Link: Learn more about the Atmos™ Rewards Summit Visa Infinite® Credit Card

The $395 annual fee Atmos™ Rewards Summit Visa Infinite® Credit Card (review) is the brand new premium credit card of Atmos Rewards, which is the name of the combined loyalty program of Alaska Airlines and Hawaiian Airlines.

I’d argue that this is one of the best airline credit cards we’ve seen in a long time, and there are many reasons to pick up this card, from the ability to earn 3x points on foreign purchases, to the Global Companion Awards offered by the card.

Perhaps the most obvious reason to get the card is that it’s offering a solid limited-time welcome bonus where you can earn 80,000 bonus points and a 25,000-point Global Companion Award with this offer after spending $4,000 or more on purchases within the first 90 days of opening your account. Like many people, I decided to apply for this new product, and want to report back with my experience. (NOTE: I applied for the card when a 100,000-point bonus was offered.)

In this post:

Basic Atmos Rewards Summit Card application restrictions

The Atmos Rewards Summit Card is issued by Bank of America. The good news is that eligibility for this card is unrelated to having any other card from Bank of America, Atmos Rewards, Alaska, or Hawaiian. So it appears that you’d be eligible for this card (including the welcome bonus) if you have any other card in the portfolio.

For example, if you look at the terms of the application, you’ll see the following:

New Account Bonus Point and Global 25K Companion Award Offer. This one-time promotion is limited to customers opening a new account in response to this offer and will not apply to requests to convert existing accounts.

That’s great, because it means that nearly everyone should be eligible for the card and the bonus, since it was just launched.

Beyond that, what general restrictions does Bank of America have when it comes to approving people for cards? Here are a couple of common Bank of America restrictions that are often discussed, though let me emphasize that enforcement seems really inconsistent:

- There’s a 2/3/4 rule, meaning you can open at most two Bank of America cards every two months, at most three Bank of America cards every 12 months, and at most four Bank of America cards every 24 months

- There’s a 3/12 rule, meaning you may not be approved for a card if you’ve opened three or more new cards with any card issuer in the past 12 months

Both of these rules are specific to personal cards, and not business cards. Beyond that, neither of those rules seem to be totally consistently enforced, and in particular, that latter policy doesn’t seem consistent at all. For example, I’ve opened more than three new cards in the past 12 months, and I still applied.

Bank of America can sometimes be quirky in terms of approvals. I find that with Bank of America, I often get instant approvals with massive credit lines, and then every once in a while, I get random, inexplicable denials. So make of that what you will.

