In addition to the great rewards they offer, one of the other awesome benefits of credit cards is the purchase protection you get. Using a credit card is the most risk free way to make a purchase. You can get robbed of cash, someone can steal info from a check, etc. Meanwhile if your credit card is compromised, the card issuer won’t hold you liable for the charges, assuming you report them (and on top of that you can dispute a charge after the fact, if the seller doesn’t hold up their end of the bargain).

Personally I’m not someone who is overly protective of my credit cards. I know plenty of people who are terrified of ever giving out their credit card information online, but at the same time have no issue using cards for in-person transactions, where your card is often out of sight for minutes at a time, and the information can easily be compromised.

Despite me not being paranoid about credit card security, prior to yesterday I only had one case of credit card fraud. That’s despite over a decade of heavy credit card use in dozens and dozens of countries.

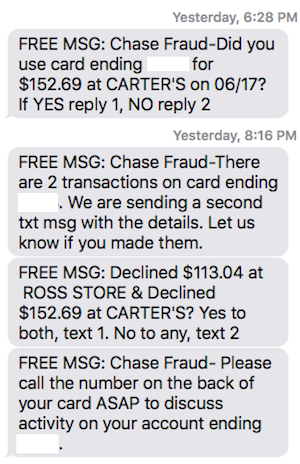

Well, yesterday I had my second case of credit card fraud ever. I decided to go to bed at around 3PM, and slept for almost 15 hours (well, I woke up a few times, but I was really tired — my gosh do I feel amazing today). When I woke up I saw that I had a few texts from Chase.

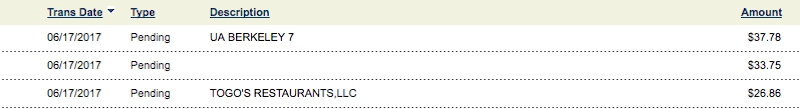

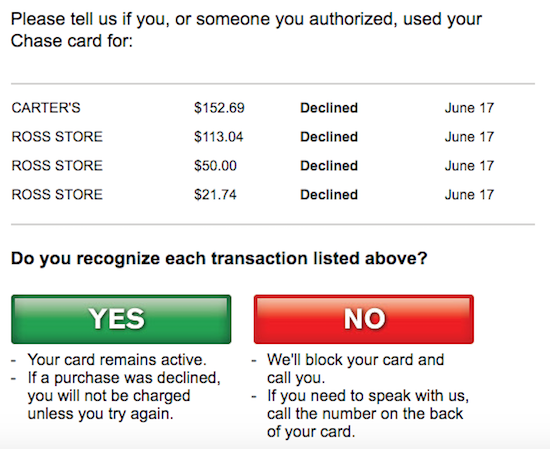

Those merchants didn’t sound familiar to me, so I further looked at my online statement, and also saw a couple of pending transactions that did go through, that weren’t mine. Specifically, a $37.78 purchase from “UA Berkeley 7” (which seems to be a movie theater in Berkeley, California), and a $26.86 purchase at “Togo’s Restaurant,” a chain restaurant in the same area.

I had also received an email from Chase.

This was almost identical to my first case of credit card fraud, which happened almost two years ago to the day.

I was surprised by the type of fraud here. Prior to my first case of credit card fraud, I had assumed that most fraud happens in the form of them either physically having your card, or in the form of them having your card info and making online purchases.

However, as I learned last time, a common type of credit card fraud is that they have your info and then create “fake” cards that they use for transactions. Personally I find this all a bit puzzling. Maybe it’s just me, but if you’re going to go through the effort of making a fake card, you’d think that you’d aim higher than a purchase at a sandwich shop and movie theater? Ultimately it looks like they tried to make a purchase at Ross and Carter’s as well, but that was declined. But I’m surprised they didn’t try larger transactions.

I’m also a bit puzzled by this because I thought that the introduction of chip readers in credit card terminals mitigated the risk of this type of fraud. I’m not sure if these merchants don’t have chip readers, or what…

But that’s the beauty of credit cards. I phoned up Chase, they went over all my recent transactions to confirm which were mine and which weren’t, and said they’d send me a new card within a couple of days (which is a bit problematic, given that my travel schedule at the moment, though fortunately I have no shortage of credit cards). 😉

Bottom line

It’s interesting that the only two times I’ve dealt with credit card fraud have been similar situations, where my card was seemingly recreated and used for in-person transactions. This seems to be quite common, though in the past I didn’t even know this was a thing. Ultimately this is the beauty of credit cards, though — I’m not “out of pocket” anything here.

