Link: Apply or upgrade your existing card to the no annual fee Bilt Blue Card, $95 annual fee Bilt Obsidian Card, or $495 Bilt Palladium Card

A few days ago, Bilt announced massive changes, including details of three new credit cards, plus a complete overhaul to how rewards can be earned for housing payments (read my Bilt credit card review & comparison). One complaint that people had was that the new housing rewards system was incredibly complex. So Bilt has acted quickly to address that, and I think many people will come out ahead here.

In this post:

The note to members from Bilt Founder & CEO Ankur Jain

Bilt has just sent the following email to members, explaining changes that are already being made to the new system for rewarding housing payments:

Over the past few days, I’ve spent a lot of time reading our members’ emails, DMs, and notes. Many were thoughtful and passionate. Some were frustrated. All were fair.

I feel incredibly lucky to lead a company with members who care this deeply.

On one hand, there have been record applications for the cards, and I’m excited for members to get them. However, I’ve also seen real and reasonable confusion about the new value proposition—especially around rent and mortgage points. That’s on me, and we’re fixing it.

Let me be clear and upfront: Bilt cardholders will never be charged a fee to earn rewards on housing payments.

There’s also an important reality behind how we deliver the richest rewards possible. The more members use the card for everyday spend, the more unique value we can sustainably provide across the Bilt ecosystem. It is probably not a surprise to any of you, but if members only purchase four bananas and earn free rent points, it doesn’t allow us to sustain such a rich value proposition for everyone.

With all that in mind, we are introducing a new, simpler option to earn fee-free rewards on rent and mortgage: now up to 1.25X on each payment.

You will now be able to choose one of the two options for how you want to be rewarded on housing payments with the new Bilt Card 2.0. The core benefits of each card are not changing. This is only an update to how you earn rewards on housing payments.

Option 1:

A simple, fee-free way to earn rewards on housing.

- Pay your full rent or mortgage every month with no transaction fee

- Earn points on housing automatically in lieu of earning Bilt Cash

- The more you use your card for everyday spend, the higher your points multiplier on housing, now up to 1.25x:

You’ll see your progress to each tier clearly in the app each month.

Just like today, if you don’t hit the minimum spend requirement, you still earn 250 points per month. Bilt Card 2.0 also removes the 100,000 rent point cap that existed with Card 1.0, so you can now earn unlimited points on housing payments.

Option 2:

If you prefer the original, fee-free structure we launched Card 2.0 with, it’s still available for you:

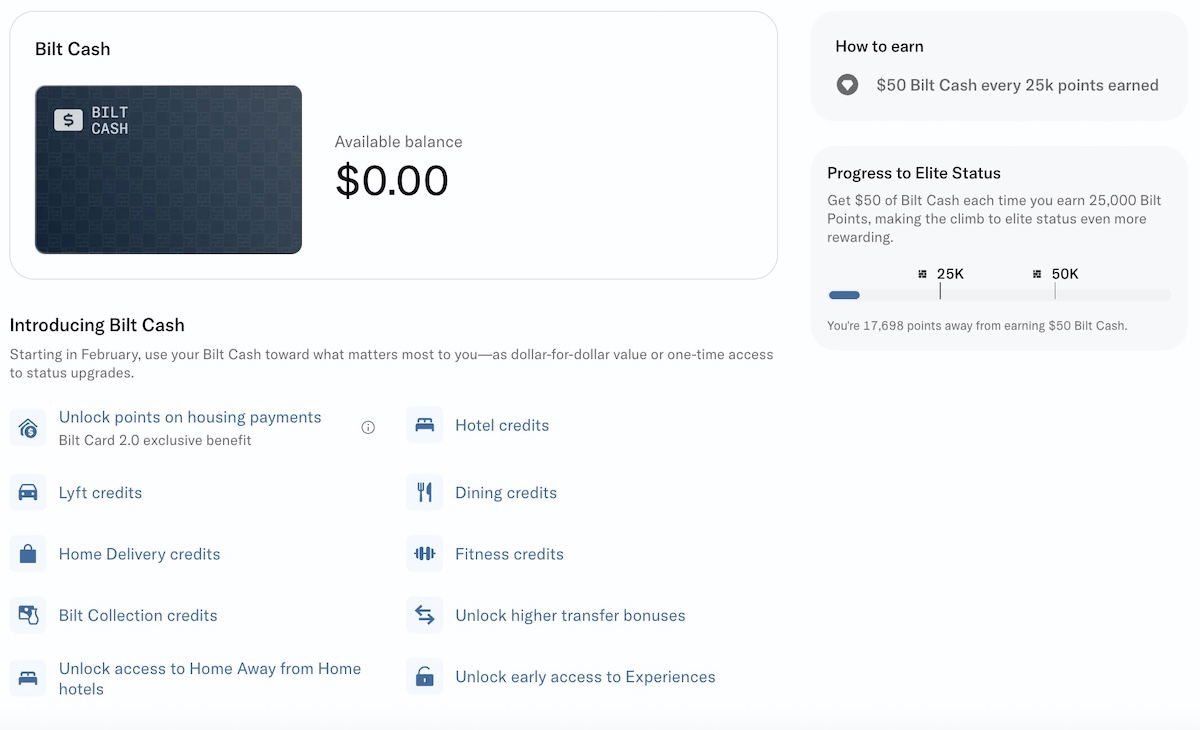

- Earn 4% back in Bilt Cash on everyday purchases, in addition to base points. Think of Bilt Cash as “choose your own reward”.

- Pay your full rent or mortgage every month with no transaction fee

- You can use as little or as much of your Bilt Cash to increase the total points you earn on housing that month and you do not ever pay anything out of pocket.

- You can also redeem Bilt Cash dollar-for-dollar for monthly credits across the Bilt ecosystem (with monthly, merchant-specific caps), or for exclusive benefits like higher transfer bonuses and special access to experiences.

The more you use your card for everyday spend, the more Bilt Cash you earn. We’ll continue adding new ways to spend Bilt Cash as the ecosystem grows.

You choose the option that works the best for you when you activate your card. You can change at any time, and your choice will take effect the following month. And, both options come with the same rich everyday point earnings and premium card benefits you saw at Card 2.0 launch.

We move fast at Bilt. That means we won’t always get everything right the first time, but I read all of your feedback and we will adjust quickly when we miss. I know that for some of you, no explanation of change will fully replace what you loved about the card 1.0 model–I understand that. At the same time, I’m genuinely excited about what this model sustainably enables going forward: giving you the richest rewards on rent, mortgages and everything else.

I’ve also included an FAQ below to answer some of the other questions I’ve been hearing.

We’re grateful to keep building this with you. Thank you for being a Bilt Member.

Ankur

There are still many unknowns, but these are positive updates!

I commend Bilt for making changes to its new program so quickly. I’m a little confused how they didn’t find the new system confusing internally prior to launching the whole thing, but that’s a different story. For that matter, I worry that giving people two choices (one of which is rather complex) doesn’t necessarily simplify things that much.

That being said, this is unarguably great news, as I see it. As I’ve explained, I’ve picked up the Bilt Palladium Card, which offers 2x points on everyday spending. As I see it, that potentially makes this one of the most rewarding cards out there for non-bonused, everyday spending. With the Bilt Cash concept, you could earn up to 1x points on housing payments.

So the good news is that if you were planning on putting a significant amount of spending on the card (which can make sense independently), you can now earn up to 1.25x points on your housing payment, rather than 1x points. That’s 25% more rewards on housing, and that’s great.

Now, the big wild card here is still which of the two earnings options is better, since we don’t know the full details of how Bilt Cash can be redeemed. The idea is that you earn 4% back on all credit card spending in the form of Bilt Cash, and that Bilt Cash can be used to offset fees on housing rewards, or otherwise “dollar-for-dollar” for other rewards. That latter option sounds too good to be true, which is why there are so many questions.

Bottom line

Bilt recently announced major changes, which are based on the concept of redeeming Bilt Cash for rewards on housing payments. The new system was no doubt complex and left many confused, which is why we’re already seeing Bilt backtrack somewhat.