Atmos Rewards Summit Card application & approval experience

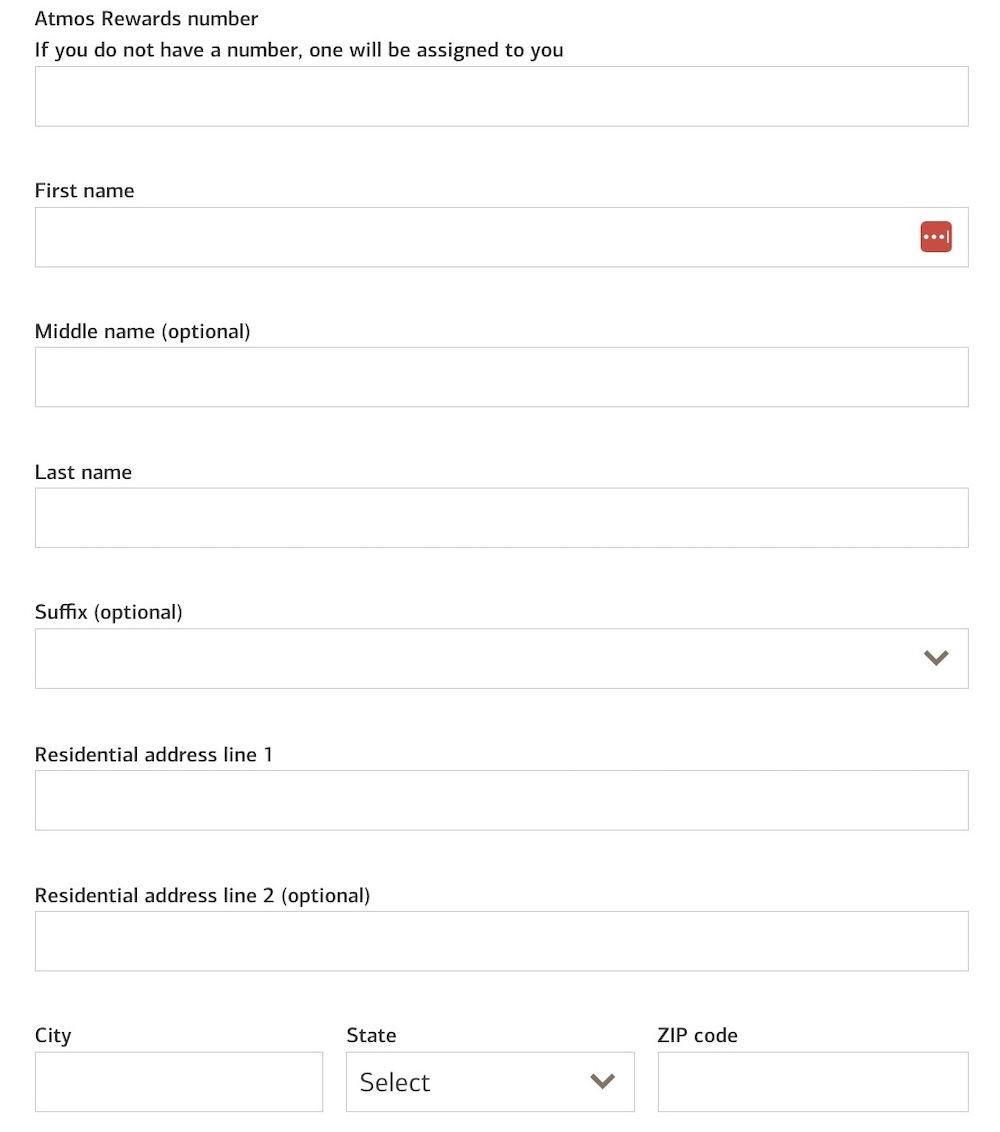

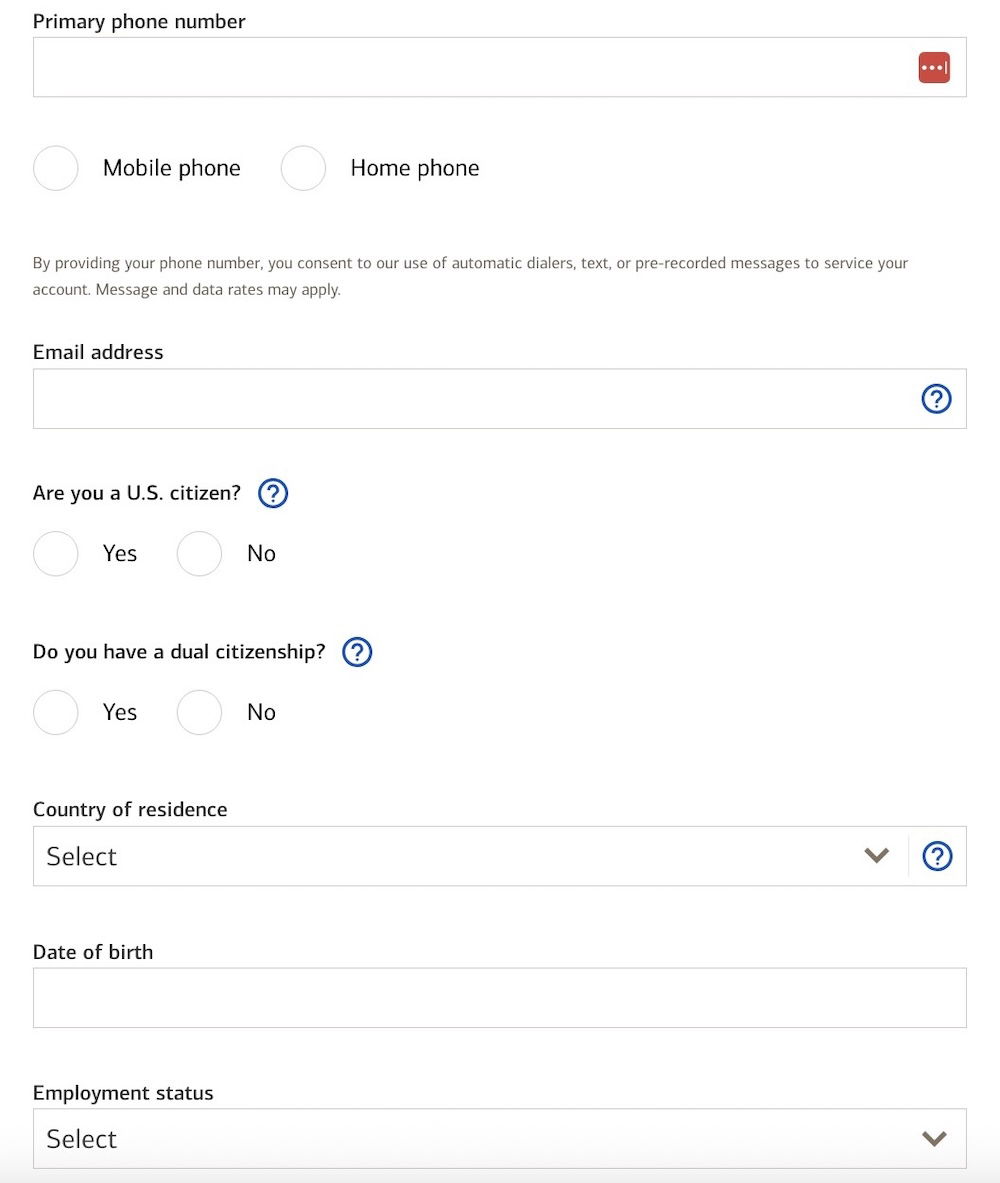

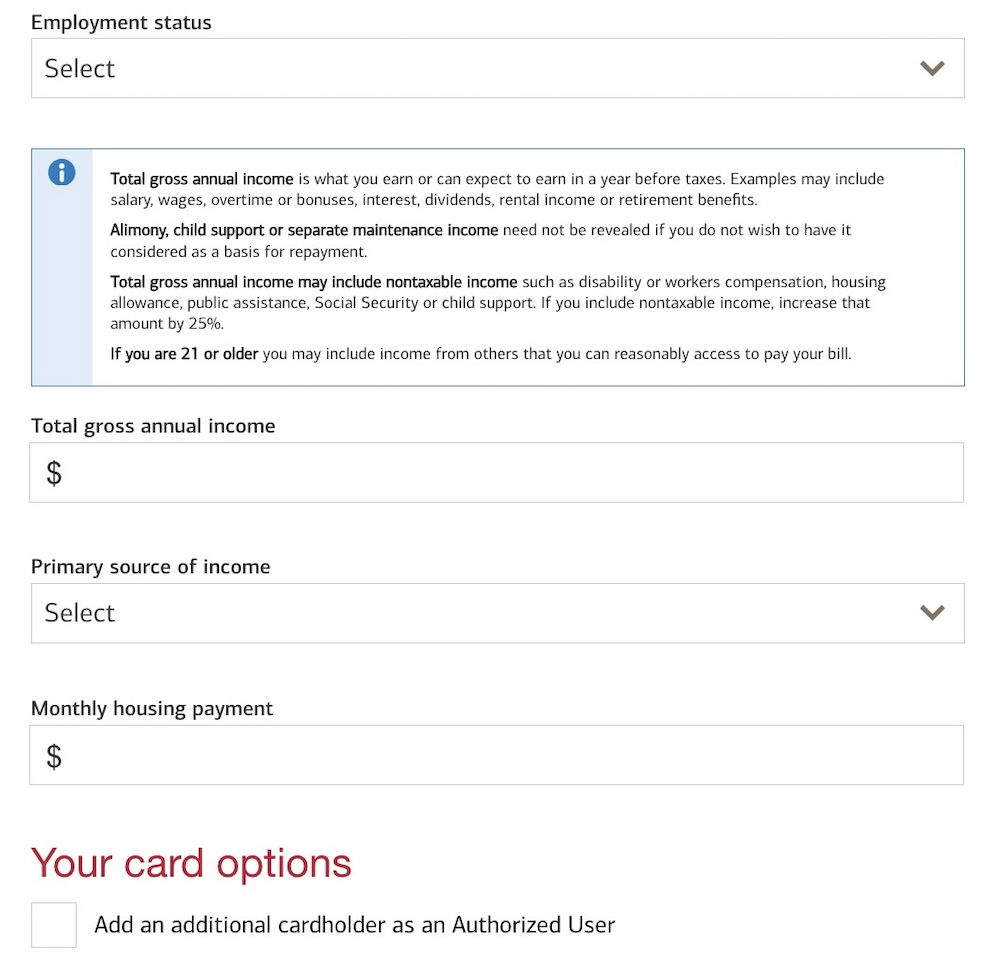

What’s the application process like when applying for the Atmos Rewards Summit Card? The online application process is really straightforward, and consists of just one page.

It just asks for personal details — name, date of birth, social security number, address, phone number, income, etc. You’ll also be asked for your Atmos Rewards number, so you’ll want to include that, so that your points are credited to the right account.

The process is even simpler if you already have a Bank of America account, as you’ll be asked to log-in with your account, and then you only have to provide updated income information.

