The United States is easily the most lucrative market in the world for credit card welcome bonuses and general loyalty bonuses. I recently wrote about considering beginning the process of building credit history there myself.

Australia is now a lucrative market too. Nowadays, 100,000 point bonuses in Australia are the norm, not the exception.

When I left Australia two years ago, I also left behind my credit history which I had closely monitored and had either been in the ‘very good’ or ‘excellent’ range for many years. I held three or four credit cards at a time, limiting my number of new cards to one or two each year to protect my score. The different credit scoring system in Australia means it’s not practical to hold 20+ credit cards at once like in the United States, but it is easy to earn hundreds of thousands of points each year in Australia without spending that much money.

I think I checked my credit score more regularly than I would check my weight on bathroom scales!

I didn’t really know where to start with credit cards, when I arrived in the UK as a new resident, but expected it would take several years to build my credit.

I researched as much as I could, and then started the long road to rewards.

Unfortunately the UK is not a very lucrative market for credit card sign-up bonuses, and 20,000 points is considered decent!

Here’s what I’ve done so far to obtain credit, and build credit history in the UK.

Step One: Register as a local

This was easy. I registered on the local electoral roll where I was living. This allowed me to vote in British elections, a right I still find a bit weird as I am a resident but not a citizen.

Registering on the electoral roll let credit reporting agencies know I had arrived and indicated I am intending to stay, and starts building my local credit profile.

Step Two: Verify your address

Address history is taken seriously in the UK, so I needed to prove I actually lived somewhere in the country, and have lived there for some time. The easiest way to do this was to get my name on a utility account. Electricity, gas, water, internet, etc., are all acceptable.

Mobile/cell phone accounts are usually not.

It might seem obvious that your name would be on a utility account where you are living, but I am flat-sharing with others and that means having several of us on the account.

This also gave me a good form of ID for doing things like opening a bank account (I could have also used a tenancy agreement).

Step Three: Obtain low limit, high interest credit cards

It was a humbling experience to apply for these type of credit cards. In Australia I had no trouble obtaining a credit card with a $15,000 limit, and the card issuer would regularly send me invites to increase the credit limit to over $25,000.

With no actual credit history in the UK, the best I could initially do was a Capital One Classic Card with a measly £200 limit that earned absolutely no rewards. Fortunately, it had no annual fee.

It is a card designed specifically for people like me who are trying to build credit history in the UK (or have bad credit history they are trying to repair). While it does not offer any rewards, it is a way for me to show that I can service debt responsibly, to then be trusted with higher amounts at a later date.

I have a direct debit set up each month to pay off the full balance, which doesn’t exactly break the bank! I try and remember to use it a few times each month so there is some actual credit servicing rather than just having an open line of credit, but it is difficult to remember when there’s no rewards and little other motivation.

I also need to remember that any medium sized or large purchases will exceed the credit limit quickly, so I keep only use it for coffees, Ubers, etc.

