I’ve written in the past about the Mesa Homeowners Card, which awards points for paying your mortgage, along with offering all kinds of other lucrative opportunities. I had posed the question of whether the card was too good to be true… as it turns out, it was.

In this post:

Mesa Homeowners Card suddenly goes out of business

Mesa has reached out to cardmembers to inform them that their accounts are being closed effective immediately:

We are reaching out today to share the unfortunate news that, effective immediately, your Mesa Homeowners Card account will be closed. As such, your credit card will be deactivated and you will not be able to make any new purchases or earn Mesa Points. We will provide you with separate guidance with regards to your remaining Mesa Points balance. This account closure has nothing to do with your account standing and is not the result of any wrongdoing or any actions taken by you with regards to your account.

Over the past week or so, there have been reports that all transactions on the Mesa Homeowners Card have been declined for cardmembers, which was mighty suspicious. The company didn’t communicate this proactively, but when customers reached out, they claimed it was a temporary outage. So it’s not surprising to learn that there was more to the story.

Unfortunately those with existing points balances with Mesa no longer seem to be able to transfer points to travel partners. Well, at least in theory, as they tried to remove that capability from the app. However, commenter Jay at Doctor Of Credit points out a workaround that’s functioning as of now (though who knows for how much longer).

Just uninstall the Mesa app, and then reinstall the the Mesa app. Once the app is reinstalled, cut off the internet connection on your phone, by putting it into airplane mode.

Then start up the app — it will try to update automatically, but it will fail due to no internet. After failing, it should again go to the log-in screen. Wait for several seconds, and then turn on your internet again. You should then be able to log in normally, and see the standard transfer options, as it will bring you to the app without the latest updates, which removed that functionality.

The Mesa Homeowners Card was too good to be true

The Mesa Homeowners Card was launched in late 2024, so it stuck around for a little over a year, before ultimately being discontinued.

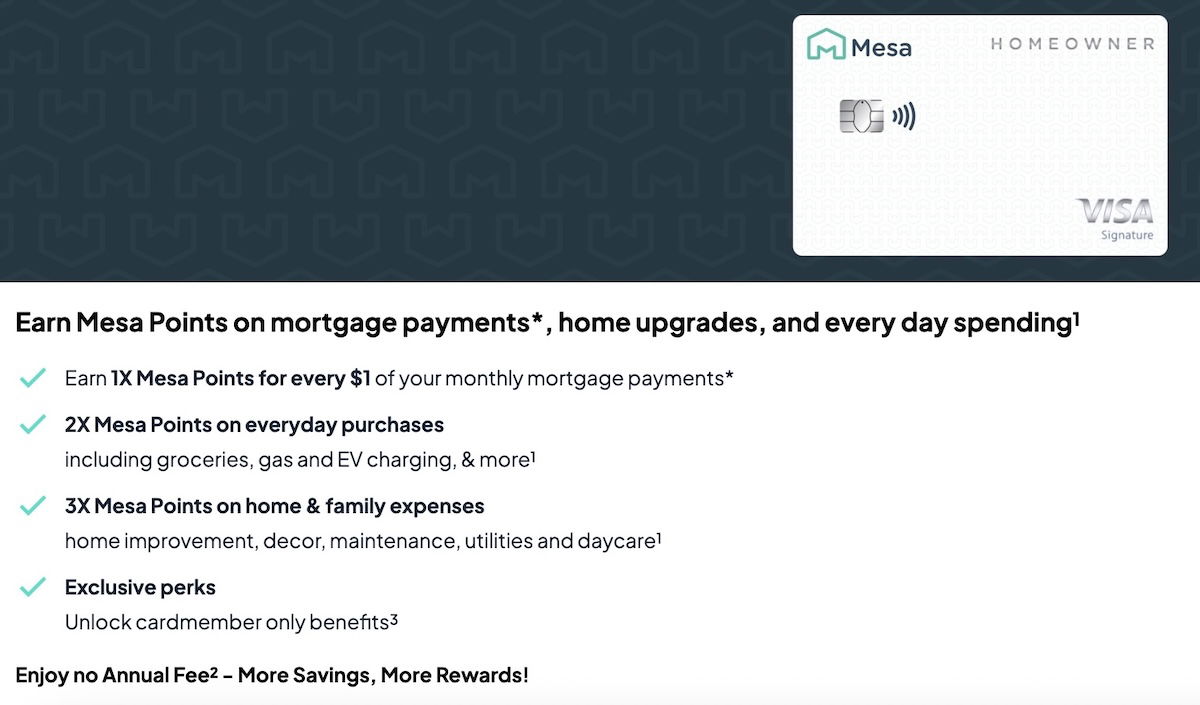

The card had no annual fee, and the selling point was that it offered one point per dollar that you spend on your mortgage, up to 100,000 points per year. You didn’t even have to use your Mesa Homeowners Card to pay your mortgage, but instead, you just needed to make $1,000 in qualifying purchases on the account per billing cycle to unlock that.