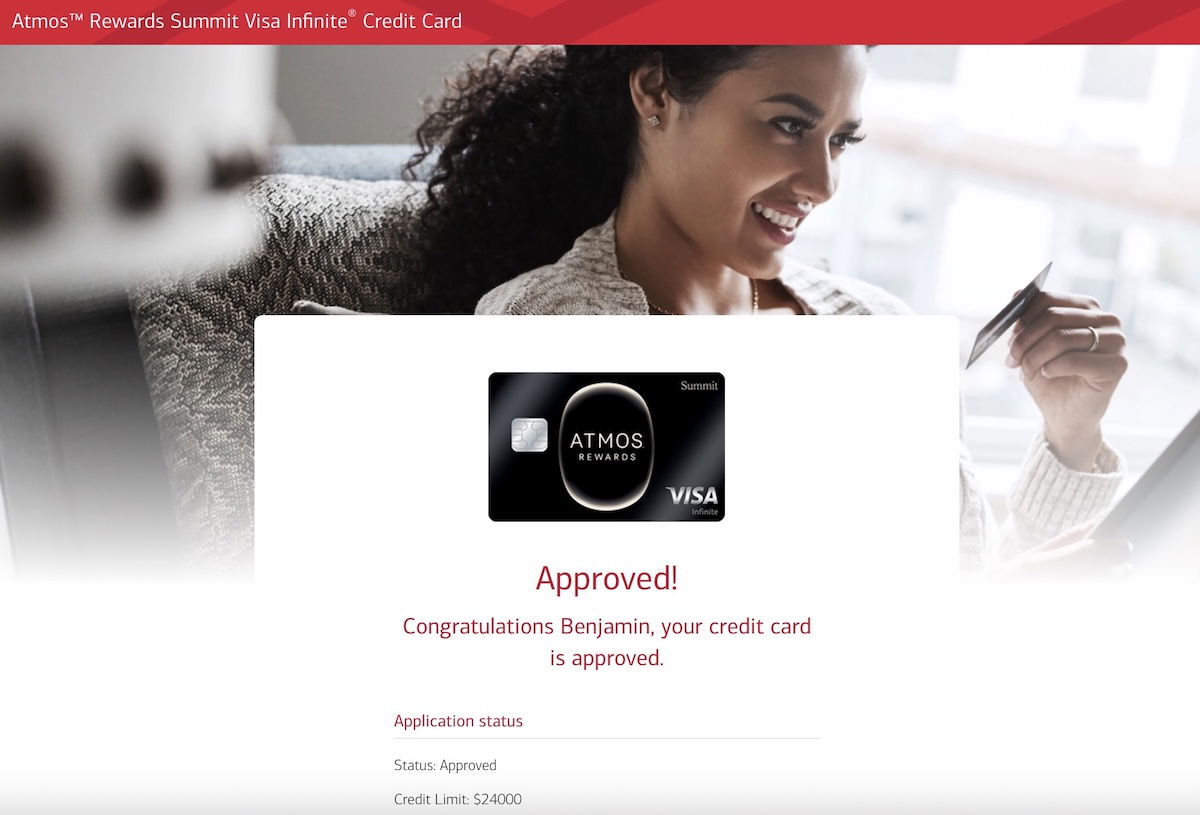

I submitted my application last night, and was instantly approved, with a pretty big credit line, no less!

My long term Atmos Rewards Summit Card strategy

Now that I have the Atmos Rewards Summit Card, what’s my strategy? I think the first thing to acknowledge is that the welcome bonus on this card is significant — I value Atmos Rewards points at 1.5 cents each, so the current 80,000 points plus a 25,000-point Global Companion Award are worth around $1,575 to me. There’s no reason not to give this card a try, and see how it works out.

What about beyond that, though? At a minimum, I suspect that this is a card that I’ll keep, even if I don’t spend much on it. The annual 25,000-point Global Companion Award plus waived partner award booking fees will more than justify the annual fee for me, given how many awards I book through the Atmos Rewards program (you also get great travel protection with this card, which is useful).

Beyond that, though, I’m really tempted to sort of go all-in on the Atmos Rewards program, and be loyal to that instead of American AAdvantage. I’m still on the fence, but my general thought is that:

- Spending $60,000 on the card every anniversary year would earn me a 100,000-point Global Companion Award, which is quite a great reward

- The card offers 3x points on all foreign purchases, so this is a card that I could see myself consistently using aborad

- Since the card offers one status point per $2 spent, elite status can also be earned pretty quickly at that point, and this might be the most compelling way to go for oneworld elite status

Bottom line

The Atmos Rewards Summit Card is Bank of America’s premium credit card in the Alaska & Hawaiian Atmos Rewards ecosystem. It’s an incredibly compelling card — it’s worth signing up for given the huge welcome bonus, it’s worth keeping for the ongoing perks, and for many people, it’ll be worth spending money on.

Bank of America can be quirky with approving people for cards, but the good news is that many people should be eligible for this product, given that it’s brand new, and eligibility is unrelated to having other Atmos Rewards, Alaska, or Hawaiian cards. I recently applied for the card, and was instantly approved. I’m looking forward to giving this card a spin, and figuring out what my long term strategy will be.

If you’ve applied for the Atmos Rewards Summit Card, what was your experience like?

I've had my Summit reward card since the 1st of October. The application process is more involved than simply filling out an online form (at least it was for myself). You also pay a $395.00 fee to earn rewards with purchases however not all purchase are honored. If the purchase is large BofA will decline this as fraud regardless if you are actually on the phone with a BofA rep @ the time of the...

I've had my Summit reward card since the 1st of October. The application process is more involved than simply filling out an online form (at least it was for myself). You also pay a $395.00 fee to earn rewards with purchases however not all purchase are honored. If the purchase is large BofA will decline this as fraud regardless if you are actually on the phone with a BofA rep @ the time of the charge (they cannot make it work either) so this truly is not as advertised. Alaska rolled this out without a good working corporate relationship with BofA which is a huge fail on there part!. I'd wait to get the card, it's currently not worth the money!!

Like another comment, BofA sucks. The worst application process in my life. After a month of sending in additional info via snail mail to Bank of America I finally get a denial letter, "unable to verify indentification". I am beyond confused how archaic their system and underwriting is. I applied the card via a banker at their branch, after opening a checking and brokerage account for the relationship bonus. I have also had trouble adding...

Like another comment, BofA sucks. The worst application process in my life. After a month of sending in additional info via snail mail to Bank of America I finally get a denial letter, "unable to verify indentification". I am beyond confused how archaic their system and underwriting is. I applied the card via a banker at their branch, after opening a checking and brokerage account for the relationship bonus. I have also had trouble adding an external bank to transfer money. Needless to say I will be pulling my money out of the checking and canceling all my accounts with them

Is there any way around having to send in the SSA form? I have never been asked to do anything like that and am uncomfortable with that information floating around.

I have applied for the Atmos Summit card and my experience has been AWFUL. I applied almost 30 days ago. I am a long time Alaska Air Credit Card Holder and always pay my bills on time and have a credit score over 100. Inexplicably they requested that I send more information (this came in a letter and I was travelling so I didn't receive it for about 12 days). I was told on the...