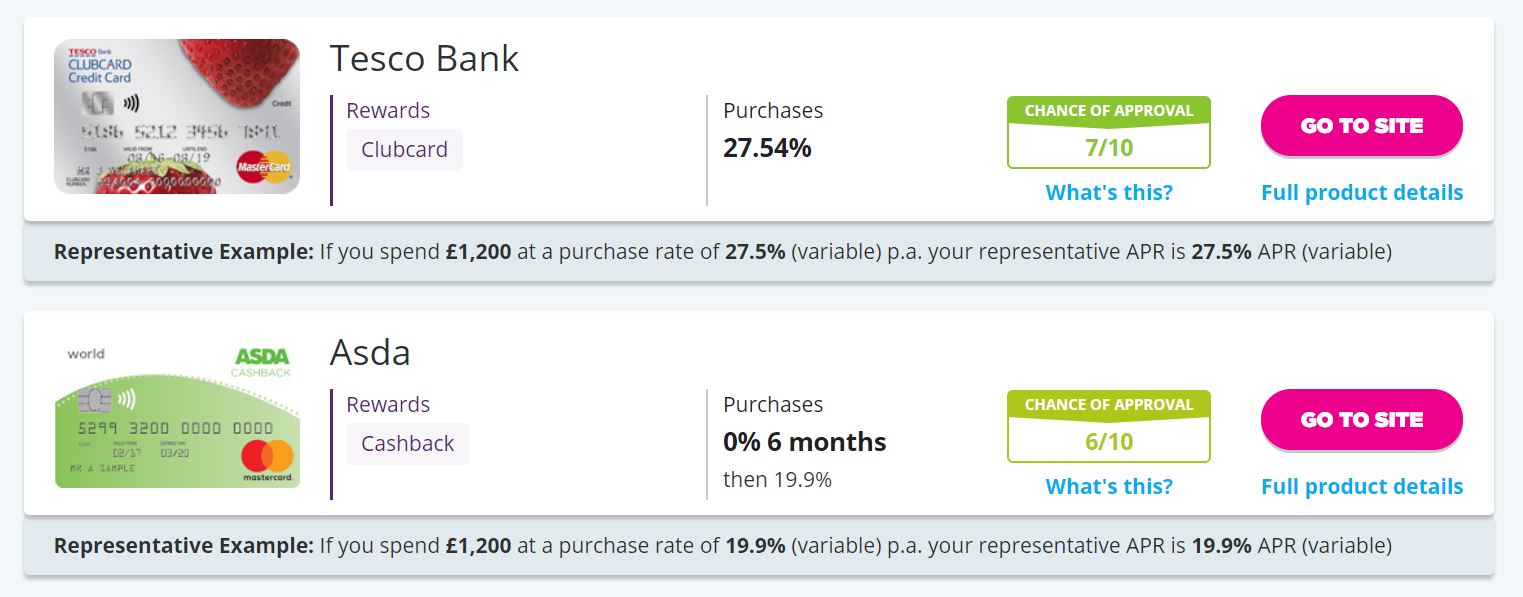

Step Four: Check if you have built sufficient credit

There are plenty of credit card consolidator websites in the UK like Money Supermarket, that will show you the likelihood of being approved for each type of card, based on the personal details you provide. I’m at the stage now where some actual new rewards cards give me a more than 50% chance of being approved, and I would be comfortable actually applying for those cards.

The biggest problem I will face is that I only have two years proof of address. I know that some people in my situation simply ‘say’ they were at their first address five years ago when they are applying for credit and say that the credit providers never check (or care).

I’m not sure I want to say anything dishonest in a credit application, when I’ve been working so carefully to build my credit history.

A potentially instant short-cut: American Express

I didn’t know this little trick until early last year, when an Australian friend who had arrived in London after me, pulled out a UK-issued American Express Gold Card when we split a bill for dinner. My jaw dropped and I asked him how he had managed to get an Amex card, when he had not been in the country long.

He explained that American Express would transfer your credit history from Australia to the UK, and allow you to use it to apply for American Express cards, but only Amex-issued Amex cards (not bank or airline issued Amex cards).

My friend also advised me that the best chance I had of being approved, was to apply for an Amex charge card which requires the full balance to be paid each and every billing statement, rather than a standard credit card. This is a much lower risk to American Express because the balance must be paid each month so you can’t rack up a huge, long-standing debt. The American Express Preferred Rewards Gold Card came with:

- 20,000 Membership Rewards as a welcome bonus, after spending £2,000 in the first three months

- No annual fee for the first year

- 1 Membership Reward Point earned per £1 spent

I applied for the card on the way home from dinner, and received it in the mail in less than a week, no questions asked.

I now understand American Express offers an international transfer program called Global Card Transfer, where if you move to a new country and are an existing customer, you can transfer your credit history/account to your new country over the phone and they will issue you with a similar local card immediately.

If I moved countries again, I would do this as soon as I arrived.

I’m not sure how recent this formal program has been in place, but it’s important to note that I was approved last year for the Preferred Rewards Gold Card without utilising this service (it may not have been in place then) — I simply provided all my personal details and indicated that I had held Amex cards before, and Amex connected the dots.

American Express UK has many transfer partners, and I chose (via SPG), American Airlines AAdvantage as I (still) think it’s a better value program than British Airways Executive Club, although I hold status in Executive Club.

As the annual fee kicked in at the start of year two of this card, I always planned to cancel it before then. That’s because the annual fee of £140 would likely outweigh any points I may earn. You do receive 10,000 Membership Rewards Points each anniversary where you spend £15,000 in that year, but for me that was not a compelling value proposition to retain the card.

