Link: Learn more about the Atmos™ Rewards Summit Visa Infinite® Credit Card

We recently saw the launch of the $395 annual fee Atmos™ Rewards Summit Visa Infinite® Credit Card (review), which is the new premium personal credit card of Alaska & Hawaiian, coinciding with the introduction of the Atmos Rewards program.

There are lots of reasons to get this card, from a huge welcome bonus, to the ability to spend your way toward status, to the great perks, ranging from Global Companion Awards, to Alaska Lounge passes, to waived partner award booking fees, to free points sharing. It’s a card I’ve already applied for.

In this post, I’d like to talk about the rental car coverage offered by the Atmos Rewards Summit Card. I know many people have been curious whether the card offers this benefit, and if so, how it works. So let’s take a look at everything you need to know, as it’s very good news. Separately, I’ve covered the card’s travel protection, including for delayed flights, lost bags, and more.

In this post:

Primary auto rental collision damage waiver basics

One thing that travelers should look for in a premium credit card is good rental car coverage, given how valuable this can be when things go wrong. Fortunately, the Atmos Rewards Summit Card offers primary auto rental collision damage waiver coverage, which is what travelers should be looking for.

To start, let me emphasize that you should always consult the cardholder benefits guide, since these benefits are subject to change. You can access that by logging into your account, going to the “Statements & Documents” section, and then clicking on “Your Cardholder Benefits Guide,” which will then populate a PDF.

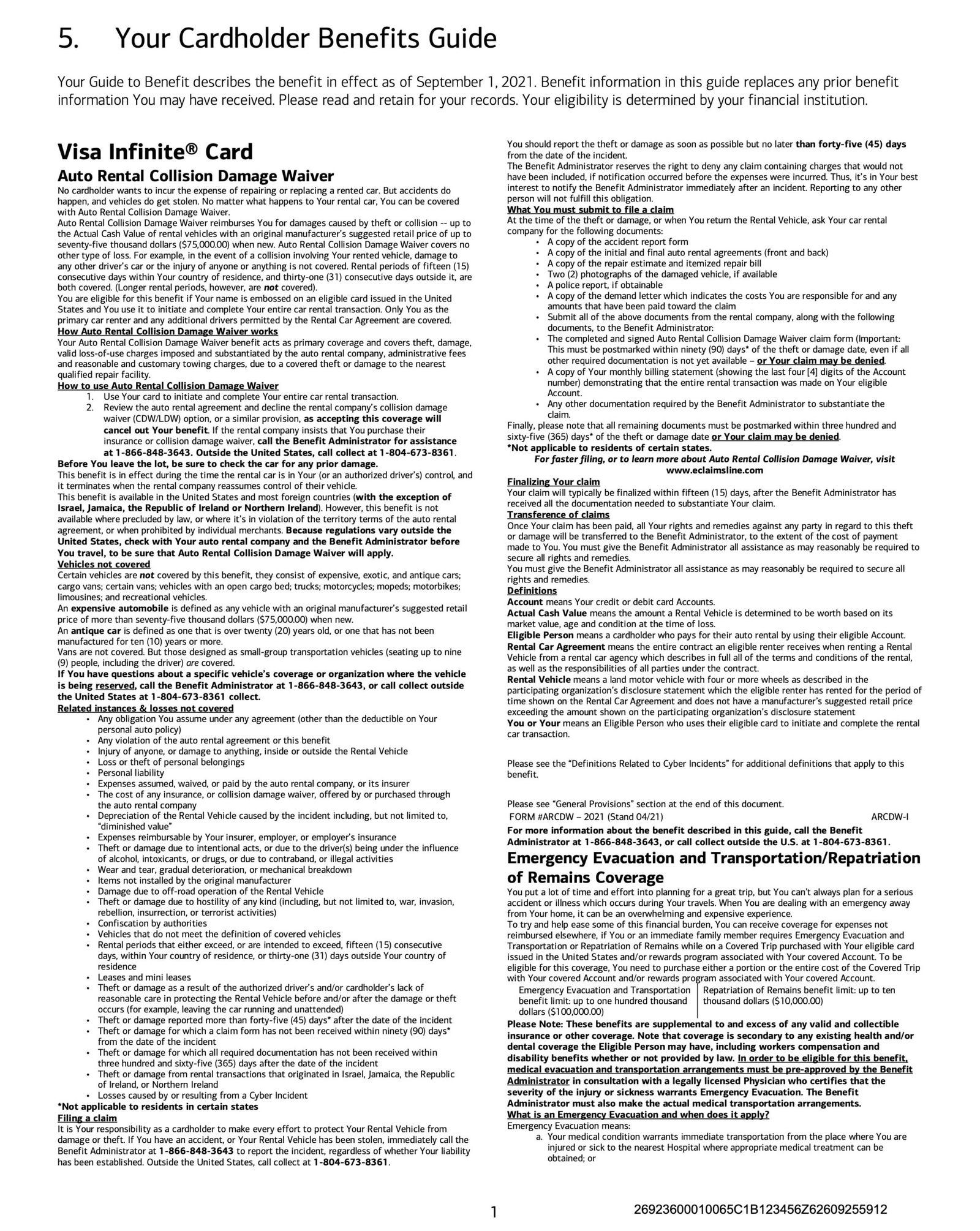

Below is the relevant part of the cardmember guide (you can open this in a new window to view a higher resolution version).