I have applied for the Atmos Summit card and my experience has been AWFUL. I applied almost 30 days ago. I am a long time Alaska Air Credit Card Holder and always pay my bills on time and have a credit score over 100. Inexplicably they requested that I send more information (this came in a letter and I was travelling so I didn't receive it for about 12 days). I was told on the phone when I applied that it was approved so I expected the card to be in the mail when I returned from my trip - I did not expect this letter. The letter requested that I send a SS form, recent pay and now, similar to Gary, a signed tax return. They only provide a PO Box so the only way to send all of this highly sensitive information is overnight from the post office. I sent all but the tax return overnight and after a week of hearing nothing I called today. I spent over an hour on the phone with a kind associate who was not allowed to connect me to the credit department. He spoke to 3 different credit reps and received 3 different answers. None of them would acknowledge that they could see the documents I sent or a copy of the letter they sent me and no one knew their address for sending additional documentation. This Ludicrous. If I didn't love Alaska Airlines so much I would cancel all my cards.

Bank of America is demanding a signed tax return from me for my Summit application and a signed social security form despite having verified my 850 credit score with Transunion and having access to my credit history, and already having my social security number. I have had a B of A card for 18 years, and pay it off each month with no issues.

I find this ridiculous and don’t know if Alaska Airlines...

Bank of America is demanding a signed tax return from me for my Summit application and a signed social security form despite having verified my 850 credit score with Transunion and having access to my credit history, and already having my social security number. I have had a B of A card for 18 years, and pay it off each month with no issues.

I find this ridiculous and don’t know if Alaska Airlines is aware of this. B of A will not provide a Summit card to me without that tax return (I am self-employed and have no pay stubs) and say they are requiring this for all applications in order to reduce fraud. Is this true?

I have never heard of this before with any card previous application, including for an AmEx Platinum.

Is anybody else encountering this bizarre obstacle?

Gary,

I applied for the Summit card, sent all the documents in (thru USPS) and my Summit card gets declined when charging large purchases for fraud everytime.......so the documentation cannot be to help reduce fraud charges!! Alaska needs to work on there corporate relationship with BofA before this card will be any good....Good luck.

For the 10% Rewards bonus - what is an eligible BofA account? I have an Alaska Business Card. Do I need to open a checking acount? With a minimum balance?

Why would BofA require validation from SSA as well as a copy of my tax return for approval? I’ve never had anything but instant approval for any other credit card.

This reeks of age discrimination now that I’m retired.

They asked for the same for me. I also have never been asked for this before. They told me on the phone they were going to send me a letter with a request for more information. They wouldn't tell me over the phone what they would ask for. I had to wait for the US Mail letter and send it back by US Mail.

Talk about quirky. I didn’t get immediate approval and the next business day I got a text asking me to call them. I spoke to an agent and verified a lot of information over the phone and they pulled a credit report. (Over 800 credit score, no late payments). Instead of approval, I was told I would be getting a letter asking for more information and to send in documents for income verification and other...

Talk about quirky. I didn’t get immediate approval and the next business day I got a text asking me to call them. I spoke to an agent and verified a lot of information over the phone and they pulled a credit report. (Over 800 credit score, no late payments). Instead of approval, I was told I would be getting a letter asking for more information and to send in documents for income verification and other items. I have never heard of such a thing, and while I probably don’t have as many cards as Ben, I do have quite a few, including the B of A Alaska visa. Go figure.

I applied and was instantly denied. I don't have a BofA checking account or any other card with them. But my letter was not an outright denial. I have to send them an SSN verification form and my tax return (or income stub, which doesn't work).

I've never had this happen. They reported my FICO as 796.

Anyone else have this?

Same happened to me and I have a B of A Alaska visa.

I have the existing BA AS card, had signed up for the early access on the new card and used the email (for the 5K bonus) to apply for the new Summit card, was instantly approved. Have 50K limit on the previous card and got 25K for the new summit card, will probably cancel the previous one before its next renewal.

Am I able to still get the SUB if I already have an alaska card but sign up for the Atmos Ascend card since its is sort of now a similar product?

@ Daniel — Yes, if you have one of the previous cards, you are eligible for the welcome offer on this card.

Hello,

Sorry if I missed this.. I signed up for and got the Alaska Credit card sign up bonus back in March/2025.. could I sign up for one of the new Atmos Credit Cards and still get that sign up bonus also without having to wait 24 months?

Thank You

@ Gordon -- Yep, this is considered a separate product, so you're absolutely eligible to sign-up for this card as well, and receive the bonus.

@Ben ---> Like you, I applied for and was instantly approved for the Atmos Summit card (which is a Visa Infinite card, BTW) with a fairly high credit line. I've had my BofA Alaska co-branded Visa Signature card for quite some time, which also has a high limit.

In so far as pursuing status via AAdvantage or Alaska Atmos/Mileage Plan, I have had no problem earning and maintaining Atmos [MVP] Gold/oneworld Sapphire -- and I...

@Ben ---> Like you, I applied for and was instantly approved for the Atmos Summit card (which is a Visa Infinite card, BTW) with a fairly high credit line. I've had my BofA Alaska co-branded Visa Signature card for quite some time, which also has a high limit.