So I prepared to cancel it, while actively looking for a suitable replacement.

And I found it.

The best credit card in the UK?

As I had not yet built sufficient credit to obtain independent credit cards on my own merit (especially Visa or Mastercards), I continued to explore options within the American Express family. Fortunately, the British Airways Premium Plus American Express is widely considered to be the best credit card in the UK (Amex or otherwise), and was also ideal for my situation. As I now had a UK Amex account from my charge card, I simply logged into that account, and applied for this new card online.

I was approved instantly.

It came with:

- 26,000 Avios as a welcome bonus after spending £3,000 in the first three months

- 3 Avios per £1 spent with British Airways, 1.5 Avios per £1 spent on everything else

- Travel insurance

- A £195 annual fee

Oh yeah, and the 2-4-1 Companion Voucher.

People in the UK go nuts about this Companion Voucher. Essentially, when you spend £10,000 on the card each year, you receive a 2-4-1 redemption voucher with British Airways each year. This means you can redeem Avios for two people traveling together, on any British Airways operated return flight (ex-London) and you will only pay the Avios for one person.

Any destination, any class, any date with award availability.

Given how high the redemption rates are for British Airways long-haul premium travel, this could potentially save you hundreds of thousands of Avios each year.

You can use it for a one-way redemption ex-London, however you essentially ‘forfeit’ the right to use it for a second, return leg.

Now the BIG caveat of this generous offer, is that you must pay the fees, taxes and frustrating fuel/carrier surcharges for both travellers, and this can be substantial – up to £1,000 per person depending on the route and class.

I am thinking about going to Miami later this year. Normally for two people, return in Club World, it would be an eye-watering 275,000 Avios plus around £1,000 in total fees, taxes and surcharges. Applying the 2-4-1 voucher, which can easily be done online in your Executive Club account, keeps the taxes, fees and charges the same, but reduces the Avios required by half.

A nice supplement

I’ve been very happy with the British Airways Premium Plus American Express, but have realised that once I have earned my 2-4-1 voucher by spending £10,000 each year, there are no additional bonuses, beyond the standard 1.5 Avios per £1 spent. Given how generous Amex has been, I thought I would try my luck obtaining another Amex issued card earlier this year.

I settled on the Starwood Preferred Guest Credit Card from American Express for a few reasons:

- Although I’m not a regular at luxury hotels and resorts around the world I know that SPG Starpoints are about the most valuable loyalty points you can earn (and more valuable than Avios)

- It came with 11,000 Starpoints after spending a very reasonable £1,000 in the first three months

- It has a low annual fee of £75

- While it only earned 1 Starpoint per £1 spent (although 2 Starpoints per £1 spent with SPG/Marriott), versus the 1.5 Avios on the BA Amex, I recognised the flexibility and value of Starpoints meant this earn rate is equal to, or more than the BA Amex, and I can easily switch back to the BA Amex once I’ve reached my minimum spend.

Again, this was approved instantly, and has been a nice little side-card, as it nicely supplements the BA Amex after I have earned the 2-4-1 Companion Voucher.

My next steps

While I’m very grateful to American Express for allowing me to obtain credit so easily in the UK with such limited credit history, my wallet is far from perfect and I regularly face the following problems:

- Some companies in the UK don’t accept American Express, although this is resonably rare

- I purchase many things in foreign currencies (especially flights with non-UK airlines), and the FX fees Amex imposes are in my opinion higher than the value of the points I would earn by using this card, so I use my trusty Monzo pre-paid debit card for all purchases that are not in Pounds Sterling.

My credit history is now at a level where I’m more than 50% likely to be approved for various independent Visa or Mastercards. Ideally I would like one that both earns rewards and has no FX fees.

Unfortunately outside the American Express family there are very few compelling offers, most simply offer some cashback or a giftcard with your first purchases.

I’m planning to stay away from Virgin Atlantic Flying Club, as I still have a healthy balance of Virgin Australia Velocity points, and the two Virgin brands have similar redemption partners.

Bottom line

It’s been a humbling experience building credit in a new country, after financial institutions in Australia were throwing me offers for years.

