Link: Learn more about the Atmos™ Rewards Visa Signature® Business Card

I have a lot of Atmos Rewards points coming my way! Recently, I shared my experience getting approved for the brand new Atmos™ Rewards Summit Visa Infinite® Credit Card (review), which is an incredibly lucrative new card.

I figured I might as well push my luck and try to pick up a second Atmos Rewards card, so I decided to apply for the Atmos™ Rewards Visa Signature® Business Card (review), which is the business card in the Atmos Rewards portfolio, and a rebranding of the former Alaska Airlines Visa Business Card. The card has a minimum of a $95 annual fee ($70 for the company, and then $25 per card).

There are lots of great perks to this card, including a big welcome bonus, so I’d like to share my experience applying for the card, as I didn’t (quite) get an instant approval. I find this to be one of the easier business cards to get approved for, so it’s a product that many people should consider, in my opinion.

In this post:

Basic Atmos Rewards Business Card application restrictions

The Atmos Rewards Business Card is issued by Bank of America. So, what are the eligibility restrictions for this card? A few things to note:

- Eligibility is completely unrelated to whether you have the Atmos™ Rewards Ascent Visa Signature® credit card (review) or Atmos™ Rewards Summit Visa Infinite® Credit Card (review), as you’re potentially eligible for all three cards

- You’re eligible for this card and the bonus even if you have any HawaiianMiles Barclays cards, including the Barclays Hawaiian business card

- Bank of America has very few consistent restrictions when it comes to getting approved for business cards; while the issuer has the 2/3/4 and 3/12 rules, those only apply to personal cards, and not business cards

Are you eligible for the welcome bonus on the Atmos Rewards Business Card if you’ve had the Alaska Airlines Visa Business Card in the past? Anecdotally, the answer is yes — all reports I’ve seen suggest that one can get approved for this card and earn the bonus even if they’ve had it in the past.

If you look at the terms when applying for the card, you’ll see the following:

I also understand that I may be declined for additional credit card accounts if my business entity currently has, or has had, another business card with Bank of America in the preceding 24 month period.

The key word here is “may be declined,” not “will be declined.” Furthermore, keep in mind that with Bank of America, if you get approved for the card, you’re also generally eligible for the welcome bonus. So on the business version of the card, the general belief is that you’re eligible for the card even if you’ve had it in the past. You just typically can’t pick up a second one, if you already have one open.

For what it’s worth, I find Bank of America to be one of the easier issuers when it comes to getting approved for business cards.

