We recently saw the introduction of the Mesa Homeowners Card. Okay, that’s not exactly the sexiest card name, and the card’s lack of obvious affiliation with a major bank might make some people skeptical. However, the card offers some really good benefits, all with no annual fee.

I’m trying to decide whether to apply for this myself, so let me cover all the details, because (dare I say) this almost sounds too good to be true.

In this post:

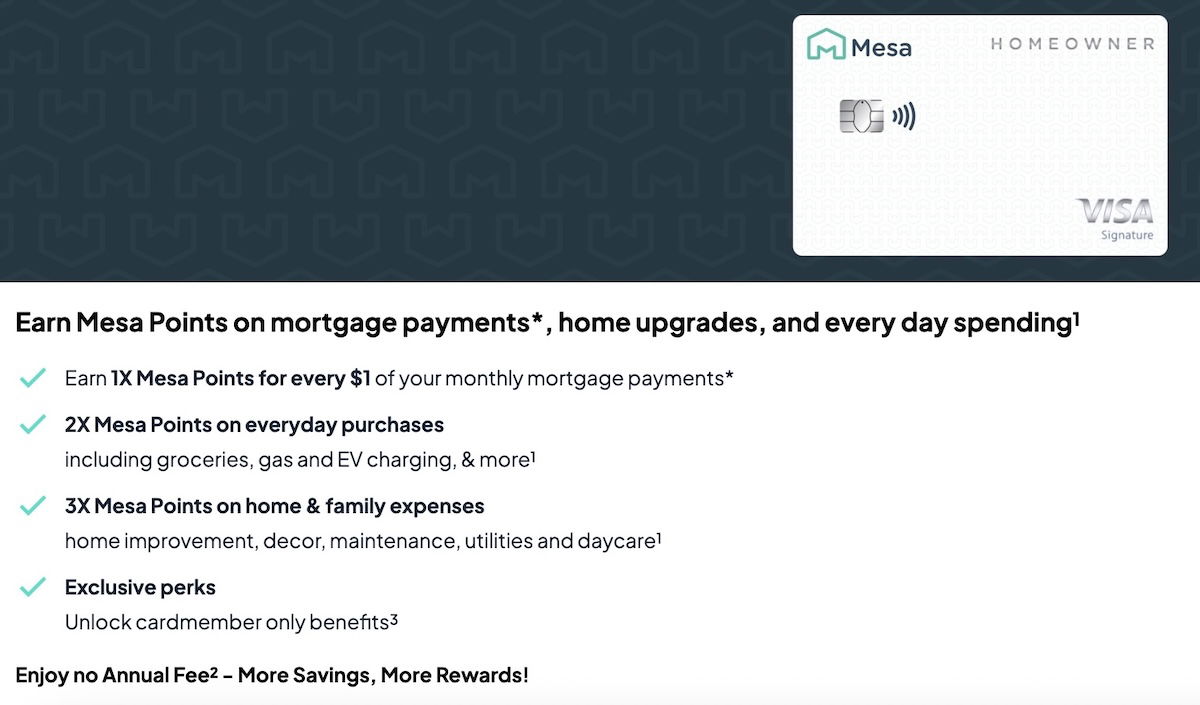

Basics of the Mesa Homeowners Card

The Mesa Homeowners Card is a Visa Signature product issued by Celtic. It has no annual fee, gives you points for paying your mortgage (without even using the card!), and even offers some credits that can help you come out ahead.

On the surface, I’m almost suspicious of this concept, because I don’t understand how exactly Mesa is supposed to make money. Then again, I largely had the same skepticism when Bilt first launched, yet Bilt is still chugging along, and at least has a very high valuation. Think of Mesa as being to mortgages as Bilt is to paying rent (even though we know that Bilt also plans to get into the mortgage space).

Mesa Homeowners Card points for mortgage payments

The Mesa Homeowners Card offers offers 1x points on your mortgage payments, up to a maximum of 100,000 points per year. You don’t even have to use your Mesa Homeowners Card to pay your mortgage, but instead, you just need to make $1,000 in qualifying purchases on the account per billing cycle to unlock that.

The way it works is that you connect your bank account from which your mortgage is debited to the Mesa app, and then Mesa will give you points for that amount. It’s my understanding that there’s typically little verification and validation when it comes to this. Yes, you’re literally getting points without using the card for those purchases, though you do have to make $1,000 in purchases per billing cycle.