I’m very grateful to American Express for how easy they have made the process, and continue to look for Visa or Mastercards with good value propositions, although unfortunately, they are currently few and far between.

Some summary advice:

- My advice to you if you are new to the UK and have held credit cards with American Express in another country, is to contact them to understand your eligibility to use this credit history through their Global Card Transfer Program. American Express issued cards are really the best place to start with rewards in the UK, whether you are concentrating on British Airways Avios or not.

- If you are native to the UK, and/or have never held an American Express card, I would follow the steps I have listed above to slowly and carefully build a credit history in the UK, so that you can eventually apply for rewards cards, Amex or not.

Have you ever build credit in a new country?

I'm not sure if things have changed. I just rang Amex to try to get myself a credit card (just moved to the UK last month) and mentioned I held a Singapore Amex. They said I could get an Amex here but I'd lose my Singapore Amex - basically it's a transfer of credit cards? Was that what you meant in your article? Thanks.

Very interesting article, thanks for the info! I relocated from the US to the UK over a year ago and have found myself in a similar situation. I was able to open a bank account with HSBC UK and was approved for one of their credit cards, but it does not offer any rewards and has foreign transaction fees, so I really only use it solely for the sake of establishing credit in the UK....

Very interesting article, thanks for the info! I relocated from the US to the UK over a year ago and have found myself in a similar situation. I was able to open a bank account with HSBC UK and was approved for one of their credit cards, but it does not offer any rewards and has foreign transaction fees, so I really only use it solely for the sake of establishing credit in the UK. I've been using Clear Score to monitor my credit and am keen to open a more lucrative British card. My main problem, like you mentioned, is the lack of three years of residential history here (although I'm tempted to try lying about that one). I'm not crazy about Amex here, as I've encountered a lot of places that don't accept it--I think even Costa Coffee (last time I tried), didn't take it!

For now, I've actually been mainly using my US cards that don't charge foreign transaction fees. I use my parents' address as the billing address. So I'm still able to earn points and take advantage of the generous US based sign up bonuses.

Ah, the stereotyping - all London Antipodeans live in Earls (aka Kangaroo) Court, throw shrimps on the barbie, drink Fosters, etc. Slightly true (of a very few) 31 years ago during my first stint in U.K. but that old Earls Court is long gone, demolished and replaced by expensive new apartment buildings and other gentrification.

And the Antipodeans in the low paid sh*t jobs have also long gone, replaced largely by ‘free movement’ Eastern Europeans.

...Ah, the stereotyping - all London Antipodeans live in Earls (aka Kangaroo) Court, throw shrimps on the barbie, drink Fosters, etc. Slightly true (of a very few) 31 years ago during my first stint in U.K. but that old Earls Court is long gone, demolished and replaced by expensive new apartment buildings and other gentrification.

And the Antipodeans in the low paid sh*t jobs have also long gone, replaced largely by ‘free movement’ Eastern Europeans.

A trail of verifiable addresses is handy. After two years in the U.K., I returned down under for seven - keeping previously opened bank and credit car accounts active - and eventually returned to take up a job offer. After 21 months back here, setting up a new house, I had enough credit history to get a mortgage but was knocked back buying a TV on no deposit, six months interest-free credit as my ‘history’ wasn’t long enough. Luckily, I could remember two former addresses from 7-9 years before. Into the computer they went and the loan was approved. Bizarre.

This has been an interesting article which has provided useful ideas for some readers but also raised some debate for many. I think the moral of the story is this - when you are writing an article, whether to go in print or in digital format - research the themes diligently and exhaustively. Then, and only then, publish.

You cannot vote in the UK by virtue of being a Commonwealth citizen: you must be a qualifying Commonwealth citizen which means fulfilling the residency rules as detailed here:

http://www.electoralcommission.org.uk/faq/voting-and-registration/who-is-eligible-to-vote-at-a-uk-general-election

and

https://www.gov.uk/elections-in-the-uk

@John, I am an Australian living in the US, and not only do I still have my Australian credit card account, but in fact I still do all my banking through my Australian savings/transaction accounts. I have my US address registered with the banks and they have no problem at all. I have found zero value in opening up any accounts in the US because for me, the products are inferior.

PS agree with John - UK rules far stricter re blogs, you need to be FCA licensed, quote APRs, etc. - you can't just do a referral link - esp without making it clear that it's a referral link!!

