get approved (and so I did!). I was without high expectation for the approval because I'm right at 5/24 + 1 recent denial and have just been approved for a Venture X, Aeroplan and an IHG Platinum Elite within the last 2 months (trying to rack up...

Thank you so much for your post. I've just applied and got approved (very surprisingly). By learning from your post, I realized I might have a chance to get approved (and so I did!). I was without high expectation for the approval because I'm right at 5/24 + 1 recent denial and have just been approved for a Venture X, Aeroplan and an IHG Platinum Elite within the last 2 months (trying to rack up as many points as possible for a three-month travel around Asia in December to February). So, again, thanks so much!

This card is a moneymaker for a lot of people. If you take even one domestic flight a year as a couple:

Figure $300 for the Companion ticket.

$100 for the hotel stays

These two alone put you ahead.

Add in bags at $70 per person so that can be up to $140.

Lounge visits save you spending money on airport food and drink.

In flight credit again saves on food and drinks.

And...

This card is a moneymaker for a lot of people. If you take even one domestic flight a year as a couple:

Figure $300 for the Companion ticket.

$100 for the hotel stays

These two alone put you ahead.

Add in bags at $70 per person so that can be up to $140.

Lounge visits save you spending money on airport food and drink.

In flight credit again saves on food and drinks.

And of course you can really ramp up the baggage savings per year with more travel.

This card isn’t right for everyone but it makes a lot of a lot of sense.

Looking forward to the meetup later this year where you redeem all 8 of your otherwise worthless Elite/Globe AAdmirals Club passes and buy $100 of… uh… drinks on board? More festive than $100 of WiFi.

With thanks to citi for the calendar year passes and credits, I assume that will be replicated for the 2/14 v-day MIA-BIM inaugural? Think you can get a FA to sell you something on that short flight?? I guess...

Looking forward to the meetup later this year where you redeem all 8 of your otherwise worthless Elite/Globe AAdmirals Club passes and buy $100 of… uh… drinks on board? More festive than $100 of WiFi.

With thanks to citi for the calendar year passes and credits, I assume that will be replicated for the 2/14 v-day MIA-BIM inaugural? Think you can get a FA to sell you something on that short flight?? I guess you could theoretically still buy the then to theoretically be free WiFi? :-)

I wonder if it had to be a separate call because I thought I read somewhere that Citi doesn’t move credit lines around when considering approvals…

The card seems fine. I wish it had 8 - 10 passes. Not sure how they came up with 4.

Are you over 5/24 now?

@ Slappy -- I have to check, but I believe that I'm exactly at 5/24 now...

Even with a $350 annual fee, it's still domestic-only for the free checked bag. As someone who flies to Mexico a lot, that really limits this card's utility for me.

It’s not a ‘keeper’… it’s a net $550 value proposition for the SUB minus AF, 1 year, hardpull, 5/24 slot. ‘What do you have to lose!’

I would have liked to apply for this card, but I was recently denied the Strata Elite due to “opening too many cards” this year (I guess 4 is too many). Figure I’ll keep the Globe on the backburner while waiting on the new Bilt offerings (have the Exec so there’s no rush for AC access).

Also - I am wondering what Citi's strategy is with offering this card now. Most think it will be the Barclay Silver replacement when Citi takes over. I suspect Citi would be paying Barclay for each account that converts over from Barclay to Citi. By offering the card now, many (with Barclay) may just take it now and get the 90K bonus - then not bother to convert the old Barclay card - hence Citi doesn't have to pay Barclay if you decline the conversion?????

Oh that dreaded ‘thanks for applying, deadbeat.’ (Glad it worked out in the end.)

Did you pay the $350 AF up front? Or is first year waived?

@ Randy -- The first year's fee isn't waived. But I haven't paid it yet, since I haven't received the card yet...

I’d think only a ‘secured’ card has an upfront fee. You know, one of those products that Capital One will still ‘approve’ us for, even when we’re LOL/24, and, no SUB. No thanks!