Atmos Rewards Business Card application & approval experience

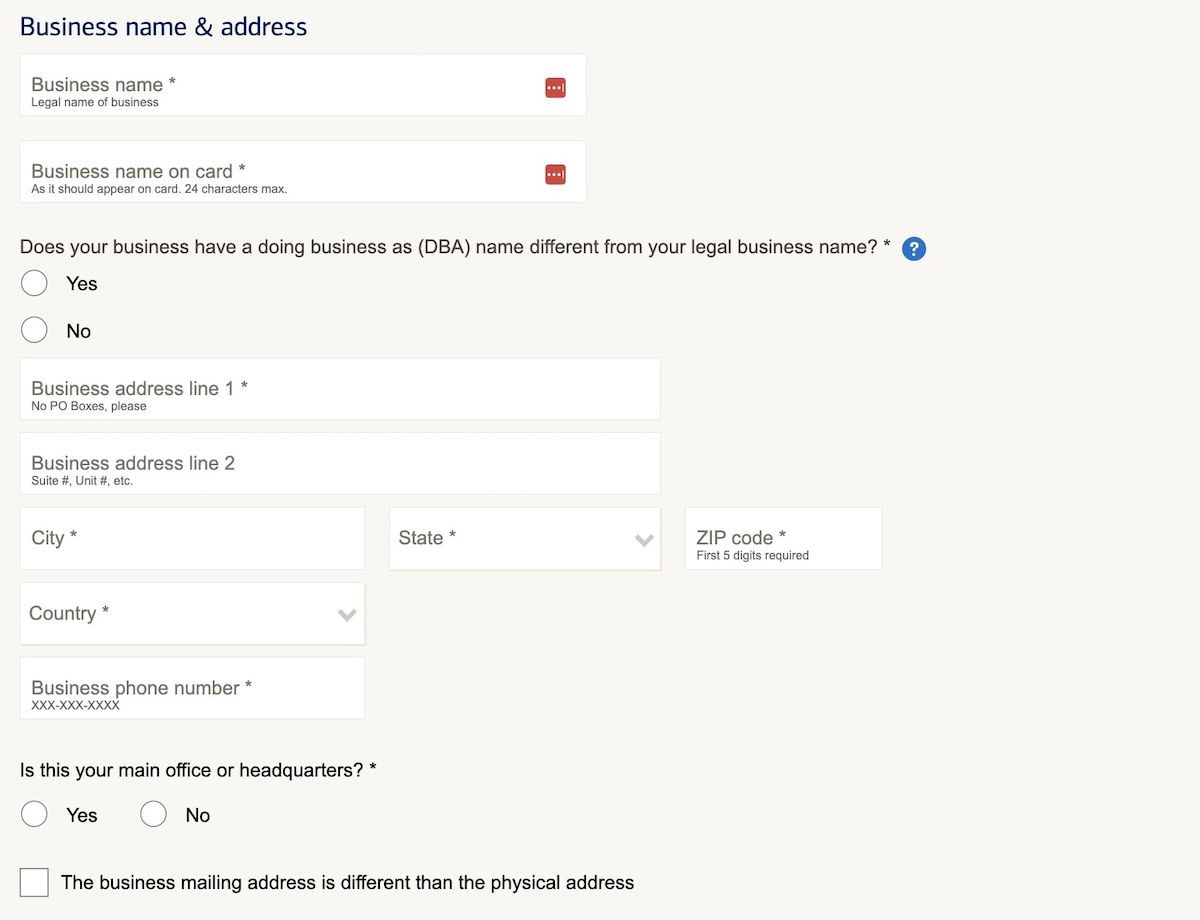

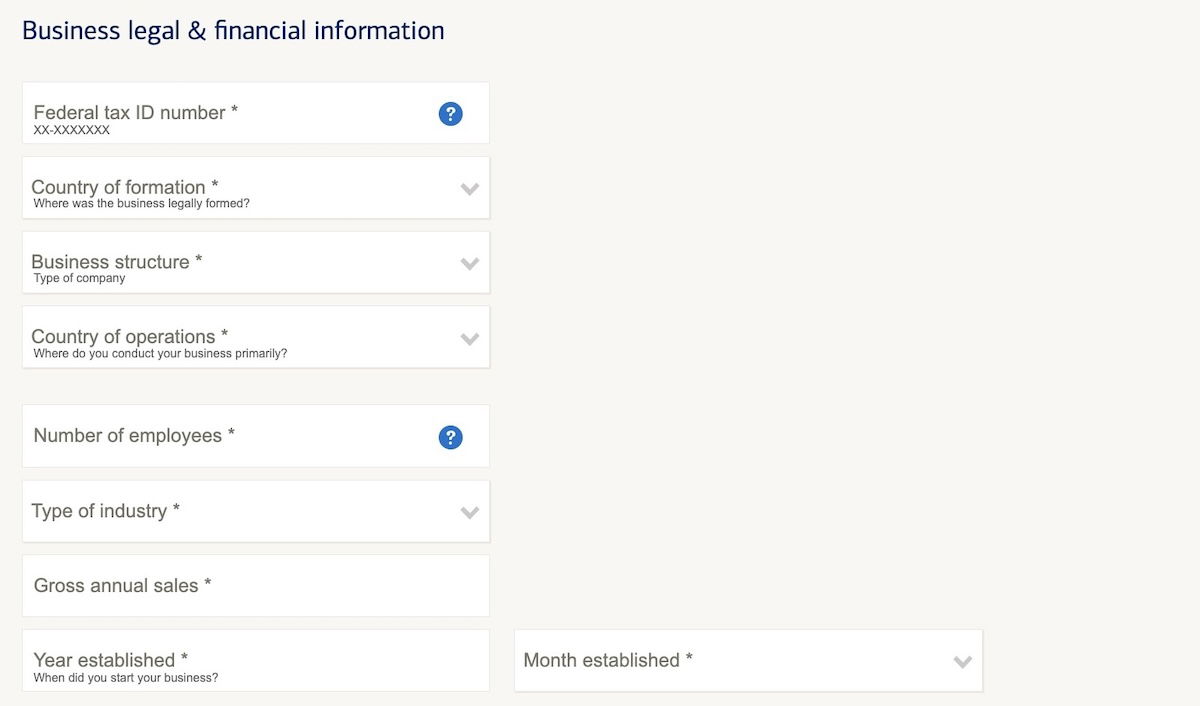

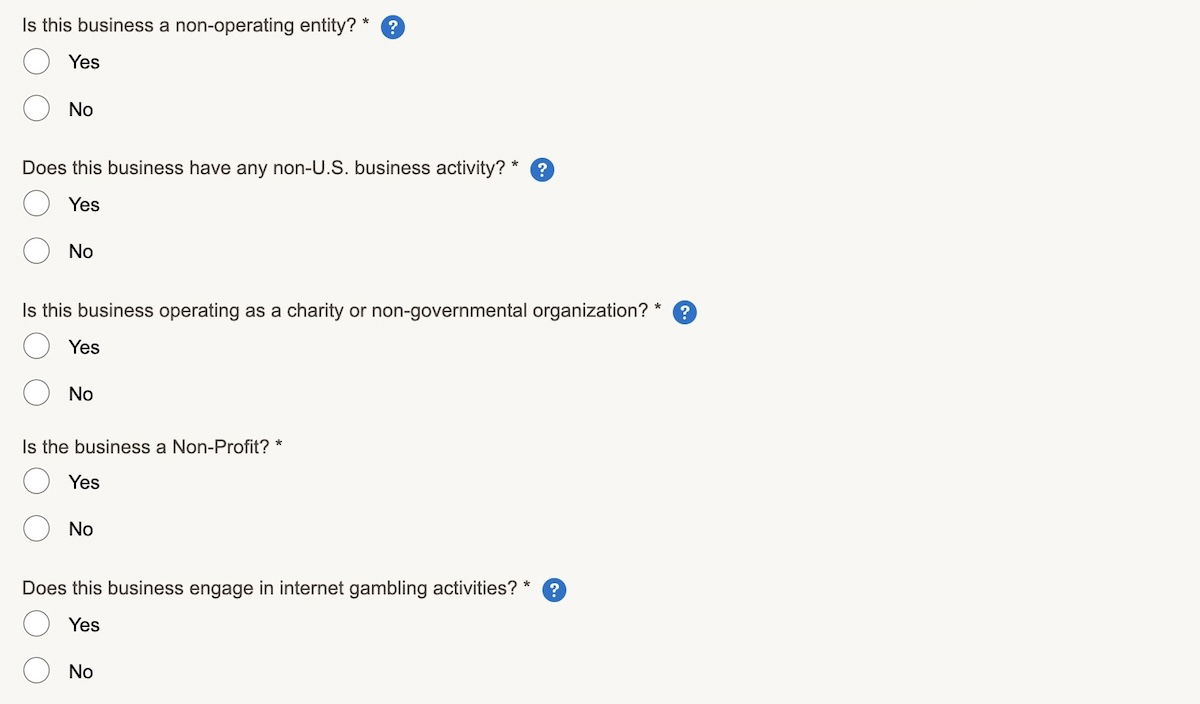

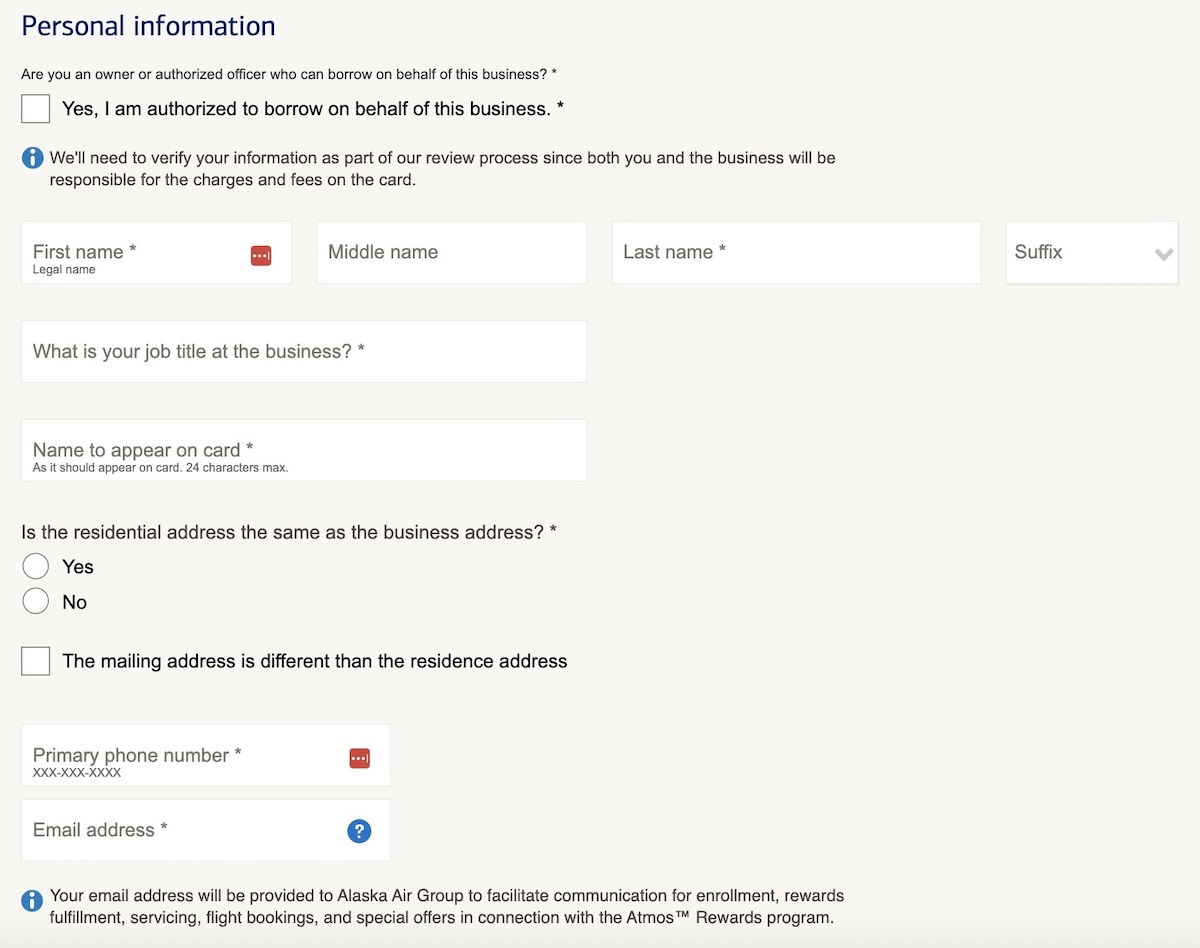