The card also had some unique bonus points categories, like offering 3x points on home and family expenses, including home decor, home improvement, general contractors, cable and streaming services, home insurance, property taxes, maintenance, telecommunications, utilities, and daycare.

It basically seemed that Mesa tried to be to mortgages what Bilt is to rent. Now, it’s a bit funny that Bilt is worth many billions of dollars, while Mesa went bust. But I suspect that comes down to Bilt having a larger strategy of building partnerships in a variety of spaces (on the rental side, and with other ways to engage the community). Meanwhile Mesa was pretty singularly focused on the credit card, which seemed to be a loss leader of sorts for Bilt.

Bottom line

The Mesa Homeowners Card has shut down, so all cardmembers have had their cards canceled. Over the past week, transactions had been declined, so I guess the writing was on the wall (despite Mesa’s denial that anything was wrong). The Mesa concept was simply too generous, with not enough ways to actually make money on customers.

Are you surprised to see Mesa go out of business?

Rove miles giving Mesa members up to 5k miles for stranded Mesa points. Submit form for 5k request. Sign up first if you don’t have an account –

http://www.rovemiles.com/?signup&referralCode=OARZGTOZ

Submit 5k giveaway request form –

https://giveaway.rovemiles.com/matchyourmesa

I just received emails from Ascenda canceling my upcoming flights I booked months ago through Mesa. How can this be??

All of you transferring points now don't be shocked when the receiving airline declines them (maybe not immediately but over the next few days). If Mesa doesn't have funds to compensate the airlines for the points that are being transferred they almost certainly will be declined. Just because the transfer works doesn't mean you will ever be able to use the points.

Thank you Ben for your article last night! I was able to transfer out 90k points. I held out for months before applying for this card because I had a bad gut feeling about a bank I’ve never heard of but pulled trigger when they had the 50k SUB. Once again thanks for always sharing with the community and helping out! Love reading your articles.

Attempting the workaround, when I click continue in the points transfer section, it doesn’t proceed. It loads but stays in same page :/

Mesa is such a small city anyways. Makes sense they would have difficulty funding this.

A mortgage is a debt instrument.

A credit card is a debt instrument

The credit card networks have always prohibited paying a debt with a debt as there is technically no payment occurring. I am reasonably confident that Visa told them - "not on our cards".

I always raise a jaundiced eye when I see products like these.

Will be interesting to see how Bilt will “get away with it” when they implement mortgage payments.

MasterCard permits it.

You misunderstand how Mesa worked. You didn't pay your mortgage through them. Basically you uploaded your mortgage statement and they gave you 1x points for nothing more than putting $1k of spend on the card elsewhere. There was no paying debt with debt.

There was never a payment. It was simply a data play to get customer info and offer cheap refi and new mortgages worth better consumer data.

Wow, what the actual fuck. Glad I thought twice about applying for this card.

Hope others can get their points out before it's too late.

If you compare Bilt and Mesa.

One ended up with VC funded substance parties like WeWork.

Both are heading the same direction, just when.

Are you suggesting that Bilt will ultimately fold? If so, I would disagree.

And the town of Bilt is even smaller than Mesa

@Pam

That's the fake Eskimo talking but who cares. Bilt or Mesa all going to crash.

@Jack

I'm not looking for your approval but if you're going to debate about it then at least add something intelligible.

Ben-- I cannot thank you enough for this info. I was so sad this afternoon and frustrated at myself for not seeing the writing on the wall with this card. I had 111k parked in the account that I kept thinking the last couple months I should probably transfer just in case to Aeroplan, and I never did. I nearly cried today. Then right before bed I logged on to see what your thoughts were...

Ben-- I cannot thank you enough for this info. I was so sad this afternoon and frustrated at myself for not seeing the writing on the wall with this card. I had 111k parked in the account that I kept thinking the last couple months I should probably transfer just in case to Aeroplan, and I never did. I nearly cried today. Then right before bed I logged on to see what your thoughts were about the shutdown. I'm so glad I did. This workaround saved all those points and all that work strategizing with spend on the card the last 8 months. A heartfelt thank you!!! PS- this workaround still a go at 9:45p Hawai'i time. Hopefully others can save their points too!

Great work around !!!! Thank you thank you.

You just allowed me get get more that 100k points out worth more than $1k!

This card was for poseurs

Eight Figurers wouldn't understand

Ugh!