Good article, James. Amex transfers been about for many years - potentially can be good if the exchange rate works in your favour and you undertake an MR points transfer too!

When moving to Oz unfortunately the one route I couldn't use was Amex-issed cards as they didn't like the visa type I was on (mainly only wanted 457). Thankfully NAB, CommBank, ANZ, etc. were all quite happy to do so!

Plat card is still...

Good article, James. Amex transfers been about for many years - potentially can be good if the exchange rate works in your favour and you undertake an MR points transfer too!

When moving to Oz unfortunately the one route I couldn't use was Amex-issed cards as they didn't like the visa type I was on (mainly only wanted 457). Thankfully NAB, CommBank, ANZ, etc. were all quite happy to do so!

Plat card is still worth a look - although high fee remember you can cancel at any time and receive pro-rata fee refund and retain some status benefits. Also the referral bonus with Plat is far higher and can pay for the annual fee. Need to give 6/12 between closing PRG and opening Plat though to be eligible.

Are you going via SPG to obtain AA miles? Not a direct transfer partner in the UK.

Great article James. I'm returning to the UK after many years in South Africa. Reward cards here are both poor and expensive but I've been surprised that they're not much better in the UK.

AAdvantage transfers from UK Membership Rewards have never been possible!

On a more serious note has OMAAT or James registered with the UK Financial Conduct Authority to act as a credit broker? The laws in the UK are very different in regards to promoting financial products.

By recommending credit cards on this site and posting your referral links you are acting as a credit broker for which you need to be registered and authorised by...

AAdvantage transfers from UK Membership Rewards have never been possible!

On a more serious note has OMAAT or James registered with the UK Financial Conduct Authority to act as a credit broker? The laws in the UK are very different in regards to promoting financial products.

By recommending credit cards on this site and posting your referral links you are acting as a credit broker for which you need to be registered and authorised by the Financial Conduct Authority to act as a credit broker.

1) Just to clarify, the author of this article would be permitted to vote in UK elections due to his being a Commonwealth Citizen (Australian in this case) and resident in the UK.

2) Registering on the electoral roll is not optional but mandatory. It is compulsory to fill in the annual voting registration form which is sent to every home each autumn. Not everyone chooses to vote but there is no choice in your name being registered on the electoral roll.

James, did you consider simply keeping and using your Australian credit cards in the UK? If the rewards are notably better, it sounds like you may have been better off sticking with the Australian cards and sending money back to Australia monthly to pay off the bill. Assuming you have an Australian card that has no foreign transaction fees and you use a service like Revolut or Transferwise to convert the GBP to AUD, you're...

James, did you consider simply keeping and using your Australian credit cards in the UK? If the rewards are notably better, it sounds like you may have been better off sticking with the Australian cards and sending money back to Australia monthly to pay off the bill. Assuming you have an Australian card that has no foreign transaction fees and you use a service like Revolut or Transferwise to convert the GBP to AUD, you're paying at most 0.5%, which I guess would be offset by the better rewards.

James have you any advice for getting a cc with decent points offering for someone living in the Republic of Ireland? We have no access to BA credit card for example and no similar EI scheme. M

Thing to be aware of that in time the sort of starter cards you refer to that can help to build your credit profile can eventually work against you. Cards such as Aqua etc. are designed for people with poor credit have high APRs and can suggest financial distress.

On the point of Monzo it is no longer a prepaid debit card you have but a current account. They closed all remaining accounts down and converted them a few months ago.

A benefit with Amex in the UK is that you can pay the balance from an international bank account using IBAN/SWIFT. I don't think this is possible if you get Visa or MC or Amex issued by a bank.

Hello James,

We met at the reader's meet though since I came at the end couldn't discuss much. Nice article though American Airlines has never been a direct transfer partner for UK Amex since at least the 5 years I have had the card. Maybe you transferred it to SPG and then to Amex?

Perhaps you could have also mentioned the IHG credit card for non-Amex spend (unless your focus was exclusively airline miles...

Hello James,

We met at the reader's meet though since I came at the end couldn't discuss much. Nice article though American Airlines has never been a direct transfer partner for UK Amex since at least the 5 years I have had the card. Maybe you transferred it to SPG and then to Amex?