The Atmos Rewards Summit Card is a Visa Infinite Card, so it offers the type of rental car coverage you’d expect to find on such a card. Again, consult the benefits guide, but here are some of the things that I think are worth emphasizing:

- This is auto rental collision damage waiver coverage, which reimburses you for damage caused by theft or collision (this doesn’t provide any sort of insurance for bodily injury, etc.)

- This is primary rental car coverage, rather than secondary coverage, meaning it’s not supplemental to other coverage you have (that’s a good thing)

- This applies for cars with an MSRP of up to $75,000, on rentals of up 15 consecutive days in your country of residence, and up to 31 days outside your country of residence

- Vehicle types not covered include expensive, exotic, and antique cars, cargo vans, vehicles with an open cargo bed, trucks, motorcycles, mopeds, motorbikes, limousines, and recreational vehicles

- You need to pay with your card to be covered, and only you as the primary renter plus any additional drivers permitted by the rental agreement are covered

- The benefit is available in the United States and most foreign countries, with the exception of

Israel, Jamaica, the Republic of Ireland, and Northern Ireland - To file a claim, contact the benefits administrator at 866-848-3643

This might be the best card for foreign rental car spending

It’s great that the Atmos Rewards Summit Card has a rental collision damage waiver benefit, given what a useful perk this is for frequent travelers, since rental car agencies typically otherwise charge quite a bit for this protection.

But as I see it, there’s another thing that makes this card especially great for rental car spending. Specifically, the card offers 3x points on foreign purchases. So not only do you have great coverage when renting cars, but this is among the best return you’ll get on rental car spending abroad. You can even boost that to 3.3x points if you have an eligible Bank of America account, given the 10% points relationship bonus offered.

Bottom line

The Atmos Rewards Summit Card offers global primary rental car coverage, with the exception of rentals in a small number of countries. Of course you’ll always want to consult the cardmember agreement, but this is about as good as it gets. Best of all, the card even offers 3x points on foreign purchases, making this a pretty unbeatable card for spending abroad.

What do you make of the Atmos Rewards Summit Card rental car coverage?

Minor point of BofA Website Navigation: “Your Cardholder Benefits Guide” didn't show beneath "Most Recent" for me but I did find by it scrolling down to "View All" and expanding "Notifications and Letters"

Just checked to see If I can get a One Way Fare from Europe to California, Only 250,000 miles required per person via Atmos !

What a rage bait. I just booked J VIE-JFK for 45,000 Atmos in December. Move along.

CSR coverage is secondary for NYS residents who have other auto coverage. Disappointed when this change happened a couple of years ago. Does Atmos card have the same exception, or is their coverage primary even for NYS residents?

I believe this is primary for NY as is C1VX.

Honestly think C1 could run an ad outside their new LGA and JFK lounges that says “Sapphire Reserve took away primary rental car insurance for NY. Funny, our card still has it. And we have brand new and better lounges in the exact same terminals in NY. What’s in your wallet?”

I’m sure someone in marketing can make that pithier.

Another nail in the Chase Sapphire Coffin. With ATMOS covering Primary Rental Car insurance, no need to maintain a Sapphire Card for that benefit.

How does this compare with the Chase Sapphire Reserve primary auto rental collision damage waiver? Should Atmos be my preferred card for car rental?

Chase sapphire reserve covers Ireland Jamaica and Israel etc

Anyone know if a convertible is considered "exotic"? I rent these a lot in Hawaii.

Jeeps are not exotic.

Anyone know why Ireland is excluded?

Just go drive there and see how many rental cars have torn off mirrors. Things are narrow - with a stone wall on one side zero shoulder and an oncoming tour bus - all on a 18 foot wide road.

I got a diners club way back when to deal with the lack of insurance in Ireland. Italy has been on the "not covered" list for certain credit cards as well.

Italy is not on the list because car rental already comes with insurance included (mandatory).

Not sure what the deal is with Ireland.

This also beats CSR for NY residents, who only get secondary coverage with their CSR if they already have auto insurance.

Had no idea that vehicles w open cargo bed were excluded. Is this common for other cards with primary coverage (Altitude Reserve, Venture X, Chase Sapphire)? I just rented a pickup in Hawaii and wonder if I didn't have the coverage I thought I did (used Altitude Reserve). If there is a card that doesn't exclude it I'd like to know. If not, I won't request a pickup for my paddleboard next time I go to Hawaii.