Credit card issuers offer all kinds of targeted promotions to keep cardmembers engaged. In particular, we frequently see bonuses for spending in certain categories, so that cardmembers keep a particular product front of wallet.

Chase frequently offers targeted, limited time spending bonuses on select cards, and the latest of these have just been rolled out, for spending in the fourth quarter. These are some fantastic bonuses that could be worth taking advantage of, if eligible.

In this post:

Chase’s card spending bonuses for 2023

Chase is offering targeted spending bonuses on many of its credit cards, with registration being required. These deals are available for purchases between October 1 and December 31, 2023.

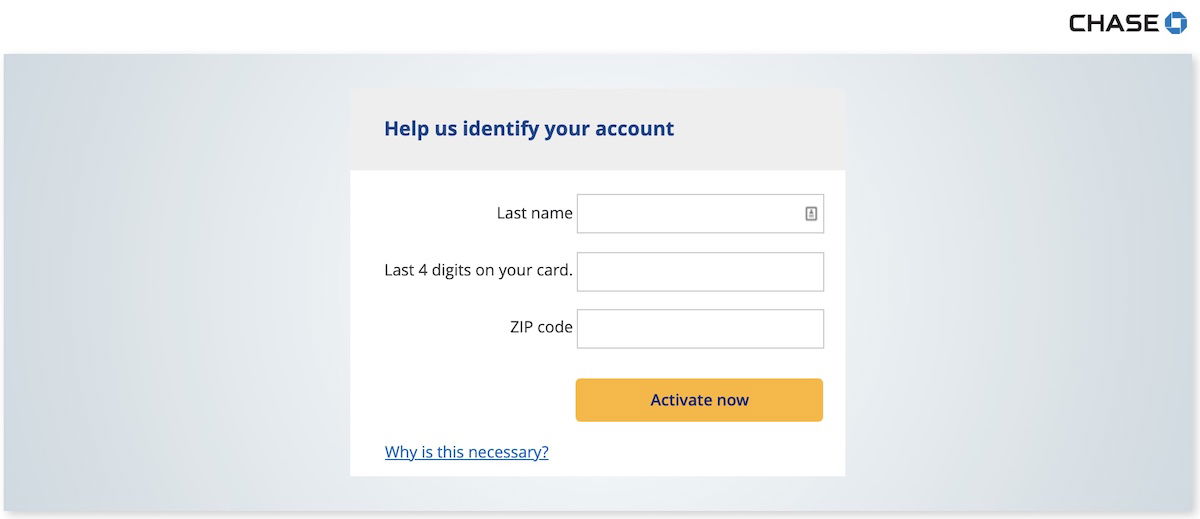

To see if you’re eligible, just visit chase.com/mybonus and enter your last name, zip code, and the last four digits of your card number. If you have multiple Chase cards, you’ll have to check your eligibility for each card individually.

What kind of bonuses is Chase offering?

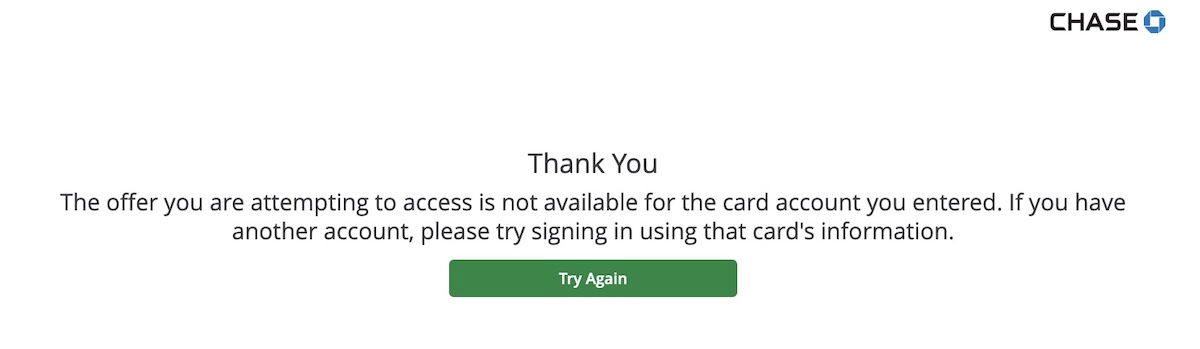

Chase credit cards are offering bonuses tailored to the particular rewards currency offered by a card. You can check what each card is eligible for at this link. These bonuses are targeted — not everyone will be eligible, and even those who are eligible may be presented with different offers. If you’re not eligible for an offer, you’ll see a message stating that an offer isn’t available to you.

