US Bank has launched a new credit card, which potentially offers 4% cash back on everyday spending. We’ve never seen a card that’s potentially quite this rewarding for all purchases, though as you’d expect, there are some hoops to jump through. Should this card be in your wallet?

In this post:

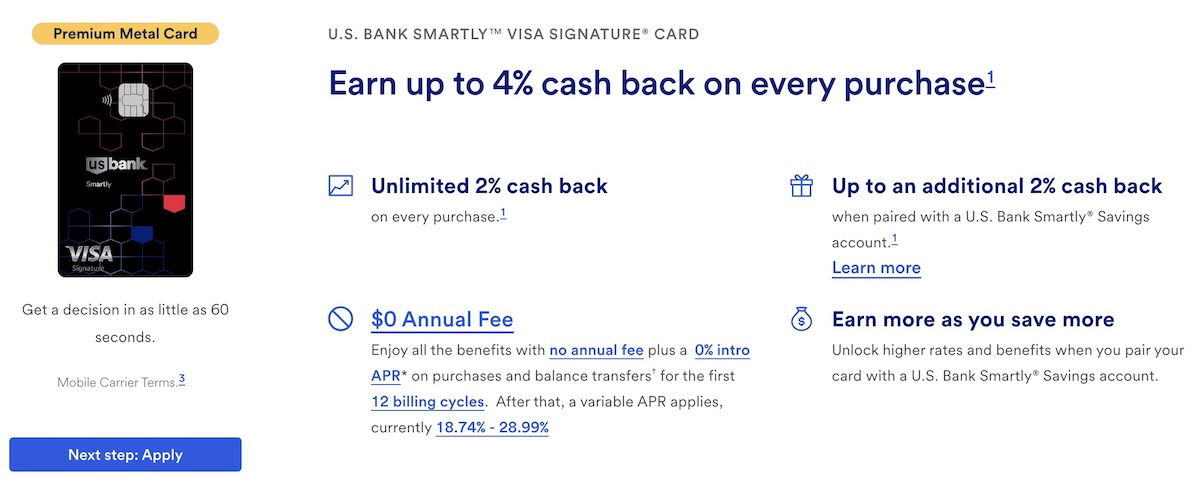

Basics of the US Bank Smartly Visa Signature Card

The US Bank Smartly Visa Signature Card has no annual fee, and offers unlimited 2% cash back on all eligible purchases. In and of itself, earning 2% back is basically the gold standard of credit card rewards, and is the least that anyone should settle for.

Note that the card does have foreign transactions fees, and also doesn’t have a sign-up bonus, so those are two downsides.

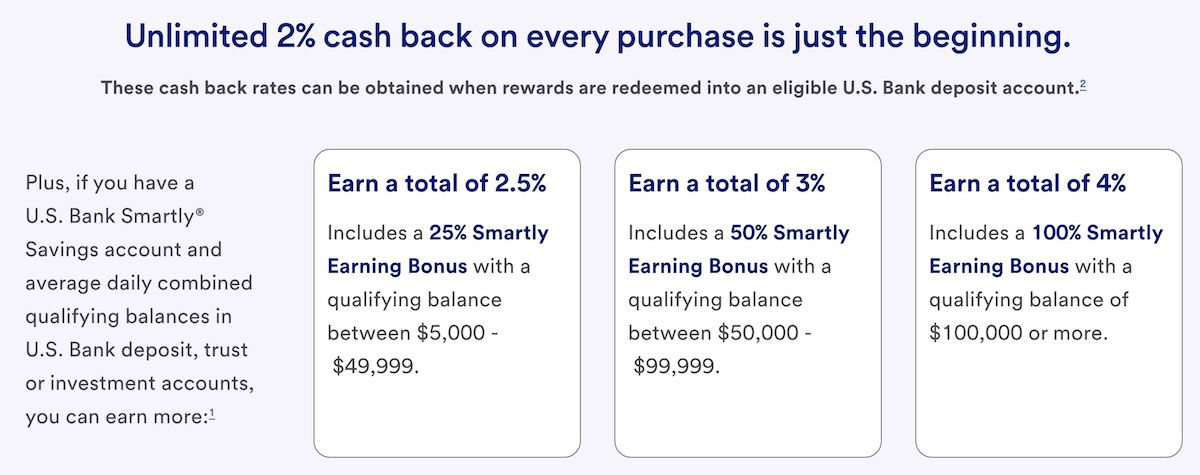

What’s exciting is that the card potentially gets way more rewarding than offering 2% cash back. That’s because you can get a better return if you have a US Bank Smartly Savings account, plus average daily combined qualifying balance in a US Bank deposit, trust, or investment account:

- Earn 2.5% cash back on spending if you have a qualifying balance of $5,000-49,999

- Earn 3% cash back on spending if you have a qualifying balance of $50,000-99,999

- Earn 4% cash back on spending if you have a qualifying balance of $100,000+

As you can see, you can potentially earn 4% cash back on all purchases, with no caps. If you are in a position to deposit that type of cash with US Bank, what’s the most efficient way to do so? Obviously you don’t just want to park cash in an account earning an uncompetitive interest rate.

You do need to open a US Bank Smartly Savings Account. While this potentially has decent interest rates (with a balance of $25,000+), it would appear that an annual investment or IRA account would be the best way to park money with US Bank with limited opportunity cost.

The catch is that this comes with a $50 annual fee, unless you have at least $250,000 invested, in which case there’s no fee. Some people may be able to move over their IRA with little opportunity cost, in which case that could be a great deal.

Is this up to 4% cash back card worth it?

It really is incredible how far credit card rewards have come over the years. The thought of earning 4% cash back on everyday spending is basically unheard of. Just as an example, you can pay income taxes by credit card for a fee of under 2%, so you could basically earn a 2%+ “profit” on your tax payments by using this card. That’s kind of wild.

Admittedly this card isn’t for everyone, and the key to it being worthwhile is having cash that you can move around with a low opportunity cost. If you an investment account or IRA and you’re able to move it around without giving up much, then this is a worthwhile opportunity, if you ask me.

A few thoughts on the concept of earning 4% cash back, and this overall value proposition:

- I do sort of wonder if this is almost too good to be true, and if we could see US Bank start to add restrictions, like capping rewards, restricting tax payments (even though it’s a totally legitimate form of credit card spending), etc.

- While you can probably get a better return with points cards for purchases in bonus categories (like dining, groceries, etc.), earning 4% cash back on everyday spending is unheard of, and in a completely different league

- Being able to earn 4% cash back should really make us reframe how we view earning miles & points, and the opportunity cost of doing so

- If you’re not a huge credit card spender, then it’s probably not worth jumping through the hoops to get this card, while if you’re a big spender, this card could earn you a lot of rewards

Bottom line

The new no annual fee US Bank Smartly Visa Signature Card offers 2% cash back. While that’s pretty good, what makes this card exceptional is that it offers up to an additional 2% cash back if you maintain a certain balance with US Bank. For those with at least $100K with US Bank, you could receive 4% cash back on all purchases.

This card won’t be for everyone, but it’s at least worth being aware of…

What do you make of US Bank’s new credit card?

@Lucky, you should update this post to reflect that U.S Bank is doing away with the 4% cashback. You can only earn 4% back on the first $10k in purchases. This kicks in for existing cardholders starting september 15th. Knew this was too good to be true

Unfortunately US Bank does not appear to offer auto-redemption of rewards, which can be a huge plus for cashback cards, since your cashback can start earning interest without you doing anything. Examples: Bank of America and Fidelity.

For most the earning interest part on the 4% is insignificant. Really nothing. Its the 4% that matters. Not worrying about the interest. You can move the money out for that. Interest rates could drop further and really is 4% Apr on this going to matter?

The $50 annual fee for the IRA can be avoided with less than $250K invested. If you have the US Bank Smartly Checking account and have $50K+ in "the combined balances of all your qualifying accounts". Your IRA should be one of the "qualifying" accounts". https://www.usbank.com/bank-accounts/checking-accounts/smart-rewards.html

So, if you go all in with US Bank, as I'm sure they're intending with this kind of return on spend, then you can get a Smartly Checking account,...