In so far as pursuing status via AAdvantage or Alaska Atmos/Mileage Plan, I have had no problem earning and maintaining Atmos [MVP] Gold/oneworld Sapphire -- and I cannot imagine that someone who flies as often as you do wouldn't *easily* get to Atmos Titanium/oneworld Emerald. (After all, this year I'll be Atmos Platinum/MVP Gold 75k/oneworld Emerald for the first time.) And since you can *either* get 1 point per mile or 5 points per $1, I'd think it would be a piece of cake for you.

I'll keep my $95AF Atmos Ascent (presuming my current Alaska Visa gets converted), as well as the Atmos Summit card, AND the Citi AAdvantage Executive card. The latter's $595 annual fee is less expensive than an AA Admirals Club membership and an Alaska Lounge+ membership, so with the amount I fly, I find it's definitely worth it.

Ben- Do you know what credit bureaus they use to run the credit report?

Want to write out my experience, in case anyone (especially existing BofA card holders) reads this article and is denied.

I applied yesterday, was initially denied. Called BofA for reconsideration. They reviewed the reasons for denial, and asked me if I would be willing to split the credit from my only other card with them - which I was happy to do. They said that would give them a reason to reconsider the application....

Want to write out my experience, in case anyone (especially existing BofA card holders) reads this article and is denied.

I applied yesterday, was initially denied. Called BofA for reconsideration. They reviewed the reasons for denial, and asked me if I would be willing to split the credit from my only other card with them - which I was happy to do. They said that would give them a reason to reconsider the application. Today I received a phone call from the rep that a manager had approved the card.

If ever denied and calling reconsideration, it seems like a decent idea would be to volunteer that action yourself. See if they would reconsider if using existing credit limits from other cards. Worked on my account today.

Ben, forgive me for not paying more attention to your credit card articles, however, I am intrigued …. just how many credit cards do you hold?

How many pairs of sneakers does Michael Jordan own?

…. and your point is exactly?

https://onemileatatime.com/guides/current-credit-cards/

Ben lists his current credit cards in this article

RealTaylor, thank you for posting the link …. it is such a shame that Ben couldn’t be bothered to do so himself.

@Ben

I know you said you're just posting stuff as it comes up. And we're not suspicious of any sponsorship milestones at all ;)

But can you try to do Atmos 2-3 posts per day regarding Atmos.

Please remember the generic disclosure isn't sufficient to show this content to citizen of the European Union. You must disclose the exact relationship you have with this advertiser - who paid for 6+ articles on your front page.

We're talking SERIOUSLY hefty fines, Ben.

He doesn't have one, other than the generic referral link.

Congratulations on the new card. Alaska will maybe kick start future posts on Mileage Runs. Luck has it MIA - ANC is the most popular one currently.

Last year when this card was announced, I recommended to many friends and family to register and pickup an easy 500 miles, which posted to their accounts within a few weeks of one another.

Yesterday some in the group received the email announcing the new program with a link to apply for this new Card and receive the promised 5k bonus, while others didn't have the application link included in the email announcing the...

Last year when this card was announced, I recommended to many friends and family to register and pickup an easy 500 miles, which posted to their accounts within a few weeks of one another.

Yesterday some in the group received the email announcing the new program with a link to apply for this new Card and receive the promised 5k bonus, while others didn't have the application link included in the email announcing the new program!

Question - wondering how many of you didn't receive the 5k bonus application link in your Atmos Intro email yesterday?

I am one of those people :( it seems there might be many

I am a current Alaska Airlines Visa card holder and received an email announcing the new Atmos program yesterday. Naturally, I applied and was immediately approved for the Atmos Summit card. Well, when I checked, I note that Bank of America took the $30,000 limit on my current Alaska Visa/Atmos Ascent account and split the credit limits such that my Atmos Ascent now has a $6700 limit while my new Atmos Summit account has a...

I am a current Alaska Airlines Visa card holder and received an email announcing the new Atmos program yesterday. Naturally, I applied and was immediately approved for the Atmos Summit card. Well, when I checked, I note that Bank of America took the $30,000 limit on my current Alaska Visa/Atmos Ascent account and split the credit limits such that my Atmos Ascent now has a $6700 limit while my new Atmos Summit account has a $23300 limit. I'm sure some BoA "special algorithm" was used, but the OCD in me in just can't stand looking at those figures! I'm just going to cancel the Ascent and have them move the credit limit to the Summit once I receive the card.

Isn’t it easier to get one world emerald on American if you are looking at pure cc spend ?

Between the loyalty points boosts from the aa executive card , the Barclays silver (for now), the advantage hotels and aa shopping portal the spend is less on AA than on this card

@ John -- Yes, if you look at this exclusively through credit card spending, then that's true. But that overlooks two factors. First of all, with Atmos Rewards, award flights count toward elite status, and if you're racking up a lot of points, that should be worth something. Second of all, I'd argue there's a lower opportunity cost to spending on this card, given the great rewards structure, the ability to earn a 100,000-point Global Companion Award, etc.

Thanks for your response. to play devils advocate, you can also get AA loyalty points by booking AA flights on alaska. Is there an advantage to using my Alaska ff number instead?

