Link: Apply now for the Ink Business Preferred® Credit Card, Ink Business Cash® Credit Card, or Ink Business Unlimited® Credit Card

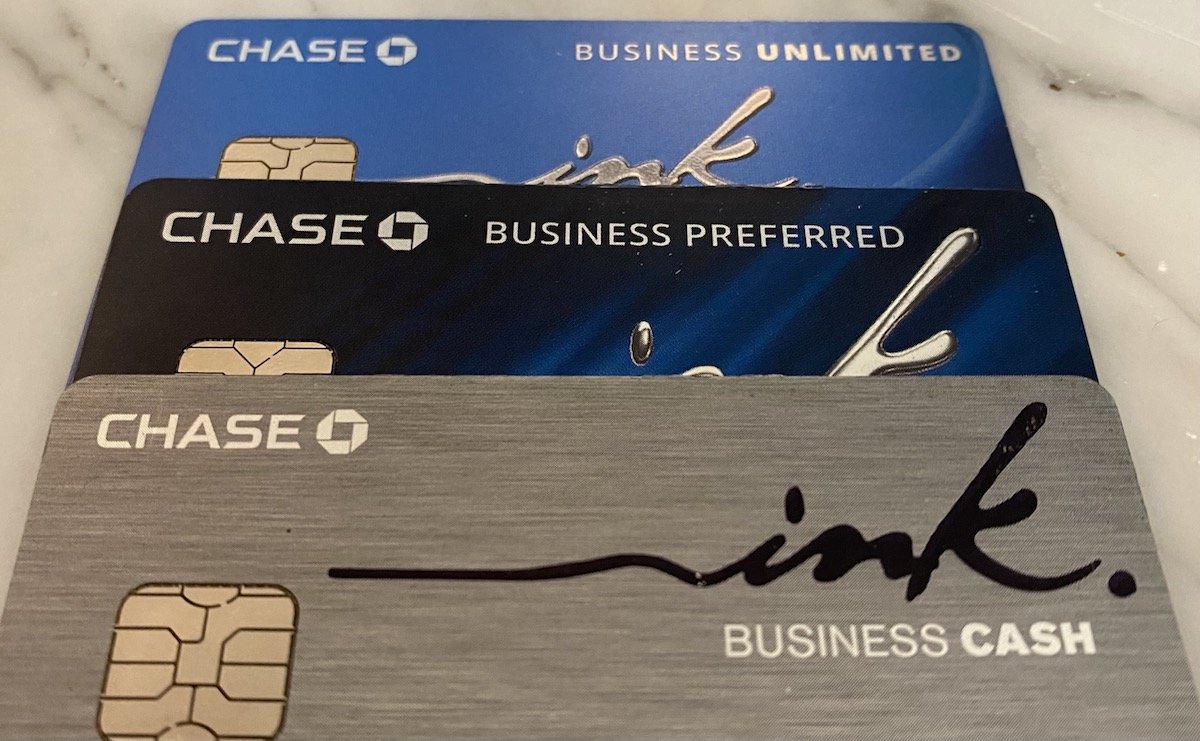

While there are lots of excellent business credit cards out there, I’d argue that Chase’s “Ink” cards are the best portfolio you can get. This includes the following three cards, which are all offering exceptional welcome bonuses at the moment, among the best out there:

- Ink Business Preferred® Credit Card (review), which offers up to 3x points

- Ink Business Unlimited® Credit Card (review), which offers 1.5x points

- Ink Business Cash® Credit Card (review), which offers up to 5x points

The best part about these three cards is that they’re complementary rather than substitutes, so you can really maximize your rewards by having all three cards.

I have all three of these cards, and they add a lot of value to my card portfolio. One common question from people is how they can acquire all three Chase Ink cards, so I wanted to share the approach I recommend in this post.

In this post:

Chase Ink Card basics

Here are the basic details of Chase’s three Chase Ink Cards:

Ink Business Cash® Credit Card

Ink Business Cash® Credit Card

How much are Chase Ink points worth?

Assuming you have the Ink Business Preferred® Credit Card, then all the points you earn on these three cards could be redeemed in one of two ways.

One option is that they could be redeemed for 1.25 cents each toward the cost of a travel purchase through the Chase Travel Portal. If you have the Chase Sapphire Reserve® Card (review), then all the points you earn could be redeemed for 1.5 cents each toward the cost of a travel purchase.

The second choice is that you can convert these points into airline miles or hotel points, using one of the Ultimate Rewards transfer partners, which are as follows:

Airline Partners | Hotel Partners |

|---|---|

Aer Lingus AerClub | IHG One Rewards |

Air Canada Aeroplan | Marriott Bonvoy |

Air France-KLM Flying Blue | World of Hyatt |

British Airways Executive Club | |

Emirates Skywards | |

Singapore Airlines KrisFlyer | |

Southwest Rapid Rewards | |

United MileagePlus | |

Virgin Atlantic Flying Club |

If you don’t have either the Ink Business Preferred, Sapphire Reserve, or Sapphire Preferred, then points earned on the Ink Cash and Ink Unlimited can only be redeemed for a penny each, which isn’t nearly as good. The key to maximizing value is to build up a portfolio of Chase cards.

What are the restrictions on applying for Chase business cards?