Mesa Homeowners Card 1-3x points rewards structure

Beyond the ability to earn points simply for paying your mortgage, the Mesa Homeowners Card has the following rewards structure, all with no foreign transaction fees:

- 3x points on home & family expenses, including home decor, home improvement, general contractors, cable and streaming services, home insurance, property taxes, maintenance, telecommunications, utilities, and daycare

- 2x points on groceries, gas, and EV charging

- 1x points on other eligible purchases

Those 3x points categories seem super lucrative to me. For example, 3x points on general contractors, property taxes, and daycare, all seem like unique bonus categories that you won’t find on other cards.

Anecdotally, I’ve heard that paying income taxes and HOA fees with the card also triggers the 3x points, but I can’t guarantee that will continue to be the case, and don’t have any firsthand experience.

Mesa Homeowners Card welcome bonus of 5,000 points

Here’s the bad news — the Mesa Homeowners Card doesn’t have a substantial sign-up bonus. There’s no publicly available bonus, though if you sign-up through a refer a friend link, both the person referring and person being referred can get 5,000 points.

Mesa Homeowners Card referral offer of 50,000 points

Separate from the standard refer a friend offer, the Mesa Homeowners Card has a lucrative new promotion for both new and existing users. Specifically, if you successfully refer two people to the card and then spend $10,000 on your own card within 90 days, you’ll receive 50,000 bonus points, for a total of 60,000 bonus points (including the 10,000 points for the two referrals).

That spending bonus has the ability to be very worthwhile, especially since you can potentially unlock it while spending in categories that are eligible for bonus points.

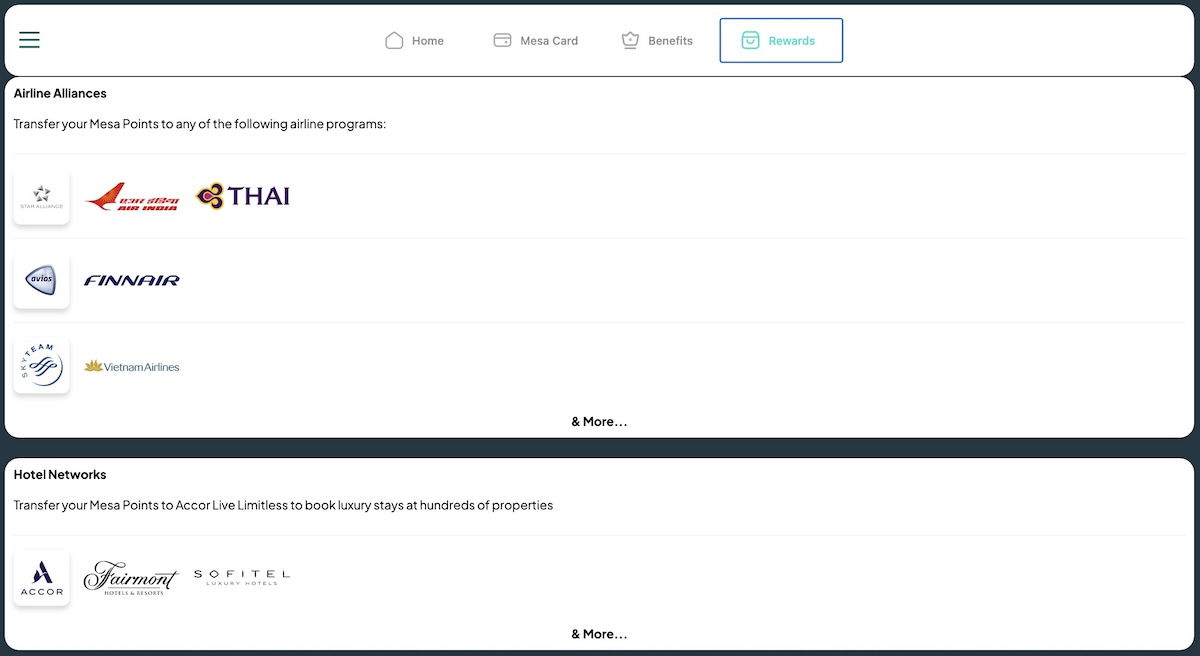

Mesa Homeowners Card points redemption options

Mesa points can be redeemed in a variety of ways. You can redeem them toward gift cards at the rate of 0.8 cents per point, or toward statement credits at the rate of 0.6 cents per point. That’s not terribly exciting, though fortunately it’s also possible to transfer points to travel partners.