The only slightly annoyance is that my card number is changing. That’s annoying both because I have some recurring payments set up, and also because I had the number memorized. Oh well. 😉

Has anyone else faced this kind of credit card fraud lately?

I'm pretty sure the lady at Popeyes got mine. Never have I felt so suspicious that I kept the receipt. Long story short a week after someone tried using a copy of my debit at a Wal-Mart for 800 bucks. Of course it got denied because I never have that much cash just laying around. I had to contact bank and worst part was honestly waiting 7 days for a new card.

Yes! It happened to me too. Imagine that...

Chase is very good at detecting ccard fraud. My Chase Signature info was stolen twice in the past three years and Chase caught it early on both times.

Some creep made a copy of my card and charged two transactions 600 miles away at 1:37 in the morning. I guess the frauds thought that no one would notice their fly by night activities. Fortunately, Chase...

Yes! It happened to me too. Imagine that...

Chase is very good at detecting ccard fraud. My Chase Signature info was stolen twice in the past three years and Chase caught it early on both times.

Some creep made a copy of my card and charged two transactions 600 miles away at 1:37 in the morning. I guess the frauds thought that no one would notice their fly by night activities. Fortunately, Chase data centers work 24/7/365 and both times Chase was very professional and efficient at handling the situation.

This is weird, but I just received practically the same text from Chase this morning and the same purchase was made at CARTER'S. Do they seem to check Carters's first? Over $150.00 too and the duplicated fake card was presented to the cashier..

Hi Lucky - I had two of my credit card compromised recently and I had an excellent experience from both card companies with reporting it and taking care of it. I do receive the text and email alerts for my cards and monitor my accounts online but because I work primarily overseas and have many odd transactions from unusual places, I have asked the card companies to allow all charges and I'll report anything strange....

Hi Lucky - I had two of my credit card compromised recently and I had an excellent experience from both card companies with reporting it and taking care of it. I do receive the text and email alerts for my cards and monitor my accounts online but because I work primarily overseas and have many odd transactions from unusual places, I have asked the card companies to allow all charges and I'll report anything strange. Both card companies immediately mentioned I would not be responsible for the charges, they would send me a new card within two business days internationally, and also all reoccurring automatic charges would be notified of the new card information on my behalf. I find the approval annoying because I am not always convenient to do so. So perhaps you may consider this. Incidentally, the new Amex Platinum is metal, I guess because of competition with the JPMorgan Reserve Card.

Here is one tip that was passed along to me and I find helpful. Although it won't prevent fraud, it at least will help in the aftermath. I have one credit card that I use exclusively for recurring payments, such as gym memberships, wine clubs, etc. If this card is ever compromised, then I only have to look at one statement to figure out which vendors I need to contact with the new number, rather...

Here is one tip that was passed along to me and I find helpful. Although it won't prevent fraud, it at least will help in the aftermath. I have one credit card that I use exclusively for recurring payments, such as gym memberships, wine clubs, etc. If this card is ever compromised, then I only have to look at one statement to figure out which vendors I need to contact with the new number, rather than going through multiple accounts. I use one other card exclusively for online purchases. Again, if that card is compromised then I know it was the result of an online purchase. I then use 1 or more other cards for in-person transactions. Again, this won't help prevent the fraud in the first place, but at least helps you deal with the aftermath and maybe figure out where the fraud occurred.

I think the best way to prevent this kind of thing to happen is to turn on the transaction notification feature of your card issuers' mobile app. I set the limit of transaction notification to 1 cent in my Chase app and turned on AMEX transaction notification in AMEX app so that every time there is a transaction or per-authorization put on my card, I would immediately get a notification.

@omgstfualready I'm not so sure Congress needs to get involved in chip and pin. This seems to me something the industry can work out and has. In the case of the move to chip cards, it was the industry and not Congress that made it happen. They worked out that retailer POS hacks were too costly, and thus it was worth the huge cost to upgrade tens of millions of card readers in the US...

@omgstfualready I'm not so sure Congress needs to get involved in chip and pin. This seems to me something the industry can work out and has. In the case of the move to chip cards, it was the industry and not Congress that made it happen. They worked out that retailer POS hacks were too costly, and thus it was worth the huge cost to upgrade tens of millions of card readers in the US to accept chip cards.

As for chip and pin, my guess it that we'll see it as an option in a few years' time, once people are used to the chip dip process at POS terminals. Once all terminals can take chip cards, it's an easy software upgrade to have it ask for a PIN.

