The Platinum Card® from American Express (review) and The Business Platinum Card® from American Express (review) are among the most popular premium cards out there.

The cards have hefty annual fees — $695 for the personal version (Rates & Fees), and $695 for the business version (Rates & Fees) — though if you use the cards right, you should get perks that more than offset it.

The main reason I have these cards is because of the great benefits they offer, including lots of credits. If you’re a new cardmember it can be tough to navigate all these perks, given the sheer number of them that exist.

In this post, I figured I’d talk about what you should do as soon as you get the Platinum Card in the mail. If you already have the card and have taken advantage of all the perks, then by all means skip this post, but it’s something I get a lot of questions about. Below is what you should be aware of, in no particular order.

In this post:

Activate your Priority Pass membership

Just for having the Amex Platinum Card you get a Priority Pass membership, which gets you access to over 1,300 lounges around the world. However, you need to specifically request the card in order to take advantage of the perk. To do so, register for Priority Pass at this link. (Enrollment required)

You’ll be asked to confirm your information, and then within a couple of weeks should receive your Priority Pass card in the mail.

Activate your Hilton Honors Gold status

Just for having the Amex Platinum Card you get Hilton Honors Gold status, which gets you room upgrades, club lounge access (subject to availability), free breakfast or a food & beverage credit, etc. This benefit is good for as long as you have the card, though you have to register for Hilton Honors Gold status. (Enrollment required)

Activate your Marriott Bonvoy Gold status

Just for having the Amex Platinum Card you get Marriott Bonvoy Gold Elite status, which gets you perks like room upgrades, enhanced internet, bonus points, late check-out (subject to availability), and more. This benefit is good for as long as you have the card, though you have to register for Marriott Bonvoy Gold Elite status. (Enrollment required)

Sign-up for Global Entry

One of the perks of the Amex Platinum Card is a Global Entry or TSA PreCheck credit. I highly recommend getting Global Entry, since that automatically comes with TSA PreCheck, while the inverse isn’t true.

To take advantage of this just charge the Global Entry or TSA PreCheck fee to your card, and it will automatically be reimbursed. There’s no registration required. You can even use this to pay the fee for a friend or family member, should you already have it.

This benefit applies once every 4.5 years for the application fee for TSA PreCheck® and every 4 years for Global Entry (As Global Entry and TSA PreCheck have to be renewed every five years, this gives you a buffer)

Sign-up for CLEAR Plus

One of the benefits of both the Amex Personal Platinum and Amex Business Platinum is that you get an up to $189 annual credit toward a CLEAR Plus membership. To take advantage of this you need to charge the membership fee to your card. There’s a way to maximize this, though. (Enrollment required)

Just for being a Delta SkyMiles or United MileagePlus member, you can get a discounted membership fee of $119 per year, which is a savings of $60. Then you can add a family member to your account for just $50 more. In other words, your credit can cover two people rather than one.

Designate a preferred airline

One of the benefits of both the Amex Personal Platinum and Amex Business Platinum is that you get a $200 annual airline fee credit. To take advantage of this you need to designate a US airline, with the choices including Alaska, American, Delta, Frontier, Hawaiian, JetBlue, Southwest, Spirit, and United. (Enrollment required)

If you’re an existing cardmember, you can select your airline of choice in January of each year, and if you don’t, your previous selection will roll over. If you’re a new cardmember then you can select your preferred airline.

To verify or select your airline of choice, log into your Amex account, and then click on the “Benefits” tab along the top. Then scroll to the section that talks about the airline fee credit, and you’ll see the link to “select an airline.”

Also keep in mind that whatever airline you designate will also be the airline for which your 35% off “Pay With Points” option applies on the Amex Business Platinum. Choose your airline carefully, especially with the business card.

Sign-up for free car rental status

Just for having an Amex Platinum Card you receive free Avis Preferred, Hertz Gold Plus Rewards, and National Emerald Club Executive status. It’s super easy to sign-up. You can register for all of these status levels on this page or by calling Amex customer service. (Enrollment required)