The $50 annual fee for the IRA can be avoided with less than $250K invested. If you have the US Bank Smartly Checking account and have $50K+ in "the combined balances of all your qualifying accounts". Your IRA should be one of the "qualifying" accounts". https://www.usbank.com/bank-accounts/checking-accounts/smart-rewards.html

So, if you go all in with US Bank, as I'm sure they're intending with this kind of return on spend, then you can get a Smartly Checking account, Smartly Savings account, a Self-directed investment account with an IRA ($100K+), then the Smartly Visa Signature card will earn 4% and you'll have no additional fees on any of the additional accounts. These are the hoops I'm considering jumping through...

I heard that you have to have a USBank smartly checking account in order for USBank to deposit the cash back instead of just a US Bank savings account. Did you hear anything about this?

Well, this card replaced the altitude reserve.

Huge fail.

Us bank could be a huge competition in the credit card game if they would have made points poolable to the altitude reserve and if they had transfer partners.

For my domestic bill paying, particularly taxes, this would be great .

The difference between earning 2.62% back (BofA Prime Rewards) on a tax payment vs 4% means instead of netting ~0.80% I’m getting ~2.2% back after fees. That’s real money to the Doubt household.

The Smartly savings accounts currently pay 4.1%. You can also invest in CDs which currently pay about the same amount.

So, if you go with USBank, you could also just get the Altitude Reserve. It gets you 4.5% cash back if you redeem the cash back for travel purchases (including Uber) and use Apple Pay or Google Pay to purchase things (otherwise most purchases are only 1.5% with travel redemptions). Not as good as a straightforward 4% cash back, but you also don’t have to move any money around. Given that almost every place I...

So, if you go with USBank, you could also just get the Altitude Reserve. It gets you 4.5% cash back if you redeem the cash back for travel purchases (including Uber) and use Apple Pay or Google Pay to purchase things (otherwise most purchases are only 1.5% with travel redemptions). Not as good as a straightforward 4% cash back, but you also don’t have to move any money around. Given that almost every place I purchase stuff from accepts Apple Pay (even Costco’s app!!), this is by far my favorite card for any purchases. I use point cards for dining and travel purchases where I can get outsized point multipliers (Amex Gold for dining for example). But for everything that uses tap to pay or Apple Pay, I use my Altitude.

Since I am a USBank customer I thought about this card. But I didn’t want to move all my cash from SoFi which offers a better interface and 4% interest regardless of how much money I park. Also checkout Pelican State Credit Union. If you can get an account there, they still offer you 6% interest on you checking account up to 20k!

It's the US Bank Visa card that is accepted everywhere, not Apply Pay ;) Try to use Apple Pay with one of your Amex cards that isn't accepted by a certain retailer and it'll fail.

Any card that requires me to use an in house travel portal to receive its elevated earnings rate is a hard no for me.

Totally agreed, Oliver85. I use it at Costco, I used it at Hermes in SFO airport, and all over Japan. I used it at Cartier in Taipei. The luddites who think Apple Pay/Google Pay isn't accepted nearly everywhere need to get out of 2014.

Uh... The Altitude Reserve is not accepting new applicants and I would suspect it's going to be discontinued.

@NID, it's not a travel portal. You essentially redeem for travel-related statement credits at a rate of 1.5 cent per point, then combined with 3% on ApplePay is what makes people say it's effectively 4.5%.... but still, 4.5% falls far short of even fairly lazy point transfer redemptions.

@Redacted - woah, I missed that! Here's to hoping they keep it around for existing cardholders. :o}

My, my, standards do vary, for sure!

Must be a strange universe in which an annual interest rate of 3.80% is a competitive interest rate and one in which Charles Schwab doesn't exist.

Charles Schwab offers a money market account currently earning a 7-day yield of 4.54%, a difference of 0.74%; on a balance of $250K, that works out to an extra $1,850 per year or about $154 per month in spendable cash in one's...

My, my, standards do vary, for sure!

Must be a strange universe in which an annual interest rate of 3.80% is a competitive interest rate and one in which Charles Schwab doesn't exist.

Charles Schwab offers a money market account currently earning a 7-day yield of 4.54%, a difference of 0.74%; on a balance of $250K, that works out to an extra $1,850 per year or about $154 per month in spendable cash in one's pocket.

That's $92,500 of annual spending earning the additional 2% to get one's head above water, without even thinking about the higher earning rates on everyday or quarterly bonus categories using other cash or points cards.