As it is, a lot of retailers still aren't on chip cards because they are waiting on acceptance testing from the vendor (another commenter mentioned this). That's why you see chip terminals with the chip slot taped over -- the hardware is ready, but they need to get recertified first.

Ben, I think your card was RFID cloned and is how they get the CC number. On the first 2 transaction the restaurant/store may not have a CC chip reader so swiping a cloned cc worked, but on Carters/Ross they use the new POS so when they tried to pay a cloned CC (which the original have a chip), the POS will tell you they need to inset the CC and that's why it was...

Ben, I think your card was RFID cloned and is how they get the CC number. On the first 2 transaction the restaurant/store may not have a CC chip reader so swiping a cloned cc worked, but on Carters/Ross they use the new POS so when they tried to pay a cloned CC (which the original have a chip), the POS will tell you they need to inset the CC and that's why it was rejected by Chase.

When they use a fake CC where the original was with a chip, they will try to run some transaction or online (with the numbers) or at a Gas station, because most of them don't have a chip reader terminal.

"Personally I find this all a bit puzzling. Maybe it’s just me, but if you’re going to go through the effort of making a fake card, you’d think that you’d aim higher than a purchase at a sandwich shop and movie theater?"

Amex phoned me one Sunday a few years ago asking if I was suddenly in Atlanta given that I'd just used my card in New York. Seems someone with a cloned copy of...

"Personally I find this all a bit puzzling. Maybe it’s just me, but if you’re going to go through the effort of making a fake card, you’d think that you’d aim higher than a purchase at a sandwich shop and movie theater?"

Amex phoned me one Sunday a few years ago asking if I was suddenly in Atlanta given that I'd just used my card in New York. Seems someone with a cloned copy of my card there attempted to refuel their car and go to Popeye's Chicken with it... and they immediately canceled it. Stupid transactions like this set off their fraud alerts. Especially if you never eat at Popeye's and have multi-year history of transactions with Amex

I usually get hit about every 2 or so years. Every single time it's been a merchant / retailer data breach which exposed my CC number. Thus far, I've never been hit with a skimmer. Also, in every fraudulent charge other than the Target breach, the hackers used the on-line hole -- no chip+pin needed for online transactions. Just CC#, exp date, CCV, and billing ZIP, all easily found when you breach a retailer.

...I usually get hit about every 2 or so years. Every single time it's been a merchant / retailer data breach which exposed my CC number. Thus far, I've never been hit with a skimmer. Also, in every fraudulent charge other than the Target breach, the hackers used the on-line hole -- no chip+pin needed for online transactions. Just CC#, exp date, CCV, and billing ZIP, all easily found when you breach a retailer.

I was always told that the reason we don't have Chip+PIN was due to banks worrying that it would be too much hassle and people would resort to other means of payment. I thought it was a bogus reason, but they appear to understand the market a bit better than I do. The banks have been getting major pushback from millennials about the new Chip cards. Apparently the extra delay in US merchants' POS systems is too long for them....which I don't understand as it takes less time than the 20-something who insisted on taking 5 selfies in the checkout lane while the cashier (and the rest of us) were waiting for her to pay.

@n An RFID blocking wallet will only work if you have cards with RFID chips in them. Honestly, I havent seen an RFID card in several years.

@ Jim there are a lot of political things that prevented chip+PIN that cannot be overlooked. Congress stopped it, it's that simple in the end. It doesn't negate your write up but in the end chip and PIN costs more and that impacts the bottom line and it was cheaper to buy off the US Congress than protect consumers.

I guess that's why your name is Lucky!

@Jim - that's a great explanation, thanks. I only quibble with this part: "credit card issuers in the US are pro-consumer in terms of making it easy for them". Well, sure, it's a win-win for customers and banks if people find it easy to use their cards. However, to the extent that fraud still happens, it might seem like the banks cover the costs, but of course they pass those costs on to customers in...

@Jim - that's a great explanation, thanks. I only quibble with this part: "credit card issuers in the US are pro-consumer in terms of making it easy for them". Well, sure, it's a win-win for customers and banks if people find it easy to use their cards. However, to the extent that fraud still happens, it might seem like the banks cover the costs, but of course they pass those costs on to customers in the form of higher interest rates and fees. Since the banks and card companies are forcing everyone to move to a chip-based system, it would have cost very little more to move to chip-and-PIN instead of chip-and-sig, and presumably there would ultimately be less fraud expense for the banks to pass on.

