Link: Learn more about the Atmos™ Rewards Summit Visa Infinite® Credit Card, Atmos™ Rewards Ascent Visa Signature® credit card, or Atmos™ Rewards Visa Signature® Business Card

We recently saw the launch of the Atmos Rewards program, and with that, we saw the introduction (or rebranding) of three cards — the Atmos™ Rewards Summit Visa Infinite® Credit Card (review), Atmos™ Rewards Ascent Visa Signature® credit card (review), and Atmos™ Rewards Visa Signature® Business Card (review).

People are potentially eligible for all three cards, and the cards are offering massive welcome offers that will be ending soon, so this is the last chance to apply. Ford just applied for a couple of these cards, and I want to report back on his experience (after all, I supervise all card applications for family). 😉

In this post:

Success with two Bank of America applications in one day

I’ve already shared my experience getting approved for the Atmos Rewards Summit Card and getting approved for the Atmos Rewards Business Card. However, I had applied on separate days.

These cards are both offering huge welcome bonuses that are ending soon, and Ford didn’t have these cards, so we decided to apply for a couple of them for him last night. I know some people wonder if it’s better to apply for two cards from the same issuer on the same day, or if it makes more sense to space out applications, so let me share our experience yesterday.

Previously, Ford didn’t have any Bank of America or Atmos Rewards cards. So he first decided to apply for the Atmos Rewards Summit Card, which is the premium card in the portfolio. If you don’t want to drop $395 on the annual fee (even though I think the card is otherwise worth it), you could instead use this strategy for the Atmos Rewards Ascent Card.

Anyway, upon submitting his application, he was instantly approved… yay!

With that being approved, we figured we’d also try submitting an application for the Atmos Rewards Business Card, given that people are eligible for both cards, and the bonuses are both huge. Fortunately he got an instant approval there as well!

So yeah, you can’t beat getting two approvals from one card issuer in a day, and that doesn’t seem to be an issue with Bank of America, especially if one is a personal card, and one is a business card.

