Link: Apply now for The Blue Business® Plus Credit Card from American Express

It’s amazing how credit card rewards structures have evolved over the years. Back in the day, you’d typically only earn one point per dollar spent on credit cards. Then we saw some cards introduce up to 1.5x points per dollar spent. Then in 2017 a card was introduced that offers a full 2x transferable points per dollar spent all with no annual fee, which was otherwise unheard of.

In this post, I wanted to take a closer look at that card, as this is one that virtually everyone who is eligible should have, in my opinion, as it’s one of the best business credit cards for everyday spending.

In this post:

Amex Blue Business Plus Card Basics For April 2024

The Blue Business Plus Credit Card from American Express is almost too good to be true, given that the card has no annual fee (Rates & Fees), offers up to 2x transferable points per dollar spent, and gives you access to some other useful perks as well.

There aren’t many credit cards that I say just about everyone should have, though this is one of them. So, what makes the Amex Blue Business Plus so rewarding? Let’s go over all the details of the card…

Welcome Offer Of 15K Bonus Amex Points

The Amex Blue Business Plus Credit Card currently has a welcome offer of 15,000 bonus Membership Rewards points after spending $3,000 within the first three months. Let me acknowledge that this isn’t a huge bonus, but historically the card generally hasn’t had any publicly available welcome offer, so this is better. This is a card you get because of the long term value that it offers, and not for the welcome offer.

Note that in some cases people may see larger targeted offers by logging into their Amex accounts, but this is the best publicly available bonus you’ll find.

Earn 2x Amex Membership Rewards Points

The Amex Blue Business Plus Credit Card earns 2x Membership Rewards points on everyday business purchases, and that applies to the first $50,000 spent per calendar year. You earn 1x points per dollar thereafter.

Membership Rewards points are one of the major transferable points currencies, and personally I value Membership Rewards points at 1.7 cents each. To me, that’s the equivalent of a 3.4% return on everyday business spending, which is phenomenal.

I should also mention that this card earns Membership Rewards points that can be transferred to Amex airline and hotel partners. There aren’t many no annual fee cards that are enrolled in the “full” Membership Rewards program, so that in and of itself is a reason to keep this card.

No Annual fee

The Amex Blue Business Plus Card has no annual fee (Rates & Fees), so this is a card that you can keep long term to maximize your rewards. You can also add authorized users to your account at no extra cost.

0% Intro APR

The Amex Blue Business Plus offers 0% intro APR on purchases for 12 months from the date of account opening. After that, your APR will be a variable rate (currently in the range of 18.49% - 26.49%), so if you do take advantage of this, make sure you can pay back the full amount within that period (Rates & Fees).

While this is a perk I typically stay away from, I know some small businesses appreciate this flexibility.

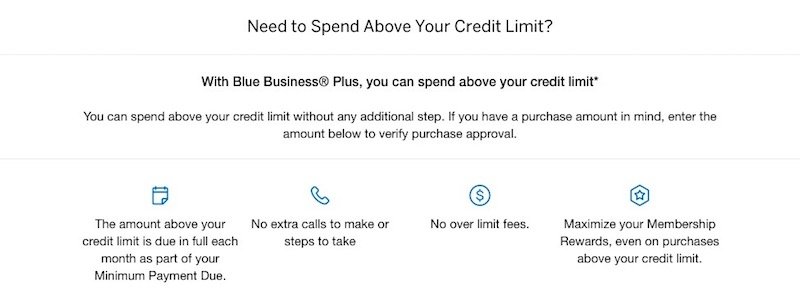

Spend Above Your Credit Limit

One thing that makes Amex business cards unique is that even though your business credit card has a credit limit, you can generally spend above that limit.

The extent to which Amex will let you spend above that limit varies based on quite a few factors, though it is something to be aware of, and something I’ve benefited from in the past when I had big purchases to make on cards with fairly low credit limits.

Save Money With Amex Offers Program

The Amex Offers program is a way that you can save money and/or earn bonus points for purchases with a variety of retailers. This program saves me hundreds of dollars per year, and it’s also a reason to have as many Amex cards as possible. That’s especially true if you can get no annual fee cards, which really cost you nothing to hold onto.

In the typical year I save hundreds of dollars with the Amex Offers program, thanks to promotions for bonus points and statement credits with a variety of retailers. I constantly see offers to save money with major hotel groups, airlines, and retailers. To me, this is one of the most underrated benefits of holding onto an Amex card.

2.7% Foreign Transaction Fees

I wouldn’t recommend using the Amex Blue Business Plus for purchases outside the United States, as the card does carry foreign transaction fees of 2.7% (Rates & Fees), which will eat up most of the value of your rewards. Fortunately there are lots of other great cards with no foreign transaction fees.

Getting Approved For The Blue Business Plus

For those with excellent credit, I find that Amex business cards are easy to get approved for. Anecdotally most people I’ve heard from have reported instant approvals on this card, so it really shouldn’t be very tough to be approved for, even if you haven’t gotten many business cards in the past.

Just make sure you know that:

- You can be approved for at most two Amex cards in a 90 day period

- There’s a limit of how many American Express credit cards you can have at any point, and typically that’s five

See this post for all major credit card application restrictions to be aware of. One of the other cool things to keep in mind is that applying for an Amex business card doesn’t count as a further card toward Chase’s 5/24 limit, so you can pick up this card without it impacting your ability to be approved for Chase cards in the future.