Bilt is now offering a second option for earning rewards for housing payments, where the multiplier of housing rewards that you earn is based on how much you spend on the card. The good news is that if you spend as much as your housing payment, you could earn 1.25x points, which is quite lucrative. I think many of us will likely wait on the details of Bilt Cash redemption options to decide which makes the most sense.

What do you make of these Bilt changes?

I like to think of myself as pretty savvy with credit cards, but Bilt has me flummoxed. Simple question: With their new program, and assuming I don't want to play with Bilt Cash, is my rent payment an EFT from my bank account, or is it a credit card payment like it is currently with WF? To avoid fees, I think the former, but damned if I know for sure

what a smooth transition... I applied for the 2.0 card but only rejected because my email address that I have been using for over a year with 1.0 card "could not be verifiied". called and emailed them and they said nothing they can do and I'm welcome to apply again in 45 days. absolutely ridiculous.

"there have been record applications for the cards"... Because you're basically asking your entire customer base to apply for one! You'd not get millions of applications at once normally... and I'm sure it's not because people are so excited to get one as it seems most options are worse than previously (unless you're a high spender). But then no card or points revamp is ever better than the previous proposition these days

What all comments miss is that whatever option you choose it seems to be worse than the current set up (unless maybe you're a high spender?). But then no one will be surprised about this, 2.0 was always going to be how can we screw over people. Since I live in NYC my monthly rent earned a lot of points, my monthly spend will need to be pretty high even to earn 0.5x points. Example...

What all comments miss is that whatever option you choose it seems to be worse than the current set up (unless maybe you're a high spender?). But then no one will be surprised about this, 2.0 was always going to be how can we screw over people. Since I live in NYC my monthly rent earned a lot of points, my monthly spend will need to be pretty high even to earn 0.5x points. Example for $4k rent, previous version 4k points earned from a minimum 5 transactions made, plus whatever points you got from those. New version need $1k pm spend on card to get 0.5x points, total points $2k on rent + ~$1k base points on card spend = 3k points. Loose by at least $1k. To earn 1x on rent (as before) need to spend $3k on the card.

Ben, your recent discussions of Bilt seem to imply that Bilt points are more valuable than other transferable currencies. However, your published valuation remains 1.7 cents, just like all the rest. Maybe you should update this.

If I understand this correctly (and that’s a very big if), this new option shouldn’t be the choice for most unless you’re a big spender with low rent/mortgage. They’re basically setting these thresholds to match the amount of Bilt Cash you have to use for all but the 1.25x option, so you’re coming out behind. And you’d have to switch a month in advance, so you’d need to know your spending plans.

As convoluted...

If I understand this correctly (and that’s a very big if), this new option shouldn’t be the choice for most unless you’re a big spender with low rent/mortgage. They’re basically setting these thresholds to match the amount of Bilt Cash you have to use for all but the 1.25x option, so you’re coming out behind. And you’d have to switch a month in advance, so you’d need to know your spending plans.

As convoluted the Bilt Cash option is, it actually seems better for points earning.

If I understand this correctly (and that’s a very big if), this new option shouldn’t be the choice for most unless you’re a big spender with low rent/mortgage. They’re basically setting these thresholds to match the amount of Bilt Cash you have to use for all but the 1.25x option, so you’re coming out behind. And you’d have to switch a month in advance, so you’d need to know your spending plans.

As convoluted...

If I understand this correctly (and that’s a very big if), this new option shouldn’t be the choice for most unless you’re a big spender with low rent/mortgage. They’re basically setting these thresholds to match the amount of Bilt Cash you have to use for all but the 1.25x option, so you’re coming out behind. And you’d have to switch a month in advance, so you’d need to know your spending plans.

As convoluted the Bilt Cash option is, it actually seems better for points earning.

The answer to nearly every question asked on their AMA was "we aren't sure yet"... not exactly a good sign when the card is already launched.

This appears like they were deciding between these 2 possible options for how to do the points on rent and when everyone hated the first one they just gave us both and said "ok you pick then" instead of asking their cardholders for feedback before launch.

Seems...