And brokerage money market accounts such as Schwab's invest in very high quality securities so, practically speaking, they are risk-free and as good as FDIC-insured deposits; I can think of only one brokerage money market fund that 'broke the buck' and that was way back in the 2008 financial re-adjustment, so no reasonable worries about the security of one's money.

Parking money market cash is the wrong answer.

Moving enough of your brokerage/ IRA assets to hit the 4% threshold is the right answer.

Whether I hold my SPY at Schwab or somewhere else is irrelevant. I rarely trade, and it’s the same asset regardless of the account.

I'll agree with you up to a point: some people are risk-averse and want their money available and invested in a riskless or almost riskless investment and a money-market account yielding in the neighborhood of 5% with almost no risk is great for them.

As well, it's a great place for something small like a couple of hundred grand emergency fund or for a short-term target-date investment for something like a new house or a...

I'll agree with you up to a point: some people are risk-averse and want their money available and invested in a riskless or almost riskless investment and a money-market account yielding in the neighborhood of 5% with almost no risk is great for them.

As well, it's a great place for something small like a couple of hundred grand emergency fund or for a short-term target-date investment for something like a new house or a wedding. And let's face it, one is foolish not to have SPY balanced by an investment with less risk and variance.

And then there are those investments that are only available at the major brokerages. I have a position in a very good high-yield bond fund (PHYZX) that I couldn't find at Merrill when I moved an IRA over to take advantage of BofA's Preferred Rewards, so that money stayed with Schwab.

Love the "couple of hundred grand emergency fund" statement. People are often advised to keep 3-6 months worth of expenses in an emergency fund so I guess yours would include emergency yacht repairs or if the Learjet needs an engine replaced. I'm genuinely curious: why are you involved in points and miles if hundreds of thousands of dollars is something small? Ennui?

Hey, if the banks want to give away free money ranging anywhere from 2.625% on up to 5% or more (remember that Chase Ultimate rewards, for example, can be redeemed for cash) for zero effort, I'll take it in spades; only the financially foolish would pass that up because they had a few bucks in the bank.

As an FYI, most reputable financial advisers recommend a 3 - 6 month emergency as a MINIMUM and,...

Hey, if the banks want to give away free money ranging anywhere from 2.625% on up to 5% or more (remember that Chase Ultimate rewards, for example, can be redeemed for cash) for zero effort, I'll take it in spades; only the financially foolish would pass that up because they had a few bucks in the bank.

As an FYI, most reputable financial advisers recommend a 3 - 6 month emergency as a MINIMUM and, in the case of retirees, many suggest several years of living expenses due to how long it can take investments like stocks and real estate to recover in the event of a market crash.

For example, the dot-com bubble burst of 2000 took the markets almost six years to recover and the re-adjustment of 2008 took the markets close to five years. Having lived through those crashes (and a couple of others), I was happily buying rather than selling to keep the house warm and the lights on.

Since you brought up owning a yacht or a Learjet, I've always lived by a great piece of free money-saving advice I got in bootcamp way back in the day: If it floats, flies, or f**ks, rent it.

Not every retiree is living a lifestyle constrained by having only the average Social Security retirement benefit coming in each month.

Depends on how wealthy you are. $100k may not be that much.

Also, as I noted in another comment, the Smartly Savings and Checking both pay 4.1% and CDs also qualify for the 4% cash back $100,000 balance requirement. They pay about 4% too.

who cares about the money market account, to use this one you'd just move over brokerage assets that you set and forget

I think you are missing the strategy. You park 100K of securities you own. Not cash earning interest. Thats that strategy. Then it comes down to the credit line they give you to see if it is worth it. I am fairly sure that the users who will cycle , will wend up shut down. This is not a comparison of what interes you can get. Frthermroe for roughly 20+ yrs you could nto get any interest on savings. This is someting fairly new but rates are coming down anyway.

Message for Ben,

As I cannot locate a contact address on this website and my previous post on this article has apparently not been received, I will try again to alert Ben to the following European aviation news item:

https://www.telegraph.co.uk/travel/news/airbus-a321xlr-first-look/

Contact email is easily found on the About page of the blog under Contact Details: lucky @ onemileatatime . com

Thank you for taking the time to respond.

Yes, eventually I located the email address hidden away as you indicated, although, hardly easily found.

Are there any 5/24 equivalent rules with USBank?