As for having a different PIN for every one of your cards - well, all you need to do is change the PIN to the same one for all your cards. I really don't see how chip-and-pin is any less customer friendly than chip-and-sig.

Jim (June 18, 2017 at 4:49 pm), that was a really thorough and amazing answer. Thank you. I wish it was the first comment posted so I wouldn't have needed to read any further. It made a lot of sense and I think your thoughts on the matter are right on!

I have all my credit card accounts set to send me a text every time they're used. I usually receive the notices while I'm still in the store. So if I get a text notifying me of a charge and I haven't just bought anything, I check it immediately to see if it's a preauthorized charge and if not call the credit card company immediately. I've had two instances of CC fraud that I caught and stopped within minutes.

There's actually a reason the US does chip-and-signature, not chip-and-pin.

First, Americans hold more cards per person compared to other countries. Now, imagine you're the first issuer to switch to chip-and-pin in the US.. that's the one people will stop using because you forget the PIN and you have 5 other cards anyway.

Next, fraud detection in the US is more sophisticated, and US cardholders are not liable for fraudulent charges. In Europe, often they...

There's actually a reason the US does chip-and-signature, not chip-and-pin.

First, Americans hold more cards per person compared to other countries. Now, imagine you're the first issuer to switch to chip-and-pin in the US.. that's the one people will stop using because you forget the PIN and you have 5 other cards anyway.

Next, fraud detection in the US is more sophisticated, and US cardholders are not liable for fraudulent charges. In Europe, often they are, and there are even banks that happily sell insurance to cover the liability for fraudulent charges.

So why did the US switch to chip, and why was it chip and signature? The hack of the retailer Target. Before that, fraud occurred on an individual basis (one person's card gets compromised) and they could easily detect and handle that. With Target, the point of sale system was hacked so they got 40 MILLION credit cards at once. That was too much of a loss and the credit card industry realized these types of breaches would become more common, and they needed to protect against that.

With chip cards of any type, it doesn't matter if the POS is hacked, since it's basically just a one-time credit card "number" that is revealed to the POS during a chip transaction. That information is useless. So now, card issuers can go back to worrying about individual fraud, which they are already good at detecting and handling.

How did they get the retailers to install chip machines in their POS systems? It was a liability shift. They said to the retailer that if they installed a chip reader, and the transaction was over chip, the retailer is not liable for the fraud any more (the issuer covers it). However, if the chip card was swiped instead, then the retailer is still liable. Go to Home Depot and try to swipe your chip card -- it will tell you it's a chip card and you need to dip it instead.

So in short, credit card issuers in the US are pro-consumer in terms of making it easy for them, and with no liability to them. That's why things are like they are.

To date, the only card I've had that was hacked was one I'd never acknowledged receipt on. Chase was right on top of it, and closed it right then. I'm impressed with Chase. They contact me anytime I'm doing something expensive online, which is fine by me.

Last year Am Ex let 9k in Uber charges on my card and said it was a mystery why it wasn't detected. All over the world on the same day while I was buying regular stuff in New York.

I never understand why it's ok for waiters and bartenders to take your card out of sight in the USA. In the UK service staff are told that you can never take the card from out of the view of the customer.

I get fraudulent charges about every couple of years. Usually (but not always) they occur a few weeks to months after a foreign trip.

By the way, one card I have (First Tech) is chip-and-pin. I used it a few times in Europe, *only* with chip and pin (i.e., I never swiped it). A few weeks later, First Tech caught a fraudulent charge and notified me. My theory is that one of the chip readers...

I get fraudulent charges about every couple of years. Usually (but not always) they occur a few weeks to months after a foreign trip.

By the way, one card I have (First Tech) is chip-and-pin. I used it a few times in Europe, *only* with chip and pin (i.e., I never swiped it). A few weeks later, First Tech caught a fraudulent charge and notified me. My theory is that one of the chip readers actually had a card stripe reader installed by thieves, and they used the magstripe info to make a fake card and try to buy something at a merchant that didn't yet use chip readers.

@N1120A

About gas stations, the only time I ever got feedback from the bank about where my card was actually skimmed was a transaction I made last year at a gas station in Bordeaux, France.

Donna,

I got feedback from the AMEX security rep that he thought it was almost certain that my last fraud hit, which was the first in a few years, was the result of a gas station I filled up at by LAX. Apparently, no-name stations are hit more often, as they don't always do a good job of monitoring.

Perhaps an RFID blocking wallet would stop this? Apparently, the details in the magnetic strip can be stolen this way, even if the card isn't contactless. Or is it possible to get the company to contact you for every purchase you make to verify? Another method is to look at any cash machines or card terminals you use, to see if there are signs of tampering as there could've been a skimmer in something you...