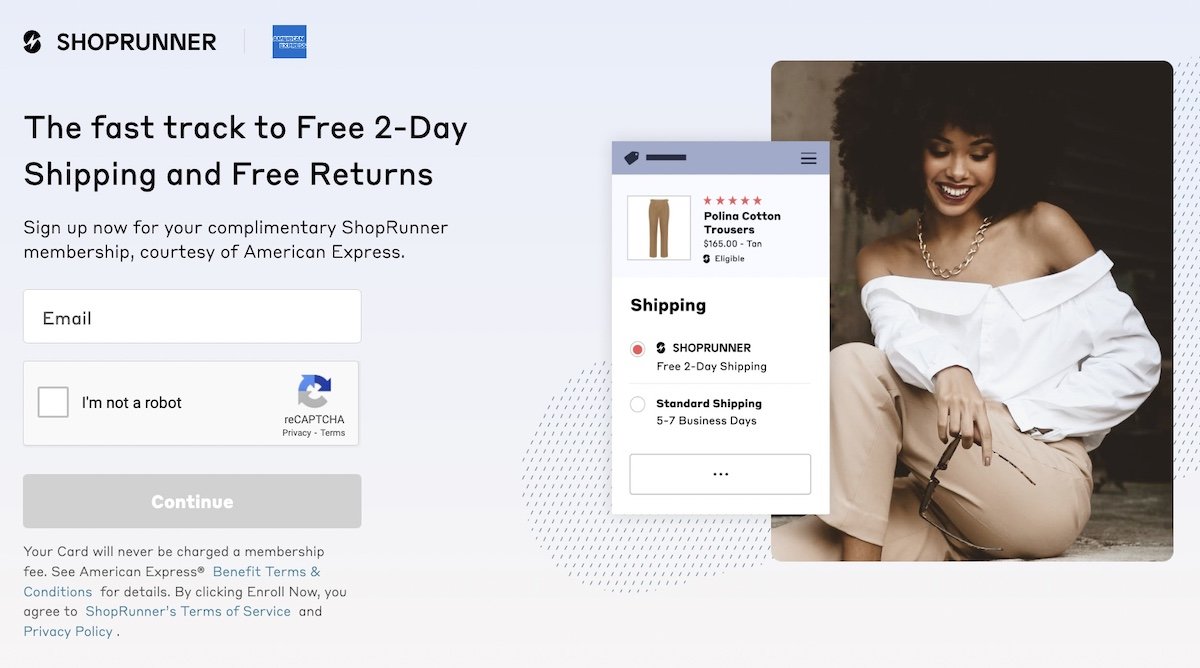

Enroll in ShopRunner for free 2-day shipping

ShopRunner gives you free two day shipping with thousands of brands from 100+ stores. Ordinarily, an annual membership costs $79, but it’s free with an Amex Platinum Card. You can sign-up for this benefit here. (Enrollment required)

Decide if you want to add authorized users

While the Amex Platinum has a high annual fee, you also have the option of adding authorized users at a cost:

- On the personal version of the card, each authorized user costs $195 (Rates & Fees)

- On the business version of the card, each authorized user costs $300 (Rates & Fees)

Why would you want to consider adding an authorized user? They’ll also get access to Centurion Lounges, Plaza Premium Lounges, Delta Sky Clubs when flying Delta, and a Priority Pass membership, along with Hilton Honors Gold status, Marriott Bonvoy Gold status, and more. (Enrollment is required for select benefits)

Use your Uber credits (Personal Platinum only)

The Amex Platinum Card offers $200 in annual Uber credits. That comes in the form of a $15 monthly Uber credit, and in December you get a $35 credit, all of which can be applied toward U.S. rides or U.S. Uber Eats purchases. To take advantage of this just add your Amex Platinum to your Uber profile, and the credit will automatically be applied toward rides.

Use your hotel credits (Personal Platinum only)

The Amex Platinum offers a $200 annual hotel credit. You receive an annual statement credit valid for prepaid bookings at Fine Hotels & Resorts or The Hotel Collection properties (two-night minimum stay required), when booked through American Express travel.

So while there’s no real rush to use this, this is essentially like a free $200 hotel stay; just charge the purchase to your card.

Enroll for digital entertainment credits (Personal Platinum only)

The Amex Platinum Card offers $240 in annual digital entertainment credits. The way this breaks down, you can get $20 in monthly statement credits on eligible subscriptions purchases with Peacock, Audible, The New York Times, Disney+, The Disney Bundle, ESPN+, and Hulu. This is a great deal if you otherwise have subscriptions with one (or more) of these services. (Enrollment is required for select benefits)

Enroll for Equinox credits (Personal Platinum only)

The Amex Platinum Card offers up to $300 in statement credits each year on a digital or club membership at Equinox. (Enrollment required)

This will be useful to those are Equinox members or have an Equinox location close to them, while for others this probably won’t be worth it. You need to enroll for the Equinox benefit.

Enroll for Walmart+ credits (Personal Platinum only)

The Amex Platinum offers up to $155 in annual Walmart+ credits. The way this works, receive a $12.95 monthly credit toward a Walmart+ membership, which covers the entire cost of it. Walmart+ can save you money on shipping and delivery of Walmart purchases, as well as on prescriptions and gas. You need to enroll for the Walmart+ benefit.

