The Chase Freedom FlexSM Credit Card (review) is an incredible no annual fee card belonging to Chase’s Freedom portfolio, which can help you maximize your points thanks to its quarterly bonus categories. With it now being April, Chase has just launched its Q2 2024 bonus categories, so I’d highly recommend registering.

Note that these same bonus categories are also valid for the Chase Freedom Card, which is no longer open to new applicants.

In this post:

Why I love the Chase Freedom Flex

The Chase Freedom Flex Card is easily one of the best no annual fee cards out there, as it offers 5x points in rotating quarterly categories, for up to $1,500 of spending per quarter. Most people use this as a cashback card, meaning the 5x points really translates into 5% cashback in these categories.

The card has other bonus categories as well, as it offers 3x points (or 3% cash back) at drugstores and on dining.

The best part is that in conjunction with the Chase Sapphire Preferred® Card (review), Chase Sapphire Reserve® Card (review), or Ink Business Preferred® Credit Card (review), points earned on this card can be converted into Ultimate Rewards points, and be transferred to the Ultimate Rewards airline and hotel partners, or can be redeemed at a favorable rate through the Chase Travel Portal.

Since I value one Ultimate Rewards point at significantly more than one cent, that’s my preferred use of those points.

Chase Freedom Flex Q2 2024 bonus categories

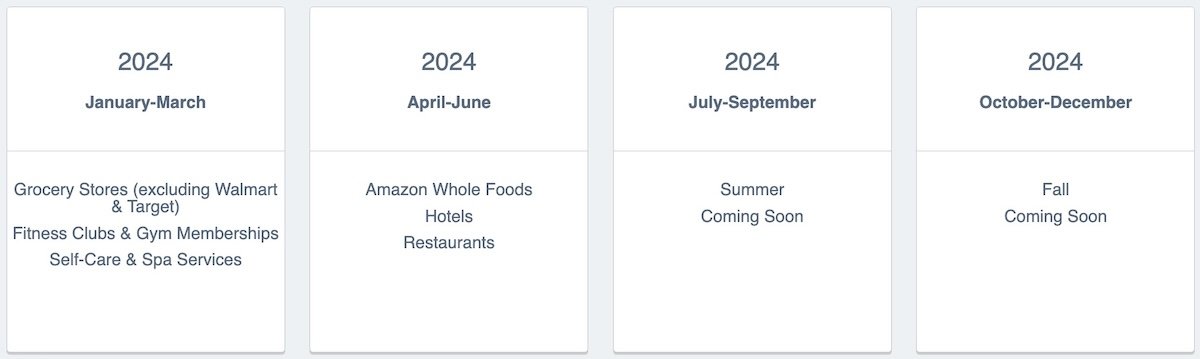

For the second quarter of 2024, the Freedom Flex Card is offering 5x points on the first $1,500 spent with Amazon, Whole Foods, hotels, and restaurants. As far as key dates go:

- You need to register between March 15 and June 14, 2024

- If you register, you can earn 5x points between April 1 and June 30, 2024

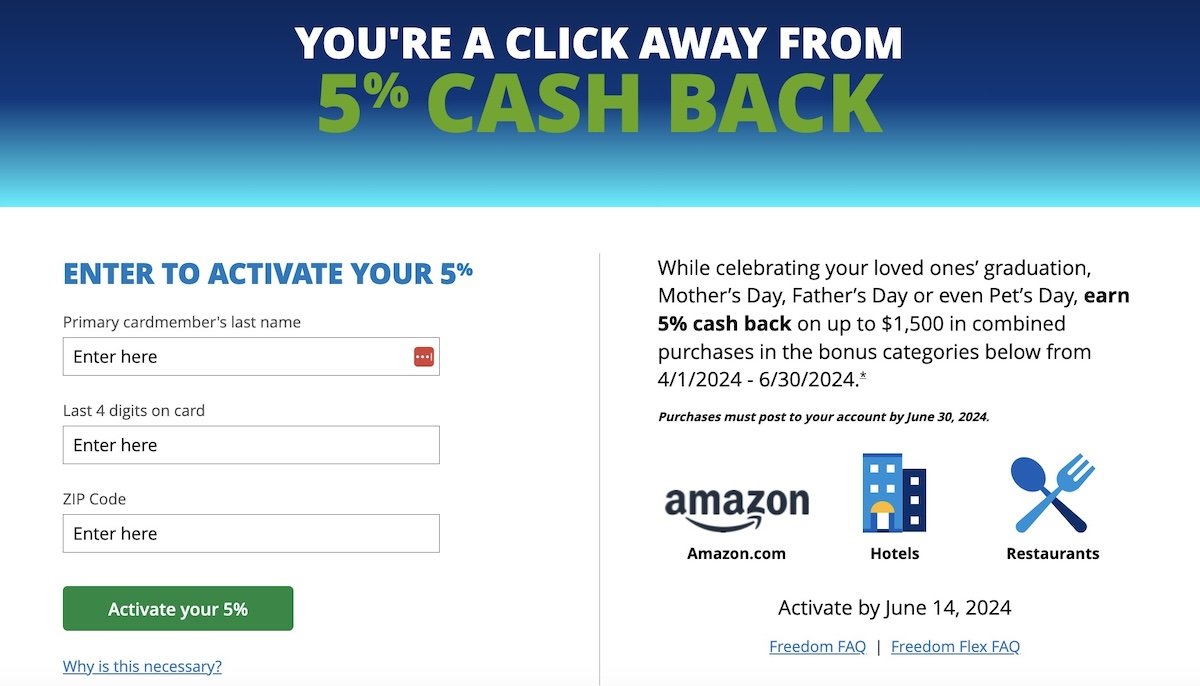

How to register your Chase Freedom Flex

Registration is easy — just go to the registration page and enter your last name, billing zip code, and the last four digits on your card, and you’ll be registered.

What’s included in each 5x bonus points category

It’s always worth understanding what exactly is included with each bonus category, so let’s cover that.

The Amazon and Whole Foods bonus category includes the following:

The Amazon.com category includes purchases made at Amazon.com (including digital downloads, Amazon.com Gift Cards, Amazon Fresh orders, Amazon Prime subscriptions, and items sold by third party merchants through Amazon.com’s marketplace) and Whole Foods Market (including physical Whole Foods Market and Whole Foods Market 365 stores, and the website accessible at www.wholefoodsmarket.com

The hotel bonus category includes the following:

If purchased directly through hotel: Merchants in this category include hotels and motels, and many smaller establishments like bed & breakfasts, and inns.

If purchased through Chase travel: This category includes prepaid hotel accommodation purchases made on chasetravel.com or by calling the number on the back of your card to book.

The restaurant bonus category includes the following:

This category’s merchants’ primary business is sit-down or eat-in dining, including fast food restaurants and fine dining establishments.

My take on Chase Freedom Flex Q2 2024 bonus categories

Everyone has different spending patterns. Personally I think the Q2 2024 bonus categories are fantastic and easy to maximize, as it’s a quarter where I like all the options. Being able to earn bonus points across Amazon, Whole Foods, hotels, and restaurants, should be pretty easy for many of us to maximize.

How to make Chase Freedom Flex points more valuable

To recap, you earn points on the Chase Freedom Flex, and each point can be redeemed for one cent cashback.

However, if you have this card in addition to one of the cards that accrues Ultimate Rewards points, you can transfer these points to Ultimate Rewards. Cards that accrue Ultimate Rewards Cards include the:

So 5% cashback converts into 5x Ultimate Rewards points per dollar with one of the above cards.

Bottom line

The Chase Freedom Flex is one of the best no annual fee cards out there, thanks largely to the ability to earn 5x points in rotating quarterly categories.

The Q2 2024 bonus categories have now launched. Those who register are able to earn 5x points with Amazon, Whole Foods, hotels, and restaurants. This is capped on up to $1,500 in spending through June 30, 2024. I’m happy to see these bonus categories, and should have no issues maximizing them.

What do you make of the Q2 2024 Chase Freedom Flex bonus categories?

Does Whole Foods sell $500 Visa GC? I ask because Whole Foods is 100 miles away.

The categories used to be much more general and useful for this card.

I just activated for Q2. The bonus categories listed on the Chase App are Amazon.com, hotels, and restaurants. No explicit mention of Whole Foods. The FAQ and Merchant list hasn’t been updated for Q2 yet.

There's still no clarity whether the bonus hotel category includes prepaid stays booked on third party OTAs. My guess is that it doesn't.

Just remember freedom flex has a foreign fee if you were thinking of using it at restaurants on your foreign travel.

eh. It's not as good as it used to be. Categories used to be much more general. The amazon offer is nothing to cheer about since the Amazon credit card also offered by Chase gives 5% back on Amazon and whole foods.

Can you confirm whether it is Amazon or Whole Foods? I just saw a Chase page that said Amazon.com. I’m hoping it’s Amazon as I don’t go to Whole Paycheck very often but order from Amazon all the time. Plus, I may be making a sizable purchase in Q2.