Perhaps an RFID blocking wallet would stop this? Apparently, the details in the magnetic strip can be stolen this way, even if the card isn't contactless. Or is it possible to get the company to contact you for every purchase you make to verify? Another method is to look at any cash machines or card terminals you use, to see if there are signs of tampering as there could've been a skimmer in something you used and did genuinely buy something, and the details could've been sent electronically to wherever the arseholes are?

Given your credit card usage, consider yourself lucky (no pun intended) to have only had 2 of these. Between having a card physically stolen and several clones, I've had my AMEX Gold/Plat and AMEX Blue ripped off probably 5-6 total times. I think I had a Chase card also cloned once.

The interesting thing is that I've not had as many of these test pattern type scams. Instead, I've had each of these rip...

Given your credit card usage, consider yourself lucky (no pun intended) to have only had 2 of these. Between having a card physically stolen and several clones, I've had my AMEX Gold/Plat and AMEX Blue ripped off probably 5-6 total times. I think I had a Chase card also cloned once.

The interesting thing is that I've not had as many of these test pattern type scams. Instead, I've had each of these rip offs take different paths.

On one, I was in South Africa and saw several charges on my AMEX in Philadelphia. A lot of stuff at places like Babies R Us, which I think are big targets for these scammers. On another, my card was being used in Brazil, despite my having never been there. On another, someone tried to hit my card for HKD30,000 to buy a ticket on Cathay - they caught that quickly.

One of the reasons you might not have been hit as often is your living arrangement. You don't seem to use cars that often, which means you don't often use credit card readers at gas stations. That is often the biggest place they see scams, as skimmers can be put on the card readers. The last time I was hit, that is where it seemed they got me. What is really interesting is that these clones appear to get out fairly quickly - like within hours.

Between my travel, business purchases and personal purchases I make a lot of credit card transactions. About once a year I have a fraud problem on a card. Most fraud transactions are in Europe where I travel for work and the card companies always mention skimming as a huge problem (I never use a Debit Card because of skimming risk). I make a habit of checking my accounts often, especially on travel, and never use "free" WiFi. And I always carry backup!!!

@ Lucky A typo: "in dozens and dozens of country." > countries

@omgstfualready - The U.S. government doesn't specify chip+ pin or chip+signature or swipe or any way to "use" your card. It's up to the card issuers, merchants and data processors. Sheesh.

After 6 years of traveling and many countries mine have only been stolen once in Brazil. Bank of America insisted that my card was present and that I'd have to pay until I sent them documentation proving I was in Antarctica at the time. Several of my friends have had their card info stolen at restaurants so many will either require the credit card machine be brought to the table or go back with the waiter and watch them run the card to prevent further issues.

@BrianP +1 for chip and pin instead of pointless chip and signature. People should complain to their banks.

I HATE using my credit cards in the US - there is zero reason in todays day and age of technology to have the card removed from sight.

I now have no qualms about getting up and going to the front counter to pay - because if I am in the US calling a fraud line is usually a PITA - even if its a company cell phone.

I've had probably 5 or 6 fraud issues with my Amex Platinum over the years. Surprisingly most of the time they follow the same patterns talked about here and in the comments.

Test run of a small amount at a convenience store or online retailer, followed almost immediately by hundreds of dollars of charges at (in my case) a shoe store. Sneakers must have a solid resale value?

After about the 4th time my...

I've had probably 5 or 6 fraud issues with my Amex Platinum over the years. Surprisingly most of the time they follow the same patterns talked about here and in the comments.

Test run of a small amount at a convenience store or online retailer, followed almost immediately by hundreds of dollars of charges at (in my case) a shoe store. Sneakers must have a solid resale value?

After about the 4th time my partner and I were able to deduct that the fraud only seemed to happen in the weeks/month after he took business trips to Las Vegas. I even have my suspicions as to the exact restaurant responsible for the card cloning since it was a popular spot for him to take coworkers, and the fraud only started after they began eating there and stopped once his travel patterns changed.

To Amex's credit they caught every single fraudulent transaction before I did, and have been great about dealing with card replacements, etc.

My grocery store says they would like to have a chip enabled POS, but they are still waiting to get it delivered.

Last year I bought a $500 Visa gc at a grocery store. It came with a pre set pin, but I called immediately after the purchase and changed the pin. Then a few days later when I tried to buy a $500 money order it was declined. I checked the card online,...