Mesa points can be transferred to the following travel partners (all at a 1:1 ratio, except Accor, which is at a 1.5:1 ratio):

- Accor Live Limitless

- Air Canada Aeroplan

- Air India Maharaja Club

- Finnair Plus

- Hainan Airlines Fortune Wings Club

- SAS EuroBonus

- Thai Airways Royal Orchid Plus

- Vietnam Airlines LotusMiles

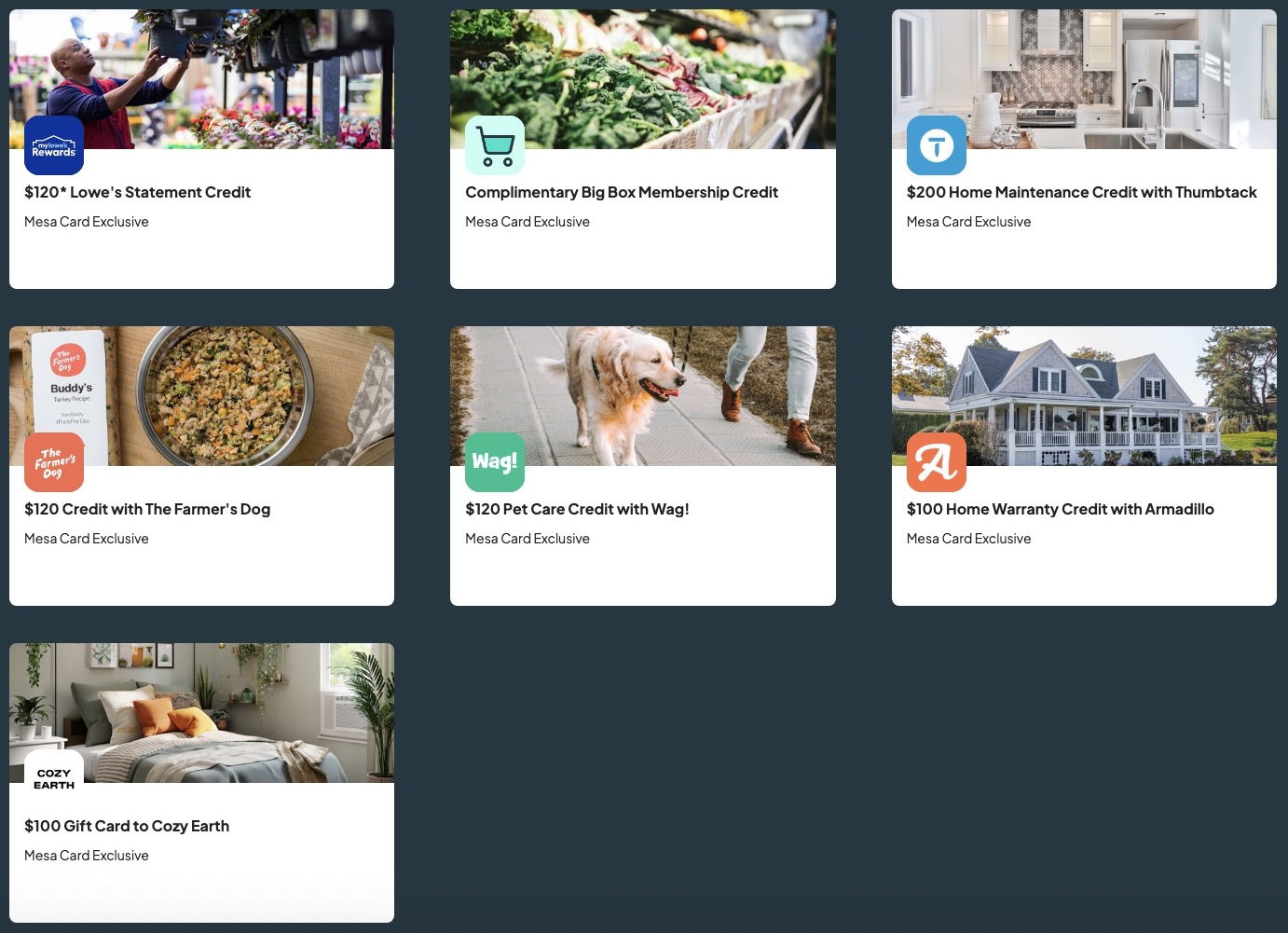

Mesa Homeowners Card credits & benefits

Despite being a no annual fee product, the Mesa Homeowners Card offers a surprising number of credits and benefits, which in and of themselves could make it worthwhile to acquire the card. Here are some of the credits offered, with enrollment generally being required, and some offers only being valid the first year:

- A complimentary big box membership credit of up to $65, toward a membership for Costco, Sam’s Club, and BJ’s

- Up to $200 per year in home maintenance credits with Thumbtack, in the form of a $25 credit per job

- Up to $120 per year in Lowe’s statement credits, in the form of a $30 quarterly statement credit

- Up to $120 per year in credits for The Farmer’s Dog, in the form of a $10 monthly credit

- Up to $120 per year in Wag! credits, in the form of a $10 monthly credit

- Up to $100 in Cozy Earth gift cards, for home essentials & bedding

- Up to $100 in home warranty credits with Armadillo, toward a home warranty deductible

Is the Mesa Homeowners Card worth it?

A no annual fee card that gives you points for paying your mortgage, offers credits, and even has some awesome bonus categories? Sounds pretty great, no? Here’s my take, because I’ll admit, I was a bit skeptical at first.

In fairness, the card doesn’t have a very big welcome offer (unless you can refer two people to the card), so I suppose many people would consider there to be an opportunity cost to this application, compared to the larger welcome bonus they could get on another card. In theory, cards aren’t mutually exclusive, but I know some people try to keep their total number of inquiries down.

With that out of the way, this card really seems like a no brainer for many, if you don’t mind picking up another card:

- If you pay a substantial mortgage, then earning points for that is fantastic, and worth taking advantage of

- Yes, you have to spend $1,000 per billing cycle, but I think that could be worth the effort, especially with the bonus categories, and could be done with minimal (or no) opportunity cost

- Speaking of the bonus categories, there are some really lucrative published ones, like 3x points on property tax payments, which in and of themselves may be a good reason to pick up this card

- The transfer partners aren’t the most exciting on earth, and I don’t think there have been any transfer bonuses yet, but still, given the earnings rates, that’s not a huge issue

- The credits seem like the icing on the cake, especially the membership club fee statement credit

I’ve gotta say, I’m seriously considering applying for this card, but am curious to hear how OMAAT readers feel, and if anyone has firsthand experience.

I guess my one hesitation is that with these new concepts that I don’t know much about, I always wonder how sustainable the business model is, and how long it is until serious changes are made. Then again, I had that same skepticism with Bilt, and it seems to have worked out pretty well for them, so…

Bottom line

The no annual fee Mesa Homeowners Card is an interesting product that’s worth a look, if nothing else. The card offers points for paying your mortgage (without even putting the mortgage cost on the card), as long as you spend at least $1,000 on the card per billing cycle.

Even beyond that, the card offers unique bonus categories, like 3x points on everything ranging from property tax payments to daycare. The icing on the cake is that the card even offers credits, despite not having an annual fee. It sure feels to me like this card borders on being too good to be true, so I’m mighty tempted to apply.

What do you make of the Mesa Homeowners Card?

lol this post

How to get off the waitlist in Oct 2025?

Had $8k in city permits to pay for, applied got approved and card ready to use on app instantly. Coded as utility so got 3x. Should hit 50k sub with $12k spend. Linked checking account that I don’t pay mortgage with thru Plaid. Had to upload mortgage statement on app to verify and approved within 1 day. Made purchase on Lowe’s and got $30 credit next day. So far love the card. Hope it last!

Use my code to apply: fb9nek

Thx!

i have 3 separate mortgages. can i get credited with points on all 3?

Only for your primary home.

Hi! I'd greatly appreciate it if you would consider using my referral code. Thanks!!

We both get 5,000 bonus points if you get approved and spend. Use my code to apply: jtcxfc

Terms apply. https://mesa.onelink.me/odOT/gge86l53?referral_code=jtcxfc

If anyone else is looking for a referral code, mine is below:

https://mesa.onelink.me/odOT/gge86l53?referral_code=detfvj

I would welcome use of my referral code. Many thanks!

https://mesa.onelink.me/odOT/gge86l53?referral_code=pyegt9

I love my Mesa card. Finally a card I can earn points on mortgage.

We both get 5,000 bonus points if you get approved and spend. Here is my code: w82bc2

Do you know how many mortgages you can pay and get points?

Understand that the hotel partners are the same because all three hotels are part of the same group. I think the 3x points is only useful if you value the transfer partners but much like the other card mentioned, the transfer partners are limiting. I think the other benefits such as the money toward certain shops/retailers is a common trend but is only useful if you shop at those establishments as it is not for...