The answer to nearly every question asked on their AMA was "we aren't sure yet"... not exactly a good sign when the card is already launched.

This appears like they were deciding between these 2 possible options for how to do the points on rent and when everyone hated the first one they just gave us both and said "ok you pick then" instead of asking their cardholders for feedback before launch.

Seems like a good first year value with the sign up bonus but long term value is TBD. The average consumer is likely just going to drop the card since the no annual fee card is bad compared to the current version. Their app is also the most bloated app I've ever used, it crashes nearly every time I use it. Lack of decisiveness in all areas with BILT.

I can see myself toggling between Options 1 and 2, depending on what I have to pay that upcoming month. Spending 75% of my rent payment in everyday spend MIGHT happen twice a year, at most.

I give up.

I don't fly as much as you guys do. This site is nothing but ads and promos it cedudir cards. Where is Tiffany?

Good luck Ben. No reviews on anything lately. Still not one from your dad in Africa.

Just clit bait ads. You are better than this. At least you used to be.

Thanks for sharing. Goodbye.

I get this is a complicated setup, but at the end of the day, even if I value Bilt Points at 1c and I don't have any mortgage to complicate things, I'm earning 5% in normal spend (4%+1%) on a no-annual-fee card. Sure, I have to redeem the 4% as a dining credit (or whatever), but so what? It's still 4%. Earning 5% back on everything w/o any brain damage seems like, well, a no-brainer. Bin the rent/mortgage overlay. What am I missing?

What you are missing is this: There are those who would venomously criticize Bilt no matter what it rolled out. Separately, many don't have the insight you have to strip away the noise to get to the heart of the matter. Think about what you wrote: forget about rent, this is a 5% cash back card on everything (with no foreign transaction fees). For some, this is great.

"or whatever" - that's the key. We don't know how you can use the Bilt Cash, so calling this 4% + 1% is generous at best. Based on the new option, Bilt Cash was never really intended to be used for any good value, it was just a new phantom metric for paying 1.33x Bilt points on housing.

IE let's say you can use your Bilt Cash 1x per month for $5 off a...

"or whatever" - that's the key. We don't know how you can use the Bilt Cash, so calling this 4% + 1% is generous at best. Based on the new option, Bilt Cash was never really intended to be used for any good value, it was just a new phantom metric for paying 1.33x Bilt points on housing.

IE let's say you can use your Bilt Cash 1x per month for $5 off a $30+ Lyft ride, or a similar coupon for a fitness class. Or up to $50 on a $200+ 2+ night hotel booking through the portal. Would you still consider this a 5% cash back card?

Wow, more confused on 2.1…If I have to re-read an article or explanation more than once to understand a credit card’s reward structure, it’s too complex and not worth the effort.

This card makes the coupon clip book and monthly credits look appealing. BILT will fold or reengineer again in 2 years tops.

So the new option is based on monthly spend? So if you have $2k in rent and spend $3k in month one you get 2.5k points right? But if you spend $1k in month two you get 1.5k points? Or does the extra $1k from month one carry over so you would still get 2.5k points?

What a train wreck.

And how are they tracking monthly spend because credit card statements dont usually align perfectly with calendar months

If I understand option 1 and 2 can kind of get the the same rent/housing rewards. Except Option 1 you can max out at 1.25x but Option 2 would be 1x.

And by picking option 1 you don’t earn Bilt cash, correct?

What is over time Bilt cash becomes more valuable, more options etc and you’ve chosen option 1. Can you change to option 2? Or flip back and forth? How often?

You can switch between the two options each month. The new option takes effect at the start of the month immediately after the switch.

Seems like they don't know their own program.

This is merely a software update, BILT 2.1

This more like Bilt 0.2.1 alpha feat. Cardless.

They will kill the project by version 0.2.74 beta.

I've seen this movie before. Adding less confusion to already a lot of confusion = people tune away immediately. If the points community finds this complex, the average won't even bother reading up on how it works. In this generation of getting what you expect in 3 clicks of your phone, most people won't bother with a already fringe card. I don't expect this card to last long so to me there is very little...