My grocery store says they would like to have a chip enabled POS, but they are still waiting to get it delivered.

Last year I bought a $500 Visa gc at a grocery store. It came with a pre set pin, but I called immediately after the purchase and changed the pin. Then a few days later when I tried to buy a $500 money order it was declined. I checked the card online, and there had been @$150 of purchases on it, over several days. Nothing over $10, just lots of purchases from McDs, Starbucks, and the like. This had me perplexed, as I hadn't used the card anywhere, and had changed the pin right away. The CSR for the card said the pin didn't matter, as you can just run the purchase as credit. But how they got the card number in the first place, and why they didn't use up the full $500 after a small purchase to be sure it was working, is a mystery.

From what I've read this is a recurring problem with US Bank Visa and AMEX gcs. So now I buy a MO right away when I get a gc, rather than give someone time to mess with it.

The good news is the card company closed down the card at that point, and sent me a new one with the full $500 balance.

I was hit for more than $30,000 a few years ago. Someone was making multiple Air Canada payments in NYC with a card I had never used. My bank failed to follow up with me (I was in Australia at the time) and it was by chance that I looked at my account and noticed. I contacted the bank and they were apologetic (and embarrassed at such a huge mistake).

However, they told me it...

I was hit for more than $30,000 a few years ago. Someone was making multiple Air Canada payments in NYC with a card I had never used. My bank failed to follow up with me (I was in Australia at the time) and it was by chance that I looked at my account and noticed. I contacted the bank and they were apologetic (and embarrassed at such a huge mistake).

However, they told me it would take several weeks to resolve. I escalated the matter much higher up and gave them 24 hours to resolve the problem. Within 17 hours it was resolved and I was compensated all bank fees for 12 months and several hundred dollars for my trouble.

Allegedly some criminals use random number generators and see if they get lucky. That's what I was told (it had been happening a lot at the time according to the bank). But it was apparently very surprising that such huge fraudulent payments were being made. Normally criminals start with small payments to test the water. Bold individuals it seemed.

Although I was annoyed by the fraud, I was more offended that the fraud team manager asked me 'are you sure you didn't buy any Air Canada tickets?' I would never fly that airline. They don't even have an on board bar, let alone showers!

1. The thieves first put through smaller charges to make sure the stolen card info works.

2. IMHO the banks don't do enough to find these thieves and press criminal charges.

The cards can be programmed to act as non-chip enabled cards. There is apparently a security feature to prevent this working, but I do not believe an US merchants (or perhaps it's the banks?) have enabled it.

it is amazing the number of stores that still don't have chip readers. The grocery store I most frequently visit has machines with a chip slot but they have "no chip" signage inserted in them. And many, many retail establishments are the same. I guess they've done a calculation that the card readers cost them more than the fraud they have to pay for.

@ Brian P I agree that chip and pin is very difficult to hack, though nothing is impossible why try to hack that when there are easier marks out there. The US Congress years ago decided that the US populations couldn't handle the 'complexity' of chip and pin and that was why it was not implemented as such and it is only chip technology. The Obama administration did try for the chip and pin but the lobbyists got their claws into Congress. It's shameful.

Lucky, sometimes if asked Chase will overnight you the card if you need it sooner. Once I had a fraud issue when I was getting ready to leave the country in a couple days, spoke with the Chase rep Friday at 4pm, and had a new card on my doorstep at 9am Saturday. I don't know how much it cost to overnight like that, but they had an extremely satisfied customer!

@ Robert, it's a little more complicated than merchants not wanting to switch over, though there is some of that. But they have to get the hardware inspected by the same people that fine them if they are late. There are a ton of merchants waiting on their inspections long past the due date and they are paying fines to people that can stop it from happening. The fox is watching the hen house.

I have had two cases of fraud in the past few years, both on Citi Cards. The first time, I was impressed by their service. They shipped a new card immediately, and I had it in my hand in less than 24 hours.

I find the fraud algorithms quite amazing. Having multiple cards, I switch my spend around between them quite a bit. I also travel a bit, and don't always get around to notifying...

I have had two cases of fraud in the past few years, both on Citi Cards. The first time, I was impressed by their service. They shipped a new card immediately, and I had it in my hand in less than 24 hours.

I find the fraud algorithms quite amazing. Having multiple cards, I switch my spend around between them quite a bit. I also travel a bit, and don't always get around to notifying them. And even when I buy gifts (which would be at "unusual" stores), it don't trigger fraud alerts. At the same time, both cases of fraud were detected quickly, and only have had my account incorrectly flagged once or twice.