Perhaps you could have also mentioned the IHG credit card for non-Amex spend (unless your focus was exclusively airline miles earning cards). Gold status with free card and Platinum with premium ( GBP 99 annual fee) which also gives a free night voucher after 10K spend. You get 20K bonus in the first year so definitely worth it in1 year if one can earn the free night voucher. The free IHG card will keep any IHG points from expiring if an infrequent traveller due to Gold status.

@James very timely post for me. I am a U.K. Lawyer and I am about to be relocated to the US. One of my main worries has been getting credit in the US because it seems to us Brits that the US revolves on credit a lot more than the UK (e.g.: no real pay as you go phones in the US so you need credit to get a phone, getting a car revolves around...

@James very timely post for me. I am a U.K. Lawyer and I am about to be relocated to the US. One of my main worries has been getting credit in the US because it seems to us Brits that the US revolves on credit a lot more than the UK (e.g.: no real pay as you go phones in the US so you need credit to get a phone, getting a car revolves around having a credit history and so on).

This AMEX service may save us. We have been using both the uk Gold card and BAEC PRemium card so hopefully we will be able to get credit via the Amex route.

As an aside, you think your Capital One card was bad! My brother who had an excellent credit history in the UK, house etc moved to NYC. Only card he could get was a capital one card which required him to provide a $300 deposit and then they gave him a $400 credit limit! In effect his limit was only $100!

When using the Amex program, do they cancel the cards in your original country?

@ anonn - no you can hold cards in two countries at the same time.

@PatFromNCL - rather an ignorant comment, right from the start -- low paid jobs etc.? Would be good to give The Sun, Daily Mail and such bit of a break.

While this subject has no interest to me personally (I don't mean that in the (read the following in a mocking tone) "I don't like it so I'm going to stop reading this blog!" sort of way), as I will never be needing to establish a credit history in the UK.

That said, James, you continue to contribute well-written, engaging content that is much broader in scope than we're used to. Thrilled that you joined...

While this subject has no interest to me personally (I don't mean that in the (read the following in a mocking tone) "I don't like it so I'm going to stop reading this blog!" sort of way), as I will never be needing to establish a credit history in the UK.

That said, James, you continue to contribute well-written, engaging content that is much broader in scope than we're used to. Thrilled that you joined this blog. I tend to read everything that you and Tiffany and Steph write irrespective of whether or not it personally benefits me, as y'all write your blog pieces in ways that are fun to read. Keep it up, please.

Hi James,

I remember chatting about such an article when we met in London, at the readers' meet and greet. Very glad you found the time and went ahead with the post.

Really helpful, and it gives me some research of my own to do! Thanks a lot!

Utlimately, would you recommend being faithful to BA and racking up the avios or go with Virgin when you have gone through your Velocity points?

@ Baptiste - I remember you as well! Hello again.

I would stick with BA mainly because they have better partners with their oneworld membership than Virgin Atlantic do (I don't really rate Delta). I start planning redemptions on Qatar these days, and then work down to other airlines if Qatar is not available.

James,

This is relevant for people who enter low skilled / payed / we do not give a fu*k jobs.

I guess you moved into a bedsit in Earl's Court with seven other Australians and you all worked for the same Man And a Van Company?

Companies who hire skilled workers globally usually have an agreement with their bank, whereby new recruits will have everything set-up once they join. Bank accounts, debit cards and indeed...

James,

This is relevant for people who enter low skilled / payed / we do not give a fu*k jobs.

I guess you moved into a bedsit in Earl's Court with seven other Australians and you all worked for the same Man And a Van Company?

Companies who hire skilled workers globally usually have an agreement with their bank, whereby new recruits will have everything set-up once they join. Bank accounts, debit cards and indeed credit cards with sufficient limits.

Again, I am not saying that your information is wrong. But there are a lot of (proper) professionals who'd have a very different story to tell.

@ PatFromNCL - I'm an 8 year qualified Finance Lawyer/Attorney who lives in Zone 1, and takes 3 plus months a year of holidays to travel.

I wouldn't expect my employer to find me a credit card, unless they were expecting me to spend the rest of my career there, working 80 hours a week. I'd much rather be travelling than working.