I've seen this movie before. Adding less confusion to already a lot of confusion = people tune away immediately. If the points community finds this complex, the average won't even bother reading up on how it works. In this generation of getting what you expect in 3 clicks of your phone, most people won't bother with a already fringe card. I don't expect this card to last long so to me there is very little point in spending too much time strategizing vs just get the sign up bonus and dump the card making things 10x worse for them.

I agree with you. I have Sapphire Reserve, VenureX and AA admiral card. While they’ve all added “coupon book” stuff (which is such a turnoff to me), this crap with Bilt is just confusing. I read the original Lucky article on Bilt 2.0 twice and am still confused. Now another options just makes me think it’s too much work.

I've seen this before.

Bilt comes out with a card too good.

Cardless comes out with a card too good.

Neither card lasted more than a few years.

Ummm am I missing something? The new bonus option for mortgage pmt is worse off if you can actually spend 75% of your pmt. Effectively you'll be capping yourself at 3.25x instead of 3.33x /$. I mean its minimal but still.

You know, I feel like these people were not ready for their card launch

Richard Kerr: "I worked on this for, like, a year..."

So under option 1 if you spend $2K on rent payment and a further $1.5K in everyday purchases you will earn a total of 5K points?

My mortgage is with Wells Fargo. I didn’t realize mortgage companies accept credit cards. Does anyone have experience doing this with Wells?

1.25x is not better than 1.33x. But now there is a sweat spot by spending 25% of rent/mortgage and get 2x on that spending.

So the feedback he got was that people wanted more math?

While its nice that he's receptive to input, do you really want a card where the terms can change that quickly? (I know its in the fine print of every card but still)

Usually changes are made after analyzing actual performance data in the marketplace, not based on the loudest complainers on social media

The first option is what I thought they would do. So it's good that they added it.

But now the math is even more confusing!

Address confusion with even more confusion?!?….either way you’re still having to spend on card to (pay for) earning points on rent/mortgage. This, in no way, changes the underlying sustainability issue of the business model that Wells Fargo ran away from.

Ben out there still trying to hawk Bilt cards as the Bilt ship hits the iceberg and starts to slip below the waves. Like the band on the Titanic.

That might all be but I’m confused as how this updated option is that bad? For me with the Bilt card you can just spend 50% of your rent each month and earn 1pt per dollar on it. For someone with a rent in the high 4k area that means just spending 2k a month and still getting those 4000 points with no fees. What am I missing?

Yup. "So Bilt has acted quickly to address" is incredibly ass kissy.

Comparing Bilt 2.0 with Titanic is way too generous.

This is like a paper drawing of Titanic getting wet.

Wait till you see how Gary hawk these 2 paper drawings.

Just to clarify the new changes, this is how many points you get per dollar in their example:

Housing multiplier / spend / points / ppd

0.5 / $500 / 1000 / 2

0.75 / $1000 / 1500 / 1.5

1 / $1500 / 2000 / 1.33

1.25 / $2000 / 2500 / 1.25

Bilt Cash option was equivalent to 1.33 ppd. So seems like the new option is more lucrative...

Just to clarify the new changes, this is how many points you get per dollar in their example:

Housing multiplier / spend / points / ppd

0.5 / $500 / 1000 / 2

0.75 / $1000 / 1500 / 1.5

1 / $1500 / 2000 / 1.33

1.25 / $2000 / 2500 / 1.25

Bilt Cash option was equivalent to 1.33 ppd. So seems like the new option is more lucrative in all cases, since Bilt Cash option is limited to 1x on rent/mortgage (even if you spend more than the rent, you just end up with more Bilt Cash). I suppose depending on how Bilt Cash is valued, that it might be better? But the earn rates if you spend less than the max would be less, and you can't get Bilt points for the amount you spend above your rent/mortgage.

Another question is whether these are 4 tiers that need to be met. If they are, then Bilt Cash option would be better for finer grain control. I'm not sure if the 1000 points / $30 Bilt Cash needs to be in those increments, but even so that's more fine grained than this. For example, if you spent $999, you would still only get 1000 points, making the worst case for each tier about >1X Bilt PPD. While with Bilt Cash you could get 1000 points + Bilt Cash leftover.