Bonuses are primarily available on co-branded credit cards, including those issued in conjunction with Hyatt, IHG, Marriott, Southwest Airlines, and United Airlines cards. On top of that, the Chase Freedom FlexSM Credit Card (review) and Chase Freedom Unlimited® (review) may be targeted for bonuses.

In my experience, Chase doesn’t target people for an offer on the same card two quarters in a row, so you might only be targeted for offers every other quarter.

What kind of offers can you expect? Best I can tell, here are some of the offers (and please share your data points below!):

- The IHG One Rewards Premier Credit Card (review) has an offer to earn 7x points at gas stations and 5x points at restaurants and Amazon, valid on up to $1,500 in combined purchases

- The World of Hyatt Credit Card (review) has an offer to earn 5x points at gas stations, grocery stores, and Amazon, valid on up to $1,500 in combined purchases

- The United℠ Explorer Card (review) has an offer to earn 5x miles at gas stations, grocery stores, and Amazon, valid on up to $1,500 in combined purchases

- The British Airways Visa Signature® Card (review), Iberia Visa Signature® Card (review), and Aer Lingus Visa Signature® Card (review), have offers to earn 5x Avios at gas stations, grocery stores, and Amazon, valid on up to $1,500 in combined purchases

Whether or not these offers are worth taking advantage of depends on how you value various points currencies, and what other cards you have. For example, 5x World of Hyatt points is worth way more than 5x IHG One Rewards points. Based on my valuation of points, the Hyatt Card is offering an 8.5% return on spending in these categories.

Bottom line

Chase has some new targeted spending bonuses on credit cards, valid for purchases between October 1 and December 31, 2023. You can check your eligibility here. Many cardmembers should be eligible, and this could be a fantastic way to pick up some bonus rewards. The catch is that often if you’re targeted for an offer in one quarter, you won’t see any offers the next quarter.

It seems that the most common offer is for 5x points on gas stations, grocery stores, and Amazon. Just remember that not all points currencies are created equal, so 5x Hyatt points is worth more than 5x IHG points.

Were you targeted for Chase spending bonuses, and if so, do you plan on taking advantage of them?

I have three Chase cards. Received an offer on my BA Visa for 10x Avios. I rarely use the card... probably why. Usually the bonus categories aren't very useful -- ev driver and travel constantly for work so gas and groceries... not impressive. But this time, it included Amazon. 10x Avios at Amazon is a pretty good deal.

I got offers on my Marriott, IHG Premier, MileagePlus Select and Iberia cards, all capped at $1000 in total spend (first time I’ve ever gotten less than $1500). Most interesting is the Iberia card offer at 10x. A couple had 7x offers at gas stations, but I haven’t found any near me that allow credit card payments for vgcs. Everything else is 5x. Not earthshaking, but I’ll take it. :)

In addition to the Hyatt offer on gas/groceries, I got the following on the no-fee United card:

"Spend a total of $100 between 8/29/23 – 10/31/23 on your utilities, internet, cable, and phone services, insurance, local transit and commuting, or fitness club and gym membership payments to earn a $5 statement credit.*"

Dont imagine I'll be changing behavior much for $5

Data point - last quarter, I received a spend $3,000, get 5,000 points promotion on my Word of Hyatt Card. This quarter, I am eligible for 5x on groceries, gas, and Amazon. So at least one person received the promotion on the same card two quarters in a row. I maxed out last quarter and will max out this quarter...

Bonvoy family of cards have 5x up to $1000.

To clarify, purchase BOTH flight and hotel or just one or the other? Assuming it’s both. Thanks!

I got Spend a total of $100 between 8/29/23 – 10/31/23 on your utilities, internet, cable, and phone services, insurance, local transit and commuting, or fitness club and gym membership payments to earn a $5 statement credit.* lol

Got an offer on my CSR for making a booking thru Chase Travel. 5K pts if I have booked since Sep 2022 and 7K pts if not. Booking needs to be hotel + flight for at least $105.

My Hyatt offer is 5x points up to $1,000, not $1,500. Still not a bad offer.

For the quarter just ended, I earned 5x miles on gasoline, grocery stores, and restaurants on my United Quest card. Concurrently I worked on earning 6,000 bonus miles for $8,900 spend, but I didn’t have enough expenses to earn that.

Does the CSP 7k bonus offer require flight and hotel purchase, or can it be just a flight purchase? TIA

I see a spend bonus on my Chase Flex/Freedom card account for Insurance, Utilities, Internet & Cable thru the end of October.

And 7k bonus offer on both CSR & CSP for flight & hotel purchase thru January '24.