Understand that the hotel partners are the same because all three hotels are part of the same group. I think the 3x points is only useful if you value the transfer partners but much like the other card mentioned, the transfer partners are limiting. I think the other benefits such as the money toward certain shops/retailers is a common trend but is only useful if you shop at those establishments as it is not for a general category. Further, interesting how it only applies to mortgages but nothing if you own it outright.

Adding another referral code for those that have better luck than i did.

6jpdm6

I tried applying but they wrote me they needed to review something and it would be 1 to 2 business days. Been 2 weeks now so I assume its a no? Bizarre.

Adding another referral code to the mix so we can both benefit: kvghtr

Thanks!

This sounds like a classic Ponzi scheme

Use my referred code: dgjgdk

You don't have to allow them to see your bank activity. You can also email them your mortgage statement

What if your property taxes are tied in with your mortgage? Is there a way to get the 3x on the property taxes if your bank shows the mortgage payment that includes the property taxes?

I have been a cardholder for several months now. I have not redeemed any points, however, outside of transfers, the best value appears to be booking travel where points are worth more than $0.01. I have used them for estimated federal taxes the last 3 quarters and have earned 3x on the payment and also 3x on the fees. I have been very pleased with the benefits and think it's an absolute no brainer for...

I have been a cardholder for several months now. I have not redeemed any points, however, outside of transfers, the best value appears to be booking travel where points are worth more than $0.01. I have used them for estimated federal taxes the last 3 quarters and have earned 3x on the payment and also 3x on the fees. I have been very pleased with the benefits and think it's an absolute no brainer for anyone with a decently sized mortgage, estimated federal taxes, and if you can take advantage of the various rebates. I also know the CEO personally who is brilliant and a great leader. I'm excited for this product and the promise it holds, particularly when I need to refi my mortgage in the future. Here's a referral code if anyone needs it!

https://mesa.onelink.me/odOT/gge86l53?referral_code=k4ke92

Can your friend the CEO shed any light on how to get off the waitlist?

Mesa just closed everyone's account and limited point redemption. Can you ask the CEO for clarification as it looks like they are going out of business and people might lose their points and/or only be able to redeem for subpar value.

Decided to give it a try and was approved immediately. Thanks to Craig M for the referral code.

For anyone else considering applying my referral code is ykpcwk - would appreciate it!

No annual fee. 1x points on monthly mortgage payments (not necessarily paid on card); 3x on property taxes & insurance; Points transfer 1:1 to Air Canada. Makes this a no-brainer. Use my link and we both get 5k bonus points too. Thx.

https://mesa.onelink.me/odOT/gge86l53?referral_code=6nxh5x

Ben - I'm confused how you have a refer-a-friend link but say you are still considering whether to apply.

@ Nate -- You don't need to have the card to refer other people to it. You can just download the Mesa app and sign-up for an account, without getting the credit card.

Adding another referral code to the mix - 2tnxmx

Great card and a no brainer if you have a mortgage!!!

Numerous DP on Facebook physician moms group (Pointme to first class) indicate that federal tax payment as well as processing fees code for 3x. That was a clincher for me to sign up.

Feel free to use my referral code, you’ll get 5k for signing up (as welll as I):

ewntxm

Hmm, I'll wait for Bilt to support it. I already have a card with Elan (for Fidelity) and I try to only do business with one sketchy company at a time.

Elan is sketchier than Bilt in your mind? Bilt is better now that Evolve Bank isn't the issuer.

Elan is really US Bank as the issuer.

In all serious, I do remember Elan being annoying to work with due to poor tech, but that was a few years ago.

So far great card. Whether it is sustainable we will see. I just had to upload a mortgage statement to prove my number was correct. I live in a townhouse do get to the $1000 by using my condo fees, utilities etc at 3x whereas previously it came out of my checking. You don’t need to pay your mortgage with the card. Could use my Lowe’s credit immediately and about to get my Costco membership...

So far great card. Whether it is sustainable we will see. I just had to upload a mortgage statement to prove my number was correct. I live in a townhouse do get to the $1000 by using my condo fees, utilities etc at 3x whereas previously it came out of my checking. You don’t need to pay your mortgage with the card. Could use my Lowe’s credit immediately and about to get my Costco membership reimbursed. Transfer partners include aeroplan and avios.

Basically for me there is no opportunity cost. It bonuses where I had no bonus and I use my other cards for dining, groceries etc. Basically approximately 50-60k extra points per year for me for no annual fee

If you do apply and want to get the 5k “sign up bonus” feel free to use my code: vwhttp.