Enroll for Saks credits (Personal Platinum only)

The Amex Platinum Card offers $100 in annual Saks credits. That comes in the form of a $50 credit in the first half of the year, and a $50 credit in the second half of the year. Those apply to purchases made in-store or online with Saks. You need to enroll for the Saks benefit.

Use your Dell credits (Business Platinum only)

The Amex Business Platinum Card offers $400 in annual Dell credits. That comes in the form of a $200 credit in the first half of the year, and a $200 credit in the second half of the year. Dell sells all kinds of products that you might not expect, so this should be pretty easy to take advantage of. (Enrollment required)

Use your wireless credits (Business Platinum only)

The Amex Business Platinum Card offers $120 in annual wireless credits, in the form of a $10 monthly statement credit toward purchases made directly from any U.S. wireless telephone provider. (Enrollment required)

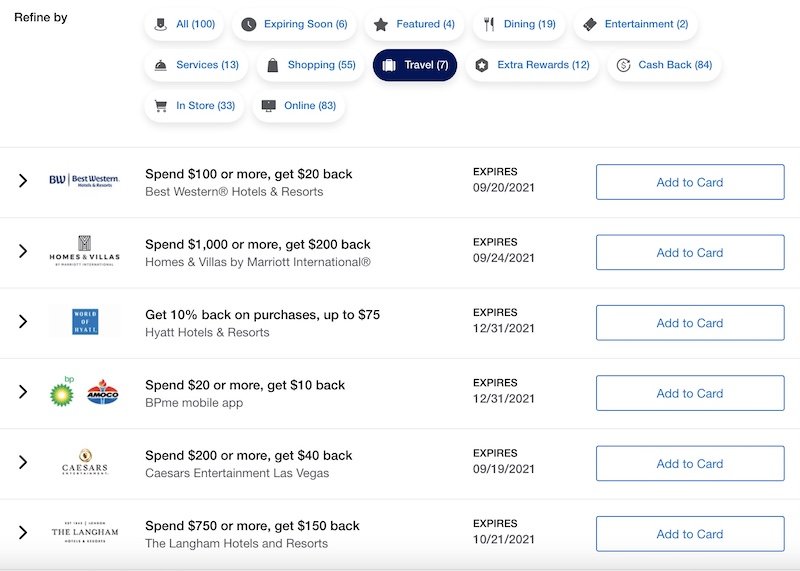

Start loading Amex Offers

One of my favorite perks of Amex cards is the Amex Offers program. With this, you can save money and earn bonus points on all kinds of purchases with American Express.

To take advantage of this, log into your account and scroll down, and you’ll see all kinds of offers. Start adding them to your account and then using your card for purchases where you can score discounts or bonus points.

I earn a significant number of points and cash back using this.

Bottom line

There are so many great perks to both the Amex Personal Platinum and Amex Business Platinum, to the point that it can be overwhelming at first. While there’s a lot more to uncover, the above are the first things I’d do when you get this card in the mail.

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: The Business Platinum® Card from American Express (Rates & Fees), and The Platinum Card® from American Express (Rates & Fees).

Terrific insights. Is there a downside to getting the card later in the year? Do the benefits have a 12-month runtime from when you get the card (e.g. September 2022 to September 2023) or is it just through end-of-year?

I already have the first six (most valuable?) benefits - or better - from other cards, so I can't see paying this huge annual fee for what would mostly be a duplication of benefits I already have.

the very first thing to do is TURN OFF THE PAY OVER TIME.

Thanks for the nice summary and links. While I have the card for a while already I did forget to use the digital subscription credits.

I have a different question others might be able to answer. With chat now available did any of you try to get a retention offer via chat (I prefer chat to phone call) and if so what script did you use (ask to cancel the card, ask straight out for a retention offer, ...)? Thanks

I just did this yesterday after reading a post about it! I used the online Chat feature and first asked about the date my annual fee would charge (I knew it was sometime in August, but I wasn't positive of when - for me it was going to hit in two weeks.) I told them I was reconsidering the card because my husband carries the same one and paying two of those fees is hefty...

I just did this yesterday after reading a post about it! I used the online Chat feature and first asked about the date my annual fee would charge (I knew it was sometime in August, but I wasn't positive of when - for me it was going to hit in two weeks.) I told them I was reconsidering the card because my husband carries the same one and paying two of those fees is hefty even though we do use the cards. I specifically said "I'm wondering if you have any retention offers available if I decide to keep my card open?" And within like two minutes, they'd offered me 55,000 points if I kept the card opened and charged $4000 within the coming three months. I was thrilled!