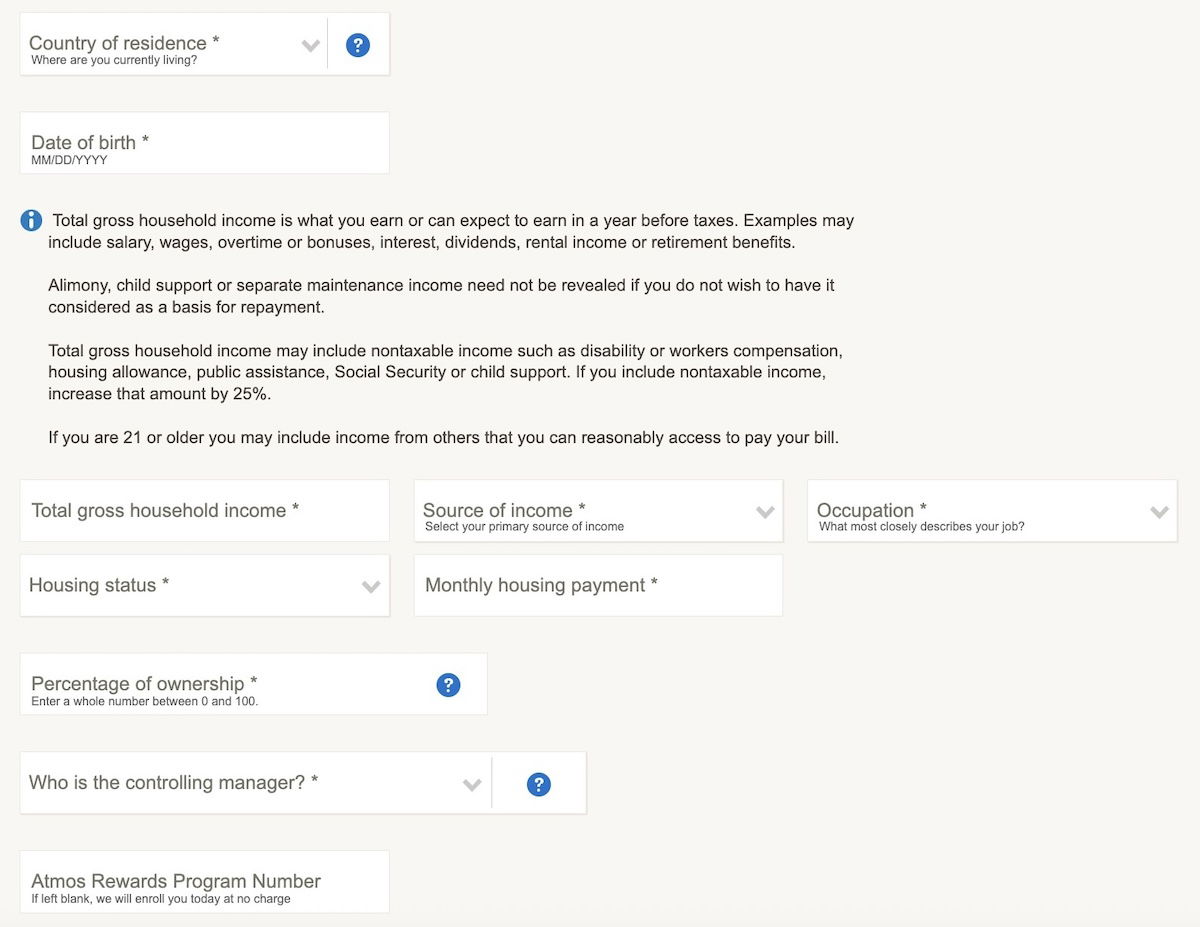

What’s the application process like when applying for the Atmos Rewards Business Card? The application is a single page, though it’s perhaps a bit longer than your typical business card application.

The first section asks for business information, including the business name, address, phone number, federal tax ID, business structure, type of industry, etc. Of course it’s fine to apply as a sole proprietorship, in which case you’d use your social security number as your federal tax ID.

The second section then asks for personal information, including name, phone number, email address, date of birth, income, and more.