Buy an Amazon gift card at "Whole Paycheck."

Nice bonus. I’m about to finish up my SUB on Amex Gold by end of month / early April, this I can transition smoothly into 5x restaurant bonuses. As for Whole Foods, mostly too expensive for me for regular grocery shopping but their hot food bar can be quite reasonably priced.

My Q2 strategy, valuing Chase points at $0.02

Whole Foods — CFF: 5% x $0.02 = 10% return

other grocery — AMEX Cash Preferred 6% cash back

Restaurants — CFU with points doubled SUB: 3% x 2 x $0.02 = 12%

Hotels (in US) — CFF: 5% x $0.02 = 10%

For CFF, you would get 7x UR on restaurants, since there is the normal 2x category bonus, plus the 4x quarterly bonus and 1x baseline earning. Using your 2 cents/UR valuation, that would be 14% back.

For CFF, you would get 7x UR on restaurants, since there is the normal 2x category bonus, plus the 4x quarterly bonus and 1x baseline earning. Using your 2 cents/UR valuation, that would be 14% back.

Shame all my hotel stays during this quarter are international and this card still has a foreign transaction fee

5x at hotels means that I will actually not use my World of Hyatt card for Hyatt stays in Q2

Isn't Whole Foods considered grocery? Meaning, wouldn't Whole Foods purchases be 5x spend right now (Q1), and then 5x spend in Q2?

Yes, I have been earning 5x on Whole Foods purchases all quarter

Correct, and Chase has often done Amazon/Whole Foods quarters in addition to general grocery quarters in recent years. So you end up getting 5X at Whole Foods for half a year (up to $3000 total spend)!

I haven't used Chase Freedom card for the bonus hotel category before. Does the category cover hotel stays booked on a third party travel portal?

To all commentating, I think you will earn 7x on restaurant on the Freedom Flex

1x for all spending

2x Freedom flex restaurant bonus

4x 2Q category bonus

Total: 7x

This is compared to 3x for CSR/CSP, 4x for Amex Gold, etc....

You will only earn 5x on the regular Freedom

My plan is to put all restaurant spend on Freedom Flex while putting Whole Foods (my main grocer) spend on Freedom.

Sucks that there are foreign transaction fees though. Hurts my hotel/restaurant maximization possibilities

yeah only makes sense if you are traveling for work and can expense the FTF

Does this only include Whole Foods or also Amazon.com? I know you can buy Amazon GCs at WF, but that seems like a pointless extra step.

Not really impressed with Q2 to be honest. I sparingly shop at Whole Foods, it's a small bonus on top of the Chase Sapphire Preferred/Reserve for restaurants, ditto with hotels (which you don't want to use the Freedom for anyways if they are overseas). Amazon yes I'm sure I can get a few things but spending habits aren't conducive to me spending that much there.

I also do wonder how the 5% on restaurant spend on Freedom flex stacks with the already 3% earn on the card.

2Q looks like honestly one of the better quarters in years for categories. Restaurants is easy for everyone to maximize, Whole Foods are plentiful, and the card could be very useful for boutique hotels (or all hotels). Will max out across two cards.

I hold on to this card because it is free and it is part of the Chase group of cards, but I often wonder why I still do so. The categories on this card have become less and less useful and increasingly specific or conflict with other cards.

My wife recently signed up for the Chase Freedom Flex. For the next 12 months, she gets 5x at Grocery Stores and Gas Stations (up to 12k spend). Do you think this is a double-dip opportunity? ie 10x at grocery stores during Q1. Thanks.

In the past categories like this have stacked. However, the math is a little different. The bonus categories are considered an extra 4x on top of the usual 1x back. So if it does stack, it would be 1x + 4x + 4x = 9x back.

For the current quarter, when you use 5x Paypal at a drugstore, which usually gets 3x on the Freedom Flex, you end up with 1x + 4x + 2x = 7x back.

Actually some nice categories. Grocery is always nice - plus, gym/fitness is great too. I usually switch my Equinox payments to Amex Platinum at the beginning of the year to get the $300 credits. Now, it looks like I will wait until 2Q to do that.

I also second the other comment - people should generally have both a Freedom and Freedom Flex. I am guessing people can apply for another chase card, like a Slate, and product change to a Freedom?

"...I’ll probably spend $1,500 there over the course of the quarter."

I'm a bit surprised you only have one Freedom card as its quite easy to have multiple. I think once you get the sign-up bonus for the Freedom unlimited, its best to convert that to a Freedom card because any non-bonus spend is better put on the Venture X or Amex BBP