Why I see value in picking up two Atmos Rewards cards

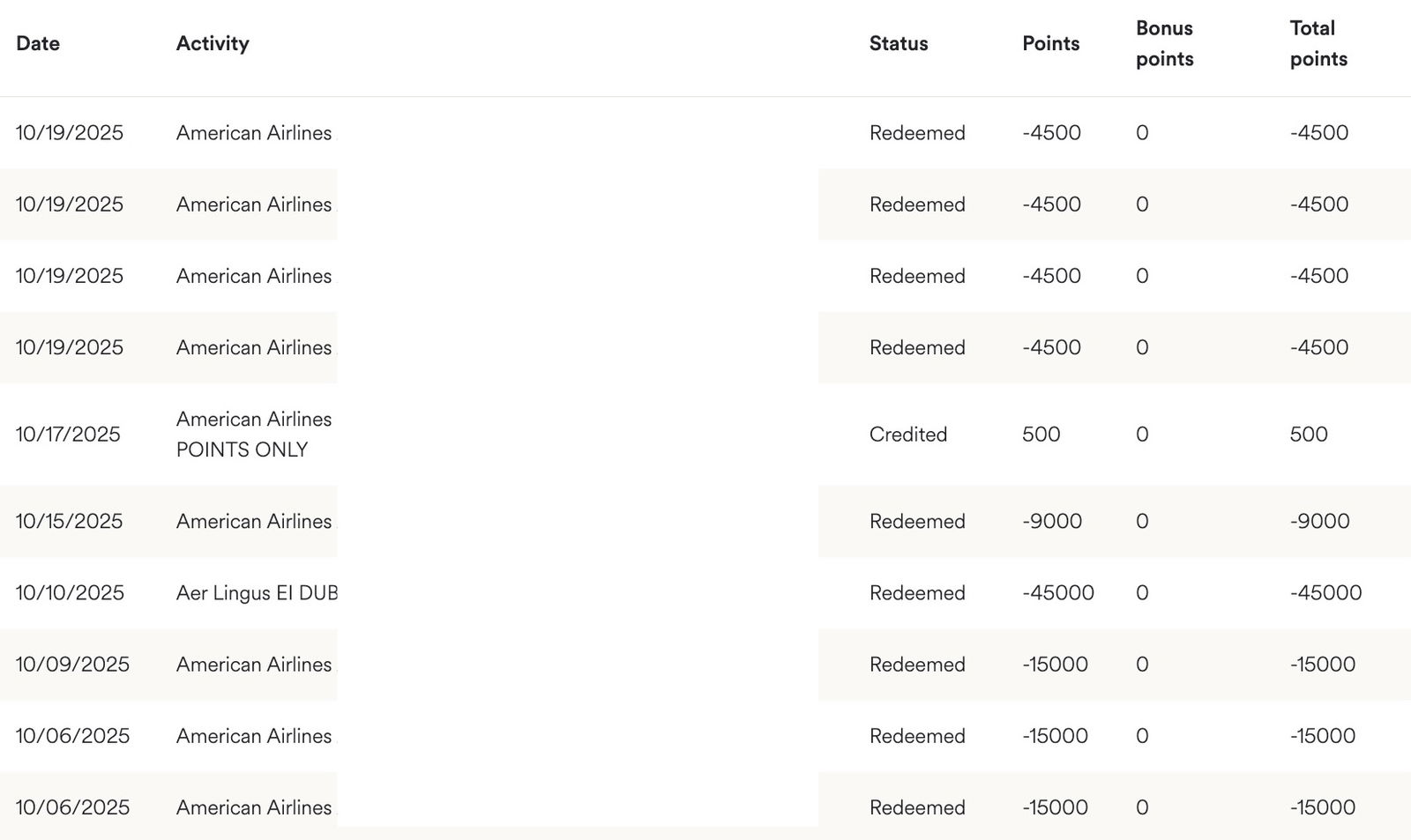

On the most basic level, the welcome bonuses on these Atmos Rewards cards are phenomenal, and there are many great uses of Atmos Rewards points. I know it might not be the sexiest redemption on earth, but I constantly redeem Atmos Rewards points for travel on American, and I find it to be one of the most useful currencies for that.

Jut to prove that, below are my Atmos Rewards redemptions from the last two weeks alone.

So taking advantage of those big bonuses makes a lot of sense, as that will fund a lot of domestic and short haul international travel.

However, I actually think these cards make a lot of sense in the long run, especially the Summit Card. I’ve covered the card perks in great detail separately, so let me simply mention:

- The Atmos Rewards Summit Card is a stellar card, one of the best airline cards we’ve seen in a long time, and I’d say the perks more than justify the annual fee, from the annual 25K-point Global Companion Award, to the waived partner award booking fees, to the Alaska Lounge passes, to the 3x points on international spending, to the ability to spend your way to status, and much more

- The Atmos Rewards Business Card has a more reasonable annual fee, but also has more limited perks; it’s great if you fly Alaska or Hawaiian occasionally, though since I have oneworld elite status, the main potential ongoing perk is the $99 Companion Fare with spending

Bottom line

We’re seeing incredible welcome offers on Atmos Rewards cards, which will be ending soon. While I picked up a couple of cards several weeks back on different dates, Ford just tried applying for the Atmos Rewards Summit Card and Atmos Rewards Business Card the same day, and got instantly approved for both. That’s in addition to applying for the Citi Strata Elite℠ Card (review), but that’s a different story.

With these offers ending soon, I highly recommend applying ASAP, if interested. Atmos Rewards points are super useful, even if it’s primarily “just” for domestic and short haul international redemptions on American, where you can get outsized value.

Anyone else apply for multiple Atmos Rewards cards on the same day?

Mike, I agree, does anyone have suggestions on finding out if the award space is phathom prior to actually booking your flight?

Which bureau did they query ? Assuming just one hard pull.

It. Depends. On. Your. State. Of. Residence.

(You really should know that already, unless this is your 'first time,' and if it is your first time, please excuse my sarcasm, and don't worry, there is a learning curve, so please keep at it, this is a 'safe space'... *wink*)

I'm in NY; BofA pulled Equifax.

why not save the sarcasm until you've proven it's required? Or just leave it out all together?

How do you rack up so many Atmos miles if you primarily fly AA? Tell us your strategy

I donno about Ben, but, I'mm'a 'rack up' a buttload on foreign spend using that new 3x category with this Summit card... (I predict they'll scale that back, like US Bank quickly realized their 4% cash-back on the Smartly was unsustainable for their bottom line, which, by the way, one more time, not-cool USB... not freaking cool. Nuked to just $10K each cycle, no taxes. Reminds me of BILT reducing their Double Rent day to...