Is The Amex Blue Business Plus Worth It?

If you’re into collecting points, then the Amex Blue Business Plus Card is a card you should absolutely consider. Earning 2x Membership Rewards points, which I value at a ~3.4% return, is awesome. Best of all, you’re getting all of this with a no annual fee card that earns points that can be transferred to airline and hotel programs, and you’re getting access to Amex Offers and more.

Just keep in mind the $50,000 limit every calendar year for earning the 2x points.

Let’s take a look at some of the other cards that are worth considering, either in place of the Amex Blue Business Plus, if you’re looking for a cash back card, or if you’re looking for a card to use beyond your first $50,000 of spending per calendar year.

Comparison: Blue Business Plus Vs. Blue Business Cash

The American Express Blue Business Cash™ Card (review) is the cash back version of the Amex Blue Business Plus Card. How does it compare?

Most aspects of the cards are the same, with the major distinction being that the Amex Blue Business Cash earns 2% cash back on the first $50,000 spent annually, while the Amex Blue Business Plus earns 2x Membership Rewards points on the first $50,000 spent annually.

While 2% cash back is a solid return for a no annual fee business card, personally I have a strong preference for earning 2x Membership Rewards points rather than 2% cash back.

Best Business Credit Card Beyond $50K Of Spending

The Amex Blue Business Plus offers an incredible 2x points on the first $50,000 spent every calendar year, so what are the best cards for everyday spending beyond that? There are lots of great business credit cards out there, though I’d say two are most competitive for everyday spending.

The Ink Business Unlimited® Credit Card (review) is an awesome option as well, as the card offers 1.5x points per dollar spent, and has no annual fee. Those points can be transferred to Ultimate Rewards partners if you have the card in conjunction with the Chase Sapphire Preferred® Card (review), Chase Sapphire Reserve® Card (review), or Ink Business Preferred® Credit Card (review).

The Capital One Venture X Business (review) (Rates & Fees) is another incredible card. The card offers 2x miles per dollar spent with no foreign transaction fees. While the card has a $395 annual fee, that’s easy to justify thanks to the $300 annual Capital One Travel credit, 10,000 anniversary bonus miles, and much more. Capital One miles can also be transferred to a variety of airline and hotel partners.

Best Amex Blue Business Plus Credit Card Complement

If you want to earn as many Membership Rewards points as possible, the American Express® Business Gold Card (review) is worth considering. The Amex Business Gold Card earns 4x Membership Rewards points on the two categories where your business spends the most each billing cycle, from six eligible categories.

You will earn 4x points on the first $150,000 in combined purchases from these categories each calendar year (then 1x thereafter). The bonus categories are as follows:

- Purchases at US media providers for advertising in select media (online, TV, radio)

- U.S. purchases made from electronic goods retailers and software & cloud system providers

- U.S. purchases at restaurants, including takeout and delivery

- U.S. purchases at gas stations

- Transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways

- Monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S.

Best Comparable Personal Credit Card

There’s only one no annual fee personal card that’s at all comparable to the Blue Business Plus, and that’s the Citi Double Cash® Card (review). The card also has no annual fee, and offers 1% cash back when you make a purchase, and an additional 1% cash back when you pay for that purchase in the form of ThankYou points.

If you have the card in conjunction with a card earning Citi ThankYou points, like the Citi Premier® Card (review), then rewards can be converted into ThankYou points at a rate of one cent per point. That makes this card incredibly versatile, as you can redeem rewards efficiently as cash back or toward travel.

Alternatively, the Capital One Venture X Rewards Credit Card (review) (Rates & Fees) and Capital One Venture Rewards Credit Card (review) (Rates & Fees) earn 2x miles per dollar spent, which can be transferred to airline and hotel partners. Those are fantastic cards as well, though they do have annual fees.

Bottom Line

The Amex Blue Business Plus Card is one of the most lucrative cards out there. It offers 2x Membership Rewards points on the first $50,000 spent every calendar year, all with no annual fee. On top of that, the card gets you access to Amex Offers.

This is also a fantastic “hub” card for holding onto Amex points, in situations where you want to cancel other premium Amex cards but want to hold onto your points. This is a card that anyone who is eligible should get, assuming you’re into collecting points.

If you want to learn more about the Amex Blue Business Plus Card or apply, follow this link.

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: The Blue Business® Plus Credit Card from American Express (Rates & Fees).

I got a approved on a targeted offer for the Blue Business Plus for 75,000 MR for $15,000 spend over the first 12 months - spend likely too high for that kind of bonus, but a long period of time to meet it.

Hopefully, I still qualify for the bonus MRs, even though I downgraded to a Blue for Business card years ago (but no bonus received on it, so I think I am).

I got a approved on a targeted offer for the Blue Business Plus for 75,000 MR for $15,000 spend over the first 12 months - spend likely too high for that kind of bonus, but a long period of time to meet it.

Hopefully, I still qualify for the bonus MRs, even though I downgraded to a Blue for Business card years ago (but no bonus received on it, so I think I am).

I plan to close the Blue for Business (don't think I ever used it), but will keep the Blue Business Plus going forward to keep my MRs alive in case I close other accounts.