@John, I put my AS ff number (now Atmos Rewars number) on *everything.* This includes every oneworld and/or partner airline flight possible, including award flights. The reasons are simple:

1) Accumulating points on a single FF acct. is a faster way to achieve status than putting them on multiple accounts. Now, admittedly, I fly AS more than I do AA (or BA, IB, JL, or other one world carrier), but if I (e.g.) purchase...

@John, I put my AS ff number (now Atmos Rewars number) on *everything.* This includes every oneworld and/or partner airline flight possible, including award flights. The reasons are simple:

1) Accumulating points on a single FF acct. is a faster way to achieve status than putting them on multiple accounts. Now, admittedly, I fly AS more than I do AA (or BA, IB, JL, or other one world carrier), but if I (e.g.) purchase my ticket on AA by logging into my AAdvantage account, American does not recognize that I have any status at all. So either I book my flight this way, then call American and have them switch the FF number to my AS account and -- boom! -- I'm oneworld Sapphire. This is also true if/when I book an award ticket. (And as Ben previously stated, AS will credit the miles flown even on award tickets...flown on AS.)

2) AS OF NOW, and this is of course subject to change, the thresholds on American are: 40k = AA Gold (oneworld Ruby), 75k = AA Platinum (Sapphire), 125k =AA Platinum Pro (Emerald), and 200k = Executive Platinum (Emerald). But on Alaska, it's 20k = Atmos Silver (Ruby), 40k = Atmos Gold (Sapphire), 75k = Atmos Platinum (Emerald), and 100k = Atmos Titanium (Emerald). Just sayin'...

Would be great to hear your thoughts on this hard for someone who likely won’t use the companion pass, won’t go for status, and puts most spend already on transferrable points card.

I have a good balance of Alaskan…err Atmos points right now but have really started getting a lot of value over last year or so on expensive paid AA flights (where as I used to save them for long haul partner business...

Would be great to hear your thoughts on this hard for someone who likely won’t use the companion pass, won’t go for status, and puts most spend already on transferrable points card.

I have a good balance of Alaskan…err Atmos points right now but have really started getting a lot of value over last year or so on expensive paid AA flights (where as I used to save them for long haul partner business flights).

Is this a churn and burn for the sign up bonus card for someone like me? Better to move some my 3x dining away from Chase to this in long run? Only thing I’m worried about is potential devalue of points coming where they’re all locked up in Atmos and can’t optimize with another transfer partner then..

@ Alec -- It's a great question, and soon I'll have another post on my general thoughts on getting more into the Atmos Rewards ecosystem (I apologize for the amount of content here, but my mind is racing about all the possibilities, and I tend to write about what interests me at a particular point).

If you're not going for status and don't value the companion award certificate, then the value of the card is...

@ Alec -- It's a great question, and soon I'll have another post on my general thoughts on getting more into the Atmos Rewards ecosystem (I apologize for the amount of content here, but my mind is racing about all the possibilities, and I tend to write about what interests me at a particular point).

If you're not going for status and don't value the companion award certificate, then the value of the card is definitely less than it would otherwise be.

Either way, the card seems worth picking up given the great incentive for doing so. I guess my main question is how much you've been using Atmos Rewards points for American flights, and also how much you spend abroad? I'm in the same camp in using a lot of these points for American flights, and it definitely makes me want to keep earning them.

Hi, if I currently have the Alaska Airline Visa card (new name that was just changed to Atmos Reward Ascent Visa Signature), if I apply for this new one, do you think they would still offer the massive sign up benefits?

Thanks in advance

@ Chris Tran -- Yep, you should be eligible for the card, including the welcome bonus!

I got an instant denial. I was not expecting that. But I did just open a Strata Elite and applied for a couple of other cards in the past weeks, however, none with BofA. I do have a ton of cards (though I imagine Ben has more), but all my other financials are in good shape (credit score, income, etc). Oh well…

@ MFK -- Sorry to hear about that. Bank of America can be a bit quirky with that at times...

Do you have a banking relationship with them? If not you should open up a checking and do some banking. I read somewhere that will help you get approved as the 3/12 rule gets relaxed to 7/12 or something like that.

It's worth calling reconsideration, or just waiting to see what comes in the mail. When I called in they said it wasn't actually a denial, even though my notice specifically said "Although we declined your application...". I was told they needed more information and the request would come in the mail, which I would need to fill out, sign, and return to BofA to complete the application. Others have noted this usually means they want...

It's worth calling reconsideration, or just waiting to see what comes in the mail. When I called in they said it wasn't actually a denial, even though my notice specifically said "Although we declined your application...". I was told they needed more information and the request would come in the mail, which I would need to fill out, sign, and return to BofA to complete the application. Others have noted this usually means they want income verification (paystub, tax return, or other verification).

Same here. They said I don’t have any history with them even I have stellar credit, etc. After denial, I realize maybe it’s good thing for me since I live on rural part in east coast and don’t fly with AS unless it’s part of international J award flights.

Oh well, I’ll just focus on AMEX, Citi and Chase ecosystem.

Bank of America sucks...approval and denials seem random regardless of banking relationship, credit scores and income...They appear to be using some poorly functioning AI and you still end up with a credit report pull

they seem to be using an awful data analytics company from socal whom apparently cant do their jobs

Hey Ben,

Congrats on the approval! Did you get the 10k status points on signup? I'm not sure how to interpret the terms saying you'll receive it every anniversary, whether obe receives it in the 1st year.