I donno about Ben, but, I'mm'a 'rack up' a buttload on foreign spend using that new 3x category with this Summit card... (I predict they'll scale that back, like US Bank quickly realized their 4% cash-back on the Smartly was unsustainable for their bottom line, which, by the way, one more time, not-cool USB... not freaking cool. Nuked to just $10K each cycle, no taxes. Reminds me of BILT reducing their Double Rent day to just 1,000 bonus points, and worst of all... no more trivia!)

@ Geni -- While I'll rack up quite a few on an ongoing basis for spending, historically I've earned them in a few different ways. For example, I transfered some Amex points to Hawaiian before that partnership ended. Furthermore, thanks to the points sharing that's now allowed between accounts for free if you have the Summit Card, I moved over points from Ford's account and from my dad's account, since they had balances from having Alaska cards back in the day.

Thanks for the reply; that makes sense! Many folks got a lot of Atmos points through Amex. Also, as a relatively new reader, who's Ford?

Hi Ben,

Can you write an article about how to deal with all the AA phantom availability when trying to use Alaska Atmos points? Like there are so many times I've searched for AA space and it pops up and I get through the whole process of putting in payment details and everything, then it errors out at the end.

Thanks!

This phantom issue is the bane of my existence.

Bane, you say?

Peace has cost you your strength. Victory has defeated you...

You merely adopted the dark; I was born in it, molded by it!!!

@ Mike -- Interestingly, that's something I've never dealt with, probably because I never start my award availability search on Alaska's website. I always find American award space through ExpertFlyer, and if it's available there ("U" for business class and "T" for economy), I've never had an issue ticketing it through Atmos Rewards.

It's a Citi Strata Elite & BofA Alaska Atmos app-a-rama! *gong*

What I truly don't understand, given your wealth, is why you play the credit card/points game at all.

For. The. Love. Of. The. Game. Dawg.

There are more fulfilling and prosocial "games" out there. Have you considered teaching?

Are you 'recruiting' on here? Ya gotta 'sweeten' this honeypot, bud.

Ben, you mentioned Ford didn’t have any Bank of America or Atmos Rewards cards, but did you? Specifically, did you have the legacy Alaska Visa when you applied for the Atmos?

@ Todd -- I had a couple in the past, but not at the time that I applied for the cards.

If you are 0/24 and have a bunch of cards you are thinking about, would you generally recommend that you apply for them all in the same day? Genuinely curious about this especially as more folks think about a P2 strategy and incorporating cards like Strata Elite, C1 Venture X, etc. that may care more about whether you are 0 or 1/24, etc. No clue how long “the systems” takes to update - presume with...

If you are 0/24 and have a bunch of cards you are thinking about, would you generally recommend that you apply for them all in the same day? Genuinely curious about this especially as more folks think about a P2 strategy and incorporating cards like Strata Elite, C1 Venture X, etc. that may care more about whether you are 0 or 1/24, etc. No clue how long “the systems” takes to update - presume with checks against multiple different vendors, it may take a little while for them to communicate with each other?

Remember applying for them all on the same day also means having to put an enormous amount of spend (for the bonuses) across those cards in the same short amount of time.

I suppose the holidays are coming up which may mean a lot of planned spending for gifts. However, if you're someone like me who doesn't have any friends to buy gifts for, my gift-giving expenditures over the holidays are pure cash (as is customary to residential building staff in New York City).

Yep. I hear you. The building staff would not take kindly to gift cards from the Capital One shopping portal, sadly.

@ Peter -- It depends how many cards you plan to apply for, but yes, personally if I have several cards on my radar, I prefer to apply for them all the same day. Sometimes it takes a couple of days for a new card to show on a credit report, and other times it can take weeks. But I tend to think there's merit to just applying as quickly as possible, before there's any ding from inquiries on the credit report (not that it should make a huge difference for most).

Very helpful, thanks!

If you or anyone is 0/24, for the love of... apply C1 first. Those picky sons of... then Chase... then Citi... then BofA... finally, Amex.

If you or anyone is 0/24, for the love of... let's hope you've just started.

Or this isn't your game.

0/24 you might as well just use a bank debit card.

Eskimo, perhaps, instead of punching-down, and assuming those at 0/24 are deadbeats... have you considered, oh wise sage, that maybe, just maybe, those at 0/24 are the most disciplined among us... waiting... patiently... for that perfect moment to strike!

...C1 Venture X. Submit. "APPROVED." (instantly) *GASP*