This only happened because the US refuses to fully implement Chip and pin like the rest of the civilized world. It is sad that the banks would rather pay for fraud rather then update their systems to Chip and pin. A chipped card and 5 digit pin cannot be hacked. I have been noticing an increase in fraud for myself and all my extended family. The problem continues to get worse, especially if you travel internationally a lot.

A lot of companies will not even question conflicting information on transactions under a certain amount ($25, $50). I saw a charge for movie tickets from fandango on my card. It was for a Harry Potter screening in Seattle. The person just put in the wrong number and fandango accepted it. The expiration date and name did not match. But they left it up to me to do all the leg work to fix their...

A lot of companies will not even question conflicting information on transactions under a certain amount ($25, $50). I saw a charge for movie tickets from fandango on my card. It was for a Harry Potter screening in Seattle. The person just put in the wrong number and fandango accepted it. The expiration date and name did not match. But they left it up to me to do all the leg work to fix their error. You have to review every single transaction because these companies are sloppier than we think with credit card charges. That wasn't even fraud.

@Sam must really despise cabbies! Unless that St. Louis cab ride was the only charge ever on his Chase Sapphire, he cannot know with certainty where and how the card was cloned. Cloning can happen wherever you swipe your physical card--especially restaurants, shops, and supermarkets that use those small, easily tampered with point of sale machines. You will not suspect a thing until it is too late. That's why cloning is such a well established...

@Sam must really despise cabbies! Unless that St. Louis cab ride was the only charge ever on his Chase Sapphire, he cannot know with certainty where and how the card was cloned. Cloning can happen wherever you swipe your physical card--especially restaurants, shops, and supermarkets that use those small, easily tampered with point of sale machines. You will not suspect a thing until it is too late. That's why cloning is such a well established form of card fraud and why the thieves and store staffers in cahoots with them have gotten away with it for so long.

I had fraudulent transactions, in the thousands, on a couple of Citi cards. Not the cards I used a lot, so I didn't notice right away. The transactions were way out of character (several drug stores in neighbouring towns). Not a peep from Citi.

I did get a fraud alert from Citi once... when I went to use my Citi card at a store I often shop at and it was declined as fraud because...

I had fraudulent transactions, in the thousands, on a couple of Citi cards. Not the cards I used a lot, so I didn't notice right away. The transactions were way out of character (several drug stores in neighbouring towns). Not a peep from Citi.

I did get a fraud alert from Citi once... when I went to use my Citi card at a store I often shop at and it was declined as fraud because it was an "unusual purchase." I asked what was so unusual and they said the amount. It was something like $112 while in the weeks prior I had several purchases between $80 and $200 in the same store.

I had several attempts at illegal transactions with Chase cards. Immediate text message like you received alerting me to it. Each time they questioned it, it was indeed fraud.

Amazing, the difference between banks! I rarely use Citi cards, except to meet minimum spend. Embarrassing to have your card declined, and the benefits aren't as good anyway.

The rules on chipped card are interesting. If the merchant allows a swipe of a chipped card, THEY are 100% liable for the transaction, the cardholder and the card company are off the hook.

Merchants have had years of warning on this, yet many still don't take chipped cards due to the expense of new equipment (their words, not mine.)

A few charge-backs will help them get the message.

In my experience, Chase has been very good at recognizing and sending fraud alerts. I've had several Chase cards compromised. The last time my card was hacked at a gas station two blocks from San Diego airport. I took a flight home and by the time I landed, 4 hours later, there was over $700 worth of Starbucks gift card purchases up and down the California coast. I responded to Chase's text messages, and I...

In my experience, Chase has been very good at recognizing and sending fraud alerts. I've had several Chase cards compromised. The last time my card was hacked at a gas station two blocks from San Diego airport. I took a flight home and by the time I landed, 4 hours later, there was over $700 worth of Starbucks gift card purchases up and down the California coast. I responded to Chase's text messages, and I immediately received a call from Chase informing me I would receive a new card and they would investigate the charges.

After my mom had this happen by someone who worked for a credit card company, the police told her that a lot of these fraudster make small purchases at convienence stores to see if they are still active.

The banks have algorithms to have an idea of the types of charges done with the card. They also ratings for various merchant types and look for patterns between types of merchants. For example if they see a small charge at a gas station and then a purchase at a sports store (think high end sneakers) or electronics they will typically flag as the gas charge was an attempt by the fraudster to see if...