@ TT -- The 10,000 status points are only offered on the account anniversary, so you wouldn't receive them with card opening, unfortunately.

Instant approval, thanks Lucky!

@ Izz -- Nice, congrats!

I worry about Alaska devaluing the program given how "generous" this card is. In particular, increasing partner redemption fees to drive take up of the card, and increasing redemption costs to factor the companion aspect (as BA have done). This card is only generous when paired with the current program and I see that changing in the relatively near future.

@ Chris D -- Obviously I can't say anything with certainty, but here's my take. The folks at Alaska (and in particular, at loyalty at the airline) are really, really bright. They understand the power of loyalty, and it's not like some other airlines, where they view their loyalty program as an opportunity to take advantage of customers.

The card's perks are really generous, but I don't see anything in particular that's unsustainable from Alaska's...

@ Chris D -- Obviously I can't say anything with certainty, but here's my take. The folks at Alaska (and in particular, at loyalty at the airline) are really, really bright. They understand the power of loyalty, and it's not like some other airlines, where they view their loyalty program as an opportunity to take advantage of customers.

The card's perks are really generous, but I don't see anything in particular that's unsustainable from Alaska's perspective. For example, partner redemptions aren't actually that costly for airlines (which is also why airlines have increasingly limited award space to members of their own programs -- that's probably the bigger threat to the value of miles).

So maybe I have too much faith in the folks at Alaska, but I think I know what they stand for, and what they're trying to go for. Yes, there might be a devaluation at some point, but I don't think they're trying to pull a fast one here.

Also keep in mind that this new program and card is launching at a time where Alaska is kicking off a global expansion. The airline is using these loyalty changes to make people even more interested in flying with the carrier.

I think they had to agree to not devalue the program as a condition of merger approval so I don't think they will test that anytime soon. They did have an increase in redemption rates not too long ago so some of that already happened. I've been happy with how many upgrades I've gotten as a MVP and their redemption rates have been fantastic. This year they were able to get me home early with...

I think they had to agree to not devalue the program as a condition of merger approval so I don't think they will test that anytime soon. They did have an increase in redemption rates not too long ago so some of that already happened. I've been happy with how many upgrades I've gotten as a MVP and their redemption rates have been fantastic. This year they were able to get me home early with a 15k F redemption DFW-LAX when AA wanted 28k for the same flight and as an AA Platinum Pro I was nowhere near the upgrade. I was shocked because the upgrade list said 0 available in F with a long list and I swooped in and took the last F seat for only 15k miles. I got a 75k JX J seat TPE-LAX fantastic product. I went for AA status this year as well and I think I'm done with it. I don't see the value in pushing for EXP. I renewed MVP for the year so next year with the cap removal I will shoot for titanium.

Alaska only has Bilt as a transfer partner now, which is a pretty niche program compared to Citi, Amex, or Chase. I think AA is at a bigger risk of a devaluation than Alaska is.

I had instant approval and a high credit limit set. Surprised as I don't have a BoA Bank account (but do have one of their cards). I was more so surprised since I was well past Chases 5/25 and have opened a few cards in the last six months churning for SUBs. One of the was the BoA KLM/AF Flying Blue Card.

Will make good use of the Foreign Purchases 3X on some upcoming...

I had instant approval and a high credit limit set. Surprised as I don't have a BoA Bank account (but do have one of their cards). I was more so surprised since I was well past Chases 5/25 and have opened a few cards in the last six months churning for SUBs. One of the was the BoA KLM/AF Flying Blue Card.

Will make good use of the Foreign Purchases 3X on some upcoming travel.

Signed up for the advance notice, so I will take the extra 5K in Atmos using the personalized email you get if you signed up.

Alaska miles (Atmos points now I guess) are great.

Is this card eligible for x3 Atmos points on Bilt renti? Previously, it was with the Alaska signature card. Trying to figure out if only the lower annual fee card would be eligible because m is more like the old signature card or if this premium one is too.

I have the same question!

@ Ted -- Yep! "Atmos™ Rewards Ascent Visa Signature® and Atmos™ Rewards Summit Visa Infinite® cardholders earn 3 points for every $1 spent on eligible rent when they pay through Bilt, up to $50,000 per calendar year. Terms apply."

@Ted I added my card in yesterday and it does! Still a bit quirky in the Bilt app (the card is titled “Alaska Airlines Premium Visa” and shows the old Chester design for the now Ascent card), but it does say 3x Alaska miles per $.

Got instant approval this morning on "Atmos Rewards Summit Visa Infinite". The only thing I did not like in the approval process is that you cannot use your existing BofA account if you already have the old Alaska Credit Card.

Also noticed today that my existing Alaska Credit Card has been rebranded as "Atmost Rewards Ascent Visa Signature".

I would add that they seem to be more generous with those that have a Bank of America deposit account. It may even be worth to open up a checking account prior to applying for this card. I think it would enhance your approval process.

@ James -- That does often seem to be the case with Bank of America. Though as someone who doesn't have an account, I've had luck even without that. Then again, I don't pick up that many Bank of America cards.