I've never worked for a removal company or lived with 7 people ; )

@James, given you're now a freelance consultant - run the expense through your Limited company (assuming that's how you're setup) and then you too, can own the AMEX Platinum Charge Card. Depends whether you'll get the value out of the car insurance, priority pass etc. though.

AA have also never been a direct transfer partner for me either, only via SPG. I'm not sure if they're a direct transfer partner if you hold the IDC AMEX and thus they were able to leverage that and offer it up as an option for you? Either way, you got lucky!

So glad you brought up Monzo! Has been a life saver in terms of avoiding the nasty foreign transaction fees since I moved to London a few years ago!

BTW, when you do the AMEX transfer they will also happily let you keep your AU issued card. I did that 8 years ago and still have both.

James, you do realise you could’ve applied for a Platinum instantly, as I got a Platinum with no credit history.

@ Karlis - annual fee on the platinum is waaaay too high for me.

Hi James, do you know if the AMEX Global Card Transfer Program works also for AMEX cards given by companies to their employees? I currently hold a gold AMEX card in Germany, that is given to certain employees within the company I work for and it may be used for both business and personal expenses (hence linked to my account).

@ Ben Holz - I would call Amex Global Transfer to check with them however for their terms and conditions say you must have been the 'primary cardholder' for your previous card. You cannot apply for a new company card using the transfer program.

Hey James,

Are you able to do a post like this on earning credit the best way in Australia? Given that the credit system there is so different I would be quite interested (in the same sort of style in this post and Ben's old post about him building credit

@ Callum - yes its on my list but I need to give it some thought as I just applied for an AU credit card after 26 years of living there, rather than going through quick steps to build credit history. Leave it with me.

James, were you able to retain and use any of your Australian cards after your move to the UK, or did they all cancel your accounts due to your relocation abroad?

@ John - I still hold an emergency Australian credit card from GE with no annual fees and a huge limit but rarely use it. Most AU card issuers won't care if you relocate provided you still service the debt properly.

I guess Canada is a bit different in that most financial institutions operate on both sides of the border. I had no trouble getting capone to issue me a CD$ card based on my US history, and got a cash-back card from my local credit union after showing them print-outs of my US credit report. The lesson is that credit unions are more likely to take extra info into account, and a bank you already...

I guess Canada is a bit different in that most financial institutions operate on both sides of the border. I had no trouble getting capone to issue me a CD$ card based on my US history, and got a cash-back card from my local credit union after showing them print-outs of my US credit report. The lesson is that credit unions are more likely to take extra info into account, and a bank you already have a relationship with is likely to work to keep that business.

@James I really didn't think you could xfer UK MR points directly to aadvantage. I thought the only way was through spg.

The way you explained this was amazing.I know almost nothing about credit cards.

Amex has been doing their global program for many years (at least 15) and it's the first route (and by far the easiest) that I always use to get a credit card and establish credit when moving countries. I didn't find out about it on my first few moves and definitely felt the pain. Now it's easy! I just wish they'd make it easier for others to find.

@ khatl - I didn't know about it until I began investigating US credit history building options as I've written about previously. I applied for the first UK charge card because I was advised (by someone who works in the UK and AU credit card markets) that this would be the best chance I would have as a new resident.

James, you have the right to vote in all British elections because you are Commonwealth citizen, not because you have residence. EU citizens have the right to vote only in local elections (while UK remains in the EU). All other residents don’t have any voting rights. So for example, US citizens who are resident in the UK don’t have these rights.

A direct transfer?

I would have loved the ability to transfer UK MR points to AA but they're definitely not a current partner and I've never seen the option to transfer to AA in recent years.

https://catalogue.membershiprewards.co.uk/viewpartneroverview.mtw

Hey James:

How did register for the local electoral roll, I am a US citizen and a UK resident and it doesn't allow me. Does it have to do with commonwealth?

@ Daniel - wow - lots of comments on this already! Okay, as @ meta has explained Commonwealth citizens are given certain additional visa rights, as well as the right to vote as a resident.

James - you may want to correct this:

"American Express UK has many transfer partners, and I chose American Airlines AAdvantage"

While Amex UK does have many transfer partners AA isn't one of them, unfortunately.

@ Harry - I transferred UK MR points to AA last year.