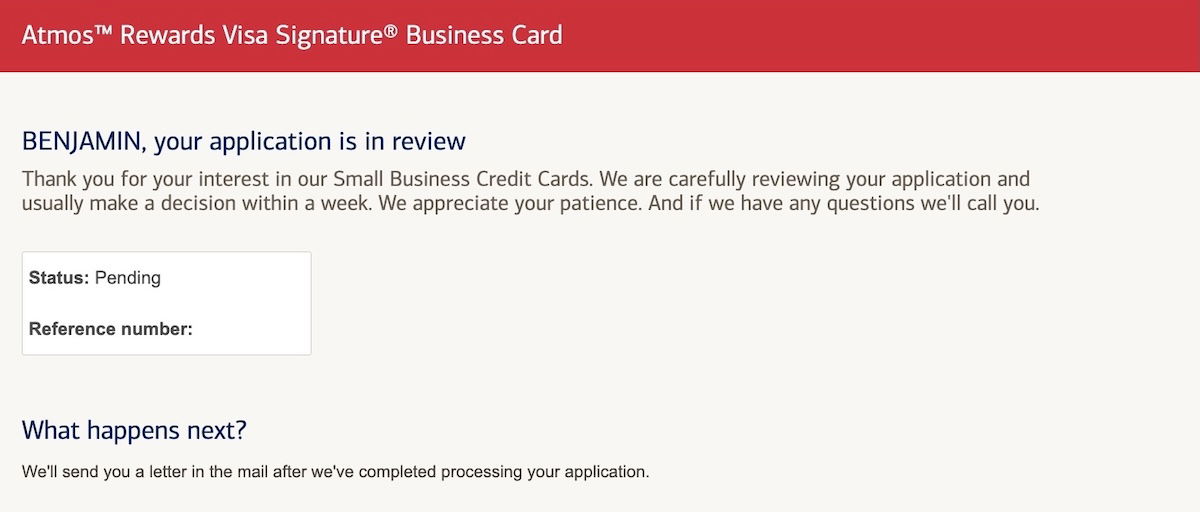

After confirming all the details were correct, I submitted my application. Up until now, I’ve always received instant approvals on Bank of America business cards. To my surprise, I got a message telling me my application was in review.

I was worried I might not be approved (for whatever reason), though I was pleasantly surprised when I received an email just minutes later, confirming that I had been approved. Yay!

For what it’s worth, I last had the Alaska Airlines Visa Business Card around two years ago.

My long term Atmos Rewards Business Card strategy

I couldn’t turn down the huge welcome bonus on the Atmos Rewards Business Card, which was honestly the main thing that initially got me to apply. Between this and getting approved for the Atmos Rewards Summit Card just days earlier, I have quite the bounty of Atmos Rewards points headed my way, and there are lots of great uses of those.

So, what’s my long term strategy with the card? Well, as I’ve already covered, my plan is to switch to Atmos Rewards as my primary loyalty program, even as someone who mostly flies American. The Atmos Rewards Summit Card is a key part of that strategy, since it’s the Atmos Rewards card that racks up status points at the fastest rate.

What about the Atmos Rewards Business Card? Well, beyond the great bonus, I think there’s merit to spending $6,000 per year on the card, if possible, to earn an annual $99 companion fare (with taxes & fees starting from $23), given that this could save hundreds of dollars. While I don’t plan on flying Alaska or Hawaiian a ton, it will come in handy, especially as we love traveling to Hawaii. That’s the main plan I have with the card at this point.

For someone who flies Alaska or Hawaiian more casually, there’s merit to getting this card for the first checked bag free, inflight savings, and more.

Bottom line

I recently picked up the new Atmos Rewards Summit Card, and then figured I might as well pick up the Atmos Rewards Business Card, to really go all-in on maximizing points in the ecosystem. The good news is that the Atmos Rewards business credit card has limited approval restrictions, so it’s not too hard to get approved and earn the bonus.

I just submitted my application, and while I initially got a “pending review” message, I received an email minutes later indicating I had been approved.

I’m excited about all these Atmos Rewards points, as this program really feels like it was designed for me (by awarding status points for award flights on all partners, among other things).

If you’ve applied for the Atmos Rewards Business Card, what was your experience like?

Instant denial for the Atmos business card. Can you hold a personal and a business at the same time? I really don't understand why they denied me. This is the second time I have applied for the Alaska business card and was denied.