Have had the card since Jan. Been great so far specially since they added Aeroplan as a transfer partner and it was instantaneous. I put a 1000 dollars whenever I am not trying to reach a sub on another card.

In July they had a 50k bonus for 6K spend. Did it over three months to maximize mortgage return of 5K. So 65K on 3k spend for a no annual fee card was pretty satisfying.

I worked with folks at Mesa and with Mesa on some of their backend. I have seen a lot in the world of creative fintechs, cobrands, and points, but honestly, nothing ever felt quite so sketch as Mesa. I wouldn’t touch it with a ten foot pole.

Their business practices seem really fishy. They offer 50k at the outset in late May, then pull the offer in a week. Now they have a new sign up offer, extend it for two weeks but have been putting everyone on a waitlist for the past several days. I'll probably just wait for Bilt - Mesa is just giving, as the kids say, the ick to me.

Have you had any luck getting off the Mesa waitlist?

For those of us waiting for Bilt mortgage, it’s only with United Wholesale Mortgage.

This really is a brilliant card for homeowners. Feel free to use my referral code for 5K points: mhtany

Great card on many levels as described. Non problems with 3x w painter, electrician, carpenter. Set and forget utilities and helps with hitting the $1k per month spend tea’s for the bonus mortgage points. Lots of value here.

If you are interested in applying would be grateful if you use my referral code. Thanks!!

e26p5p

For those of you who are wondering about applying now, just wanted to let you know that I had no trouble getting this card using a referral code from this comment stream. I downloaded the app August 24th and applied and it took only minutes to be approved. I had the card number and was able to use it online right away. The 5,000 referral bonus miles appeared on my account the following day.

If anyone needs a referral code, mine is 8nx8v3

What if your don't have your mortgage with a bank but with a mortgage lender - does this still qualify?

You're linking to the bank account you pay the mortgage with.

I applied July 22nd with a referral code and was given the "we need more information" message. I'm curious if the mortgage amount ($5K) is why? Are they just accepting lower mortgages so they dont have to give out as many points? Anyone get accepted in late July/August?

Ty!

For everyone wanting the card but stuck on a waiting list, it appears using a referral link works, with a 5K SUB. There are some in this thread, thanks in advance if you use mine!

https://mesa.onelink.me/odOT/gge86l53?referral_code=e26p5p

I got in on the 50k SUB for eventual transfer to ALL. Everything has worked exactly as advertised. Received card and same day 1. Renewed by Costco mbrship for free 2. Got $50 credit at Lowe’s 3. Got free pillowcase protectors 4. Paid my HOA; USAA insurance; & Home Warranty fee to meet the $1k spend all at 3x (over 3 months will also take care of the SUB spend). So far so good &...

I got in on the 50k SUB for eventual transfer to ALL. Everything has worked exactly as advertised. Received card and same day 1. Renewed by Costco mbrship for free 2. Got $50 credit at Lowe’s 3. Got free pillowcase protectors 4. Paid my HOA; USAA insurance; & Home Warranty fee to meet the $1k spend all at 3x (over 3 months will also take care of the SUB spend). So far so good & about to be awarded 1x on my mortgage pmt. Guys who own used to be with Bilt so know what they’re doing!

Please use my referral code if you decide to apply, thank you: emwmcd

Bilt gets kick-backs from enough apartment companies to make it worth it. This is literally giving you lots of points for nothing, just $1000 in monthly spend. But here is where the math makes me scratch my head. The target market is obviously families, and while I can’t speak for other families, an overwhelming portion of our discretionary spending is daycare, and most of the rest is groceries. Imagine we put all spending on this...

Bilt gets kick-backs from enough apartment companies to make it worth it. This is literally giving you lots of points for nothing, just $1000 in monthly spend. But here is where the math makes me scratch my head. The target market is obviously families, and while I can’t speak for other families, an overwhelming portion of our discretionary spending is daycare, and most of the rest is groceries. Imagine we put all spending on this card that is payable by card, 87% would be bonused. This can’t be profitable unless they are getting an amazing deal on points transfers.

Agree with being careful about linking your account. Would also mention their transfer partners are nothing so special....

Applied and was told they were reviewing my application, then got an email saying the following. lol.

"Thank you for your application for the Mesa Card, issued by Celtic Bank. The following information is needed to process your application:

No additional information is required at this time."

Ha run by now Larry and….

I got this same message. Did it ever move from there. It is bizarre.

I got a waiting list indication as well. I assume its just a waiting game at this point for that to clear up?

I wanted to apply, but got a message that I need to join the waitlist. So I joined the waitlist.