Before we talk about the specific strategy that’s best for applying for these cards, here are some general things to be aware of when applying for Chase business cards:

- There’s no hard limit on how many Chase credit cards you can be approved for, but rather there’s often a maximum amount of credit the bank is willing to extend you, in which case you may be asked to switch around your credit limits on some cards in order to facilitate an approval

- While you can typically be approved for up to two Chase cards in a 30 day period, that doesn’t usually work when both are business cards; you typically want to wait at least 30 days between business credit card applications to be on the safe side, though there are mixed reports (some people don’t have to wait that long, others have to wait longer)

- Chase has the 5/24 rule, whereby you typically won’t be approved for a Chase card if you’ve opened five or more new card accounts in the past 24 months; however, note that this no longer seems to consistently be enforced

- Regarding the 5/24 rule, the good news is that when you’re approved for a Chase business credit card, that application shouldn’t count as a further card toward the 5/24 limit, given that it won’t show up on your personal credit report

- You can have each of the three different Ink Cards, so if you have the Ink Business Preferred you’re still eligible for the Ink Business Cash and Ink Business Unlimited (including the bonuses)

See this post for all the details on how to get approved for Chase business cards.

How can you get approved for all three Chase Ink Cards?

If your goal is to be approved for all three Ink cards, your best strategy is “slow and steady,” as they say. I’d recommend applying for the cards a bit over 30 days apart, at the absolute fastest. If you apply for the first card on day one, apply for the second card on day 35 (or so), and then the last card on day 70 (or so). Or maybe wait even longer between applications.

If it were me, I’d definitely recommend making the Ink Business Preferred® Credit Card one of the first cards you apply for. The card has great bonus categories, an excellent cell phone protection plan, and having that card lets you transfer all your points to airline and hotel partners.

Then you have to decide whether the Ink Business Unlimited® Credit Card or Ink Business Cash® Credit Card is a better option for you as the second card to apply for. If it were me, I’d probably apply for the Ink Business Unlimited, given that it offers 1.5x points on all purchases, so it nicely balances the 3x points categories on the Ink Business Preferred.

I’d note that while this is how it’s supposed to work, Chase also sometimes has limits on how much credit can be extended to someone, so it’s totally possible that Chase will approve you for two of these, but not the third. Everyone’s situation will vary.

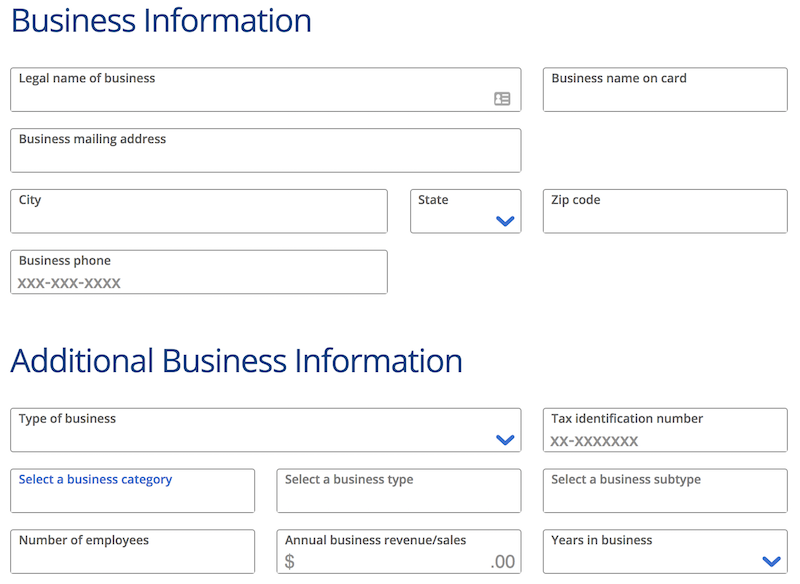

How should you fill out a Chase business credit card application?

Those who already have business credit cards are probably familiar with the application process, but for those who aren’t, here’s what you need to know.

Chase is definitely the toughest issuer when it comes to approving business cards, though even a sole proprietorship should be eligible. You could be eligible for a business card if you have a business selling things online, have a rental property, do freelance work, etc.

When applying for a Chase business card, you’ll be asked the following questions, in addition to the typical personal questions about your income, social security number, etc.:

- Legal name of business

- Business mailing address & phone number

- Type of business

- Tax identification number

- Number of employees

- Annual business revenue/sales

- Years in business

If you’re a sole proprietorship, how should you approach this? First of all, and most importantly, answer everything truthfully. I think the concern that a lot of people have is that they think they need an incorporated business, a separate office, etc., in order to be considered for a business card. That’s not the case:

- You can use your name as the legal name of your business

- The business mailing address and phone number can be the same as your personal address and phone number

- If you’re a sole proprietorship, you can select that as your type of business

- For the tax identification number, you can put your social security number if you don’t have a tax ID

- For number of employees, saying just one is perfectly fine

- For your annual business revenue, there’s nothing wrong with saying zero, or whatever the amount is

- For years in business, there’s no shame in saying that it’s new, that it has been 1-2 years, etc.

Bottom line

Having the Ink Business Preferred® Credit Card, Ink Business Unlimited® Credit Card, and Ink Business Cash® Credit Card is an incredible card combination. They can help you maximize your return on everyday business spending thanks to the great bonus categories they offer. The Ink Preferred even has a great cell phone protection plan.

Getting all three of these cards is possible, it just takes some patience. This is a great time to apply as well, given the excellent bonuses.

What about the Ink premier? Can that bonus not be converted into UR points if you have the preferred?

I feel like annual fee should be mentioned somewhere but its not. Its all upside in this post.

How long would you advise waiting after a card was cancelled before applying again?

My wife and I have 6 combined and get a 40k referral each time. Easiest points ever earned.