Hey Ben, what email address did your approval email arrive from?

I vagely remember applying for the business card, but did not get an email, untol todya ( 3 days later saying i got approved). Checked my credit report and zero hard or soft pulls.

My approval email came from "[email protected]"

I never received an approval email! Maybe I’ll get in a few days like you. I just checked my app about 5 minutes after applying and the new biz account was there. I also had a hard pull at Transunion. Pretty interesting..

Honestly Ben

You could have boiled this down to:

“I applied. I got approved”

So Ben, did you already have an Alaska Airlines credit card either the personal or business version through B of A? I'd love to get the bonus miles for the new card, but already have the Alaska BofA cards, so wondering if that will be an issue.

Generally you are limited to one of each card at a time. The days of strip-mining Alaska and getting 10 cards at the same time are over.

i had quite a different experience.

i have a current BofA Alaska card and am a power user of it :-) for over 5 years

applied and then got an envelope where i had to send them my soc security release and a pay stub?!!? after a ton of business, i wanted to give them more and then am getting all these extra processes... feels icky

@ben - same experience here, too. Already a customer, excellent credit, and "uh, we need your social security release and pay stub". Nope. Hard pass.

So far, so "meh" with my application experience. I applied for (and was approved for) an Atmos Summit within hours of its release. Day three I received notice that the card was created. Day seven I received notice the card was shipped via USPS (with no tracking) and expected in another 7 to 10. I called B of A and they have not way track on their end or provide any other details. Maybe my...

So far, so "meh" with my application experience. I applied for (and was approved for) an Atmos Summit within hours of its release. Day three I received notice that the card was created. Day seven I received notice the card was shipped via USPS (with no tracking) and expected in another 7 to 10. I called B of A and they have not way track on their end or provide any other details. Maybe my expectations were a little high for a new premium card, but taking four days for a card to sit around before it is mailed seems a bit lazy and another 7-10 standard mail for a welcome kit seems even lazier. I am so accustomed to AMEX platinum where all cards—both new and replacements—are trackable and sent via 2-day courier service. Heck, AMEX even sends out my Home Depot gift cards via 2-day service. I am def excited by the possibilities of this card, but not yet feeling the Summit love.

@Stevie B, my experience was disappointing. I applied for the personal Atmos card (already have the basic AS BofA card) and immediately received an email directing me to call customer service. After a 15-minute hold, I spoke with a curt agent who asked additional questions, then informed me I'd receive a letter requesting more documentation.

The letter arrived requesting I download and print an SSA authorization form to release my Social Security number. I declined...

@Stevie B, my experience was disappointing. I applied for the personal Atmos card (already have the basic AS BofA card) and immediately received an email directing me to call customer service. After a 15-minute hold, I spoke with a curt agent who asked additional questions, then informed me I'd receive a letter requesting more documentation.

The letter arrived requesting I download and print an SSA authorization form to release my Social Security number. I declined to proceed and shredded the letter. Since I already provided my SSN in the original application, this additional requirement seems unnecessary and indicative of poor customer service.

I've decided the card isn't worth these bureaucratic hurdles. I may reconsider in the future, but for now, it's a hard pass.

Wasn’t instantly approved, but about 5 minutes after I applied I checked my BofA app and there it was. Pretty massive credit line as well. I got the Summit card last week, so lots of Atmos miles on the way!

@ KD -- Congrats, sounds very similar to my situation!

It's been a long time Ben! You and I were on the QR A350 inaugural back in Jan '15. I can't remember exactly, but you were either sitting behind me or in front of me. You were cracking me up with your commentary about AAB and his entourage. Long time fan of your site but mostly a lurker. Keep up the good work.

For some reason the credit rating bureaus alerted me when I applied for this card. I thought that should not happen for a business card?

Hopefully the card approval and issuance itself will not show up on my credit report.

@ AtmosBizApproved -- Congrats on the approval! There is still a credit check, which is standard, and would trigger an alert. The point is that the card account shouldn't show up as a new product, which is how things like 5/24 are measured.