And now waiting for a month already

You can apply now. Just use the code dgjgdk

Even if I don’t keep spending 1000 per month so that I don’t earn points from mortgage, can I still get Costco membership fee covered beyond the first year? That alone sounds tempting.

The $65 Big Box mbrship fee credit annually + $120 Lowe’s credit first yr + $100 Cozy Earth first year (& lots more if you have a pet!) I think are great, but the real value is 3x in otherwise-overlooked cats + 1x mortgage. I was paying my HOA previously with Bilt for 3.1x AS miles (with BOA relationship bonus) but switched that pmt over to Mesa instead. The extra 1x points on mortgage is worth more than what I was earming with BOA.

Has anyone applied for this card in the last few days? I downloaded the app and it says that I'm on the waitlist for the card.

Am I missing something in terms of how to apply? Any ideas on how long waitlist takes to move to ability to apply?

Use a referral code — We both get 5,000 bonus points if you get approved and spend.

Code: e26p5p

Thanks!

Worth noting that the partnership with Finnair Plus means you can eventually transfer to BA, Qatar or Iberia.

With my valuation of $0.03 per avios (I fly short haul a lot at my own expense), I think that's an excellent return and I'd definitely apply if I were in the US.

I also think the food strategy is probably to direct tax and other spend which would not be eligible on other cards to this card to meet the $1k spend minimum.

Amazing card, but I’m on the sign on bonus train. I’m on like card 90+ after 7 years.

First of all, just sign up for thumbtacks pro yourself and pay yourself.

Second, free Costco membership or Sam’s

Third, Lowe’s credits

Fourth 3x on cell phone, insurance, utilities, cable, day care, etc easily cover 1000 a month.

Fifth: 1:1 transfer to avios, aeroplan and Asia miles.

Godly tier for no fee annual card. MILK IT WHILE YOU CAN!

Thanks for #1 tip!

I tried multiple times to sign up and upload proof of identity, but it rejected me twice, stating that they couldn't verify my ID. I have called and left a few messages with customer support, and no one ever returns my call or answers. I'm not sure if it's growing pains or if this is going to be an ongoing issue.

I had eventual success w email

The transfer partners kind of suck. I don't have a mortgage though, I paid $5.1m cash for the house because rates were too high. I imagine if rates went down then I would have a mortgage.

But getting 3x on property taxes, daycare, and GC would be worth. But how do you get your GC to qualify? There has to be caps. I can't possibly pay for my construction for apartment buildings for contractors that will take it on this and get 3x.

What are you talking about:

Finnair 1:1 gives you access to all of avios programs, BA IB EI and QR

Aeroplan 1:1

Cathay 1:1

It’s godly given this is a no fee card

I paid $5.100001m for my house just to show mine is bigger.

Your wealth manager did you wrong, and you are leaving a ton of money on the table by paying cash over a loan. Let’s round to $5 million and say a 20% down payment or $1 million. For jumbo loans, a 6% interest rate is about as high as it has been in the last 20 years. So at that rate, you would be paying $250kish in interest yearly, declining year over year. Having $4...

Your wealth manager did you wrong, and you are leaving a ton of money on the table by paying cash over a loan. Let’s round to $5 million and say a 20% down payment or $1 million. For jumbo loans, a 6% interest rate is about as high as it has been in the last 20 years. So at that rate, you would be paying $250kish in interest yearly, declining year over year. Having $4 million in assets means you could be making money on it. To keep things simple and conservative, we will say long term dividend producing stock holdings. That would give you 6% a year in qualified dividends, taxed at the 20% capital gains tax rate, leaving you with $192k a year. So already, we are only at -$58k.

But you can also deduct your mortgage interest from your taxable income. Given the home value, it is likely you are making more than $500k a year, meaning $250k of your income would now not be taxed at the 35% tax rate, which is about $87k a year less taxes.

We are already at $29,000 a year you are losing by forgoing a home loan and those are only the most obvious implications and worst case numbers, not utilizing tax advantaged accounts for any of that 4$ million. So, either you need to find a new wealth manager, or you are lying.

Can I use Bilt ACH to pay off Mesa balance since it is home related payment and double dip?

Genius

Payments for Mesa acct balances code as “Bills & Utilities” so doubtful

How does this appear on your credit report? Does it count as a new credi card for banks that track these things like Chase? Thanks!