The problem wasn't just the change in earnings rate - it's also the fact that the new system is horrendously complex. The value proposition is not clear at all to the customer. That's only compounded by 1) shitty customer support (Amex is many things but their chat support agents are top tier and uber responsive) 2) frequent changes to the program (card changes, pre auth, new banks, new card providers, earning rate changes, etc.) and 3) unreliability (bad tech infra, missing payments, missing notifications, etc.).

Does anyone know if we use Bilt to pay a mortgage and also a separate homeowner's association fee, if they both count as 'housing spend'? Or would the HOA fee potentially count as 2X everyday spend? Thanks

HOA.

Union for the houses.

@Pancho - if you’re paying your HOA through Bilt then it counts as rent spend (and won’t count toward the minimum), but if you pay directly to the HOA then it’d be everyday spend.

Its still the same pay 3.3 cents per bilt point to earn on your housing dollar. The lipstick does not change the pig.

If you a heavy spending Hyatt Globalist the Palladium is for you. It is truly the best card in the Hyatt universe.

For everyone else, save your spending for signup bonuses.

Use a venture x for everyday and pay your rent with an Atmos card. You will come out way ahead.

The...

Its still the same pay 3.3 cents per bilt point to earn on your housing dollar. The lipstick does not change the pig.

If you a heavy spending Hyatt Globalist the Palladium is for you. It is truly the best card in the Hyatt universe.

For everyone else, save your spending for signup bonuses.

Use a venture x for everyday and pay your rent with an Atmos card. You will come out way ahead.

The problem with Bilt bananas is that green is temporary and yellow is a sign of impending rot.

I'm not sure I understand why using an Atmos card is particularly useful? Atmos doesn't bonus rent/mortgage and the same cc fee is charged regardless which cc is used. For example: why is paying a 3% fee for 1 Atmos point preferred?

If you pay your rent with a qualifying Atmos card via BILT, you earn 3x (or 3.3x with a BoA relationship) Atmos points for that transaction. You do have to pay the 3% transaction fee. This does not apply to mortgage payments, only rent. I'd be all over this deal if it worked with mortgage payments.

OMG!!!!!

I predicted the incompetent Cardless would backtrack within a year.

Darn was I completely wrong.

It took them just days.

Like I said before, the reason there isn't any details out is because these incompetent companies still have no clue what they are doing, up until the last minute.

VC money is running out.

The fun part would be finally finding out between Cardless and Bilt that who is actually scamming...

OMG!!!!!

I predicted the incompetent Cardless would backtrack within a year.

Darn was I completely wrong.

It took them just days.

Like I said before, the reason there isn't any details out is because these incompetent companies still have no clue what they are doing, up until the last minute.

VC money is running out.

The fun part would be finally finding out between Cardless and Bilt that who is actually scamming who.

My advice to fellow readers. Drain out the bonus and stop using it within a few months before they can backstab you.

Scam them before they scam you.

This business is so half-baked I'm sure they are going to screw stuff up and magnetize litigation. Lawyers are going to lick lips with these hacks.

I'm waiting for Ben to comment on Richard Kerr's Instagram post that denigrated Bilt Redditors as basement dwellers (which is a great way to alienate people who are asking legitimate questions), but I am assuming Ben wants to remain in good graces with them.

I understand Bilt has to make money, but I think they've made this way more confusing than necessary.

Next week, there will be a third option to earn Bilt Rent Pesos, which can be converted to Bilt cash at a rate of y=(monthly spend / number of Bilt neighborhood visits) * Π * r^2.

It's interesting you say this, because they announced it as a "lifestyle membership" (cringe) but they've said nothing about the neighborhood program.

They weren't able to pull together the partners before the WB deal ran out but that's the ultimate play.

When I got Ankur's email this afternoon, I was like... well, at least he's well aware of the 'four bananas' meme. Not sure Option 1 or 2 is better or worse, but... smoke 'em, if ya got 'em, I guess.

Like, this last-minute 'update' feels like a shark-nado just collided with the pre-existing train-wreck.