The banks have algorithms to have an idea of the types of charges done with the card. They also ratings for various merchant types and look for patterns between types of merchants. For example if they see a small charge at a gas station and then a purchase at a sports store (think high end sneakers) or electronics they will typically flag as the gas charge was an attempt by the fraudster to see if the card is still working without having to hand the card over. When it works they stop and go buy their items. But if you've not gone to a certain type of merchant, eg cheap woman's clothing and children's stores, they will also flag that as unusual regardless of the amount. Often when you get a new card any online transaction of a reasonably high amount will result in a call or text as well as they don't know your patterns yet. For those that don't travel outside of their local areas often it is a best practice to contact the bank in advance so they do not freeze the card. I do that with my business card for work just to be cautious (I can't be reimbursed if I use a personal card for work charges so if they shut me off I'm screwed). Ben obviously has a pattern of being all over the place so location isn't going to trigger the fraud alert but the merchant type will as it seems he doesn't shop in the types of stores being shown in this post. Overall the banks have extremely sophisticated ways to know what you are typically doing so they can determine fast what is not you and get it shut down fast before you or they are out any significant money or time/hassle.

I was in Japan for 2 weeks last April, and in the middle of the trip, I received a text message (similar to what you got from Chase with a simple 1/2 reply transaction verification) from Amex. It was a transaction in Euros (over EUR150). I replied no. Then they asked me to contact their fraud hotline.

I immediately checked my monthly transactions online, and found there was an initial fraud in USD made with...

I was in Japan for 2 weeks last April, and in the middle of the trip, I received a text message (similar to what you got from Chase with a simple 1/2 reply transaction verification) from Amex. It was a transaction in Euros (over EUR150). I replied no. Then they asked me to contact their fraud hotline.

I immediately checked my monthly transactions online, and found there was an initial fraud in USD made with a dental care company in the States (less than USD10)!?!

During the whole trip, I did not use WiFi, and did not do any online shopping.

It's not the first time my credit card details was stolen. (That was with another bank.) It appears the fraudsters' general practice is to test with a small transaction amount first, and after successful attempt, would roll out with larger amounts.

I just didn't expect this would happen to me in Japan, though when I shared my story with a Japanese friend, he said there have been more recent cases where Chinese travellers using UnionPay credit cards fell victim.

Oh, and I forgot to add about my last credit card fraud experience. I was at a conference in St. Louis and used my Sapphire Preferred to pay for the taxi. The cab driver, as soon as he took my card, said, "Ah yes, I know this card," and swiped it on something. I thought to myself, "just watch, I'm going to have fraud on this card." Sure enough, around a month later or so...

Oh, and I forgot to add about my last credit card fraud experience. I was at a conference in St. Louis and used my Sapphire Preferred to pay for the taxi. The cab driver, as soon as he took my card, said, "Ah yes, I know this card," and swiped it on something. I thought to myself, "just watch, I'm going to have fraud on this card." Sure enough, around a month later or so I noticed a transaction for some store called Chowdaheadz or something like that. I called up Chase as soon as I saw it. The fraud specialist looked up the information and said that she had no idea how the transaction went through. None of the information was right (wrong expiration date, security code, etc.). She said she had no idea how the transaction even went through and that I definitely wouldn't be liable for that.

My platinum card was just used to attempt to purchase over $100 of Uber rides over two days (and I did not use Uber during that time--my Uber account also does not show corresponding rides in my account, so my account was not hacked). Amex didn't catch the initial $1 preauthorization or the first $47 in rides. I got noticed on my Apple Watch and called them right away. So the next day they declined...

My platinum card was just used to attempt to purchase over $100 of Uber rides over two days (and I did not use Uber during that time--my Uber account also does not show corresponding rides in my account, so my account was not hacked). Amex didn't catch the initial $1 preauthorization or the first $47 in rides. I got noticed on my Apple Watch and called them right away. So the next day they declined $70 worth of Uber rides. My new Platinum card is on the way.

Like you feel about what happened to you, Lucky, I find it surprising that people would engage in this kind of credit card fraud. Doesn't Uber collect a lot of information about you when you create and use accounts?

The only time I had my card info stolen was on my Discover card. Someone bought a first class ticket to Germany for the following day. I did some detective work and found out the name on the ticket and filed a police report. Also, Discover was very helpful and obviously I wasn't held liable for the charge.

They often do small purchases to not attract attention, didn't work this time. They often do a small test transaction too. One time I had fraud from someone in Brazil who ran it through a soda machine reader to test it first. Since I was in Ireland, they flagged it immediately.