Hasn’t yet posted as a CL (yey for CSR on Mon) but inquiry prior to approval: MESA/CB/HN/ALY

My referral code is 9rb2kd. Thank you if you use it. I signed up during that brief window when the offer was 50k. I am still making spend on the signup bonus. So far I have made a $34 purchase at Lowes and received $30 credit back. I have also already received the points for my mortgage after 1k spend. I used the Cozy Earth credit. I wouldn't bother with Cozy Earth credit since they...

My referral code is 9rb2kd. Thank you if you use it. I signed up during that brief window when the offer was 50k. I am still making spend on the signup bonus. So far I have made a $34 purchase at Lowes and received $30 credit back. I have also already received the points for my mortgage after 1k spend. I used the Cozy Earth credit. I wouldn't bother with Cozy Earth credit since they are overpriced and you can't combine with any sales they have. So far so good on what they promised. I also have had one customer support request, and they answered the next day.

Incredibly happy so far. I received all of my bonus points on my utilities and hoa fees and 1 points per dollar of mortgage w/o any issues. I transferred all to finair with immediate confirmation. Take advantage as long as this lasts!

My referral code is dyr2hg - appreciate it! Cool card if your mortgage is over 2k!

Be careful about linking your bank account to the card, Mesa is scraping transactions and my guess is they are selling your transaction information.

However, I did look at the Mesa Terms, and you can receive the mortgage credit via "document upload", I don't know what that involves but I assume you can upload a paid mortgage statement.

Actually I didn't "link" anything. They just asked me for the amount of my monthly mortgage payment without ANY documentation. They may have somehow verified it (credit rating company?) but all I gave them was the monthly amount.

My referral code is 8wrfc8 if anyone would like to use it please!

I have a pretty big HOA payment, but no mortgage payment.

I currently pay the HOA via BILT at 1x points (with a much better set of transfer partners).

Is having a mortgage payment a requirement for any points with the Mesa card? 3x on an inferior set of transfer partners might be worth more than BILT's 1x.

I signed up a month ago and have confirmed that I received points for my mortgage (which is paid from my checking account), received 3x bonus for the category spend, and the 5k opening bonus. So far, it’s very legit! My whole $1k qualifying spend was in 3x categories that wouldn’t earn bonuses on any other cards. I’m feeling pretty good about it - especially since they just added two transfer partners this month!

I got the Mesa Card. Here's what I am doing: Healthcare $700/month which is a 3x points category (Healthcare counts in the 3x insurance category). $300 Internet/Hulu/etc. (all 3x category). My mortgage is $5300/month (not paying it with Mesa). If I used one of my 2x points cards I am still getting an extra 12,000 points per year PLUS 63,600 points for my mortgage. It makes perfect sense if you have a decent sized mortgage....

I got the Mesa Card. Here's what I am doing: Healthcare $700/month which is a 3x points category (Healthcare counts in the 3x insurance category). $300 Internet/Hulu/etc. (all 3x category). My mortgage is $5300/month (not paying it with Mesa). If I used one of my 2x points cards I am still getting an extra 12,000 points per year PLUS 63,600 points for my mortgage. It makes perfect sense if you have a decent sized mortgage. (This is on top of the 50k bonus if you spend $5k in 3 months which I signed up for.) I will put the points into Finnair Avios, move them to BA, and then move them to QR.

Health insurance codes 3x? I wonder if car/umbrella will code 3x.

I combined all my insurance premiums with my ins company into 1 pmt & it earned 3x.

Car does...

Perhaps they scrape your bank account data and are selling that off?

Right but that must be pretty boring unless you routinely use debit cards, no? Regardless, having a separate checking account just for mortgages would seem prudent.

"anecdotally I've heard income taxes work as well"

Well in that case make sure you make it as public as possible! Take out billboards! Facebook ads!

so all we gotta do is connect the card to our bank account and then get points for paying our mortgage? what exactly is this socery? are they just logging our purchase patterns from the bank account? how do they make money on this then if i never ever make a purchase?

@ huh? -- Correct, you just have to link the account out of which your mortgage is paid. How do they make money? Well, that's a good question. I suspect it's partly a growth and market share play, as they see the success of Bilt. Keep in mind you have to spend $1,000 per billing cycle to be rewarded in that way, so that's at least something in terms of interchange fees.

I would just create a new checking account specifically for mortgage payments. Easy to do, and therefore no concern for "data harvesting" (not that I make many interesting debit transactions anyway lol).

Sounds too much like Mesa Verde Bank from Better Call Saul.

Does anyone know if you can get points for making extra mortgage payments in addition to the monthly payments?

Yes, we do this

Only requirement is must be only 1 mortgage